Professional Documents

Culture Documents

MJ Lhuiller vs. CIR

MJ Lhuiller vs. CIR

Uploaded by

KRISIA MICHELLE ORENSEOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MJ Lhuiller vs. CIR

MJ Lhuiller vs. CIR

Uploaded by

KRISIA MICHELLE ORENSECopyright:

Available Formats

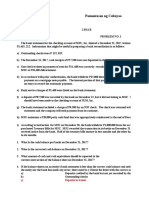

Section 195 of the National Internal Revenue Code motion and modified the June 29, 2004 decision as

(NIRC) is the document evidencing the covered follows:

transaction. Holding that a pawn ticket is neither a

security nor a printed evidence of indebtedness, the WHEREFORE, the instant petition is hereby GRANTED.

tax court concluded that such pawn ticket cannot be The decision of the Court of Tax Appeals dated

the subject of a DST. The dispositive portion thereof, October 24, 2001 is REVERSED and SET ASIDE. In lieu

FIRST DIVISION states: thereof, respondent Michel J. Lhuillier Pawnshop,

Inc., is ORDERED TO PAY: (1) 19,961,636.09, as

[G.R. NO. 166786 : May 3, 2006] WHEREFORE, in view of all the foregoing, the instant deficiency Value-Added Tax, inclusive of surcharge

Petition for Review is hereby GRANTED. Accordingly, and interest; (2) P3,142,986.02, as deficiency

MICHEL J. LHUILLER Pawnshop, Assessment Notices Nos. 81-VAT-13-97-99-12-118 Documentary Stamp Tax, inclusive of surcharge and

Inc. Petitioner, v. COMMISSIONER OF INTERNAL and 81-DST-13-97-99-11-119 are hereby CANCELLED interest, for the year 1997; and (3) Delinquency

REVENUE, Respondent. and SET ASIDE. Interest at the rate of 20% per annum from January 2,

2000, until the deficiency assessment are fully paid,

SO ORDERED.3 pursuant to Section 249 of the National Internal

DECISION

Revenue Code. No pronouncement as to costs.

YNARES-SANTIAGO, J.: Respondent filed a Petition for Review with the Court

of Appeals which reversed the CTA decision and SO ORDERED.5

sustained the assessments against petitioner. It

Assailed in this Petition for Review on Certiorari is the

ratiocinated, among others, that a pawn ticket, per On January 25, 2005, petitioner elevated the case to

June 29, 2004 Decision1 of the Court of Appeals in CA-

se, is not subject to DST; rather, it is the transaction this Court. Subsequently, it filed a motion to withdraw

G.R. SP No. 67667, which reversed the October 24,

involved, which in this case is pledge, that is being the petition with respect to the issue of

2001 Decision2 of the Court Tax Appeals and ordered

taxed. Hence, petitioner was properly assessed to pay VAT.6 Petitioner manifested that the Chamber of

petitioner Michel J. Lhuillier Pawnshop, Inc., to pay (1)

DST. The decretal portion thereof, provides: Pawnbrokers of the Philippines, where it is a member,

P19,961,636.09 as deficiency Value Added Tax (VAT);

entered into a Memorandum of Agreement7 with the

and (2) P3,142,986.02 as deficiency Documentary

WHEREFORE, the instant petition is hereby GRANTED. Bureau of Internal Revenue (BIR) allowing the

Stamp Tax (DST), for the year 1997.

The decision of the Court of Tax Appeals dated pawnshop industry to compromise the issue of VAT

October 24, 2001 is REVERSED and SET ASIDE. In lieu on pawnshops. Considering that petitioner already

The facts show that petitioner, a corporation engaged paid the agreed amount of settlement, it prayed that

thereof, respondent Michel J. Lhuillier Pawnshop,

in the pawnshop business, received Assessment the case be decided solely on the issue of DST.

Inc., is ORDERED TO PAY: (1) P19,961636.09, as

Notice Nos. 81-VAT-13-97-99-12-118 and 81-DST-13-

deficiency Value-Added Tax, inclusive of surcharge

97-99-12-119, issued by the Chief Assessment

and interest; and (2) P3,142,986.02, as deficiency On September 28, 2005, the Court granted

Division, Revenue Region No. 13, Cebu City, for

Documentary Stamp Tax, inclusive of surcharge and petitioner's partial withdrawal of the

deficiency VAT in the amount of P19,961,636.09 and

interest, for the year 1997. No pronouncement as to petition.8 Hence, the lone question to be resolved in

deficiency DST in the amount of P13,142,986.02, for

cost. the present petition is whether petitioner's

the year 1997. Petitioner filed a motion for

pawnshop transactions are subject to DST.

reconsideration of said assessment notices but was

denied by respondent Commissioner of Internal SO ORDERED.4

Revenue (CIR). The Court rules in the affirmative.

