Professional Documents

Culture Documents

pf2 Chap 2 en Ca

pf2 Chap 2 en Ca

Uploaded by

Shi-vam KhuranaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

pf2 Chap 2 en Ca

pf2 Chap 2 en Ca

Uploaded by

Shi-vam KhuranaCopyright:

Available Formats

Chapter

2

Federal Remittances and

Reconciliations

Chapter 2 2

Learning Objectives:

Upon completion of this chapter, you should be able to:

1. Differentiate between monies held in trust and operating capital

2. Apply statutory remittance schedules

3. Calculate statutory remittances

o Canada Pension Plan

o Employment Insurance

o Federal and non-Québec provincial income taxes

4. Reconcile the Canada Revenue Agency account

Communication Objective:

Upon completion of this chapter, you should be able to explain the financial and legal

consequences of non-compliance with statutory remittance requirements.

© The Canadian Payroll Association – Payroll Fundamentals 2 2-1

Vs 15.0

Chapter 2

Federal Remittances and Reconciliations

Chapter Contents

Introduction....................................................................................................................2-4

Remittance Responsibilities............................................................................................2-4

In Trust ......................................................................................................................2-4

Remitter Type ............................................................................................................2-5

Remittance Schedule ..................................................................................................2-5

Content Review ........................................................................................................ 2-19

Review Questions ..................................................................................................... 2-20

Remittance Calculations ............................................................................................... 2-22

Content Review ........................................................................................................ 2-24

Review Questions ..................................................................................................... 2-25

Reconciling the Canada Revenue Agency Account....................................................... 2-26

Content Review ........................................................................................................ 2-28

Review Questions ..................................................................................................... 2-29

Chapter Review Questions and Answers ......................................................................2-30

© The Canadian Payroll Association – Payroll Fundamentals 2 2-2

Chapter 2

Federal Remittances and Reconciliations

© The Canadian Payroll Association – Payroll Fundamentals 2 2-3

Chapter 2

Federal Remittances and Reconciliations

Introduction

The Payroll Compliance Legislation course provides information on when to withhold, and

how to calculate, the statutory deductions for Canada Pension Plan contributions,

Employment Insurance premiums and federal and non-Québec provincial income taxes. This

chapter focuses on the remittance of these statutory deductions, along with the employer

portion, to the Canada Revenue Agency (CRA). This material discusses the concept of

monies held in trust, the required remittance reporting forms, remitter types, remittance

schedules, the calculation of the remittance amount and source deduction account

reconciliations.

The statutory deductions withheld from employees’ pays, along with any employer portion,

must be held in trust for the Receiver General until the remittance is made. The remittance,

payable to the Receiver General for Canada, must be calculated accurately, accompanied by

the correct reporting form and received by the Canada Revenue Agency on or before the

established due date, according to schedule.

A periodic reconciliation of the source deduction account is necessary to ensure that all

deductions and employer portions have been remitted to the Receiver General accurately and

on time, keeping in compliance with legislation.

Remittance Responsibilities

Employers are responsible for registering and maintaining a payroll program account with

the Canada Revenue Agency. The employer will remit the statutory deductions withheld

from the employees’ remuneration for Canada Pension Plan (CPP) contributions,

Employment Insurance (EI) premiums, and federal and non-Québec provincial income taxes,

along with the employer portions of CPP and EI to this account.

In Trust

Statutory deductions are deemed to be held in trust for the Receiver General for Canada. This

means the amounts withheld from employees, along with the employer’s portion, must be

kept separate from the operating funds of the business and cannot be part of an estate in

liquidation, assignment, receivership, or bankruptcy.

Employers who make their own government remittances, as opposed to having them remitted

by a service provider, must separate all CPP contributions, EI premiums and income tax

withholdings, along with any employer portion, from the organization’s regular bank

account. All statutory deductions and contributions must be held in a separate payroll account

until the remittance is made to the Receiver General.

