Professional Documents

Culture Documents

Insurance Claim

Insurance Claim

Uploaded by

Nikhil Nagendra0 ratings0% found this document useful (0 votes)

67 views7 pagesThis document provides guidance on calculating insurance claims for loss of stock and loss of profit due to fire. For loss of stock, the summary includes determining the claim stock amount on the date of fire, subtracting any salvaged stock, and applying an average clause or not to calculate the net claim. For loss of profit, the summary outlines calculating short sales, determining the gross profit percentage, computing gross profit lost and additional expenses, and applying clauses to determine the net claim. The document also provides guidance on valuing abnormal items and calculating the appropriate policy value.

Original Description:

Original Title

Insurance claim

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides guidance on calculating insurance claims for loss of stock and loss of profit due to fire. For loss of stock, the summary includes determining the claim stock amount on the date of fire, subtracting any salvaged stock, and applying an average clause or not to calculate the net claim. For loss of profit, the summary outlines calculating short sales, determining the gross profit percentage, computing gross profit lost and additional expenses, and applying clauses to determine the net claim. The document also provides guidance on valuing abnormal items and calculating the appropriate policy value.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

67 views7 pagesInsurance Claim

Insurance Claim

Uploaded by

Nikhil NagendraThis document provides guidance on calculating insurance claims for loss of stock and loss of profit due to fire. For loss of stock, the summary includes determining the claim stock amount on the date of fire, subtracting any salvaged stock, and applying an average clause or not to calculate the net claim. For loss of profit, the summary outlines calculating short sales, determining the gross profit percentage, computing gross profit lost and additional expenses, and applying clauses to determine the net claim. The document also provides guidance on valuing abnormal items and calculating the appropriate policy value.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 7

Insurance claim

Content:

Loss of stock by fire

Loss of profit by fire

Calculation of sum to be insured

Loss of stock by fire:

Steps for computation of claim for loss of stock by fire:

Step- 1 : ascertain GP % (i.e. GP %= GP X 100 )

Sales

If GP is not given in Q then prepare trading and P/l a/c

for previous year .

Step-2: Prepare memorandum trading a/c from the

beginning of the year till the date of fire and ascertain

the cl.stock on the date of fire as bal fig .

Step-3: calculate gross claim as under:

Stock as on the date of fire xxx

(-) Salvaged stock (i.e. rescued stock ) (xxx)

(+) fire fighting exp ( if any ) xxx

Gross claim xxx

Note: fire fighting exp shall be restricted to lower of

salvaged stock or actual expense

Step-4: Calculation of net claim :

o by applying average clause:

Gross claim X policy value

Stock on date of fire

o without applying average clause:

Gross claim or policy value (whichever is lower)

Note: Net claim cannot exceed gross claim . If it exceeds

then limit your answer to gross claim.

Treatment of Abnormal items or slow-moving items or poor

selling line of items:

Abnormal goods refer to outdated and obsolete goods whose

demand has decreased due to innovation and invention. So,

the realizable value of these goods is generally below cost.

So, these goods are valued at NRV.

For the purpose of the determining the normal GP%, these

goods are brought to cost in trading a/c. whenever abnormal

goods are given in the question, prepare memorandum

trading a/c in columnar for and determine the stock

separately for each type of goods.

In memorandum trading a/c , abnormal goods sold are

recorded at sold amt and loss on sale is also recorded and

carried down.

For reference:

Sale of goods on approval – journal entries

on the date of sending the goods to the buyer:

Debtors a/c Dr

To sales ( @sales val)

on year end (when goods are pending approval)

o sales a/c Dr

to Debtors a/c (@sales val)

o goods with customer on approval a/c Dr

to trading a/c

so, reduce goods sold on approval but not approved

from sales and Dr stock with customer(@cost) to the

trading a/c.

