Professional Documents

Culture Documents

Chapter 5 Accounting For Business Combinations Solman

Chapter 5 Accounting For Business Combinations Solman

Uploaded by

Kissi Lynn MartinCopyright:

Available Formats

You might also like

- Answers - Activity 2.4 2.5 and 3.1Document38 pagesAnswers - Activity 2.4 2.5 and 3.1Tine Vasiana Duerme83% (6)

- Sol. Man. Chapter 4 Consol. Fs Part 1Document37 pagesSol. Man. Chapter 4 Consol. Fs Part 1itsmenatoy43% (7)

- Chapter 1 Accounting For Business Combinations SolmanDocument10 pagesChapter 1 Accounting For Business Combinations SolmanKhen FajardoNo ratings yet

- Advacc 2 Chapter 1 ProblemsDocument5 pagesAdvacc 2 Chapter 1 ProblemsClint-Daniel Abenoja100% (1)

- Answers and Solutions For Business Combination Chapter 3 and Chapter 4Document4 pagesAnswers and Solutions For Business Combination Chapter 3 and Chapter 4Kyree Vlade0% (1)

- Accounting For Business Combinations Final Examination: Name: Date: Professor: Section: ScoreDocument6 pagesAccounting For Business Combinations Final Examination: Name: Date: Professor: Section: ScoreCyrine Miwa Rodriguez100% (2)

- Dividend and BondsDocument3 pagesDividend and BondsJanuary Ann Bete100% (1)

- Sol. Man. Chapter 10 Installment Sales Method 2020 EditionDocument13 pagesSol. Man. Chapter 10 Installment Sales Method 2020 EditionJam Surdivilla100% (1)

- Business Combinations (Part 2) : Problem 1: True or FalseDocument12 pagesBusiness Combinations (Part 2) : Problem 1: True or FalseAlexanderJacobVielMartinez100% (3)

- Quiz Chapter 5 Consol. Fs Part 2Document14 pagesQuiz Chapter 5 Consol. Fs Part 2Maryjoy Sarzadilla JuanataNo ratings yet

- Home Office, Branch and Agency Accounting: Problem 1: True or FalseDocument23 pagesHome Office, Branch and Agency Accounting: Problem 1: True or Falsese no100% (1)

- Chapter 10 Effects of Changes in Forex RatesDocument16 pagesChapter 10 Effects of Changes in Forex RatesJeeramel TorresNo ratings yet

- Discussion Problem No. 1 - (Estimating Goodwill - Direct Valuation)Document1 pageDiscussion Problem No. 1 - (Estimating Goodwill - Direct Valuation)Jean Kathyrine Chiong100% (1)

- Assign 4 Answer Partnership Liquidation Millan 2021Document12 pagesAssign 4 Answer Partnership Liquidation Millan 2021mhikeedelantar100% (1)

- Sol. Man. Chapter 6 Consolidated Fs Part 3 Acctg For Bus. CombinationsDocument13 pagesSol. Man. Chapter 6 Consolidated Fs Part 3 Acctg For Bus. CombinationsFery Ann100% (5)

- Solution Chapter 6 Joint ArrangementsDocument15 pagesSolution Chapter 6 Joint ArrangementsVernnNo ratings yet

- Chapter 1 Business Combinations - Part 1Document24 pagesChapter 1 Business Combinations - Part 1Kathlyn Tajada0% (1)

- Use The Following Information For The Next Three Questions:: Rainy SunnyDocument14 pagesUse The Following Information For The Next Three Questions:: Rainy SunnyAndy Lalu100% (3)

- MGMT 30A: Midterm 2Document25 pagesMGMT 30A: Midterm 2FUSION AcademicsNo ratings yet

- ABC Chapter 5 Accounting For Business Combinations by Millan 2020Document25 pagesABC Chapter 5 Accounting For Business Combinations by Millan 2020Nayoung LeeNo ratings yet

- ACCBCOMB - Oct 10Document13 pagesACCBCOMB - Oct 10kimkim100% (1)

- Consolidated Financial Statements (Part 2) : Problem 1: Multiple Choice - TheoryDocument24 pagesConsolidated Financial Statements (Part 2) : Problem 1: Multiple Choice - TheoryKeith Alison ArellanoNo ratings yet

- Sol Man Chapter 8 Separate Fs Acctg For Bus CombinationsDocument2 pagesSol Man Chapter 8 Separate Fs Acctg For Bus Combinationsitsmenatoy100% (2)

- Chapter 9 Financial Reporting in Hyperinflationary EconomiesDocument10 pagesChapter 9 Financial Reporting in Hyperinflationary EconomiesKathrina RoxasNo ratings yet

- Abc Chapter 7 Accounting For Business Combinations by Millan 2020Document21 pagesAbc Chapter 7 Accounting For Business Combinations by Millan 2020Charlene Bolandres100% (2)

- Chapter 4 Accounting For Business Combinations SolmanDocument16 pagesChapter 4 Accounting For Business Combinations SolmanCharlene Bolandres100% (1)

- CHAPTER 7 - Solman CONSOLIDATED FS PART 4 - ACCTG FOR BUS. COMBINATIONSDocument20 pagesCHAPTER 7 - Solman CONSOLIDATED FS PART 4 - ACCTG FOR BUS. COMBINATIONSJeeramel TorresNo ratings yet

- Sol. Man. Chapter 10 The Effects of Changes in Foreign Exchange Rates Acctg For Bus. CombinationsDocument19 pagesSol. Man. Chapter 10 The Effects of Changes in Foreign Exchange Rates Acctg For Bus. CombinationsJulyca C. LastimosoNo ratings yet

- Chapter 4 Business Combination Solution ManualDocument19 pagesChapter 4 Business Combination Solution ManualMaxineNo ratings yet

- Consolidated Financial Statements 1 SolDocument18 pagesConsolidated Financial Statements 1 SolChristine Dela Rosa Carolino100% (1)

- Activity - Consolidated Financial Statement - Part 2 (1) (REVIEWER MIDTERM0Document6 pagesActivity - Consolidated Financial Statement - Part 2 (1) (REVIEWER MIDTERM0PaupauNo ratings yet

- Consolidated Financial Statement Classroom Discussion Part 2Document6 pagesConsolidated Financial Statement Classroom Discussion Part 2Sunshine KhuletzNo ratings yet

- Assign 5 Answer Corporate Liquidation and Reorganization Millan 2021Document18 pagesAssign 5 Answer Corporate Liquidation and Reorganization Millan 2021mhikeedelantarNo ratings yet

- Chapter 6 ADVAC (Excel +Document43 pagesChapter 6 ADVAC (Excel +Christine Jane RamosNo ratings yet

- Chapter 7 BusscomDocument65 pagesChapter 7 BusscomJM Valonda Villena, CPA, MBANo ratings yet

- Bright Co. Dull Co. AssetsDocument5 pagesBright Co. Dull Co. AssetsJJ JaumNo ratings yet

- Chapter 2 Accounting For Business Combinations SolmanDocument13 pagesChapter 2 Accounting For Business Combinations SolmanKhen FajardoNo ratings yet

- Corporate Liquidation & Reorganization: Problem 1: True or FalseDocument20 pagesCorporate Liquidation & Reorganization: Problem 1: True or FalseRicalyn Bugarin0% (2)

- Abc Chapter 6 Accounting For Business Combinations by Millan 2020Document14 pagesAbc Chapter 6 Accounting For Business Combinations by Millan 2020Nayoung LeeNo ratings yet

- Chapter 25 - Acctg For Derivatives & Hedging Transactions Part 2 - ADocument10 pagesChapter 25 - Acctg For Derivatives & Hedging Transactions Part 2 - AGlennizze Galvez100% (3)

- Illustration Financial Reptg. in HyperinflationaryDocument4 pagesIllustration Financial Reptg. in HyperinflationaryKian GaboroNo ratings yet

- Business Combi Quiz (Part1)Document9 pagesBusiness Combi Quiz (Part1)Rica Joy RuzgalNo ratings yet

- ACC 113 Module 7 AnswerDocument4 pagesACC 113 Module 7 AnswerYahlianah Lee100% (2)

- Accounting For Business CombinationsDocument29 pagesAccounting For Business CombinationsAmie Jane Miranda100% (1)

- Accounting For Business Combinations First Grading ExaminationDocument18 pagesAccounting For Business Combinations First Grading ExaminationNhel AlvaroNo ratings yet

- Pre Buscomok PDF FreeDocument9 pagesPre Buscomok PDF FreeheyNo ratings yet

- Consolidated FS - QUIZ PART 3Document4 pagesConsolidated FS - QUIZ PART 3Christine Jane Ramos100% (1)

