Professional Documents

Culture Documents

Equal The: Credits. These Are The Rules of Debit and Credit. The Following Summarizes The Rules

Equal The: Credits. These Are The Rules of Debit and Credit. The Following Summarizes The Rules

Uploaded by

Shoyo HinataOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Equal The: Credits. These Are The Rules of Debit and Credit. The Following Summarizes The Rules

Equal The: Credits. These Are The Rules of Debit and Credit. The Following Summarizes The Rules

Uploaded by

Shoyo HinataCopyright:

Available Formats

The Accounting Equation and the Double Entry System 73

DEBITS AND CREDITS-THE DOUBLE-ENTRY SYSTEM

Accounting is based on a double-entry system which means that the dual effects of a

business transaction is recorded. A debit side entry must have a corresponding credit

side entry. For every transaction, there must be one or more accounts debited and one

or more accounts credited. Each transaction affects at least two accounts. The total

debits fora transaction must always equal the total credits.

An account is debited when an amount is entered on the left side of the account and

credited when an amount is entered on the right side. The abbreviations for debit and

credit are Dr. (from the Latin debere) and Cr. (from the Latin credere), respectively.

The account type determines how increases or decreases in it ar recorded. increases in

assets are recorded as debits (on the left side of the account) while decreases in assets

are recorded as credits (on the right side). Conversely, increases in liabilities and

owner's equity are recorded by credits and decreases are entered as debits.

The rules of debit and credit for income and expense accounts are based on the

relationship of these accounts to owner's equity. Income increases owner's equity and

expense decreases owner's equity. Hence, increases in income are recorded as credits

and decreases as debits. Increases in expenses are recorded as debits and decreases as

credits. These are the rules of debit and credit. The following summarizes the rules:

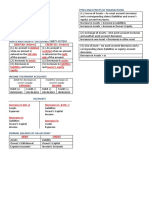

Balance Sheet Accounts

Assets Liabilities and Owner's Equity

Debit Credit Debit Credit

(+) ( () (+)

Increases Decreases Decreases Increases

Normal Balance Normal Balance

Income Statement Accounts

Debit for Credit for

decreases in owner's equity increases in owner's equity

Expenses Income

Debit Credit Debit Credit

(+) ( () (+)

Increases Decreases Decreases Increases

Normal Balante Normal Balance

You might also like

- Account ClassificationDocument2 pagesAccount ClassificationAzeemAkram100% (1)

- Chart of Accounts FABM1Document8 pagesChart of Accounts FABM1Mylene Santiago100% (3)

- Original PetitionDocument14 pagesOriginal PetitionCraigNo ratings yet

- Accounting Equation and Double Entry System3Document10 pagesAccounting Equation and Double Entry System3John rafael Morojo 11-ABMNo ratings yet

- Accounting Lec#3Document13 pagesAccounting Lec#3abbasikashifali83No ratings yet

- LESSON 7 The Accounting EquationDocument3 pagesLESSON 7 The Accounting EquationUnamadable UnleomarableNo ratings yet

- Accounting Equation and Double Entry System3Document11 pagesAccounting Equation and Double Entry System3Malvin Roix OrenseNo ratings yet

- LESSON 4 Part II Without AnswerDocument3 pagesLESSON 4 Part II Without AnswerJulliene Sanchez DamianNo ratings yet

- Debit and Credit RulesDocument1 pageDebit and Credit RulesYonas D. EbrenNo ratings yet

- Week 3-1 The AccountsDocument2 pagesWeek 3-1 The AccountsSelenaNo ratings yet

- Cengage Learning Accounting 27th Edition-Copy RemovedDocument4 pagesCengage Learning Accounting 27th Edition-Copy Removedkaya waffles12No ratings yet

- Accounts Debit Credit: Normal Balance Normal BalanceDocument4 pagesAccounts Debit Credit: Normal Balance Normal BalanceVG R1NG3RNo ratings yet

- TOPIC 4 Principle - Of.double - EntryDocument4 pagesTOPIC 4 Principle - Of.double - EntryNurul Ain Binti Abd RahimNo ratings yet

- The Golden Rules of AccountingDocument1 pageThe Golden Rules of AccountingRamesh ManiNo ratings yet

- Chapter 3 The Accounting Equation The Double Entry SystemDocument7 pagesChapter 3 The Accounting Equation The Double Entry System2023302256No ratings yet

- Basic Accounting and Reporting (Ballada, W., Et. Al) Chapter 3 - The Accounting Equation and The Double Entry System The AccountDocument5 pagesBasic Accounting and Reporting (Ballada, W., Et. Al) Chapter 3 - The Accounting Equation and The Double Entry System The AccountJohn Joseph100% (4)

