Professional Documents

Culture Documents

AIR TRANSPORTATION OFFICE V SPOUSES RAMOS

AIR TRANSPORTATION OFFICE V SPOUSES RAMOS

Uploaded by

Rochelle Joy SolisOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AIR TRANSPORTATION OFFICE V SPOUSES RAMOS

AIR TRANSPORTATION OFFICE V SPOUSES RAMOS

Uploaded by

Rochelle Joy SolisCopyright:

Available Formats

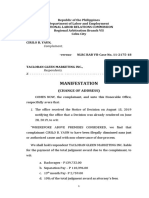

AIR TRANSPORTATION OFFICE v SPOUSES DAVID and ELISEA RAMOS

GR no. 159402; February 23, 2011

FACTS: Spouses David and Elisea Ramos discovered that a portion of their land was being used as part

of the runway and running shoulder of the Loakan Airport being operated by petitioner Air

Transportation Office (ATO). The respondents agreed after negotiations to convey the affected portion

by deed of sale to the ATO in consideration of the amount of P778, 150.00. However, the ATO failed to

pay despite repeated verbal and written demands. Thus, the respondents filed an action for collection

against the ATO and some of its officials in the RTC.

PROCEDURAL HISTORY: ATO invoked as an affirmative defense the issuance of Proclamation No. 1358,

whereby President Marcos had reserved certain parcels of land that included the respondents’ affected

portion for use of the Loakan Airport. They asserted that the RTC had no jurisdiction to entertain the

action without the State’s consent considering that the deed of sale had been entered into the

performance of governmental functions. The RTC denied the ATO’s motion for the preliminary hearing

of the affirmative defense. ATO then commenced a special civil action for certiorari in the CA to assail

RTC’s orders. The CA dismissed the petitioner upon fining that the assailed orders were not tainted with

grave abuse of discretion. Subsequently, the RTC rendered its decision ordering ATO to pay respondents

the agreed amount including damages. ATO appealed to the CA, which affirmed the RTC’s decision.

ISSUE: WON ATO could be sued without the State’s consent

RULING: YES. An unincorporated government agency without any separate juridical personality of its

own enjoys immunity from suit because it is invested with an inherent power of sovereignty.

Accordingly, a claim for damages against the agency cannot prosper; otherwise, the doctrine of state

immunity is violated. However, the need to distinguish between an unincorporated government agency

performing governmental function and one performing proprietary functions has arisen. The immunity

has been upheld in favor of the former because its function is governmental or incidental to such

function. It has not been upheld in favor of the latter whose function was not in pursuit of a necessary

function of government but was essentially a business.

The character of ATO as an agency of the Government not performing a purely governmental or

sovereign function, but was instead involved in the management and maintenance of the Loakan

Airport, an activity that was not the exclusive prerogative of the State in its sovereign capacity. Hence,

the ATO had no claim to the State’s immunity from suit. The doctrine of sovereign immunity cannot be

successfully invoked to defeat a valid claim for compensation arising from the taking without just

compensation and without the proper expropriation proceedings being first resorted to of the plaintiff’s

property.

Lastly, the issue of whether or not the ATO could be sued without the State’s consent has been

rendered moot by the passage of RA no. 9497, which established in place of the ATO the Civil Aviation

Authority of the Philippines (CAAP). With CAAP having legally succeeded the ATO, the obligations that

the ATO had incurred by virtue of the deed of sale with the Ramos spouses might now be enforced

against the CAAP.

Wherefore, petition denied.

