Professional Documents

Culture Documents

Application of Demand and Supply Analysis (Applied Eco)

Application of Demand and Supply Analysis (Applied Eco)

Uploaded by

aenCopyright:

Available Formats

You might also like

- Tugas Problem Set 4 Ekonomi ManajerialDocument4 pagesTugas Problem Set 4 Ekonomi ManajerialRuth Adriana100% (1)

- EC2102 Topic 10 - Solution SketchDocument2 pagesEC2102 Topic 10 - Solution SketchsqhaaNo ratings yet

- Human Resources ManagementDocument9 pagesHuman Resources ManagementMehwish AwanNo ratings yet

- OFW MigrationDocument6 pagesOFW MigrationFe Pauline YeeNo ratings yet

- High Rate of Unemployment Polgov InvestigationDocument8 pagesHigh Rate of Unemployment Polgov InvestigationLili PadNo ratings yet

- Unemployment Rate 2021-The Cause and EffectsDocument27 pagesUnemployment Rate 2021-The Cause and EffectsJeffrey Paul Ventura100% (1)

- Module 5Document4 pagesModule 5Marbe Joy RazonNo ratings yet

- Chapter - I IntorductionDocument36 pagesChapter - I IntorductionMohd Natiq KhanNo ratings yet

- Lesson 7 Factor MarketsDocument9 pagesLesson 7 Factor MarketsDaniela CaguioaNo ratings yet

- Demand Function For Real EstateDocument3 pagesDemand Function For Real EstatesairamskNo ratings yet

- HousingDocument4 pagesHousingMary Joyce Camile CarantoNo ratings yet

- Supply-Demand and Philippine Economic ProblemDocument12 pagesSupply-Demand and Philippine Economic ProblemCatherine Rose Villarin Alferez100% (1)

- Impact of Unemployment To The Economic GrowthDocument20 pagesImpact of Unemployment To The Economic GrowthCyrelle MagpantayNo ratings yet

- Far Eastern University: Sampaloc, Metro Manila, PhilippinesDocument12 pagesFar Eastern University: Sampaloc, Metro Manila, Philippinescrisenalyn LeanoNo ratings yet

- The Problem Background of The StudyDocument12 pagesThe Problem Background of The StudyBrayan CaceresNo ratings yet

- Economics As An Applied Science: Lesson 1.2Document19 pagesEconomics As An Applied Science: Lesson 1.2Catherine Rose Villarin AlferezNo ratings yet

- They Serve, We Protect A Policy Analysis of Government Safeguards For ODWs From The PhilippinesDocument28 pagesThey Serve, We Protect A Policy Analysis of Government Safeguards For ODWs From The PhilippinesjvtignoNo ratings yet

- Real Estate: Unobservable Theoretical Construct. Housing Stock Depreciates Making It QualitativelyDocument9 pagesReal Estate: Unobservable Theoretical Construct. Housing Stock Depreciates Making It QualitativelykrupaleeNo ratings yet

- I Don't KnowDocument6 pagesI Don't Knowlatok48052No ratings yet

- Research Method II - Final VersionDocument19 pagesResearch Method II - Final Versionanelya360067No ratings yet

- OFWGaurd App - Business Proposal by Klara FranciscoDocument9 pagesOFWGaurd App - Business Proposal by Klara FranciscoKlara Jerica FranciscoNo ratings yet

- (Asahan, Diamse, Evangelista, Mendoza, Romano, Santiago) Group Work 1Document3 pages(Asahan, Diamse, Evangelista, Mendoza, Romano, Santiago) Group Work 1Vi AnneNo ratings yet

- Final Thesis AmbendanoDocument30 pagesFinal Thesis AmbendanoMylin Garciano AngcogNo ratings yet

- Research Paper Unemployment PhilippinesDocument6 pagesResearch Paper Unemployment Philippinesgvzcrpym100% (1)

- INEQUALITYDocument6 pagesINEQUALITYjacquelyn.salvador001No ratings yet

- ACTIVITY SHEET Title of The Activity: Basic Economic Problems of SocietyDocument6 pagesACTIVITY SHEET Title of The Activity: Basic Economic Problems of SocietyMariella Olympia PanuncialesNo ratings yet

- Assessing The Dynamics of Housing Stock in Urban Areas - Causes, Implications, and Strategies For Sustainable Housing SupplyDocument24 pagesAssessing The Dynamics of Housing Stock in Urban Areas - Causes, Implications, and Strategies For Sustainable Housing Supplymsyncast1No ratings yet

- Factors That Affect Supply and Demand in HousingDocument25 pagesFactors That Affect Supply and Demand in HousingEvie Liz GarciaNo ratings yet

- Running Head: Net Advantage or Disadvantage of Immigrants 1Document5 pagesRunning Head: Net Advantage or Disadvantage of Immigrants 1otieno vilmaNo ratings yet