© The Canadian Payroll Association – Payroll Fundamentals 2 2-4

Chapter 2

Federal Remittances and Reconciliations

Remitter Type

An organization’s remittance frequency depends on its average monthly withholding amount

for the second preceding calendar year. For example, the withholding amount for 2021 will

depend on the employer’s average monthly withholding amount made in 2019. Employers

may apply to the Canada Revenue Agency to have their average monthly withholding

amount for the current or previous year used instead of the second preceding year. This

would be advantageous if the employer’s payroll for the previous year was lower than the

payroll for the second preceding year.

Note:

The average monthly withholding amount is based on the total withholding amount of all

associated corporations as defined by the Income Tax Act.

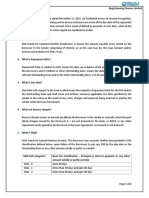

There are four remitter types as shown in the following chart:

Exhibit 2-1

REMITTER TYPE DEFINITION

Quarterly For new employers who have a monthly remittance of less

than $1,000.00, perfect compliance history for their payroll

and GST/HST tax obligations and who have been notified

that they qualify for quarterly remitting

For employers whose average monthly withholding amount

is less than $3,000.00

Regular For employers whose average monthly withholding amount

is from $3,000.00 to $24,999.99, and for new employers who

have not been notified by the CRA that they qualify for

quarterly remitting

Accelerated threshold 1 For employers whose average monthly withholding amount

is from $25,000.00 to $99,999.99

Accelerated threshold 2 For employers whose average monthly withholding amount

is $100,000.00 or more

Remittance Schedule

Once an employer has been advised by the CRA what type of remitter they are, a schedule,

based on that type, is used to determine when the remittances are due to the CRA.

The payment for the first three types of remitters – quarterly, regular, and accelerated

threshold 1 – is due by a specified date based on the payroll payment date.

The remittance for accelerated threshold 2 remitters is due three business days after the end

of the weekly period, established by the CRA, in which the payroll payment date falls.

© The Canadian Payroll Association – Payroll Fundamentals 2 2-5

Chapter 2

Federal Remittances and Reconciliations

In all cases, the payroll cheque/deposit date is the date when the money is paid to the

employee or directly deposited in their bank account. The period end date, the payroll

processing date and the date the pay statement is handed to the employee are all irrelevant in

determining the remittance date.

The remittance schedule for the four types of remitters is as follows:

Exhibit 2-2

REMITTER PAYROLL CHEQUE/DEPOSIT REMITTANCE IS DUE NO

TYPE DATES LATER THAN...

Quarterly January 1 – March 31 April 15

April 1 – June 30 July 15

July 1 – September 30 October 15

October 1 – December 31 January 15

Regular 1st of the month to the end of the The 15th of the following month

month

Accelerated 1st to 15th of the month The 25th of the same month

threshold 1 16th to end of the month The 10th of the following month

Accelerated 1st to 7th of the month 3 business days from the last

threshold 2 8th to 14th of the month day of each weekly period

15th to 21st of the month

22nd to end of the month

Note:

If the remittance due date falls on a Saturday, Sunday or statutory/general/public or bank

holiday recognized by the CRA, the remittance is due on the next business day.

Example:

Regular remitter:

The remittance for all remuneration paid during the month is due no later than the

15th of the following month

Employees are paid semi-monthly with payments dated the 15th and the end of the month.

The statutory deductions withheld from the payments dated the 15th and the 31st of May,

along with the employer’s portion of CPP contributions and EI premiums, are due to the

CRA by June 15th (presuming June 15th is not a Saturday, Sunday or a statutory/bank

holiday).

© The Canadian Payroll Association – Payroll Fundamentals 2 2-6

Chapter 2

Federal Remittances and Reconciliations

Example:

Accelerated threshold 1 remitter:

The remittance for remuneration paid from the 1st to the 15th of the month is due on

the 25th of the month

The remittance for remuneration paid from the 16th to the end of the month is due

on the 10th of the following month

Employees are paid semi-monthly with payments dated the 15th and the end of the month.

The statutory deductions withheld from the payments dated May 15th, along with the

employer’s portions of CPP contributions and EI premiums, are due to the CRA by May 25th

(presuming May 25th is not a Saturday, Sunday or a statutory/bank holiday).

