Professional Documents

Culture Documents

Reliance Industries LTD: Retail To Drive Next Leg of Growth

Reliance Industries LTD: Retail To Drive Next Leg of Growth

Uploaded by

nitinmuthaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Reliance Industries LTD: Retail To Drive Next Leg of Growth

Reliance Industries LTD: Retail To Drive Next Leg of Growth

Uploaded by

nitinmuthaCopyright:

Available Formats

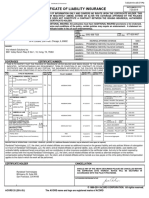

Stock Update

Reliance Industries Ltd

Retail to drive next leg of growth

Powered by the Sharekhan 3R Research Philosophy Oil & Gas Sharekhan code: RELIANCE Company Update

3R MATRIX + = - Summary

Reliance Industries Ltd (RIL) eyes a 3x growth in retail revenues in 3-5 years, implying a

Right Sector (RS) ü revenue CAGR of 32% over FY21-26E and an estimated EBITDA of >Rs20,000 crore. EV/

EBITDA of 30x would mean retail EV of ~$80-85 bn (vs. our valuation of $68 billion).

Right Quality (RQ) ü JioPhone Next’s launch would sustain strong subscriber addition (large-scale migration of

30 crore 2G customers) and potential ARPU hike to help gain revenue market share. Ramp-

up of broadband services to drive growth for Jio.

Right Valuation (RV) ü Recovery in Singapore GRM to $4.9/bbl could help finalise potential deal in oil-to-chemical

(O2C) with Saudi Aramco. Strengthening of balance sheet would support inorganic growth

+ Positive = Neutral - Negative and new energy investment.

We maintain a Buy on RIL with a revised SoTP-based PT of Rs. 2,700 given our expectation

What has changed in 3R MATRIX robust 27% PAT CAGR over FY21-24E. Further value unlocking in digital and retail businesses

(with a likely IPO) are key catalysts for RIL.

Old New

RIL’s management aims to grow the retail business by ~3x in next 3-5 years, which indicates

RS strong 32% revenue CAGR for retail business over FY21-FY26E and drive next leg of growth

and valuation re-rating. In addition, Jio is likely to witness a telecom revenue market share

RQ gain led by continued strong subscriber additions (likely launch of JioPhone Next in Nov’21)

and potential tariff hike. Also, earnings outlook for O2C business is improving given a sharp

RV recovery in Singapore complex GRMs at ~$3.4/bbl in Q2FY22QTD and the same could

support finalization of deal with Saudi Aramco. Clean energy investment of $10 billion could

create long-term value and add $30 billion to valuations (not factored in our valuation).

Reco/View Change

Retail on hyper growth trajectory: RIL is focused on tapping Google’s cloud and AI

Reco: Buy capabilities to scale up the retail business and aim to grow retail segment’s revenue by at

least 3x in the next 3-5 years, which implies very high CAGR of 32% over FY21-26E. RIL’s

CMP: Rs. 2,394 aims to bring 1 crore merchants in next 3 years through leveraging JioMart and become top

10 retailer globally. We believe that a high growth outlook warrants high multiple and thus

Price Target: Rs. 2,700 á we increase value for retail business to Rs. 662/share.

á Upgrade Maintain â Downgrade Reliance JIO – 4G smart phone launch and potential tariff hike to drive growth: RIL has

recently announced to launch JioPhone Next (a fully-loaded 4G smartphone with entire

Android operating system developed by JIO-Google) at affordable price. The launch is

Company details slated for November (a slight delay from initial timeline of September) and could lead to

Market cap: Rs. 1,517,599 cr large-scale migration of 30 crore 2G users and aid continuous strong subscriber addition

along with revenue market share gain for Jio. A potential tariff hike (amid weak third telecom

52-week high/low: Rs. 2,480/1,830 player) and ramp-up of home and enterprise broadband to drive robust earnings growth

for Jio.