- Literature ReviewDocument3 pagesLiterature Reviewwaleedrana786No ratings yet

- Remittances As A Factor For Encouraging Entrepreneurship Among Filipino Overseas WorkersDocument6 pagesRemittances As A Factor For Encouraging Entrepreneurship Among Filipino Overseas WorkersLeigh LynNo ratings yet

- Analysis of Socio-Economic Development of Haiti Through Haitian Diaspora Dual Citizenship.Document12 pagesAnalysis of Socio-Economic Development of Haiti Through Haitian Diaspora Dual Citizenship.Johnson muhaviNo ratings yet

- Effect of Domestic Debt On Economic Growth in The East African CommunityDocument23 pagesEffect of Domestic Debt On Economic Growth in The East African CommunityvanderwijhNo ratings yet

- LCCM Research Digest (February-April 2010 Ed.)Document4 pagesLCCM Research Digest (February-April 2010 Ed.)mis_administratorNo ratings yet

- The Widening GapDocument5 pagesThe Widening GapDorothy PuguonNo ratings yet

- Efr Vol 57 No 4 December 2019 Addressing Housing Deficit in Nigeria Issues, Challenges and Prospects Moore BEAUTYDocument22 pagesEfr Vol 57 No 4 December 2019 Addressing Housing Deficit in Nigeria Issues, Challenges and Prospects Moore BEAUTYjonathanNo ratings yet

- Economic Growth and Income Distribution in Peru: Luis Varona-Castillo and Jorge Ricardo Gonzales-CastilloDocument15 pagesEconomic Growth and Income Distribution in Peru: Luis Varona-Castillo and Jorge Ricardo Gonzales-Castilloidulia castañedaNo ratings yet

- RemittancesDocument15 pagesRemittancesfantastic worldNo ratings yet

- Immigration and Poverty in The United StatesDocument5 pagesImmigration and Poverty in The United StatesNahar SabirahNo ratings yet

- SPEECHDocument3 pagesSPEECHFlorence Balino AjeroNo ratings yet

- Predicaments of The Third World Unemployment in The Philippines (Roldeo's Group)Document13 pagesPredicaments of The Third World Unemployment in The Philippines (Roldeo's Group)Roldeo Rien AsuncionNo ratings yet

- Review Related LiteratureDocument2 pagesReview Related LiteratureChristian Capulong CasimiroNo ratings yet

- Name Class Assignment DateDocument6 pagesName Class Assignment Datehyna_khanNo ratings yet

- Application of Supply and DemandDocument55 pagesApplication of Supply and DemandRio Vina Ado Subong100% (2)

- Me Research Paper Pes1202202920Document11 pagesMe Research Paper Pes1202202920The Desi TrevorNo ratings yet

- Income Inequality Between Countries and Within Countries - EditedDocument11 pagesIncome Inequality Between Countries and Within Countries - Editedkelvin waweruNo ratings yet

- EditedDocument7 pagesEditedWild WestNo ratings yet

- Powell 20210210 ADocument20 pagesPowell 20210210 AZerohedgeNo ratings yet

- Applied EconomicsDocument13 pagesApplied EconomicsAstherielle RiegoNo ratings yet

- Research Paper About Unemployment Rate in The PhilippinesDocument5 pagesResearch Paper About Unemployment Rate in The PhilippinescwzobjbkfNo ratings yet

- Conference Draft Dhingra KondirolliDocument25 pagesConference Draft Dhingra KondirolliSakshi ShirodkarNo ratings yet

- Navero, Samantha A. GED0101 Section 83 Annotated Bibliography Topic: Unemployment ForeignDocument7 pagesNavero, Samantha A. GED0101 Section 83 Annotated Bibliography Topic: Unemployment ForeignMaccachinNo ratings yet

- THE EFFECTS OF CONTEMPORARY ISSUES ON THE PURCHASING POWER - Applied EconomicsDocument14 pagesTHE EFFECTS OF CONTEMPORARY ISSUES ON THE PURCHASING POWER - Applied EconomicsFredemira Butaslac100% (1)

- Math ArticleDocument2 pagesMath ArticleJohn Michael Valencia SabioNo ratings yet

- Introduction TariqDocument4 pagesIntroduction TariqRizwana AshrafNo ratings yet

- Conceptual FrameworkDocument10 pagesConceptual FrameworkAnonymous 97dbabE5No ratings yet

- Market For Resendtial Property in MalaysiaDocument12 pagesMarket For Resendtial Property in MalaysiaWSLeeNo ratings yet

- CTBA Human Services Fact SheetDocument7 pagesCTBA Human Services Fact SheetjkalvenNo ratings yet

- 10 - 8 Labor Issues in The Philippines - UnemploymentDocument74 pages10 - 8 Labor Issues in The Philippines - Unemploymentmewtiny31No ratings yet