- Business Combination Midterm ExamDocument12 pagesBusiness Combination Midterm Examcharlene lizardoNo ratings yet

- PDF Valle Quiz ABC CompressDocument6 pagesPDF Valle Quiz ABC CompressPotie RhymeszNo ratings yet

- Consolidated FS - QUIZ PART 2Document5 pagesConsolidated FS - QUIZ PART 2Christine Jane RamosNo ratings yet

- Sol. Man. Chapter 12 Acctg For Derivatives Hedging Transactions Part 2 Acctg For Bus. CombinationsDocument11 pagesSol. Man. Chapter 12 Acctg For Derivatives Hedging Transactions Part 2 Acctg For Bus. CombinationsJulyca C. LastimosoNo ratings yet

- Assign 3 Answer Partnership Dissolution Millan 2021Document6 pagesAssign 3 Answer Partnership Dissolution Millan 2021mhikeedelantarNo ratings yet

- Chapter 17 - Teacher's Manual - Aa Part 2Document24 pagesChapter 17 - Teacher's Manual - Aa Part 2Mydel AvelinoNo ratings yet

- Chapters 5-6 Classroom Discussion Answer KeyDocument12 pagesChapters 5-6 Classroom Discussion Answer KeyJeeramel TorresNo ratings yet

- Module 5Document11 pagesModule 5Jacqueline OrtegaNo ratings yet

- 2076 - Varias, Aizel Ann B - Module 3Document14 pages2076 - Varias, Aizel Ann B - Module 3Aizel Ann VariasNo ratings yet

- Answer-Key-Chapter-5-BC DeJesusDocument15 pagesAnswer-Key-Chapter-5-BC DeJesusMerel Rose FloresNo ratings yet

- 268,800 Rommel SP CorpDocument10 pages268,800 Rommel SP CorpnovyNo ratings yet

- 2076 - Varias, Aizel Ann B - Module 3Document16 pages2076 - Varias, Aizel Ann B - Module 3AIZEL ANN VARIASNo ratings yet

- Solutions:: I. In-Transit ItemDocument6 pagesSolutions:: I. In-Transit ItemMary EdsylleNo ratings yet

- BusinessCombi (Chapter 5)Document18 pagesBusinessCombi (Chapter 5)richmond naragNo ratings yet

- FINANCIAL-STATEMENT - Business FinanceDocument22 pagesFINANCIAL-STATEMENT - Business FinanceRhea Mae SumalpongNo ratings yet

- Government Audit Training Institute (GATI) Brochure (October 2011 - March 2012)Document6 pagesGovernment Audit Training Institute (GATI) Brochure (October 2011 - March 2012)Graduate School USANo ratings yet

- Limba Engleza Si Comunicare de Specialitate I Si II - Suport de Curs IDDocument120 pagesLimba Engleza Si Comunicare de Specialitate I Si II - Suport de Curs IDLuizaNo ratings yet

- Financial Statement AnalysisDocument9 pagesFinancial Statement Analysiswahab_pakistan50% (2)

- Procentriq Commerce Academy Classes For 11th 12thDocument12 pagesProcentriq Commerce Academy Classes For 11th 12thProcentrIQNo ratings yet

- Auditing Inventory, Goods and Services, and Accounts Payable - The Acquisition and Payment CycleDocument64 pagesAuditing Inventory, Goods and Services, and Accounts Payable - The Acquisition and Payment CycleAuliya HafizNo ratings yet

- Introduction To AccountingDocument12 pagesIntroduction To AccountingchristineNo ratings yet

- Admission of PartnerDocument3 pagesAdmission of PartnerLakshay SainiNo ratings yet

- 03 - TE - Applying Theory To Accounting RegulationDocument32 pages03 - TE - Applying Theory To Accounting RegulationPriska OctwentyNo ratings yet

- Acc 311 - Exam 1 SolutionsDocument6 pagesAcc 311 - Exam 1 SolutionsSteve SmithNo ratings yet

- CYBERT-AnnualReport2012 (1.6MB)Document74 pagesCYBERT-AnnualReport2012 (1.6MB)kokueiNo ratings yet

- TheurimainareportDocument22 pagesTheurimainareportVoke Magnus DigeratusNo ratings yet

- Terminal Sample 2 SolvedDocument11 pagesTerminal Sample 2 SolvedFami FamzNo ratings yet

- Suggested Structure For OBU Research Report: Using Secondary Data CollectionDocument2 pagesSuggested Structure For OBU Research Report: Using Secondary Data CollectionAaryanNo ratings yet

- WB CA-Seminar PPT Session-3.0Document40 pagesWB CA-Seminar PPT Session-3.0shane natividadNo ratings yet

- Contingencies and Subsequent EventsDocument7 pagesContingencies and Subsequent EventsArlyn Pearl PradoNo ratings yet

- ACC 557 Week 1 Chapter 1Document11 pagesACC 557 Week 1 Chapter 1acurashah100% (2)

- 0452 s11 QP 22Document20 pages0452 s11 QP 22Athul TomyNo ratings yet

- CRC Auditing Oct 2022 (1st PB)Document18 pagesCRC Auditing Oct 2022 (1st PB)Rodmae VersonNo ratings yet

- Tutor Revenue RecognitionDocument20 pagesTutor Revenue RecognitionAngel Valentine TirayoNo ratings yet

- ABFA 3114 Principle of AuditDocument151 pagesABFA 3114 Principle of AuditGary Siaw100% (2)

- 100 Business IdeasDocument20 pages100 Business IdeasFrank KeeNo ratings yet

- Fazri Ramadhan - 1118103023 - Tugas SAP FundamentalDocument3 pagesFazri Ramadhan - 1118103023 - Tugas SAP Fundamentalzal edinwswdNo ratings yet

- Ac110 24032023Document4 pagesAc110 24032023Lyana InaniNo ratings yet

- Dip FinManagement 2022Document9 pagesDip FinManagement 2022mwinnie581No ratings yet

- Accounting, Economics and Law - A ConviviumDocument10 pagesAccounting, Economics and Law - A ConviviumborremenNo ratings yet

- 2018 Top 100 FirmsDocument40 pages2018 Top 100 FirmsbhuvsnNo ratings yet

- Final Examination in Management Strategic Business Analysis Name: Date: Score: Course/Year/Section: Student #Document2 pagesFinal Examination in Management Strategic Business Analysis Name: Date: Score: Course/Year/Section: Student #Jessa Mae LavadoNo ratings yet

- Advanced Financial Reporting Module OutlineDocument4 pagesAdvanced Financial Reporting Module Outlineevans muteeraNo ratings yet

Chapter 5 Accounting For Business Combinations Solman

Chapter 5 Accounting For Business Combinations Solman

Uploaded by

Kissi Lynn MartinOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 5 Accounting For Business Combinations Solman

Chapter 5 Accounting For Business Combinations Solman

Uploaded by

Kissi Lynn MartinCopyright:

Available Formats

lOMoARcPSD|9373940

ABC Chapter 5 - Accounting for Business Combinations by

Millan 2020

Accountancy (Universal College of Parañaque)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Yellow Green (yellowgreengirl@gmail.com)

lOMoARcPSD|9373940

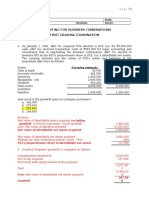

Chapter 5

Consolidated

Consolidated Financial Statements (Part 2)

PROBLEM 1: MULTIPLE CHOICE - THEORY

1. A 6. B

2. C 7. B

3. A 8. B

4. A 9. C

5. B 10. A

PROBLEM 2: FOR CLASSROOM DISCUSSION

1. Solutions:

Requirement (a):

Sales of Parent 1,000,000

Sales of Subsidiary 700,000

Less: Intercompany sales during the year (38,000 +

40,000) (78,000)

Consolidated sales 1,622,000

Requirement (b):

The unrealized profits in ending inventory are computed as follows:

Downstream Upstream Total

Sale price of intercompany sale 38,000

Cost of intercompany sale (20,000)

Prof

ofiit from inter

erc

com

omp

pany sale

ale 18

18,,000 8,000a

8,0

Multiply by: Unsold portion as of yr.-

end (9.5/38) 3/4

6,00

Unrealized gross profit 4,500 10,500

0

a

(40,000 x 20%) = 8,000

Cost of sales of Parent 400,000

Cost of sales of Subsidiary 350,000

Less: Intercompany sales

sales during the yr.

yr. (38,000 + (78,000

40,000) )

Add: Unrealized profit in ending inventory 10,500

1

Downloaded by Yellow Green (yellowgreengirl@gmail.com)

lOMoARcPSD|9373940

Less: Realized profit in beginning inventory -

Add: Depreciation of FVA on inventory -

682,50

Consolidated cost of sales 0

Requirement (c):

Ending inventory of Parent 300,000

Ending inventory of Subsidiary 80,000

Less: Unrealized profit in ending inventory (10,500)

Consolidated ending inventory 369,500

2. Solutions:

Requirement (a):

Historical cost 120,000

Accumulated dep'n. 1/1/x1

1/1/x1 (72,000)

Depreciation based on historical cost (12,000)

Carrying amount 36,000

The solution above is based on the notion that it is as if the intercompany

sale never happened .