Calculation for loss of profit due to fire

loss of profit policy refers to a policy which enables the entity

(insured) to recover the foll 3 things from insurance co.

decline in profits caused due to decline in sales caused

by fire

fixed exp (insured standing charges)

addn exp (ex. Rent of the new premises)

every loss of profit policy will have 2 periods mentioned

in it:

o policy period- the damage must take place during

this period. It is for 1 year.

o Indemnity period- Max period for which insurance

co. will compensate the insured

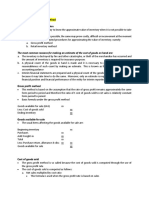

Calculation of claim under loss of profit policy:

Step 1: Calculation short sales

Standard sales xxx

+/- trend in sales xxx

xxx

(-) Actually sales (xxx)

Short sales xxx

Step 2: Computation of GP%

(NP of Py + ISC ) X 100 = xx ( GP=UISC+ISC+NP py)

Sales of py (GP- UISC=ISC+ NP py)

+/- trend in GP = xx

(ISC= insured standing charges)

Step 3: computation of GP lost

Short sales X GP% = xxx

Step 4: calculation of additional exp:

Least of the following :

o Actual additional exp ( AAE) xxx

o Proportionate additional expenses= xxx

AAE X GPR X AAT

GPR X AAT+UISC

AAE= Actual additional exp

GPR= gross profit ratio (i.e. GP%)

AAT= Adjusted annual turnover.

UISC= uninsured standing charges

o RITA X GPR xxx

(if RITA is not available use actual sales )

RITA= Reduction in turnover avoided

(extra sales generated by incurring additional

expenses)

Step 5: Calculation of Gross Claim :

GP loss (step 3) xxx

+ claim for additional exp xxx

- Savings in insured standing charges (xxx)

Gross claim xxx

Step 6: Computation of Net claim

a) By applying any clause

Policy value X gross claim

GPR X AAT

b) Without applying Avg Clause:

Gross claim or PV lower of the two

Types of Sales req to solve the q on loss of profit

Policy value to be taken :

The following steps are applied

Step 1: Determine expected sales for the prospective

policy period.

Step 2: Determine expected GP for the prospective

policy period ( Expected sales- Expected COGS )

Step 3: Determine Increase in Standing charges to be

incurred in the prospective policy period.

Step 4: Determine Uninsured standing charges (UISC)

Step 5: Policy val to be taken

= expected GP + Increase in standing charges - UISC

Notes:

Increase in Sales volume = increase in CP

You might also like

- Test Bank Principles of Risk Management Insurance 10th Edition George RejdaDocument13 pagesTest Bank Principles of Risk Management Insurance 10th Edition George Rejdaaklil100% (12)

- Fire Insurance ClaimsDocument17 pagesFire Insurance ClaimsRakshikaa V100% (1)

- Philippine Accountancy Review For Excellence: A. Format of Computation (Bir Form 1801)Document17 pagesPhilippine Accountancy Review For Excellence: A. Format of Computation (Bir Form 1801)beayaoNo ratings yet

- Summary Notes With AS Charts by CS Rohan Nimbalkar - Account - StepFly YJYB160521Document82 pagesSummary Notes With AS Charts by CS Rohan Nimbalkar - Account - StepFly YJYB160521Deep MehtaNo ratings yet

- Loss of Property and StocksDocument4 pagesLoss of Property and StocksAnil YadavNo ratings yet

- Calculation of Claim If The Policy Has Average Clause: WWW - Rracademy.inDocument7 pagesCalculation of Claim If The Policy Has Average Clause: WWW - Rracademy.inJanani PriyaNo ratings yet

- S.N. Arts, D.J. Malpani Commerce and B.N. Sarda Science College, Sangamner T.Y. B. Com. Notes: Advanced AccountingDocument34 pagesS.N. Arts, D.J. Malpani Commerce and B.N. Sarda Science College, Sangamner T.Y. B. Com. Notes: Advanced AccountingAnant DivekarNo ratings yet

- Advanced Financial Accounting and Reporting G.P. Costa Installment SalesDocument6 pagesAdvanced Financial Accounting and Reporting G.P. Costa Installment SalesmkNo ratings yet