- India and BotswanaDocument6 pagesIndia and Botswanaapi-242215284100% (1)

- Radhakrishna Foodland Private LimitedDocument4 pagesRadhakrishna Foodland Private LimitedSneha GodseNo ratings yet

- JPSP - 2022 - 512Document10 pagesJPSP - 2022 - 512Khanh TranNo ratings yet

- Sample Self Introduction EssayDocument7 pagesSample Self Introduction Essayafibybflnwowtr100% (2)

- بحث التوريق المنشور195257868Document17 pagesبحث التوريق المنشور195257868Chiku ProdNo ratings yet

- 9 Steps To Overcome Competition in Retail BusinessDocument3 pages9 Steps To Overcome Competition in Retail BusinessMarina IvanNo ratings yet

- The Grove, Croydon - Price ListDocument2 pagesThe Grove, Croydon - Price ListThalib KPNo ratings yet

- Sant HoshDocument3 pagesSant HoshSantosh SethumadhavanNo ratings yet

- SAP Business Blue Print (Materials Management) : Import ProcurementDocument18 pagesSAP Business Blue Print (Materials Management) : Import ProcurementAshish GuptaNo ratings yet

- 2.1 - Optimal Risk PortfoliosDocument25 pages2.1 - Optimal Risk PortfoliosMuhammad MuhaiminNo ratings yet

- Multiple Choice Questions: C. Adam SmithDocument23 pagesMultiple Choice Questions: C. Adam SmithSuhaib QaisarNo ratings yet

- Does CEMEX Have A Global AdvantageDocument3 pagesDoes CEMEX Have A Global AdvantageCarla Mairal MurNo ratings yet

- Andres Soriano Colleges of Bislig: Task A-1Document5 pagesAndres Soriano Colleges of Bislig: Task A-1Darioz Basanez LuceroNo ratings yet

- Evaluation of Import Policy Order 2021-2024Document6 pagesEvaluation of Import Policy Order 2021-2024Mohammad Shahjahan SiddiquiNo ratings yet

- ANSWER Assessment ExamDocument21 pagesANSWER Assessment ExamJazzy Mercado100% (1)

- Sawit-Sumbermas-Sarana TBK Billingual 30 Sep 22 - Released1667285054Document135 pagesSawit-Sumbermas-Sarana TBK Billingual 30 Sep 22 - Released1667285054Kon tTNo ratings yet

- Nicole F. Apin Engineering Economy Bs Che3 Depreciation: Given: RequiredDocument7 pagesNicole F. Apin Engineering Economy Bs Che3 Depreciation: Given: RequiredJohn Lloyd De CastroNo ratings yet

- Forex JuthiDocument16 pagesForex JuthiShamsun NaharNo ratings yet

- The Age of Exploration and Early CapitalismDocument2 pagesThe Age of Exploration and Early CapitalismSára UhercsákNo ratings yet

- Cash Flow and OL and FLDocument24 pagesCash Flow and OL and FLrayNo ratings yet

- 5 Property Plant and Equipment Intermediate Accounting Reviewer StucleanerDocument6 pages5 Property Plant and Equipment Intermediate Accounting Reviewer Stucleanermrsjeon0501No ratings yet

- TOPIC 8 Chapter 18 Cash and Marketable Securities ManagementDocument21 pagesTOPIC 8 Chapter 18 Cash and Marketable Securities ManagementIrene KimNo ratings yet

- Ratio Analysis Is The One of The Instruments Used For Measuring Financial Success of CompaniesDocument3 pagesRatio Analysis Is The One of The Instruments Used For Measuring Financial Success of CompaniesSapcon ThePhoenixNo ratings yet

- The Bell Trade Act of 1946Document2 pagesThe Bell Trade Act of 1946weng100% (11)

- Alcoa PresentationDocument94 pagesAlcoa PresentationvibhavNo ratings yet

- Part A Fin STMT TemplatesDocument15 pagesPart A Fin STMT Templatesvrushali_acharyaNo ratings yet

- ITF Assignment - SAIKAT SAHA (A44)Document3 pagesITF Assignment - SAIKAT SAHA (A44)Saikat SahaNo ratings yet

- Value Chain Analysis of Brinjal in The Chittagong Hill Tracts of BangladeshDocument13 pagesValue Chain Analysis of Brinjal in The Chittagong Hill Tracts of BangladeshZara KhanNo ratings yet

- (S) (S) (S) (S) (S) (S) (S) : Consumer ProductsDocument21 pages(S) (S) (S) (S) (S) (S) (S) : Consumer ProductsPeach PeaceNo ratings yet

- 6DL1136 6AA00 0PH1 (AI 8ch)Document2 pages6DL1136 6AA00 0PH1 (AI 8ch)m.kiani1984.3No ratings yet

Application of Demand and Supply Analysis (Applied Eco)

Application of Demand and Supply Analysis (Applied Eco)

Uploaded by

aenOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Application of Demand and Supply Analysis (Applied Eco)

Application of Demand and Supply Analysis (Applied Eco)

Uploaded by

aenCopyright:

Available Formats

BMSH2007

Application of Demand and Supply Analysis (Part 1)

I. Philippine Labor Market (McEachern & Burrow, 2017)

Developing countries, like the Philippines, have relatively less human and physical capital. The quality of

labor (skill, experience, and education of workers) is a vital source of productivity. There should be growth

in labor productivity to increase the standard of living.