You might also like

- Ranciere - Does Democracy Mean SomethingDocument18 pagesRanciere - Does Democracy Mean SomethingNatural LogNo ratings yet

- 0 UST 2019 Deans Circle - Partnership, Agency and Trust Cases PDFDocument46 pages0 UST 2019 Deans Circle - Partnership, Agency and Trust Cases PDFMark Emmanuel LazatinNo ratings yet

- Endrinal, Jeffrey C. Persons and Family RelationsDocument1 pageEndrinal, Jeffrey C. Persons and Family RelationsJeffrey EndrinalNo ratings yet

- Facts: The Main Target of This Petition Is Section 35 ofDocument17 pagesFacts: The Main Target of This Petition Is Section 35 ofFrances Grace DamazoNo ratings yet

- Case 27 Internal Revenue-Vs.-primetownDocument2 pagesCase 27 Internal Revenue-Vs.-primetownangelo doceoNo ratings yet

- Dioquino Vs LaureanoDocument2 pagesDioquino Vs Laureanocmv mendozaNo ratings yet

- Municipality of Makati Vs CA DigestDocument2 pagesMunicipality of Makati Vs CA DigestAnonymous 5k7iGyNo ratings yet

- UntitledDocument3 pagesUntitledFredie Ancheta VedaniaNo ratings yet

- Case Digest - The Philippines Judges Association Vs PradoDocument3 pagesCase Digest - The Philippines Judges Association Vs Pradotany purrNo ratings yet

- Ang Yu VS CaDocument2 pagesAng Yu VS Cairene anibongNo ratings yet

- U.P. v. DizonDocument2 pagesU.P. v. DizonMadeliniaNo ratings yet

- 55 Casco V JimenezDocument1 page55 Casco V JimenezGelay PererasNo ratings yet

- Leg Res CasesDocument5 pagesLeg Res CasesVina LangidenNo ratings yet

- Tobias v. Abalos, 239 SCRA 106Document4 pagesTobias v. Abalos, 239 SCRA 106zatarra_12No ratings yet

- Mecano V COA and Sssea Vs CADocument2 pagesMecano V COA and Sssea Vs CANEWBIENo ratings yet

- Leon Sibal, Plaintiff-Appellant v. Emiliano J. Valdez, Et. Al., Defendants-Appellee GR No. 26278, August 4, 1927 Johnson, J. Bai Malyanah A. SalmanDocument1 pageLeon Sibal, Plaintiff-Appellant v. Emiliano J. Valdez, Et. Al., Defendants-Appellee GR No. 26278, August 4, 1927 Johnson, J. Bai Malyanah A. Salmanbai malyanah a salmanNo ratings yet

- Digest 1Document11 pagesDigest 1Francess Mae AlonzoNo ratings yet

- Republic Vs SandovalDocument2 pagesRepublic Vs SandovalivyNo ratings yet

- Holy See VSDocument2 pagesHoly See VSMicho DiezNo ratings yet

- VIDAYLIN YAMON-LEACH v. ATTY. ARTURO B. ASTORGADocument17 pagesVIDAYLIN YAMON-LEACH v. ATTY. ARTURO B. ASTORGAsejinmaNo ratings yet

- Icmc Vs Calleja ManglapuzDocument4 pagesIcmc Vs Calleja ManglapuzKaren GinaNo ratings yet

- Statcon Notes (UST)Document12 pagesStatcon Notes (UST)AYRHA JHANE CRUZNo ratings yet

- Agustin vs. EduDocument4 pagesAgustin vs. EduvivivioletteNo ratings yet

- 02 THE UNITED STATES V. TAYLOR-BigalbalDocument2 pages02 THE UNITED STATES V. TAYLOR-BigalbalIsay Yason100% (1)

- Sta Rosa Realty V Court of AppealsDocument4 pagesSta Rosa Realty V Court of AppealsPaul Joshua Torda SubaNo ratings yet

- Labor Law 1 - Calalang v. Williams GR No. 47800 02 Dec 1940 70 Phil 727 SC Full TextDocument5 pagesLabor Law 1 - Calalang v. Williams GR No. 47800 02 Dec 1940 70 Phil 727 SC Full TextJOHAYNIENo ratings yet

