Professional Documents

Culture Documents

Final Exam Answer

Final Exam Answer

Uploaded by

Pham Ngoc AnhOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final Exam Answer

Final Exam Answer

Uploaded by

Pham Ngoc AnhCopyright:

Available Formats

Question 1

Solution

(a) FIFO

Beginning inventory (250 X $7)......................................................... $1,750

Purchases

June 12 (325 X $8).................................................................. $2,600

June 23 (475 X $9).................................................................. 4,275 6,875

Cost of goods available for sale........................................................ 8,625

Less: Ending inventory (110 X $9).................................................... 990

Cost of goods sold............................................................................. $7,635

LIFO

Cost of goods available for sale........................................................ $8,625

Less: Ending inventory (110 X $7).................................................... 770

Cost of goods sold............................................................................. $7,855

(b) The FIFO method will produce the higher ending inventory because costs have been rising. Under this

method, the earliest costs are assigned to cost of goods sold and the latest costs remain in ending

inventory. For Tevis Company, the ending inventory under FIFO is $990 or (110 X $9) compared to

$770 or (110 X $7) under LIFO.

(c) The LIFO method will produce the higher cost of goods sold for Tevis Company. Under LIFO the most

recent costs are charged to cost of goods sold and the earliest costs are included in the ending

inventory. The cost of goods sold is $7,855 or [$8,625 – (110 X $7)] compared to $7,635 or ($8,625 –

$990) under FIFO.

Question 2

Solution

(a) VOX CORPORATION

Statement of Cash Flows

For the Year Ended December 31, 2017

Cash flows from operating activities

Net income................................................................................. $ 27,630)

Adjustments to reconcile net income

to net cash provided by operating activities

Depreciation expense........................................................ $ 5,000 )

Loss on disposal of land*.................................................. 2,100

Decrease in accounts receivable....................................... 1,800

Decrease in accounts payable.......................................... (12,630 ) (3,730)

Net cash provided by operating activities.................................... 23,900

Cash flows from investing activities

Sale of land................................................................................ 3,900

Cash flows from financing activities

Issuance of common stock......................................................... $ 6,000

Payment of dividends................................................................. (24,500 )

Net cash used by financing activities.......................................... (18,500)

Net increase in cash........................................................................... 9,300 )

Cash at beginning of period................................................................ 10,000 )

Cash at end of period......................................................................... $ 19,300

* $26,000 – 20,000 = $6,000; $6,000 - $3,900 = $ 2,100

(b) $23,900 – $0 – $24,500 = ($600)

Question 3

Solution

(a) (1) 2017: ($50,000 – $4,000)/8 = $5,750

2018: ($50,000 – $4,000)/8 = $5,750

(2) ($50,000 – $4,000)/100,000 = $0.46 per mile

2017: 15,000 X $0.46 = $6,900

2018: 12,000 X $0.46 = $5,520

(3) 2017: $50,000 X 25% = $12,500

2018: ($50,000 – $12,500) X 25% = $9,375

(b) (1) Depreciation Expense................................................................... 5,750

Accumulated Depreciation—Equipment...................................... 5,750

(2) Equipment.................................................................................... $50,000

Less: Accumulated Depreciation—

Equipment....................................................................... 5,750

$44,250

Question 4

Solution

A.

(a) Accounts Receivable Amount % Estimated Uncollectible

1–30 days $62,000 2.0 $ 1,240

31–60 days 18,000 5.0 900

61–90 days 17,000 30.0 5,100

Over 90 days 13,000 50.0 6,500

$13,740

(b) Mar. 31 Bad Debt Expense.............................................................. 11,640

Allowance for Doubtful Accounts

($13,740 – $2,100)................................................. 11,640

B.

May 10 Cash ($2,700 – $108)................................................... 2,592

Service Charge Expense

(4% X $2,700)........................................................... 108

Sales Revenue.................................................... 2,700

Question 5

Solution

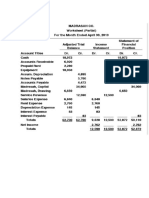

(a) GREENWOOD COMPANY

Partial Worksheet

For the Year Ended December 31, 2017

Adjusted Income Balance

Account Trial Balance Statement Sheet

No. Titles Dr. Cr. Dr. Cr. Dr. Cr.