NSE volume: New energy business – A step toward clean energy with potential to create long-term

78 lakh

(No of shares) value: RIL has announced a total capital outlay of Rs. 75,000 crore (~$10 billion) for new

energy and material business over next three years. It plans to invest Rs. 60,000 crore on

BSE code: 500325 four Giga factories and Rs. 15,000 crore in the value chain, etc in the next three years and

aims to establish at least 100GW of solar energy by 2030 (22% of India’s RE target of 450GW).

NSE code: RELIANCE A potential PLI scheme for electrolysers could reduce capex for a proposed electrolyser giga

factory, while investment in clean energy could create long-term value.

Free float:

334.1 cr

(No of shares) Our Call

Valuation – Maintain Buy with a revised SoTP-based PT of Rs. 2,700: We expect continued

Shareholding (%) recovery in RIL’s earnings led by cyclical recovery in O2C margins, gradual telecom tariff

hike, high growth in retail and ramp-up of new revenue streams (broadband services and new

Promoters 50.6 commerce). A potential deal in O2C business and further value unlocking in the digital and retail

businesses (with a likely IPO for consumer business in next few years) are key catalysts for the

FII 25.1 stock and would add to shareholders’ returns in the coming years. Hence, we maintain a Buy

rating on RIL with a revised PT SoTP-based PT of Rs. 2,700 (reflects higher valuation across

DII 13.1 retail, O2C and Jio).

Others 11.2 Key Risks

Lower-than-expected refining and petrochemical margins in case global capacity additions

Price chart surpass incremental demand. Slower-than-expected pace of subscriber addition and ramp-up

of broadband services and slowdown in retail business amid COVID-19 could affect earnings

2500 and valuations.

2400

2300

2200

2100 Valuation (Consolidated) Rs cr

2000

1900

Particulars FY2021 FY2022E FY2023E FY2024E

1800 Revenues 4,66,924 5,64,755 6,90,232 7,68,172

Sep-20

Sep-21

Jan-21

May-21

OPM (%) 17.3 19.9 19.4 20.1

Adjusted PAT 43,486 58,316 74,381 88,732

Price performance Adjusted EPS (Rs.) 73.5 86.2 110.0 131.2

y-o-y change (%) -1.9 17.4 27.5 19.3

(%) 1m 3m 6m 12m

PER (x) 32.6 27.8 21.8 18.2

Absolute 11 7 16 6

EV/EBIDTA (x) 17.1 12.3 10.3 9.0

Relative to

5 -4 -1 -48 RoCE (%) 7.0 9.3 10.4 11.0

Sensex

RoNW (%) 6.2 7.3 8.1 8.3

Sharekhan Research, Bloomberg

Source: Company; Sharekhan estimates

September 20, 2021 2

Stock Update

Powered by the Sharekhan

3R Research Philosophy

Retail business – ambitious target to grow revenue by 3x over next 3-5 years

India’s retail market sector to clock a CAGR of 8% over FY20-FY26E and reach $1.3 trillion by FY2026E. Within

that, organised retail is likely to grow at higher rate of 16% as its share is slated to expand to 18% (from 11%

currently) and reach ~$250 billion by FY26E. We believe that Reliance Retail’s market share (across formats –

grocery, fashion & lifestyle and customer electronics) would increase to ~15-20% over next 4-5 years and margin

to expand with an estimated retail EBITDA of >Rs20,000 crore (from Rs. 8,483 crore excluding investment income

in FY2021). EV/EBITDA multiple of 28-30x would mean a retail business EV of ~$80-85 billion.