Respondent filed a motion for partial reconsideration

On Petition for Review with the Court of Tax Appeals, praying that petitioner be ordered to pay deficiency Sections 173 and 195 of the NIRC, state:

the latter rendered decision in favor of petitioner interest of 20% per annum for failure to pay the same

setting aside the assessment notices issued by the on January 2, 2000, as indicated in the notices. On SEC. 173. Stamp Taxes Upon Documents, Loan

CIR. It ruled, inter alia, that the subject of a DST under December 29, 2004, the Court of Appeals granted the Agreements, Instruments, and Papers. - Upon

documents, instruments, loan agreements and specific legal relationships through the execution of Section 3 of the Pawnshop Regulation Act defines a

papers, and upon acceptances, assignments, sales specific instruments. Examples of such privileges, the pawn ticket as follows:

and transfers of the obligation, right or property exercise of which, as effected through the issuance of

incident thereto, there shall be levied, collected and particular documents, are subject to the payment of "Pawn ticket" is the pawnbrokers' receipt for a pawn.

paid for, and in respect of the transaction so had or documentary stamp taxes are leases of lands, It is neither a security nor a printed evidence of

accomplished, the corresponding documentary mortgages, pledges and trusts, and conveyances of indebtedness."

stamp taxes x x x. (Emphasis supplied)cralawlibrary real property. (Emphasis added)

True, the law does not consider said ticket as an

SEC. 195. Stamp Tax on Mortgages, Pledges, and Pledge is among the privileges, the exercise of which evidence of security or indebtedness. However, for

Deeds of Trust. - On every mortgage or pledge of is subject to DST. A pledge may be defined as an purposes of taxation, the same pawn ticket is proof of

lands, estate, or property, real or personal, heritable accessory, real and unilateral contract by virtue of an exercise of a taxable privilege of concluding a

or movable, whatsoever, where the same shall be which the debtor or a third person delivers to the contract of pledge. At any rate, it is not said ticket that

made as security for the payment of any definite and creditor or to a third person movable property as creates the pawnshop's obligation to pay DST but the

certain sum of money lent at the time or previously security for the performance of the principal exercise of the privilege to enter into a contract of

due and owing or forborne to be paid, being payable obligation, upon the fulfillment of which the thing pledge. There is therefore no basis in petitioner's

and on any conveyance of land, estate, or property pledged, with all its accessions and accessories, shall assertion that a DST is literally a tax on a document

whatsoever, in trust or to be sold, or otherwise be returned to the debtor or to the third and that no tax may be imposed on a pawn ticket.

converted into money which shall be and intended person.10 This is essentially the business of

only as security, either by express stipulation or pawnshops which are defined under Section 3 of The settled rule is that tax laws must be construed in

otherwise, there shall be collected a documentary Presidential Decree No. 114, or the Pawnshop favor of the taxpayer and strictly against the

stamp tax at the following rates: Regulation Act, as persons or entities engaged in government; and that a tax cannot be imposed

lending money on personal property delivered as without clear and express words for that

"(a) When the amount secured does not exceed Five security for loans. purpose.14 Taking our bearing from the foregoing

thousand pesos (P5,000), Twenty pesos doctrines, we scrutinized Section 195 of the NIRC, but

(P20).ςηαñrοblεš νιr†υαl lαω lιbrαrÿ Section 12 of the Pawnshop Regulation Act and there is no way that said provision may be interpreted

Section 21 of the Rules and Regulations For in favor of petitioner. Section 195 unqualifiedly

(b) On each Five thousand pesos (P5,000), or Pawnshops11 issued by the Central Bank12 to subjects all pledges to DST. It states that "[o]n every

fractional part thereof in excess of Five thousand implement the Act, require every pawnshop or x x x pledge x x x there shall be collected a

pesos (P5,000), an additional tax of Ten pesos (10.00). pawnbroker to issue, at the time of every such loan or documentary stamp tax x x x." It is clear, categorical,

pledge, a memorandum or ticket signed by the and needs no further interpretation or construction.