Requirement (b):

Equipment - net (Bright Co.) 400,000

Equipment - net (Dull Co.) 190,000

Unamortized deferred gain (see Step 1 below) (9,000)

Consolidated equipment - net 581,000

OR

Equipment - net (Bright Co.) 400,000

Equipment - net (Dull Co.) 190,000

Carrying amount of equipment sold in Dull's books (45,000)

Carrying amount of equipment sold in Bright's books if the

sale never happened 36,000

Consolidated equipment - net 581,000

Requirement (c):

Depreciation expense (Bright Co.) 40,000

Depreciation expense (Dull Co.) 12,000

Amortization of the deferred gain

2

Downloaded by Yellow Green (yellowgreengirl@gmail.com)

lOMoARcPSD|9373940

(12,000 gain on sale ÷ 4 years) (3,000)

Consolidated depreciation expense 49,000

OR

Depreciation expense (Bright Co.) 40,000

Depreciation expense (Dull Co.) 12,000

Depreciation in Dull's books (60,000 ÷ 4 yrs.) (15,000)

Depreciation in Bright's books if the sale never happened

(120,000 ÷ 10 yrs.) 12,000

Consolidated depreciation expense 49,000

Step 1: Analysis of effects of intercompany transaction

The

The inte

interc

rcom

ompa

pany

ny sale

sale is do

down

wnst

strea

ream

m be

beca

caus

use

e the se

sell

lle

er is the

parent (Bright Co.).

The unamortized balance of the deferred gain is computed as follows:

Deferred gain on sale - Jan. 1, 20x1 [60K – (120K -

72K)] 12,000

Multiply by: (3 yrs. remaining as of Dec. 31, 20x1 over 4 yrs.) 3/4

Deferred gain on sale - Dec. 31, 20x1 9,000

Step 2: Analysis of net assets

Acquisition Consolidation Net

Dull Co.

date date change

Total net assets at carrying amounts 160,000 210,000

Fair value adjustments at acquisition

date - -

Subsequent depreciation of FVA NIL -

Unrealized profits (Upstream only) NIL -

Subsidiary's net assets at fair value 160,000 210,000 50,000

Step 3: Goodwill computation

Consideration transferred 180,000

Non-controlling interest in the acquiree (160K x 25%) 40,000

Previously held equity interest in the acquire -

Total 220,000

Fair value of net identifiable assets acquired (160,000)

Goodwill 60,000

Step 4: Non-controlling interest in net assets

3

Downloaded by Yellow Green (yellowgreengirl@gmail.com)

lOMoARcPSD|9373940

Dull's net assets at fair value – Dec. 31, 20x1 (Step 2) 210,000

Multiply by: NCI percentage 25%

Total 52,500

Add: Goodwill to NCI net of accumulated impairment losses - *

Non-controlling interest in net assets – Dec. 31,

20x1 52,500

*No goodwill is attributed to NCI because NCI is measured at proportionate

at proportionate share.

share.

Step 5: Consolidated retained earnings

Bright's retained earnings – Dec. 31, 20x1 110,000

Consolidation adjustments:

Bright's share in the net change in Dull's net assets

(a)

37,500

Unamortized deferred gain (Downstream only) - (Step

1) (9,000)

Gain or loss on extinguishment of bonds -

Impairment loss on goodwill attributable to

Parent -

28,50

Net consolidation adjustments 0

Consolidated retained earnings – Dec. 31,

20x1 138,500

(a)

Net change in Dull’s net assets (Step 2) of ₱50,000 x 75% = ₱37,500.

₱37,500.

Step 6: Consolidated profit or loss

Subsidiar

Parent y Consolidated

Profits before adjustments 240,000 50,000 290,000

Consolidation adjustments:

Unamortized def. gain - (Step (9,000

1)

Dividend income from ( - ) ( - ) (9,000)

subsidiary ) N/A ( - )

Gain or loss on extinguishment ( -

of bonds ) ( - ) ( - )

Net consolidation (9,000

adjustments ) ( - ) (9,000)

231,00

Profits before FVA 0 50,000 281,000

( -

Depreciation of FVA ) ( - ) ( - )

( -

Impairment loss on goodwill ) ( - ) ( - )

Consolidated profit 231,000 50,000 281,000

4

Downloaded by Yellow Green (yellowgreengirl@gmail.com)

lOMoARcPSD|9373940

Step 7: Profit or loss attributable to owners of parent

pare nt and NCI

Owners Consoli-

of parent NCI dated

Bright's profit before FVA (Step 6) 231,000 N/A 231,000

(c)

Share in Dull’s profit before FVA 37,500 12,500 50,000

Depreciation of FVA ( - ) ( - ) ( - )

Share in impairment loss on goodwill ( - ) ( - ) ( - )

Totals 268,500 12,500 281,000

(c)

Shares in Dull’s profit before FVA (Step 6 ): (50,000 x 75%); (50,000 x 25%)

Requirement (d):

Consolidated

ASSETS

Investment in subsidiary (at cost) - eliminated -

Equipment - net

net (Requirement 'b') 581,000

Otther assets (200,000 + 45,000)

O 245,000

Goodwill (Step 3) 60,000

TOTAL ASSETS 886,000

LIABILITIES AND EQUITY

Liabilities (70,000 + 25,000) 95,000

Share capital (Bright's only) 600,000

Retained earnings

earnings (Step 5) 138,500

Equity attributable to owners of the parent 738,500

Non-controlling interest (Step 4) 52,500

Total equity 791,000

TOTAL LIABILITIES AND EQUITY 886,000

Consolidated

Revenues (300,000 + 80,000) 380,000

Depreciation expense (Requirement 'c') (49,000)

Other expenses (32,000 + 18,000) (50,000)

Gain on sale of equipment (eliminated) -

Profit for the year 281,000

Profit attributable to owners of the parent (Step 7) 268,50

5

Downloaded by Yellow Green (yellowgreengirl@gmail.com)

lOMoARcPSD|9373940

0

12,50

Profit attributable to NCI (Step 7)

0

281,00

Profit for the year

0

3. Solutions:

Step 1: Analysis

The dividends of effects

declared by theofsubsidiary

intercompany transaction

are allocated as follows:

Total dividends declared ₱100,000

Allocation:

Owners of the parent (100,000 x 75%) 75,000

Non-controlling interest (100,000 x 25%) 25,000

As allocated

₱100,000

Step 2: Analysis of net assets

Acquisition Consolidation Net

Subsidiary

date date change

Net assets at carrying amts. 240,000 320,000

Fair value adjustments at acquisition

date - -

Subsequent depreciation of FVA NIL -

Unrealized profits (Upstream only) NIL -

80,00

Subsidiary's net assets at fair value 240,000 320,000 0

Step 3: Goodwill computation

We can leave out this step because the information is insufficient.

Step 4: Non-controlling interest in net assets

Sub.'s net assets at fair value – Dec. 31, 20x1 (Step 2) 320,000

Multiply by: NCI percentage 25%

Total 80,000

Add: Goodwill to NCI net of accumulated impairment losses -

Non-controlling interest in net assets – Dec. 31,

20x1 80,000

Downloaded by Yellow Green (yellowgreengirl@gmail.com)

lOMoARcPSD|9373940

Step 5: Consolidated retained earnings

Parent's retained earnings – Dec. 31, 20x1 280,000

Consolidation adjustments:

Parent's sh. in the net change in Sub.'s net assets

(a)

60,000

Unrealized profits (Downstream only) -

Gain or loss on extinguishment of bonds -

Impairment loss on goodwill attributable to

Parent -

60,00

Net consolidation adjustments 0

Consolidated retained earnings – Dec. 31,

20x1 340,000

(a)

₱80,000

₱80,000 Net change in subsidiary’s assets (Step 2) x 75%

The divi

divide

dend

ndss rece

receiv

ive

ed fr

from

om the subs

subsid

idia

iarry ar

are

e not separately

adjusted in the formula above because their effect is automatically

eliminated by including only the parent’s share in the net change in

the subsidiary’s net assets.