- The Expanded Ledger: Revenue, Expense, and DrawingsDocument37 pagesThe Expanded Ledger: Revenue, Expense, and DrawingsNavroopamNo ratings yet

- Module 3 Recording and Posting TransactionsDocument20 pagesModule 3 Recording and Posting TransactionsXiavNo ratings yet

- Financial Accounting 15Th Edition 15 E Edition Duchac Full ChapterDocument53 pagesFinancial Accounting 15Th Edition 15 E Edition Duchac Full Chapterjoyce.clewis414100% (17)

- Debit and Credit RulesDocument4 pagesDebit and Credit RulesDanica VetuzNo ratings yet

- Principle of Double Entry & Trial Balance: Prepared By: Nurul Hassanah HamzahDocument35 pagesPrinciple of Double Entry & Trial Balance: Prepared By: Nurul Hassanah HamzahNur Amira NadiaNo ratings yet

- Ebook Financial Accounting PDF Full Chapter PDFDocument67 pagesEbook Financial Accounting PDF Full Chapter PDFjulie.morrill858100% (35)

- Analyzing and Recording TransactionsDocument43 pagesAnalyzing and Recording TransactionsAndrea ValdezNo ratings yet

- Basic Accounting - First BridgingDocument20 pagesBasic Accounting - First BridgingMae NamocNo ratings yet

- Increases Increases: DecreasesDocument9 pagesIncreases Increases: Decreaseswinter fallsNo ratings yet

- Debit Definition: Meaning and Its Relationship To Credit: Related TermsDocument1 pageDebit Definition: Meaning and Its Relationship To Credit: Related TermsThuraNo ratings yet

- 1999 John Wiley & Sons, Inc. Weygandt/Principles 5eDocument1 page1999 John Wiley & Sons, Inc. Weygandt/Principles 5eSteven SandersonNo ratings yet

- Acc. ch-6 Key Terms and Chapter Summary-6Document2 pagesAcc. ch-6 Key Terms and Chapter Summary-6AARYAN JESWANINo ratings yet

- Lesson 3.3: T-AccountsDocument3 pagesLesson 3.3: T-AccountsJamiellaNo ratings yet

- Transaction 1: Company A Sold Its Products at $120 and Received The Full Amount in CashDocument24 pagesTransaction 1: Company A Sold Its Products at $120 and Received The Full Amount in CashPoonam RedkarNo ratings yet

- IBS More Journal EntriesDocument23 pagesIBS More Journal EntriesRitam chaturvediNo ratings yet

- Financial Accounting Module 2 SummaryDocument2 pagesFinancial Accounting Module 2 Summarymohita.gupta4No ratings yet

- Accounting: Assets Liabilities + Equity A L + EDocument4 pagesAccounting: Assets Liabilities + Equity A L + EJohn LeeNo ratings yet

- Accounting: Assets Liabilities + Equity A L + EDocument4 pagesAccounting: Assets Liabilities + Equity A L + EjermaineNo ratings yet

- Analyzing and Recording TransactionDocument24 pagesAnalyzing and Recording TransactionĐàm Quang Thanh TúNo ratings yet

- Book Keeping 101 by Tom Clendon 1688995453Document6 pagesBook Keeping 101 by Tom Clendon 1688995453amayarNo ratings yet

- Lecture 06Document21 pagesLecture 06Mohammad ZiaullahNo ratings yet

- Accounting Essentials Chapter 3 SynthesisDocument1 pageAccounting Essentials Chapter 3 SynthesisdaraNo ratings yet

- Journal Entry Debit and Credit ConventionDocument2 pagesJournal Entry Debit and Credit ConventionSandy Y SandysanthoshkumarNo ratings yet

- The Recording Process: Weygandt - Kieso - KimmelDocument68 pagesThe Recording Process: Weygandt - Kieso - Kimmelatia fariaNo ratings yet

- Kami Export - Deven Sainovic - 2-1 Work Together PG 31Document1 pageKami Export - Deven Sainovic - 2-1 Work Together PG 31Deven SainovicNo ratings yet

- Fundamentals of Accounting 3 1Document5 pagesFundamentals of Accounting 3 1Ale EalNo ratings yet

- The Accounting Process The Bookkeeping: BasicDocument17 pagesThe Accounting Process The Bookkeeping: Basicmouhammad mouhammadNo ratings yet

- Ii. The Recording ProcessDocument2 pagesIi. The Recording Processby ScribdNo ratings yet