Management aims 3x growth retail revenue over next 3-5 years

500,000 461,454

450,000

400,000

350,000

300,000

Rs crore

250,000

200,000 162,936 153,818

150,000

100,000

50,000

-

FY20 FY21 FY26E

Retail revenue

Source: Company, Sharekhan Research

JioPhone Next launch – to help sustain high subscriber addition and market share gain for Jio

RIL announced the launch of 4G smartphone – JioPhone Next by November 2021 (a slight delay from initial

launch timeline of September 2021) at an affordable price to tap 30 crore 2G customers in India. However, the

exact pricing details of JioPhone Next is yet to disclosed by the company but the expectation are that it would

be priced lower than the entry-level smartphone price of Rs5,000-7,500. JioPhone Next is a fully loaded 4G

smartphone with entire Android operating system developed by JIO-Google. Additionally, Jio has purchased Rs.

57,123 crore worth 4G spectrum and thus Jio network can accommodate 20 crore additional subscribers. This

would help large-scale migration of 2G customers to 4G and aid strong subscriber addition for RIL along with an

improvement in ARPUs (as tariff hikes are expected given the weak competitive position of Vodafone Idea).

Jio’s leadership position in digital connectivity and strategic partnership with global players would transform it to

leading technology & platforms company. The next leg of earnings growth for Jio would be driven by potential

ARPU hike, subscriber additions, development of new revenue streams (home & enterprise broadband, cloud

computing and block chain). With this, we see the valuation of Jio Platforms for RIL’s stake at ~$89 billion.

Telecom subscriber marker share

Active subscriber market share

Others, 5%

Bharti Airtel, 35%

Reliance Jio, 35%

Vodafone Idea, 25%

Source: TRAI, Industry report, Sharekhan Research

September 20, 2021 3

Stock Update

Powered by the Sharekhan

3R Research Philosophy

Telecom revenue market share

Revenue market share

100% 8% 8%

9% 9% 10% 9%

80%

34% 38% 38% 40% 37% 39%

60%

26% 21% 20% 20% 18% 18%

40%

20% 32% 32% 32% 36% 35%

31%

0%

Q4FY20 Q1FY21 Q2FY21 Q3FY21 Q4FY21 Q1FY22

Bharti Airtel Vodafone Idea Reliance Jio Others

Source: TRAI, Industry report, Sharekhan Research

Cyclical recovery in GRM to support potential deal in O2C business

Singapore complex GRM has recovered sharply to $4.9/bbl currently and has averaged $3.4/bbl in Q2FY22QTD

led by improving demand, declining petroleum product inventories and refinery outages (3% of global production)

in Gulf of Mexico due to hurricane Ida. This would not only improve earnings outlook for standalone O2C business

but also support finalisation of potential minority sake sale deal in O2C business with Saudi Aramco.

Singapore complex GRM recovers sharply to mid-cycle level of $4-5/bbl

7.0 6.5

6.0 4.9

5.0

4.0 3.5 3.4

3.0 2.4

$/bbl

1.6 1.8

2.0 1.2 1.2

1.0 0.0

0.0

-1.0

-2.0 -0.9

Q2FY22QTD

Q1FY20

Q2FY20

Q3FY20

Q4FY20

Q1FY21

Q2FY21

Q3FY21

Q4FY21

Q1FY22

Singapore complex GRM Current

Source: Industry reports; Sharekhan Research

New energy and material initiative investment plan of $10 billion

In its recent AGM, RIL announced total capital outlay of Rs. 75,000 crore (~$10 billion) for new energy and

material business over next three years. It would invest Rs .60,000 crore on four Giga factories and Rs15,000

crore in value chain, etc, in the next three years and aim to establish at least 100GW of solar energy by 2030

(22% of India’s RE target of 450GW).

Under its renewable energy (RE) strategy plan, RIL plans to develop the Dhirubhai Ambani Green Energy

Giga Complex on 5,000 acres in Jamnagar. The company has three-part renewable energy plan.

Part 1 - Four Giga Factories: 1) integrated solar photovoltaic module factory, 2) advanced energy storage

battery factory, 3) green hydrogen — electrolyser factory and 4) fuel cell factory.

