Professional Documents

Culture Documents

Intermediate Accounting 1 - MODULE 8: Content Standards

Intermediate Accounting 1 - MODULE 8: Content Standards

Uploaded by

Gee-Anne GonzalesCopyright:

Available Formats

You might also like

- Use The Following Information For The Next Two (2) QuestionsDocument37 pagesUse The Following Information For The Next Two (2) QuestionsAbdulmajed Unda Mimbantas50% (4)

- Part 1 Principles QuizzersDocument27 pagesPart 1 Principles QuizzersGee-Anne Gonzales100% (1)

- Qualifying Asset: Commencement of CapitalisationDocument11 pagesQualifying Asset: Commencement of Capitalisationjktech 36No ratings yet

- Ia1 BC 2020Document33 pagesIa1 BC 2020Jm Sevalla100% (6)

- ACC1100 S1 2018 Exam SolutionDocument15 pagesACC1100 S1 2018 Exam SolutionFarah PatelNo ratings yet

- Chapter 25 - Borrowing CostsDocument35 pagesChapter 25 - Borrowing Costsmhel moyetNo ratings yet

- Pas 23: Borrowing Cost Borrowing CostDocument7 pagesPas 23: Borrowing Cost Borrowing CostJustine Reine CornicoNo ratings yet

- Borrowing Costs CVDocument34 pagesBorrowing Costs CVRigine Pobe Morgadez100% (1)

- Accounting 5 CFAS Chapter 17Document27 pagesAccounting 5 CFAS Chapter 17박은하No ratings yet

- CHAPTER 17 - PAS 23 Borrowing CostsDocument16 pagesCHAPTER 17 - PAS 23 Borrowing CostsMarriel Fate CullanoNo ratings yet

- PAS 23 Borrowing Costs: Learning ObjectivesDocument5 pagesPAS 23 Borrowing Costs: Learning ObjectivesFhrince Carl CalaquianNo ratings yet

- Borrowing Costs That Are Directly Attributable To The Acquisition, Construction orDocument4 pagesBorrowing Costs That Are Directly Attributable To The Acquisition, Construction orJustine VeralloNo ratings yet

- Borrowing Cost (PAS 23)Document6 pagesBorrowing Cost (PAS 23)CharléNo ratings yet

- Final Requirment (Case Study)Document2 pagesFinal Requirment (Case Study)Gerry SajolNo ratings yet

- Accounting For Borrowing Cost (English)Document9 pagesAccounting For Borrowing Cost (English)gracel angela tolejanoNo ratings yet

- Financial Accounting ACCT 201 Assignment 4: Last Date For Submission 16 December 2017Document4 pagesFinancial Accounting ACCT 201 Assignment 4: Last Date For Submission 16 December 2017jhie boterNo ratings yet

- Borrowing CostsDocument34 pagesBorrowing CostsJeremae AbellanidaNo ratings yet

- CHAPTER 25 - Borrowing CostsDocument6 pagesCHAPTER 25 - Borrowing CostsRosee D.No ratings yet

- ACFrOgCZvV8y8c31SB9JwJMX3w-YM9CorcTp3WIbzdLvq5I7h5g1Mn9yq JGGLJyxyxmHcTSrgN3xkjSd1VF5Qy9lJ2U83Tq54bUz-mUPzoP123Gs3yrkbJ2lizVYLj qzPyoo7SEGPLRGR1 HVMDocument12 pagesACFrOgCZvV8y8c31SB9JwJMX3w-YM9CorcTp3WIbzdLvq5I7h5g1Mn9yq JGGLJyxyxmHcTSrgN3xkjSd1VF5Qy9lJ2U83Tq54bUz-mUPzoP123Gs3yrkbJ2lizVYLj qzPyoo7SEGPLRGR1 HVMRamin AminNo ratings yet

- IAS 23 Borrowing CostDocument6 pagesIAS 23 Borrowing CostArm ButtNo ratings yet

- IAS 23 Borrowing CostDocument6 pagesIAS 23 Borrowing CostButt ArhamNo ratings yet

- Question 2 LPS Limited-EngDocument3 pagesQuestion 2 LPS Limited-Engchad sampsonNo ratings yet

- Quizzer BridgingDocument94 pagesQuizzer Bridgingglady sanchezNo ratings yet

- Borrowing CostsDocument18 pagesBorrowing CostsTsegay ArayaNo ratings yet

- Principal Borrowing CostDocument3 pagesPrincipal Borrowing Costjustine reine cornicoNo ratings yet

- FTME Reviewer Part 2Document7 pagesFTME Reviewer Part 2Mel BoqueNo ratings yet

- AMF 2202 Test 2 2022-2023 - 221111 - 085401Document3 pagesAMF 2202 Test 2 2022-2023 - 221111 - 085401mugenyi DixonNo ratings yet