- Accounting Enhancemen1Document1 pageAccounting Enhancemen1Ishiangreat100% (1)

- Debit and CreditDocument10 pagesDebit and CreditAnne Thea AtienzaNo ratings yet

- Analyses of Transactions and Rules of Debit and CreditDocument6 pagesAnalyses of Transactions and Rules of Debit and CreditJay-r HermosoNo ratings yet

- CHAPTER 1 - PPT Intro To AccountingDocument14 pagesCHAPTER 1 - PPT Intro To AccountingAmrinNo ratings yet

- ACFM CH-THREE 2022-UpdatedDocument130 pagesACFM CH-THREE 2022-Updatedmihiretche0No ratings yet

- TRial BalanceDocument8 pagesTRial BalanceBarcelona, Tricia Mae F.No ratings yet

- Accounting LedgerDocument5 pagesAccounting LedgerlekalonzoNo ratings yet

- CH2Document44 pagesCH2星喬No ratings yet

- First SpetDocument30 pagesFirst Spetteem teerutNo ratings yet

- T - Account: Liabilities Liability Account Assets Asset Accounts Owner'S Equity Owner's Capital AccountDocument1 pageT - Account: Liabilities Liability Account Assets Asset Accounts Owner'S Equity Owner's Capital Accountraymond guintibanoNo ratings yet

- Basic AccountingDocument2 pagesBasic Accountingram sagarNo ratings yet

- T Accounts: Basic Representations of The AccountsDocument21 pagesT Accounts: Basic Representations of The Accountscnsuu_No ratings yet

- 02 Accounting Interview QuestionsDocument2 pages02 Accounting Interview QuestionsanitalauymNo ratings yet

- Basis of Debit and CreditDocument17 pagesBasis of Debit and CreditBanaras KhanNo ratings yet

- Account Titles: Accounting (Cagayan State University)Document6 pagesAccount Titles: Accounting (Cagayan State University)Keith Anthony AmorNo ratings yet

- Chapter Two - Fundamentals of AcctDocument14 pagesChapter Two - Fundamentals of AcctGedionNo ratings yet

- Teeter-Totter Accounting: Your Visual Guide to Understanding Debits and Credits!From EverandTeeter-Totter Accounting: Your Visual Guide to Understanding Debits and Credits!Rating: 2 out of 5 stars2/5 (1)

- Internal Management Information : Education/AcademeDocument1 pageInternal Management Information : Education/AcademeShoyo HinataNo ratings yet

- Oartnership: AccouDocument1 pageOartnership: AccouShoyo HinataNo ratings yet

- Accounting: Postings UpdatedDocument1 pageAccounting: Postings UpdatedShoyo HinataNo ratings yet

- Qualified: Management AccountingDocument1 pageQualified: Management AccountingShoyo HinataNo ratings yet

- Chap. 2Document1 pageChap. 2Shoyo HinataNo ratings yet

- AssetDocument1 pageAssetShoyo HinataNo ratings yet

- Bus. TransactionsDocument1 pageBus. TransactionsShoyo HinataNo ratings yet

- 2 NDDDDDDocument2 pages2 NDDDDDShoyo HinataNo ratings yet

- Optimal Decisions Using Marginal AnalysisDocument6 pagesOptimal Decisions Using Marginal AnalysisShoyo Hinata100% (1)

- The JournalDocument1 pageThe JournalShoyo HinataNo ratings yet

- Registration For Campus Organizations: Kabacan, Cotabato PhilippinesDocument2 pagesRegistration For Campus Organizations: Kabacan, Cotabato PhilippinesShoyo HinataNo ratings yet

- Accounting CycleDocument1 pageAccounting CycleShoyo HinataNo ratings yet

- Acc. QuestionsDocument1 pageAcc. QuestionsShoyo HinataNo ratings yet

- CASE PROBLEM: The Not-So-Harmless Cage DiversDocument2 pagesCASE PROBLEM: The Not-So-Harmless Cage DiversShoyo HinataNo ratings yet

- The Accounting Profession Definition of Accounting: Important PointsDocument9 pagesThe Accounting Profession Definition of Accounting: Important PointsShoyo HinataNo ratings yet

- LiiiiiiiiiiittttDocument2 pagesLiiiiiiiiiiittttShoyo HinataNo ratings yet

- Partnership Liquidation 1Document17 pagesPartnership Liquidation 1Shoyo HinataNo ratings yet

- Module 3 Section 3 TaskDocument1 pageModule 3 Section 3 TaskShoyo Hinata0% (1)

