Professional Documents

Culture Documents

Equity Reports For The Week (11th - 15th April 11)

Equity Reports For The Week (11th - 15th April 11)

Uploaded by

Dasher_No_1Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Equity Reports For The Week (11th - 15th April 11)

Equity Reports For The Week (11th - 15th April 11)

Uploaded by

Dasher_No_1Copyright:

Available Formats

WEEKLY REPORT

11th Apr - 15th Apr 2011

Global Research Limited

STOCKS

R E P O R T

TOUGH TUSSLE, BEARS SMELL VICTORY @ END!!

WEEK WRAP

The markets closed the last trading day of the week on a soft note owing to profit taking, mainly in realty stocks. The Nifty dropped 44 points at 5,842. After

outperforming for several days, the mid-cap and small-cap indices too underperformed today.

The FII (Foreign Institutional Investor) investments have slowed in the past few sessions, according to provisional data from Bombay Stock Exchange FIIs were net

buyers of Rs 221 crore while DIIs were net sellers of Rs 213 crore in the equity market on Thursday.

On the realty front, after rallying for nearly nine trading sessions, the index was in the negative due to the profit booking seen since morning. The scrips that

were battered were Orbit Corporation down 6%, Ackruti City, HDIL, Sobha Developers and DLF down 4-5% each.

ASIAN & EMERGING MARKET

Asian markets were trading firm. China's Shanghai Composite was up 0.11% or 3.19 points at 3,011.09.

Singapore Exchange ends ASX bid after Australian government rejection : Singapore Exchange terminated its $8 billion bid for Australia's ASX , after the

Australian government formally rejected the offer, saying changes to the country's financial systems were needed before foreigners could buy the bourse.

Singapore Exchange ends ASX bid after Australian government rejection : Singapore Exchange terminated its $8 billion bid for Australia's ASX , after the

Australian government formally rejected the offer, saying changes to the country's financial systems were needed before foreigners could buy the bourse.

US MARKET

The US markets closed off the day's lows after recovering from a knee-jerk reaction to the fresh quake in Japan.

In economic data, initial unemployment claims fell by 10,000 to 382,000 from an upwardly revised 392,000. The four week moving average of unemployment

claims fell by 5,750 to 389,500.

Oil traded at 2.5 year highs as fears of violence amid the Nigerian elections spurred oil prices higher. Demand-supply concerns also pressurised crude as Nymex

traded above the USD 110 per barrel mark, while Brent traded over USD 122 per barrel.

The White House and Congress faced a midnight deadline to break a budget deadlock. Democratic and Republican leaders said there was still no overall deal on

government funding for the rest of the fiscal year.

MICRO ECONOMIC FRONT

The White House and Congress faced a midnight deadline to break a budget deadlock. Democratic and Republican leaders said there was still no overall deal on

government funding for the rest of the fiscal year.

The government aims at increasing the share of manufacturing sector from 16-17% to 25-26% of the GDP by 2020. Manufacturing contributes over 80% in the

country's overall industrial production.

Auto exports soar 30% in FY11: Automobile exports from India grew at a robust 29.64% in 2010-11 riding on two-wheelers and commercial vehicles despite a

sluggish demand from Europe, one of the main markets for small cars.

1 | APRIL 2011 | www.capitalvia.com

WEEKLY REPORT

11th Apr - 15th Apr 2011

Global Research Limited

TOUGH TUSSLE, BEARS SMELL VICTORY @ END!!