x x x x. (Emphasis supplied)cralawlibrary pawnbroker and containing the following details: (1) The explicit tenor thereof requires hardly anything

name and residence of the pawner; (2) date the loan than a simple application.15

is granted; (3) amount of principal loan; (4) interest

It is clear from the foregoing provisions that the

rate in percent; (5) period of maturity; (6) description The onus of proving that pawnshops are not subject

subject of a DST is not limited to the document

of pawn; (7) signature of pawnbroker or his to DST is thus shifted to petitioner. In establishing tax

embodying the enumerated transactions. A DST is an

authorized agent; (8) signature or thumb mark of exemptions, it should be borne in mind that taxation

excise tax on the exercise of a right or privilege to

pawner or his authorized agent; and (9) such other is the rule, exemption is the exception. Accordingly,

transfer obligations, rights or properties incident

terms and conditions as may be agreed upon between statutes granting tax exemptions must be

thereto. In Philippine Home Assurance Corporation v.

the pawnbroker and the pawner. In addition, Central construed in strictissimi juris against the taxpayer and

Court of Appeals,9 it was held that:

Bank Circular No. 445,13 prescribed a standard form of liberally in favor of the taxing authority. One who

pawn tickets with entries for the required details on claims an exemption from tax payments rests the

In general, documentary stamp taxes are levied on its face and the mandated terms and conditions of the burden of justifying the exemption by words too plain

the exercise by persons of certain privileges conferred pledge at the dorsal portion thereof.

by law for the creation, revision, or termination of

to be mistaken and too categorical to be Revenue v. Michel J. Lhuillier Pawnshop, Inc., because

misinterpreted.16 nowhere was it mentioned therein that the

pawnshop involved was directed to pay DST.

In the instant case, there is no law specifically and Otherwise stated, the declaration of nullity of RMC

expressly exempting pledges entered into by No. 43-91 was the Court's finding, among others, that

pawnshops from the payment of DST. Section 19917 of pawnshops cannot be classified as lending investors;

the NIRC enumerated certain documents which are and certainly not because pawnshops are not subject

not subject to stamp tax; but a pawnshop ticket is not to DST. The invocation of said ruling is therefore

one of them. Hence, petitioner's nebulous claim that misplaced.

it is not subject to DST is without merit. It cannot be

over-emphasized that tax exemption represents a WHEREFORE, the petition is DENIED and the June 29,

loss of revenue to the government and must, 2004 Decision of the Court of Appeals, as modified on

therefore, not rest on vague inference.18 Exemption December 29, 2004, in CA-G.R. SP No. 67667,

from taxation is never presumed. For tax exemption is AFFIRMED.

to be recognized, the grant must be clear and express;

it cannot be made to rest on doubtful implications.19 SO ORDERED.

The Court notes that BIR Ruling No. 305-87,20 and BIR

Ruling No. 018-88,21 which held that a pawn ticket is

subject to DST because it is an evidence of a pledge

transaction, had been revoked by BIR Ruling No. 325-

88.22 In the latter ruling, the BIR held that DST is a tax

on the document; and since a pawn ticket is not an

evidence of indebtedness, it cannot be subject to DST.

Nevertheless, this interpretation is not consistent

with the provisions of Section 195 of the NIRC which

categorically taxes the privilege to enter into a

contract of pledge. Indeed, administrative issuances

must not override, supplant or modify the law but

must be consistent with the law they intend to carry

out.23

Finally, petitioner invokes the declaration of nullity of

Revenue Memorandum Circular (RMC) No. 43-91

in Commissioner of Internal Revenue v. Michel J.

