Professional Documents

Culture Documents

Nifty Options (Positional) Delta Hedging

Nifty Options (Positional) Delta Hedging

Uploaded by

sachin0 ratings0% found this document useful (0 votes)

65 views4 pagesThis document outlines a positional options strategy called Nifty Delta Hedging. The strategy involves selling one put option and one call option at different strike prices to maintain a delta-neutral position. Positions are adjusted throughout the month to keep the options out of the money as the underlying stock price fluctuates. The goal is to profit from changes in implied volatility while remaining delta-neutral to the underlying price movements. Positions are squared off if a 2% profit or loss is reached before the monthly expiration.

Original Description:

Nifty Options (Positional) Delta Hedging

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines a positional options strategy called Nifty Delta Hedging. The strategy involves selling one put option and one call option at different strike prices to maintain a delta-neutral position. Positions are adjusted throughout the month to keep the options out of the money as the underlying stock price fluctuates. The goal is to profit from changes in implied volatility while remaining delta-neutral to the underlying price movements. Positions are squared off if a 2% profit or loss is reached before the monthly expiration.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

65 views4 pagesNifty Options (Positional) Delta Hedging

Nifty Options (Positional) Delta Hedging

Uploaded by

sachinThis document outlines a positional options strategy called Nifty Delta Hedging. The strategy involves selling one put option and one call option at different strike prices to maintain a delta-neutral position. Positions are adjusted throughout the month to keep the options out of the money as the underlying stock price fluctuates. The goal is to profit from changes in implied volatility while remaining delta-neutral to the underlying price movements. Positions are squared off if a 2% profit or loss is reached before the monthly expiration.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

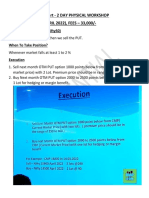

Nifty Delta Hedging

Positional Options Strategy

Rules:

• Sell One PE and One CE , PE Buy out of the money (OTM) (1:1:1)

• PE Sell : CE Sell : PE Buy

• Should enter on last month of the expiry (For month of Feb, should enter in

Jan last trading day)

• Check current Nifty spot on month end Friday add 200 points to nearest

strike price to CE Sell, subtract 200 points from spot to sell PE and then

subtract 300 points to buy PE to hedge.

• Ex : Nifty Spit (Friday) : 9780

• Nearest Nifty Strike price : 9800

• PE Sell : 9800 -200 : 9600 PE

• CE Sell : 9800 +200 : 10000 CE

• PE Buy : 9800 – 300 : 9500 PE

• Based on the market moment positions to be adjusted to maintain

the OTM by square-off current positions and re-initiate the same

positions.

• Check everyday and adjust positions to keep 200 points for sell and

300 points for buy until 15th of the Month.

• Current date is after 15th, positions to be adjusted to 100 points for

sell and 200 points to buy.

• Ex : Nifty Spit (Friday) : 9780

• Nearest Nifty Strike price : 9800

• PE Sell : 9800 -100 : 9700 PE

• CE Sell : 9800 +100 : 9900 CE

• PE Buy : 9800 – 200 : 9600 PE

• Above cycle to be repeated until month-end or it reaches 2%

profit/loss.

• If 2% profit/loss reached before month-end, square-off all positions and wait

for month-end Friday to trade next month options.

• Maintain strict stop loss to 2%.

• This strategy gives 10 months positive results out of 12 months.

• Capital required 2 lacs for lot.

• * Its required hourly monitoring.