NIFTY WORLD INDICES

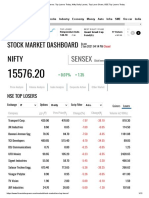

NIFTY Properties Values World Indices Close Weekly Chg Points % Chg

Weekly Open 5842.00 Sensex 19451.45 +31.06 +0.15%

Weekly High 5944.45 Nifty 5842.00 0 UNCHANGED

Weekly Low 5822.00 DOW Jones 12380.05 +3.33 +0.2%

Weekly Close 5842.00 Shanghai Comp. 3030.10 +63 +2.12%

Weekly Chg Points 0 Nikkei 9768.08 +59.69 +0.61%

Weekly Chg% UNCHANGED CAC 40 4061.91 +7.15 +0.17%

FTSE 6055.75 +45.85 +0.76%

SECTORIAL INDICES

Indices Open High Low Close

BANK NIFTY 11614.45 11861.15 11614.45 11673.25

CNX NIFTY JUNIOR 11375.20 11758.15 11714.50 11544.35

S&P CNX 500 4648.75 4753.50 4648.75 4684.50

CNX IT 7130.25 7344.90 7130.25 7168.80

CNX MIDCAP 8129.60 8451.05 8129.60 8288.30

CNX 100 5724.85 5835.90 5719.60 5739.10

GAINERS LOSERS

Scrip GAINERS

Current Close Change Chg % Scrip Current Close Change Chg %

PERIA KARAMA 219.55 127.20 72.60 ACROPET.TECH 53.25 68.20 -21.92

AP PAPR MILL 390.35 236.95 64.73 OSWAL INERAL 39.90 47.80 -16.52

TEXMO PIPES 49.15 32.05 53.35 HIMADRI CHEM 39.85 45.45 -12.32

ASTER SILICA 36.60 24.85 47.28 COM.ENGINEER 40.70 46.15 -11.80

SARDA ENERGY 285.70 197.50 44.65 PTC FINANCE 22.50 24.90 -9.63

DII’S INVESTMENTS FII’S INVESTMENTS

Indices Buy Value Sell Value Net Value Indices Buy Value Sell Value Net Value

07-Apr-2011 339.00 389.00 -50.00 08-Apr-2011 2687.90 2304.60 383.30

06-Apr-2011 537.60 740.20 -202.60 07-Apr-2011 2983.70 2267.50 716.30

05-Apr-2011 303.30 649.00 -345.80 06-Apr-2011 4917.90 3355.20 1562.70

04-Apr-2011 189.40 332.20 -142.90 05-Apr-2011 9929.90 5842.60 4087.30

1 | DECEMBER 2010 | www.capitalvia.com

2 | APRIL 2011 | www.capitalvia.com

WEEKLY REPORT

11th Apr - 15th Apr 2011

Global Research Limited

TOUGH TUSSLE, BEARS SMELL VICTORY @ END!!

WEEK AHEAD SPOT NIFTY

TECHNICALS

Properties Values

Support 1 5830

Support 2 5780

Resistance 1 5935

Resistance 2 6000

Figure: 1 Nifty Weekly

The Nifty futures closed and settled finally at 5854.90, down by -47.10 points or -0.80 %. It looking bullish in the coming

trading session if it manages to trade above the resistance level of 5935 else below 5830 it would be in a downward trend.

WEEK AHEAD BANK NIFTY

TECHNICALS

Properties Values

Support 1 11665

Support 2 11580

Resistance 1 11925

Resistance 2 12050

Figure: Bank Nifty Weekly

Bank Nifty Futures shut stop at 11804.90 up by 19.85 points or 0.17 %.It is looking bullish in the coming trading session if it

manages to trade above the resistance level of 11956 else below 11665 it would be in a downward trend.

3 | APRIL 2011 | www.capitalvia.com

WEEKLY REPORT

11th Apr - 15th Apr 2011

Global Research Limited

TOUGH TUSSLE, BEARS SMELL VICTORY @ END!!

STOCK OF THE WEEK - JUBILANT LIFE SCIENCES BUY

TECHNICAL PICTURE

JUBILANT LIFE SCIENCE IS IN CONSOLIDATION PHASE FROM LAST FEW TRADING SESSION. .IF IT MANAGES TO SUSTAIN ABOVE 190IT

WILL TAKE UP MOVE .WE RECOMMEND TO BUY JUBILANT LIFE SCIENCE IN CASH ABOVE 190 TARGET 197,200 WITH STOP LOSS OF

182.