Lhuillier Pawnshop, Inc.24 Said case, however, is not

applicable to the present controversy. RMC No. 43-91

is actually a clarification of Revenue Memorandum

Order No. 15-91 which classified pawnshops as

"lending investors" and imposed upon them a 5%

lending investor's tax. While RMC No. 43-91 declared

in addition that pawnshops are subject to DST, such

was never an issue in Commissioner of Internal

You might also like

- Spouses Pastor v. CA and Quemada DigestDocument2 pagesSpouses Pastor v. CA and Quemada DigestJP Murao IIINo ratings yet

- Churchill v. ConcepcionDocument6 pagesChurchill v. ConcepcionUnis BautistaNo ratings yet

- Deed of Sale With Assumption of MortgageDocument3 pagesDeed of Sale With Assumption of MortgageEarnswell Pacina TanNo ratings yet

- GR No. 166786 M Lhuillier V CIR (Good Faith)Document10 pagesGR No. 166786 M Lhuillier V CIR (Good Faith)Jerwin DaveNo ratings yet

- Ortega v. ValmonteDocument12 pagesOrtega v. ValmonteHayden Richard AllauiganNo ratings yet

- The Heirs of The Late Matilde Montinola-Sanson v. CA and Eduardo HernandezDocument12 pagesThe Heirs of The Late Matilde Montinola-Sanson v. CA and Eduardo HernandezCourtney TirolNo ratings yet

- Trusteeship of The Estate of Doña MargaritaDocument8 pagesTrusteeship of The Estate of Doña MargaritaKaren TorresNo ratings yet

- Maloles II Vs PhillipsDocument17 pagesMaloles II Vs PhillipsSheena Reyes-BellenNo ratings yet

- Rufina Lim v. CaDocument17 pagesRufina Lim v. CaCarolOngNo ratings yet

- ISRAEL - Spouses Magdalino and Cleofe Badilla v. Fe BragatDocument3 pagesISRAEL - Spouses Magdalino and Cleofe Badilla v. Fe BragatJohn Patrick IsraelNo ratings yet

- Agency - EDocument25 pagesAgency - EvalkyriorNo ratings yet

- 19 Dinoy Vs Rosal A.M. No. 3721Document2 pages19 Dinoy Vs Rosal A.M. No. 3721John JurisNo ratings yet

- Labor Congress of The Philippines vs. NLRCDocument17 pagesLabor Congress of The Philippines vs. NLRCAllan Gutierrez JrNo ratings yet

- Phil. Veterans Bank V CADocument8 pagesPhil. Veterans Bank V CAApril DiolataNo ratings yet

- Angelia Vs Comelec 332 Scra 757Document4 pagesAngelia Vs Comelec 332 Scra 757Marianne Shen PetillaNo ratings yet

- Persons - Mallilin Vs CastilloDocument2 pagesPersons - Mallilin Vs Castilloangelene_marcianoNo ratings yet

- Docena V Lapesura DigestDocument1 pageDocena V Lapesura DigestYvette MoralesNo ratings yet

- Go V Fifth Division SandiganbayanDocument2 pagesGo V Fifth Division Sandiganbayandorian100% (1)

- Acain V IacDocument9 pagesAcain V Iacnia_artemis3414No ratings yet

- Corpo DigestDocument1 pageCorpo DigestLea AndreleiNo ratings yet

- Eduardo Agtarap VsDocument3 pagesEduardo Agtarap VsCherry DuldulaoNo ratings yet

- 015 Pedrosa V CADocument2 pages015 Pedrosa V CADarrell MagsambolNo ratings yet

- Gonzaga v. CA, 51 SCRA 381 (1973)Document1 pageGonzaga v. CA, 51 SCRA 381 (1973)Lovely Grace HechanovaNo ratings yet

- DEVELOPMENT BANK OF THE PHILIPPINES , petitioner, vs. COURT OF APPEALS and the ESTATE OF THE LATE JUAN B. DANS, represented by CANDIDA G. DANS, and the DBP MORTGAGE REDEMPTION INSURANCE POOL, respondents..docxDocument3 pagesDEVELOPMENT BANK OF THE PHILIPPINES , petitioner, vs. COURT OF APPEALS and the ESTATE OF THE LATE JUAN B. DANS, represented by CANDIDA G. DANS, and the DBP MORTGAGE REDEMPTION INSURANCE POOL, respondents..docxWilliam AzucenaNo ratings yet

- Tayag V CA DigestDocument1 pageTayag V CA DigestBryan Jayson BarcenaNo ratings yet

- Nuguid v. Nuguid DDocument2 pagesNuguid v. Nuguid DSean GalvezNo ratings yet

- Bpi vs. SMPDocument2 pagesBpi vs. SMPDessamie Buat SanchezNo ratings yet

- 13 Habana V RoblesDocument5 pages13 Habana V RoblesMarioneMaeThiamNo ratings yet

