Professional Documents

Culture Documents

AY2021-22 ANISETTY SINDHU-EFPPS3410N-Computation

AY2021-22 ANISETTY SINDHU-EFPPS3410N-Computation

Uploaded by

forty oneOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AY2021-22 ANISETTY SINDHU-EFPPS3410N-Computation

AY2021-22 ANISETTY SINDHU-EFPPS3410N-Computation

Uploaded by

forty oneCopyright:

Available Formats

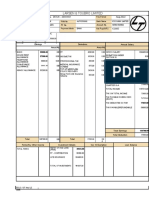

ANISETTY SINDHU AY 2021-2022

Address: 307/A, Janapriya Nivas, Nacharam Uppal

K.V.RANGAREDDY, TELANGANA - 500076

Mobile: 91-7893663359

E-Mail: Sindhuanisetty@gmail.com

Computation of Income (ITR4)

PAN: EFPPS3410N Status: Individual

Date of Birth 03/06/1992 Residential Status: Resident

Father's Name: ANISETTY KRISHNA Gender: Male

Bank A/C no.: 4538000100014567 IFSC code: PUNB0393500

E-Filing Status: Not E-Filed Aadhaar Card Number: 750027682967

Tax Summary (Amount in 'Rs')

Business and Profession 8,44,576

Gross Total Income 8,44,576

Less: Total Deductions - 2,35,000

Rounded off from 6,09,576 as per

Total Income (Taxable) Section 288A 6,09,580

Tax Payable 35,793

Interest & Fees + 1,638

Total Tax Payable 37,431

Less: Taxes Paid TCS - 8,445

Rounded off from 28,986 as per

Tax Due Section 288B 28,990

Taxes are applicable as per normal provision

Please refer Annexure for details

Business and Profession

Particulars Amount

Presumptive Income u/s 44AD 8,44,576

Net Income under the head "Business and Profession" 8,44,576

Profit (where books of accounts maintained)

Business nature Business code Trade Name

Medical clinics 18010 Sindhu Medical Clinic

Section 44AD

Business nature Business code Trade Name

Retail sale of other products n.e.c 09028 ANISETTY SINDHU

Particulars From Non-Digital Transactions Total

Gross Receipt 35,58,786 35,58,786

Income u/s 44AD 8,44,576 8,44,576

Deductions

Section Gross Amount Deductible Amount

80C (Total) 1,50,000 1,50,000

80D (Total) 25,000

Medical Insurance Premium - Self, Spouse or Children 40,000

80GG (Refer Annexure for calculation) 60,000

80GG 60,000

Total 2,35,000

Income Tax

Total Income 6,09,580

Basic Exemption 2,50,000

Income Tax 34,416

Health and Education Cess 1,377

Total Tax 35,793

Interest Due 1,638

234B(5 month(s)) 1,365

234C 273

Tax Paid -8,445

TCS 8,445

Payable 28,990

Interest u/s 234C

Installment Tax Percentage of Tax Tax to be Tax Remaining Interest Interest

period Due to be Deposited Deposited Paid Tax due Rate u/s 234C

1st Quarter

0 15% 0 0 0 3% 0

(Upto 15th Jun)

2st Quarter

0 45% 0 0 0 3% 0

(Upto 15th Sep)

3st Quarter

0 75% 0 0 0 3% 0

(Upto 15th Dec)

4st Quarter

27,348 100% 27,348 0 27,348 1% 273

(Upto 15th Mar)

273

Taxes Paid

(Self-Assessment Tax, TCS)

Self-Assessment Tax

BSR Code Date Challan No Amount

U/S 140(A) 28,990

TCS

Name Tan Type of Deducted Brought TDS Income For Balance

Income Year Forward Amount Which TDS

TDS Claimed Paid

RADHA KRISHNA

AUTOMOBILES HYDR05204D 2020 8,445 11,26,000 0

PRIVATE LIMITED

Annexures

Deduction u/s 80GG for Rent Paid

Particulars Amount

A. Rs 5000 per month 60,000

B. 25% of Adjusted total Income 1,67,394

C. Rent Paid - 10% of Adjusted total Income 77,042

Deductible Amount (Minimum of above) 60,000

Bank Account Details

SI No. IFSC Code Name of the Bank Account No.