JUBILANT LIFE SCIENCES LTD. Indices JUBILANT LIFE SCIENCES

Support 182

Resistance 190

Symbol JUBILANT (NSE)

Company Name JUBILANT LIFE SCIENCES LTD.

Price `185

Change `2.60

Volume 144489

52 Week High 394.80

% From High -53.15%

Day High 189.50

EPS 21.44

4 | APRIL 2011 | www.capitalvia.com

WEEKLY REPORT

11th Apr - 15th Apr 2011

Global Research Limited

TOUGH TUSSLE, BEARS SMELL VICTORY @ END!!

KEY STATISTICS

C Current Quarter Earning per Share. The Higher The Better.

WHY CAN SLIM?

Primary Factors

Almost 27.27% decrease in Q o Q Earnings.

A Annual Earnings Increases: Look for a significant growth.

Primary Factors

Annual Earnings showed an increment of 39.25% Y o

N New Products, New Management, New Highs, Buying at

Right Time.

Primary Factors

JUBILANT LIFESCIENCE LTD. is set to have a breakout as it is being

consolidating with positive biasness from last many trading

sessions.

“CAN SLIM is a formula created by

William J. O'Neil, who is the founder

of the Investor's Business Daily and

author of the book How to Make

S Supply and Demand: Shares Outstanding Plus Big Volume

Demand.

Money in Stocks - A Winning System Primary Factors

in Good Times or Bad. JUBILANT LIFESCIENCE LTD. is a midcap stock consisting of Rs.

2722.95 crores Shares Outstanding (Total Public Shareholding)

Each letter in CAN SLIM stands for

one of the seven chief

characteristics that are commonly

found in the greatest winning L Leader or Laggard: Which is your stock?

Primary Factors

stocks. The C-A-N-S-L-I-M.

JUBILANT LIFESCIENCE LTD. is a leading stock with a relative strength

above 33.69% in Weekly and 66.11% in Daily.

characteristics are often present

prior to a stock making a significant

rise in price, and making huge

profits for the shareholders! I Institutional Sponsorship: Follow the Leaders.

Primary Factors

Approximately 32.20% of Shares are held by the Institutional

O'Neil explains how he conducted

Investors (FII”s, Mutual Funds etc.)

an intensive study of 500 of the

biggest winners in the stock market

from 1953 to 1990. A model of each

of these companies was built and

M Market Direction

Primary Factors

studied. Again and again, it was

noticed that almost all of the If Market continues to remain in a secular uptrend, hence overall

biggest stock market winners had conditions are appropriate to initiate long position in the stock: A Big

very similar characteristics just plus for the Stock

before they began their big moves.”

Sources: Sihl.in

5 | APRIL 2011 | www.capitalvia.com

WEEKLY REPORT

11th Apr - 15th Apr 2011

Global Research Limited

DISCLAIMER

The information and views in this report, our website & all the service we provide are believed to be reliable, but we do not accept any responsibility (or

liability) for errors of fact or opinion. Users have the right to choose the product/s that suits them the most.

Investment in Stocks has its own risks. Sincere efforts have been made to present the right investment perspective. The information contained herein is

based on analysis and up on sources that we consider reliable. We, however, do not vouch for the accuracy or the completeness thereof. This material is

for personal information and we are not responsible for any loss incurred based upon it & take no responsibility whatsoever for any financial profits or

loss which may arise from the recommendations above.

The stock price projections shown are not necessarily indicative of future price performance. The information herein, together with all estimates and

forecasts, can change without notice.

CapitalVia does not purport to be an invitation or an offer to buy or sell any financial instrument.

Analyst or any person related to CapitalVia might be holding positions in the stocks recommended.

It is understood that anyone who is browsing through the site has done so at his free will and does not read any views expressed as a recommendation for

which either the site or its owners or anyone can be held responsible for.

