Professional Documents

Culture Documents

Test Your Knowledge: Questions

Test Your Knowledge: Questions

Uploaded by

RITZ BROWNOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Test Your Knowledge: Questions

Test Your Knowledge: Questions

Uploaded by

RITZ BROWNCopyright:

Available Formats

INDIAN ACCOUNTING STANDARD 41 8.

17

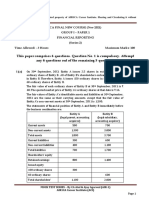

TEST YOUR KNOWLEDGE

Questions

1. As at 31st March, 20X1, a plantation consists of 100 Pinus Radiata trees that were planted

10 years earlier. The tree takes 30 years to mature, and will ultimately be processed into

building material for houses or furniture. The enterprise’s weighted average cost of capital

is 6% p.a.

Only mature trees have established fair values by reference to a quoted price in an active

market. The fair value (inclusive of current transport costs to get 100 logs to market) for a

mature tree of the same grade as in the plantation is:

As at 31st March, 20X1: 171

As at 31st March, 20X2: 165

Assume that there would be immaterial cash flow between now and point of harvest.

The present value factor of ` 1 @ 6% for

19th year = 0.331

20th year = 0.312

State the value of such plantation as on 31st March, 20X1 and 20X2 and the gain or loss to

be recognised as per Ind AS.

2. XY Ltd. is a farming entity where cows are milked on a daily basis. Milk is kept in cold storage

immediately after milking and sold to retail distributors on a weekly basis. On 1 April 20X1,

XY Ltd. ad a herd of 500 cows which were all three years old.

During the year, some of the cows became sick and on 30 September 20X1, 20 cows died. On

1 October 20X1, XY Ltd. purchased 20 replacement cows at the market for ` 21,000 each.

These 20 cows were all one year old when they were purchased.

On 31 March 20X2, XY Ltd. had 1,000 litres of milk in cold storage which had not been sold to

retail distributors. The market price of milk at 31 March 20X2 was ` 20 per litre. When selling

the milk to distributors, XY Ltd. incurs selling costs of ` 1 per litre. These amounts did not

change during March 20X2 and are not expected to change during April 20X2.

Information relating to fair value and costs to sell is given below:

Date Fair value of a dairy cow (aged) Costs to sell a cow

1 year 1.5 years 3 years 4 years

1st April 20X1 20,000 22,000 27,000 25,000 1,000

© The Institute of Chartered Accountants of India

8.18 FINANCIAL REPORTING

1st October 20X1 21,000 23,000 28,000 26,000 1,000

31st March 20X2 21,500 23,500 29,000 26,500 1,100

You can assume that fair value of a 3.5 years old cow on 1st October 20X1 is ` 27,000.

Pass necessary journal entries of above transactions with respect to cows in the financial

statements of XY Ltd. for the year ended 31st March, 20X2? Also show the amount lying in

inventory if any.

3. Company X purchased 100 beef cattle at an auction for ` 1,00,000 on 30 September 20X1.

Subsequent transportation costs were ` 1,000 that is similar to the cost X would have to incur

to sell the cattle at the auction. Additionally, there would be a 2% selling fee on the market price

of the cattle to be incurred by the seller.

On 31 March 20X2, the market value of the cattle in the most relevant market increases to

` 1,10,000. Transportation costs of ` 1,000 would have to be incurred by the seller to get the

cattle to the relevant market. An auctioneer’s fee of 2% on the market price of the cattle would

be payable by the seller.

On 1 June 20X2, X sold 18 cattle for ` 20,000 and incurred transportation charges of

` 150. In addition, there was a 2% auctioneer’s fee on the market price of the cattle paid by the

seller.

On 15 September 20X2, the fair value of the remaining cattle was ` 82,820. 42 cattle were

slaughtered on that day, with a total slaughter cost of ` 4,200. The total market price of the

carcasses on that day was ` 48,300, and the expected transportation cost to sell the carcasses

is ` 420. No other costs are expected.