Step 6: Consolidated profit or loss

Subsidiar

Parent y Consolidated

Profits before adjustments 475,000 132,000 607,000

Consolidation adjustments:

Unrealized profits - - -

Dividend income from (75,000

subsidiary ) N/A (75,000)

Gain or loss on extinguishment

of bonds - - -

Net consolidation (75,000

adjustments ) - (75,000)

400,00

Profits before FVA 0 132,000 532,000

( -

Depreciation of FVA ) ( - ) ( - )

7

Downloaded by Yellow Green (yellowgreengirl@gmail.com)

lOMoARcPSD|9373940

( -

Impairment loss on goodwill ) ( - ) ( - )

Consolidated profit 400,000 132,000 532,000

Step 7: Profit or loss attributable to owners of parent

pare nt and NCI

Owners Consoli-

of parent NCI dated

Parent's profit before FVA (Step 6) 400,000 N/A 400,000

Share in Sub.’s profit before FVA (c) 99,000 33,000 132,000

Depreciation of FVA (Step 6) ( - ) ( - ) ( - )

Share in impairment loss on goodwill ( - ) ( - ) ( - )

Totals 499,000 33,000 532,000

(c)

Shares in Sub.’s profit before FVA (Step 6 ) – (132,000 x 75%);

(132,000 x 25%)

SUMMARY OF ANSWERS TO REQUIREMENTS:

a. NCI in the net assets = 80,000 (Step 4)

b. Consolidated retained earnings = 340,000 (Step 5)

c. Consolidated profit = 532,000 (Step 6)

Attributable

Attributable to

to owners of parent

NCI = 33,000

NCI = 499,000

(Step 7) (Step 7)

4. Solutions:

Step 1: Analysis of effects of intercompany transaction

Requirement (a): Gain (loss) on extinguishment of bonds

The gain or loss on the extinguishment of bonds is computed as:

Acquisition cost of bonds (assumed retirement price) 250,000

Carrying amount of bonds payable (300,000)

Gain on extinguishment of bonds 50,000

Requirement (b): Consolidated total bonds payable

Bonds payable (at face amount) - issued by Parent 300,000

Portion acquired by Subsidiary

(300,000)

Consolidated total bonds payable -

Step 2: Analysis of net assets

Acquisition Consolidation Net

Subsidiary

date date change

8

Downloaded by Yellow Green (yellowgreengirl@gmail.com)

lOMoARcPSD|9373940

Net assets at carrying amounts 200,000 270,000

Fair value adjustments at acquisition

date - -

Subsequent depreciation of FVA NIL -

Unrealized profits (Upstream only) NIL -

70,00

Subsidiary's net assets at fair value 200,000 270,000 0

Step 3: Goodwill computation

Consideration transferred (cost of investment in sub.) 180,000

Non-controlling interest in the acquiree (200K x 25%) 50,000

Previously held equity interest in the acquire -

Total 230,000

Fair value of net identifiable assets acquired (200,000)

Goodwill 30,000

Step 4: Non-controlling interest in net assets

Sub.'s net assets at fair value – Dec. 31, 20x1 (Step 2) 270,000

Multiply by: NCI percentage 25%

Total 67,500

Add: Goodwill to NCI net of accumulated impairment losses -

Non-controlling interest in net assets – Dec. 31,

20x1 67,500

Step 5: Consolidated retained earnings

Parent's retained earnings – Dec. 31, 20x1 140,000

Consolidation adjustments:

Parent's share in the net change in Sub.'s net assets

(a)

52,500

Unrealized profits (Downstream only) -

Gain on extinguishment of bonds (Step 1) 50,000

Impairment loss on goodwill attributable to

Parent -

102,50

Net consolidation adjustments 0

Consolidated retained earnings – Dec. 31,

20x1 242,500

(a)

Net change in Subsidiary’s net assets (Step 2) of ₱70,000

₱70,000 x 75% = ₱52

₱52,500.

,500.

Step 6: Consolidated profit or loss

9

Downloaded by Yellow Green (yellowgreengirl@gmail.com)

lOMoARcPSD|9373940

Subsidiar

Parent y Consolidated

Profits before adjustments 80,000 20,000 100,000

Consolidation adjustments:

( -

Unrealized profits ) ( - ) ( - )

Dividend income from ( -

subsidiary ) N/A ( - )

Gain on extinguishment of

bonds 50,000 ( - ) 50,000

Net consolidation

adjustments 50,000 ( - ) 50,000

130,00

Profits before FVA 0 20,000 150,000

( -

Depreciation of FVA ) ( - ) ( - )

( -

Impairment loss on goodwill ) ( - ) ( - )

Consolidated profit 130,000 20,000 150,000

Step 7: Profit or loss attributable toOwners

owners of parent

pare nt and NCI

Consoli-

of parent NCI dated

Parent's profit before FVA (Step 6) 130,000 N/A 130,000

(c)

Share in Sub.’s profit before FVA 15,000 5,000 20,000

Depreciation of FVA ( - ) ( - ) ( - )

Share in impairment loss on goodwill ( - ) ( - ) ( - )

Totals 145,000 5,000 150,000

(c)

Shares in Sub.’s profit before FVA (Step 6 ): (20,000 x 75%); (20,000 x 25%)

Requirement (c): Consolidated financial statements

Consolidated

ASSETS

Investment in subsidiary (at cost) - eliminated -

Investment in bonds - eliminated -

Other assets (500,000 + 50,000) 550,000

Goodwill (Step 3) 30,000

TOTAL ASSETS 580,000

LIABILITIES AND EQUITY

Accounts payable (40,000

(40,000 + 30,000) 70,000

Bonds payable (at face amount)

amount) - eliminated -

Total liabilities 70,000

200,000

Share capital (Parent only)

10

Downloaded by Yellow Green (yellowgreengirl@gmail.com)

lOMoARcPSD|9373940

Retained earnings (Step 5) 242,500

Equity attributable to owners of parent 442,500

NCI in net assets (Step 4) 67,500

Total equity 510,000

TOTAL LIABILITIES AND EQUITY 580,000

Consolidate

d

Revenues (300,000 + 120,000) 420,000

Operating expenses (217,000 + 100,000) (317,000)

(3,000

Interest expense (3,000* + 0)

)

Gain on extinguishment of bonds (Step 1) 50,000

Profit for the year 150,000

Profit attributable to owners of the parent (Step 7) 145,000

5,00

Profit attributable to NCI (Step 7)

0

Profit for the year 150,000

*The interest

was paid expense parties,

to unrelated is not eliminated because

the previous theofinterest

holder expense

the bonds (i.e.,

the bonds were acquired by the subsidiary only at year-end.

SUMMARY OF ANSWERS TO REQUIREMENTS

a. Gain

Gain (los

(loss)

s) on ex

exti

ting

ngui

uishshme

mentnt of bo

bond

nds

s = 50,000 gain (Step 1)

b. Co

Cons

nsol

olid

idat

ated

ed bo

bond

ndss pa

paya yabl

ble

e = 0 (Step 1)

c. Cons

Consol

olid

idat

ated

ed fi

fina

nanc

ncia

iall sta

state

teme

ment

nts

s (See above)

PROBLEM 3: EXERCISES

1. Solutions:

Requirement (a):

Sales of Parent 1,000,000

Sales of Subsidiary 700,000

Less: Intercompany sales during the year (16K* +

60K) (76,000)

Consolidated sales 1,624,000

* (12,000 ÷ 75%) = 16,000

Requirement (b):

The unrealized profits in ending inventory are computed as follows:

Downstream Upstream Total

Sale price of intercompany sale 16,000

11

Downloaded by Yellow Green (yellowgreengirl@gmail.com)

lOMoARcPSD|9373940

Cost of intercompany sale (12,000)

Prof

Profit

it from

from inte

interc

rcom

ompa

panyny sa

sale

le 4,

4,00

000

0 10

10,000a

,000

Multiply by: Unsold portion as of yr.-

end ½ 1/4

2,50

Unrealized gross profit 2,000 4,500

0

a

(60,000 ÷ 120%) x 20% = 10,000

Cost of sales of Parent 400,000

Cost of sales of Subsidiary 350,000

Less: Intercompany sales

sales during the yr.

yr. (16,000 + (76,000

60,000) )

Add: Unrealized profit in ending inventory 4,500

Less: Realized profit in beginning inventory -

Add: Depreciation of FVA on inventory (Step 2) -

678,50

Consolidated cost of sales 0

Requirement (c):

Ending inventory of Parent 300,000

Ending inventory of Subsidiary 80,000

Less: Unrealized profit in ending inventory (4,500)

Consolidated ending inventory 375,500

2. Solutions:

Requirement (a):

Historical cost 144,000

Accumulated dep'n. 1/1/x1

1/1/x1 (86,400)

Depreciation based on historical cost (14,400)

Carrying amount 43,200

The solution above is based on the notion that it is as if the intercompany

sale never happened .

