Professional Documents

Culture Documents

Chapter 18 - FCRA, 2010

Chapter 18 - FCRA, 2010

Uploaded by

Harshada NarkhedeCopyright:

Available Formats

You might also like

- IAS 41 Application of Fair Value MeasurementDocument22 pagesIAS 41 Application of Fair Value MeasurementgigitoNo ratings yet

- Phuket Beach Hotel: Valuing Mutually Exclusive Capital ProjectsDocument23 pagesPhuket Beach Hotel: Valuing Mutually Exclusive Capital Projectsdarwin_butonNo ratings yet

- CV 1e - PPT - Ch01 - 051115Document74 pagesCV 1e - PPT - Ch01 - 051115Yu FengNo ratings yet

- Foreign Contribution (Regulation) Act, 2010: Important DefinitionsDocument9 pagesForeign Contribution (Regulation) Act, 2010: Important Definitionskhushi jaiswalNo ratings yet

- FCRA (PPT Notes)Document26 pagesFCRA (PPT Notes)Udaykiran Bheemagani100% (1)

- 3 Fcra PDFDocument11 pages3 Fcra PDFRaj Reddy BurujukatiNo ratings yet

- CCM 236 (2010-11) FCRA: Foreign Contribution (Regulation) Act, 2010Document28 pagesCCM 236 (2010-11) FCRA: Foreign Contribution (Regulation) Act, 2010snehal188No ratings yet

- Frequently Asked Questions (Faqs) On FcraDocument23 pagesFrequently Asked Questions (Faqs) On Fcrarvaidya2000No ratings yet

- Faqs On Foreign ContributionsDocument10 pagesFaqs On Foreign ContributionsrkhariNo ratings yet

- Proposed FCPA AmendmentsDocument13 pagesProposed FCPA AmendmentsMike KoehlerNo ratings yet

- Amendments To The FCPA's Anti-Bribery Provisions Capable of Capturing The "Demand Side" of Bribery.Document13 pagesAmendments To The FCPA's Anti-Bribery Provisions Capable of Capturing The "Demand Side" of Bribery.Mike KoehlerNo ratings yet

- Anti-BriberyProvision NewDocument4 pagesAnti-BriberyProvision NewJames KimothoNo ratings yet

- FEM Unit2 PDFDocument48 pagesFEM Unit2 PDFSurjan SinghNo ratings yet

- Guid ForeignHospitalityDocument5 pagesGuid ForeignHospitalitygupta91No ratings yet

- Prevention of Bribery, 26 of 2011Document13 pagesPrevention of Bribery, 26 of 2011aakibiNo ratings yet

- FAQ On FCRA 2010 - FCRA Registration - FCRA Return - FCRA Online - FCRA Offence - FCRA PenaltyDocument33 pagesFAQ On FCRA 2010 - FCRA Registration - FCRA Return - FCRA Online - FCRA Offence - FCRA Penaltyfcra-registration.com100% (1)

- d10z enDocument21 pagesd10z enShengulovski IvanNo ratings yet

- The Foreign Contribution (Regulation) Act, 2010: by The End of This Chapter, You Will Be Able ToDocument31 pagesThe Foreign Contribution (Regulation) Act, 2010: by The End of This Chapter, You Will Be Able ToHand MadeNo ratings yet

- Chapter - 3 Foreign Contributions (Regulation) Act, 2010: Total 1Document13 pagesChapter - 3 Foreign Contributions (Regulation) Act, 2010: Total 1arushiNo ratings yet

- FcraDocument15 pagesFcraRanjan MayanglambamNo ratings yet

- The Foreign Exchange Management Act, 1999: Legislative HistoryDocument26 pagesThe Foreign Exchange Management Act, 1999: Legislative HistoryPrince VenkatNo ratings yet

- Foreign Contribution Regulation Act, 2010: 1. BasicDocument5 pagesForeign Contribution Regulation Act, 2010: 1. BasicNarinderpal SinghNo ratings yet

- Foreign Exchange Management ActDocument23 pagesForeign Exchange Management ActvaibhavkumarsharmaNo ratings yet

- CA Certificate DPT 3 (Annual Return)Document3 pagesCA Certificate DPT 3 (Annual Return)ivsmurthyNo ratings yet

- FC Faq 07062019 PDFDocument20 pagesFC Faq 07062019 PDFsandeep kulhariaNo ratings yet

- Article 19 INDDocument28 pagesArticle 19 INDMaria Sola Gratcia BanjarnahorNo ratings yet

- 31 Usc 5312 We Are A Financial InstitutionDocument3 pages31 Usc 5312 We Are A Financial InstitutionMichael Focia100% (1)

- Foreign Exchange Management Act-1999 PDFDocument18 pagesForeign Exchange Management Act-1999 PDFtimirkantaNo ratings yet

- Foreign Exchange Management ActDocument22 pagesForeign Exchange Management ActJignesh SoniNo ratings yet

- The Foreign Contribution (Regulation) Act, 1976: Reliminary EctionsDocument13 pagesThe Foreign Contribution (Regulation) Act, 1976: Reliminary Ectionskritika tailorNo ratings yet

- Overseas Employment and Migrants Act 2013Document16 pagesOverseas Employment and Migrants Act 2013Md. ImranNo ratings yet

- Preliminary Short Title, Extent, Application and CommencementDocument25 pagesPreliminary Short Title, Extent, Application and Commencementdeepak_71No ratings yet

- Foreign Exchange Management Act, 1999Document41 pagesForeign Exchange Management Act, 1999ShameenNo ratings yet

- USDOL ExCol Conditions - GuidanceNote - 032018Document3 pagesUSDOL ExCol Conditions - GuidanceNote - 032018adventius S.SNo ratings yet

- Bit GhanaDocument13 pagesBit GhanaTimore FrancisNo ratings yet

- Chapter IDocument16 pagesChapter IevteduNo ratings yet

- Chapter I - Definitions SEC. 22. Definitions - When Used in This TitleDocument10 pagesChapter I - Definitions SEC. 22. Definitions - When Used in This TitleKayzer SabaNo ratings yet

- Title Ii Tax On Income (As Last Amended by RA No. 10653) Chapter I-Definitions SEC. 22. Definitions. - When Used in This TitleDocument6 pagesTitle Ii Tax On Income (As Last Amended by RA No. 10653) Chapter I-Definitions SEC. 22. Definitions. - When Used in This TitleniniNo ratings yet

- Title Ii Tax On Income Chapter I - Definitions SEC. 22. Definitions - When Used in This TitleDocument2 pagesTitle Ii Tax On Income Chapter I - Definitions SEC. 22. Definitions - When Used in This TitleEdward Kenneth KungNo ratings yet

- Foreign Exchange Management ActDocument21 pagesForeign Exchange Management Actanon_370052343No ratings yet

- Tax On Income Chapter I - Definitions Section 22. Definitions - When Used in This TitleDocument37 pagesTax On Income Chapter I - Definitions Section 22. Definitions - When Used in This TitleMirriam EbreoNo ratings yet

- Foreign Exchange Management Act, 1999Document18 pagesForeign Exchange Management Act, 1999Manoj BajpaiNo ratings yet

