Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

29 viewsCycle Conversion Cash Period Conversion Inv. Period Collection Rec. Period Deferral Pay

Cycle Conversion Cash Period Conversion Inv. Period Collection Rec. Period Deferral Pay

Uploaded by

GA ZinThe document contains calculations related to accounting concepts such as accounts receivable, inventory conversion period, payables deferral period, and cash conversion cycle. It also includes a cash budget showing monthly sales, cash receipts, purchases, expenses, and ending cash gain/loss. Key figures calculated include a cash conversion cycle of 40 days, inventory turnover of 5.84, and monthly cash gain of P776.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Ontario Bar Exam Study GuideDocument6 pagesOntario Bar Exam Study Guidejoe100% (3)

- Fin420.540 Jan 2018 Q2-5Document8 pagesFin420.540 Jan 2018 Q2-5Amar AzuanNo ratings yet

- EXECUTIVE CLEMENCY (Non-Institutional)Document19 pagesEXECUTIVE CLEMENCY (Non-Institutional)Wena Mae Cristobal100% (10)

- 1) Answer: Interest Expense 0 Solution:: Financial Statement AnalysisDocument9 pages1) Answer: Interest Expense 0 Solution:: Financial Statement AnalysisGA ZinNo ratings yet

- BIOETHICSDocument243 pagesBIOETHICSJoebeth Competente100% (5)

- UNIT 3 Tutorial Q & ADocument14 pagesUNIT 3 Tutorial Q & AAlicia AbsolamNo ratings yet

- Ratio AnalysisDocument56 pagesRatio AnalysissrinivasNo ratings yet

- Corporate Finance II Section: 01 Homework No: 02Document5 pagesCorporate Finance II Section: 01 Homework No: 02Sumaiya TithiNo ratings yet

- Chapter 6 - Activity 2: Problem 1 (Day Sales Outstanding)Document8 pagesChapter 6 - Activity 2: Problem 1 (Day Sales Outstanding)Ravena ReyesNo ratings yet

- FM FinalDocument7 pagesFM FinalStoryKingNo ratings yet

- 1 2021 FAR FinalsDocument6 pages1 2021 FAR FinalsZatsumono YamamotoNo ratings yet

- BAFINMAX Learning Activity 1 Finals - With Answers - StudentsDocument5 pagesBAFINMAX Learning Activity 1 Finals - With Answers - Studentsfaye pantiNo ratings yet

- BUSI 2001 - Intermediate Accounting 1 Assignment 2 - Notes Receivable, Inventories Solution Problem 1Document2 pagesBUSI 2001 - Intermediate Accounting 1 Assignment 2 - Notes Receivable, Inventories Solution Problem 1Kate BNo ratings yet

- BUSI 2001 - Intermediate Accounting 1 Assignment 2 - Notes Receivable, Inventories Solution Problem 1Document2 pagesBUSI 2001 - Intermediate Accounting 1 Assignment 2 - Notes Receivable, Inventories Solution Problem 1Kate BNo ratings yet

- ACC-132 Quiz 4 Answer KeyDocument3 pagesACC-132 Quiz 4 Answer KeyG18 Yna RecintoNo ratings yet

- Valuation Methods - Activity 1Document5 pagesValuation Methods - Activity 1Rosario BacaniNo ratings yet

- ACTY04 s.2020 2021Document3 pagesACTY04 s.2020 2021Gelay MagatNo ratings yet

- Examples For Review (Income Statement)Document9 pagesExamples For Review (Income Statement)Michelle S. AlejandrinoNo ratings yet

- M4-WK2-HIA - SubmissionDocument7 pagesM4-WK2-HIA - Submissionbim269No ratings yet

- Quiz Finma 0920Document6 pagesQuiz Finma 0920Danica Jane RamosNo ratings yet

- Tutorial Solutions - Week 10Document5 pagesTutorial Solutions - Week 10Finn WilsonNo ratings yet

- # Selected+study+guide-Problem - Solutions - SU 5, 6, 7, 8Document7 pages# Selected+study+guide-Problem - Solutions - SU 5, 6, 7, 8PHilipNo ratings yet

