Professional Documents

Culture Documents

NO. 27.central Azucarera VS. CTA Vs

NO. 27.central Azucarera VS. CTA Vs

Uploaded by

Bruno GalwatOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NO. 27.central Azucarera VS. CTA Vs

NO. 27.central Azucarera VS. CTA Vs

Uploaded by

Bruno GalwatCopyright:

Available Formats

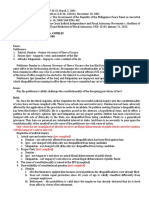

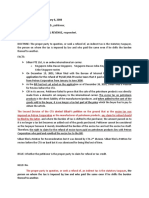

Central Azucarera Don Pedro vs.

CIR and CTA

G.R. Nos. L-23236 and L-23254 May 31, 1967

Facts;

These two (2) appeals involved the same parties and identical issues; and the Solicitor General, upon

motion, was allowed by this Court to file a consolidated brief in these two cases.

Petitioner paid the deficiency tax but protested on the imposition of the interest, claiming that the

imposition of ½% monthly interest on its deficiency tax for the fiscal year 1954 to 1958, Pursuant to

Section 51 (d) of the Revenue Code, as amended by Republic Act No. 2343, is illegal, because the

imposition of interest on efficiency income tax earned prior to the effectivity of the amendatory law RA

2343 on 1959 will be tantamount to giving it RA No. 2343 retroactive application. It further contends

that the application of the amended provision (now Sec. 51-d of the Tax Code) to the cases at bar would

run counter to the constitutional restriction against the enactment of ex post facto laws.

In both cases, the Court of Tax Appeals ruled that Congress had power to impose interest on deficiency

income tax due on income earned prior to the amendatory law, but assessed after its enactment, that

the deficiency income tax in the case it bar was assessed after the effectivity of the new law RA No.

2343, and inasmuch as the interest imposed thereon has been computed only from June 20, 1959

(which was the date of effectivity of said law), RA No. 2343 is not being applied retroactively.

Issue; Whether or not the imposition of the interest, is unconstitutional

Ruling;

No.

The interest was correctly imposed. It is to be noted that the collection of interest in these cases is not

penal in nature, thus the imposition of interest is but a just compensation to the state for the delay in

paying the tax, and for the concomitant use by the taxpayer of funds that rightfully should be in the

government's hands. The fact that the interest charged is made proportionate to the period of delay

constitutes the best evidence that such interest is not penal but compensatory.

The doctrine of unconstitutionality raised by petitioner based on the prohibition against ex post facto

laws. But this prohibition applies only to criminal or penal matters, and not to laws which concern civil

matters or proceedings generally, or which affect or regulate civil or private rights.

Finally, section 13 of the amendatory Republic Act No. 2343 refers only to the basic tax rates, which are

made applicable to income received in 1959 onward, but does not affect the interest due on

deficiencies, which are left to be governed by section 51 (d).

You might also like

- Accenture Solutions PVT LTDDocument6 pagesAccenture Solutions PVT LTDChethan ChinnuNo ratings yet

- Accy272.Session11.Template - PP 682 720Document28 pagesAccy272.Session11.Template - PP 682 720MohitNo ratings yet

- Central Vs CTADocument2 pagesCentral Vs CTATon Ton CananeaNo ratings yet

- Central Azucarera Don Pedro vs. CTA.Document2 pagesCentral Azucarera Don Pedro vs. CTA.maximum jicaNo ratings yet

- Central Azucarera v. CTADocument1 pageCentral Azucarera v. CTAChou TakahiroNo ratings yet

- G.R. No. L-31156 February 27, 1976 Pepsi-Cola Bottling Company of The Philippines, Inc., Plaintiff-Appellant, Municipality of Tanauan, Leyte, The Municipal Mayor, Et Al., Defendant AppelleesDocument8 pagesG.R. No. L-31156 February 27, 1976 Pepsi-Cola Bottling Company of The Philippines, Inc., Plaintiff-Appellant, Municipality of Tanauan, Leyte, The Municipal Mayor, Et Al., Defendant AppelleesYumeko JabamiNo ratings yet