The statutory deductions withheld from the payments dated May 31st, along with the

employer’s portion of CPP contributions and EI premiums, are due to the CRA by June 10th

(presuming June 10th is not a Saturday, Sunday or a statutory/bank holiday).

Using the ‘current’ year calendar provided in this material, June 10 th falls on a Sunday. In

this situation the remittance would be due on June 11th, the next business day.

Example:

Accelerated threshold 2 remitter:

The remittances are due three business days after the end of each weekly period:

1st to 7th of the month

8th to 14th of the month

15th to 21st of the month

22nd to the end of the month

Employees are paid bi-weekly with payments for May dated the 11th and the 25th. The

statutory deductions withheld from the payments dated May 11th, along with the employer’s

portions of CPP contributions and EI premiums, are due to the CRA by May 17th, three

business days after the end of the weekly period, May 14th (presuming May 15th, 16th and/or

17th are not Saturday, Sunday or a statutory/bank holiday).

The statutory deductions withheld from the payments dated May 25th, along with the

employer’s portions of CPP contributions and EI premiums, are due to the CRA by June 3rd,

three business days after the end of the weekly period, May 31st (presuming June 1st, 2nd

and/or 3rd are not Saturday, Sunday or a statutory/bank holiday).

Using the ‘current’ year calendar provided in this material, June 2 nd and 3rd fall on a Saturday

and Sunday. In this situation the remittance would be due on June 5th, three business days

after the end of the weekly period, May 31st.

© The Canadian Payroll Association – Payroll Fundamentals 2 2-7

Chapter 2

Federal Remittances and Reconciliations

Accelerated threshold 1 and threshold 2 remitters who have a monthly payroll are considered

by the CRA to be monthly accelerated remitters. The average monthly withholding amount

for the second previous taxation year will determine whether these organizations use the

remittance schedule for an accelerated threshold 1 or threshold 2 remitter; they do not follow

the regular remitter schedule. The payroll payment date will determine the due date.

Example:

Monthly accelerated remitter – average monthly withholding amount between

$25,000.00 and $99,999.99 – follows the accelerated threshold 1 remittance schedule:

The remittance for remuneration paid from the 1st to the 15th of the month is due on

the 25th of the month

The remittance for remuneration paid from the 16th to the end of the month is due

on the 10th of the following month

Employees are paid once a month on the 15th of every month. The statutory deductions

withheld from the payments dated May 15th, along with the employer’s portions of CPP

contributions and EI premiums, are due to the CRA by May 25th (presuming May 25th is not

a Saturday, Sunday or a statutory/bank holiday).

Monthly accelerated remitter – average monthly withholding amount over $100,000.00

– follows the accelerated threshold 2 remittance schedule:

The remittances are due three business days after the end of each weekly period:

1st to 7th of the month

8th to 14th of the month

15th to 21st of the month

22nd to the end of the month

Employees are paid once a month with the payments for May dated the 15th. The statutory

deductions withheld from the payments dated May 15th, along with the employer’s portions

of CPP contributions and EI premiums, are due to the CRA by May 24th, three business days

after the end of the weekly period, May 21 st (presuming May 22nd, 23rd and/or 24th are not a

Saturday, Sunday or a statutory/bank holiday).

Statutory deductions withheld from manual payments issued outside of the normal payroll

cycle must also be taken into consideration in determining the remittance amount for the due

date as defined above. The date of the manual payment determines the remittance period for

the statutory deductions withheld. In other words, if a manual payment is issued on the 12th

of the month and the employer is an accelerated threshold 1 remitter type, the remittance due

date is the 25th of the same month.

© The Canadian Payroll Association – Payroll Fundamentals 2 2-8

Chapter 2

Federal Remittances and Reconciliations

Special attention is required at year-end when processing any manual payments issued in the

month of December. Remittances to the federal government for any CPP contributions, EI

premiums, and federal and non-Québec provincial income tax deductions on the manual

payment, including any employer portions, must be received by the CRA by the regular due

date for that remittance period.

Example:

Loges Entertainment is paying bonus payments to their employees after the last bi-weekly

payroll for December has been processed. Loges is a regular remitter whose payroll

remittances are made by their payroll service provider; their December remittance is due by

January 15th.