On 30 September 20X2, the market price of the remaining 40 cattle was ` 44,800. The expected

transportation cost is ` 400. Also, there would be a 2% auctioneer’s fee on the market price of

the cattle payable by the seller.

Pass Journal entries so as to provide the initial and subsequent measurement for all above

transactions. Interim reporting periods are of 30 September and 31 March and the company

determines the fair values on these dates for reporting.

Answers

1. As at 31st March, 20X1, the mature plantation would have been valued at 17,100 (171 x 100).

As at 31st March, 20X2, the mature plantation would have been valued at 16,500 (165 x 100).

Assuming immaterial cash flow between now and the point of harvest, the fair value (and

therefore the amount reported as an asset on the statement of financial position) of the

plantation is estimated as follows:

© The Institute of Chartered Accountants of India

INDIAN ACCOUNTING STANDARD 41 8.19

As at 31st March, 20X1: 17,100 x 0.312 = 5,335.20.

As at 31st March, 20X2: 16,500 x 0.331 = 5,461.50.

Gain or loss

The difference in fair value of the plantation between the two year end dates is 126.30

(5,461.50 – 5,335.20), which will be reported as a gain in the statement or profit or loss

(regardless of the fact that it has not yet been realised).

2. Journal Entries on 1st October, 20X1

(All figures in `)

Loss (on death of 20 cows) (Refer W.N.) Dr. 5,20,000

To Biological asset 5,20,000

(Loss booked on death of 20 cows)

Biological Asset (purchase of 20 new cows) (Refer W.N.) Dr. 4,00,000

To Bank 4,00,000

(Initial recognition of 20 new purchased cows at fair value

less costs to sell)

Journal Entries on 31st March, 20X2

Loss on remeasurement of old cows Dr. 2,88,000

To Biological asset [(1,30,00,000 – 5,20,000) – 2,88,000

1,21,92,000]

(Subsequent measurement of cows at fair value less costs to

sell)

Biological Asset (4,48,000 – 4,00,000) Dr. 48,000

To Gain on remeasurement of new cows 48,000

(Subsequent measurement of cows at fair value less costs to

sell)

Inventory (Milk) as at 31st March,20X2 = ` 19,000 (1,000 x (20 – 1))

Working Note:

Calculation of Biological asset at various dates

Date Number Age Fair Value (` ) Cost to Sell Net (` ) Biological

(` ) asset (` )

1st April 20X1 500 3 years 27,000 1,000 26,000 1,30,00,000

1st October 20X1 (20) 3.5 years 27,000 1,000 26,000 (5,20,000)

1st October 20X1 20 1 year 21,000 1,000 20,000 4,00,000

1,28,80,000

© The Institute of Chartered Accountants of India

8.20 FINANCIAL REPORTING

31st March 20X2 480 4 years 26,500 1,100 25,400 1,21,92,000

20 1.5 years 23,500 1,100 22,400 4,48,000

1,26,40,000

3. Value of cattle at initial recognition (30 September 20X1) (All figures are in `)

Biological asset (cattle) Dr. 97,000*

Loss on initial recognition Dr. 4,000

To Bank (Purchase and cost of transportation) 1,01,000

(Initial recognition of cattle at fair value less costs to sell)

*Fair value of cattle = 1,00,000 – 1,000 – 2,000 (2% of 1,00,000) = 97,000

Subsequent measurement at 31 March 20X2 (All figures are in `)

Biological Assets (Cattle) Dr. 9,800

To Gain on Sale (Profit & Loss) 9,800

(Subsequent measurement of Cattle at fair value less costs to

sell (1,06,800** – 97,000))

** Fair value of cattle = 1,10,0000 – 1,000 – 2,200 (2% of 1,10,000) = 1,06,800

Sale of cattle on 1 June 20X2 (All figures are in ` )