- DefinitionsDocument49 pagesDefinitionsMohammad Ramiz ShaikhNo ratings yet

- Tax CodalDocument22 pagesTax CodalMary BalojaNo ratings yet

- No. 31 of 2016Document57 pagesNo. 31 of 2016Balaji KondaNo ratings yet

- An Act To Provide For Prevention of Money LaunderingDocument46 pagesAn Act To Provide For Prevention of Money LaunderingRireNo ratings yet

- Anti Money Laundering Act, 2010Document20 pagesAnti Money Laundering Act, 2010vu psyNo ratings yet

- NIRD Sec 21-33Document13 pagesNIRD Sec 21-33Jed MacaibayNo ratings yet

- Income-Tax-for-Ind.-and-Corp. - Wo-A 2Document10 pagesIncome-Tax-for-Ind.-and-Corp. - Wo-A 2shai santiagoNo ratings yet

- Chapter - 15 Foreign Exchange - 240111 - 123533Document22 pagesChapter - 15 Foreign Exchange - 240111 - 123533fs3482335No ratings yet

- Foreign Exchange Management Act, 1999Document27 pagesForeign Exchange Management Act, 1999Tapan ShroffNo ratings yet

- Fema Act 1999Document22 pagesFema Act 1999vishalllmNo ratings yet

- Fequently Asked Questions (Faqs) On FcraDocument10 pagesFequently Asked Questions (Faqs) On FcraJATEENKAPADIA123No ratings yet

- Authorised by The Central Government Under Section 37A )Document25 pagesAuthorised by The Central Government Under Section 37A )Balaji KondaNo ratings yet

- Short Title, Extent and Commencement.Document32 pagesShort Title, Extent and Commencement.navinkapilNo ratings yet

- Immigration and Extradition RDCDDocument52 pagesImmigration and Extradition RDCDisabellanein2No ratings yet

- Perpres Nomor 39 Tahun 2020 - EngDocument41 pagesPerpres Nomor 39 Tahun 2020 - EngAgri QisthiNo ratings yet

- RR No 13-98 DonationsDocument16 pagesRR No 13-98 DonationsGil PinoNo ratings yet

- Income Tax For Ind. and CorpDocument11 pagesIncome Tax For Ind. and CorpsophiaNo ratings yet

- Tax Code of The PhilippinesDocument10 pagesTax Code of The PhilippinesPooja MurjaniNo ratings yet

- Convention on International Interests in Mobile Equipment - Cape Town TreatyFrom EverandConvention on International Interests in Mobile Equipment - Cape Town TreatyNo ratings yet

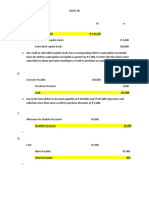

- Chapter19 - AnswerDocument27 pagesChapter19 - AnswerxxxxxxxxxNo ratings yet

- Fundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manual 1Document36 pagesFundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manual 1jillhernandezqortfpmndz100% (34)

- Byrd and Chens Canadian Tax Principles 2018 2019 1st Edition Byrd Test BankDocument14 pagesByrd and Chens Canadian Tax Principles 2018 2019 1st Edition Byrd Test BankDavidRobertsdszbc100% (9)

- MAAC 502 Question Bank 2019Document32 pagesMAAC 502 Question Bank 2019Stephen NdambakuwaNo ratings yet

- Salary SlipDocument1 pageSalary SlipAbhishek BabalNo ratings yet

- John Bala Maps Worksheet December 31, 2015 Account Title Unadjusted Trial Balance Adjustments Debit Credit Debit CreditDocument3 pagesJohn Bala Maps Worksheet December 31, 2015 Account Title Unadjusted Trial Balance Adjustments Debit Credit Debit CreditPauline BiancaNo ratings yet

- BHMCT Sem VII Spl. Front Office Mgt. II CED 701 Chapter 3Document6 pagesBHMCT Sem VII Spl. Front Office Mgt. II CED 701 Chapter 3neelsequeira.9No ratings yet

- Nfjpia Nmbe Taxation 2017 AnsDocument9 pagesNfjpia Nmbe Taxation 2017 AnsJeric RebandaNo ratings yet

- Exercise 5.1: Angtud, Mary Joy Bsma-3BDocument8 pagesExercise 5.1: Angtud, Mary Joy Bsma-3BKathlyn TajadaNo ratings yet

- Test Series: October, 2021 Mock Test Paper 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument10 pagesTest Series: October, 2021 Mock Test Paper 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionPriyanshu TomarNo ratings yet

- Partnership DissolutionDocument46 pagesPartnership Dissolutionxenovia chuchuNo ratings yet

- Working Capital Management: A Case On Nagarjuna Construction Company LTD (NCCL)Document14 pagesWorking Capital Management: A Case On Nagarjuna Construction Company LTD (NCCL)Shourya SardanaNo ratings yet

- Introduction To Finance: Course Code: FIN201 Lecturer: Tahmina Ahmed Section: 7 Email: Tahmina98ahmedsbe@iub - Edu.bdDocument17 pagesIntroduction To Finance: Course Code: FIN201 Lecturer: Tahmina Ahmed Section: 7 Email: Tahmina98ahmedsbe@iub - Edu.bdTarif IslamNo ratings yet

- Noman Ahmed Consulting - Profit and LossDocument1 pageNoman Ahmed Consulting - Profit and LossNoman ChoudharyNo ratings yet

- I Sem AccountingDocument323 pagesI Sem AccountingYashu MaruNo ratings yet

- Techno Module 1BDocument22 pagesTechno Module 1BJohn Paul MorilloNo ratings yet

- Chapter 3 Property, Plant and EquipmentDocument70 pagesChapter 3 Property, Plant and Equipmentmikiyas zeyedeNo ratings yet

- Study Mterial For Class Xi 2014-15 PDFDocument192 pagesStudy Mterial For Class Xi 2014-15 PDFrajlagwalNo ratings yet

- AF208 FE S1 2019 Revision Package - QPDocument27 pagesAF208 FE S1 2019 Revision Package - QPRavinesh Amit PrasadNo ratings yet

- Term Test 1 (Sol.)Document5 pagesTerm Test 1 (Sol.)iamneonkingNo ratings yet

- Contract CostingDocument20 pagesContract CostingtaliaferomwasNo ratings yet

- Ch05 - Basics of AnalysisDocument37 pagesCh05 - Basics of AnalysisSamar MessaoudNo ratings yet

- Medley Bites FeasibDocument59 pagesMedley Bites FeasibJunanti ArcillasNo ratings yet

- ELIZABETHDocument19 pagesELIZABETHJerickho JNo ratings yet

- Acc101 - 5Document13 pagesAcc101 - 5Nguyen Thi My Ngan (K17CT)No ratings yet

- Buko SarapDocument18 pagesBuko SarapJesika Mae100% (7)

- 21decentralized Operations and Segment ReportingDocument130 pages21decentralized Operations and Segment ReportingAilene QuintoNo ratings yet

Chapter 18 - FCRA, 2010

Chapter 18 - FCRA, 2010

Uploaded by

Harshada NarkhedeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 18 - FCRA, 2010

Chapter 18 - FCRA, 2010

Uploaded by

Harshada NarkhedeCopyright:

Available Formats

18 The Foreign Contribution (Regulation) Act, 2010

Objectives of FCRA: To Regulate the acceptance and utilisation of Foreign Contribution or Foreign Hospitality by certain persons from foreign source.