Our Clients (Paid Or Unpaid), Any third party or anyone else have no rights to forward or share our calls or SMS or Report or Any Information Provided by

us to/with anyone which is received directly or indirectly by them. If found so then Serious Legal Actions can be taken.

Any surfing and reading of the information is the acceptance of this disclaimer.

All Rights Reserved.

Contact Number:

Hotline: +91-91790-02828

Landline: +91-731-668000

Fax: +91-731-4238027

C O N TA C T U S

Corporate Office Address:

India: No. 99, 1st Floor, Surya Complex

CapitalVia Global Research Limited R. V. Road, Basavangudi

No. 506 West, Corporate House Opposite Lalbagh West Gate

169, R. N. T. Marg, Near D. A. V. V. Bangalore - 560004

Indore - 452001

Singapore:

CapitalVia Global Research Pvt. Ltd.

Block 2 Balestier Road

#04-665 Balestier Hill

Shopping Centre

Singapore - 320002

6 | APRIL 2011 | www.capitalvia.com

You might also like

- Completed Chapter 5 Mini Case Working Papers Fa14Document12 pagesCompleted Chapter 5 Mini Case Working Papers Fa14Gauri KarkhanisNo ratings yet

- Bekaert International Financial Management 2eDocument6 pagesBekaert International Financial Management 2essinh100% (1)

- Equity Market Reports For The Week (18th - 22nd April 11)Document6 pagesEquity Market Reports For The Week (18th - 22nd April 11)Dasher_No_1No ratings yet

- Equity Reports For The Week (25th - 29th April '11)Document6 pagesEquity Reports For The Week (25th - 29th April '11)Dasher_No_1No ratings yet

- Equity Reports For The Week (2nd - 6th May '11)Document6 pagesEquity Reports For The Week (2nd - 6th May '11)Dasher_No_1No ratings yet

- Stock Market Reports For The Week (9th - 13th May '11)Document6 pagesStock Market Reports For The Week (9th - 13th May '11)Dasher_No_1No ratings yet

- Stock Market Reports For The Week (16th - 20th May '11)Document6 pagesStock Market Reports For The Week (16th - 20th May '11)Dasher_No_1No ratings yet

- Stock Market Reports For The Week (21st - 25th March - 2011)Document6 pagesStock Market Reports For The Week (21st - 25th March - 2011)Dasher_No_1No ratings yet

- Watch Out CapitalHeight Weekly Performance Report From 23 To 27 July.Document11 pagesWatch Out CapitalHeight Weekly Performance Report From 23 To 27 July.Damini CapitalNo ratings yet

- Weekly Special Report of CapitalHeight 23 July 2018Document11 pagesWeekly Special Report of CapitalHeight 23 July 2018Damini CapitalNo ratings yet

- Equity Reports For The Week (4th October '10)Document10 pagesEquity Reports For The Week (4th October '10)Dasher_No_1No ratings yet

- Index Movement:: National Stock Exchange of India LimitedDocument36 pagesIndex Movement:: National Stock Exchange of India LimitedTrinadh Kumar GuthulaNo ratings yet

- Derivative Report 02 May UpdateDocument6 pagesDerivative Report 02 May UpdateDEEPAK MISHRANo ratings yet

- Daily Market Coverage 8th Dec 2017Document1 pageDaily Market Coverage 8th Dec 2017Riya ShrivastavNo ratings yet

- Stock Trading Analysis by Mansukh Investment and Trading Solutions 10/5/2010Document5 pagesStock Trading Analysis by Mansukh Investment and Trading Solutions 10/5/2010MansukhNo ratings yet

- Scriptwise Cummulative Report For Equity Segment Between 01-Apr-2006 and 31-Mar-2007Document1 pageScriptwise Cummulative Report For Equity Segment Between 01-Apr-2006 and 31-Mar-2007api-3730755No ratings yet

- Equity Report 6 To 10 NovDocument6 pagesEquity Report 6 To 10 NovzoidresearchNo ratings yet