Labor supply (labor force) is the portion of the population who are 15 years old and over willing and able

to work, which include (1) those who are actively seeking work but have not found work and (2) those

who are employed. It is important to look at the age distribution of the population, seeing how much is

made up of the age group that could join the labor supply and contributes to income generation and goods

production. The value of the country's gross domestic product (GDP) is determined by the labor supply's

contribution to the production of products and services. (Dinio & Villasis, 2017)

Gross Domestic Product (GDP) refers to the total monetary or market value of all finished goods and

services produced within a country's borders in a specific period (Fernando, 2020). In 2015, the Philippine

output per capita estimated at US$ 2,635.04, maintaining the upward trend of the output per capita.

Output per capita, the real GDP divided by the population, refers to how much the economy produces on

average per resident.

Underemployed are workers who are highly skilled but working in low-paying or low-skill jobs and part-

time workers who would prefer to be full-time (Chen, 2020). Full employment occurs when the economy

has relatively low unemployment. Unemployed refers to people who have no jobs and are looking for

work. There are four (4) types of unemployment:

1. Frictional Unemployment is created during the time required to bring together labor suppliers and

demanders. This employment does not last long, resulting in a better match-up between employees

and jobs.

2. Structural Unemployment occurs when job seekers do not have the skills demanded; posing more

problems than frictional unemployment since the unemployed may need retraining to develop the

skills required.

3. Seasonal Unemployment occurs when unemployment is due to seasonal changes in labor demand

during the year.

4. Cyclical Unemployment occurs when there is an increase in unemployment due to the recession phase

in the business cycle, although it decreases during the expansion phase.

There are significant occurrences of labor migration of Filipinos since there are a lot of overseas Filipino

workers (OFWs) (Tullao Jr., 2016).

Minimum wage refers to the lowest allowed wage paid to workers under the legislation and government

policies (Viray Jr. & Avila-Bato, 2018). The government's mandated minimum wage rates in the country

depend on the cost of living in the specific region or sector. The setting of such rates is to protect workers

from being underpaid by their employers and to give a guarantee of a sufficient income meeting their

basic needs. Issues about the minimum wage are connected with the unemployment problem – the wage

inadequacy problem worsens as the unemployment rate gets higher. In the long run, creating more jobs

shall encourage people to readily look for employment and demand higher wages. (Dinio & Villasis, 2017)

04 Handout 1 *Property of STI

student.feedback@sti.edu Page 1 of 4

BMSH2007

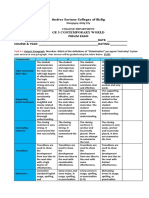

Figure 4.1 Labor Market Equilibrium in a Competitive Market with a Minimum Wage

Labor demand is similar to product demand and follows the law of demand. When wage increases, the

number of laborers decreases as employers hire more employees when wages go down. Labor supply

follows the law of supply – when wage increases, the labor supply also increases, and vice versa. Market-

clearing is the equilibrium point where labor demand and supply meet at a certain wage and quantity of

labor. A competitive equilibrium could lead to efficient resource allocation. As illustrated in Figure 4.1, in

a perfectly competitive market, full employment with a free market wage (at market-clearing) happens

as businesses and employees freely enter and exit the market leading to an efficient equilibrium allocation

of workers to businesses. The labor shortage is below market-clearing, and labor surplus is above market-

clearing. Furthermore, when there is a mandated minimum wage, employees are willing to supply 20,000

labor hours while the labor demand is only 10,000 hours. Thus, the labor market is not in equilibrium. The

amount of hired labor in the market lessens. More people are looking for a job. However, they cannot

find one, creating unemployment. Also, people may want to have a job with mandated minimum wage,

however unable to find a job due to limited labor demand. (Viray Jr. & Avila-Bato, 2018)

There are wage differences across labor markets due to the differences in labor demand and supply. With

little or no workforce reduction, the minimum wage increases the income of the poorest workers.

However, if the minimum wage is above the free market wage, employers change the job specifications

such as work schedule, work location, and duties, among others. Employers may also decrease the

number of laborers to be hired.