1 PUNB0393500 PUNJAB NATIONAL BANK 4538000100014567

Financial Particulars

In case of presumptive income

Financial particulars as on 31/03/2021

Sundry Debtors 0

Sundry Creditors 0

Stock-in-trade 0

Cash Balance 12

Signature Prepared by Venkat Raghava

For ANISETTY SINDHU Raghava & Associates

You might also like

- Income Tax Computation FormatDocument2 pagesIncome Tax Computation Formatrathan50% (4)

- Convertible Bond - Credit SuisseDocument52 pagesConvertible Bond - Credit Suissenyj martin100% (1)

- CompDocument3 pagesCompTANMOY BISWASNo ratings yet

- Computation FY 18-19 PDFDocument6 pagesComputation FY 18-19 PDFRuch JainNo ratings yet

- NON MEDICLAIM AY2024-25 SARBANI BORA-BDPPB0721G-ComputationDocument2 pagesNON MEDICLAIM AY2024-25 SARBANI BORA-BDPPB0721G-ComputationlaskarmohinNo ratings yet

- 2017-18 CoiDocument2 pages2017-18 CoiAshok ShahNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument2 pagesIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriNo ratings yet

- Dimension Data India PVT LTD: Pay Slip For The Month of August 2019Document1 pageDimension Data India PVT LTD: Pay Slip For The Month of August 2019Ashok ChauhanNo ratings yet

- Profits and Gains of Business or ProfessionDocument3 pagesProfits and Gains of Business or ProfessionKumar GajulaNo ratings yet

- Parmjit Singh Comp Ay 202324Document2 pagesParmjit Singh Comp Ay 202324SANJEEV KUMARNo ratings yet

- Adobe Scan 10 Mar 2022Document3 pagesAdobe Scan 10 Mar 2022LET'S SQUASH LET'S SQUASHNo ratings yet

- Upgrad PayslipDocument1 pageUpgrad PayslipSantanu SauNo ratings yet

- May 2023 Pay SlipDocument2 pagesMay 2023 Pay Slipgomathi7777_33351404No ratings yet

- AY2021-22 NAGENDER GATTU-BYVPG0689K-Computation-1Document2 pagesAY2021-22 NAGENDER GATTU-BYVPG0689K-Computation-1forty oneNo ratings yet

- Vinod Singh Computation Revised-3Document4 pagesVinod Singh Computation Revised-3vinodNo ratings yet

- Nov Salary SlipDocument1 pageNov Salary Slipvarunyadav3050No ratings yet

- June 2023 PayslipDocument2 pagesJune 2023 Payslipgomathi7777_33351404100% (1)

- Comp. 2223Document2 pagesComp. 2223yatan kapoorNo ratings yet

- Draft Computation SheetDocument3 pagesDraft Computation Sheettax advisorNo ratings yet

- Srinivas Vutukuri AY 2021-2022: Computation of Income (ITR4)Document3 pagesSrinivas Vutukuri AY 2021-2022: Computation of Income (ITR4)forty oneNo ratings yet

- Basic SolDocument3 pagesBasic SolADARSH MISHRANo ratings yet

- Employee Tax Calculation ReportDocument10 pagesEmployee Tax Calculation ReportFawazilHamdalahNo ratings yet

- Sri. v. Siva Kumar 31.03.2021Document2 pagesSri. v. Siva Kumar 31.03.2021Saravana SaruNo ratings yet

- Computation of Total Income Income From Business or Profession (Chapter IV D) 385000Document3 pagesComputation of Total Income Income From Business or Profession (Chapter IV D) 385000Rohit kandpalNo ratings yet

- Tax - Osman Gani - 22-23Document1 pageTax - Osman Gani - 22-23M N Sharif MintuNo ratings yet

- 1% Stock Movement StrategyDocument1 page1% Stock Movement Strategyashish10mca9394No ratings yet

- Itr-3 Coi - F.Y 2021-22 - Ayush BhosleDocument6 pagesItr-3 Coi - F.Y 2021-22 - Ayush Bhosledarshil thakkerNo ratings yet

- Tele:: Total Tax, Fee and InterestDocument1 pageTele:: Total Tax, Fee and Interestamarnath ojhaNo ratings yet