- Money Maker Research Pvt. LTD.: Daily Equity ReportDocument6 pagesMoney Maker Research Pvt. LTD.: Daily Equity ReportMoney Maker ResearchNo ratings yet

- Way2Wealth Daily Trading Bites Apr1Document3 pagesWay2Wealth Daily Trading Bites Apr1Srikanth RamakrishnaNo ratings yet

- Equity Research Report 27 November 2018 Ways2CapitalDocument17 pagesEquity Research Report 27 November 2018 Ways2CapitalWays2CapitalNo ratings yet

- Index Movement:: National Stock Exchange of India LimitedDocument36 pagesIndex Movement:: National Stock Exchange of India Limitedanilkhubchandani9744No ratings yet

- Equity Research Report 13 November 2018 Ways2CapitalDocument17 pagesEquity Research Report 13 November 2018 Ways2CapitalWays2CapitalNo ratings yet

- Derivative Report 6march2017Document6 pagesDerivative Report 6march2017ram sahuNo ratings yet

- Daily Recap August 9 2022Document2 pagesDaily Recap August 9 2022Jay-Rald TorresNo ratings yet

- Technical and DerivativesDocument5 pagesTechnical and DerivativesSarvesh BhagatNo ratings yet

- 26oct 16 PDFDocument3 pages26oct 16 PDFasifNo ratings yet

- Nifty Today Previous Change: Nifty Close vs. VIXDocument4 pagesNifty Today Previous Change: Nifty Close vs. VIXshivratan007No ratings yet

- Derivatives Report 29 Dec 2010Document3 pagesDerivatives Report 29 Dec 2010parishkaaNo ratings yet

- 1st Dec NewsletterDocument23 pages1st Dec NewsletterPrashant BhanotNo ratings yet

- Equity DailyDocument4 pagesEquity DailyArvsrvNo ratings yet

- Most Active Calls: Map of The Market Top Ten Gainers / Losers Most Active Securities / ContractsDocument2 pagesMost Active Calls: Map of The Market Top Ten Gainers / Losers Most Active Securities / ContractstapasNo ratings yet

- Tech Report 05.01Document3 pagesTech Report 05.01Swayam MangwaniNo ratings yet

- Equity Report 16 - 20 OctDocument6 pagesEquity Report 16 - 20 OctzoidresearchNo ratings yet

- Indian Market Research Daily Market Summary: Paterson Securities PVT LTDDocument3 pagesIndian Market Research Daily Market Summary: Paterson Securities PVT LTDmuthu_theone6943No ratings yet

- Weekly Stock Market Trend and UpdatesDocument6 pagesWeekly Stock Market Trend and UpdatesRahul SolankiNo ratings yet

- Derivative Premium Daily Journal-16th November 2017, ThursdayDocument12 pagesDerivative Premium Daily Journal-16th November 2017, ThursdaySiddharth PatelNo ratings yet

- Caps TrendDocument5 pagesCaps TrendNiraj KumarNo ratings yet

- Weekly 12082017Document5 pagesWeekly 12082017Thiyaga RajanNo ratings yet

- High Brow Market Research Investment Advisor Private LimitedDocument16 pagesHigh Brow Market Research Investment Advisor Private LimitedWays2CapitalNo ratings yet

- Equity Research Report 14 August 2018 Ways2CapitalDocument17 pagesEquity Research Report 14 August 2018 Ways2CapitalWays2CapitalNo ratings yet

- Total Sales 4800 8000 Gross Profit 1968 3200Document28 pagesTotal Sales 4800 8000 Gross Profit 1968 3200lika rukhadzeNo ratings yet

- Morning Notes 14 July 2010: Mansukh Securities and Finance LTDDocument5 pagesMorning Notes 14 July 2010: Mansukh Securities and Finance LTDMansukhNo ratings yet