- Petitioners: La Bugal-B'Laan Tribal Association Inc, Rep. Chariman F'Long Miguel Lumayong Etc Respondent: Secretary Victor O. Ramos, DENR EtcDocument2 pagesPetitioners: La Bugal-B'Laan Tribal Association Inc, Rep. Chariman F'Long Miguel Lumayong Etc Respondent: Secretary Victor O. Ramos, DENR EtcApple Gee Libo-onNo ratings yet

- Facts:: Hon. Executive Secretary Eduardo R. Ermita, It Was Held ThatDocument1 pageFacts:: Hon. Executive Secretary Eduardo R. Ermita, It Was Held ThatBea Cape100% (1)

- Jalojos (Digest)Document1 pageJalojos (Digest)Anonymous joeguHlNo ratings yet

- 10 Bacabac v. PeopleDocument10 pages10 Bacabac v. PeopleCarlota Nicolas VillaromanNo ratings yet

- 18 - CA 327 As Amended by PD 1445Document1 page18 - CA 327 As Amended by PD 1445Aquiline ReedNo ratings yet

- Equal Protection of The LawsDocument5 pagesEqual Protection of The LawsMark LagsNo ratings yet

- 002 Macariola v. AsuncionDocument3 pages002 Macariola v. AsuncionKathrinaFernandezNo ratings yet

- 6456347Document1 page6456347Kirstine Mae GilbuenaNo ratings yet

- Romualdez and Aquino Residency CaseDocument3 pagesRomualdez and Aquino Residency CaseThessaloe May FernandezNo ratings yet

- Crim Law Week 3 CasesDocument13 pagesCrim Law Week 3 CasesSahoooNo ratings yet

- 101Document1 page101PAMELA DOLINANo ratings yet

- Arigo vs. Swift - DigestDocument5 pagesArigo vs. Swift - DigestStruggler 369No ratings yet

- Magallona Vs Ermita Et AlDocument3 pagesMagallona Vs Ermita Et AlVir Stella MarianitoNo ratings yet

- Tagaytay Highlands International Golf Club Incorporated vs. Tagaytay Highlands Employees UnionPTGWODocument9 pagesTagaytay Highlands International Golf Club Incorporated vs. Tagaytay Highlands Employees UnionPTGWOKanglawNo ratings yet

- Oblicon 2nd Meeting RecordingsDocument9 pagesOblicon 2nd Meeting RecordingsMaverick Jann Esteban100% (1)

- Oposa vs. FactoranDocument2 pagesOposa vs. FactorandingledodyNo ratings yet

- Cordillera v. COADocument2 pagesCordillera v. COAJemson Ivan WalcienNo ratings yet

- Brentwood Academy v. Tennessee Secondary School Athletic Assn., 531 U.S. 288 (2001)Document20 pagesBrentwood Academy v. Tennessee Secondary School Athletic Assn., 531 U.S. 288 (2001)Scribd Government DocsNo ratings yet

- Mecano Vs Commission On Audit. G.R 103982 Dec 11 1992Document6 pagesMecano Vs Commission On Audit. G.R 103982 Dec 11 1992Jen AniscoNo ratings yet

- Imbong vs. Ochoa - SCRA DoctrineDocument136 pagesImbong vs. Ochoa - SCRA DoctrineGuiller C. MagsumbolNo ratings yet

- NPC DAMA vs. National Power CorpDocument16 pagesNPC DAMA vs. National Power CorpChristine Karen BumanlagNo ratings yet

- Amigable Vs CuencaDocument1 pageAmigable Vs CuencaPNP MayoyaoNo ratings yet

- DigestsDocument4 pagesDigestsNica Cielo B. LibunaoNo ratings yet

- De Leon v. Esguerra (Autonomy of Barangays)Document19 pagesDe Leon v. Esguerra (Autonomy of Barangays)kjhenyo218502No ratings yet

- Imbong vs. OchoaDocument11 pagesImbong vs. OchoaAnn Dela TorreNo ratings yet

- Petitioner/s: Manila Prince Hotel (MPH) Respondent/s: Government Service Insurance System (GSIS) Manila HotelDocument6 pagesPetitioner/s: Manila Prince Hotel (MPH) Respondent/s: Government Service Insurance System (GSIS) Manila HotelMark Angelo Cabillo100% (1)