- ReportDocument1 pageReportsumayaNo ratings yet

- Ageeta AY 2018-2019: Computation of Income (ITR4)Document50 pagesAgeeta AY 2018-2019: Computation of Income (ITR4)pmcmbharat264No ratings yet

- May'24 Salary SlipDocument1 pageMay'24 Salary Slipayanbhargav3No ratings yet

- Draft Comp 23-24-1Document2 pagesDraft Comp 23-24-1Vishal SinghNo ratings yet

- CompDocument3 pagesCompchalukrcNo ratings yet

- R K S Infra Computation 2022Document4 pagesR K S Infra Computation 2022birpal singhNo ratings yet

- Total Income StatementDocument2 pagesTotal Income StatementMohan Ganesh S/o A.MurugesanNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument2 pagesIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriNo ratings yet

- Ilovepdf MergedDocument7 pagesIlovepdf MergedRavi ChristoNo ratings yet

- April'24 Salary SilpDocument1 pageApril'24 Salary Silpayanbhargav3No ratings yet

- It Computation Sheet Fy 2020-21 - LopamudraDocument3 pagesIt Computation Sheet Fy 2020-21 - LopamudraGirija Prasad SwainNo ratings yet

- HTMLReportsDocument1 pageHTMLReportsRashmi Awanish PandeyNo ratings yet

- Sal Slip Feb 2019Document1 pageSal Slip Feb 2019pankajNo ratings yet

- Direct Tax Solution PDFDocument8 pagesDirect Tax Solution PDFGaurav SoniNo ratings yet

- UnknownDocument1 pageUnknownAjit KumarNo ratings yet

- Tata MD ShafeeqDocument2 pagesTata MD ShafeeqAnkit ChoudharyNo ratings yet

- Kamlesh AY 2021-2022: Computation of Income (ITR4)Document2 pagesKamlesh AY 2021-2022: Computation of Income (ITR4)Varun AgarwalNo ratings yet

- Bikash Kirtania 2023Document3 pagesBikash Kirtania 2023jaiswalv629057No ratings yet

- Gebr. Pfeiffer (India) Pvt. LTD.: Pay Slip For The Month of February 2018Document1 pageGebr. Pfeiffer (India) Pvt. LTD.: Pay Slip For The Month of February 2018Abhijeet SahuNo ratings yet

- Ay2023 24 Meharvan Mewada Eiapm7602g ComputationDocument2 pagesAy2023 24 Meharvan Mewada Eiapm7602g ComputationSteve BurnsNo ratings yet

- Earnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Document1 pageEarnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Nanha-Munna swaggerNo ratings yet

- Itr 1 FormatDocument3 pagesItr 1 FormatPawanNo ratings yet

- Book 1Document2 pagesBook 1NandhakumarNo ratings yet

- Salary Slip - June 2022 - UnlockedDocument2 pagesSalary Slip - June 2022 - UnlockedRmillionsque FinserveNo ratings yet

- Compu PDFDocument4 pagesCompu PDFMihir ThakkarNo ratings yet

- Comp 2324Document2 pagesComp 2324ranjeetdecorater023No ratings yet

- Total Earnings Total Deductions: Net Pay (RS.) 41,000.00Document1 pageTotal Earnings Total Deductions: Net Pay (RS.) 41,000.00Diwakar ChaturvediNo ratings yet

- Oct2023 PayslipDocument1 pageOct2023 PayslipTKSVELNo ratings yet

- STEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Document1 pageSTEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Amaresh NayakNo ratings yet

- Employees Pay Slip Jan 2024 10114831Document1 pageEmployees Pay Slip Jan 2024 10114831foxek65301No ratings yet

- CG APR 2024 1356579 PayslipDocument1 pageCG APR 2024 1356579 Payslipshobhitpaliwal16No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Profit & Loss A/c Projected Profit and Loss Account For The 3 YearsDocument3 pagesProfit & Loss A/c Projected Profit and Loss Account For The 3 Yearsforty oneNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961forty oneNo ratings yet

- Checklist Builder FinanceDocument1 pageChecklist Builder Financeforty oneNo ratings yet

- Requirements For Tie UpDocument3 pagesRequirements For Tie Upforty oneNo ratings yet