- Chapter 3 Warranty LiabilitiesDocument6 pagesChapter 3 Warranty LiabilitiesJoana MarieNo ratings yet

- Installment Sales - NotesDocument2 pagesInstallment Sales - NotesTEOPE, EMERLIZA DE CASTRONo ratings yet

- Quick Summary of Imp. ChaptersDocument35 pagesQuick Summary of Imp. ChaptersvenumadhavanNo ratings yet

- Tybcom NotesDocument182 pagesTybcom NotesAnant DivekarNo ratings yet

- Insurance ClaimsDocument7 pagesInsurance ClaimsWilliam C JacobNo ratings yet

- Insurance ClaimsDocument17 pagesInsurance Claimshk7012004No ratings yet

- Module 5 - Ias 2 Inventory (CN)Document14 pagesModule 5 - Ias 2 Inventory (CN)Given RefilweNo ratings yet

- Fire Insurance ClaimDocument38 pagesFire Insurance ClaimUTSAV KOTHARINo ratings yet

- Practical Accounting 2: Theory & Practice Advanced Accounting Installment SalesDocument65 pagesPractical Accounting 2: Theory & Practice Advanced Accounting Installment Salesclarence dominic espino0% (1)

- Loss of ProfitDocument15 pagesLoss of Profitsoumyaviyer@gmail.com100% (1)

- E Resourse G 0 9 5e51735f3e7eeDocument2 pagesE Resourse G 0 9 5e51735f3e7eeRohit RanaNo ratings yet

- Installment SalesDocument5 pagesInstallment SalesBryan ReyesNo ratings yet

- Practical Accounting Two PDFDocument35 pagesPractical Accounting Two PDFDea Lyn Bacula100% (1)

- Summary After MidDocument40 pagesSummary After Midmc2hin9No ratings yet

- Accounting For Installment SalesDocument16 pagesAccounting For Installment SalesLeimonadeNo ratings yet

- Afar Income Recognition Installment Sales Franchise Long Term Construction PDFDocument10 pagesAfar Income Recognition Installment Sales Franchise Long Term Construction PDFKim Nicole ReyesNo ratings yet

- ACCOUNTING FOR SPECIAL TRANSACTIONS - ReviewerDocument10 pagesACCOUNTING FOR SPECIAL TRANSACTIONS - ReviewerJohn Carlo DelorinoNo ratings yet

- Farap 4503Document12 pagesFarap 4503Marya Nvlz100% (1)

- Capital Gains Tax - ArticleDocument6 pagesCapital Gains Tax - ArticleMr RizviNo ratings yet

- 19 - Chargeable Gains TaxDocument13 pages19 - Chargeable Gains Taxayushagarwal23No ratings yet

- Lectures 5, 6Document10 pagesLectures 5, 6Lolita IsakhanyanNo ratings yet

- Installment Sales: Installment Sale-A Contract Whereby The Buyer, in Exchange For TheDocument24 pagesInstallment Sales: Installment Sale-A Contract Whereby The Buyer, in Exchange For TheAbegail S. BuliginNo ratings yet

- 05 - Accounting For Merchandising Operations (Notes) PDFDocument6 pages05 - Accounting For Merchandising Operations (Notes) PDFJamie ToriagaNo ratings yet

- Arun LamsalDocument50 pagesArun LamsalSmith TiwariNo ratings yet

- Intermediate-Accounting Handout Chap 13Document2 pagesIntermediate-Accounting Handout Chap 13Joanne Rheena BooNo ratings yet

- Insurance Claim AccountDocument26 pagesInsurance Claim AccountAdiNo ratings yet

- Fabm ReviewerDocument16 pagesFabm Reviewersab lightningNo ratings yet

- Toa 9 01 Accounting Process Answer KeyDocument11 pagesToa 9 01 Accounting Process Answer KeyChris LutzNo ratings yet

- FARAP-4403 (Inventories)Document14 pagesFARAP-4403 (Inventories)Dizon Ropalito P.No ratings yet