- Null 1Document3 pagesNull 1Rakesh MothukuriNo ratings yet

- Bài Tập Về Cấu Trúc Ngữ PhápDocument5 pagesBài Tập Về Cấu Trúc Ngữ PhápKhánh HàNo ratings yet

- PNP Patrol Plan Proficiency Evaluation Process GuidelinesDocument10 pagesPNP Patrol Plan Proficiency Evaluation Process GuidelinesCpsmu Santiago Cpo0% (1)

- Porsche's Attempt To Acquire VW - Part 2Document4 pagesPorsche's Attempt To Acquire VW - Part 2Wes StapleyNo ratings yet

- It's Christmas 3rDocument1 pageIt's Christmas 3rMaiite CerroNo ratings yet

- SafetyDocument3 pagesSafetymseroplanoNo ratings yet

- Schematic Document: Phantom (Huron River) Sandy Bridge (BGA1023) + Cougar Point (SFF)Document56 pagesSchematic Document: Phantom (Huron River) Sandy Bridge (BGA1023) + Cougar Point (SFF)Juan Carlos Ramiréz DjNo ratings yet

- Crim III DigestsDocument18 pagesCrim III DigestsErika PotianNo ratings yet

- November 26 Shabbat AnnouncementsDocument4 pagesNovember 26 Shabbat AnnouncementsgnswebNo ratings yet

- MOOC VAUDE Academy SolutionDocument19 pagesMOOC VAUDE Academy SolutionNgô CẩmNo ratings yet

- Business Communication 1Document5 pagesBusiness Communication 1Sugandha KumariNo ratings yet

- AI-enabled Recruiting: What Is It and How Should A Manager Use It?Document12 pagesAI-enabled Recruiting: What Is It and How Should A Manager Use It?prasanna hemalathaNo ratings yet

- Production and Operations Management Individual Assignment-1: Jatin Gereja: 208113 Company Name: KIA Motors CorporationDocument13 pagesProduction and Operations Management Individual Assignment-1: Jatin Gereja: 208113 Company Name: KIA Motors Corporationram avtar BansalNo ratings yet

- HWSETA-Learner Employment Contract 2Document11 pagesHWSETA-Learner Employment Contract 2Rodgers Nsama KazembeNo ratings yet

- Cornelius HILL Trudie Hastings Hill, H/W, Appellants v. Reederei F. Laeisz G.M.B.H., Rostock Schiffarhtsgesellschaft MS Priwall MBH & CO. KGDocument29 pagesCornelius HILL Trudie Hastings Hill, H/W, Appellants v. Reederei F. Laeisz G.M.B.H., Rostock Schiffarhtsgesellschaft MS Priwall MBH & CO. KGScribd Government DocsNo ratings yet

- BPMIndustryFramework V5 PDFDocument27 pagesBPMIndustryFramework V5 PDFDaveNo ratings yet

- 2 Specifications: 2-1 Nominal Capacity and Nominal InputDocument1 page2 Specifications: 2-1 Nominal Capacity and Nominal InputBMCNo ratings yet

- CAPE 2019 Information Technology Unit 2 Paper 2Document22 pagesCAPE 2019 Information Technology Unit 2 Paper 2get thosebooksNo ratings yet

- Program Bubble Meet Badminton EventDocument8 pagesProgram Bubble Meet Badminton Eventtrishaabellar31No ratings yet

- Pointers On SalesDocument19 pagesPointers On SalesDonvidachiye Liwag CenaNo ratings yet

- Assignment 1Document13 pagesAssignment 1林佑邦No ratings yet

- Result PMRDFDocument35 pagesResult PMRDFChandra Shekhar GohiyaNo ratings yet

- Sonza vs. ABS CBNDocument26 pagesSonza vs. ABS CBNDani McstNo ratings yet

- Knowledge As Salvation - A Study in Early BuddhismDocument299 pagesKnowledge As Salvation - A Study in Early BuddhismGuhyaprajñāmitra3No ratings yet

- Bibliografía de La Parte ADocument26 pagesBibliografía de La Parte AIgnacio RojasNo ratings yet

- Arii 2018Document207 pagesArii 2018Bisa AcademyNo ratings yet

- OASGFO 2022 058 Requests For The Participation of Learners and Teachers in Extra CurricularDocument2 pagesOASGFO 2022 058 Requests For The Participation of Learners and Teachers in Extra CurricularRocky Nathaniel SalesNo ratings yet

- MythologyDocument6 pagesMythologysharlymarieNo ratings yet

- KalkiDocument8 pagesKalkidavidroygcNo ratings yet