- CIR v. AcostaDocument2 pagesCIR v. AcostaJepaybelovedNo ratings yet

- Petitioner vs. vs. Respondents Leido, Andrada, Perez & Associates Solicitor General Arturo A Alafriz, Solicitor A B Afurong Atty M R BalasbasDocument7 pagesPetitioner vs. vs. Respondents Leido, Andrada, Perez & Associates Solicitor General Arturo A Alafriz, Solicitor A B Afurong Atty M R BalasbasPatricia BenildaNo ratings yet

- Pepsi Cola BottlingDocument7 pagesPepsi Cola BottlingMWinbee VisitacionNo ratings yet

- Remrev 2 (Specpro 2) CasesDocument174 pagesRemrev 2 (Specpro 2) Casesart villarinoNo ratings yet

- 160-Central Azucarera de Don Pedro v. CTA, Et. Al., May 3, 1967Document6 pages160-Central Azucarera de Don Pedro v. CTA, Et. Al., May 3, 1967Jopan SJNo ratings yet

- Central Azucarera vs. CA, 20 SCRA 344Document7 pagesCentral Azucarera vs. CA, 20 SCRA 344Han SamNo ratings yet

- Pepsi Cola vs. Mun. of Tanawan, G.R. No. L-31156 February 27, 1976 (FULL CASE)Document4 pagesPepsi Cola vs. Mun. of Tanawan, G.R. No. L-31156 February 27, 1976 (FULL CASE)Sharliemagne B. BayanNo ratings yet

- Cagayan Electric Power vs. CIR, 138 S 629Document3 pagesCagayan Electric Power vs. CIR, 138 S 629Han SamNo ratings yet

- 15.pepsi Cola Vs TanauanDocument5 pages15.pepsi Cola Vs TanauanClyde KitongNo ratings yet

- CIR Vs Lingayen GulfDocument1 pageCIR Vs Lingayen GulfRobertNo ratings yet

- Cagayan Electric Power Vs - Cir and Court of Appeals, RespondentsDocument2 pagesCagayan Electric Power Vs - Cir and Court of Appeals, RespondentsErmeline TampusNo ratings yet

- PEPSI COLA BOTTLING CO. vs. TANAUAN LEYTE Et - Al. G.R. No. L 31156 February 27 1976Document7 pagesPEPSI COLA BOTTLING CO. vs. TANAUAN LEYTE Et - Al. G.R. No. L 31156 February 27 1976Clarisse-joan GarmaNo ratings yet

- 16) Cagayan Electric Co. v. CIR, G.R. No. L-60126, September 25, 1985Document2 pages16) Cagayan Electric Co. v. CIR, G.R. No. L-60126, September 25, 1985ZackNo ratings yet

- Pepsi-Cola v. Mun of Tanauan (1976)Document16 pagesPepsi-Cola v. Mun of Tanauan (1976)Joshua DulceNo ratings yet

- 27.PEPSI-COLA BOTTLING COMPANY OF THE PHILIPPINES, INC v. TanauanDocument7 pages27.PEPSI-COLA BOTTLING COMPANY OF THE PHILIPPINES, INC v. TanauanLaw SchoolNo ratings yet

- CIR Vs Insular LumberDocument3 pagesCIR Vs Insular LumberAnonymous vAVKlB1No ratings yet

- Republic of The PhilippinesDocument3 pagesRepublic of The Philippinesdat1996No ratings yet

- (Parker vs. Panlilio, 91 Phil. 1 (1952) )Document1 page(Parker vs. Panlilio, 91 Phil. 1 (1952) )Mark Angelo S. EnriquezNo ratings yet

- Tax 1 DigestsDocument120 pagesTax 1 DigestsAl Ibs100% (1)