Biological Assets (Cattle) Dr. 226

To Gain on Sale (Profit & Loss) 226

(Subsequent re-measurement of 18 Cattle at fair value

less costs to sell just prior to the point at which they are

sold [19,450 - {(1,06,800/100) x 18}]

Cost to Sales Dr. 19,450

To Biological Assets (Cattle) 19,450

(Recording a cost of sales figure separately with a

corresponding reduction in the value of the biological

assets)

Bank Dr. 19,450

Selling expenses (150 + 400) Dr. 550

To Revenue 20,000

(Recognition of revenue from sale of cattle)

© The Institute of Chartered Accountants of India

INDIAN ACCOUNTING STANDARD 41 8.21

Transfer of Cattle to Inventory on 15 September 20X2 (All figures are in ` )

Inventory (48,300 - 420) Dr. 47,880

Loss on remeasurement Dr. 1,176

To Biological Asset (Cattle) 44,856#

To Bank (Slaughtering cost) 4,200

(Transfer of cattle to inventory)

#Note: 44,856 is calculated as the proportion of cattle sold using the fair value (1,06,800+ 226

– 19,450) x 42/82)

Subsequent measurement of cattle at 30 September 20X2 (All figures are in ` )

Loss on remeasurement Dr. 18,440

To Biological Asset (Cattle) 18,440

(Subsequent measurement of Cattle

at fair value less costs to sell

[43,504## – {(1,06,800 + 226 –

19,450)– 44,856}]

##Fair value of cattle = 44,800 – 400 – 896 (2% of 44,800) = 43,504

© The Institute of Chartered Accountants of India

You might also like

- ICWIM Sample QuestionsDocument31 pagesICWIM Sample QuestionsSenthil Kumar K100% (7)

- VALLEJOS ACCTG 301 Biological Assets Answer KeyDocument4 pagesVALLEJOS ACCTG 301 Biological Assets Answer KeyEllah Rah78% (9)

- Acc133 PQ4Document2 pagesAcc133 PQ4Karina Barretto Agnes0% (2)

- NASDAQ Level II Trading StrategiesDocument55 pagesNASDAQ Level II Trading Strategiesyiweiw80% (15)

- LIQUIDITY A-Z SMC For BeginnersDocument5 pagesLIQUIDITY A-Z SMC For BeginnersCaser TOtNo ratings yet

- Ias 41 PQ With SolDocument3 pagesIas 41 PQ With SolÃhmed AliNo ratings yet

- CHAPTER 34 - Biological Assets: Problem 34-1 (IFRS)Document13 pagesCHAPTER 34 - Biological Assets: Problem 34-1 (IFRS)Kimberly Claire Atienza100% (3)

- Business Strategies in ItDocument13 pagesBusiness Strategies in ItAlex ZodNo ratings yet

- Practical Questions: Strategic Financial ManagementDocument50 pagesPractical Questions: Strategic Financial ManagementRITZ BROWNNo ratings yet

- Inventory With SolutionDocument11 pagesInventory With Solutionjjabarquez100% (1)

- SheDocument12 pagesSheMark Anthony Tibule80% (5)

- Rogue Currency Trades at Allied Irish BankDocument12 pagesRogue Currency Trades at Allied Irish BankRais MulaniNo ratings yet

- 13 - IND AS 41 - Agriculture (R)Document14 pages13 - IND AS 41 - Agriculture (R)S Bharhath kumarNo ratings yet

- Suggested Answers - Test 2 - InD As 36, 105, 41, 2Document8 pagesSuggested Answers - Test 2 - InD As 36, 105, 41, 2pratikdubey9586No ratings yet

- Biological AssetsDocument4 pagesBiological AssetsAlizeyy100% (1)

- Biological AssetsDocument1 pageBiological AssetsUlaine Gayle EsnaraNo ratings yet