The payroll service provider will make the remittance for the December payrolls processed

through their system. However the payroll service provider will not remit the withholdings

on the manual payments issued after the last payroll for the year has been processed.

Loges is responsible for remitting the statutory deductions withheld on the bonus payments,

along with their portions for CPP contributions and EI premiums, by the December

remittance due date of January 15th.

Penalties and Interest Charges

The CRA may assess a penalty of up to 10% of the required amount of CPP contributions, EI

premiums and income taxes due for late remittances (20% on the second and later

occurrences). An employer who withholds the statutory deductions but does not remit them,

or fails to deduct the required deductions will be subject to a 10% penalty for the first

occurrence on the amount that should have been deducted and remitted (20% on the second

and later occurrences).

The penalties for late remittances are as follows:

3% if payment is late 3 business days or less

5% if payment is late 4 or 5 business days

7% if payment is late 6 or 7 business days

10% if payment is 8 or more business days late

Normally the penalty is only applied to the part of the amount that the employer fails to remit

that is more than $500.00, however the CRA may apply the penalty to the total amount if the

failure to remit, or the late remittance, was made knowingly or under circumstances of gross

negligence.

Again, special attention is required at the end of the year if producing any manual payments

after the final pay period for the year has been processed.

© The Canadian Payroll Association – Payroll Fundamentals 2 2-9

Chapter 2

Federal Remittances and Reconciliations

Example:

If you are an accelerated threshold 2 employer, your last remittance for the taxation year is

due three business days after December 31st. Any payment made after this date is considered

a late remittance.

The CRA also charges interest, compounded daily, on any unpaid remittances and unpaid

penalties from the day the payment was due. The interest rate is determined every three

months, in accordance with the prescribed interest rates, and is available on CRA’s website.

Failure to comply with the withholding, remitting, and reporting requirements may result in

prosecution. Fines from $1,000.00 up to $25,000.00, or imprisonment for a term of up to 12

months may also be imposed.

Remittance forms

The remittance forms for the statutory deductions for CPP contributions, EI premiums and

income tax, along with any employer portion, are as follows:

Statement of Account for Current Source Deductions PD7A, for regular and quarterly

remitters

Statement of Account for Current Source Deductions PD7A(TM), for accelerated

threshold 1 and 2 remitters

Remittance Voucher for Current Source Deductions PD7A-RB, a booklet of PD7A-

RB forms that is sent to accelerated threshold 1 and 2 remitters each December for the

next year’s remittances

If an organization remits electronically for six months in a row or its first remittance on the

account is made electronically, the CRA will stop sending paper statements of account and

remittance vouchers. These organizations can view their statements and transactions online

through My Business Account or contact the CRA to resume receiving paper statements and

vouchers.

Forms PD7A and PD7A(TM)

Forms PD7A and PD7A(TM) are statements of account and current source deductions

remittance vouchers. The PD7A form is for regular and quarterly remitters and the

PD7A(TM) form is for accelerated remitters. The PD7A(TM) is sent in April, July, October

and January for the previous quarter’s transactions.

The information sections on the PD7A and PD7A(TM) are similar. An explanation of the

sections is provided below; a sample PD7A page 1 follows.

© The Canadian Payroll Association – Payroll Fundamentals 2 2-10

Chapter 2

Federal Remittances and Reconciliations

Exhibit 2-3

PAGE 1

Top left The organization’s name and address is shown.

Statement details The organization’s payroll account number and the date the form

was issued is shown on the top right.

Centre of form General information is provided

Bottom of form The organization’s current year remittance account balance is

shown in the box at the bottom of the form

PAGE 2

Account Summary This section details the transactions posted since the last

statement:

remittance account balances – shows paid and unpaid

amounts for the year and will only be shown if there has

been any remittance activity during the statement period

arrears account balances – shows assessed amounts,

including any accumulated balance owing, if there was any

arrears activity during the statement period

explanation of changes and other important information –

provides a more detailed explanation of the activity on the

account, if required

PAGE 3

How do you remit? This section lists the ways an organization can remit its

deductions.