- Mining On Private LandsDocument3 pagesMining On Private LandsGlory Perez-ReyesNo ratings yet

- Globe-Mackay Cable and Radio Corporation v. NLRC: ShallDocument1 pageGlobe-Mackay Cable and Radio Corporation v. NLRC: ShallRem SerranoNo ratings yet

- PBM EMPLOYEES V PBMDocument2 pagesPBM EMPLOYEES V PBMLloyd David P. VicedoNo ratings yet

- Incaosti vs. YuloDocument4 pagesIncaosti vs. YuloArkhaye SalvatoreNo ratings yet

- 28 G.R. No. 170139, August 05, 2014 Sameer Vs CabilesDocument12 pages28 G.R. No. 170139, August 05, 2014 Sameer Vs CabilesrodolfoverdidajrNo ratings yet

- Philippine Apparel Workers Union, Petitioner, vs. The National Labor Relations COMMISSION and PHILIPPINE APPAREL, INC., RespondentsDocument2 pagesPhilippine Apparel Workers Union, Petitioner, vs. The National Labor Relations COMMISSION and PHILIPPINE APPAREL, INC., RespondentsRaymondNo ratings yet

- Spouses Ponciano Almeda and Eufemia P. Almeda The Court of Appeals and Philippine National Bank G.R. No. 113412 April 17, 1996 FactsDocument2 pagesSpouses Ponciano Almeda and Eufemia P. Almeda The Court of Appeals and Philippine National Bank G.R. No. 113412 April 17, 1996 FactsJovz BumohyaNo ratings yet

- 060 Peralta v. CSCDocument3 pages060 Peralta v. CSCDarrell MagsambolNo ratings yet

- Air Transportation Vs David G.R. No. 159402 CASE DIGESTDocument1 pageAir Transportation Vs David G.R. No. 159402 CASE DIGESTLBitzNo ratings yet

- City of Manila vs. Judge Grecia-Cuerdo, Et AlDocument2 pagesCity of Manila vs. Judge Grecia-Cuerdo, Et AlRochelle Joy SolisNo ratings yet

- BPI V CADocument3 pagesBPI V CARochelle Joy SolisNo ratings yet

- Ayala Corp. vs. MadayagDocument2 pagesAyala Corp. vs. MadayagRochelle Joy SolisNo ratings yet

- Anita Mangila v.CA and Loreta GuinDocument3 pagesAnita Mangila v.CA and Loreta GuinRochelle Joy SolisNo ratings yet

- Benigno Magpale Vs CSCDocument2 pagesBenigno Magpale Vs CSCRochelle Joy SolisNo ratings yet

- Bulawan v. AquendeDocument3 pagesBulawan v. AquendeRochelle Joy Solis100% (1)

- Agra 3 Laws For MidtermsDocument84 pagesAgra 3 Laws For MidtermsRochelle Joy SolisNo ratings yet

- A.L. ANG NETWORK, INC. v. MONDEJAR (G.R. No. 200804, January 22, 2014)Document2 pagesA.L. ANG NETWORK, INC. v. MONDEJAR (G.R. No. 200804, January 22, 2014)Rochelle Joy SolisNo ratings yet

- Employeesd Union of BAyer Phils. V. Bayer Phils.Document4 pagesEmployeesd Union of BAyer Phils. V. Bayer Phils.Rochelle Joy SolisNo ratings yet

- Bernabe Vs AlejoDocument2 pagesBernabe Vs AlejoRochelle Joy SolisNo ratings yet

- People's Broadcasting Service (Bombo Radyo Phils. Inc.) v. The Secretary of The DOLEDocument3 pagesPeople's Broadcasting Service (Bombo Radyo Phils. Inc.) v. The Secretary of The DOLERochelle Joy SolisNo ratings yet