- 01 Alvarez V IACDocument2 pages01 Alvarez V IACFranco David BaratetaNo ratings yet

- 193 Sarmiento Vs CA, 394 SCRA 315 (2002)Document1 page193 Sarmiento Vs CA, 394 SCRA 315 (2002)Alan GultiaNo ratings yet

- Introduction To Financial Statement AnalysisDocument53 pagesIntroduction To Financial Statement AnalysislychhethaiNo ratings yet

- Cta Vat CaseDocument9 pagesCta Vat CasemmeeeowwNo ratings yet

- Adtel v. ValdezDocument2 pagesAdtel v. ValdezIldefonso Hernaez0% (1)

- Nuguid Vs NuguidDocument1 pageNuguid Vs NuguidJanlo FevidalNo ratings yet

- Republic V AsiaPro CoopDocument4 pagesRepublic V AsiaPro CoopMikaela Denise PazNo ratings yet

- 163952-2009-Rural Bank of Sta. Barbara Pangasinan Inc.Document9 pages163952-2009-Rural Bank of Sta. Barbara Pangasinan Inc.Arnold Villena De CastroNo ratings yet

- Commissioner of Internal Revenue vs. Toshiba Information Equipment (Phils.), Inc., 466 SCRA 211, August 09, 2005Document4 pagesCommissioner of Internal Revenue vs. Toshiba Information Equipment (Phils.), Inc., 466 SCRA 211, August 09, 2005idolbondocNo ratings yet

- Sps. Portic v. Cristobal, G.R. No. 156171, 22 April 2005Document2 pagesSps. Portic v. Cristobal, G.R. No. 156171, 22 April 2005Tryzz dela MercedNo ratings yet

- Duran Vs IACDocument2 pagesDuran Vs IACApple ObiasNo ratings yet

- #41 Estrada v. Desierto - REYESDocument3 pages#41 Estrada v. Desierto - REYESRuby ReyesNo ratings yet

- Beatriz Gonzales V CFI Manila, Benito Legarda Et Al Aquino, JDocument3 pagesBeatriz Gonzales V CFI Manila, Benito Legarda Et Al Aquino, Jkenken320No ratings yet

- 2 Alfredo v. Borras, 404 SCRA 145 (2003) PDFDocument29 pages2 Alfredo v. Borras, 404 SCRA 145 (2003) PDFIan Kenneth MangkitNo ratings yet

- CIR v. First Express PawnshopDocument16 pagesCIR v. First Express PawnshopHansel Jake B. PampiloNo ratings yet

- CorpoDocument2 pagesCorpoBerch MelendezNo ratings yet

- Vivos, With Reservation of Beneficial Title During The Lifetime of The DonorDocument1 pageVivos, With Reservation of Beneficial Title During The Lifetime of The DonorEditha RoxasNo ratings yet

- De Villanueva vs. CADocument1 pageDe Villanueva vs. CAMildred Donaire Cañoneo-ClemeniaNo ratings yet

- Perlas - de Rossi vs. NLRCDocument2 pagesPerlas - de Rossi vs. NLRCKen AliudinNo ratings yet

- ObananaDocument2 pagesObananamgenota100% (1)

- #6 Arriola v. Arriola GARCIA, Mark Evan G01DLSU Week 5Document2 pages#6 Arriola v. Arriola GARCIA, Mark Evan G01DLSU Week 5Mark Evan GarciaNo ratings yet

- Case Digest 2019 Batch 1Document9 pagesCase Digest 2019 Batch 1Anonymous aRIameNo ratings yet

- 69 Fernandez Hermanos Vs CIRDocument22 pages69 Fernandez Hermanos Vs CIRYaz CarlomanNo ratings yet

- 16 Mendoza v. RepublicDocument6 pages16 Mendoza v. RepublichdhshNo ratings yet

- Dissenting Opinion Justice Lucenito Tagle On Vizconde Massacre Court of Appeals G.R. CR HC No. 00336Document38 pagesDissenting Opinion Justice Lucenito Tagle On Vizconde Massacre Court of Appeals G.R. CR HC No. 00336Janette ToralNo ratings yet

- Pang Et Vd. Manacnes Dao AsDocument20 pagesPang Et Vd. Manacnes Dao AsisaaabelrfNo ratings yet