- Digest Tax 2Document5 pagesDigest Tax 2Kwesi DelgadoNo ratings yet

- CIR Vs Lingayen 164 SCRA 27Document4 pagesCIR Vs Lingayen 164 SCRA 27Atty JV Abuel0% (1)

- CIR Vs Lingayen ElectricDocument2 pagesCIR Vs Lingayen ElectricRobert Quiambao100% (2)

- Rozas V CtaDocument7 pagesRozas V CtaRonn PagcoNo ratings yet

- People v. Gatchalian 104 PHIL 664Document21 pagesPeople v. Gatchalian 104 PHIL 664Anonymous100% (1)

- Quimpo V MendozaDocument7 pagesQuimpo V Mendozadar0800% (1)

- 1 Tan V Del Rosario, 237 SCRA 324 (2000)Document8 pages1 Tan V Del Rosario, 237 SCRA 324 (2000)JenNo ratings yet

- G.R. No. L-31156Document15 pagesG.R. No. L-31156Henson MontalvoNo ratings yet

- Rule 111 - Crimpro - Case Doctrines: Proton Pilipinas Corporation vs. RepublicDocument12 pagesRule 111 - Crimpro - Case Doctrines: Proton Pilipinas Corporation vs. RepublicgrurocketNo ratings yet

- Statcon - ReviewerDocument5 pagesStatcon - ReviewerHiezll Wynn R. RiveraNo ratings yet

- 11 Pepsi Cola Bottling Company vs. Municipality of TanauanDocument5 pages11 Pepsi Cola Bottling Company vs. Municipality of TanauanRaiya AngelaNo ratings yet

- Tax 1 CasesDocument68 pagesTax 1 CasesTIGAO ACTIVE YOUTH ORGANIZATIONNo ratings yet

- CHATO Vs Fortune 2008Document6 pagesCHATO Vs Fortune 2008marwantahsinNo ratings yet

- Pepsi Cola v. TanauanDocument1 pagePepsi Cola v. TanauanChou TakahiroNo ratings yet

- Pepsi Cola vs. City of ButuanDocument9 pagesPepsi Cola vs. City of ButuanKrishtineRapisoraBolivarNo ratings yet

- Tan Vs Del RosarioDocument6 pagesTan Vs Del RosarioLovely OhNo ratings yet

- The Commissioner of Internal Revenue, Petitioner, vs. Lingayen Gulf Electric Power Co., Inc. and The Court of Tax Appeals, RespondentsDocument10 pagesThe Commissioner of Internal Revenue, Petitioner, vs. Lingayen Gulf Electric Power Co., Inc. and The Court of Tax Appeals, RespondentsQhryszxianniech SaiburNo ratings yet

- Fitness by Design Vs CIRDocument4 pagesFitness by Design Vs CIRGavin Reyes CustodioNo ratings yet

- CIR Vs Vda de PrietoDocument2 pagesCIR Vs Vda de PrietokrisninNo ratings yet

- Mactan Cebu Int'l Airport (MCIAA) Vs Judge MarcosDocument6 pagesMactan Cebu Int'l Airport (MCIAA) Vs Judge MarcosKristel YeenNo ratings yet

- Tan Vs Del Rosario 237 SCRA 324 - 1994Document108 pagesTan Vs Del Rosario 237 SCRA 324 - 1994Alyssa Mae Basallo100% (1)

- Cagayan Electric Company v. CIRDocument2 pagesCagayan Electric Company v. CIRCocoyPangilinanNo ratings yet

- Office of The Solicitor General and A.H. Garces For Plaintiff-Appellant. Tongco, Tongco and de Leon For Defendant-AppelleeDocument5 pagesOffice of The Solicitor General and A.H. Garces For Plaintiff-Appellant. Tongco, Tongco and de Leon For Defendant-AppelleeRandee CeasarNo ratings yet

- United Provinces v. Atiqa BegumDocument19 pagesUnited Provinces v. Atiqa BegumKirithika HariharanNo ratings yet

- RULE 110 PO Cases PDFDocument71 pagesRULE 110 PO Cases PDFCeasar PagapongNo ratings yet