Part 2 - Investment of Rs. 15,000 crore in value chain, partnerships and future technologies, including upstream

and downstream industries.

Part 3 - Plans to build Renewable Energy Project Management and Construction Division and Renewable

Energy Project Finance Division.

We believe that RIL would collaborate with global leaders in the clean energy space for technology and build

large projects for economies of scale. In addition, the government could come up with supportive policies (like

PLI scheme for electrolyser) and same would reduce overall capital cost and create long-term value for RIL.

September 20, 2021 4

Stock Update

Powered by the Sharekhan

3R Research Philosophy

Financials in charts

Retail revenue to clock high growth on market gain Jio subscriber addition to remain strong

350,000 600 526

486 506

300,000 500 426

250,000

400

Rs crore

200,000

150,000 300

100,000 200

50,000 100

0

0

FY21

FY22E

FY23E

FY24E

FY21

FY22E

FY23E

FY24E

Retail Revenue Jio subscribers (million)

Source: Company, Sharekhan Research Source: Company, Sharekhan Research

EBITDA to clock 24% CAGR over FY21-FY24E PAT to clock 27% CAGR over FY21-FY24E

200,000 100,000 88,732

154,444

134,207 80,000 74,381

150,000

112,310 58,316

Rs crore

60,000

Rs crore

100,000 80,737 43,486

40,000

50,000

20,000

0

0

FY21

FY22E

FY23E

FY24E

FY21

FY22E

FY23E

FY24E

EBITDA PAT

Source: Company, Sharekhan Research Source: Company, Sharekhan Research

RoE Trend RoCE Trend

9.0 8.3 12.0 11.0

8.1 10.4

11.0

8.0 7.3 10.0 9.3

9.0

7.0 6.2 8.0 7.0

%

%

6.0 7.0

6.0

5.0 5.0

4.0

4.0

FY21

FY22E

FY23E

FY24E

FY21

FY22E

FY23E

FY24E

RoE RoCE

Source: Company, Sharekhan Research Source: Company, Sharekhan Research

September 20, 2021 5

Stock Update

Powered by the Sharekhan

3R Research Philosophy

Outlook and Valuation

n Sector view - Indian retail market to grow strongly; telecom to benefit from potential increase in APRU while

GRM likely to recover in FY2022

India’s retail sector is expected to clock a CAGR of 8% over FY20-FY26 and reach $1.3 trillion by FY26. Within that,

organised retail is likely to grow at higher rate of 16% as its share is slated to expand to 18% (from 11% currently) and

reach ~$250 billion by FY26. India’s telecom sector has consolidated to only four players (three private players

and one government-owned telecom company) from more than eight players earlier. With this, we believe that

pricing war is largely over for telecom companies and ARPU is expected to improve going forward. We believe that

higher bundling with home entertainment, partnerships with content providers and increasing data consumption

due to work from home could be major drivers for price hikes going ahead. Additionally, the focus to switch 2G

customers to 4G with likely introduction of affordable smartphones also bodes well for telecom players. We

expect refining margins to recover over FY2022-FY2023 led by a likely improvement in demand for petroleum

products and decline in product inventories.

n Company outlook - Downstream margins to recover; consumer biz to drive next leg of growth

We expect RIL’s GRMs to recover over FY2022E-FY2023E as diesel and petrol crack spreads are likely to recover

with an improvement in demand and a decline in global inventories. We believe that the next leg of growth for RIL

would be driven by an improvement in earnings contribution from ramp-up of fibre broadband services, enterprise

business and new commerce. Additionally, the company’s unique online-offline retailing strategy would aid

growth and drive up the retail business’ margins. Overall, we expect 27% PAT CAGR over FY2021-FY2024E.

n Valuation - Maintain Buy rating on RIL with a revised SOTP based PT of Rs. 2,700