101 Cash 18,800 18,800

112 Accounts Receivable 16,200 16,200

126 Supplies 2,300 2,300

130 Prepaid Insurance 4,400 4,400

157 Equipment 46,000 46,000

158 Acc. Depr.—Equip. 20,000 20,000

200 Notes Payable 20,000 20,000

201 Accounts Payable 8,000 8,000

212 Salaries and Wages Payable

2,600 2,600

230 Interest Payable 1,000 1,000

301 Owner’s Capital 26,000 26,000

306 Owner’s Drawings 12,000 12,000

400 Service Revenue 87,800 87,800

610 Advertising Expense 10,000 10,000

631 Supplies Expense 3,700 3,700

711 Depreciation Expense 8,000 8,000

722 Insurance Expense 4,000 4,000

726 Salaries and Wages

Expense 39,000 39,000

905 Interest Expense 1,000 1,000

Totals 165,400 165,400 65,700 87,800 99,700 77,600

Net Income 22,100 22,100

Totals 87,800 87,800 99,700 99,700

(b) GREENWOOD COMPANY

Income Statement

For the Year Ended December 31, 2017

Revenues

Service revenue................................................................... $87,800

Expenses

Salaries and wages expense............................................... $39,000

Advertising expense............................................................ 10,000

Depreciation expense.......................................................... 8,000

Insurance expense.............................................................. 4,000

Supplies expense................................................................ 3,700

Interest expense.................................................................. 1,000

Total expenses........................................................... 65,700

Net income ................................................................................... $22,100

GREENWOOD COMPANY

Owner’s Equity Statement

For the Year Ended December 31, 2017

Owner’s Capital, January 1................................................................................... $26,000

Add: Net income............................................................................................. 22,100

48,100

Less: Drawings.................................................................................................... 12,000

Owner’s Capital, December 31............................................................................. $36,100

GREENWOOD COMPANY

Balance Sheet

December 31, 2017

Assets

Current assets

Cash ................................................................................... $18,800

Accounts receivable............................................................. 16,200

Supplies............................................................................... 2,300

Prepaid insurance................................................................ 4,400

Total current assets.................................................... $41,700

Property, plant, and equipment

Equipment........................................................................... 46,000

Less: Accumulated depreciation—

equipment.............................................................. 20,000 26,000

Total assets................................................................ $67,700

Liabilities and Owner’s Equity

Current liabilities

Notes payable...................................................................... $5,000

Accounts payable................................................................ 8,000

Salaries and wages payable................................................ 2,600

Interest payable................................................................... 1,000

Total current liabilities................................................ $16,600

Long-term liabilities

Notes payable...................................................................... 15,000

Total liabilities............................................................ 31,600

Owner’s equity

Owner’s capital.................................................................... 36,100

Total liabilities and owner’s

equity...................................................................... $67,700

You might also like

- SOP LaboratoryDocument78 pagesSOP LaboratoryMykey Moran94% (16)

- CH 9 Part 1 RevisionDocument5 pagesCH 9 Part 1 Revisiondima sinnoNo ratings yet

- Merchandising Exercises Answers PDFDocument4 pagesMerchandising Exercises Answers PDFHamzaFathi100% (3)

- Jawaban Chapter 16 KeisoDocument9 pagesJawaban Chapter 16 Keisovica100% (1)

- Problems: Final Review Intermediate 1Document33 pagesProblems: Final Review Intermediate 1Nguyên NguyễnNo ratings yet

- 10 Principles of Concentration of Wealth and PowerDocument3 pages10 Principles of Concentration of Wealth and PowerAnita Lukanovic100% (3)

- Answer Key For EmpleoDocument17 pagesAnswer Key For EmpleoAdrian Montemayor100% (2)

- This Study Resource Was: SolutionDocument5 pagesThis Study Resource Was: SolutionTien NguyenNo ratings yet

- Final Exam AnsDocument8 pagesFinal Exam AnsTien NguyenNo ratings yet

- More Cash Flow ExercisesDocument4 pagesMore Cash Flow ExercisesLorenzodeLunaNo ratings yet

- ITFA Solution June 2018 ExamDocument7 pagesITFA Solution June 2018 ExamF A Saffat RahmanNo ratings yet