Requirement (b):

Equipment - net (Day Co.) 480,000

Equipment - net (Night Co.) 228,000

Unamortized deferred gain (see Step 1 below) (10,800)

Consolidated equipment - net 697,200

OR

Equipment - net (Day Co.) 480,000

Equipment - net (Night Co.) 228,000

12

Downloaded by Yellow Green (yellowgreengirl@gmail.com)

lOMoARcPSD|9373940

(54,000

Carrying amount of equipment sold in Night's books )

Carrying amount of equipment sold in Day's books if the

43,200

sale never happened

Consolidated equipment - net 697,200

Requirement (c):

Depreciation expense (Day Co.) 48,000

Depreciation expense (Night Co.) 14,400

Amortization of the deferred gain

(3,600)

(12,000 gain on sale ÷ 4 years)

Consolidated depreciation expense 58,800

OR

Depreciation expense (Day Co.) 48,000

Depreciation expense (Night Co.) 14,400

Depreciation in Night's books (72,000 ÷ 4 yrs.) (18,000)

Depreciation in Day's books if the sale never happened

14,400

(144,000 ÷ 10 yrs.)

Consolidated depreciation expense 58,800

Step 1: Analysis of effects of intercompany transaction

The

The inte

interc

rcom

ompa

pany

ny sale

sale is do

down

wnststrea

ream

m be

beca

caus

use

e the se

sell

lle

er is the

parent (Day Co.).

The unamortized balance of the deferred gain is computed as follows:

Deferred gain on sale - Jan. 1, 20x1 [72K – (144K –

86.4K)] 14,400

Multiply by: (3 yrs. remaining as of Dec. 31, 20x1 over 4 yrs.) 3/4

Deferred gain on sale - Dec. 31, 20x1 10,800

Step 2: Analysis of net assets

Acquisition Consolidation Net

Night Co.

date date change

Total net assets at carrying amounts 192,000 252,000

Fair value adjustments at acquisition

date - -

Subsequent depreciation of FVA NIL -

Unrealized profits (Upstream only) NIL -

Subsidiary's net assets at fair value 192,000 252,000 60,000

Step 3: Goodwill computation

Consideration transferred 216,000

13

Downloaded by Yellow Green (yellowgreengirl@gmail.com)

lOMoARcPSD|9373940

Non-controlling interest in the acquiree (192K x 25%) 48,000

Previously held equity interest in the acquire -

Total 264,000

Fair value of net identifiable assets acquired (192,000)

Goodwill 72,000

Step 4: Non-controlling interest in net assets

Night's net assets at fair value – Dec. 31, 20x1 (Step 2) 252,000

Multiply by: NCI percentage 25%

Total 63,000

Add: Goodwill to NCI net of accumulated impairment losses - *

Non-controlling interest in net assets – Dec. 31,

20x1 63,000

*No goodwill is attributed to NCI because NCI is measured at proportionate

at proportionate share.

share.

Step 5: Consolidated retained earnings

Day's retained earnings – Dec. 31, 20x1 132,000

Consolidation adjustments:

Day's share in the net change in Night's net assets

(a)

45,000

Unamortized deferred gain (Downstream only) - (Step (10,800

1) )

Gain or loss on extinguishment of bonds -

Impairment loss on goodwill attributable to

Parent -

34,20

Net consolidation adjustments 0

Consolidated retained earnings – Dec. 31,

20x1 166,200

(a)

Net change in Night’s net assets (Step 2) of ₱60,000 x 75% = ₱45,000.

Step 6: Consolidated profit or loss

Subsidiar

Parent y Consolidated

Profits before adjustments 288,000 60,000 348,000

Consolidation adjustments:

Unamortized def. gain - (Step (10,800

1) ) ( - ) (10,800)

Dividend income from ( -

subsidiary ) N/A ( - )

Gain or loss on extinguishment ( -

of bonds ) ( - ) ( - )

14

Downloaded by Yellow Green (yellowgreengirl@gmail.com)

lOMoARcPSD|9373940

Net consolidation (10,800

adjustments ) ( - ) (10,800)

277,20

Profits before FVA 0 60,000 337,200

( -

Depreciation of FVA ) ( - ) ( - )

( -

Impairment loss on goodwill ) ( - ) ( - )

Consolidated profit 277,200 60,000 337,200

Step 7: Profit or loss attributable to owners of parent

pare nt and NCI

Owners Consoli-

of parent NCI dated

Day's profit before FVA (Step 6) 277,200 N/A 277,200

Share in Night’s profit before FVA (c) 45,000 15,000 60,000

Depreciation of FVA ( - ) ( - ) ( - )

Share in impairment loss on goodwill ( - ) ( - ) ( - )

Totals 322,200 15,000 337,200

(c)

Shares in Night’s profit before FVA (Step 6 ): (60,000 x 75%); (60,000 x 25%)

Requirement (d):

Consolidated

ASSETS

Investment in subsidiary (at cost) - eliminated -

Equipment - net

net (Requirement 'b') 697,200

Other assets (240,000 + 54,000) 294,000

Goodwill (Step 3) 72,000

TOTAL ASSETS 1,063,200

LIABILITIES AND EQUITY

Liabilities (84,000 + 30,000) 114,000

Share capital (Day's only) 720,000

Retained earnings

earnings (Step 5) 166,200

Equity attributable to owners of the parent 886,200

Non-controlling interest (Step 4) 63,000

Total equity 949,200

TOTAL LIABILITI

LIABILITIES

ES AND EQUITY 1,063,200

Consolidated

Revenues (360,000 + 96,000) 456,000

Depreciation expense (Requirement 'c') (58,800)

Other expenses (38,400 + 21,600) (60,000)

Gain on sale of equipment (eliminated) -

15

Downloaded by Yellow Green (yellowgreengirl@gmail.com)

lOMoARcPSD|9373940

Profit for the year 337,200

322,20

Profit attributable to owners of the parent (Step 7)

0

15,00

Profit attributable to NCI (Step 7)

0

337,20

Profit for the year

0

3. Solutions:

Step 1: Analysis of effects of intercompany transaction

The dividends declared by the subsidiary are allocated as follows:

Total dividends declared ₱150,000

Allocation:

Owners of the parent (150,000 x 75%) 112,500

Non-controlling interest (150,000 x 25%) 37,500

As allocated

₱150,000

Step 2: Analysis of net assets

Acquisition Consolidation Net

Subsidiary

date date change

Net assets at carrying amts. 360,000 480,000

Fair value adjustments at acquisition

date - -

Subsequent depreciation of FVA NIL -

Unrealized profits (Upstream only) NIL -

Subsidiary's net assets at fair value 360,000 480,000 120,000

Step 3: Goodwill computation

We can leave out this step because the information is insufficient.

Step 4: Non-controlling interest in net assets

Sub.'s net assets at fair value – Dec. 31, 20x1 (Step 2) 480,000

Multiply by: NCI percentage 25%

Total 120,000

Add: Goodwill to NCI net of accumulated impairment losses -

Non-controlling interest in net assets – Dec. 31,

20x1 120,000

16

Downloaded by Yellow Green (yellowgreengirl@gmail.com)

lOMoARcPSD|9373940

Step 5: Consolidated retained earnings

Parent's retained earnings – Dec. 31, 20x1 420,000

Consolidation adjustments:

Parent's sh. in the net change in Sub.'s net assets

(a)

90,000

Unrealized profits (Downstream only) -

Gain or loss on extinguishment of bonds -

Impairment loss on goodwill attributable to

Parent -

90,00

Net consolidation adjustments 0

Consolidated retained earnings – Dec. 31,

20x1 510,000

(a)

₱120,000

₱120,000 Net change in subsidiary’s assets (Step 2) x 75%

Step 6: Consolidated profit or loss

Subsidiar

Parent y Consolidated

Profits before adjustments 712,500 198,000 910,500

Consolidation adjustments:

Unrealized profits - - -

Dividend income from

subsidiary (112,500) N/A (112,500)

Gain or loss on extinguishment

of bonds - - -

Net consolidation

adjustments (112,500) - (112,500)

600,00

Profits before FVA 0 198,000 798,000

( -

Depreciation of FVA ) ( - ) ( - )