- Taxation Cases 2Document29 pagesTaxation Cases 2Claudine SumalinogNo ratings yet

- Pepsi VS. Mun of TanuanDocument5 pagesPepsi VS. Mun of TanuanMichelle Jude TinioNo ratings yet

- Philippine Long Distance Telephone Company, Inc., Petitioner, The City Treasurer of Davao, RespondentsDocument7 pagesPhilippine Long Distance Telephone Company, Inc., Petitioner, The City Treasurer of Davao, RespondentsJuris FormaranNo ratings yet

- Cagayan Electric Vs CIRDocument4 pagesCagayan Electric Vs CIRRaymond MedinaNo ratings yet

- Cir V Lingayen Gulf Electric PowerDocument4 pagesCir V Lingayen Gulf Electric PowerkeloNo ratings yet

- Zaldvia To ReodicaDocument85 pagesZaldvia To Reodicapartnership101No ratings yet

- Quimpo v. MendozaDocument9 pagesQuimpo v. MendozaGibran AbubakarNo ratings yet

- Batch 6 CompleteDocument98 pagesBatch 6 CompleteAlexis Von TeNo ratings yet

- CIR v. Gotamco & Sons, GR No. 31092, 27 Feb. 1987, 148 SCRA 36Document3 pagesCIR v. Gotamco & Sons, GR No. 31092, 27 Feb. 1987, 148 SCRA 36Dom ValdezNo ratings yet

- Pepsi Cola Bottling vs. Municipality of Tanuan 69 SCRA 460Document42 pagesPepsi Cola Bottling vs. Municipality of Tanuan 69 SCRA 460Celine GarciaNo ratings yet

- The Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemFrom EverandThe Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemNo ratings yet

- Revised 6th Edition PBDs - Goods - 012521 - RevDocument42 pagesRevised 6th Edition PBDs - Goods - 012521 - RevBruno GalwatNo ratings yet

- I. GENERAL PROVISIONS (Sections 1-2) : A. Concept, Purpose and HistoryDocument38 pagesI. GENERAL PROVISIONS (Sections 1-2) : A. Concept, Purpose and HistoryBruno GalwatNo ratings yet

- Assignment 1 1. Sps. Sanchez vs. Aguilar (G.R.No. 228680 September 17, 2018) FactsDocument26 pagesAssignment 1 1. Sps. Sanchez vs. Aguilar (G.R.No. 228680 September 17, 2018) FactsBruno GalwatNo ratings yet

- Consolidated Transpo Cases 1 43Document55 pagesConsolidated Transpo Cases 1 43Bruno Galwat100% (1)

- Watered StocksDocument10 pagesWatered StocksBruno GalwatNo ratings yet

- Case DigestsDocument3 pagesCase DigestsBruno GalwatNo ratings yet

- 30 Gonzales V GonzalesDocument1 page30 Gonzales V GonzalesBruno GalwatNo ratings yet

- Garcia Vs GatchalianDocument2 pagesGarcia Vs GatchalianBruno GalwatNo ratings yet

- Roxas Vs RaffertyDocument2 pagesRoxas Vs RaffertyBruno GalwatNo ratings yet

- TOPIC: Notarial or Ordinary Will Manuel Gonzales V. Manolita Gonzales de CarungcongDocument1 pageTOPIC: Notarial or Ordinary Will Manuel Gonzales V. Manolita Gonzales de CarungcongBruno GalwatNo ratings yet

- CIR vs. CADocument2 pagesCIR vs. CABruno GalwatNo ratings yet

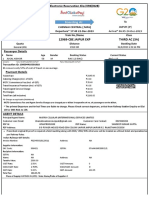

- Morth Delegation April InvoiceDocument1 pageMorth Delegation April InvoiceAshu SinghNo ratings yet

- Problems Partnership OperationsDocument25 pagesProblems Partnership OperationsMaryjoy EscarezNo ratings yet