We have increased our FY2023-FY2024 earnings estimate to factor in high growth/margin for retail business. We

expect a continued recovery in RIL’s earnings led by cyclical recovery in O2C margins, gradual telecom tariff

hike, high growth for retail and ramp-up of new revenue streams (broadband services and new commerce). A

potential deal in O2C business and further value unlocking in the digital and retail businesses (with a likely IPO

for consumer business in next few years) are key catalysts for the stock and would add to shareholders’ returns in

the coming years. Hence, we maintain a Buy rating on RIL with a revised PT SoTP-based PT of Rs. 2,700 (reflects

higher valuation across retail, O2C and Jio). At CMP, the stock trades at 21.8x FY2023E EPS and 10.3x FY2023E

EV/EBITDA.

SoTP based valuation

Particulars Methodology Value per share (Rs/share)

Refining 8x FY23E EV/EBITDA 309

Petrochem 8x FY23E EV/EBITDA 396

Upstream oil & gas EV/BOE 56

Retail 30x FY23E EV/EBITDA 662

Digital Services 16x FY23E EV/EBITDA 1,047

Others 35

Enterprise Value 2,505

Net Debt (195)

Price target 2,700

Source: Sharekhan Research

One-year forward P/E (x) band

35.0

30.0

25.0

20.0

P/E(x)

15.0

10.0

5.0

0.0

Jul-11

Aug-12

Jul-13

Aug-14

Oct-11

Aug-16

Oct-13

Jul-18

Oct-15

Jul-20

Apr-11

May-12

May-14

Nov-14

Apr-16

Nov-16

Apr-18

Apr-20

Nov-18

May-21

Nov-20

Feb-12

Jan-14

Sep-17

Jan-16

Jan-18

Feb-19

Sep-19

Feb-21

Sep-21

Mar-13

Mar-15

Mar-17

Dec-12

Jun-15

Jun-17

Jun-19

Dec-19

P/E (x) Avg. P/E (x) Peak P/E (x) Trough P/E (x)

Source: Sharekhan Research

September 20, 2021 6

Stock Update

Powered by the Sharekhan

3R Research Philosophy

About company

RIL is a diversified conglomerate with business interests across oil refining, petrochemicals, exploration and

production, retail and digital services. The company has one of the world’s largest refining assets with high

Nelson complexity level and an integrated petrochemical complex. RIL launched its telecom services, under

the brand JIO, in September 2016 and this business has already started reporting profits. Core business of

O2C accounted for ~39% of consolidated EBITDA in FY2021, while customer-centric businesses (retail and

digital services) contributed 45% to consolidated EBITDA.

Investment theme

RIL has completed its capital expenditure for expansion of downstream capacities, which have already started

yielding strong earnings growth. Improving growth prospects of telecom business with potential ARPU hike

and ramp-up of broadband services in digital business and sustained high growth in retail business would

be key catalysts for long-term value creation. RIL’s balance sheet has strengthened with recent fund raising

and the company has become virtually net debt free. The company target to increase share of EBITDA from

consumer centric over next few years bodes well for RIL amid volatility in refining and petrochemical margins.

Potential carving out of the O2C segment as a separate subsidiary is a key near-term catalyst for RIL Further

value unlocking in digital and retail (post recent stake sale deals) would add value to shareholders return

over coming years.

Key Risks

Lower-than-expected refining and petrochemical margins in case global capacity additions surpass

incremental demand.

Slower-than-expected pace of subscriber addition and ramp-up of broadband services and slowdown in

retail business could impact earnings and valuations

Additional Data

Key management personnel

Mukesh D. Ambani Chairman & Managing Director

Alok Agarwal Chief Financial Officer

PMS Prasad Executive Director

Source: Bloomberg

Top 10 shareholders

Sr. No. Holder Name Holding (%)

1 Life Insurance Corp of India 5.6

2 Capital Group Cos Inc/The 4.0

3 Power Corp of Canada 2.8

4 FMR LLC 2.6

5 Europacific Growth Fund 2.4

6 Vanguard Group Inc/The 1.7

7 BlackRock Inc 1.5

8 SBI Funds Management Pvt Ltd 1.4

9 Republic of Singapore 1.1

10 Government Penion Fund Global 0.7

Source: Bloomberg

Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article.