- Friday November 26, 2010: Total Turnover (RS.)Document14 pagesFriday November 26, 2010: Total Turnover (RS.)Don Nuwan DanushkaNo ratings yet

- Equity Research Report 06 November 2018 Ways2CapitalDocument17 pagesEquity Research Report 06 November 2018 Ways2CapitalWays2CapitalNo ratings yet

- June 2Document5 pagesJune 2Pallavi M SNo ratings yet

- Index Movement:: National Stock Exchange of India LimitedDocument37 pagesIndex Movement:: National Stock Exchange of India LimitedJayant SharmaNo ratings yet

- Tech Report 24 (1) .02.2011Document3 pagesTech Report 24 (1) .02.2011Arijit TagoreNo ratings yet

- Moneysukh Market Insight Report 25/3/2010Document5 pagesMoneysukh Market Insight Report 25/3/2010MansukhNo ratings yet

- Case Study Analysis Cash Flows:: Year CFBT (-) DEP PBT (-) TAX EAT (+) DEP CfatDocument3 pagesCase Study Analysis Cash Flows:: Year CFBT (-) DEP PBT (-) TAX EAT (+) DEP CfatGnana PrasunaNo ratings yet

- Symbol Underlying Asset Open HighDocument6 pagesSymbol Underlying Asset Open HighutkarshgadiaNo ratings yet

- 15 July 2010Document4 pages15 July 2010kartikdhl7No ratings yet

- Hero Honda Motors Limited: Company Profile Mission Statement Board of Directors PromotersDocument35 pagesHero Honda Motors Limited: Company Profile Mission Statement Board of Directors PromotersCharan KowtikwarNo ratings yet

- Daily Market Coverage 11th Jan 2018Document1 pageDaily Market Coverage 11th Jan 2018Riya ShrivastavNo ratings yet

- Nifty Today Previous Change: Nifty Close vs. VIXDocument4 pagesNifty Today Previous Change: Nifty Close vs. VIXshivratan007No ratings yet

- FMG1 Exercise Set B SolutionsDocument78 pagesFMG1 Exercise Set B SolutionsArnold BernasNo ratings yet

- Snack Corner Restaurant Input Variables For The Proposed Investment Particulars Data ValueDocument12 pagesSnack Corner Restaurant Input Variables For The Proposed Investment Particulars Data ValueReagan SsebbaaleNo ratings yet

- OMSEC Morning Note 06 09 2022Document6 pagesOMSEC Morning Note 06 09 2022Ropafadzo KwarambaNo ratings yet

- Weekly Newsletter Equity 30-SEPT-2017Document7 pagesWeekly Newsletter Equity 30-SEPT-2017Market Magnify Investment Adviser & ResearchNo ratings yet

- Gain & Loss FY EQUITY Report FNR352D101Document1 pageGain & Loss FY EQUITY Report FNR352D101PALLAVI SHARMANo ratings yet

- Capital Investment 12-1 To 6 PanisalesDocument8 pagesCapital Investment 12-1 To 6 PanisalesVincent PanisalesNo ratings yet

- The Joy of SOX: Why Sarbanes-Oxley and Services Oriented Architecture May Be the Best Thing That Ever Happened to YouFrom EverandThe Joy of SOX: Why Sarbanes-Oxley and Services Oriented Architecture May Be the Best Thing That Ever Happened to YouRating: 3.5 out of 5 stars3.5/5 (1)

- Securities Operations: A Guide to Trade and Position ManagementFrom EverandSecurities Operations: A Guide to Trade and Position ManagementRating: 4 out of 5 stars4/5 (3)

- III Sem MBA Class Time Table 2020-2022 Batch (16.11.2021)Document1 pageIII Sem MBA Class Time Table 2020-2022 Batch (16.11.2021)Sana RahmanNo ratings yet

- E14-3 (Entries For Bond Transactions) Presented Below Are Two Independent SituationsDocument3 pagesE14-3 (Entries For Bond Transactions) Presented Below Are Two Independent SituationsAsuna SanNo ratings yet