( -

Impairment loss on goodwill ) ( - ) ( - )

Consolidated profit 600,000 198,000 798,000

Step 7: Profit or loss attributable to owners of parent

pare nt and NCI

Owners Consoli-

of parent NCI dated

Parent's profit before FVA (Step 6) 600,000 N/A 600,000

Share in Sub.’s profit before FVA (c) 148,500 49,500 198,000

Depreciation of FVA (Step 6) ( - ) ( - ) ( - )

Share in impairment loss on goodwill ( - ) ( - ) ( - )

Totals 748,500 49,500 798,000

17

Downloaded by Yellow Green (yellowgreengirl@gmail.com)

lOMoARcPSD|9373940

(c)

Shares in Sub.’s profit before FVA (Step 6 ) – (198,000 x 75%);

(198,000 x 25%)

SUMMARY OF ANSWERS TO REQUIREMENTS:

a. NCI in the net assets = 120,000 (Step 4)

b. Consolidated retained earnings = 510,000 (Step 5)

c. Consolidated profit = 798,000 (Step 6)

Attributable to owners of parent = 748,500 (Step 7)

Attributable to NCI

NCI = 49,500 (Step 7)

4. Solutions:

Step 1: Analysis of effects of intercompany transaction

Requirement (a): Gain (loss) on extinguishment of bonds

The gain or loss on the extinguishment of bonds is computed as:

Acquisition cost of bonds (assumed retirement price) 320,000

Carrying amount of bonds payable (300,000)

Loss on extinguishment of bonds

( 20,000

)

Requirement (b): Consolidated total bonds payable

Bonds payable (at face amount) - issued by Parent 300,000

Portion acquired by Subsidiary

(300,000)

Consolidated total bonds payable -

Step 2: Analysis of net assets

Acquisition Consolidation Net

Subsidiary

date date change

Net value

Fair assetadjustments

s at carryingataacquisition

mounts 208,000 234,000

date - -

Subsequent depreciation of FVA NIL -

Unrealized profits (Upstream only) NIL -

26,00

Subsidiary's net assets at fair value 208,000 234,000 0

Step 3: Goodwill computation

Consideration transferred (cost of investment in sub.) 234,000

Non-controlling interest in the acquiree (208K x 25%) 52,000

Previously held equity interest in the acquire -

18

Downloaded by Yellow Green (yellowgreengirl@gmail.com)

lOMoARcPSD|9373940

Total 286,000

Fair value of net identifiable assets acquired (208,000)

Goodwill 78,000

Step 4: Non-controlling interest in net assets

Sub.'s net assets at fair value – Dec. 31, 20x1 (Step 2) 234,000

Multiply by: NCI percentage 25%

Total 58,500

Add: Goodwill to NCI net of accumulated impairment losses -

Non-controlling interest in net assets – Dec. 31,

20x1 58,500

Step 5: Consolidated retained earnings

Parent's retained earnings – Dec. 31, 20x1 182,000

Consolidation adjustments:

Parent's share in the net change in Sub.'s net assets

(a)

19,500

Unrealized profits (Downstream only) -

Gain on extinguishment of bonds (Step 1) (20,000)

Impairment loss on goodwill attributable to

Parent -

Net consolidation adjustments (500)

Consolidated retained earnings – Dec. 31,

20x1 181,500

(a)

Net change in Subsidiary’s net assets (Step 2) of ₱26,000

₱26,000 x 75% = ₱19

₱19,500.

,500.

Step 6: Consolidated profit or loss

Subsidiar

Parent y Consolidated

Profits before adjustments 104,900 26,000 130,900

Consolidation adjustments:

( -

Unrealized profits ) ( - ) ( - )

Dividend income from ( -

subsidiary ) N/A ( - )

Loss on extinguishment of (20,000

bonds ) ( - ) (20,000)

Net consolidation (20,000

adjustments ) ( - ) (20,000)

Profits before FVA 84,900 26,000 110,900

Depreciation of FVA ( - ( - ) ( - )

19

Downloaded by Yellow Green (yellowgreengirl@gmail.com)

lOMoARcPSD|9373940

)

( -

Impairment loss on goodwill ) ( - ) ( - )

Consolidated profit 84,900 26,000 110,900

Step 7: Profit or loss attributable to owners of parent

pare nt and NCI

Owners Consoli-

of parent NCI dated

Parent's profit before FVA (Step 6) 84,900 N/A 84,900

Share in Sub.’s profit before FVA (c) 19,500 6,500 26,000

Depreciation of FVA ( - ) ( - ) ( - )

Share in impairment loss on goodwill ( - ) ( - ) ( - )

Totals 104,400 6,500 110,900

(c)

Shares in Sub.’s profit before FVA (Step 6 ): (26,000 x 75%); (26,000 x 25%)

Requirement (c): Consolidated financial statements

Consolidated

ASSETS

Investment in subsidiary (at cost) - eliminated -

Investment in(bonds

Other assets 650,00-0eliminated

+ 64,000) 714,000-

Goodwill (Step 3) 78,000

TOTAL ASSETS 792,000

LIABILITIES AND EQUITY

Accounts payable (52,000

(52,000 + 150,000) 202,000

Bonds payable (at face amount)

amount) - eliminated -

Total liabilities 202,000

Share capital (Parent only) 350,000

Retained earnings (Step 5) 181,500

Equity attributable to owners of the parent 531,500

NCI in net assets (Step 4) 58,500

Total equity 590,000

TOTAL LIABILITIES AND EQUITY 792,000

Consolidated

Revenues (390,000 + 156,000) 546,000

Operating expenses (282,100 + 130,000)

(412,100)

Interest expense (3,000 + 0)

(3,000)

Loss on extinguishment of bonds (Step 1)

(20,000)

Profit for the year 110,900

20

Downloaded by Yellow Green (yellowgreengirl@gmail.com)

lOMoARcPSD|9373940

Profit attributable to owners of the parent (Step 7) 104,400

Profit attributable to NCI (Step 7)

6,500

Profit for the year 110,900

SUMMARY

a. Gain

Gain (los OFonANSWERS

(loss)

s) ex

exti

ting

ngui

uishshmeTO

ment REQUIREMENTS

nt of bo

bond

nds

s = (20,000) loss (Step 1)

b. Co

Cons

nsol

olid

idat

ated

ed bo

bond

ndss pa

paya yabl

ble

e = 0 (Step 1)

c. Cons

Consol

olid

idat

ated

ed fi

fina

nanc

ncia

iall sta

state

teme

ment

ntss (See above)

PROBLEM 4: MULTIPLE CHOICE: COMPUTATIONAL

1. D

Solution:

Sales by Parent 400,000

Sales by Subsidiary 280,000

Less: Intercompany sales during the year

(squeeze) (64,000)

Consolidated sales 616,000

2. A

Solution:

Cost of sales of Parent 300,000

Cost of sales of Subsidiary 220,000

Less: Intercompany sales

sales during the yr.

yr. (see prev. (64,000

sol’n) )

Add: Unrealized profit in ending inventory (squeeze) 6,000

Less: Realized profit in beginning inventory -

Add: Depreciation of FVA on inventory -

462,00

Consolidated cost of sales 0

3. C

Solution:

Cost of sales of Parent 400,000

Cost of sales of Subsidiary 350,000

(250,000

Less: Intercompany sales

sales during the yr.

yr. )

Add: Unrealized profit in ending inventory -*

Less: Realized profit in beginning inventory -

Add: Depreciation of FVA on inventory -

Consolidated cost of sales 500,000

21

Downloaded by Yellow Green (yellowgreengirl@gmail.com)

lOMoARcPSD|9373940

*All the inventory were sold to third parties during the year.

4. C

Solution:

Ending inventory of Banks Co. (175,000 + 60,000) 235,000

Ending inventory of Lamm Co. 250,000

Less: Unrealized profit in EI (50,000 x

60,000/200,000) (15,000)

Consolidated ending inventory 470,000

5. B

Solution:

Kidd's net assets at fair value – Dec. 31, 1994 (180K –

60K) 120,000

Multiply by: NCI percentage 25%

Total 30,000

Add: Goodwill to NCI net of accumulated impairment losses -

Non-controlling interest in net assets – Dec. 31,

1994 30,000

6. B – th

the

eccom

ommo

mon

nssto

tock

ck of the

the p

par

aren

entt

7. B – same

same as papare

rent

nt divi

divide

dend

nds

s paid,

paid, sinc

sincee div

divid

iden

ends

ds paid

paid by sub

sub (Kidd

(Kidd))

are 100% eliminated in consolidation.

Interco. dividends paid by Kidd to Pare (5,000 x .75 = 3,750) should

be eliminated.