- ITFAQuestion June 2018 ExamDocument4 pagesITFAQuestion June 2018 ExamF A Saffat RahmanNo ratings yet

- Borrowing Cost Problem SolutionsDocument17 pagesBorrowing Cost Problem SolutionsNicole ConcepcionNo ratings yet

- Module 6 CFAS PAS 23 - BORROWING COSTDocument6 pagesModule 6 CFAS PAS 23 - BORROWING COSTJan JanNo ratings yet

- These Questions Help You Recognize Your Existing Background Knowledge On The Topic. Answer Honestly. Yes NoDocument2 pagesThese Questions Help You Recognize Your Existing Background Knowledge On The Topic. Answer Honestly. Yes NocykenNo ratings yet

- ConfrasDocument6 pagesConfrasJustine Reine CornicoNo ratings yet

- Pas 23Document11 pagesPas 23Justine VeralloNo ratings yet

- 2020-12 ICMAB FL 001 PAC Year Question December 2020Document3 pages2020-12 ICMAB FL 001 PAC Year Question December 2020Mohammad ShahidNo ratings yet

- Borrowing CostsDocument9 pagesBorrowing Costsphoebelyn acdogNo ratings yet

- Ipsas 5 Borrowing CostDocument26 pagesIpsas 5 Borrowing Costnemz2593No ratings yet

- Corporate Reporting Assignment 1 - GroupDocument18 pagesCorporate Reporting Assignment 1 - GroupangelaNo ratings yet

- Icandocumentsnovemebr 2017 Pathfinder Skills PDFDocument179 pagesIcandocumentsnovemebr 2017 Pathfinder Skills PDFDaniel AdegboyeNo ratings yet

- FAR MA-2023 Suggested AnswersDocument10 pagesFAR MA-2023 Suggested AnswersMd HasanNo ratings yet

- 2021-06 Icmab FL 001 Pac Year Question June 2021Document3 pages2021-06 Icmab FL 001 Pac Year Question June 2021Mohammad ShahidNo ratings yet

- IAS 23 - Borrowing CostsDocument5 pagesIAS 23 - Borrowing CostsAmmad AzharNo ratings yet

- Borrowing Cost Sample ProblemsDocument8 pagesBorrowing Cost Sample Problemslet me live in peaceNo ratings yet

- Borrowing Cost Problem Solutions - CompressDocument16 pagesBorrowing Cost Problem Solutions - CompressSyreNo ratings yet

- Ias 23Document19 pagesIas 23Reever RiverNo ratings yet

- IAS 23 Borrowing Costs 11122020 052354pmDocument19 pagesIAS 23 Borrowing Costs 11122020 052354pmAbdul SamiNo ratings yet

- Audit of Liabilities QuizDocument13 pagesAudit of Liabilities QuizAldrin DagamiNo ratings yet

- 7 21 Revaluation PDFDocument5 pages7 21 Revaluation PDFargoNo ratings yet

- Review - SFP To Interim ReportingDocument3 pagesReview - SFP To Interim ReportingAna Marie IllutNo ratings yet

- Borrowing Costs - Sample ProblemsDocument8 pagesBorrowing Costs - Sample ProblemsKimberly PanganNo ratings yet

- Chapter 3 - IAS 23Document5 pagesChapter 3 - IAS 23Chandan SamalNo ratings yet

- BCOMSC - Accounting 1 - 15-Jan-24 - S1Document8 pagesBCOMSC - Accounting 1 - 15-Jan-24 - S1blessingmudarikwa2No ratings yet

- Revision Paper - 2023Document12 pagesRevision Paper - 2023chaanNo ratings yet

- Chapter 22 Investment PropertyDocument5 pagesChapter 22 Investment PropertyEllen MaskariñoNo ratings yet

- 1 Borrowing CostDocument2 pages1 Borrowing CostNeighvestNo ratings yet

- Accounting Standards and Company Audit AnswersDocument9 pagesAccounting Standards and Company Audit AnswersrinshaNo ratings yet

- Borrowing CostDocument3 pagesBorrowing Costtyler1No ratings yet

- UTS Pengantar Akutansi 2Document3 pagesUTS Pengantar Akutansi 2Pia panNo ratings yet

- 206B 3rd Preboard ActivityDocument9 pages206B 3rd Preboard ActivityJERROLD EIRVIN PAYOPAYNo ratings yet

- WCM NotesDocument2 pagesWCM NotesTharunNo ratings yet

- BudgetDocument4 pagesBudgetJunaid SiddiquiNo ratings yet

- Handbook for Developing Joint Crediting Mechanism ProjectsFrom EverandHandbook for Developing Joint Crediting Mechanism ProjectsNo ratings yet