II. Philippine Peso and Foreign Currencies (Dinio & Villasis, 2017)

The exchange rate refers to the value of a nation's currency versus the currency of another nation or

economic zone (Chen, 2020). For instance, if another currency (e.g., US Dollars) is in demand, there will

be an increase in the price of such currency, having a higher exchange rate. One shall need more Philippine

peso to buy that other currency. Currency depreciation refers to a fall in the value of a currency in terms

of its exchange rate versus other currencies (Smith, 2021). Currency appreciation refers to an increase in

the value of one currency to another currency (Sharma, 2020). The exchange rate affects the country in

various ways. It affects the supply of OFWs – the higher the value of the foreign currencies in terms of the

Philippine peso, the more Filipinos will want to work abroad (Tullao Jr., 2016). OFWs contribute to

economic growth by sending millions of dollars to their families. The exchange rate also affects the trading

04 Handout 1 *Property of STI

student.feedback@sti.edu Page 2 of 4

BMSH2007

of the country to foreign countries (importing and exporting) and the willingness of people to travel to

other countries for leisure.

Effects of peso depreciation against US dollars: (Leaño Jr., 2016)

A. Negative effects

1. Peso depreciation (weaker currency) causes imported products and services to be more

expensive. Peso depreciation drives inflation since there is a price increase in imported products,

including crude oil.

2. The government has higher debt servicing. Debt service is the cash that is required to cover the

repayment of interest and principal on a debt for a particular period (Tuovila, 2020). With a

weaker currency, the government needs more cash to pay the debt service in foreign currency.

3. People think it is expensive to visit places abroad since they need more pesos to buy US dollars.

B. Positive effects

1. Exporters and OFWs (together with their dependents) are receiving more pesos for every US

dollar exchanged.

2. Foreign tourists think it is attractive to visit the country since their US dollars can now buy more

pesos.

III. Philippine Housing Shortage and Real Estate Boom (Dinio & Villasis, 2017)

Housing affordability refers to the ability of the household to pay, housing market price, and available

financing schemes. The country has low house affordability due to (1) the rapidly increasing ratio of unit

housing cost to income and (2) having few low-cost alternatives to ownership in the formal market. (Leaño

Jr., 2016)

During the Asian Financial Crisis in the late 1990s, construction hit low levels in the country, with some

high-profile projects being abandoned and real estate companies had to close. There is a low level of

demand for housing, thus decreasing demand for projects. As soon as the Asian countries recovered, the

construction sector started to recover as well. For years, the country is experiencing a boom in the

Business Process Outsourcing (BPO) sector. There is a growing demand for commercial spaces to

accommodate the growing sector, as well as an increase in demand for residential spaces. Families of

OFWs contributed to the demand for real estate.

There are financial institutions that people may borrow money from. However, there is a long process for

real estate loans. Renting with a monthly payment scheme is an option for those who cannot afford to

buy a house. Rent control is an intervention process that corresponds to the setting of the price ceiling

on rent. The issue of unaffordable decent housing affects the poor the most. The poor are unable to afford

decent housing due to not having formal employment and paying capacity. This then leads them to squat

on another one's land.

The National Shelter Program of the government provides housing for informal settlers and other families

who do not have enough income to buy or rent houses with rates in the prevailing market. Socialized

housing units can be bought with Php 2,302 monthly amortization. Also, the Pag-IBIG Fund (Home

Development Mutual Fund), the government-owned and subsidized housing loan provider, has a fixed

rate of 4.5% for 30 years for the socialized housing units. Although such units are located far from places

where employees work. (Leaño Jr., 2016)

04 Handout 1 *Property of STI

student.feedback@sti.edu Page 3 of 4

BMSH2007

References:

Chen, J. (2020, November 20). Underemployment. Investopedia.

https://www.investopedia.com/terms/u/underemployment.asp.

Chen, J. (2020, January 31). Exchange rate definition. Investopedia.

https://www.investopedia.com/terms/e/exchangerate.asp.

Dinio, R. P., & Villasis, G. A. (2017). Applied Economics (1st ed.). Rex Book Store, Inc.

Fernando, J. (2020, November 13). Gross domestic product (GDP). Investopedia.

https://www.investopedia.com/terms/g/gdp.asp.

Leaño, R. D. (2016). Applied Economics for senior high school. Mindshapers Co., Inc.

McEachern, W. A., & Burrow, J. L. (2017). Applied Economics: An introduction (Philippine ed.). Abiva

Publishing House, Inc.

Sharma, R. (2020, November 28). Currency appreciation definition. Investopedia.

https://www.investopedia.com/terms/c/currency-appreciation.asp.

Smith, T. (2021, January 26). What is currency depreciation? Investopedia.

https://www.investopedia.com/terms/c/currency-

depreciation.asp#:~:text=Currency%20depreciation%20is%20a%20fall%20in%20the%20value,its%

20products%20and%20services%20become%20cheaper%20to%20buy.

Tullao, T. S. (2016). Applied Economics for a progressive Philippines. The Phoenix Publishing House, Inc.