- 2018 (NOV-DEC) : (6) What Is Meant by International Financial Reporting Standards ( - FRS3) ?Document18 pages2018 (NOV-DEC) : (6) What Is Meant by International Financial Reporting Standards ( - FRS3) ?treasurebts19No ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-4Document3 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-4Pramod VasudevNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-4Document3 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-4Pramod VasudevNo ratings yet

- Solutions To Selected End-Of-Chapter 10 Problem Solving QuestionsDocument5 pagesSolutions To Selected End-Of-Chapter 10 Problem Solving QuestionsNguyen Quynh AnhNo ratings yet

- Quiz Finma 0920Document5 pagesQuiz Finma 0920Danica RamosNo ratings yet

- BFF2341 Tri A 2020 Mini Test 2 SolutionDocument3 pagesBFF2341 Tri A 2020 Mini Test 2 SolutionDuankai LinNo ratings yet

- Far AnswersDocument2 pagesFar AnswersMikhail Ayman MasturaNo ratings yet

- Goodwill - SumsDocument5 pagesGoodwill - SumsFatimaNo ratings yet

- Chapter 3 - Budgetary Process - 15022022Document14 pagesChapter 3 - Budgetary Process - 15022022linh nguyễnNo ratings yet

- M9 Enrichment ActivityDocument2 pagesM9 Enrichment ActivityEdelberto AnilaoNo ratings yet

- Week 9 & 10 - Seminar SolutionDocument2 pagesWeek 9 & 10 - Seminar SolutionYediyildiz Filofteia ElisaNo ratings yet

- FIN 081 - P2 Quiz2Document55 pagesFIN 081 - P2 Quiz2Grazielle DiazNo ratings yet

- BT Tổng Hợp Topic 7 8 2Document12 pagesBT Tổng Hợp Topic 7 8 2Man Tran Y NhiNo ratings yet

- Simulasi Penggajihan Dan Bonus CleanerDocument5 pagesSimulasi Penggajihan Dan Bonus Cleanerfahmiwahono.bsc03No ratings yet

- Model Ans - Sas - I April 2018Document68 pagesModel Ans - Sas - I April 2018প্রীতম সেনNo ratings yet

- Day Per Sold Goods of Cost InventoryDocument2 pagesDay Per Sold Goods of Cost InventoryJohn Brian D. SorianoNo ratings yet

- Assigned Problems FinmarDocument8 pagesAssigned Problems FinmarTABUADA, Jenny Rose V.No ratings yet

- Diagnostic Level 3 AccountingDocument17 pagesDiagnostic Level 3 AccountingRobert CastilloNo ratings yet

- Corporate Finance Week 5 Slide SolutionsDocument3 pagesCorporate Finance Week 5 Slide SolutionsKate BNo ratings yet

- Name: Shania Rose P. Binwag Illustration 1Document3 pagesName: Shania Rose P. Binwag Illustration 1ShaniaRose BinwagNo ratings yet

- FM Eco Full Test 1 Unscheduled Nov 2023 Solution 1691563701Document34 pagesFM Eco Full Test 1 Unscheduled Nov 2023 Solution 1691563701Srushti AgarwalNo ratings yet

- Managerial Finance GitmanDocument3 pagesManagerial Finance GitmanjessicaNo ratings yet

- Corporate FinanceDocument3 pagesCorporate FinanceRitesh BangNo ratings yet

- Partnership AccountingDocument46 pagesPartnership AccountingAether SkywardNo ratings yet

- Partnership Operation ReviewerDocument4 pagesPartnership Operation ReviewerNathaly Nicolle CapuchinoNo ratings yet

- Mid Semester Assignment: Course Code: FIN - 254 Section: 08Document8 pagesMid Semester Assignment: Course Code: FIN - 254 Section: 08Fahim Faisal 1620560630No ratings yet

- Afs - Practice Question SolutionsDocument3 pagesAfs - Practice Question SolutionsShakeel IqbalNo ratings yet

- Fnce370 Assign3Document29 pagesFnce370 Assign3smaNo ratings yet

- Capital Budgeting TechniquesDocument5 pagesCapital Budgeting TechniquesRukhsar Abbas Ali .No ratings yet

- Profit Analysis: Kolehiyo NG Subic Subic, ZambalesDocument3 pagesProfit Analysis: Kolehiyo NG Subic Subic, ZambalesWynphap podiotanNo ratings yet