- For MidtermDocument107 pagesFor MidtermAngelica RubiosNo ratings yet

- Installment SalesDocument3 pagesInstallment SalesMixx MineNo ratings yet

- Week 08 - 02 - Module 19 - Accounting For InventoriesDocument17 pagesWeek 08 - 02 - Module 19 - Accounting For Inventories지마리No ratings yet

- 1 ++Marginal+CostingDocument71 pages1 ++Marginal+CostingB GANAPATHYNo ratings yet

- Budgeting (Refer To Chapter 9 of Hilton Text)Document3 pagesBudgeting (Refer To Chapter 9 of Hilton Text)ShiTheng Love UNo ratings yet

- The Accounting Process-A ReviewDocument11 pagesThe Accounting Process-A ReviewLeoreyn Faye MedinaNo ratings yet

- IA Chap13-14Document20 pagesIA Chap13-14Patrick Jayson VillademosaNo ratings yet

- Inventory EstimationDocument3 pagesInventory EstimationdayanNo ratings yet

- 1 Lecture Financial Statements Is and BSDocument60 pages1 Lecture Financial Statements Is and BSby Scribd100% (1)

- 2 Book Final PDFDocument316 pages2 Book Final PDFSidra MalikNo ratings yet

- 1 - Installment Sales Accounting - Docx, Francise, Constarction ContractDocument8 pages1 - Installment Sales Accounting - Docx, Francise, Constarction ContractJason BautistaNo ratings yet

- Income Statement and Balance SheetDocument20 pagesIncome Statement and Balance Sheetpankaj tiwariNo ratings yet

- Part A: Theory Section: Fire Insurance ClaimDocument35 pagesPart A: Theory Section: Fire Insurance Claimjahnvi saraiyaNo ratings yet

- 4 Insurance ClaimDocument10 pages4 Insurance Claimazharnadvi0% (1)

- Revenue RecognitionDocument8 pagesRevenue RecognitionSedrick ChiongNo ratings yet

- LOP CalculationDocument5 pagesLOP Calculationpradeeprajendran1988No ratings yet

- CAPE U1 Preparing Financial Statemt IAS 1Document34 pagesCAPE U1 Preparing Financial Statemt IAS 1Nadine DavidsonNo ratings yet

- Lecture 1-2 Marginal Vs Absoption CostingDocument23 pagesLecture 1-2 Marginal Vs Absoption CostingAfzal AhmedNo ratings yet

- Unit-6C Insurance-ClaimsDocument49 pagesUnit-6C Insurance-Claimsadityaupreti2003No ratings yet

- Invty EstimationDocument6 pagesInvty EstimationdmiahalNo ratings yet

- Summary Notes Installment Sales and Consignment SalesDocument11 pagesSummary Notes Installment Sales and Consignment SalesJaycel OngyNo ratings yet

- RECEIVABLESDocument3 pagesRECEIVABLESTrazy Jam BagsicNo ratings yet

- Capital Gains Tax Calculation GuideDocument9 pagesCapital Gains Tax Calculation GuideAffan AliNo ratings yet

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- Allowed Amount Balance Billing Coinsurance Copayment Deductible Provider WWW - Healthcare.gov/sbc-GlossaryDocument7 pagesAllowed Amount Balance Billing Coinsurance Copayment Deductible Provider WWW - Healthcare.gov/sbc-GlossaryEmilyNo ratings yet

- Virginia's Annual Holder Report Forms & Instructions: Unclaimed Property DivisionDocument27 pagesVirginia's Annual Holder Report Forms & Instructions: Unclaimed Property DivisionWilliamsNo ratings yet

- Risk Management & Marine Insurance: BY: Gaurav Tendulkar Mbals018012 Nishidha Bhalla Mbals018013Document17 pagesRisk Management & Marine Insurance: BY: Gaurav Tendulkar Mbals018012 Nishidha Bhalla Mbals018013Hamza MasalawalaNo ratings yet

- National Housing Authority Executive Summary 2018Document8 pagesNational Housing Authority Executive Summary 2018Maki CrespoNo ratings yet