September 20, 2021 7

Understanding the Sharekhan 3R Matrix

Right Sector

Positive Strong industry fundamentals (favorable demand-supply scenario, consistent

industry growth), increasing investments, higher entry barrier, and favorable

government policies

Neutral Stagnancy in the industry growth due to macro factors and lower incremental

investments by Government/private companies

Negative Unable to recover from low in the stable economic environment, adverse

government policies affecting the business fundamentals and global challenges

(currency headwinds and unfavorable policies implemented by global industrial

institutions) and any significant increase in commodity prices affecting profitability.

Right Quality

Positive Sector leader, Strong management bandwidth, Strong financial track-record,

Healthy Balance sheet/cash flows, differentiated product/service portfolio and

Good corporate governance.

Neutral Macro slowdown affecting near term growth profile, Untoward events such as

natural calamities resulting in near term uncertainty, Company specific events

such as factory shutdown, lack of positive triggers/events in near term, raw

material price movement turning unfavourable

Negative Weakening growth trend led by led by external/internal factors, reshuffling of

key management personal, questionable corporate governance, high commodity

prices/weak realisation environment resulting in margin pressure and detoriating

balance sheet

Right Valuation

Positive Strong earnings growth expectation and improving return ratios but valuations

are trading at discount to industry leaders/historical average multiples, Expansion

in valuation multiple due to expected outperformance amongst its peers and

Industry up-cycle with conducive business environment.

Neutral Trading at par to historical valuations and having limited scope of expansion in

valuation multiples.

Negative Trading at premium valuations but earnings outlook are weak; Emergence of

roadblocks such as corporate governance issue, adverse government policies

and bleak global macro environment etc warranting for lower than historical

valuation multiple.

Source: Sharekhan Research

Know more about our products and services

For Private Circulation only

Disclaimer: This document has been prepared by Sharekhan Ltd. (SHAREKHAN) and is intended for use only by the person or entity

to which it is addressed to. This Document may contain confidential and/or privileged material and is not for any type of circulation

and any review, retransmission, or any other use is strictly prohibited. This Document is subject to changes without prior notice.

This document does not constitute an offer to sell or solicitation for the purchase or sale of any financial instrument or as an official

confirmation of any transaction. Though disseminated to all customers who are due to receive the same, not all customers may

receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is obtained from publicly available data or other sources believed to be reliable and SHAREKHAN

has not independently verified the accuracy and completeness of the said data and hence it should not be relied upon as such. While

we would endeavour to update the information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated companies,

their directors and employees (“SHAREKHAN and affiliates”) are under no obligation to update or keep the information current. Also,

there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and affiliates from doing so. This document is

prepared for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Recipients

of this report should also be aware that past performance is not necessarily a guide to future performance and value of investments

can go down as well. The user assumes the entire risk of any use made of this information. Each recipient of this document should

make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies

referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and

risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to

advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach

different conclusions from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any

locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation

or which would subject SHAREKHAN and affiliates to any registration or licensing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession

this document may come are required to inform themselves of and to observe such restriction.

The analyst certifies that the analyst has not dealt or traded directly or indirectly in securities of the company and that all of the

views expressed in this document accurately reflect his or her personal views about the subject company or companies and its or

their securities and do not necessarily reflect those of SHAREKHAN. The analyst and SHAREKHAN further certifies that neither he

or his relatives or Sharekhan associates has any direct or indirect financial interest nor have actual or beneficial ownership of 1% or

more in the securities of the company at the end of the month immediately preceding the date of publication of the research report

nor have any material conflict of interest nor has served as officer, director or employee or engaged in market making activity of the

company. Further, the analyst has also not been a part of the team which has managed or co-managed the public offerings of the

company and no part of the analyst’s compensation was, is or will be, directly or indirectly related to specific recommendations or

views expressed in this document. Sharekhan Limited or its associates or analysts have not received any compensation for investment

banking, merchant banking, brokerage services or any compensation or other benefits from the subject company or from third party

in the past twelve months in connection with the research report.