- Master Iron Labor Union Vs NLRCDocument2 pagesMaster Iron Labor Union Vs NLRCRochelle Joy SolisNo ratings yet

- Title: Veloso V China Airlines GR No.: 104302Document3 pagesTitle: Veloso V China Airlines GR No.: 104302Rochelle Joy SolisNo ratings yet

- Title Lansangan v. Amkor Technology Philippines G. R. No. 177026Document3 pagesTitle Lansangan v. Amkor Technology Philippines G. R. No. 177026Rochelle Joy SolisNo ratings yet

- Maternity Children's Hospital v. Sec of LaborDocument2 pagesMaternity Children's Hospital v. Sec of LaborRochelle Joy SolisNo ratings yet

- Title MC Engineering, Inc. v. NLRC: G.R. No. 142314Document2 pagesTitle MC Engineering, Inc. v. NLRC: G.R. No. 142314Rochelle Joy SolisNo ratings yet

- Manila Midtown Hotel v. VA BorromeoDocument3 pagesManila Midtown Hotel v. VA BorromeoRochelle Joy SolisNo ratings yet

- Manuel D. Yngson Jr. v. Philippine National BankDocument2 pagesManuel D. Yngson Jr. v. Philippine National BankRochelle Joy SolisNo ratings yet

- UST v. NLRC and UST Faculty UnionDocument3 pagesUST v. NLRC and UST Faculty UnionRochelle Joy SolisNo ratings yet

- Title Garcia v. KJ Commercial: G. R. No. 196830Document3 pagesTitle Garcia v. KJ Commercial: G. R. No. 196830Rochelle Joy SolisNo ratings yet

- Philippine Airlines, Inc. (PAL) Vs NLRC: Title: GR No. 126805Document2 pagesPhilippine Airlines, Inc. (PAL) Vs NLRC: Title: GR No. 126805Rochelle Joy SolisNo ratings yet

- Veloso vs. DOLEDocument3 pagesVeloso vs. DOLERochelle Joy SolisNo ratings yet

- Yupangco Cotton Mills vs. CADocument3 pagesYupangco Cotton Mills vs. CARochelle Joy SolisNo ratings yet

- Vivero Vs CA: Title: GR No. 138938Document2 pagesVivero Vs CA: Title: GR No. 138938Rochelle Joy SolisNo ratings yet

- Title: Tancinco V GSIS GR No.: 132916Document3 pagesTitle: Tancinco V GSIS GR No.: 132916Rochelle Joy SolisNo ratings yet

- Landtex Industries Vs CA: Title: GR No. 105278Document3 pagesLandtex Industries Vs CA: Title: GR No. 105278Rochelle Joy SolisNo ratings yet

- Buenviaje v. CA and Cottonway Marketing Corp.Document3 pagesBuenviaje v. CA and Cottonway Marketing Corp.Rochelle Joy SolisNo ratings yet

- Title: Genuino V NLRC GR No.:142732-33Document2 pagesTitle: Genuino V NLRC GR No.:142732-33Rochelle Joy SolisNo ratings yet

- Abbot Laboratories Phils. v. Abbot LaboratoriesDocument2 pagesAbbot Laboratories Phils. v. Abbot LaboratoriesRochelle Joy SolisNo ratings yet

- Title Del Monte v. Saldivar G.R. No. 158620Document3 pagesTitle Del Monte v. Saldivar G.R. No. 158620Rochelle Joy SolisNo ratings yet

- Memorial Filed On Behalf of Petitioner PDFDocument36 pagesMemorial Filed On Behalf of Petitioner PDFKaran VyasNo ratings yet

- Breakfast For Leadership That Listens PACDocument2 pagesBreakfast For Leadership That Listens PACSunlight FoundationNo ratings yet