NIL remittance If no remittance is being made for the statement period, this

section must be completed.

Remittance Voucher This section must be completed when using the voucher to make

a remittance:

end of remitting period

gross payroll in remitting period (dollars only)

number of employees in last pay period

amount paid

PAGE 4

More information This section details how to:

get more payroll information

access and manage a payroll account

register for direct deposit

get a statement in another format, for those with a visual

impairment

© The Canadian Payroll Association – Payroll Fundamentals 2 2-11

Chapter 2

Federal Remittances and Reconciliations

PD7A

© The Canadian Payroll Association – Payroll Fundamentals 2 2-12

Chapter 2

Federal Remittances and Reconciliations

Form PD7A-RB

Each December, the CRA provides accelerated remitters a booklet of PD7A-RB forms

(either 27 or 54 forms) to use to remit their payments. If a company has been sending their

source deduction remittances to the CRA electronically for at least six months, they will not

receive a paper remittance booklet (PD7A-RB) in December. If a company receives a paper

remittance booklet but has started to send in their remittances electronically, the company

can choose not to receive the booklet in the future.

The form has two parts as follows:

Exhibit 2-4

PART COMMENTS

Top – Part 1 The top part of the form is a receipt.

Receipt

If making the remittance at a financial institution, the top part

will be date-stamped and returned.

Bottom – Part 2 The bottom part of the form is the remittance form for the

Remittance form for current remittance. It is completed with the following

current remittances information:

employer name, address and account number

gross payroll for the remitting period (rounded to nearest

dollar)

end of the remitting period

number of employees in the last pay period

the amount paid - the total CPP contributions, EI premiums

(employer and employee portions), and income tax being

remitted

© The Canadian Payroll Association – Payroll Fundamentals 2 2-13

Chapter 2

Federal Remittances and Reconciliations

PD7A-RB

Remittance methods

There are several methods available for remitting payroll deductions and employer portions.

Accelerated threshold 2 remitters must make their remittances through a Canadian financial

institution (either electronically or in person) or through their payroll service provider.

Payments are considered paid to the CRA at the time indicated by the date stamped by the

financial institution on the remittance voucher or receipt.

Electronic Payments

Employers can make their payments online using the CRA’s My Payment service.

Employers may be able to pay their remittances electronically through their financial

institution’s telephone or Internet banking services. Information on these methods is

available from the CRA and the financial institution.

Pre-authorized debit payments can be set up using My Account, authorizing the CRA to

withdraw a pre-set payment from the employer’s Canadian chequing account on one or

more dates.

© The Canadian Payroll Association – Payroll Fundamentals 2 2-14

Chapter 2

Federal Remittances and Reconciliations

Financial institution

Employers can make remittance payments in person at their Canadian financial

institution. The payment is presented with the required CRA remittance form, a portion

of which will be date-stamped by the financial institution and returned to the employer as

a receipt.

Employers who make their payments at an Automated Teller Machine (ATM) must allow

sufficient time for the financial institution to process the payment, even though the

employer’s account will be debited at the time of payment. An ATM receipt is not proof

of payment by the due date.

By mail

Employers can mail a cheque or money order payable to the Receiver General for Canada

to the address listed on the back of the remittance form. The payroll program account

number should be referenced on the cheque or money order. The payment must be sent

with the bottom part of the remittance form (or a note attached to the cheque or money

order providing instructions on how the payment must be applied), allowing for sufficient

mailing time to ensure that the CRA receives the payment by the due date. Cheques that

are post-dated to the due date are acceptable.

Service Provider

Employers who have their payroll processed by a service provider have the choice of

making the remittance themselves using one of the options above or having the

remittance done by the service provider. If the employer chooses to have the service

provider do the remittance on their behalf, they must give the provider a copy of the

notice from the CRA advising of their remittance schedule. The provider will debit the

employer’s bank account on a pre-established day and make the remittance on their

behalf.

Note:

CRA has closed all of their payment and enquiry offices across Canada. Therefore,

employers and individuals are no longer able to use the self-stamping machines or make

payments in-person. However, the CRA has maintained their external after hours drop boxes

for employers and individuals to leave their returns and payments.