The dividends paid to the non-c

non-control

ontrolling

ling sharehol

shareholders

ders (5,000 x .25

= 1,250) would decrease their non-controlling interest.

8. D

Solution:

Saul's net assets at fair value – 12/31/20x9 (6M+ 550K– 6,385,00

165K) 0

Multiply by: NCI percentage 20%

1,277,00

Total 0

Add: Goodwill to NCI net of accumulated impairment losses* 50,000

1,327,00

Non-controlling interest in net assets – 12/31/20x9 0

*Goodwill to NCI is computed as follows:

22

Downloaded by Yellow Green (yellowgreengirl@gmail.com)

lOMoARcPSD|9373940

Consideration transferred (cost of investment in sub.) xx

Previously held equity interest in the acquiree -

Total xx

Less: Parent's proportionate share in the net assets of

subsidiary (xx x 80%) (xx)

Goodwill attrib. to owners of parent - acquisition date xx

Less: Parent's share in goodwill impairment -

Goodwill attrib. to owners of parent xx

Fair value of NCI [(5,000,000 ÷ 80%) x 20%] 1,250,000

Less: NCI's proportionate share in net assets

(1,200,000)

of subsidiary (6,000,000 x 20%)

Goodwill attributable to NCI - acquisition date 50,000

Less: NCI's share in goodwill impairment -

Goodwill attributable to NCI – current year 50,000

Goodwill, net – current year xx

9. C

Solution:

Total consolidated current assets before elimination 320,000

Unrealized profit on purchases from Kent (48K x

60/240) (12,000)

Consolidated current assets 308,000

No elimination is made on the transaction with Dean because Clark does not

control Dean, and therefore, Dean is not consolidated.

10. A

Solution:

The gain or loss on the extinguishment of the bonds is computed as follows:

Carrying amount 1,075,000

Settlement amount 975,000

Gain on extinguishment 100,000

The gain pertains to the owners of the parent only because the issuer of the

bonds is the parent. Therefore, the transaction does not affect NCI.

NCI.

23

Downloaded by Yellow Green (yellowgreengirl@gmail.com)

lOMoARcPSD|9373940

24

Downloaded by Yellow Green (yellowgreengirl@gmail.com)

You might also like

- Answers - Activity 2.4 2.5 and 3.1Document38 pagesAnswers - Activity 2.4 2.5 and 3.1Tine Vasiana Duerme83% (6)

- Sol. Man. Chapter 4 Consol. Fs Part 1Document37 pagesSol. Man. Chapter 4 Consol. Fs Part 1itsmenatoy43% (7)

- Chapter 1 Accounting For Business Combinations SolmanDocument10 pagesChapter 1 Accounting For Business Combinations SolmanKhen FajardoNo ratings yet

- Advacc 2 Chapter 1 ProblemsDocument5 pagesAdvacc 2 Chapter 1 ProblemsClint-Daniel Abenoja100% (1)

- Answers and Solutions For Business Combination Chapter 3 and Chapter 4Document4 pagesAnswers and Solutions For Business Combination Chapter 3 and Chapter 4Kyree Vlade0% (1)

- Accounting For Business Combinations Final Examination: Name: Date: Professor: Section: ScoreDocument6 pagesAccounting For Business Combinations Final Examination: Name: Date: Professor: Section: ScoreCyrine Miwa Rodriguez100% (2)

- Dividend and BondsDocument3 pagesDividend and BondsJanuary Ann Bete100% (1)

- Sol. Man. Chapter 10 Installment Sales Method 2020 EditionDocument13 pagesSol. Man. Chapter 10 Installment Sales Method 2020 EditionJam Surdivilla100% (1)

- Business Combinations (Part 2) : Problem 1: True or FalseDocument12 pagesBusiness Combinations (Part 2) : Problem 1: True or FalseAlexanderJacobVielMartinez100% (3)

- Quiz Chapter 5 Consol. Fs Part 2Document14 pagesQuiz Chapter 5 Consol. Fs Part 2Maryjoy Sarzadilla JuanataNo ratings yet

- Home Office, Branch and Agency Accounting: Problem 1: True or FalseDocument23 pagesHome Office, Branch and Agency Accounting: Problem 1: True or Falsese no100% (1)

- Chapter 10 Effects of Changes in Forex RatesDocument16 pagesChapter 10 Effects of Changes in Forex RatesJeeramel TorresNo ratings yet

- Discussion Problem No. 1 - (Estimating Goodwill - Direct Valuation)Document1 pageDiscussion Problem No. 1 - (Estimating Goodwill - Direct Valuation)Jean Kathyrine Chiong100% (1)

- Assign 4 Answer Partnership Liquidation Millan 2021Document12 pagesAssign 4 Answer Partnership Liquidation Millan 2021mhikeedelantar100% (1)

- Sol. Man. Chapter 6 Consolidated Fs Part 3 Acctg For Bus. CombinationsDocument13 pagesSol. Man. Chapter 6 Consolidated Fs Part 3 Acctg For Bus. CombinationsFery Ann100% (5)

- Solution Chapter 6 Joint ArrangementsDocument15 pagesSolution Chapter 6 Joint ArrangementsVernnNo ratings yet

- Chapter 1 Business Combinations - Part 1Document24 pagesChapter 1 Business Combinations - Part 1Kathlyn Tajada0% (1)

- Use The Following Information For The Next Three Questions:: Rainy SunnyDocument14 pagesUse The Following Information For The Next Three Questions:: Rainy SunnyAndy Lalu100% (3)

- MGMT 30A: Midterm 2Document25 pagesMGMT 30A: Midterm 2FUSION AcademicsNo ratings yet

- ABC Chapter 5 Accounting For Business Combinations by Millan 2020Document25 pagesABC Chapter 5 Accounting For Business Combinations by Millan 2020Nayoung LeeNo ratings yet

- ACCBCOMB - Oct 10Document13 pagesACCBCOMB - Oct 10kimkim100% (1)

- Consolidated Financial Statements (Part 2) : Problem 1: Multiple Choice - TheoryDocument24 pagesConsolidated Financial Statements (Part 2) : Problem 1: Multiple Choice - TheoryKeith Alison ArellanoNo ratings yet

- Sol Man Chapter 8 Separate Fs Acctg For Bus CombinationsDocument2 pagesSol Man Chapter 8 Separate Fs Acctg For Bus Combinationsitsmenatoy100% (2)

- Chapter 9 Financial Reporting in Hyperinflationary EconomiesDocument10 pagesChapter 9 Financial Reporting in Hyperinflationary EconomiesKathrina RoxasNo ratings yet

- Abc Chapter 7 Accounting For Business Combinations by Millan 2020Document21 pagesAbc Chapter 7 Accounting For Business Combinations by Millan 2020Charlene Bolandres100% (2)

- Chapter 4 Accounting For Business Combinations SolmanDocument16 pagesChapter 4 Accounting For Business Combinations SolmanCharlene Bolandres100% (1)

- CHAPTER 7 - Solman CONSOLIDATED FS PART 4 - ACCTG FOR BUS. COMBINATIONSDocument20 pagesCHAPTER 7 - Solman CONSOLIDATED FS PART 4 - ACCTG FOR BUS. COMBINATIONSJeeramel TorresNo ratings yet

- Sol. Man. Chapter 10 The Effects of Changes in Foreign Exchange Rates Acctg For Bus. CombinationsDocument19 pagesSol. Man. Chapter 10 The Effects of Changes in Foreign Exchange Rates Acctg For Bus. CombinationsJulyca C. LastimosoNo ratings yet

- Chapter 4 Business Combination Solution ManualDocument19 pagesChapter 4 Business Combination Solution ManualMaxineNo ratings yet

- Consolidated Financial Statements 1 SolDocument18 pagesConsolidated Financial Statements 1 SolChristine Dela Rosa Carolino100% (1)

- Activity - Consolidated Financial Statement - Part 2 (1) (REVIEWER MIDTERM0Document6 pagesActivity - Consolidated Financial Statement - Part 2 (1) (REVIEWER MIDTERM0PaupauNo ratings yet

- Consolidated Financial Statement Classroom Discussion Part 2Document6 pagesConsolidated Financial Statement Classroom Discussion Part 2Sunshine KhuletzNo ratings yet

- Assign 5 Answer Corporate Liquidation and Reorganization Millan 2021Document18 pagesAssign 5 Answer Corporate Liquidation and Reorganization Millan 2021mhikeedelantarNo ratings yet

- Chapter 6 ADVAC (Excel +Document43 pagesChapter 6 ADVAC (Excel +Christine Jane RamosNo ratings yet