- Dr. Antonio P. Cabugao vs. People of The Philippines and Spouses Rodolfo M. Palma and Rosario F. Palma. G.R. No. 163879 July 30, 2014Document4 pagesDr. Antonio P. Cabugao vs. People of The Philippines and Spouses Rodolfo M. Palma and Rosario F. Palma. G.R. No. 163879 July 30, 2014Pao InfanteNo ratings yet

- KP Form No. 6Document2 pagesKP Form No. 6Anob EhijNo ratings yet

- TCCP Vol. IiDocument3 pagesTCCP Vol. Iiladyfat100% (1)

- Local Self GovtDocument20 pagesLocal Self GovtMd. Abid Afsan HamidNo ratings yet

- Audit Plan TemplateDocument2 pagesAudit Plan TemplateSaniNo ratings yet

- Special Power of AttorneyDocument2 pagesSpecial Power of AttorneyJson GalvezNo ratings yet

- Legal Aspects of Business: Digital Assignment - 1 Practical Problems - 1Document2 pagesLegal Aspects of Business: Digital Assignment - 1 Practical Problems - 1Nivya NagarajanNo ratings yet

- Manifestation Re Change of AddressDocument2 pagesManifestation Re Change of Addressamy faith susonNo ratings yet

- Admelec Quasi Judicial Power Case Full TextDocument22 pagesAdmelec Quasi Judicial Power Case Full TextSamuel BaulaNo ratings yet

- 2023 2024 The Constitution and by Laws The Fidelis Press 1Document7 pages2023 2024 The Constitution and by Laws The Fidelis Press 1darksilver.wasfoundbynewtNo ratings yet

- ID Application FormDocument3 pagesID Application FormSaratiNo ratings yet

- Gulf Resorts V Phil CharterDocument2 pagesGulf Resorts V Phil Charterdivine ventura100% (1)

- Albert M. Churilla, JR., Etc. v. Wachusett Mountain Associates, Inc., 963 F.2d 366, 1st Cir. (1992)Document4 pagesAlbert M. Churilla, JR., Etc. v. Wachusett Mountain Associates, Inc., 963 F.2d 366, 1st Cir. (1992)Scribd Government DocsNo ratings yet

- The Merchant of Venice CrosswordDocument2 pagesThe Merchant of Venice CrosswordAnonymous lTXTx1fNo ratings yet

- Chapter 21 - Solution ManualDocument16 pagesChapter 21 - Solution ManualjuanNo ratings yet

- Elias Casiano Statement of FactsDocument3 pagesElias Casiano Statement of FactsEmily BabayNo ratings yet

- 26 - in Re Elmo S. AbadDocument1 page26 - in Re Elmo S. AbadckqashNo ratings yet

- Dacanay v. PeopleDocument1 pageDacanay v. PeopleJamiah Obillo HulipasNo ratings yet

- 2018, 2019, 2020 & 2021 Nigeria Current Affairs Quiz Questions & AnswersDocument41 pages2018, 2019, 2020 & 2021 Nigeria Current Affairs Quiz Questions & AnswersTaiwo MohammedNo ratings yet

- Affidavit by Parent/Guardian: 5/2, Halder para Lane - Howrah, WestbengalDocument1 pageAffidavit by Parent/Guardian: 5/2, Halder para Lane - Howrah, WestbengaladsfdgfhgjhkNo ratings yet

- Discrepancy Reporting FormDocument2 pagesDiscrepancy Reporting FormLanz BelgarNo ratings yet

- Zeta Vs MalinaoDocument2 pagesZeta Vs MalinaoAriel Mark Pilotin100% (1)

- Jaipur National University Seedling School of Law & GovernanceDocument15 pagesJaipur National University Seedling School of Law & GovernancePrashant MahawarNo ratings yet

- Contract Eng 1 1Document31 pagesContract Eng 1 1100No ratings yet

- Assessor - County Clerk - RecorderDocument1 pageAssessor - County Clerk - RecorderGeraldyneNo ratings yet

- ABS-CBN vs. PMSIDocument2 pagesABS-CBN vs. PMSIjuliNo ratings yet