No Remittance

When there is no remittance due, employers may notify the CRA by:

using the "Provide a nil remittance" service in My Business Account or Represent a

Client

using TeleReply or

sending the remittance form, or a letter by mail.

© The Canadian Payroll Association – Payroll Fundamentals 2 2-15

Chapter 2

Federal Remittances and Reconciliations

My Business Account is a secure online portal that provides an opportunity to interact

electronically with the CRA on various business accounts such as GST/HST, payroll,

corporation income taxes, excise taxes and excise duties.

TeleReply is a secure reporting service where employers inform the Canada Revenue Agency

by phone when they have no payroll deductions remittance to make during a remittance

period; the remittance form is completed and kept on file for future reference, it is not sent to

the CRA.

TeleReply is available across Canada to employers who meet all of the following conditions:

they had no employees who are subject to payroll deductions

they want to report a nil remittance

the correct name and payroll program account number are on the remittance form sent

by the CRA

Employers can also submit their regular remittance form by mail to show no remittance for

the period and indicate when they expect to make their next remittance.

Payment on Filing (PoF)

Employers often rely on essential third party information to accurately report earnings and

taxable benefit values for T4 slip reporting. These amounts may not become available until

after the final regular pay period of the year. A new policy from CRA will enable a final

remittance of statutory withholding amounts on or before the last day of February, under

certain circumstances, without late payment penalties being assessed.

This new policy comes into effect for the 2019 tax reporting year, with any final remittances

being due on or before February 28, 2020.

To be eligible for a penalty-free payment on filing the employer must meet certain

conditions:

The remittance amount must be:

o received by CRA on or before the last day of February following the tax year

in which the amounts were or should have been deducted

o less than 1% of the total annual remittances (total paid plus unpaid)

The employer must have a perfect payroll compliance history

o No late or outstanding remittances for the tax reporting year

o No assessments

o The annual T4 slip filing was completed on or before the due date

The employer experiences one of the following circumstances:

o Employees exercise stock-based remuneration

o Employees that reside in a different tax jurisdiction

o Third-party information is required to accurately report amounts for taxable

benefits such as insurance and employer-provided automobile benefits

© The Canadian Payroll Association – Payroll Fundamentals 2 2-16

Chapter 2

Federal Remittances and Reconciliations

Example:

Marlow Consulting Services provides company vehicles to its employees who are required to

travel to client sites as part of their employment responsibilities.

The employer requires detailed mileage logs from these employees to reconcile and report the final

taxable benefit value for the year. However, as some employees are out on the road the employer

often receives these reports in early January after the last regular pay run of the year from their

third party benefit provider.

Under the new PoF policy, the employer can now calculate any adjustments to the taxable benefit

value and remit outstanding CPP contributions with no penalty, as long as they have met the PoF

policy conditions.

If the final remittance due is equal to or greater than 1% of the total remittances for the year PoF does

not apply and a late penalty will be assessed.

The perfect payroll compliance history applies to each individual payroll remittance account. An

employer that has established multiple accounts will still be eligible to apply PoF on each account

with a perfect compliance history.

CONFIRM ELIGIBILITY FOR PAYMENT ON FILING

1. Validate that the final remittance will be less than 1% of total annual remittances.

A Year-to-date remittances processed $

B Final remittance due $

C Total annual remittances (A + B) $

D 1% of total remittances (C x 1%) $

If value B is less than value D proceed to step 2.

If value B is greater than or equal to value D the final remittance will be subject to a late payment

penalty.

2. Validate the organization’s payroll account compliance history for the tax reporting year.

Were there any late remittances? Yes No

Were there any assessments? Yes No

Were T4 slips filed late? Yes No

If all responses are ‘No’ proceed to step 3.

If any responses are ‘Yes’ then PoF does not apply and penalties will be assessed on late

remittances.