18.1 - Important Definitions

Foreign Contribution Foreign Hospitality Foreign Source Person

– Sec. 2(1)(h) – Sec. 2(1)(i) – Sec. 2(1)(j) – Sec. 2(1)(m)

Foreign contribution (FC) means the donation, delivery or Foreign source includes: The term person includes:

transfer made by any foreign source of: (i) Govt. of any foreign country or territory & its agencies; (i) an individual;

(i) any article, not being an article given to a person as a (ii) any international agency, not being the UN or its specialized (ii) a HUF;

agencies, World Bank, IMF or other agencies notified by C.G.; (iii) an association;

gift for his personal use, if the market value, in India, of

(iii) a foreign company; (iv) a company registered

such article, on the date of such gift, is not more than

(iv) a corporation, incorporated in a foreign country or territory; u/s 8 of Companies

such sum as may be specified from time to time, by the (v) a multi-national corporation; Act, 2013.

C.G. by the rules made by it in this behalf (Amount (vi) a company whose more than 50% of nominal value of share

specified is ₹ 1,00,000 – Rule 6A); capital is held, by one or more of the following, namely:

(ii) any currency, whether Indian or foreign; (A) the Government of a foreign country or territory;

(iii) any security as defined in the SCRA, 1956 & includes (B) the citizens of a foreign country or territory;

any foreign security as defined in the FEMA Act, 1999. (C) corporations incorporated in a foreign country or

territory;

(D) trusts, societies or other AOI, formed or registered in a

foreign country or territory;

Foreign hospitality means any offer, not being a purely casual one, made (E) Foreign company;

in cash or kind by a foreign source for providing a person (vii) a trade union in any foreign country or territory;

• with the costs of travel to any foreign country or territory (viii) a foreign trust or a foreign foundation;

or (ix) a society, club or other AOI formed or registered outside India;

• with free boarding, lodging, transport or medical treatment. (x) a citizen of a foreign country.

Compiled by: CA. Pankaj Garg Page 1

18.2 – Regulation of Foreign Contribution (FC) and Foreign Hospitality [Sec. 3-Sec. 8] (Part I)

Prohibition to accept Foreign Person to whom Sec. 3 shall not apply Procedure to notify an organisation of a political

Contribution (Sec. 3) (Sec. 4) nature (Sec. 5)

No FC shall be accepted by any: Nothing contained in Sec. 3 shall apply to the acceptance, by any • C.G. may, having regard to the activities/ideology/ programme of

(a) candidate for election; person specified in that section, of any FC where such any organisation, by an order published in the Official Gazette,

(b) correspondent, columnist, contribution is accepted by him: specify such organisation as an organisation of a political nature

cartoonist, editor, owner, printer or (a) by way of salary, wages or other remuneration due to him not being a political party.

publisher of a regd. newspaper; or to any group of persons working under him, from any • Before making an order, C.G. shall give the organisation, a notice

(c) public servant, Judge, Govt. foreign source or by way of payment in the ordinary course in writing informing it of the grounds, on which it is proposed to

servant or employee of any of business transacted in India by such foreign source; or be specified as an organisation of political nature.

corporation or any other body (b) by way of payment, in the course of international trade or • Organisation may within a period of 30 days from the date of the

controlled or owned by the Govt.; commerce, or in the ordinary course of business notice, make a representation to the C.G. giving reasons for not

(d) member of any Legislature; transacted by him outside India; or specifying such organisation as an organisation of political

(e) political party or office-bearer (c) as an agent of a foreign source in relation to any nature.

thereof; transaction made by such foreign source with the C.G. or • C.G. may entertain the representation after the expiry of the said

(f) organisation of a political nature as S.G.; or period of 30 days, if it is satisfied that the organisation was

may be specified u/s 5 by the C.G.; (d) by way of a gift or presentation made to him as a member prevented by sufficient cause from making the representation

(g) association or company engaged in of any Indian delegation; or within 30 days.

the production or broadcast of (e) from his relative; or • C.G. may, if it considers it appropriate, forward the

audio news or audio-visual news or (f) by way of remittance received, in the ordinary course of representation to any authority to report on such representation.

current affairs programmers’ business through any official channel, post office, or any • C.G. may, after considering the representation and the report of

through any electronic mode, or authorised person in foreign exchange under the FEMA, the authority, specify such organisation as an organisation of a

any other electronic form as 1999; or political nature not being a political party and make an order

defined in the IT Act, 2000 or any (g) by way of any scholarship, stipend or any payment of like accordingly.

other mode of mass nature. • Every order made under this section shall be made within a

communication; Rule 6 of FCRR, 2011 period of 120 days from the date of issue of notice informing the

(h) Correspondent or columnist, Any person receiving FC in excess of ₹ 1 Lakh or equivalent grounds. In case no order is made within the said period of 120

cartoonist, editor, owner of the thereto in a financial year from the relatives shall inform the C.G. days, the C.G. shall, after recording the reasons therefor, make an

association or company referred to regarding the details of the FC received by him in electronic order under this section within a period of 60 days from the

in clause (g). form in Form FC 1 within 30 days of receipt of such contribution. expiry of the said period of 120 days.

Compiled by: CA. Pankaj Garg Page 2

18.3 – Regulation of Foreign Contribution and Foreign Hospitality [Sec. 3-Sec. 8] (Part II)

Restriction on acceptance of foreign hospitality Prohibition to transfer foreign Restriction to utilize foreign contribution for

(Sec. 6) contribution to other person (Sec. 7) administrative purpose (Sec. 8)

• Members of a Legislature, No person who—

• Office bearers of political parties, (a) is registered and granted a certificate, or has obtained prior permission under this Act; and

• Judges, (b) receives any foreign contribution,

• Government servants, shall transfer such foreign contribution to any other person.

• Employees of any corporation or any other body owned or

controlled by the Government Every person, who is registered and granted a certificate or given prior permission and receives any FC, shall-

shall not, while visiting any country or territory outside India, (a) utilise such contribution for the purposes for which the contribution has been received:

accept any foreign hospitality, except with the prior permission Provided that any FC or any income arising out of it shall not be used for speculative business.

from C.G. (b) not defray sum exceeding 20% of such contribution, received in a FY, to meet administrative expenses:

Exception Provided that expenses exceeding 20% of such contribution may be defrayed with prior approval of the C.G.