- DocxDocument17 pagesDocxVy Pham Nguyen KhanhNo ratings yet

- Balance Sheet and Statement of Cash FlowsDocument8 pagesBalance Sheet and Statement of Cash FlowsAntonios FahedNo ratings yet

- Ch10 ExercisesDocument15 pagesCh10 Exercisesjamiahamdard001No ratings yet

- Cash FlowsDocument6 pagesCash FlowsZaheer AhmadNo ratings yet

- Test # 1 Review Material - BACC 152 16th EditionDocument14 pagesTest # 1 Review Material - BACC 152 16th EditionskswNo ratings yet

- ACCT336 Chapter23 SolutionsDocument7 pagesACCT336 Chapter23 SolutionskareemrawwadNo ratings yet

- Chapter 5 Assigned Question SOLUTIONS PDFDocument28 pagesChapter 5 Assigned Question SOLUTIONS PDFKeyur PatelNo ratings yet

- Solutions WK 6Document8 pagesSolutions WK 6simamo4203No ratings yet

- Chapter 18Document21 pagesChapter 18Sunny SunnyNo ratings yet

- Solutions To Exercises Exercise 18-1-15Document50 pagesSolutions To Exercises Exercise 18-1-15Aiziel OrenseNo ratings yet

- Test # 3 Review Material - BACC 152 16th EditionDocument17 pagesTest # 3 Review Material - BACC 152 16th EditionskswNo ratings yet

- 2010 06 24 - 172141 - P3 3aDocument4 pages2010 06 24 - 172141 - P3 3aVivian0% (1)

- P 13-9A - SolutionDocument1 pageP 13-9A - SolutionMichelle GraciaNo ratings yet

- 03 Course Notes On Statement of Cash Flows-2 PDFDocument4 pages03 Course Notes On Statement of Cash Flows-2 PDFMaxin TanNo ratings yet

- CW 2 SolutionDocument4 pagesCW 2 SolutionMtl AndyNo ratings yet

- Bryant Ritchie Trisnodjojo - 041911333021 - AKM 3 Week 10Document4 pagesBryant Ritchie Trisnodjojo - 041911333021 - AKM 3 Week 10Goji iiiNo ratings yet

- Extra Applications - Lecture Week 2Document5 pagesExtra Applications - Lecture Week 2Muhammad HusseinNo ratings yet

- 2010-09-10 013205 WinterschidDocument6 pages2010-09-10 013205 WinterschidJa Mi LahNo ratings yet

- CH 3 Solutions ENDocument17 pagesCH 3 Solutions ENHayat AliNo ratings yet

- The Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineAmit PandeyNo ratings yet

- 111Document7 pages111haerudinsaniNo ratings yet

- Akm3 Week-10Document5 pagesAkm3 Week-10pizzaanutriaNo ratings yet

- Acct 3101 Chapter 05Document13 pagesAcct 3101 Chapter 05Arief RachmanNo ratings yet

- Chapter 7 Solutions: Exercise 7-2 Requirement 1 ExercisesDocument22 pagesChapter 7 Solutions: Exercise 7-2 Requirement 1 ExercisesMuhamad BayuNo ratings yet

- gr12 Chapter 5 SolutionsDocument14 pagesgr12 Chapter 5 SolutionsMrinmoy SahaNo ratings yet

- Financial Management, MBA511, Section: 01 Chapter 3: ProblemsDocument2 pagesFinancial Management, MBA511, Section: 01 Chapter 3: ProblemsShakilNo ratings yet

- CH 10 - End of Chapter Exercises SolutionsDocument57 pagesCH 10 - End of Chapter Exercises SolutionssaraNo ratings yet

- 06 Fischer10e SM Ch06 Final PDFDocument50 pages06 Fischer10e SM Ch06 Final PDFvivi anggiNo ratings yet

- Sources of CapitalDocument17 pagesSources of Capitaliniwan.sa.ere0No ratings yet

- Solutions - CH 5Document4 pagesSolutions - CH 5Khánh AnNo ratings yet

- Chapter+10+ +11+Selected+SolutionsDocument2 pagesChapter+10+ +11+Selected+SolutionsDiane Askew NealNo ratings yet