- ApplicationTAX - LecturePROBLEMDocument2 pagesApplicationTAX - LecturePROBLEMAyessa ViajanteNo ratings yet

- Kertas Kerja BBDocument16 pagesKertas Kerja BBdniarNo ratings yet

- Lesson 14-Budget Planning WorksheetDocument6 pagesLesson 14-Budget Planning Worksheetapi-253889154No ratings yet

- Tax Form W-8BEN-E PDFDocument17 pagesTax Form W-8BEN-E PDFNEWKHALSA ENTNo ratings yet

- CPA A2.3 - ADVANCED TAXATION - Study ManualDocument92 pagesCPA A2.3 - ADVANCED TAXATION - Study ManualZIHERAMBERE AnastaseNo ratings yet

- 2023 Introduced Budget - Wayne Township NJDocument74 pages2023 Introduced Budget - Wayne Township NJMichelle Rotuno-JohnsonNo ratings yet

- Silkair V Cir DigestDocument6 pagesSilkair V Cir Digestbdjn bdjnNo ratings yet

- Composition Scheme For Sarafa and JewellersDocument6 pagesComposition Scheme For Sarafa and JewellersVirender ChaudharyNo ratings yet

- PreInvoice Pel 31336Document1 pagePreInvoice Pel 31336Harikrishan BhattNo ratings yet

- CV DestaDocument1 pageCV DestadestaputrantoNo ratings yet

- Far510 MFRS120Document22 pagesFar510 MFRS120faiqahn602No ratings yet

- Question 1: Ias 8 Policies, Estimates & Errors: Page 1 of 3Document3 pagesQuestion 1: Ias 8 Policies, Estimates & Errors: Page 1 of 3Bagudu Bilal GamboNo ratings yet

- Addai CompanyDocument3 pagesAddai Companylaale djaanNo ratings yet

- Taxation (United Kingdom) : September/December 2017 - Sample QuestionsDocument9 pagesTaxation (United Kingdom) : September/December 2017 - Sample QuestionsAyushman BhardwajNo ratings yet

- 1604 CFDocument8 pages1604 CFNette CutinNo ratings yet

- GSTIN 18ABPFM4435K1ZQ: InvoiceDocument2 pagesGSTIN 18ABPFM4435K1ZQ: InvoicenirajNo ratings yet

- Tax3761 2023 TL204 0Document6 pagesTax3761 2023 TL204 0themrmoonlightNo ratings yet

- Income Tax in India - Wikipedia, The Free EncyclopediaDocument10 pagesIncome Tax in India - Wikipedia, The Free EncyclopediakandurimaruthiNo ratings yet

- CPWD Circular 270619 1Document1 pageCPWD Circular 270619 1JaslinrajsrNo ratings yet

- Ias 36 Example Simple Impairment Test of CGU Based On Value in UseDocument7 pagesIas 36 Example Simple Impairment Test of CGU Based On Value in Usedevanand bhawNo ratings yet

- 12969-Cbe Jaipur Exp Third Ac (3A) : Start Date 22-Dec-2023 Arrival 06:45 24-Dec-2023Document1 page12969-Cbe Jaipur Exp Third Ac (3A) : Start Date 22-Dec-2023 Arrival 06:45 24-Dec-2023sharesth sharmaNo ratings yet

- COMMISSIONER OF INTERNAL REVENUE vs. FITNESS BY DESIGN INC.Document11 pagesCOMMISSIONER OF INTERNAL REVENUE vs. FITNESS BY DESIGN INC.JaysonNo ratings yet

- Income Tax BotswanaDocument15 pagesIncome Tax BotswanaFrancisNo ratings yet

- Adobe Scan Jan 26, 2023Document25 pagesAdobe Scan Jan 26, 2023Rafael AbedesNo ratings yet

- RR No. 9-2016 PDFDocument1 pageRR No. 9-2016 PDFJames SusukiNo ratings yet

- IAS 12 GuideDocument52 pagesIAS 12 Guidezubair_zNo ratings yet