Either, SHAREKHAN or its affiliates or its directors or employees / representatives / clients or their relatives may have position(s), make

market, act as principal or engage in transactions of purchase or sell of securities, from time to time or may be materially interested

in any of the securities or related securities referred to in this report and they may have used the information set forth herein before

publication. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company

mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved

in, or related to, computing or compiling the information have any liability for any damages of any kind.

Compliance Officer: Mr. Joby John Meledan; Tel: 022-61150000; email id: compliance@sharekhan.com;

For any queries or grievances kindly email igc@sharekhan.com or contact: myaccount@sharekhan.com

Registered Office: Sharekhan Limited, 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg

Railway Station, Kanjurmarg (East), Mumbai – 400042, Maharashtra. Tel: 022 - 61150000. Sharekhan Ltd.: SEBI Regn. Nos.: BSE

/ NSE / MSEI (CASH / F&O / CD) / MCX - Commodity: INZ000171337; DP: NSDL/CDSL-IN-DP-365-2018; PMS: INP000005786;

Mutual Fund: ARN 20669; Research Analyst: INH000006183;

Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and the T&C on www.sharekhan.com;

Investment in securities market are subject to market risks, read all the related documents carefully before investing.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5835)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chopra Scm5 Tif Ch13Document23 pagesChopra Scm5 Tif Ch13Madyoka RaimbekNo ratings yet

- Marketing Functions and Roles and Responsibilities of Marketing ManagerDocument19 pagesMarketing Functions and Roles and Responsibilities of Marketing ManagerFayez ShriedehNo ratings yet

- Lone Pine CaféDocument3 pagesLone Pine Caféchan_han123No ratings yet

- GSL Goldman 130921 EBRDocument27 pagesGSL Goldman 130921 EBRnitinmuthaNo ratings yet

- PVR Kotak 200921 EBRDocument7 pagesPVR Kotak 200921 EBRnitinmuthaNo ratings yet

- Dalmia Bharat 3R Sept20 2021Document8 pagesDalmia Bharat 3R Sept20 2021nitinmuthaNo ratings yet

- 321 - AUM - Gravita IndiaDocument7 pages321 - AUM - Gravita IndianitinmuthaNo ratings yet

- Stalwart of Bio-Economy Revolution!Document22 pagesStalwart of Bio-Economy Revolution!nitinmuthaNo ratings yet

- Film Review Maximum Tolerated Dose PDFDocument183 pagesFilm Review Maximum Tolerated Dose PDFnitinmuthaNo ratings yet

- Blown Film Presentation PDFDocument14 pagesBlown Film Presentation PDFnitinmuthaNo ratings yet

- Magna T Injection Moulding MachineDocument7 pagesMagna T Injection Moulding MachinenitinmuthaNo ratings yet

- Indian Plastics IndustryDocument10 pagesIndian Plastics IndustrynitinmuthaNo ratings yet

- SBI HSG Loan Application FormDocument5 pagesSBI HSG Loan Application Formrajesh.bhagiratiNo ratings yet

- Part and Mold Design Guide (2005)Document174 pagesPart and Mold Design Guide (2005)naitikpanchal100% (4)

- Case StudiesDocument114 pagesCase Studiesnitinmutha0% (1)

- Best Practices For Work-At-Home (WAH) Operations: Webinar SeriesDocument24 pagesBest Practices For Work-At-Home (WAH) Operations: Webinar SeriesHsekum AtpakNo ratings yet