- Solve 6Document2 pagesSolve 6lalalalaNo ratings yet

- Tutorial Test 4 AnswerDocument5 pagesTutorial Test 4 AnswerHoang Bich Kha NgoNo ratings yet

- Description Income Statement Adjustments Statement of Cash FlowsDocument2 pagesDescription Income Statement Adjustments Statement of Cash FlowsFhem Leighn SimetraNo ratings yet

- ch12 AssignedTextSolutionsDocument10 pagesch12 AssignedTextSolutionsMaryNo ratings yet

- Presentation of FS With AnsDocument19 pagesPresentation of FS With AnsMichael BongalontaNo ratings yet

- Module 2 Homework Answer KeyDocument5 pagesModule 2 Homework Answer KeyMrinmay kunduNo ratings yet

- 3512 Chapter 23 Cash Flows HW Exercises ProblemsDocument12 pages3512 Chapter 23 Cash Flows HW Exercises ProblemsM MustafaNo ratings yet

- AHM Chapter 3 Exercises CKvxWXG1tmDocument2 pagesAHM Chapter 3 Exercises CKvxWXG1tmASHUTOSH BISWALNo ratings yet

- Tutorial 3 - Questions - RevisedDocument2 pagesTutorial 3 - Questions - RevisedHuang ZhanyiNo ratings yet

- TP2Document9 pagesTP2frenky bayuNo ratings yet

- Solutions To Exercises - Chapter 17Document6 pagesSolutions To Exercises - Chapter 17Ng. Minh ThảoNo ratings yet

- AKM 1 Bab 3Document5 pagesAKM 1 Bab 3alesha nindyaNo ratings yet

- Chapetr 5 - RevisionDocument16 pagesChapetr 5 - Revisionhw17488No ratings yet

- Solutions To Problems: 13/e, Solutions Manual (For Instructor Use Only)Document5 pagesSolutions To Problems: 13/e, Solutions Manual (For Instructor Use Only)Adam IngberNo ratings yet

- Jawaban S 3-2Document4 pagesJawaban S 3-2Lamtiur LidiaqNo ratings yet

- Weygandt Accounting Principles, 12e Chapter Five Solutions To Challenge ExercisesDocument2 pagesWeygandt Accounting Principles, 12e Chapter Five Solutions To Challenge ExercisesHương ThưNo ratings yet

- Solutions Manual Advanced Accounting 12th Edition by Hoyle Schaefer DoupnikDocument30 pagesSolutions Manual Advanced Accounting 12th Edition by Hoyle Schaefer DoupnikThu NguyenNo ratings yet

- Debt Investments TutorialDocument4 pagesDebt Investments TutorialRawan YasserNo ratings yet

- The Boston Institute of Finance Mutual Fund Advisor Course: Series 6 and Series 63 Test PrepFrom EverandThe Boston Institute of Finance Mutual Fund Advisor Course: Series 6 and Series 63 Test PrepNo ratings yet

- Some Small Countries Do It Better: Rapid Growth and Its Causes in Singapore, Finland, and IrelandFrom EverandSome Small Countries Do It Better: Rapid Growth and Its Causes in Singapore, Finland, and IrelandNo ratings yet

- HPG 2020Document34 pagesHPG 2020Pham Ngoc AnhNo ratings yet

- Braun6ceMod09 Persuasive MessagesDocument21 pagesBraun6ceMod09 Persuasive MessagesPham Ngoc AnhNo ratings yet

- Braun6ceMod08 Negative MessagesDocument28 pagesBraun6ceMod08 Negative MessagesPham Ngoc AnhNo ratings yet

- Braun6ceMod05 Docs Slides ScreensDocument32 pagesBraun6ceMod05 Docs Slides ScreensPham Ngoc AnhNo ratings yet

- Braun6ceMod07 Informative Positive MessagesDocument25 pagesBraun6ceMod07 Informative Positive MessagesPham Ngoc AnhNo ratings yet

- Braun6ceMod06 Communicating ElectronicallyDocument25 pagesBraun6ceMod06 Communicating ElectronicallyPham Ngoc AnhNo ratings yet

- True-False QuestionsDocument11 pagesTrue-False QuestionsPham Ngoc AnhNo ratings yet

- Specific Heat Relations of Ideal GasesDocument8 pagesSpecific Heat Relations of Ideal GasesNicole Anne BorromeoNo ratings yet