- Artapp Module 3 - 9hum5-5-6week - Module 3Document150 pagesArtapp Module 3 - 9hum5-5-6week - Module 3Gee-Anne GonzalesNo ratings yet

- Artapp Module 1 9hum5 1 2week - Module 1Document50 pagesArtapp Module 1 9hum5 1 2week - Module 1Gee-Anne GonzalesNo ratings yet

- Intermediate Accounting 1 - MODULE 7: Content StandardsDocument8 pagesIntermediate Accounting 1 - MODULE 7: Content StandardsGee-Anne GonzalesNo ratings yet

- Intermediate Accounting 1 - MODULE 5Document7 pagesIntermediate Accounting 1 - MODULE 5Gee-Anne GonzalesNo ratings yet

- This Study Resource Was: Tax QuizzerDocument5 pagesThis Study Resource Was: Tax QuizzerGee-Anne GonzalesNo ratings yet

- Ravi Shankar PrasadDocument3 pagesRavi Shankar PrasadAadarsh KumarNo ratings yet

- Opportunity CostDocument7 pagesOpportunity CostJamiemarie PinedaNo ratings yet

- Sample Question Paper-Ii Accountancy Class Xii Maximum Marks: 80 Time Allowed: 3 Hrs. General InstructionsDocument38 pagesSample Question Paper-Ii Accountancy Class Xii Maximum Marks: 80 Time Allowed: 3 Hrs. General Instructionsmohit pandeyNo ratings yet

- Structural Adjustment Programmes: Composition and Effects: Chapter 14: Akbar ZaidiDocument45 pagesStructural Adjustment Programmes: Composition and Effects: Chapter 14: Akbar Zaidirabia liaqatNo ratings yet

- Construction Quality Management Assignment: Group 2Document6 pagesConstruction Quality Management Assignment: Group 2Vicky VigneshNo ratings yet

- PORTFOLIO REVISION NOTES Unit 5Document5 pagesPORTFOLIO REVISION NOTES Unit 5antonette asumpthaNo ratings yet

- UCSP Q2 - W5 Addressing Social Inequalities Lecture NotesDocument5 pagesUCSP Q2 - W5 Addressing Social Inequalities Lecture NotesML CreationsNo ratings yet

- Wholesaler: PricelistDocument60 pagesWholesaler: PricelistLiane CahanapNo ratings yet

- Colgate Financial ModelDocument34 pagesColgate Financial ModelRendy Oliver Mariano PonoNo ratings yet

- 6088-G301r6 Tank Capacity PlanDocument1 page6088-G301r6 Tank Capacity PlanArmada BarusNo ratings yet

- RINCIAN TRANSAKSI KAS OFFICE PT - AII 01 SD 15 Oktb 2023Document5 pagesRINCIAN TRANSAKSI KAS OFFICE PT - AII 01 SD 15 Oktb 2023noejwooNo ratings yet

- Challenges Faced by Fintechs in IndiaDocument2 pagesChallenges Faced by Fintechs in IndiaSRISHTI NARANGNo ratings yet

- Chapter 7 DepreciationDocument50 pagesChapter 7 Depreciationpriyam.200409No ratings yet

- Corporate Reporting-1Document69 pagesCorporate Reporting-1Najmul IslamNo ratings yet

- TM-Block 14: P-OKITM07-10: P-OKITM07-10.EF - HO.SP2.001: Stock Preparation #2Document5 pagesTM-Block 14: P-OKITM07-10: P-OKITM07-10.EF - HO.SP2.001: Stock Preparation #2robby a. malikNo ratings yet

- Effect of Globalization On National BusinessDocument6 pagesEffect of Globalization On National BusinessAhmed ElbazNo ratings yet

- Excel Expense Report TemplateDocument1 pageExcel Expense Report TemplateTom CatNo ratings yet

- Insurance Solutionsby EtiqaDocument30 pagesInsurance Solutionsby EtiqaAdam TanNo ratings yet

- Rosemont Hills Montessori College: Appendix BDocument4 pagesRosemont Hills Montessori College: Appendix BRichard CruzNo ratings yet

- Career Objective: Swe Zin Oo Bachelor of Engineering (Civil)Document4 pagesCareer Objective: Swe Zin Oo Bachelor of Engineering (Civil)Swe Zin OoNo ratings yet

- Leo 3Document44 pagesLeo 3cadeau01No ratings yet

- Moodys CdmsDocument2 pagesMoodys CdmssaurabhanandsuccessNo ratings yet

- PT. Pertamina Retail: PO Service Purchase Order (PO)Document2 pagesPT. Pertamina Retail: PO Service Purchase Order (PO)Firman PrimahardhikaNo ratings yet

- Module 2.3 - Cash Flow TechniqueDocument11 pagesModule 2.3 - Cash Flow TechniqueGerald RamiloNo ratings yet