- M2.4D Diy-Problems (Answer Key)Document6 pagesM2.4D Diy-Problems (Answer Key)Liandrew MadronioNo ratings yet

- Lets Goat Company AkeyDocument2 pagesLets Goat Company AkeyJeane Mae BooNo ratings yet

- CPA Board Operation Page 1 of 1Document1 pageCPA Board Operation Page 1 of 1Tina PascualNo ratings yet

- ACC124 - QuestionnaireDocument16 pagesACC124 - QuestionnaireJr DalabajanNo ratings yet

- Biological AssetsDocument8 pagesBiological AssetsAYEZZA SAMSONNo ratings yet

- Bca 302 Special Accounts Dec 1Document6 pagesBca 302 Special Accounts Dec 1omondifoe23No ratings yet

- 16 and IAS 41), Which Applies To Annual Periods Beginning On or After 1 January 2016Document4 pages16 and IAS 41), Which Applies To Annual Periods Beginning On or After 1 January 2016Jewel Ishi RomeroNo ratings yet

- Homework 3 - AgricultureDocument1 pageHomework 3 - AgriculturealvarezxpatriciaNo ratings yet

- Bac 402 Cat 2 (Part 2)Document2 pagesBac 402 Cat 2 (Part 2)mwitajanepherNo ratings yet

- Activity 10Document2 pagesActivity 10Randelle James FiestaNo ratings yet

- Biological AssetsDocument2 pagesBiological AssetsAnonymous LC5kFdtcNo ratings yet

- Pas 41 AgricultureDocument30 pagesPas 41 AgricultureJenny Mae MercadoNo ratings yet

- BAFACR16 04 Problem IllustrationsDocument3 pagesBAFACR16 04 Problem IllustrationsThats BellaNo ratings yet

- Pas 41 AgricultureDocument5 pagesPas 41 Agriculturetrevor.v.philips23No ratings yet

- Steven Dave OñasDocument6 pagesSteven Dave OñasnenzzmariaNo ratings yet

- FR 2 New Question PaperDocument7 pagesFR 2 New Question PaperkrishNo ratings yet

- Feasibility Report On German Shepherd Dog Farming (: 1.capital CostDocument2 pagesFeasibility Report On German Shepherd Dog Farming (: 1.capital CostmasharabNo ratings yet

- Biological Asset ProblemsDocument1 pageBiological Asset ProblemsMaxineNo ratings yet

- Biological Assets Quizzer Problem 1Document5 pagesBiological Assets Quizzer Problem 1GooJaeRiNo ratings yet

- Accounting For Price Level Changes 2Document9 pagesAccounting For Price Level Changes 2lil telNo ratings yet

- Chapter 5 - Biological AssetsDocument4 pagesChapter 5 - Biological AssetsMarjorie PrietosNo ratings yet

- SHE Problems PDFDocument12 pagesSHE Problems PDFMinie KimNo ratings yet

- Numerical Problems: Roblem ET ON OpicDocument21 pagesNumerical Problems: Roblem ET ON OpicMahimMajumderNo ratings yet

- VALLEJOS ACCTG 301 Biological Assets Answer KeyDocument3 pagesVALLEJOS ACCTG 301 Biological Assets Answer Keyyes yesnoNo ratings yet

- PRELEC1 Exercise Worksheet Unit 01Document3 pagesPRELEC1 Exercise Worksheet Unit 01Ann Diane Renz DongsalNo ratings yet

- Sol. Man. - Chapter 21 - Agriculture - Ia Part 1BDocument9 pagesSol. Man. - Chapter 21 - Agriculture - Ia Part 1BRezzan Joy Camara MejiaNo ratings yet

- Project Plan For A Commercial Dairy Farm of 100 Cows Dairy HerdDocument6 pagesProject Plan For A Commercial Dairy Farm of 100 Cows Dairy Herdahmr.comNo ratings yet