- BA4202 Capital Budgeting Solved ProblemsDocument9 pagesBA4202 Capital Budgeting Solved ProblemsVasugi KumarNo ratings yet

- Tugas Chapter 4 - Tri Sasmita - 1181002091 - Corfin 42Document3 pagesTugas Chapter 4 - Tri Sasmita - 1181002091 - Corfin 42WisnualdiwibowoNo ratings yet

- Answers and Solutions Chap 3Document8 pagesAnswers and Solutions Chap 3Ricalyn BugarinNo ratings yet

- MA1 - Session 4 - Home Work Questions (Answers)Document5 pagesMA1 - Session 4 - Home Work Questions (Answers)sramnarine1991No ratings yet

- BA4202 Capital Budgeting Solved ProblemsDocument10 pagesBA4202 Capital Budgeting Solved ProblemsVasugi KumarNo ratings yet

- Working Capital PolicyDocument5 pagesWorking Capital PolicyNaima HossainNo ratings yet

- HMW 2 - AnswersDocument2 pagesHMW 2 - Answersbrahim.safa2018No ratings yet

- CHAPTER 4 DERIVATIONS 7 PGDocument7 pagesCHAPTER 4 DERIVATIONS 7 PGzee abadillaNo ratings yet

- Assignment AnswerDocument7 pagesAssignment AnswerTemesgenNo ratings yet

- Practice Problem Absorptionvariable Costing With Solutions PDFDocument5 pagesPractice Problem Absorptionvariable Costing With Solutions PDFOne DozenNo ratings yet

- Exam (2012 - 2013 - 2014)Document18 pagesExam (2012 - 2013 - 2014)Magdy KamelNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- ST-1 (Analysis of Recessionary Cash Flows) ADocument4 pagesST-1 (Analysis of Recessionary Cash Flows) AGA ZinNo ratings yet

- Paper ReactionDocument1 pagePaper ReactionGA ZinNo ratings yet

- Case 1Document2 pagesCase 1GA ZinNo ratings yet

- Management of CA 2Document2 pagesManagement of CA 2GA ZinNo ratings yet

- Solution:: Market/book RatioDocument3 pagesSolution:: Market/book RatioGA ZinNo ratings yet

- 1) Answer: Interest Expense 0 Solution:: Financial Statement AnalysisDocument3 pages1) Answer: Interest Expense 0 Solution:: Financial Statement AnalysisGA ZinNo ratings yet

- IntraDay TradingDocument73 pagesIntraDay TradingIssaka Ouedraogo100% (1)

- Practical Guides To Property Transactions in Nigeria PDFDocument68 pagesPractical Guides To Property Transactions in Nigeria PDFOlufemi DavidNo ratings yet

- Mississippi Medical Cannabis LawsuitDocument34 pagesMississippi Medical Cannabis LawsuitMarijuana MomentNo ratings yet

- The Authority of English Decisions in Colonial CourtsDocument18 pagesThe Authority of English Decisions in Colonial CourtsMtaki FrancisNo ratings yet

- Whos Who Legal Thought LeadersDocument59 pagesWhos Who Legal Thought LeadersChiefJustice MiddletonNo ratings yet

- Moot Proposition - 11th NASCENT Moot Court Competition, 2021Document5 pagesMoot Proposition - 11th NASCENT Moot Court Competition, 2021Kinjal KeyaNo ratings yet

- Kolmogorov 25Document12 pagesKolmogorov 25dawid.horoszkiewiczNo ratings yet

- Evidence Cases Atty. MacababbadDocument43 pagesEvidence Cases Atty. MacababbadEnriq LegaspiNo ratings yet

- Rice N Life Enterptise 1Document103 pagesRice N Life Enterptise 1Jasmin ZuluetaNo ratings yet

- aAFF OF LOSS JAMES CEDRIC UY ALEGREDocument2 pagesaAFF OF LOSS JAMES CEDRIC UY ALEGRERobert marollanoNo ratings yet

- Partnership Q6 SolutionDocument4 pagesPartnership Q6 SolutionLorraine Mae RobridoNo ratings yet

- FIFA 558 CommentaryDocument1 pageFIFA 558 Commentarysantiago palaciosNo ratings yet