- IAS 36 - ImpairmentDocument2 pagesIAS 36 - ImpairmentdominicNo ratings yet

- A Project Proposal From Bangladesh: Strengthening ICT and Telecom Sector in Bangladesh (STIB)Document21 pagesA Project Proposal From Bangladesh: Strengthening ICT and Telecom Sector in Bangladesh (STIB)Rabbir AhmedNo ratings yet

- SodapdfDocument10 pagesSodapdfv adamNo ratings yet

- Screenshot 2022-09-30 at 6.23.18 PMDocument9 pagesScreenshot 2022-09-30 at 6.23.18 PMMahesh BalasubramaniyanNo ratings yet

- The National Budget and Local BudgetDocument42 pagesThe National Budget and Local BudgetCherry Virtucio100% (1)

- Current Affairs: Energy Crisis in PakistanDocument10 pagesCurrent Affairs: Energy Crisis in PakistanArsalan Khan GhauriNo ratings yet

Intermediate Accounting 1 - MODULE 8: Content Standards

Intermediate Accounting 1 - MODULE 8: Content Standards

Uploaded by

Gee-Anne GonzalesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Intermediate Accounting 1 - MODULE 8: Content Standards

Intermediate Accounting 1 - MODULE 8: Content Standards

Uploaded by

Gee-Anne GonzalesCopyright:

Available Formats

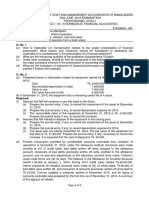

Intermediate Accounting 1 - MODULE 8

Content Standards:

▪ Elaboration of the items included in borrowing costs.

▪ Explaination about the concept of a qualifying asset for purposes of capitalization of borrowing cost.

▪ Enumeration of the distinctions between specific borrowing and general borrowing in relation to

capitalization of borrowing costs.

Declarative Knowledge:

▪ Definition of Borrowing Costs

▪ Qualifying Asset

▪ Accounting for Borrowing Cost

▪ Asset financed by Specific Borrowing

▪ Asset financed by General Borrowing

▪ Asset financed both by specific and general borrowing

▪ Specific borrowing for asset used for general purposes

▪ Disclosures related to borrowing Cost

Functional Knowledge:

▪ Enumerating the items included in borrowing costs.

▪ Describing the concept of a qualifying asset for purposes of capitalization of borrowing cost.

▪ Identifying the distinctions between specific borrowing and general borrowing in relation to

capitalization of borrowing costs.

Intended Learning Outcome:

▪ Identify the items included in borrowing costs and understand the concept of a qualifying asset for

purposes of capitalization of borrowing cost.

▪ Analyze the distinctions between specific borrowing and general borrowing in relation to capitalization

of borrowing costs.

Suggested Teaching/ Learning Activities:

▪ Chapter assessment theory questions and problem solving.

Chapter 25: Borrowing Cost

Borrowing Costs are interest and other costs that an entity incurs in connection with borrowing of funds.

Borrowing cost may include: [IAS 23.6]

▪ Interest expense calculated by the effective interest method under IAS 39.

▪ Finance charges in respect of finance leases recognised in accordance with IAS 17 Leases.

▪ Exchange differences arising from foreign currency borrowings to the extent that they are regarded as an

adjustment to interest costs.

A qualifying asset is an asset that takes a substantial period of time to get ready for its intended use or sale.

[IAS 23.5] That could be property, plant, and equipment and investment property during the construction

period, intangible assets during the development period, or "made-to-order" inventories.

Two types of assets that would otherwise be qualifying assets are excluded from the scope of IAS 23:

▪ Qualifying assets measured at fair value, such as biological assets accounted for under IAS 41

▪ Agriculture inventories that are manufactured, or otherwise produced, in large quantities on a repetitive

basis and that take a substantial period to get ready for sale (for example, maturing whisky)

▪ Assets that are ready for their intended use or sale when acquired.

Accounting for Borrowing Cost

▪ Borrowing costs that are directly attributable to the acquisition, construction or production of a

qualifying asset form part of the cost of that asset and, therefore, should be capitalised.

▪ Other borrowing costs are recognised as an expense. [IAS 23.8]

Asset financed by “specific borrowing”

Where funds are borrowed specifically for the purpose of acquiring a qualifying assets, costs eligible for

capitalisation are the actual costs incurred less any income earned on the temporary investment of such

borrowings.

Illustration 1

On January 1 of the current year, an entity obtained a loan of P4,000,000 at an interest rate of 10%, specifically

to finance the construction of its new building. Availments from the loan were made quarterly in equal amounts.