No permission is required for an emergent medical aid needed on Speculative Activities - Rule 4 Administrative Expenses - Rule 5 of FCRR, 2011

account of sudden illness contracted during a visit outside India. (a) Any activity or investment 1. Salaries, wages, travel expenses or any remuneration realised by the

However, an intimation to C,G. is to be made within 1 month from that was an element of risk Members of Executive Committee or Governing Council of the person;

the date of receipt of such hospitality, and the source from which, of appreciation or 2. Expenses towards hiring of personnel for management of the activities of

and the manner in which, such hospitality was received by him. depreciation of the original the person and salaries, wages or any kind of remuneration paid, including

Rule 7 of FCRR, 2011 investment, linked to cost of travel, to such personnel;

(1) Persons specified u/s 6 who wishes to avail foreign market forces, including 3. Expenses related to consumables like electricity & water charges, telephone

hospitality shall apply to the C.G. in electronic form in investment in mutual funds & postal charges, stationery and printing charges, transport and travel

Form FC-2. or in shares; charges and expenditure on office equipment;

(2) Application shall be accompanied by an invitation letter (b) Participation in any scheme 4. Cost of accounting for and administering funds;

from the host or the host country. that promises high returns 5. Expenses towards running and maintenance of vehicles;

(3) Application must reach the appropriate authority ordinarily like investment in chits or 6. Cost of writing and filing reports;

2 weeks before the proposed date of onward journey. land or similar assets not 7. Legal and professional charges; and

(4) In case of emergent medical aid due to sudden illness during directly linked to the 8. Rent of premises, repairs to premises and expenses on other utilities.

a visit abroad, acceptance of foreign hospitality shall be declared aims and Amounts not to be counted as administrative expenses

required to be intimated to the C.G. within one month of objectives of the • Salaries of personnel engaged in training or for collection or analysis of field

such receipt. organisation or association. data of an association primarily engaged in research or training;

(5) However, no such intimation is required if the value of such Note: A debt-based secure • Expenses incurred directly in furtherance of the stated objectives of the

hospitality in emergent medical aid is upto ₹ 1 lakh or investment shall not be treated welfare-oriented organisation such as salaries to doctors of hospital,

equivalent thereto. as speculative investment. salaries to teachers of school etc.

Compiled by: CA. Pankaj Garg Page 3

18.4 – Registration [Sec. 11 - Sec. 16] (Part I)

Registration of certain Grant of certificate of registration (Sec. 12)

persons with C.G. (Sec. 11)

1. Application for grant of certificate or prior 6. Specified Condition [Sec. 12(4)]:

permission, shall be made to C.G. in prescribed (a) The 'person' making an application:

No person having a definite

form and manner along with prescribed fee. 1. is not fictitious or benami;

cultural, economic, educational, Rule 9 of FCRR, 2011 2. has not been prosecuted or convicted for indulging in activities aimed at

religious or social programme • Application for grant of prior permission conversion from one religious faith to another;

shall accept FC unless such shall be accompanied by a fee of ₹ 5,000. 3. has not been prosecuted or convicted for creating communal tension or

person obtains a certificate of • Application for the grant of registration shall disharmony in any specified district or other part of the country;

registration from the C.G. be accompanied by a fee of ₹ 10,000. 4. has not been found guilty of diversion or mis-utilisation of its funds;

2. Every person who makes an application shall be

Rule 9 of FCRR, 2011 5. is not engaged or likely to engage in propagation of sedition;

required to open ''FCRA Account'' in the manner

Application shall be in 6. is not likely to use the foreign contribution for personal gains;

specified in Sec. 17.

electronic form (Form FC-3A) 7. has not contravened any of the provisions of this Act;

3. If the application is not in the prescribed form

with an affidavit executed by 8. has not been prohibited from accepting foreign contribution;

or does not contain specified particulars, the

C.G. shall, by an order, reject the application. (b) The person making an application for registration has undertaken reasonable

each office bearer and key

4. If specified conditions are satisfied, C.G. may, activity in its chosen field for the benefit of the society.

functionary and member in

within 90 days from the date of receipt of (c) The person making an application for giving prior permission has prepared a

Proforma 'AA'.

application, register such person and grant him reasonable project for the benefit of the society.

Every person may, if it is not a certificate or give him prior permission, as the (d) In case, the applicant is an individual, he has neither been convicted under any

registered with the C.G., accept case may be, subject to such terms and law nor any prosecution for any offence is pending against him.

any FC only after obtaining the conditions as may be prescribed. (e) In case the applicant is a person other than an individual, any of its directors or

prior permission of the C.G. and Rule 9 of FCRR, 2011 office bearers has neither been convicted under any law nor any prosecution for

If the value of foreign contribution on date of any offence is pending against him.

such prior permission shall be

final disposal of application for prior permission (f) the acceptance of FC by the association/person is not likely to affect prejudicially:

valid for the specific purpose for is over ₹ 1 crore, the C.G. may permit receipt of (i) the sovereignty and integrity of India;

which it is obtained and from the foreign contribution in such instalments, as it (ii) the security, strategic, scientific or economic interest of the State;

specific source. may deem fit:

(iii) the public interest;

Rule 9 of FCRR, 2011 Provided that the 2nd & subsequent instalment

(iv) freedom or fairness of election to any Legislature;

Application for obtaining prior shall be released after submission of proof of

(v) friendly relation with any foreign State;

utilisation of 75% of foreign contribution

permission shall be in electronic (vi) harmony between religious, racial, social, linguistic, regional groups, castes

received in the previous instalment & field

form (Form FC-3B) with an inquiry of the utilisation of foreign contribution. or communities.

affidavit executed by each office 5. If C.G. does not grant, within 90 days, a (g) the acceptance of foreign contribution

bearer and key functionary and certificate or give prior permission, it shall (i) shall not lead to incitement of an offence;

member in Proforma 'AA'. communicate the reasons there for to applicant. (ii) shall not endanger the life or physical safety of any person.

Compiled by: CA. Pankaj Garg Page 4

18.5 – Registration [Sec. 11 - Sec. 16] (Part II)

Grant of certificate of registration (Sec. 12) Suspension of certificate (Sec. 13) Cancellation of Certificate (Sec. 14)

Rule 9 of FCRR, 2011 • Where the C.G. is satisfied that pending The C.G. may, by an order, cancel the certificate if:

• A person seeking registration u/s 12(4)(b) shall be in existence for 3 consideration of the question of (a) the holder of the certificate has made a

years and have spent a minimum amount of ₹ 15 lakh on its core cancelling the certificate on any of the statement in, or in relation to, the

activities for the benefit of society during the last 3 financial years. grounds mentioned in Sec. 14(1), it is application for the grant of registration or

• A person seeking prior permission for receipt of specific amount from a

necessary so to do, it may, by order in renewal thereof, which is incorrect or false;

specific donor for carrying out specific activities mentioned in Sec.

writing, suspend the certificate for a or

12(4)(c) shall meet the following criteria, namely:

(i) submit a specific commitment letter from the donor indicating the

period of 180 days or such further (b) the holder of the certificate has violated any

amount of foreign contribution and the purpose for which it is period, not exceeding 180 days as of the terms and conditions of the certificate

proposed to be given; may be specified in the order. or renewal thereof; or

(ii) for the Indian recipient persons and foreign donor organisations • Every person whose certificate has (c) in the opinion of the C.G., it is necessary in

having common members, prior permission shall be granted to the been suspended shall- the public interest to cancel the certificate;

person subject to it satisfying the following conditions, namely: not receive any foreign or

(A) the chief functionary of the recipient person shall not be a contribution during the period of (d) the holder of certificate has violated any of

part of the donor organisation;

suspension of certificate. the provisions of this Act or rules or order

(B) 75% of the office-bearers or members of the governing body

utilise, in the prescribed manner, made thereunder; or

of the person shall not be members or employees of the

foreign donor organisation; the foreign contribution in his (e) if the holder of the certificate has not been

(C) in case of foreign donor organisation being a single custody with the prior approval of engaged in any reasonable activity in its

individual that individual shall not be the chief functionary the C.G. chosen field for the benefit of the society for

or office bearer of the recipient person; and Rule 14 of FCRR, 2011

2 consecutive years or has become defunct.