- Spherical Roller Thrust Bearing With Stamped Steel Cage: DimensionsDocument4 pagesSpherical Roller Thrust Bearing With Stamped Steel Cage: DimensionsLuis DanielNo ratings yet

- Complete Guide For Ultrasonic Sensor HC-SR04 With Arduino: DescriptionDocument10 pagesComplete Guide For Ultrasonic Sensor HC-SR04 With Arduino: DescriptionfloodfreakNo ratings yet

- Resolution For Improving Sip1Document2 pagesResolution For Improving Sip1ARGIE DEJECASION100% (2)

- 2023 International Comet Race Day One ResultsDocument2 pages2023 International Comet Race Day One ResultsBernewsAdminNo ratings yet

- Unit 4Document8 pagesUnit 4lomash2018No ratings yet

- Last Call For Love Montana Dreams Book 3 Ember Kelly Full ChapterDocument67 pagesLast Call For Love Montana Dreams Book 3 Ember Kelly Full Chaptermary.brinks380100% (9)

- Modul 4 - Topologi: Praktikum Basis Data SpasialDocument18 pagesModul 4 - Topologi: Praktikum Basis Data SpasialgiokruthNo ratings yet

- Phy Lab PDFDocument4 pagesPhy Lab PDFAlisha AgarwalNo ratings yet

- Normal To Real Flow Rate and FAD Flow RateDocument25 pagesNormal To Real Flow Rate and FAD Flow RateChristopher LloydNo ratings yet

- Hi-Fi+ - Issue 210 - August 2022Document126 pagesHi-Fi+ - Issue 210 - August 2022HTET AUNGNo ratings yet

- Getachew AlemuDocument4 pagesGetachew AlemuGetachew AlemuNo ratings yet

- Certification of Fda RegistrationDocument1 pageCertification of Fda RegistrationJozsi NagyNo ratings yet

- Chapter 9 CapacitorsDocument11 pagesChapter 9 CapacitorsnNo ratings yet

- Explicit Grammar and Implicit Grammar TeachingDocument5 pagesExplicit Grammar and Implicit Grammar TeachingSigit Aprisama100% (1)

- Republic of The Philippines Polytechnic University of The Philippines College of Education - Graduate StudiesDocument4 pagesRepublic of The Philippines Polytechnic University of The Philippines College of Education - Graduate StudiesJessa MolinaNo ratings yet

- 43Lj5000 Webos Led TV Main Board Layout: 2017 Direct View TV TrainingDocument4 pages43Lj5000 Webos Led TV Main Board Layout: 2017 Direct View TV TrainingIglesia en Casa ComunidadNo ratings yet

- Fourier Series LessonDocument41 pagesFourier Series Lessonjackson246No ratings yet

- Cheney's Patterns of Industrial GrowthDocument14 pagesCheney's Patterns of Industrial GrowthProf B Sudhakar Reddy100% (1)

- Guide For Responsible Person IPADocument3 pagesGuide For Responsible Person IPAGerard GovinNo ratings yet

- Lathe Machine Lab ReportDocument8 pagesLathe Machine Lab ReportJasmine_lai00No ratings yet

- 06 Andrews 1981Document19 pages06 Andrews 1981angelpoolafpc16No ratings yet

- GTAG3 Audit KontinyuDocument37 pagesGTAG3 Audit KontinyujonisupriadiNo ratings yet

- Tractor/Trailer Inspection Form: (If Applicable)Document3 pagesTractor/Trailer Inspection Form: (If Applicable)Nicko CaesarNo ratings yet

- 4 Bedroomed House For Sale With 2 Bedroomed Self-Contained, Tiled, in A Wall Fence, Well Designed, Location: Hills View, Price: K 1.2mDocument18 pages4 Bedroomed House For Sale With 2 Bedroomed Self-Contained, Tiled, in A Wall Fence, Well Designed, Location: Hills View, Price: K 1.2mJosephine ChirwaNo ratings yet

- Faa Form 8070-1Document2 pagesFaa Form 8070-1api-520948779No ratings yet

- CB Insights - Most Promising StartupsDocument122 pagesCB Insights - Most Promising StartupsRazvan CosmaNo ratings yet