You might also like

- 142a Banknifty Weekly Options StrategyDocument6 pages142a Banknifty Weekly Options StrategyudayNo ratings yet

- Option StrategiesDocument7 pagesOption StrategiesROBIN SINGHNo ratings yet

- Optn StrategyDocument10 pagesOptn StrategyIndraneel BoseNo ratings yet

- BOC - WorkshopDocument21 pagesBOC - WorkshopVedanth MudholkarNo ratings yet

- Conclave 2 CandleDocument15 pagesConclave 2 CandleNaveen KumarNo ratings yet

- Bajaj AutoDocument4 pagesBajaj AutoSathyamurthy RamanujamNo ratings yet

- Nifty SignalDocument14 pagesNifty SignalmahendraboradeNo ratings yet

- Nifty Option Jackpot PackageDocument16 pagesNifty Option Jackpot PackageKumar NarayananNo ratings yet

- Shiv Trend FinderDocument15 pagesShiv Trend FinderstelsoftNo ratings yet

- Derivative Trading Strategy of Bank Nifty - A Heuristic ModelDocument22 pagesDerivative Trading Strategy of Bank Nifty - A Heuristic ModelkpperumallaNo ratings yet

- What To Expect From 9th MentoringDocument27 pagesWhat To Expect From 9th Mentoringgurukarthick_dbaNo ratings yet

- 0.1.JustNifty TA 1 (By Ilango)Document849 pages0.1.JustNifty TA 1 (By Ilango)Jeniffer RayenNo ratings yet

- Bank Nifty Weekly-Wednesday Option Trading FormulaDocument4 pagesBank Nifty Weekly-Wednesday Option Trading FormulamkranthikumarmcaNo ratings yet

- Stockmock - Monthly 1-3pmDocument4 pagesStockmock - Monthly 1-3pmHarieswar ReddyNo ratings yet

- Trading-Strategy FM Candlechartsacademy ComDocument19 pagesTrading-Strategy FM Candlechartsacademy ComAndrew ChanNo ratings yet

- 109aa SP Options Buying StrategyDocument8 pages109aa SP Options Buying StrategyJeniffer RayenNo ratings yet

- 24 Aug Class 7 SpreadDocument6 pages24 Aug Class 7 SpreadRakesh KumarNo ratings yet

- Stockmock PositionsDocument16 pagesStockmock Positionskumar mhNo ratings yet

- System 1-Subhadip NandyDocument2 pagesSystem 1-Subhadip Nandysanny2005No ratings yet

- Buy Level Buy LevelDocument9 pagesBuy Level Buy LevelJeniffer RayenNo ratings yet

- Price Action Madness, Part 3 - 2-22-17Document64 pagesPrice Action Madness, Part 3 - 2-22-17kalelenikhlNo ratings yet

- Max Pain AnalysisDocument3 pagesMax Pain Analysisanindya pal100% (1)

- Ilango TADocument760 pagesIlango TAThe599499No ratings yet

- Call OI Strike Put OI Call Value Put Value Total StrikeDocument19 pagesCall OI Strike Put OI Call Value Put Value Total StrikejitendrasutarNo ratings yet

- ShShort Straddle StrategyDocument6 pagesShShort Straddle StrategyDeepak RanaNo ratings yet

- Velluri Strategy Nifty FiftyDocument15 pagesVelluri Strategy Nifty FiftyPrajan JNo ratings yet

- Pre Webinar Presentation 4th 5th JanDocument11 pagesPre Webinar Presentation 4th 5th JanJenny JohnsonNo ratings yet

- Market Moves From High Level To Low Level, From Oversold To Overbought Areas and Then Reverses. As We Are inDocument3 pagesMarket Moves From High Level To Low Level, From Oversold To Overbought Areas and Then Reverses. As We Are inroughimNo ratings yet

- Method Nifty 50Document16 pagesMethod Nifty 50Richard JonesNo ratings yet

- Price Action & RM-PS Spider PDFDocument28 pagesPrice Action & RM-PS Spider PDFGenrl Use100% (1)

- How To Hedge Nifty Future With Nifty Options (Indian Stock Market)Document2 pagesHow To Hedge Nifty Future With Nifty Options (Indian Stock Market)Sachin ShirnathNo ratings yet

- BANK NIFTY WEEKLY OPTION STRATEGIES StraDocument20 pagesBANK NIFTY WEEKLY OPTION STRATEGIES Strafrank georgeNo ratings yet

- Market Mantra: Prime IndicatorsDocument3 pagesMarket Mantra: Prime IndicatorsvivekNo ratings yet