Tuovila, A. (2020, October 18). Debt service. Investopedia.

https://www.investopedia.com/terms/d/debtservice.asp.

Viray, E. B., & Avila-Bato, J. (2018). Applied Economics. Anvil Publishing, Inc.

04 Handout 1 *Property of STI

student.feedback@sti.edu Page 4 of 4

You might also like

- Tugas Problem Set 4 Ekonomi ManajerialDocument4 pagesTugas Problem Set 4 Ekonomi ManajerialRuth Adriana100% (1)

- EC2102 Topic 10 - Solution SketchDocument2 pagesEC2102 Topic 10 - Solution SketchsqhaaNo ratings yet

- Human Resources ManagementDocument9 pagesHuman Resources ManagementMehwish AwanNo ratings yet

- OFW MigrationDocument6 pagesOFW MigrationFe Pauline YeeNo ratings yet

- High Rate of Unemployment Polgov InvestigationDocument8 pagesHigh Rate of Unemployment Polgov InvestigationLili PadNo ratings yet

- Unemployment Rate 2021-The Cause and EffectsDocument27 pagesUnemployment Rate 2021-The Cause and EffectsJeffrey Paul Ventura100% (1)

- Module 5Document4 pagesModule 5Marbe Joy RazonNo ratings yet

- Chapter - I IntorductionDocument36 pagesChapter - I IntorductionMohd Natiq KhanNo ratings yet

- Lesson 7 Factor MarketsDocument9 pagesLesson 7 Factor MarketsDaniela CaguioaNo ratings yet

- Demand Function For Real EstateDocument3 pagesDemand Function For Real EstatesairamskNo ratings yet

- HousingDocument4 pagesHousingMary Joyce Camile CarantoNo ratings yet

- Supply-Demand and Philippine Economic ProblemDocument12 pagesSupply-Demand and Philippine Economic ProblemCatherine Rose Villarin Alferez100% (1)

- Impact of Unemployment To The Economic GrowthDocument20 pagesImpact of Unemployment To The Economic GrowthCyrelle MagpantayNo ratings yet

- Far Eastern University: Sampaloc, Metro Manila, PhilippinesDocument12 pagesFar Eastern University: Sampaloc, Metro Manila, Philippinescrisenalyn LeanoNo ratings yet

- The Problem Background of The StudyDocument12 pagesThe Problem Background of The StudyBrayan CaceresNo ratings yet

- Economics As An Applied Science: Lesson 1.2Document19 pagesEconomics As An Applied Science: Lesson 1.2Catherine Rose Villarin AlferezNo ratings yet

- They Serve, We Protect A Policy Analysis of Government Safeguards For ODWs From The PhilippinesDocument28 pagesThey Serve, We Protect A Policy Analysis of Government Safeguards For ODWs From The PhilippinesjvtignoNo ratings yet

- Real Estate: Unobservable Theoretical Construct. Housing Stock Depreciates Making It QualitativelyDocument9 pagesReal Estate: Unobservable Theoretical Construct. Housing Stock Depreciates Making It QualitativelykrupaleeNo ratings yet

- I Don't KnowDocument6 pagesI Don't Knowlatok48052No ratings yet

- Research Method II - Final VersionDocument19 pagesResearch Method II - Final Versionanelya360067No ratings yet

- OFWGaurd App - Business Proposal by Klara FranciscoDocument9 pagesOFWGaurd App - Business Proposal by Klara FranciscoKlara Jerica FranciscoNo ratings yet

- (Asahan, Diamse, Evangelista, Mendoza, Romano, Santiago) Group Work 1Document3 pages(Asahan, Diamse, Evangelista, Mendoza, Romano, Santiago) Group Work 1Vi AnneNo ratings yet

- Final Thesis AmbendanoDocument30 pagesFinal Thesis AmbendanoMylin Garciano AngcogNo ratings yet

- Research Paper Unemployment PhilippinesDocument6 pagesResearch Paper Unemployment Philippinesgvzcrpym100% (1)

- INEQUALITYDocument6 pagesINEQUALITYjacquelyn.salvador001No ratings yet

- ACTIVITY SHEET Title of The Activity: Basic Economic Problems of SocietyDocument6 pagesACTIVITY SHEET Title of The Activity: Basic Economic Problems of SocietyMariella Olympia PanuncialesNo ratings yet

- Assessing The Dynamics of Housing Stock in Urban Areas - Causes, Implications, and Strategies For Sustainable Housing SupplyDocument24 pagesAssessing The Dynamics of Housing Stock in Urban Areas - Causes, Implications, and Strategies For Sustainable Housing Supplymsyncast1No ratings yet

- Factors That Affect Supply and Demand in HousingDocument25 pagesFactors That Affect Supply and Demand in HousingEvie Liz GarciaNo ratings yet