(D) in case of a single foreign donor, 75%. of the office bearers or The unspent amount that can be utilised in case

Any person whose certificate has been cancelled

members of the governing body of the recipient person shall of suspension of a certificate of registration may

be as under: shall not be eligible for registration or grant of

not be the family members or close relatives of the donor.

7. Where the C.G. refuses the grant of certificate or does not give prior (i) up to 25% of the unutilised amount may prior permission for a period of 3 years from the

permission, it shall record in its order the reasons there for and furnish be spent, with the prior approval of the date of cancellation of such certificate.

a copy thereof to the applicant. However, reasons for refusal not C.G., for the declared aims and objects for Rule 15 of FCRR, 2011

required in cases where there is no obligation to give any information or which the foreign contribution was If the certificate of registration of a person who

documents or records or papers under the Right to Information Act, received. has opened an FCRA Account u/s 17 is cancelled,

2005. (ii) Remaining 75% of the unutilised foreign

the amount of foreign contribution lying

8. The certificate granted shall be valid for a period of 5 years from the contribution shall be utilised only after

unutilised in that Account shall vest with the

date of its issue. Prior permission shall be valid for the specific purpose revocation of suspension of the certificate

of registration. prescribed authority under the Act.

or specific amount of foreign contribution proposed to be received.

Compiled by: CA. Pankaj Garg Page 5

18.6 – Registration [Sec. 11 - Sec. 16] (Part III)

Surrender of Mngt. of FC of person whose

Renewal of certificate (Sec. 16)

certificate has been cancelled

certificate (Sec. 14A) or surrendered (Sec. 15)

1. Every person who has been granted a certificate, shall have such certificate renewed within 6 months before the expiry

On a request being made, the C.G. may permit any of the period of the certificate.

person to surrender the certificate granted under 2. Application for renewal of the certificate shall be made to the C.G. in prescribed form and manner with prescribed fee.

this Act, if, after making such inquiry as it deems 3. The C.G. shall renew the certificate, ordinarily within 90 days from the date of receipt of application subject to such

fit, it is satisfied that such person has not terms and conditions as it may deem fit and grant a certificate of renewal for a period of 5 years.

contravened any of the provisions of this Act, and In case the C.G. does not renew the certificate within the period of 90 days, it shall communicate the reasons there for to

the management of FC and asset, if any, created

the applicant.

out of such contribution has been vested in the

Rule 12 of FCRR, 2011

authority as provided in Sec. 15(1).

(1) Certificate of regn. issued to a person shall be liable to be renewed after the expiry of 5 years from the date of its issue.

Rule 15A of FCRR, 2011

Application for surrender of the certificate of (2) Application for renewal shall be made to the C.G. in electronic form in Form FC-3C accompanied with an affidavit

registration shall be made in electronic form in executed by each office bearer, key functionary and member in Proforma ‘AA’ within 6 months before from the date of

Form FC-7. expiry of the certificate of registration.

Rule 10 of FCRR, 2011 (3) Every person seeking renewal of the certificate shall open an FCRA Account and mention details in his application.

The validity of certificate surrendered u/s 14A of (4) An application made for renewal of the certificate of registration shall be accompanied by a fee of ₹ 5,000 only.

the Act shall be deemed to have expired on the

(5) No person whose certificate of registration has ceased to exist shall either receive or utilise the FC until the certificate is

date of acceptance of the request by the C.G.

renewed.

(6) If no application for renewal of registration is received before expiry of validity of the certificate, validity of certificate

1. The FC & assets created out of FC in custody of every

shall be deemed to have ceased from the date of completion of the period of 5 years from the date of the grant of

person whose certificate has been cancelled or

certificate of registration.

surrendered shall vest in such authority as may be

(7) The amount of FC lying unutilised in FCRA Account and utilisation account of a person whose certificate of registration

prescribed. [Addl. Chief Secretary / Principal

is deemed to have ceased and assets, if any, created out of the FC, shall vest with the prescribed authority under the Act

Secretary (Home) of the concerned State].

until the certificate is renewed or fresh registration is granted by the C.G.

2. Such authority may, if it considers necessary manage

(8) If the validity of the certificate of registration of a person has ceased in accordance with the provisions of these rules, a

the activities of the person, as the C.G. may direct and

fresh request for the grant of a certificate of registration may be made by the person to the Central Government as per

such authority may utilise the foreign contribution or

the provisions of rule 9.

dispose of the assets created out of it in case adequate

(9) In case a person provides sufficient grounds, in writing, explaining the reasons for not submitting the certificate of

funds are not available for running such activity.

registration for renewal within the stipulated time, his application may be accepted for consideration along with the

3. Authority shall return the FC and the assets vested

requisite fee and with late fees of ₹ 5000 (Five Thousand only), but not later than one year after the expiry of the

upon it to the person, if such person is subsequently

original certificate of registration.

registered under this Act.

Compiled by: CA. Pankaj Garg Page 6

18.7 – Accounts, Intimation, Audit and Disposal of Assets, etc. (Sec. 17 - Sec. 22)

FC through scheduled bank (Sec. 17) Intimation (Sec. 18) Maintenance of A/cs (Sec. 19)

(1) Every person who has been granted certificate or prior 1. Every person who has been granted a certificate or given prior approval Every person who has been

permission u/s 12 shall receive FC only in an account shall give an intimation to the C.G.: granted a certificate or given

designated as "FCRA Account" by the bank, which shall • as to the amount of each FC received by it, prior approval under this Act

be opened by him for the purpose of remittances of • the source from which and the manner in which such FC was received, shall maintain, in such form

and and manner as may be

foreign contribution in specified branch of SBI at New

• the purposes for which, and the manner in which such FC was utilised prescribed-

Delhi.

by him. (a) an account of any FC

Such person may also open another ''FCRA Account'' in 2. Every person receiving FC shall submit a copy of a statement with the received by him; and

any of the scheduled bank for the purpose of keeping or particulars of FC received duly certified by officer of the bank or (b) a record as to the manner

utilising the FC which has been received from his authorised person in foreign exchange and furnish the same to the C.G. in which such contribution

''FCRA Account'' in the specified branch of SBI at New along with the intimation. has been utilised by him.

Delhi. Rule 17 of FCRR, 2011

Such person may also open one or more accounts in one 1. Every person who receives FC, shall submit a signed report in Form FC-4 Audit of Accounts (Sec. 20)

or more scheduled banks to which he may transfer for with scanned copies of income and expenditure statement, receipt and

utilising any FC received by him in his ''FCRA Account'' payment account and B/S for every FY beginning on the 1st day of April

within 9 months of the closure of the financial year.

in the specified branch of the SBI at New Delhi or kept • If any person who has been

2. Annual return in Form FC-4 shall reflect the FC received in the exclusive

by him in another ''FCRA Account'' in a scheduled bank. granted a certificate or given

bank account and include the details in respect of the funds transferred

No funds other than FC shall be received or deposited in prior permission, fails to furnish

to other bank accounts for utilisation.

any such account. any intimation or intimation so

3. If the FC relates only to articles, the intimation shall be submitted in

(2) Specified branch of the SBI at New Delhi or the branch of Form FC-1. furnished is not in accordance

the scheduled bank where the person has opened his 4. If the FC relates to foreign securities, the intimation shall be submitted in with law or if, after inspection of