- Sealand V CA PDFDocument2 pagesSealand V CA PDFpkdg1995No ratings yet

- Gonzales V. CA and SantiagoDocument1 pageGonzales V. CA and SantiagodhadhagladysNo ratings yet

- Succession Batch 5 Digest 55.1Document28 pagesSuccession Batch 5 Digest 55.1Ma. Nova MarasiganNo ratings yet

- PEZA Vs PilhinoDocument12 pagesPEZA Vs Pilhinojovelyn davoNo ratings yet

- ILDEFONSO LACHENAL Vs EMILIO SALAS - PauloDocument1 pageILDEFONSO LACHENAL Vs EMILIO SALAS - PauloPaulo VillarinNo ratings yet

- CIR v. Nidec Copal Philippines Corp., C.T.A. EB Case Nos. 250 & 255 (C.T.A. Case No. 6577) Dated October 1, 2007Document18 pagesCIR v. Nidec Copal Philippines Corp., C.T.A. EB Case Nos. 250 & 255 (C.T.A. Case No. 6577) Dated October 1, 2007Jeffrey JosolNo ratings yet

- Rights and Remedies of The Government Under The Tax CodeDocument12 pagesRights and Remedies of The Government Under The Tax CodeAnisah AquilaNo ratings yet

- 1 Federal Builders VS Power FactorsDocument3 pages1 Federal Builders VS Power FactorsKRISIA MICHELLE ORENSENo ratings yet

- 2 Bases VS DmciDocument9 pages2 Bases VS DmciKRISIA MICHELLE ORENSENo ratings yet

- Chavez VS CADocument4 pagesChavez VS CAKRISIA MICHELLE ORENSENo ratings yet

- 6 Harold VS AlibaDocument4 pages6 Harold VS AlibaKRISIA MICHELLE ORENSENo ratings yet

- Dfa VS BcaDocument9 pagesDfa VS BcaKRISIA MICHELLE ORENSENo ratings yet

- PFR Round4Document17 pagesPFR Round4KRISIA MICHELLE ORENSENo ratings yet

- 2 Esguerra VS TrinidadDocument5 pages2 Esguerra VS TrinidadKRISIA MICHELLE ORENSENo ratings yet

- 1 Fruehauf Electronics Phils Corp Vs Technology Electronics Assembly and Management Pacific CorpDocument9 pages1 Fruehauf Electronics Phils Corp Vs Technology Electronics Assembly and Management Pacific CorpKRISIA MICHELLE ORENSENo ratings yet

- 3 Steamship Mutual Underwriting Ass Limited Vs Sulpicio LinesDocument16 pages3 Steamship Mutual Underwriting Ass Limited Vs Sulpicio LinesKRISIA MICHELLE ORENSENo ratings yet

- G.R. No. 149498 May 20, 2004 Republic of The Philippines, Petitioner, LOLITA QUINTERO-HAMANO, RespondentDocument62 pagesG.R. No. 149498 May 20, 2004 Republic of The Philippines, Petitioner, LOLITA QUINTERO-HAMANO, RespondentKRISIA MICHELLE ORENSENo ratings yet

- Domingo VS CADocument8 pagesDomingo VS CAKRISIA MICHELLE ORENSENo ratings yet

- Tongol VS TongolDocument6 pagesTongol VS TongolKRISIA MICHELLE ORENSENo ratings yet

- 1 - CSC Case: Republic of The Philippines Manila en BancDocument14 pages1 - CSC Case: Republic of The Philippines Manila en BancKRISIA MICHELLE ORENSENo ratings yet

- Tenebro VS CADocument6 pagesTenebro VS CAKRISIA MICHELLE ORENSENo ratings yet

- SEC VS ProsperityDocument2 pagesSEC VS ProsperityKRISIA MICHELLE ORENSENo ratings yet

- Carino VS CarinoDocument4 pagesCarino VS CarinoKRISIA MICHELLE ORENSENo ratings yet

- Power Homes VS SECDocument3 pagesPower Homes VS SECKRISIA MICHELLE ORENSENo ratings yet

- INDEMNITYBONDtemplateDocument2 pagesINDEMNITYBONDtemplateAlberto Martinez100% (1)

- 10 Legal Aspects of BankingDocument7 pages10 Legal Aspects of BankingFalguni SarmalkarNo ratings yet