- Activity 1 IaDocument4 pagesActivity 1 IaRikka TakanashiNo ratings yet

- Problem15 The Cost of Inventory of Coffee Beans 1,850,000 LCRNV 50,000Document9 pagesProblem15 The Cost of Inventory of Coffee Beans 1,850,000 LCRNV 50,000Kyle Vincent SaballaNo ratings yet

- Assignment On Advanced Accounting IDocument2 pagesAssignment On Advanced Accounting IAbshir C/laahiNo ratings yet

- Feasibility Report On Dairy FarmingDocument2 pagesFeasibility Report On Dairy FarmingmasharabNo ratings yet

- Cash Generated From Operations Net Cash From Operating ActivitiesDocument8 pagesCash Generated From Operations Net Cash From Operating ActivitiesnickolocoNo ratings yet

- Shareholder's EquityDocument10 pagesShareholder's EquityNicole Gole CruzNo ratings yet

- Financial Accounting Chapter 19Document2 pagesFinancial Accounting Chapter 19Meisha Klein Lee67% (3)

- 73v8l74fi - ACTIVITY - CHAPTER 15 - ACCOUNTING FOR CORPORATIONSDocument2 pages73v8l74fi - ACTIVITY - CHAPTER 15 - ACCOUNTING FOR CORPORATIONSLyra Mae De BotonNo ratings yet

- Test 2 - Ind As 36 - 105 - QuesDocument4 pagesTest 2 - Ind As 36 - 105 - Quesbhallavishal.socialmediaNo ratings yet

- Assignment On LCNRV and GP MethodDocument6 pagesAssignment On LCNRV and GP MethodAdam CuencaNo ratings yet

- AgricultureDocument4 pagesAgricultureViky Rose EballeNo ratings yet

- Adjustments For Preparation of Financial Statements (ACCA)Document9 pagesAdjustments For Preparation of Financial Statements (ACCA)team aspirantsNo ratings yet

- Agriculture-Biological Assets - 2Document9 pagesAgriculture-Biological Assets - 2let me live in peaceNo ratings yet

- 7106 - Biological AssetDocument2 pages7106 - Biological AssetGerardo YadawonNo ratings yet

- Partial: INSTRUCTION: Select From The Dropdowns The Best Answer For Each Question or EachDocument23 pagesPartial: INSTRUCTION: Select From The Dropdowns The Best Answer For Each Question or EachHope Trinity EnriquezNo ratings yet

- (Backup) (Backup) FA1 Revision 2019Document32 pages(Backup) (Backup) FA1 Revision 2019Hiền nguyễn thuNo ratings yet

- Jam Althea O. Agner Prelec Output 1Document3 pagesJam Althea O. Agner Prelec Output 1JAM ALTHEA AGNERNo ratings yet

- AC218 - Financial Statement Presentation in Compliance With IAS 41 RequirementsDocument11 pagesAC218 - Financial Statement Presentation in Compliance With IAS 41 RequirementsTINASHENo ratings yet

- Acctg 121Document3 pagesAcctg 121YricaNo ratings yet

- Biological AssetsDocument2 pagesBiological AssetsGinalyn BisongaNo ratings yet

- IAS 41 Dec 20Document5 pagesIAS 41 Dec 20Arney GumbleNo ratings yet

- Chapter 13 - Sh. Based PaymentsDocument4 pagesChapter 13 - Sh. Based PaymentsXiena75% (4)

- 5.9.2.6 Allocating Goodwill To Cash-Generating Units: Indian Accounting Standard 36Document16 pages5.9.2.6 Allocating Goodwill To Cash-Generating Units: Indian Accounting Standard 36RITZ BROWNNo ratings yet

- Indian Accounting Standard 12: © The Institute of Chartered Accountants of IndiaDocument22 pagesIndian Accounting Standard 12: © The Institute of Chartered Accountants of IndiaRITZ BROWNNo ratings yet