FCRA Account shall report to such authority as may be Form FC-1. such intimation, the C.G. has any

5. Every report submitted shall be duly certified by a CA. reasonable cause to believe that

specified:

6. Every such return in Form FC-4 shall also be accompanied by a copy of any provision of this Act has

(a) the prescribed amount of foreign remittance;

statement of account from the bank where the exclusive foreign been contravened, the C.G. may

(b) the source and manner in which the foreign

contribution account is maintained by the person, duly certified by an order, by specified officer, audit

remittance was received; and officer of such bank. of any books of account kept or

(c) other particulars, 7. The accounting statements referred to above shall be preserved by the maintained by such person.

in such form and manner as may be prescribed. person for a period of 6 years. • Every such officer shall have the

Rule 16 of FCRR, 2011 8. A 'Nil' report shall be furnished even if no foreign contribution is right to enter in or upon any

The bank shall report to the C.G. within 48 hours any received during a financial year.

premises at any reasonable

transaction in respect of receipt or utilisation of any FC by any Where FC has not been received or utilised during a financial year, it shall not

hour, before sunset and after

person whether or not such person is registered or granted be required to enclose certificate from CA or income and expenditure

sunrise, for the purpose of

statement or receipt and payment account or balance sheet with Form FC-4.

prior permission under the Act. auditing the said books.

Compiled by: CA. Pankaj Garg Page 7

18.8 – Adjudication (Sec. 28 – Sec. 30) and Appeals and Revision (Sec. 31 – Sec. 32)

Adjudication (Sec. 28 – Sec. 30) Appeals and Revision (Sec. 31 – Sec. 32)

Confiscation of article or currency or security obtained in Appeal

contravention of the Act (1) Where any person is aggrieved by any order, may prefer an appeal as per below provision:

Sec. 28

Any article or currency or security which is seized under the Order passed by Appeal to be made

Act shall be liable to confiscation if such article or currency or Court of Session to the High Court to which such Court is subordinate

security has been adjudged u/s 29 to have been received or Any officer specified Court of Session within the local limits of whose jurisdiction

obtained in contravention of this Act. u/s 29(1)(b) such order of adjudication of confiscation was made

Adjudication of confiscation Appeal may be preferred within 1 month from the date of communication of the order. However, the

(1) Any confiscation referred to in Sec. 28 may be adjudged: appellate court may, allow such appeal within a further period of 1 month, but not thereafter.

Sec. 31

(a) without limit, by the Court of Session within the (2) Any organisation referred to in Sec. 3(1)(f), or any person or association referred to in Sec. 6 or Sec. 9,

local limits of whose jurisdiction the seizure was aggrieved

made; and

• by an order made in pursuance of Sec. 5 or

(b) subject to prescribed limits, by such officer, not

• by an order of the C.G. refusing to give permission under this Act, or

below the rank of an Assistant Sessions Judge, as

• by any order made by the C.G. u/ss 12(2) or 12(4), or Sec. 14(1), as the case may be,

notified by C.G.

may, prefer an appeal against such order to the High Court within the local limits of whose

(2) When an adjudication is concluded by the Court of

jurisdiction the appellant ordinarily resides or carries on business or personally works for gain, or,

Session or Assistant Sessions Judge, as the case may be,

Sec. 29

where the appellant is an organisation or association, the principal office of such organisation or

the Sessions Judge or Assistant Sessions Judge may make

association is located within 60 days from the date of such order.

such order as he thinks fit for the disposal by confiscation

or delivery of seized article or currency or security, as the Revision of orders by C.G.

case may be, to any person claiming to be entitled to • C.G. may either-

possession thereof or otherwise, or which has been used of its own motion or

for the commission of any offence under this Act. on an application for revision by the person registered under this Act,

Rule 19 of FCRR, 2011 call for and examine the record of any proceeding under this Act and may make necessary inquiry

An officer referred to in Sec. 29(1)(b), may adjudge and, may pass such order thereon as it thinks fit.

Sec. 32

confiscation in relation to any article or currency seized u/s • C.G. shall not of its own motion revise any order if the order has been made more than 1 year

25, if the value of such article or the amount of such currency previously.

seized does not exceed ₹ 10,00,000. • Application must be made within 1 year from the date on which the order in question was

Procedure for confiscation communicated to the person or the date on which he otherwise came to know of it, whichever is

No order of adjudication of confiscation shall be made unless earlier.

Sec. 30

a reasonable opportunity of making a representation has Rule 20 of FCRR, 2011

been given to the person from whom any article or currency Application for revision of an order shall be made to the Secretary, MHA, GOI, New Delhi on a plain paper

or security has been seized. and it shall be accompanied by a fee of ₹ 3,000 only.

Compiled by: CA. Pankaj Garg Page 8

18.9 – Offences and Penalties (Sec. 33 – Sec. 41) and Misc. (Sec. 42 – Sec. 54)

Offences and Penalties (Sec. 33 to Sec. 41) Misc. (Sec. 42 – Sec. 54)

Making of false statement, declaration or Offences by companies (Sec. 39) (1) Power to call of information or

delivering false accounts document (Sec. 42)

Sec. 33

Imprisonment for a term which may extend to 6 (2) Investigation into cases under the Act

• Where an offence has been committed by a company,

every person who, at the time the offence was (Sec. 43)

months or with fine or with both.

committed, was in charge of, and was responsible for the • Any offence punishable under this Act

Penalty for article or currency or security

conduct of the business, shall be deemed to be guilty of may also be investigated into by such

obtained in contravention of section 10

Sec. 34

the offence and shall be liable to be proceeded against authority as the C.G. may specify in this

Imprisonment for a term which may extend to 3 and punished accordingly. behalf.

years, or with fine, or with both. • However, such person shall not be liable to any • The authority so specified shall have all

punishment if he proves that the offence was committed: the powers which an officer-in-charge of

Punishment for contravention of any provisions

(a) without his knowledge, or

of the act a police station has while making an

Sec. 35

(b) he had exercised all due diligence to prevent the

commission of such offence.

investigation into a cognizable offence.

Imprisonment for a term which may extend to 5

Rule 22 of FCRR, 2011

years, or with fine, or with both.

The CBI or any other Govt. investigating

Power to impose additional fine where article Compounding of certain Offences (Sec. 41) agency that conducts any investigation

or currency or security is not available for shall furnish reports to the C.G. on a

confiscation • Any offence punishable under this Act, not being an offence quarterly basis, indicating the status of each

Sec. 36

Fine not exceeding 5 times the value of the article punishable with imprisonment only, may, before the case, including information regarding the

institution of any prosecution, be compounded by such case number, date of registration, date of

or currency or security or ₹ 1,000, whichever is officers and for such sums as notified by the C.G.

filing charge sheet, court before which it

more. • Compounding shall not apply to an offence committed within

has been filed, progress of trial, date of

Penalty for offences where no separate a period of 3 years from the date on which a similar offence

committed was compounded under this section. judgment and the conclusion of each case.

punishment has been provided

Sec. 37

• Every officer or authority shall exercise the powers to (3) Power of C.G. to give directions (Sec. 46)

Imprisonment for a term which may extend to 1 compound an offence, subject to the direction, control and (4) Delegation of powers (Sec. 47)

year, or with fine or with both. supervision of the Central Government. (5) Power to make Rules (Sec. 48)

Prohibition of acceptance of FC • If any offence is compounded before the institution of any (6) Power to exempt in certain cases (Sec.

prosecution, no prosecution shall be instituted in relation to 50)

Whoever, having been convicted of any offence u/s

such offence, against the offender.