- Criminal ProcedureDocument55 pagesCriminal ProcedureKhimber Claire Lala MaduyoNo ratings yet

- For Coin & Blood (2nd Edition) - The HuntedDocument16 pagesFor Coin & Blood (2nd Edition) - The HuntedMyriam Poveda50% (2)

- PWDCertificateDocument1 pagePWDCertificateBipin PatilNo ratings yet

- Revised Debate Guidelines AP Week 2022 1Document3 pagesRevised Debate Guidelines AP Week 2022 1JUSTICE100% (1)

- Numbers 0 To 9 Matching Exercise Worksheet Birthday ThemeDocument1 pageNumbers 0 To 9 Matching Exercise Worksheet Birthday Themegarbinxuli9325No ratings yet

- Bonafide Certificate Application NewDocument2 pagesBonafide Certificate Application NewRaushan karnNo ratings yet

- Chapter 14 Answer KeyDocument68 pagesChapter 14 Answer KeyEmma Tamayo0% (1)

- C9 Norton v. Shelby CountyDocument14 pagesC9 Norton v. Shelby CountyJenNo ratings yet

- Form 66Document2 pagesForm 66skgupta2711No ratings yet

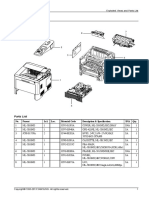

- ML 5010NDDocument34 pagesML 5010NDrodrigo pevidorNo ratings yet

- Special Proceedings and Special WritsDocument63 pagesSpecial Proceedings and Special WritsjoliwanagNo ratings yet

- MCQ On Company LAW: BSL-605 T-8Document35 pagesMCQ On Company LAW: BSL-605 T-8mayankNo ratings yet

- Supreme Court of The PhilippinesDocument13 pagesSupreme Court of The PhilippinesRaymond AnactaNo ratings yet

- Chapter 5 - Ucadia Law Series: The Law Explained: Session 5 - Documents and SecuritiesDocument23 pagesChapter 5 - Ucadia Law Series: The Law Explained: Session 5 - Documents and SecuritiesMinisterNo ratings yet

- Deanna Cook LawsuitDocument29 pagesDeanna Cook LawsuitRobert WilonskyNo ratings yet

Cycle Conversion Cash Period Conversion Inv. Period Collection Rec. Period Deferral Pay

Cycle Conversion Cash Period Conversion Inv. Period Collection Rec. Period Deferral Pay

Uploaded by

GA Zin0 ratings0% found this document useful (0 votes)

29 views3 pagesThe document contains calculations related to accounting concepts such as accounts receivable, inventory conversion period, payables deferral period, and cash conversion cycle. It also includes a cash budget showing monthly sales, cash receipts, purchases, expenses, and ending cash gain/loss. Key figures calculated include a cash conversion cycle of 40 days, inventory turnover of 5.84, and monthly cash gain of P776.

Original Description:

Original Title

Management of CA 1

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains calculations related to accounting concepts such as accounts receivable, inventory conversion period, payables deferral period, and cash conversion cycle. It also includes a cash budget showing monthly sales, cash receipts, purchases, expenses, and ending cash gain/loss. Key figures calculated include a cash conversion cycle of 40 days, inventory turnover of 5.84, and monthly cash gain of P776.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

29 views3 pagesCycle Conversion Cash Period Conversion Inv. Period Collection Rec. Period Deferral Pay

Cycle Conversion Cash Period Conversion Inv. Period Collection Rec. Period Deferral Pay

Uploaded by

GA ZinThe document contains calculations related to accounting concepts such as accounts receivable, inventory conversion period, payables deferral period, and cash conversion cycle. It also includes a cash budget showing monthly sales, cash receipts, purchases, expenses, and ending cash gain/loss. Key figures calculated include a cash conversion cycle of 40 days, inventory turnover of 5.84, and monthly cash gain of P776.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

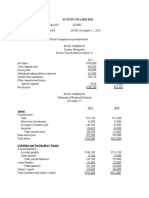

1.

) ANSWER: P194,444

Accounts receivable = DSO × Sales per day

= 35(P2,027,773/365)

= P194,444

2.) ANSWER: 60.83 days

Inventory conversion period =Inventory/(Sales/365)

=P5,000,000/ (30,000,000/365)

= P5,000,000/82,191.78

= 60.83 days.