- 3.3.1 Functions That Are Integral To Business: Financial Reporting SolutionDocument15 pages3.3.1 Functions That Are Integral To Business: Financial Reporting SolutionRITZ BROWNNo ratings yet

- Qualifying Asset: Qualifying Asset Is An Asset That Necessarily Takes A Substantial Period ofDocument12 pagesQualifying Asset: Qualifying Asset Is An Asset That Necessarily Takes A Substantial Period ofRITZ BROWNNo ratings yet

- Indian Accounting Standard 105: © The Institute of Chartered Accountants of IndiaDocument17 pagesIndian Accounting Standard 105: © The Institute of Chartered Accountants of IndiaRITZ BROWNNo ratings yet

- Indian Accounting Standard 16: © The Institute of Chartered Accountants of IndiaDocument7 pagesIndian Accounting Standard 16: © The Institute of Chartered Accountants of IndiaRITZ BROWNNo ratings yet

- Indian Accounting Standard 33 Diluted Earnings Per ShareDocument3 pagesIndian Accounting Standard 33 Diluted Earnings Per ShareRITZ BROWNNo ratings yet

- Financial Reporting: Cost of Investment PropertyDocument11 pagesFinancial Reporting: Cost of Investment PropertyRITZ BROWNNo ratings yet

- Indian Accounting Standard 37: Contingent LiabilityDocument14 pagesIndian Accounting Standard 37: Contingent LiabilityRITZ BROWNNo ratings yet

- Financial Reporting: © The Institute of Chartered Accountants of IndiaDocument7 pagesFinancial Reporting: © The Institute of Chartered Accountants of IndiaRITZ BROWNNo ratings yet

- Ind As 115Document32 pagesInd As 115RITZ BROWNNo ratings yet

- 1.2 Objective: Financial Reporting Examples 1 & 2Document8 pages1.2 Objective: Financial Reporting Examples 1 & 2RITZ BROWNNo ratings yet

- © The Institute of Chartered Accountants of India: ST ST STDocument14 pages© The Institute of Chartered Accountants of India: ST ST STRITZ BROWNNo ratings yet

- Forex Pages 42 90Document49 pagesForex Pages 42 90RITZ BROWN100% (1)

- Ind As 20Document12 pagesInd As 20RITZ BROWNNo ratings yet

- 3.5 Asset or Liability Specific Fair Value: Example 2 - Settlement Vs TransferDocument10 pages3.5 Asset or Liability Specific Fair Value: Example 2 - Settlement Vs TransferRITZ BROWNNo ratings yet

- Indian Accounting Standard 101Document19 pagesIndian Accounting Standard 101RITZ BROWNNo ratings yet

- Audit May 2020 Rev Charts - Sandhiya SarafDocument137 pagesAudit May 2020 Rev Charts - Sandhiya SarafRITZ BROWNNo ratings yet

- Chap 5-Pages-45-46,63-119Document59 pagesChap 5-Pages-45-46,63-119RITZ BROWN100% (1)

- Test Your Knowledge: 2.2.4.2 Pricing of SwaptionsDocument11 pagesTest Your Knowledge: 2.2.4.2 Pricing of SwaptionsRITZ BROWNNo ratings yet

- Test Your Knowledge: Theoretical QuestionsDocument30 pagesTest Your Knowledge: Theoretical QuestionsRITZ BROWN33% (3)

- Practical Questions: Derivatives Analysis and Valuation 7Document24 pagesPractical Questions: Derivatives Analysis and Valuation 7RITZ BROWNNo ratings yet

- Contents of An Interim Financial Report: Unit OverviewDocument5 pagesContents of An Interim Financial Report: Unit OverviewRITZ BROWNNo ratings yet

- 20 Kalpataru Sparkle PowerDocument301 pages20 Kalpataru Sparkle PowerRITZ BROWNNo ratings yet

- Paper - 2: Strategic Financial Management Questions Security ValuationDocument21 pagesPaper - 2: Strategic Financial Management Questions Security ValuationRITZ BROWNNo ratings yet