- AY2021-22 NAGENDER GATTU-BYVPG0689K-Computation-1Document2 pagesAY2021-22 NAGENDER GATTU-BYVPG0689K-Computation-1forty oneNo ratings yet

- Srinivas Vutukuri AY 2021-2022: Computation of Income (ITR4)Document3 pagesSrinivas Vutukuri AY 2021-2022: Computation of Income (ITR4)forty oneNo ratings yet

- Finance Project On Working Capital Management in Indian Overseas Bank - 151307738Document67 pagesFinance Project On Working Capital Management in Indian Overseas Bank - 151307738SANJEEV KUMARNo ratings yet

- Transamerica IULDocument20 pagesTransamerica IULJoseAliceaNo ratings yet

- Monetary Policy 1Document9 pagesMonetary Policy 1Hasan ShoaibNo ratings yet

- Balance Sheet of Eicher Motors For MonicaDocument4 pagesBalance Sheet of Eicher Motors For MonicaBBA SFNo ratings yet

- NABARDDocument40 pagesNABARDJesse LarsenNo ratings yet

- CFA Investment Research Challenge University of BahrainDocument32 pagesCFA Investment Research Challenge University of BahrainMuhammad Hamza RizwanNo ratings yet

- August 2022Document1 pageAugust 2022amitdesai92No ratings yet

- Differential Analysis PDFDocument56 pagesDifferential Analysis PDFMaria Priencess AcostaNo ratings yet

- Aliceblue Digital FormDocument29 pagesAliceblue Digital Formshemanth123No ratings yet

- Camille Realty Journal To FSDocument9 pagesCamille Realty Journal To FSVenus AriateNo ratings yet

- DBC22 Financial Accounting - IIDocument483 pagesDBC22 Financial Accounting - IIGoogle Plays50% (2)

- Case 11-1 2004Document2 pagesCase 11-1 2004Bitan BanerjeeNo ratings yet

- Standard Time at The Address of The Named Insured As Stated HereinDocument3 pagesStandard Time at The Address of The Named Insured As Stated Hereinbabichj87No ratings yet

- Step-By-Step Explanation: SubjectDocument2 pagesStep-By-Step Explanation: SubjectJeremark100% (3)

- Corporate Financial Strategy: Setting The ContextDocument33 pagesCorporate Financial Strategy: Setting The ContextSakinaNo ratings yet

- Chapter - 1 Meaning & Objectives of AccountingDocument7 pagesChapter - 1 Meaning & Objectives of AccountingAnkit SinghNo ratings yet

- Financial Inclusion in India: A Theoritical Assesment: ManagementDocument6 pagesFinancial Inclusion in India: A Theoritical Assesment: ManagementVidhi BansalNo ratings yet

- Projectoblicon BuildersDocument18 pagesProjectoblicon Builderslou017No ratings yet

- Money Market vs. Capital Market: What's The Difference? Money Market vs. Capital Market: An OverviewDocument16 pagesMoney Market vs. Capital Market: What's The Difference? Money Market vs. Capital Market: An OverviewyanaNo ratings yet

- Production Costs - ReadingDocument1 pageProduction Costs - ReadingalcheccaNo ratings yet

- Philippine Stock Exchange Power PointDocument16 pagesPhilippine Stock Exchange Power PointEd Leen Ü100% (4)

- Week 12 Investment Management: Options ContractsDocument47 pagesWeek 12 Investment Management: Options ContractsAarti J. KaushalNo ratings yet

- Module No 1 Airline FinanceDocument14 pagesModule No 1 Airline Financeshaik akhilNo ratings yet

- FF AssignmentDocument8 pagesFF Assignmentjeaner2008No ratings yet

- Tax-planning-And-management Solved MCQs (Set-1)Document8 pagesTax-planning-And-management Solved MCQs (Set-1)Umair Virk100% (1)

- EF3333 - Financial Systems, Markets and InstrumentsDocument13 pagesEF3333 - Financial Systems, Markets and InstrumentsLi Man KitNo ratings yet

- ResuméDocument11 pagesResuméyouss efNo ratings yet

- Sample Real Estate Research PaperDocument6 pagesSample Real Estate Research Paperfemeowplg100% (1)

- QuizDocument2 pagesQuizaprilbetito02No ratings yet