Total borrowing cost incurred amounted to P250,000 for the current year. Prior to their disbursement, the

proceeds of the borrowing were temporarily invested and earned interest income of P40,000. The building was

completed on December 31 of the current year. The amount of capitalizable borrowing cost is computed as

follows:

Actual Borrowing Cost 250,000

Less: Interest income from 40,000

investments proceeds

Capitalizable Borrowing 210,000

Cost

Asset financed by “general borrowing”

If the funds are borrowed generally and used for acquiring a qualifying asset, the eligible amount is determined

by applying a capitalisation rate to the expenditure on that asset. The capitalisation rate will be the average of

the borrowing costs multiplied by the average carrying amount of the asset during the asset [IAS 23.14]

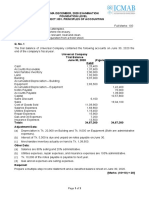

Illustration 2

An entity had the following borrowings on January 1 of the current year. The borrowings were made for general

purposes and the proceeds were partly used to finance the construction of a new building.

Principal Borrowing Cost

10% Bank Loan 2,800,000 280,000

12% Short-Term Note 1,600,000 160,000

12% Long-Term Note 2,000,000 240,000

6,400,000 680,000

The construction of the building was started on January 1 and was completed on December 31 of the current

year. Expenditures on the building were made as follows:

January 31 400,000

March 31 1,000,000

June 30 1,200,000

September 30 1,000,000

December 31 400,000

Total Cost 4,000,000

The average carrying amount of the building is determined as follows:

Date (a) Expenditures (b) Monthly (axb) Amount

Outstanding

January 31 400,000 12 4,800,000

March 31 1,000,000 9 9,000,000

June 30 1,200,000 6 7,200,000

September 30 1,000,000 3 3,000,000

December 31 400,000 0 -

24,000,000

Average Carrying 2,000,000

Amount (24,000,000/12)

Another Approach

Date (a) Expenditures (b) Fraction (axb) Average

January 31 400,000 12/12 400,000

March 31 1,000,000 9/12 750,000

June 30 1,200,000 6/12 600,000

September 30 1,000,000 3/12 250,000

December 31 400,000 - -

2,000,000

Note that any investment income from specific borrowing is deducted from the capitalizable borrowing cost.

However no specific guidance is provided for general borrowing with respect to investment income.

Accordingly, any investment income from general borrowing is not deducted from capitalizable borrowing cost.

Specific Borrowing for Asset used for General Purposes

If the asset is financed by specific borrowing but a portion is used for working capital purposes, the borrowing

shall be treated as a general borrowing in determining capitalizable borrowing cost. Thus, the capitalizable

borrowing cost is equal to the average expenditures on the asset multiplied by the average interest rate.

Commencement of Capitalization

Capitalisation should commence when:

▪ Expenditures are being incurred.

▪ Borrowing costs are being incurred.

▪ Activities that are necessary to prepare the asset for its intended use or sale are in progress.

(encompasses more than the physical construction of the asset, these include technical and

administrative work prior to the commencement pf physical construction such as drawing up plans and

obtaining permit for a building.)

Suspension of Capitalization

Capitalisation should be suspended during periods in which active development is interrupted. [IAS 23.20]

Cessation of Capitalization

Capitalisation should cease when substantially all of the activities necessary to prepare the asset for its intended

use or sale are complete. [IAS 23.22] If only minor modifications are outstanding, this indicates that

substantially all of the activities are complete. [IAS 23.23]

Where construction is completed in stages, which can be used while construction of the other parts continues,

capitalisation of attributable borrowing costs should cease when substantially all of the activities necessary to

prepare that part for its intended use or sale are complete. [IAS 23.24]

Disclosures Related to Borrowing Cost

▪ Amount of borrowing cost capitalised during the period.

▪ Capitalisation rate used.

Segregation of assets that re “qualifying assets” from other assets in the statement of financial position is not

required to be disclosed.

Prepared By: Ms. Charmaine Buan, CPA

References:

1. Financial Accounting Volume 1, 2011 ed. – Conrado T. Valix, Jose F. Peralta and Christian Aris M.

Valix

2. https://www.iasplus.com/en/standards/ias/ias40

You might also like

- Use The Following Information For The Next Two (2) QuestionsDocument37 pagesUse The Following Information For The Next Two (2) QuestionsAbdulmajed Unda Mimbantas50% (4)

- Part 1 Principles QuizzersDocument27 pagesPart 1 Principles QuizzersGee-Anne Gonzales100% (1)

- Qualifying Asset: Commencement of CapitalisationDocument11 pagesQualifying Asset: Commencement of Capitalisationjktech 36No ratings yet

- Ia1 BC 2020Document33 pagesIa1 BC 2020Jm Sevalla100% (6)

- ACC1100 S1 2018 Exam SolutionDocument15 pagesACC1100 S1 2018 Exam SolutionFarah PatelNo ratings yet