- Designing Your Home: Buyer Resources Homebuying Homebuying 101 Chapter 4Document2 pagesDesigning Your Home: Buyer Resources Homebuying Homebuying 101 Chapter 4Aimee HallNo ratings yet

- Commercialisation of Microfinancei N Sri LankaDocument7 pagesCommercialisation of Microfinancei N Sri LankaDamith ChandimalNo ratings yet

- MSMEDocument7 pagesMSMERitika SharmaNo ratings yet

- Hudco HS SDDocument6 pagesHudco HS SDSubrata DeyNo ratings yet

- Lecture 10 - Introduction To Math of FinanceDocument36 pagesLecture 10 - Introduction To Math of FinancejunainhaqueNo ratings yet

- App To Borrow On in Italy - Google SearchDocument1 pageApp To Borrow On in Italy - Google SearchCaleb OgunkoruNo ratings yet

- All Journal IJM Edit3Document255 pagesAll Journal IJM Edit3lingeshNo ratings yet

- Prelim-Pr 2a14fb4488c3b5b235Document11 pagesPrelim-Pr 2a14fb4488c3b5b235Romina LopezNo ratings yet

- Determination of Forward MarketDocument5 pagesDetermination of Forward MarketRegi CABNo ratings yet

- CB Insights - Fintech Report Q1 2021Document80 pagesCB Insights - Fintech Report Q1 2021rahulNo ratings yet

- Debt or Equity-Which One Is Better For Your Business?: Name-Avani Shah Roll No-Pgdmrba019Document2 pagesDebt or Equity-Which One Is Better For Your Business?: Name-Avani Shah Roll No-Pgdmrba019avani shahNo ratings yet

- TableauDocument3 pagesTableauAugmentatton AxerNo ratings yet

- Examining The Effects of Debt Management On The Performance of Selected Companies in Gingoog CityDocument22 pagesExamining The Effects of Debt Management On The Performance of Selected Companies in Gingoog CityLady Mivie Dayanan NericuaNo ratings yet

- Compound Interest1Document6 pagesCompound Interest1Biomass conversionNo ratings yet

- Lab - MCQDocument22 pagesLab - MCQHarihara PuthiranNo ratings yet

- Dellavigna 2009 Psychology and Economics Evidence From The FieldDocument135 pagesDellavigna 2009 Psychology and Economics Evidence From The FieldЕкатерина КаплуноваNo ratings yet

- Annexure - E Checklist For Scrutiny of TIR by The Branches/ Operating UnitsDocument2 pagesAnnexure - E Checklist For Scrutiny of TIR by The Branches/ Operating Unitsmathan aNo ratings yet

- VA Response On Home Loans For Veterans Working in Marijuana IndustryDocument1 pageVA Response On Home Loans For Veterans Working in Marijuana IndustryMarijuana MomentNo ratings yet

- Financial InstrumentsDocument4 pagesFinancial Instrumentsbad geniusNo ratings yet

- Traders Royal Bank v. Sps. Castanares DigestDocument2 pagesTraders Royal Bank v. Sps. Castanares DigestBenedict EstrellaNo ratings yet

- GenMath11 - Q2 - M 11 Business and Consumer Loans Final VersionDocument26 pagesGenMath11 - Q2 - M 11 Business and Consumer Loans Final VersionErin BernardinoNo ratings yet

- Jurists Lecture (Banking Laws and AMLA)Document39 pagesJurists Lecture (Banking Laws and AMLA)Lee Anne YabutNo ratings yet

- Haryana Real Estate Regulatory AuthorityDocument27 pagesHaryana Real Estate Regulatory AuthorityharshitsanjaychowdharyNo ratings yet

- EIN6357-Syllabus 2019Document4 pagesEIN6357-Syllabus 2019Dennis Noel de LaraNo ratings yet

- Investment and Portfolio Management Assignment 1Document1 pageInvestment and Portfolio Management Assignment 1Patricia DiaNo ratings yet

- EOF Lecture Notes - Bond Math - Sep 22Document27 pagesEOF Lecture Notes - Bond Math - Sep 22碧莹成No ratings yet

- Heirs of Fe Tan Uy vs. International Exchange Bank, GR. No. 166282, February 13, 2013Document4 pagesHeirs of Fe Tan Uy vs. International Exchange Bank, GR. No. 166282, February 13, 2013Apple ObiasNo ratings yet