- Running Head: Net Advantage or Disadvantage of Immigrants 1Document5 pagesRunning Head: Net Advantage or Disadvantage of Immigrants 1otieno vilmaNo ratings yet

- Literature ReviewDocument3 pagesLiterature Reviewwaleedrana786No ratings yet

- Remittances As A Factor For Encouraging Entrepreneurship Among Filipino Overseas WorkersDocument6 pagesRemittances As A Factor For Encouraging Entrepreneurship Among Filipino Overseas WorkersLeigh LynNo ratings yet

- Analysis of Socio-Economic Development of Haiti Through Haitian Diaspora Dual Citizenship.Document12 pagesAnalysis of Socio-Economic Development of Haiti Through Haitian Diaspora Dual Citizenship.Johnson muhaviNo ratings yet

- Effect of Domestic Debt On Economic Growth in The East African CommunityDocument23 pagesEffect of Domestic Debt On Economic Growth in The East African CommunityvanderwijhNo ratings yet

- LCCM Research Digest (February-April 2010 Ed.)Document4 pagesLCCM Research Digest (February-April 2010 Ed.)mis_administratorNo ratings yet

- The Widening GapDocument5 pagesThe Widening GapDorothy PuguonNo ratings yet

- Efr Vol 57 No 4 December 2019 Addressing Housing Deficit in Nigeria Issues, Challenges and Prospects Moore BEAUTYDocument22 pagesEfr Vol 57 No 4 December 2019 Addressing Housing Deficit in Nigeria Issues, Challenges and Prospects Moore BEAUTYjonathanNo ratings yet

- Economic Growth and Income Distribution in Peru: Luis Varona-Castillo and Jorge Ricardo Gonzales-CastilloDocument15 pagesEconomic Growth and Income Distribution in Peru: Luis Varona-Castillo and Jorge Ricardo Gonzales-Castilloidulia castañedaNo ratings yet

- RemittancesDocument15 pagesRemittancesfantastic worldNo ratings yet

- Immigration and Poverty in The United StatesDocument5 pagesImmigration and Poverty in The United StatesNahar SabirahNo ratings yet

- SPEECHDocument3 pagesSPEECHFlorence Balino AjeroNo ratings yet

- Predicaments of The Third World Unemployment in The Philippines (Roldeo's Group)Document13 pagesPredicaments of The Third World Unemployment in The Philippines (Roldeo's Group)Roldeo Rien AsuncionNo ratings yet

- Review Related LiteratureDocument2 pagesReview Related LiteratureChristian Capulong CasimiroNo ratings yet

- Name Class Assignment DateDocument6 pagesName Class Assignment Datehyna_khanNo ratings yet

- Application of Supply and DemandDocument55 pagesApplication of Supply and DemandRio Vina Ado Subong100% (2)

- Me Research Paper Pes1202202920Document11 pagesMe Research Paper Pes1202202920The Desi TrevorNo ratings yet

- Income Inequality Between Countries and Within Countries - EditedDocument11 pagesIncome Inequality Between Countries and Within Countries - Editedkelvin waweruNo ratings yet

- EditedDocument7 pagesEditedWild WestNo ratings yet

- Powell 20210210 ADocument20 pagesPowell 20210210 AZerohedgeNo ratings yet

- Applied EconomicsDocument13 pagesApplied EconomicsAstherielle RiegoNo ratings yet

- Research Paper About Unemployment Rate in The PhilippinesDocument5 pagesResearch Paper About Unemployment Rate in The PhilippinescwzobjbkfNo ratings yet

- Conference Draft Dhingra KondirolliDocument25 pagesConference Draft Dhingra KondirolliSakshi ShirodkarNo ratings yet

- Navero, Samantha A. GED0101 Section 83 Annotated Bibliography Topic: Unemployment ForeignDocument7 pagesNavero, Samantha A. GED0101 Section 83 Annotated Bibliography Topic: Unemployment ForeignMaccachinNo ratings yet

- THE EFFECTS OF CONTEMPORARY ISSUES ON THE PURCHASING POWER - Applied EconomicsDocument14 pagesTHE EFFECTS OF CONTEMPORARY ISSUES ON THE PURCHASING POWER - Applied EconomicsFredemira Butaslac100% (1)

- Math ArticleDocument2 pagesMath ArticleJohn Michael Valencia SabioNo ratings yet

- Introduction TariqDocument4 pagesIntroduction TariqRizwana AshrafNo ratings yet

- Conceptual FrameworkDocument10 pagesConceptual FrameworkAnonymous 97dbabE5No ratings yet

- Market For Resendtial Property in MalaysiaDocument12 pagesMarket For Resendtial Property in MalaysiaWSLeeNo ratings yet

- CTBA Human Services Fact SheetDocument7 pagesCTBA Human Services Fact SheetjkalvenNo ratings yet

- 10 - 8 Labor Issues in The Philippines - UnemploymentDocument74 pages10 - 8 Labor Issues in The Philippines - Unemploymentmewtiny31No ratings yet