- Chapter 25 - Borrowing CostsDocument35 pagesChapter 25 - Borrowing Costsmhel moyetNo ratings yet

- Pas 23: Borrowing Cost Borrowing CostDocument7 pagesPas 23: Borrowing Cost Borrowing CostJustine Reine CornicoNo ratings yet

- Borrowing Costs CVDocument34 pagesBorrowing Costs CVRigine Pobe Morgadez100% (1)

- Accounting 5 CFAS Chapter 17Document27 pagesAccounting 5 CFAS Chapter 17박은하No ratings yet

- CHAPTER 17 - PAS 23 Borrowing CostsDocument16 pagesCHAPTER 17 - PAS 23 Borrowing CostsMarriel Fate CullanoNo ratings yet

- PAS 23 Borrowing Costs: Learning ObjectivesDocument5 pagesPAS 23 Borrowing Costs: Learning ObjectivesFhrince Carl CalaquianNo ratings yet

- Borrowing Costs That Are Directly Attributable To The Acquisition, Construction orDocument4 pagesBorrowing Costs That Are Directly Attributable To The Acquisition, Construction orJustine VeralloNo ratings yet

- Borrowing Cost (PAS 23)Document6 pagesBorrowing Cost (PAS 23)CharléNo ratings yet

- Final Requirment (Case Study)Document2 pagesFinal Requirment (Case Study)Gerry SajolNo ratings yet

- Accounting For Borrowing Cost (English)Document9 pagesAccounting For Borrowing Cost (English)gracel angela tolejanoNo ratings yet

- Financial Accounting ACCT 201 Assignment 4: Last Date For Submission 16 December 2017Document4 pagesFinancial Accounting ACCT 201 Assignment 4: Last Date For Submission 16 December 2017jhie boterNo ratings yet

- Borrowing CostsDocument34 pagesBorrowing CostsJeremae AbellanidaNo ratings yet

- CHAPTER 25 - Borrowing CostsDocument6 pagesCHAPTER 25 - Borrowing CostsRosee D.No ratings yet

- ACFrOgCZvV8y8c31SB9JwJMX3w-YM9CorcTp3WIbzdLvq5I7h5g1Mn9yq JGGLJyxyxmHcTSrgN3xkjSd1VF5Qy9lJ2U83Tq54bUz-mUPzoP123Gs3yrkbJ2lizVYLj qzPyoo7SEGPLRGR1 HVMDocument12 pagesACFrOgCZvV8y8c31SB9JwJMX3w-YM9CorcTp3WIbzdLvq5I7h5g1Mn9yq JGGLJyxyxmHcTSrgN3xkjSd1VF5Qy9lJ2U83Tq54bUz-mUPzoP123Gs3yrkbJ2lizVYLj qzPyoo7SEGPLRGR1 HVMRamin AminNo ratings yet

- IAS 23 Borrowing CostDocument6 pagesIAS 23 Borrowing CostArm ButtNo ratings yet

- IAS 23 Borrowing CostDocument6 pagesIAS 23 Borrowing CostButt ArhamNo ratings yet

- Question 2 LPS Limited-EngDocument3 pagesQuestion 2 LPS Limited-Engchad sampsonNo ratings yet

- Quizzer BridgingDocument94 pagesQuizzer Bridgingglady sanchezNo ratings yet

- Borrowing CostsDocument18 pagesBorrowing CostsTsegay ArayaNo ratings yet

- Principal Borrowing CostDocument3 pagesPrincipal Borrowing Costjustine reine cornicoNo ratings yet

- FTME Reviewer Part 2Document7 pagesFTME Reviewer Part 2Mel BoqueNo ratings yet

- AMF 2202 Test 2 2022-2023 - 221111 - 085401Document3 pagesAMF 2202 Test 2 2022-2023 - 221111 - 085401mugenyi DixonNo ratings yet

- ITFAQuestion June 2018 ExamDocument4 pagesITFAQuestion June 2018 ExamF A Saffat RahmanNo ratings yet

- Borrowing Cost Problem SolutionsDocument17 pagesBorrowing Cost Problem SolutionsNicole ConcepcionNo ratings yet

- Module 6 CFAS PAS 23 - BORROWING COSTDocument6 pagesModule 6 CFAS PAS 23 - BORROWING COSTJan JanNo ratings yet

- These Questions Help You Recognize Your Existing Background Knowledge On The Topic. Answer Honestly. Yes NoDocument2 pagesThese Questions Help You Recognize Your Existing Background Knowledge On The Topic. Answer Honestly. Yes NocykenNo ratings yet

- ConfrasDocument6 pagesConfrasJustine Reine CornicoNo ratings yet

- Pas 23Document11 pagesPas 23Justine VeralloNo ratings yet

- 2020-12 ICMAB FL 001 PAC Year Question December 2020Document3 pages2020-12 ICMAB FL 001 PAC Year Question December 2020Mohammad ShahidNo ratings yet