3.) ANSWER: 35.46 days

Payables deferral period =Payables/ (Cost of goods sold/365)

=850,000/ (8,750,000/365)

=P850,000/23,972.60

= 35.46 days

Facts given: Payables deferral period =

30 days; Inv = $5,000,000; Rec. =

$2,000,000; ADS = $100,000.

cycle

conversion Cash

=

period

conversion Inv.

+

period

collection Rec.

–

period

deferral Pay.

.

Step 1: Determine the inventory conversion

period:

Inventory conversion period =

Inventory/Daily sales

= $5,000,000/$100,000

= 50 days.

Step 2: Determine the receivables collection

period:

Receivables collection period =

Receivables/Daily sales

= $2,000,000/$100,000

= 20 days.

Step 3: Given data and information

calculated above, determine the firm’s

cash conversion cycle:

Cash conversion cycle = 50 + 20 - 30

= 40 days.

4.) ANSWER: 40 days

CASH CONVERSION CYCLE = Inventory Conversion Period + Rec. Collection Period – Pay deferral period

Inventory Conversion Period = Inventory/Daily Sales

= P5,000,000/P100,000

= 50 days

Receivable collection Period = Receivables / Daily sales

= P2,000,000/P100,000

= 20 days

Cash conversion cycle = 50 + 20 – 30

= 40 days

5.) ANSWER: 87 days

CASH CONVERSION CYCLE = Inventory Conversion Period + Rec. Collection Period – Pay deferral period

= 72 + 60 – 45

= 87 days

6.) ANSWER: 5.84

DSO = Receivables / (Sales/365)

50 = P100,000,000 / sales/365

P100,000,000 = 50 (sales) / 365

P36,500,000,000 = 50 (sales)

P730,000,000 = Sales

Inventory turnover = Sales / Inv

= P730,000,000 / P125,000,000

= 5.84

7.) ANSWER: P776

Monthly sales = (3,000 * 40% * 0.98) + (3,000 * %60)

= 2,976

Purchases = 1,500

Other payments = 700

Cash gain = 2,976 – (1,500 + 700)

= 776

CASH BUDGET

Month 1 Month 2 Month 3

Sales 3,000 3,000 3,000

Cash sales (40% with 2% discount) 1,176 1,176 1,176

Collection (1 month lag) 1,800 1,800

TOTAL CASH RECEIPTS P1,176 P2,976 P2,976

Purchases 1500 1500 1500

Wages, Rent and Taxes 700 700 700

TOTAL CASH DISBURSEMENTS 2,200 2,200 2,200

ENDING CASH GAIN /(LOSS) P776 P776

You might also like

- Ontario Bar Exam Study GuideDocument6 pagesOntario Bar Exam Study Guidejoe100% (3)

- Fin420.540 Jan 2018 Q2-5Document8 pagesFin420.540 Jan 2018 Q2-5Amar AzuanNo ratings yet

- EXECUTIVE CLEMENCY (Non-Institutional)Document19 pagesEXECUTIVE CLEMENCY (Non-Institutional)Wena Mae Cristobal100% (10)

- 1) Answer: Interest Expense 0 Solution:: Financial Statement AnalysisDocument9 pages1) Answer: Interest Expense 0 Solution:: Financial Statement AnalysisGA ZinNo ratings yet

- BIOETHICSDocument243 pagesBIOETHICSJoebeth Competente100% (5)

- UNIT 3 Tutorial Q & ADocument14 pagesUNIT 3 Tutorial Q & AAlicia AbsolamNo ratings yet

- Ratio AnalysisDocument56 pagesRatio AnalysissrinivasNo ratings yet

- Corporate Finance II Section: 01 Homework No: 02Document5 pagesCorporate Finance II Section: 01 Homework No: 02Sumaiya TithiNo ratings yet

- Chapter 6 - Activity 2: Problem 1 (Day Sales Outstanding)Document8 pagesChapter 6 - Activity 2: Problem 1 (Day Sales Outstanding)Ravena ReyesNo ratings yet

- FM FinalDocument7 pagesFM FinalStoryKingNo ratings yet

- 1 2021 FAR FinalsDocument6 pages1 2021 FAR FinalsZatsumono YamamotoNo ratings yet