- India and BotswanaDocument6 pagesIndia and Botswanaapi-242215284100% (1)

- Radhakrishna Foodland Private LimitedDocument4 pagesRadhakrishna Foodland Private LimitedSneha GodseNo ratings yet

- JPSP - 2022 - 512Document10 pagesJPSP - 2022 - 512Khanh TranNo ratings yet

- Sample Self Introduction EssayDocument7 pagesSample Self Introduction Essayafibybflnwowtr100% (2)

- بحث التوريق المنشور195257868Document17 pagesبحث التوريق المنشور195257868Chiku ProdNo ratings yet

- 9 Steps To Overcome Competition in Retail BusinessDocument3 pages9 Steps To Overcome Competition in Retail BusinessMarina IvanNo ratings yet

- The Grove, Croydon - Price ListDocument2 pagesThe Grove, Croydon - Price ListThalib KPNo ratings yet

- Sant HoshDocument3 pagesSant HoshSantosh SethumadhavanNo ratings yet

- SAP Business Blue Print (Materials Management) : Import ProcurementDocument18 pagesSAP Business Blue Print (Materials Management) : Import ProcurementAshish GuptaNo ratings yet

- 2.1 - Optimal Risk PortfoliosDocument25 pages2.1 - Optimal Risk PortfoliosMuhammad MuhaiminNo ratings yet

- Multiple Choice Questions: C. Adam SmithDocument23 pagesMultiple Choice Questions: C. Adam SmithSuhaib QaisarNo ratings yet

- Does CEMEX Have A Global AdvantageDocument3 pagesDoes CEMEX Have A Global AdvantageCarla Mairal MurNo ratings yet

- Andres Soriano Colleges of Bislig: Task A-1Document5 pagesAndres Soriano Colleges of Bislig: Task A-1Darioz Basanez LuceroNo ratings yet

- Evaluation of Import Policy Order 2021-2024Document6 pagesEvaluation of Import Policy Order 2021-2024Mohammad Shahjahan SiddiquiNo ratings yet

- ANSWER Assessment ExamDocument21 pagesANSWER Assessment ExamJazzy Mercado100% (1)

- Sawit-Sumbermas-Sarana TBK Billingual 30 Sep 22 - Released1667285054Document135 pagesSawit-Sumbermas-Sarana TBK Billingual 30 Sep 22 - Released1667285054Kon tTNo ratings yet

- Nicole F. Apin Engineering Economy Bs Che3 Depreciation: Given: RequiredDocument7 pagesNicole F. Apin Engineering Economy Bs Che3 Depreciation: Given: RequiredJohn Lloyd De CastroNo ratings yet

- Forex JuthiDocument16 pagesForex JuthiShamsun NaharNo ratings yet

- The Age of Exploration and Early CapitalismDocument2 pagesThe Age of Exploration and Early CapitalismSára UhercsákNo ratings yet

- Cash Flow and OL and FLDocument24 pagesCash Flow and OL and FLrayNo ratings yet

- 5 Property Plant and Equipment Intermediate Accounting Reviewer StucleanerDocument6 pages5 Property Plant and Equipment Intermediate Accounting Reviewer Stucleanermrsjeon0501No ratings yet

- TOPIC 8 Chapter 18 Cash and Marketable Securities ManagementDocument21 pagesTOPIC 8 Chapter 18 Cash and Marketable Securities ManagementIrene KimNo ratings yet

- Ratio Analysis Is The One of The Instruments Used For Measuring Financial Success of CompaniesDocument3 pagesRatio Analysis Is The One of The Instruments Used For Measuring Financial Success of CompaniesSapcon ThePhoenixNo ratings yet

- The Bell Trade Act of 1946Document2 pagesThe Bell Trade Act of 1946weng100% (11)

- Alcoa PresentationDocument94 pagesAlcoa PresentationvibhavNo ratings yet

- Part A Fin STMT TemplatesDocument15 pagesPart A Fin STMT Templatesvrushali_acharyaNo ratings yet

- ITF Assignment - SAIKAT SAHA (A44)Document3 pagesITF Assignment - SAIKAT SAHA (A44)Saikat SahaNo ratings yet

- Value Chain Analysis of Brinjal in The Chittagong Hill Tracts of BangladeshDocument13 pagesValue Chain Analysis of Brinjal in The Chittagong Hill Tracts of BangladeshZara KhanNo ratings yet

- (S) (S) (S) (S) (S) (S) (S) : Consumer ProductsDocument21 pages(S) (S) (S) (S) (S) (S) (S) : Consumer ProductsPeach PeaceNo ratings yet

- 6DL1136 6AA00 0PH1 (AI 8ch)Document2 pages6DL1136 6AA00 0PH1 (AI 8ch)m.kiani1984.3No ratings yet