- Borrowing CostsDocument9 pagesBorrowing Costsphoebelyn acdogNo ratings yet

- Ipsas 5 Borrowing CostDocument26 pagesIpsas 5 Borrowing Costnemz2593No ratings yet

- Corporate Reporting Assignment 1 - GroupDocument18 pagesCorporate Reporting Assignment 1 - GroupangelaNo ratings yet

- Icandocumentsnovemebr 2017 Pathfinder Skills PDFDocument179 pagesIcandocumentsnovemebr 2017 Pathfinder Skills PDFDaniel AdegboyeNo ratings yet

- FAR MA-2023 Suggested AnswersDocument10 pagesFAR MA-2023 Suggested AnswersMd HasanNo ratings yet

- 2021-06 Icmab FL 001 Pac Year Question June 2021Document3 pages2021-06 Icmab FL 001 Pac Year Question June 2021Mohammad ShahidNo ratings yet

- IAS 23 - Borrowing CostsDocument5 pagesIAS 23 - Borrowing CostsAmmad AzharNo ratings yet

- Borrowing Cost Sample ProblemsDocument8 pagesBorrowing Cost Sample Problemslet me live in peaceNo ratings yet

- Borrowing Cost Problem Solutions - CompressDocument16 pagesBorrowing Cost Problem Solutions - CompressSyreNo ratings yet

- Ias 23Document19 pagesIas 23Reever RiverNo ratings yet

- IAS 23 Borrowing Costs 11122020 052354pmDocument19 pagesIAS 23 Borrowing Costs 11122020 052354pmAbdul SamiNo ratings yet

- Audit of Liabilities QuizDocument13 pagesAudit of Liabilities QuizAldrin DagamiNo ratings yet

- 7 21 Revaluation PDFDocument5 pages7 21 Revaluation PDFargoNo ratings yet

- Review - SFP To Interim ReportingDocument3 pagesReview - SFP To Interim ReportingAna Marie IllutNo ratings yet

- Borrowing Costs - Sample ProblemsDocument8 pagesBorrowing Costs - Sample ProblemsKimberly PanganNo ratings yet

- Chapter 3 - IAS 23Document5 pagesChapter 3 - IAS 23Chandan SamalNo ratings yet

- BCOMSC - Accounting 1 - 15-Jan-24 - S1Document8 pagesBCOMSC - Accounting 1 - 15-Jan-24 - S1blessingmudarikwa2No ratings yet

- Revision Paper - 2023Document12 pagesRevision Paper - 2023chaanNo ratings yet

- Chapter 22 Investment PropertyDocument5 pagesChapter 22 Investment PropertyEllen MaskariñoNo ratings yet

- 1 Borrowing CostDocument2 pages1 Borrowing CostNeighvestNo ratings yet

- Accounting Standards and Company Audit AnswersDocument9 pagesAccounting Standards and Company Audit AnswersrinshaNo ratings yet

- Borrowing CostDocument3 pagesBorrowing Costtyler1No ratings yet

- UTS Pengantar Akutansi 2Document3 pagesUTS Pengantar Akutansi 2Pia panNo ratings yet

- 206B 3rd Preboard ActivityDocument9 pages206B 3rd Preboard ActivityJERROLD EIRVIN PAYOPAYNo ratings yet

- WCM NotesDocument2 pagesWCM NotesTharunNo ratings yet

- BudgetDocument4 pagesBudgetJunaid SiddiquiNo ratings yet

- Handbook for Developing Joint Crediting Mechanism ProjectsFrom EverandHandbook for Developing Joint Crediting Mechanism ProjectsNo ratings yet

- Artapp Module 3 - 9hum5-5-6week - Module 3Document150 pagesArtapp Module 3 - 9hum5-5-6week - Module 3Gee-Anne GonzalesNo ratings yet

- Artapp Module 1 9hum5 1 2week - Module 1Document50 pagesArtapp Module 1 9hum5 1 2week - Module 1Gee-Anne GonzalesNo ratings yet

- Intermediate Accounting 1 - MODULE 7: Content StandardsDocument8 pagesIntermediate Accounting 1 - MODULE 7: Content StandardsGee-Anne GonzalesNo ratings yet

- Intermediate Accounting 1 - MODULE 5Document7 pagesIntermediate Accounting 1 - MODULE 5Gee-Anne GonzalesNo ratings yet

- This Study Resource Was: Tax QuizzerDocument5 pagesThis Study Resource Was: Tax QuizzerGee-Anne GonzalesNo ratings yet

- Ravi Shankar PrasadDocument3 pagesRavi Shankar PrasadAadarsh KumarNo ratings yet