- Best Intraday Trading TechniquesDocument34 pagesBest Intraday Trading TechniquesalagusenNo ratings yet

- Option PDFDocument4 pagesOption PDFjallwynaldrinNo ratings yet

- Trading Journal - WebinarDocument11 pagesTrading Journal - WebinarIsIs DroneNo ratings yet

- Nifty TrendDocument2 pagesNifty TrendLokesh NANo ratings yet

- A19 NotesDocument1 pageA19 NotesRavi SinghNo ratings yet

- Guruspeak - "My Mantra Is Cutting Loss Early and Riding Profit As Long As Possible"Document11 pagesGuruspeak - "My Mantra Is Cutting Loss Early and Riding Profit As Long As Possible"Ankit Jain100% (1)

- 2562 TheoryDocument3 pages2562 Theorymaddy_i5No ratings yet

- OptionTradingStrategy-July 31 BankNiftyDocument3 pagesOptionTradingStrategy-July 31 BankNiftyShekharNo ratings yet

- Short Straddle StockMockDocument263 pagesShort Straddle StockMockHemanth raoNo ratings yet

- Risk Management & Journal For Options Trading - 021726Document9 pagesRisk Management & Journal For Options Trading - 021726Aanindya ChoudhuryNo ratings yet

- TTC Workshop Brochure With FeeDocument4 pagesTTC Workshop Brochure With Feesiddheshpatole153No ratings yet

- Put-Call Ratio (PCR) IndicatorDocument1 pagePut-Call Ratio (PCR) Indicatorastro secretes0% (1)

- Option Chain Jyoti Budhiya NotesDocument2 pagesOption Chain Jyoti Budhiya NotesShub ShahNo ratings yet

- Arbitration 90 Hidden Secret of Indian Index and How To Use 4Document70 pagesArbitration 90 Hidden Secret of Indian Index and How To Use 4Ravi SinghNo ratings yet

- Nifty Academy Od PDFDocument29 pagesNifty Academy Od PDFSikandar KhanNo ratings yet

- Options Trading Beginner: Rach's Self ImprovementDocument4 pagesOptions Trading Beginner: Rach's Self Improvementhc87No ratings yet

- Trade Setup For TomorrowDocument7 pagesTrade Setup For TomorrowHarryNo ratings yet

- CPR BY KGS R1PDH Broken, Technical Analysis ScannerDocument6 pagesCPR BY KGS R1PDH Broken, Technical Analysis ScannerRamesh ReddyNo ratings yet

- Ema Supertrend Channel Trading LogicDocument6 pagesEma Supertrend Channel Trading Logicvish sNo ratings yet

- First Method - Banknifty BreakoutDocument5 pagesFirst Method - Banknifty BreakoutsrirubanNo ratings yet

- SantuBabaTricks AppDocument41 pagesSantuBabaTricks AppSriheri DeshpandeNo ratings yet

- You Oi Pulse & Success - SlidesDocument9 pagesYou Oi Pulse & Success - SlidesAmitNo ratings yet

- Pair Nifty Bank NiftyDocument3 pagesPair Nifty Bank NiftyRavi KiranNo ratings yet

- Nifty 50 TipsDocument52 pagesNifty 50 TipsDasher_No_1No ratings yet

- Ema TradingDocument16 pagesEma TradingMR. INDIAN VILLAINNo ratings yet

- SRT Converted CompressedDocument2 pagesSRT Converted CompressedroughimNo ratings yet

- ALGO Development Requirement Document - TemplateDocument4 pagesALGO Development Requirement Document - TemplatesachinNo ratings yet

- ReactJS Tutorial - JavatpointDocument7 pagesReactJS Tutorial - JavatpointsachinNo ratings yet

- AWS Tutorial - Amazon Web Services Tutorial - JavatpointDocument9 pagesAWS Tutorial - Amazon Web Services Tutorial - JavatpointsachinNo ratings yet

- BankNifty Futures Intraday StratagyDocument156 pagesBankNifty Futures Intraday StratagysachinNo ratings yet