- Chapter 7 BusscomDocument65 pagesChapter 7 BusscomJM Valonda Villena, CPA, MBANo ratings yet

- Bright Co. Dull Co. AssetsDocument5 pagesBright Co. Dull Co. AssetsJJ JaumNo ratings yet

- Chapter 2 Accounting For Business Combinations SolmanDocument13 pagesChapter 2 Accounting For Business Combinations SolmanKhen FajardoNo ratings yet

- Corporate Liquidation & Reorganization: Problem 1: True or FalseDocument20 pagesCorporate Liquidation & Reorganization: Problem 1: True or FalseRicalyn Bugarin0% (2)

- Abc Chapter 6 Accounting For Business Combinations by Millan 2020Document14 pagesAbc Chapter 6 Accounting For Business Combinations by Millan 2020Nayoung LeeNo ratings yet

- Chapter 25 - Acctg For Derivatives & Hedging Transactions Part 2 - ADocument10 pagesChapter 25 - Acctg For Derivatives & Hedging Transactions Part 2 - AGlennizze Galvez100% (3)

- Illustration Financial Reptg. in HyperinflationaryDocument4 pagesIllustration Financial Reptg. in HyperinflationaryKian GaboroNo ratings yet

- Business Combi Quiz (Part1)Document9 pagesBusiness Combi Quiz (Part1)Rica Joy RuzgalNo ratings yet

- ACC 113 Module 7 AnswerDocument4 pagesACC 113 Module 7 AnswerYahlianah Lee100% (2)

- Accounting For Business CombinationsDocument29 pagesAccounting For Business CombinationsAmie Jane Miranda100% (1)

- Accounting For Business Combinations First Grading ExaminationDocument18 pagesAccounting For Business Combinations First Grading ExaminationNhel AlvaroNo ratings yet

- Pre Buscomok PDF FreeDocument9 pagesPre Buscomok PDF FreeheyNo ratings yet

- Consolidated FS - QUIZ PART 3Document4 pagesConsolidated FS - QUIZ PART 3Christine Jane Ramos100% (1)

- Business Combination Midterm ExamDocument12 pagesBusiness Combination Midterm Examcharlene lizardoNo ratings yet

- PDF Valle Quiz ABC CompressDocument6 pagesPDF Valle Quiz ABC CompressPotie RhymeszNo ratings yet

- Consolidated FS - QUIZ PART 2Document5 pagesConsolidated FS - QUIZ PART 2Christine Jane RamosNo ratings yet

- Sol. Man. Chapter 12 Acctg For Derivatives Hedging Transactions Part 2 Acctg For Bus. CombinationsDocument11 pagesSol. Man. Chapter 12 Acctg For Derivatives Hedging Transactions Part 2 Acctg For Bus. CombinationsJulyca C. LastimosoNo ratings yet

- Assign 3 Answer Partnership Dissolution Millan 2021Document6 pagesAssign 3 Answer Partnership Dissolution Millan 2021mhikeedelantarNo ratings yet

- Chapter 17 - Teacher's Manual - Aa Part 2Document24 pagesChapter 17 - Teacher's Manual - Aa Part 2Mydel AvelinoNo ratings yet

- Chapters 5-6 Classroom Discussion Answer KeyDocument12 pagesChapters 5-6 Classroom Discussion Answer KeyJeeramel TorresNo ratings yet

- Module 5Document11 pagesModule 5Jacqueline OrtegaNo ratings yet

- 2076 - Varias, Aizel Ann B - Module 3Document14 pages2076 - Varias, Aizel Ann B - Module 3Aizel Ann VariasNo ratings yet

- Answer-Key-Chapter-5-BC DeJesusDocument15 pagesAnswer-Key-Chapter-5-BC DeJesusMerel Rose FloresNo ratings yet

- 268,800 Rommel SP CorpDocument10 pages268,800 Rommel SP CorpnovyNo ratings yet

- 2076 - Varias, Aizel Ann B - Module 3Document16 pages2076 - Varias, Aizel Ann B - Module 3AIZEL ANN VARIASNo ratings yet

- Solutions:: I. In-Transit ItemDocument6 pagesSolutions:: I. In-Transit ItemMary EdsylleNo ratings yet

- BusinessCombi (Chapter 5)Document18 pagesBusinessCombi (Chapter 5)richmond naragNo ratings yet

- FINANCIAL-STATEMENT - Business FinanceDocument22 pagesFINANCIAL-STATEMENT - Business FinanceRhea Mae SumalpongNo ratings yet

- Government Audit Training Institute (GATI) Brochure (October 2011 - March 2012)Document6 pagesGovernment Audit Training Institute (GATI) Brochure (October 2011 - March 2012)Graduate School USANo ratings yet

- Limba Engleza Si Comunicare de Specialitate I Si II - Suport de Curs IDDocument120 pagesLimba Engleza Si Comunicare de Specialitate I Si II - Suport de Curs IDLuizaNo ratings yet

- Financial Statement AnalysisDocument9 pagesFinancial Statement Analysiswahab_pakistan50% (2)

- Procentriq Commerce Academy Classes For 11th 12thDocument12 pagesProcentriq Commerce Academy Classes For 11th 12thProcentrIQNo ratings yet

- Auditing Inventory, Goods and Services, and Accounts Payable - The Acquisition and Payment CycleDocument64 pagesAuditing Inventory, Goods and Services, and Accounts Payable - The Acquisition and Payment CycleAuliya HafizNo ratings yet

- Introduction To AccountingDocument12 pagesIntroduction To AccountingchristineNo ratings yet

- Admission of PartnerDocument3 pagesAdmission of PartnerLakshay SainiNo ratings yet

- 03 - TE - Applying Theory To Accounting RegulationDocument32 pages03 - TE - Applying Theory To Accounting RegulationPriska OctwentyNo ratings yet

- Acc 311 - Exam 1 SolutionsDocument6 pagesAcc 311 - Exam 1 SolutionsSteve SmithNo ratings yet

- CYBERT-AnnualReport2012 (1.6MB)Document74 pagesCYBERT-AnnualReport2012 (1.6MB)kokueiNo ratings yet

- TheurimainareportDocument22 pagesTheurimainareportVoke Magnus DigeratusNo ratings yet

- Terminal Sample 2 SolvedDocument11 pagesTerminal Sample 2 SolvedFami FamzNo ratings yet

- Suggested Structure For OBU Research Report: Using Secondary Data CollectionDocument2 pagesSuggested Structure For OBU Research Report: Using Secondary Data CollectionAaryanNo ratings yet

- WB CA-Seminar PPT Session-3.0Document40 pagesWB CA-Seminar PPT Session-3.0shane natividadNo ratings yet

- Contingencies and Subsequent EventsDocument7 pagesContingencies and Subsequent EventsArlyn Pearl PradoNo ratings yet

- ACC 557 Week 1 Chapter 1Document11 pagesACC 557 Week 1 Chapter 1acurashah100% (2)

- 0452 s11 QP 22Document20 pages0452 s11 QP 22Athul TomyNo ratings yet

- CRC Auditing Oct 2022 (1st PB)Document18 pagesCRC Auditing Oct 2022 (1st PB)Rodmae VersonNo ratings yet

- Tutor Revenue RecognitionDocument20 pagesTutor Revenue RecognitionAngel Valentine TirayoNo ratings yet

- ABFA 3114 Principle of AuditDocument151 pagesABFA 3114 Principle of AuditGary Siaw100% (2)

- 100 Business IdeasDocument20 pages100 Business IdeasFrank KeeNo ratings yet

- Fazri Ramadhan - 1118103023 - Tugas SAP FundamentalDocument3 pagesFazri Ramadhan - 1118103023 - Tugas SAP Fundamentalzal edinwswdNo ratings yet

- Ac110 24032023Document4 pagesAc110 24032023Lyana InaniNo ratings yet

- Dip FinManagement 2022Document9 pagesDip FinManagement 2022mwinnie581No ratings yet

- Accounting, Economics and Law - A ConviviumDocument10 pagesAccounting, Economics and Law - A ConviviumborremenNo ratings yet

- 2018 Top 100 FirmsDocument40 pages2018 Top 100 FirmsbhuvsnNo ratings yet

- Final Examination in Management Strategic Business Analysis Name: Date: Score: Course/Year/Section: Student #Document2 pagesFinal Examination in Management Strategic Business Analysis Name: Date: Score: Course/Year/Section: Student #Jessa Mae LavadoNo ratings yet

- Advanced Financial Reporting Module OutlineDocument4 pagesAdvanced Financial Reporting Module Outlineevans muteeraNo ratings yet