- Opportunity CostDocument7 pagesOpportunity CostJamiemarie PinedaNo ratings yet

- Sample Question Paper-Ii Accountancy Class Xii Maximum Marks: 80 Time Allowed: 3 Hrs. General InstructionsDocument38 pagesSample Question Paper-Ii Accountancy Class Xii Maximum Marks: 80 Time Allowed: 3 Hrs. General Instructionsmohit pandeyNo ratings yet

- Structural Adjustment Programmes: Composition and Effects: Chapter 14: Akbar ZaidiDocument45 pagesStructural Adjustment Programmes: Composition and Effects: Chapter 14: Akbar Zaidirabia liaqatNo ratings yet

- Construction Quality Management Assignment: Group 2Document6 pagesConstruction Quality Management Assignment: Group 2Vicky VigneshNo ratings yet

- PORTFOLIO REVISION NOTES Unit 5Document5 pagesPORTFOLIO REVISION NOTES Unit 5antonette asumpthaNo ratings yet

- UCSP Q2 - W5 Addressing Social Inequalities Lecture NotesDocument5 pagesUCSP Q2 - W5 Addressing Social Inequalities Lecture NotesML CreationsNo ratings yet

- Wholesaler: PricelistDocument60 pagesWholesaler: PricelistLiane CahanapNo ratings yet

- Colgate Financial ModelDocument34 pagesColgate Financial ModelRendy Oliver Mariano PonoNo ratings yet

- 6088-G301r6 Tank Capacity PlanDocument1 page6088-G301r6 Tank Capacity PlanArmada BarusNo ratings yet

- RINCIAN TRANSAKSI KAS OFFICE PT - AII 01 SD 15 Oktb 2023Document5 pagesRINCIAN TRANSAKSI KAS OFFICE PT - AII 01 SD 15 Oktb 2023noejwooNo ratings yet

- Challenges Faced by Fintechs in IndiaDocument2 pagesChallenges Faced by Fintechs in IndiaSRISHTI NARANGNo ratings yet

- Chapter 7 DepreciationDocument50 pagesChapter 7 Depreciationpriyam.200409No ratings yet

- Corporate Reporting-1Document69 pagesCorporate Reporting-1Najmul IslamNo ratings yet

- TM-Block 14: P-OKITM07-10: P-OKITM07-10.EF - HO.SP2.001: Stock Preparation #2Document5 pagesTM-Block 14: P-OKITM07-10: P-OKITM07-10.EF - HO.SP2.001: Stock Preparation #2robby a. malikNo ratings yet

- Effect of Globalization On National BusinessDocument6 pagesEffect of Globalization On National BusinessAhmed ElbazNo ratings yet

- Excel Expense Report TemplateDocument1 pageExcel Expense Report TemplateTom CatNo ratings yet

- Insurance Solutionsby EtiqaDocument30 pagesInsurance Solutionsby EtiqaAdam TanNo ratings yet

- Rosemont Hills Montessori College: Appendix BDocument4 pagesRosemont Hills Montessori College: Appendix BRichard CruzNo ratings yet

- Career Objective: Swe Zin Oo Bachelor of Engineering (Civil)Document4 pagesCareer Objective: Swe Zin Oo Bachelor of Engineering (Civil)Swe Zin OoNo ratings yet

- Leo 3Document44 pagesLeo 3cadeau01No ratings yet

- Moodys CdmsDocument2 pagesMoodys CdmssaurabhanandsuccessNo ratings yet

- PT. Pertamina Retail: PO Service Purchase Order (PO)Document2 pagesPT. Pertamina Retail: PO Service Purchase Order (PO)Firman PrimahardhikaNo ratings yet

- Module 2.3 - Cash Flow TechniqueDocument11 pagesModule 2.3 - Cash Flow TechniqueGerald RamiloNo ratings yet

- IAS 36 - ImpairmentDocument2 pagesIAS 36 - ImpairmentdominicNo ratings yet

- A Project Proposal From Bangladesh: Strengthening ICT and Telecom Sector in Bangladesh (STIB)Document21 pagesA Project Proposal From Bangladesh: Strengthening ICT and Telecom Sector in Bangladesh (STIB)Rabbir AhmedNo ratings yet

- SodapdfDocument10 pagesSodapdfv adamNo ratings yet

- Screenshot 2022-09-30 at 6.23.18 PMDocument9 pagesScreenshot 2022-09-30 at 6.23.18 PMMahesh BalasubramaniyanNo ratings yet

- The National Budget and Local BudgetDocument42 pagesThe National Budget and Local BudgetCherry Virtucio100% (1)

- Current Affairs: Energy Crisis in PakistanDocument10 pagesCurrent Affairs: Energy Crisis in PakistanArsalan Khan GhauriNo ratings yet