- BAFINMAX Learning Activity 1 Finals - With Answers - StudentsDocument5 pagesBAFINMAX Learning Activity 1 Finals - With Answers - Studentsfaye pantiNo ratings yet

- BUSI 2001 - Intermediate Accounting 1 Assignment 2 - Notes Receivable, Inventories Solution Problem 1Document2 pagesBUSI 2001 - Intermediate Accounting 1 Assignment 2 - Notes Receivable, Inventories Solution Problem 1Kate BNo ratings yet

- BUSI 2001 - Intermediate Accounting 1 Assignment 2 - Notes Receivable, Inventories Solution Problem 1Document2 pagesBUSI 2001 - Intermediate Accounting 1 Assignment 2 - Notes Receivable, Inventories Solution Problem 1Kate BNo ratings yet

- ACC-132 Quiz 4 Answer KeyDocument3 pagesACC-132 Quiz 4 Answer KeyG18 Yna RecintoNo ratings yet

- Valuation Methods - Activity 1Document5 pagesValuation Methods - Activity 1Rosario BacaniNo ratings yet

- ACTY04 s.2020 2021Document3 pagesACTY04 s.2020 2021Gelay MagatNo ratings yet

- Examples For Review (Income Statement)Document9 pagesExamples For Review (Income Statement)Michelle S. AlejandrinoNo ratings yet

- M4-WK2-HIA - SubmissionDocument7 pagesM4-WK2-HIA - Submissionbim269No ratings yet

- Quiz Finma 0920Document6 pagesQuiz Finma 0920Danica Jane RamosNo ratings yet

- Tutorial Solutions - Week 10Document5 pagesTutorial Solutions - Week 10Finn WilsonNo ratings yet

- # Selected+study+guide-Problem - Solutions - SU 5, 6, 7, 8Document7 pages# Selected+study+guide-Problem - Solutions - SU 5, 6, 7, 8PHilipNo ratings yet

- 2018 (NOV-DEC) : (6) What Is Meant by International Financial Reporting Standards ( - FRS3) ?Document18 pages2018 (NOV-DEC) : (6) What Is Meant by International Financial Reporting Standards ( - FRS3) ?treasurebts19No ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-4Document3 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-4Pramod VasudevNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-4Document3 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-4Pramod VasudevNo ratings yet

- Solutions To Selected End-Of-Chapter 10 Problem Solving QuestionsDocument5 pagesSolutions To Selected End-Of-Chapter 10 Problem Solving QuestionsNguyen Quynh AnhNo ratings yet

- Quiz Finma 0920Document5 pagesQuiz Finma 0920Danica RamosNo ratings yet

- BFF2341 Tri A 2020 Mini Test 2 SolutionDocument3 pagesBFF2341 Tri A 2020 Mini Test 2 SolutionDuankai LinNo ratings yet

- Far AnswersDocument2 pagesFar AnswersMikhail Ayman MasturaNo ratings yet

- Goodwill - SumsDocument5 pagesGoodwill - SumsFatimaNo ratings yet

- Chapter 3 - Budgetary Process - 15022022Document14 pagesChapter 3 - Budgetary Process - 15022022linh nguyễnNo ratings yet

- M9 Enrichment ActivityDocument2 pagesM9 Enrichment ActivityEdelberto AnilaoNo ratings yet

- Week 9 & 10 - Seminar SolutionDocument2 pagesWeek 9 & 10 - Seminar SolutionYediyildiz Filofteia ElisaNo ratings yet

- FIN 081 - P2 Quiz2Document55 pagesFIN 081 - P2 Quiz2Grazielle DiazNo ratings yet

- BT Tổng Hợp Topic 7 8 2Document12 pagesBT Tổng Hợp Topic 7 8 2Man Tran Y NhiNo ratings yet

- Simulasi Penggajihan Dan Bonus CleanerDocument5 pagesSimulasi Penggajihan Dan Bonus Cleanerfahmiwahono.bsc03No ratings yet

- Model Ans - Sas - I April 2018Document68 pagesModel Ans - Sas - I April 2018প্রীতম সেনNo ratings yet