Sec. 38

(7) Act not to apply to certain Govt.

35 or 37, is again convicted of such offence shall not Rule 21 of FCRR, 2011

transactions (Sec. 51)

accept any FC for a period of 5 years from the date Application for compounding of an offence may be made to the

Secretary, MHA, New Delhi in electronic form and shall be (8) Application of other laws not barred

of the subsequent conviction. (Sec. 52)

accompanied by fee of ₹ 3,000 only.

Compiled by: CA. Pankaj Garg Page 9

You might also like

- IAS 41 Application of Fair Value MeasurementDocument22 pagesIAS 41 Application of Fair Value MeasurementgigitoNo ratings yet

- Phuket Beach Hotel: Valuing Mutually Exclusive Capital ProjectsDocument23 pagesPhuket Beach Hotel: Valuing Mutually Exclusive Capital Projectsdarwin_butonNo ratings yet

- CV 1e - PPT - Ch01 - 051115Document74 pagesCV 1e - PPT - Ch01 - 051115Yu FengNo ratings yet

- Foreign Contribution (Regulation) Act, 2010: Important DefinitionsDocument9 pagesForeign Contribution (Regulation) Act, 2010: Important Definitionskhushi jaiswalNo ratings yet

- FCRA (PPT Notes)Document26 pagesFCRA (PPT Notes)Udaykiran Bheemagani100% (1)

- 3 Fcra PDFDocument11 pages3 Fcra PDFRaj Reddy BurujukatiNo ratings yet

- CCM 236 (2010-11) FCRA: Foreign Contribution (Regulation) Act, 2010Document28 pagesCCM 236 (2010-11) FCRA: Foreign Contribution (Regulation) Act, 2010snehal188No ratings yet

- Frequently Asked Questions (Faqs) On FcraDocument23 pagesFrequently Asked Questions (Faqs) On Fcrarvaidya2000No ratings yet

- Faqs On Foreign ContributionsDocument10 pagesFaqs On Foreign ContributionsrkhariNo ratings yet

- Proposed FCPA AmendmentsDocument13 pagesProposed FCPA AmendmentsMike KoehlerNo ratings yet

- Amendments To The FCPA's Anti-Bribery Provisions Capable of Capturing The "Demand Side" of Bribery.Document13 pagesAmendments To The FCPA's Anti-Bribery Provisions Capable of Capturing The "Demand Side" of Bribery.Mike KoehlerNo ratings yet

- Anti-BriberyProvision NewDocument4 pagesAnti-BriberyProvision NewJames KimothoNo ratings yet

- FEM Unit2 PDFDocument48 pagesFEM Unit2 PDFSurjan SinghNo ratings yet

- Guid ForeignHospitalityDocument5 pagesGuid ForeignHospitalitygupta91No ratings yet

- Prevention of Bribery, 26 of 2011Document13 pagesPrevention of Bribery, 26 of 2011aakibiNo ratings yet

- FAQ On FCRA 2010 - FCRA Registration - FCRA Return - FCRA Online - FCRA Offence - FCRA PenaltyDocument33 pagesFAQ On FCRA 2010 - FCRA Registration - FCRA Return - FCRA Online - FCRA Offence - FCRA Penaltyfcra-registration.com100% (1)

- d10z enDocument21 pagesd10z enShengulovski IvanNo ratings yet

- The Foreign Contribution (Regulation) Act, 2010: by The End of This Chapter, You Will Be Able ToDocument31 pagesThe Foreign Contribution (Regulation) Act, 2010: by The End of This Chapter, You Will Be Able ToHand MadeNo ratings yet

- Chapter - 3 Foreign Contributions (Regulation) Act, 2010: Total 1Document13 pagesChapter - 3 Foreign Contributions (Regulation) Act, 2010: Total 1arushiNo ratings yet

- FcraDocument15 pagesFcraRanjan MayanglambamNo ratings yet

- The Foreign Exchange Management Act, 1999: Legislative HistoryDocument26 pagesThe Foreign Exchange Management Act, 1999: Legislative HistoryPrince VenkatNo ratings yet

- Foreign Contribution Regulation Act, 2010: 1. BasicDocument5 pagesForeign Contribution Regulation Act, 2010: 1. BasicNarinderpal SinghNo ratings yet

- Foreign Exchange Management ActDocument23 pagesForeign Exchange Management ActvaibhavkumarsharmaNo ratings yet

- CA Certificate DPT 3 (Annual Return)Document3 pagesCA Certificate DPT 3 (Annual Return)ivsmurthyNo ratings yet

- FC Faq 07062019 PDFDocument20 pagesFC Faq 07062019 PDFsandeep kulhariaNo ratings yet

- Article 19 INDDocument28 pagesArticle 19 INDMaria Sola Gratcia BanjarnahorNo ratings yet

- 31 Usc 5312 We Are A Financial InstitutionDocument3 pages31 Usc 5312 We Are A Financial InstitutionMichael Focia100% (1)

- Foreign Exchange Management Act-1999 PDFDocument18 pagesForeign Exchange Management Act-1999 PDFtimirkantaNo ratings yet

- Foreign Exchange Management ActDocument22 pagesForeign Exchange Management ActJignesh SoniNo ratings yet

- The Foreign Contribution (Regulation) Act, 1976: Reliminary EctionsDocument13 pagesThe Foreign Contribution (Regulation) Act, 1976: Reliminary Ectionskritika tailorNo ratings yet

- Overseas Employment and Migrants Act 2013Document16 pagesOverseas Employment and Migrants Act 2013Md. ImranNo ratings yet

- Preliminary Short Title, Extent, Application and CommencementDocument25 pagesPreliminary Short Title, Extent, Application and Commencementdeepak_71No ratings yet

- Foreign Exchange Management Act, 1999Document41 pagesForeign Exchange Management Act, 1999ShameenNo ratings yet

- USDOL ExCol Conditions - GuidanceNote - 032018Document3 pagesUSDOL ExCol Conditions - GuidanceNote - 032018adventius S.SNo ratings yet

- Bit GhanaDocument13 pagesBit GhanaTimore FrancisNo ratings yet

- Chapter IDocument16 pagesChapter IevteduNo ratings yet

- Chapter I - Definitions SEC. 22. Definitions - When Used in This TitleDocument10 pagesChapter I - Definitions SEC. 22. Definitions - When Used in This TitleKayzer SabaNo ratings yet

- Title Ii Tax On Income (As Last Amended by RA No. 10653) Chapter I-Definitions SEC. 22. Definitions. - When Used in This TitleDocument6 pagesTitle Ii Tax On Income (As Last Amended by RA No. 10653) Chapter I-Definitions SEC. 22. Definitions. - When Used in This TitleniniNo ratings yet

- Title Ii Tax On Income Chapter I - Definitions SEC. 22. Definitions - When Used in This TitleDocument2 pagesTitle Ii Tax On Income Chapter I - Definitions SEC. 22. Definitions - When Used in This TitleEdward Kenneth KungNo ratings yet