- Micro Economics: Econ 601: Updated: 21 Feb 2007Document15 pagesMicro Economics: Econ 601: Updated: 21 Feb 2007Anwar MuNo ratings yet

- Retail (India) LTD: Project Topic Brand Equity Prepared by Savaliya Mahesh D. StandardDocument84 pagesRetail (India) LTD: Project Topic Brand Equity Prepared by Savaliya Mahesh D. StandardRj RameshNo ratings yet

- Onward and Upward: Bloomberg Crypto OutlookDocument8 pagesOnward and Upward: Bloomberg Crypto OutlookAdetunji TaiwoNo ratings yet

- Solution To Problem 1-3: Liability For BonusesDocument16 pagesSolution To Problem 1-3: Liability For BonusesNaddieNo ratings yet

- Sephora CollabAds Webinar SolutionsDocument24 pagesSephora CollabAds Webinar Solutionsram sanjivNo ratings yet

- Information Rules: Technology Meet EconomyDocument20 pagesInformation Rules: Technology Meet EconomyMuhammad Syahrul MaulidanNo ratings yet

- Sing A Song KaraokeDocument108 pagesSing A Song Karaokewanida_suwei100% (11)

- KRG Consultants Private Limited: Group PresentationDocument25 pagesKRG Consultants Private Limited: Group PresentationSajid SarwarNo ratings yet

- Stock MarketsDocument8 pagesStock MarketsKrishnarao PujariNo ratings yet

- Microeconomics: by Robert S. Pindyck Daniel Rubinfeld Ninth EditionDocument47 pagesMicroeconomics: by Robert S. Pindyck Daniel Rubinfeld Ninth EditionNisrina Najla100% (1)

- BCG MatrixDocument17 pagesBCG MatrixGowri J BabuNo ratings yet

- How A Creditcard Is ProcessedDocument5 pagesHow A Creditcard Is Processedkk81No ratings yet

- Socsci032 Activity 2 CaroroDocument1 pageSocsci032 Activity 2 CaroroBritney ClaireNo ratings yet

- Finance 4 BSP and Monetary Policy AnswersDocument10 pagesFinance 4 BSP and Monetary Policy Answersjojie dadorNo ratings yet

- ANA Digital Marketing BPG PDFDocument48 pagesANA Digital Marketing BPG PDFDemand Metric100% (1)

- Internship-Report-KhushiDocument42 pagesInternship-Report-Khushicyberspank01No ratings yet

- Handout - 02 - Subsequent TransactionsDocument3 pagesHandout - 02 - Subsequent TransactionsPrincess NozalNo ratings yet

- A 2 - Roles and Functions of Various Participants in Financial MarketDocument2 pagesA 2 - Roles and Functions of Various Participants in Financial MarketOsheen Singh100% (1)

- Gold Leaf New Modern Pack PresentationDocument21 pagesGold Leaf New Modern Pack PresentationMuhammad AbidNo ratings yet

- Multiple Choice QuestionsDocument2 pagesMultiple Choice QuestionsMuthusamy SenthilkumaarNo ratings yet

- Economics Chapter 6-7 Guided NotesDocument2 pagesEconomics Chapter 6-7 Guided NotesTookieNo ratings yet

- Ecw2731 PR ExamDocument7 pagesEcw2731 PR Examjaylaw12No ratings yet

- Personal Finance 10Th Edition Kapoor Solutions Manual Full Chapter PDFDocument53 pagesPersonal Finance 10Th Edition Kapoor Solutions Manual Full Chapter PDFshelbyelliswimynjsrab100% (11)

- Channel ManagementDocument7 pagesChannel ManagementViplav NigamNo ratings yet

- Tutorial 11 Chap 3 StudentsDocument3 pagesTutorial 11 Chap 3 StudentsJia LeNo ratings yet