- Omnibus Counter Guarantee Aarti PhosphatesDocument3 pagesOmnibus Counter Guarantee Aarti PhosphatesChetan PatilNo ratings yet

- ReportDocument34 pagesReportDarsh SoniNo ratings yet

- Motor Insurance - Commercial Vehicle Liability Only PolicyDocument3 pagesMotor Insurance - Commercial Vehicle Liability Only PolicyJk DigitNo ratings yet

- Agent's Name/ Intermediary Name: Mobile/Landline Telephone Number: AddressDocument26 pagesAgent's Name/ Intermediary Name: Mobile/Landline Telephone Number: AddressHarshal NardeNo ratings yet

- Office of Mental Health (OMH) Outpatient Clinic Treatment Services ProtocolDocument11 pagesOffice of Mental Health (OMH) Outpatient Clinic Treatment Services ProtocolChristine KajetzkeNo ratings yet

- Bajaj Allianz General Insurance Company LTDDocument8 pagesBajaj Allianz General Insurance Company LTDSamsung M31sNo ratings yet

- Agricultural InsuranceDocument21 pagesAgricultural InsuranceSamer SahuNo ratings yet

- Types of Fire Insurance PolicyDocument3 pagesTypes of Fire Insurance PolicyAshiqur RahmanNo ratings yet

- Michigan COVID-19 Racial Disparities Task Force RecommendationsDocument34 pagesMichigan COVID-19 Racial Disparities Task Force RecommendationsWXYZ-TV Channel 7 DetroitNo ratings yet

- Introduction To BareCon 2001 - BARECON 89 Standard Bareboat Charter RevisedDocument33 pagesIntroduction To BareCon 2001 - BARECON 89 Standard Bareboat Charter Revisedrobertts2012100% (1)

- Plagiarism Checker Report - A Free Online PlagiarDocument1 pagePlagiarism Checker Report - A Free Online PlagiarAlisaNo ratings yet

- Decision Making in Insurance PoliciesDocument8 pagesDecision Making in Insurance Policiesgladiola janiNo ratings yet

- Efu Life InsuranceDocument4 pagesEfu Life InsuranceCS SNo ratings yet

- Account Statement 081221 070122Document52 pagesAccount Statement 081221 070122anandalogyNo ratings yet

- 3 PDFDocument66 pages3 PDFBiro Keuangan BEM FH UINo ratings yet

- 2019 Report Portland StateDocument79 pages2019 Report Portland StateMatt BrownNo ratings yet

- 2307Document3 pages2307Anonymous yCFuth7BL80% (1)

- Medicare Claims Processing Manual: Chapter 1 - General Billing RequirementsDocument314 pagesMedicare Claims Processing Manual: Chapter 1 - General Billing RequirementsMaurice MarchantNo ratings yet

- GenMath11 Q2 Mod7 Deffered-Annuity Version2-From-CE1-CE2 EvaluatedDocument25 pagesGenMath11 Q2 Mod7 Deffered-Annuity Version2-From-CE1-CE2 EvaluatedLarilyn BenictaNo ratings yet

- United India Insurance Company Limited: MR Shanker Ramesh AgshikarDocument9 pagesUnited India Insurance Company Limited: MR Shanker Ramesh AgshikarShambhavi AgshikarNo ratings yet

- Young Star PolicyDocument1 pageYoung Star PolicyStar HealthNo ratings yet

- HDFC Life Insurance Company Company Update 5 September 2021Document10 pagesHDFC Life Insurance Company Company Update 5 September 2021vaibhav_kaushikNo ratings yet

- 5 - Afisco Insurance Corp. vs. Court of Appeals, G.R. No. 112675, January 25, 1999Document23 pages5 - Afisco Insurance Corp. vs. Court of Appeals, G.R. No. 112675, January 25, 1999Michelle Jude TinioNo ratings yet

- Asset Class-Land & BuildingDocument6 pagesAsset Class-Land & BuildingShivamNo ratings yet