- Day Per Sold Goods of Cost InventoryDocument2 pagesDay Per Sold Goods of Cost InventoryJohn Brian D. SorianoNo ratings yet

- Assigned Problems FinmarDocument8 pagesAssigned Problems FinmarTABUADA, Jenny Rose V.No ratings yet

- Diagnostic Level 3 AccountingDocument17 pagesDiagnostic Level 3 AccountingRobert CastilloNo ratings yet

- Corporate Finance Week 5 Slide SolutionsDocument3 pagesCorporate Finance Week 5 Slide SolutionsKate BNo ratings yet

- Name: Shania Rose P. Binwag Illustration 1Document3 pagesName: Shania Rose P. Binwag Illustration 1ShaniaRose BinwagNo ratings yet

- FM Eco Full Test 1 Unscheduled Nov 2023 Solution 1691563701Document34 pagesFM Eco Full Test 1 Unscheduled Nov 2023 Solution 1691563701Srushti AgarwalNo ratings yet

- Managerial Finance GitmanDocument3 pagesManagerial Finance GitmanjessicaNo ratings yet

- Corporate FinanceDocument3 pagesCorporate FinanceRitesh BangNo ratings yet

- Partnership AccountingDocument46 pagesPartnership AccountingAether SkywardNo ratings yet

- Partnership Operation ReviewerDocument4 pagesPartnership Operation ReviewerNathaly Nicolle CapuchinoNo ratings yet

- Mid Semester Assignment: Course Code: FIN - 254 Section: 08Document8 pagesMid Semester Assignment: Course Code: FIN - 254 Section: 08Fahim Faisal 1620560630No ratings yet

- Afs - Practice Question SolutionsDocument3 pagesAfs - Practice Question SolutionsShakeel IqbalNo ratings yet

- Fnce370 Assign3Document29 pagesFnce370 Assign3smaNo ratings yet

- Capital Budgeting TechniquesDocument5 pagesCapital Budgeting TechniquesRukhsar Abbas Ali .No ratings yet

- Profit Analysis: Kolehiyo NG Subic Subic, ZambalesDocument3 pagesProfit Analysis: Kolehiyo NG Subic Subic, ZambalesWynphap podiotanNo ratings yet

- BA4202 Capital Budgeting Solved ProblemsDocument9 pagesBA4202 Capital Budgeting Solved ProblemsVasugi KumarNo ratings yet

- Tugas Chapter 4 - Tri Sasmita - 1181002091 - Corfin 42Document3 pagesTugas Chapter 4 - Tri Sasmita - 1181002091 - Corfin 42WisnualdiwibowoNo ratings yet

- Answers and Solutions Chap 3Document8 pagesAnswers and Solutions Chap 3Ricalyn BugarinNo ratings yet

- MA1 - Session 4 - Home Work Questions (Answers)Document5 pagesMA1 - Session 4 - Home Work Questions (Answers)sramnarine1991No ratings yet

- BA4202 Capital Budgeting Solved ProblemsDocument10 pagesBA4202 Capital Budgeting Solved ProblemsVasugi KumarNo ratings yet

- Working Capital PolicyDocument5 pagesWorking Capital PolicyNaima HossainNo ratings yet

- HMW 2 - AnswersDocument2 pagesHMW 2 - Answersbrahim.safa2018No ratings yet

- CHAPTER 4 DERIVATIONS 7 PGDocument7 pagesCHAPTER 4 DERIVATIONS 7 PGzee abadillaNo ratings yet

- Assignment AnswerDocument7 pagesAssignment AnswerTemesgenNo ratings yet

- Practice Problem Absorptionvariable Costing With Solutions PDFDocument5 pagesPractice Problem Absorptionvariable Costing With Solutions PDFOne DozenNo ratings yet

- Exam (2012 - 2013 - 2014)Document18 pagesExam (2012 - 2013 - 2014)Magdy KamelNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- ST-1 (Analysis of Recessionary Cash Flows) ADocument4 pagesST-1 (Analysis of Recessionary Cash Flows) AGA ZinNo ratings yet

- Paper ReactionDocument1 pagePaper ReactionGA ZinNo ratings yet

- Case 1Document2 pagesCase 1GA ZinNo ratings yet

- Management of CA 2Document2 pagesManagement of CA 2GA ZinNo ratings yet

- Solution:: Market/book RatioDocument3 pagesSolution:: Market/book RatioGA ZinNo ratings yet