- English Learning Guide Competency 1 Unit 5: Accounting Workshop 1 Centro de Servicios Financieros-CSFDocument10 pagesEnglish Learning Guide Competency 1 Unit 5: Accounting Workshop 1 Centro de Servicios Financieros-CSFalejandra machadoNo ratings yet

- HRM Assignment - InfosysDocument4 pagesHRM Assignment - Infosyssumit SinghNo ratings yet

- CertificateDocument1 pageCertificateganesh gaddeNo ratings yet

- AKT-SIP-SOP-004 SIP Management PlantDocument39 pagesAKT-SIP-SOP-004 SIP Management PlantSHES BBPNo ratings yet

- Fitness CenterDocument3 pagesFitness CenterKea Espere Sumile100% (2)

- Final Project InfosysDocument74 pagesFinal Project InfosysAmardeep SinghNo ratings yet

- Competing With It: Fundamentals of Strategic AdvantageDocument16 pagesCompeting With It: Fundamentals of Strategic Advantagejin_adrianNo ratings yet

- Comms: E3Comms Business English Course SyllabusDocument1 pageComms: E3Comms Business English Course SyllabusKinga NemethNo ratings yet

- The Strategic Role of HRDocument7 pagesThe Strategic Role of HRArchana PandaNo ratings yet

- List of CompaniesDocument10 pagesList of CompaniesAlian RamosNo ratings yet

- 2012 MBA/IMBA Salary Survey: Career Development CentreDocument9 pages2012 MBA/IMBA Salary Survey: Career Development CentreLaura MontgomeryNo ratings yet

- Multiple Choice: - ComputationalDocument4 pagesMultiple Choice: - ComputationalCarlo ParasNo ratings yet

- EY The New Case For Shared ServicesDocument12 pagesEY The New Case For Shared ServicesRahul MandalNo ratings yet

- Compare The Merits of The Entry Strategies Discussed in This ChapterDocument3 pagesCompare The Merits of The Entry Strategies Discussed in This ChapterVikram KumarNo ratings yet

- Odoo OpenERP Implementation MethodologyDocument6 pagesOdoo OpenERP Implementation MethodologyyourreddyNo ratings yet

- Brief Note On HRIS - Downsizing - VRS - RetrenchmentDocument2 pagesBrief Note On HRIS - Downsizing - VRS - RetrenchmentDanìél Koùichi HajongNo ratings yet

- Sap S4hana Technical Lead. C201904-498-Saptl-SapDocument2 pagesSap S4hana Technical Lead. C201904-498-Saptl-SapRam PNo ratings yet

- CHAPTER 9 Written ReportDocument17 pagesCHAPTER 9 Written ReportSharina Mhyca SamonteNo ratings yet

- Bus Trans Taxes Key Solution PTVAT 2013 2014Document17 pagesBus Trans Taxes Key Solution PTVAT 2013 2014Jandave ApinoNo ratings yet

- Block22 AnswersDocument5 pagesBlock22 AnswersSophia GarnerNo ratings yet

- Surveillance 02 Audit Report (Remote) - BRSU TABANAN BALI PDFDocument20 pagesSurveillance 02 Audit Report (Remote) - BRSU TABANAN BALI PDFTantie WidyaNo ratings yet

- Hul Vs P&GDocument6 pagesHul Vs P&GManvi GoyalNo ratings yet

- Project Engineering Manager Energy in Houston TX Resume Chris MellinDocument2 pagesProject Engineering Manager Energy in Houston TX Resume Chris MellinChrisMellinNo ratings yet

- Commercial Banking System and Role of RBIDocument9 pagesCommercial Banking System and Role of RBIRishi exportsNo ratings yet

- Idea Bridge - 100 Success Plan For Crisis Recovery & New CeoDocument6 pagesIdea Bridge - 100 Success Plan For Crisis Recovery & New CeoJairo H Pinzón CastroNo ratings yet