- Foreign Exchange Management ActDocument21 pagesForeign Exchange Management Actanon_370052343No ratings yet

- Tax On Income Chapter I - Definitions Section 22. Definitions - When Used in This TitleDocument37 pagesTax On Income Chapter I - Definitions Section 22. Definitions - When Used in This TitleMirriam EbreoNo ratings yet

- Foreign Exchange Management Act, 1999Document18 pagesForeign Exchange Management Act, 1999Manoj BajpaiNo ratings yet

- DefinitionsDocument49 pagesDefinitionsMohammad Ramiz ShaikhNo ratings yet

- Tax CodalDocument22 pagesTax CodalMary BalojaNo ratings yet

- No. 31 of 2016Document57 pagesNo. 31 of 2016Balaji KondaNo ratings yet

- An Act To Provide For Prevention of Money LaunderingDocument46 pagesAn Act To Provide For Prevention of Money LaunderingRireNo ratings yet

- Anti Money Laundering Act, 2010Document20 pagesAnti Money Laundering Act, 2010vu psyNo ratings yet

- NIRD Sec 21-33Document13 pagesNIRD Sec 21-33Jed MacaibayNo ratings yet

- Income-Tax-for-Ind.-and-Corp. - Wo-A 2Document10 pagesIncome-Tax-for-Ind.-and-Corp. - Wo-A 2shai santiagoNo ratings yet

- Chapter - 15 Foreign Exchange - 240111 - 123533Document22 pagesChapter - 15 Foreign Exchange - 240111 - 123533fs3482335No ratings yet

- Foreign Exchange Management Act, 1999Document27 pagesForeign Exchange Management Act, 1999Tapan ShroffNo ratings yet

- Fema Act 1999Document22 pagesFema Act 1999vishalllmNo ratings yet

- Fequently Asked Questions (Faqs) On FcraDocument10 pagesFequently Asked Questions (Faqs) On FcraJATEENKAPADIA123No ratings yet

- Authorised by The Central Government Under Section 37A )Document25 pagesAuthorised by The Central Government Under Section 37A )Balaji KondaNo ratings yet

- Short Title, Extent and Commencement.Document32 pagesShort Title, Extent and Commencement.navinkapilNo ratings yet

- Immigration and Extradition RDCDDocument52 pagesImmigration and Extradition RDCDisabellanein2No ratings yet

- Perpres Nomor 39 Tahun 2020 - EngDocument41 pagesPerpres Nomor 39 Tahun 2020 - EngAgri QisthiNo ratings yet

- RR No 13-98 DonationsDocument16 pagesRR No 13-98 DonationsGil PinoNo ratings yet

- Income Tax For Ind. and CorpDocument11 pagesIncome Tax For Ind. and CorpsophiaNo ratings yet

- Tax Code of The PhilippinesDocument10 pagesTax Code of The PhilippinesPooja MurjaniNo ratings yet

- Convention on International Interests in Mobile Equipment - Cape Town TreatyFrom EverandConvention on International Interests in Mobile Equipment - Cape Town TreatyNo ratings yet

- Chapter19 - AnswerDocument27 pagesChapter19 - AnswerxxxxxxxxxNo ratings yet

- Fundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manual 1Document36 pagesFundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manual 1jillhernandezqortfpmndz100% (34)

- Byrd and Chens Canadian Tax Principles 2018 2019 1st Edition Byrd Test BankDocument14 pagesByrd and Chens Canadian Tax Principles 2018 2019 1st Edition Byrd Test BankDavidRobertsdszbc100% (9)

- MAAC 502 Question Bank 2019Document32 pagesMAAC 502 Question Bank 2019Stephen NdambakuwaNo ratings yet

- Salary SlipDocument1 pageSalary SlipAbhishek BabalNo ratings yet

- John Bala Maps Worksheet December 31, 2015 Account Title Unadjusted Trial Balance Adjustments Debit Credit Debit CreditDocument3 pagesJohn Bala Maps Worksheet December 31, 2015 Account Title Unadjusted Trial Balance Adjustments Debit Credit Debit CreditPauline BiancaNo ratings yet

- BHMCT Sem VII Spl. Front Office Mgt. II CED 701 Chapter 3Document6 pagesBHMCT Sem VII Spl. Front Office Mgt. II CED 701 Chapter 3neelsequeira.9No ratings yet

- Nfjpia Nmbe Taxation 2017 AnsDocument9 pagesNfjpia Nmbe Taxation 2017 AnsJeric RebandaNo ratings yet

- Exercise 5.1: Angtud, Mary Joy Bsma-3BDocument8 pagesExercise 5.1: Angtud, Mary Joy Bsma-3BKathlyn TajadaNo ratings yet

- Test Series: October, 2021 Mock Test Paper 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument10 pagesTest Series: October, 2021 Mock Test Paper 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionPriyanshu TomarNo ratings yet

- Partnership DissolutionDocument46 pagesPartnership Dissolutionxenovia chuchuNo ratings yet

- Working Capital Management: A Case On Nagarjuna Construction Company LTD (NCCL)Document14 pagesWorking Capital Management: A Case On Nagarjuna Construction Company LTD (NCCL)Shourya SardanaNo ratings yet

- Introduction To Finance: Course Code: FIN201 Lecturer: Tahmina Ahmed Section: 7 Email: Tahmina98ahmedsbe@iub - Edu.bdDocument17 pagesIntroduction To Finance: Course Code: FIN201 Lecturer: Tahmina Ahmed Section: 7 Email: Tahmina98ahmedsbe@iub - Edu.bdTarif IslamNo ratings yet

- Noman Ahmed Consulting - Profit and LossDocument1 pageNoman Ahmed Consulting - Profit and LossNoman ChoudharyNo ratings yet

- I Sem AccountingDocument323 pagesI Sem AccountingYashu MaruNo ratings yet

- Techno Module 1BDocument22 pagesTechno Module 1BJohn Paul MorilloNo ratings yet

- Chapter 3 Property, Plant and EquipmentDocument70 pagesChapter 3 Property, Plant and Equipmentmikiyas zeyedeNo ratings yet

- Study Mterial For Class Xi 2014-15 PDFDocument192 pagesStudy Mterial For Class Xi 2014-15 PDFrajlagwalNo ratings yet

- AF208 FE S1 2019 Revision Package - QPDocument27 pagesAF208 FE S1 2019 Revision Package - QPRavinesh Amit PrasadNo ratings yet

- Term Test 1 (Sol.)Document5 pagesTerm Test 1 (Sol.)iamneonkingNo ratings yet

- Contract CostingDocument20 pagesContract CostingtaliaferomwasNo ratings yet

- Ch05 - Basics of AnalysisDocument37 pagesCh05 - Basics of AnalysisSamar MessaoudNo ratings yet

- Medley Bites FeasibDocument59 pagesMedley Bites FeasibJunanti ArcillasNo ratings yet

- ELIZABETHDocument19 pagesELIZABETHJerickho JNo ratings yet

- Acc101 - 5Document13 pagesAcc101 - 5Nguyen Thi My Ngan (K17CT)No ratings yet

- Buko SarapDocument18 pagesBuko SarapJesika Mae100% (7)

- 21decentralized Operations and Segment ReportingDocument130 pages21decentralized Operations and Segment ReportingAilene QuintoNo ratings yet