- 1) Answer: Interest Expense 0 Solution:: Financial Statement AnalysisDocument3 pages1) Answer: Interest Expense 0 Solution:: Financial Statement AnalysisGA ZinNo ratings yet

- IntraDay TradingDocument73 pagesIntraDay TradingIssaka Ouedraogo100% (1)

- Practical Guides To Property Transactions in Nigeria PDFDocument68 pagesPractical Guides To Property Transactions in Nigeria PDFOlufemi DavidNo ratings yet

- Mississippi Medical Cannabis LawsuitDocument34 pagesMississippi Medical Cannabis LawsuitMarijuana MomentNo ratings yet

- The Authority of English Decisions in Colonial CourtsDocument18 pagesThe Authority of English Decisions in Colonial CourtsMtaki FrancisNo ratings yet

- Whos Who Legal Thought LeadersDocument59 pagesWhos Who Legal Thought LeadersChiefJustice MiddletonNo ratings yet

- Moot Proposition - 11th NASCENT Moot Court Competition, 2021Document5 pagesMoot Proposition - 11th NASCENT Moot Court Competition, 2021Kinjal KeyaNo ratings yet

- Kolmogorov 25Document12 pagesKolmogorov 25dawid.horoszkiewiczNo ratings yet

- Evidence Cases Atty. MacababbadDocument43 pagesEvidence Cases Atty. MacababbadEnriq LegaspiNo ratings yet

- Rice N Life Enterptise 1Document103 pagesRice N Life Enterptise 1Jasmin ZuluetaNo ratings yet

- aAFF OF LOSS JAMES CEDRIC UY ALEGREDocument2 pagesaAFF OF LOSS JAMES CEDRIC UY ALEGRERobert marollanoNo ratings yet

- Partnership Q6 SolutionDocument4 pagesPartnership Q6 SolutionLorraine Mae RobridoNo ratings yet

- FIFA 558 CommentaryDocument1 pageFIFA 558 Commentarysantiago palaciosNo ratings yet

- Criminal ProcedureDocument55 pagesCriminal ProcedureKhimber Claire Lala MaduyoNo ratings yet

- For Coin & Blood (2nd Edition) - The HuntedDocument16 pagesFor Coin & Blood (2nd Edition) - The HuntedMyriam Poveda50% (2)

- PWDCertificateDocument1 pagePWDCertificateBipin PatilNo ratings yet

- Revised Debate Guidelines AP Week 2022 1Document3 pagesRevised Debate Guidelines AP Week 2022 1JUSTICE100% (1)

- Numbers 0 To 9 Matching Exercise Worksheet Birthday ThemeDocument1 pageNumbers 0 To 9 Matching Exercise Worksheet Birthday Themegarbinxuli9325No ratings yet

- Bonafide Certificate Application NewDocument2 pagesBonafide Certificate Application NewRaushan karnNo ratings yet

- Chapter 14 Answer KeyDocument68 pagesChapter 14 Answer KeyEmma Tamayo0% (1)

- C9 Norton v. Shelby CountyDocument14 pagesC9 Norton v. Shelby CountyJenNo ratings yet

- Form 66Document2 pagesForm 66skgupta2711No ratings yet

- ML 5010NDDocument34 pagesML 5010NDrodrigo pevidorNo ratings yet

- Special Proceedings and Special WritsDocument63 pagesSpecial Proceedings and Special WritsjoliwanagNo ratings yet

- MCQ On Company LAW: BSL-605 T-8Document35 pagesMCQ On Company LAW: BSL-605 T-8mayankNo ratings yet

- Supreme Court of The PhilippinesDocument13 pagesSupreme Court of The PhilippinesRaymond AnactaNo ratings yet

- Chapter 5 - Ucadia Law Series: The Law Explained: Session 5 - Documents and SecuritiesDocument23 pagesChapter 5 - Ucadia Law Series: The Law Explained: Session 5 - Documents and SecuritiesMinisterNo ratings yet

- Deanna Cook LawsuitDocument29 pagesDeanna Cook LawsuitRobert WilonskyNo ratings yet