- Internal Assessment Based On Summer Internship Company (Praedico Global Research Private Limited)Document3 pagesInternal Assessment Based On Summer Internship Company (Praedico Global Research Private Limited)Nishant BhartiNo ratings yet

- Itc Project ReportDocument71 pagesItc Project ReportHarika Achanta50% (4)

- Sroi Reports: Social Return On InvestmentDocument10 pagesSroi Reports: Social Return On InvestmentgilbertociroNo ratings yet

- Project Report: and Finance Under The University of Calcutta)Document15 pagesProject Report: and Finance Under The University of Calcutta)Amit Singh100% (1)

- Examiner's Report 0611 - p4Document4 pagesExaminer's Report 0611 - p4Duc Anh NguyenNo ratings yet

- Hilega Milega ConceptsDocument8 pagesHilega Milega ConceptsManan AgarwalNo ratings yet

- Automobiles (M&HCV) - Sector UpdateDocument7 pagesAutomobiles (M&HCV) - Sector UpdateAman GuptaNo ratings yet

- Synopsis Atul Jain (Investment Opp.)Document5 pagesSynopsis Atul Jain (Investment Opp.)Atul JainNo ratings yet

- BASF-Investor-Update PresentationDocument33 pagesBASF-Investor-Update PresentationFlavio SiqueiraNo ratings yet

- Currency Derivatives Currency DerivativesDocument22 pagesCurrency Derivatives Currency DerivativesShantonu Rahman Shanto 1731521No ratings yet

- Exam Reviewer FINMGTDocument8 pagesExam Reviewer FINMGTMary Elisha PinedaNo ratings yet

- New Petroleum Law The Future of Oil Gas in MozambiqueDocument8 pagesNew Petroleum Law The Future of Oil Gas in MozambiquemohdfirdausNo ratings yet

- Chapter 4 - IbfDocument23 pagesChapter 4 - IbfMuhib NoharioNo ratings yet

- ABC-BUSINESS COMBINATION FOR SME'sDocument2 pagesABC-BUSINESS COMBINATION FOR SME'sLeonardo MercaderNo ratings yet

- Most Common Mistakes Traders Make - OANDADocument9 pagesMost Common Mistakes Traders Make - OANDAGideonNo ratings yet

- Gen Annuity NolianDocument26 pagesGen Annuity NolianCarlLacambra80% (5)

- ADIB SukukDocument27 pagesADIB SukukalamctcNo ratings yet

- Mutual Funds Offer DocumentDocument118 pagesMutual Funds Offer Documentaanu1234No ratings yet

- BFC5935 - Tutorial 5 SolutionsDocument5 pagesBFC5935 - Tutorial 5 SolutionsXue XuNo ratings yet

- Summary - Reading 20Document5 pagesSummary - Reading 20derek_2010No ratings yet

- Bull & Bear Market HistoryDocument1 pageBull & Bear Market Historykrunaldoshi84@gmail.comNo ratings yet

- Paper 12 - Company Accounts and Audit Syl2012Document116 pagesPaper 12 - Company Accounts and Audit Syl2012sumit4up6rNo ratings yet

- General Electric's Financial Management Program - The Most Prestigious Corporate Finance Gig AroundDocument11 pagesGeneral Electric's Financial Management Program - The Most Prestigious Corporate Finance Gig AroundabegailpguardianNo ratings yet

- About CashlessFX & FOREX TRUTHDocument4 pagesAbout CashlessFX & FOREX TRUTHCitizen AmissahNo ratings yet

- Jason Zweig With Seth Klarman - Interview 170510 (CFA Institute)Document6 pagesJason Zweig With Seth Klarman - Interview 170510 (CFA Institute)neo269100% (1)

- 146-Chapter Manuscript-9068-1-10-20210809Document4 pages146-Chapter Manuscript-9068-1-10-20210809Nassyiwa Dwi KesyaNo ratings yet