3. Confirm the final remittance due is as a result of any of the following:

Employee stock benefits

Employee who resides in a different tax jurisdiction

Third-party information was required to determine taxable benefit values for

o Employer-provided vehicle (fleet mileage)

© The Canadian Payroll Association – Payroll Fundamentals 2 2-17

Chapter 2

Federal Remittances and Reconciliations

o Insurance plans

o Health benefits

o Other taxable benefit _______________________

If the final remittance is not for one of the above reasons PoF does not apply and penalties will be

assessed on late remittances.

4. Process the final remittance, on or before the last day of February via:

a. Pre-authorized debit through My Business Account

b. Online using the CRA My Payment option which requires the following type of bank card

i. VISA® Debit

ii. Debit MasterCard®

iii. Interac®

c. By cheque submitted with the T4 Summary. Note: The CRA will honor the date the mail is

received by CRA and not the postmarked date by Canada Post.

d. Through a financial institution. Request a PD7R PoF remittance voucher from CRA through the

Business Enquiries line 1-800-959-5525

© The Canadian Payroll Association – Payroll Fundamentals 2 2-18

Chapter 2

Federal Remittances and Reconciliations

Content Review

All statutory deductions for Canada Pension Plan (CPP) contributions, Employment

Insurance (EI) premiums and income tax (except for Québec provincial income tax),

along with any employer portion, must be held in trust for the Receiver General for

Canada.

All statutory deductions and contributions must be held in a separate payroll account

until the remittance is made to the Receiver General.

The employer’s remittance frequency depends on the amount of the employer’s

average monthly withholding amount for the second preceding calendar year.

There are four remitter types: quarterly, regular, accelerated threshold 1 and

accelerated threshold 2.

A remittance schedule based on remitter type is used to determine when the statutory

deduction remittances are due to the Canada Revenue Agency (CRA).

Statutory deductions withheld from manual payments issued outside of the normal

payroll cycle must also be remitted according to the remittance due dates.

The CRA may assess a penalty of up to 10% of the required amount of CPP

contributions, EI premiums and income taxes due for late remittances (20% on the

second and later occurrences).

Payments are considered paid to the CRA at the time indicated by the date stamped

by the financial institution on the remittance voucher or receipt.

© The Canadian Payroll Association – Payroll Fundamentals 2 2-19

Chapter 2

Federal Remittances and Reconciliations

Review Questions

1. How is an organization’s remittance frequency determined?

2. Complete the following chart:

REMITTER TYPE DEFINITION

For employers whose average monthly

withholding amount is from $25,000.00 and

$99,999.99

For employers whose average monthly

withholding amount is less than $3,000.00

For employers whose average monthly

withholding amount is $100,000.00 or more

For employers whose average monthly

withholding amount is from $3,000.00 to

$24,999.99

For new employers who have a monthly

remittance of less than $1,000.00 and perfect

compliance history

3. True or False. Deadlines for remitting the federal statutory deductions are based on the

actual date of the payroll cheque/deposit, not on the pay period ending date.

© The Canadian Payroll Association – Payroll Fundamentals 2 2-20

Chapter 2

Federal Remittances and Reconciliations

4. Complete the following chart with the remittance due date using the current year calendar

provided at the beginning of this chapter.

PAY PERIOD REMITTANCE DUE

PAY DATE REMITTER TYPE

ENDING DATE DATE

January 12 January 19 Quarterly

February 23 March 2 Accelerated threshold 1

March 15 March 15 Regular

June 29 June 29 Accelerated threshold 1

July 13 July 20 Accelerated threshold 2

August 31 September 7 Regular

September 14 September 14 Accelerated threshold 2

October 31 October 31 Quarterly

November 9 November 16 Accelerated threshold 2

November 9 November 16 Regular

5. What are the reporting choices for an employer with no remittance due for the reporting

period?

© The Canadian Payroll Association – Payroll Fundamentals 2 2-21

Chapter 2

Federal Remittances and Reconciliations

Remittance Calculations

Employers are responsible for remitting the following amounts to the Canada Revenue

Agency (CRA):

employee Canada Pension Plan (CPP) contributions withheld in the remitting period

and the employer portion (employer CPP contributions equal employee contributions)

employee Employment Insurance (EI) premiums withheld in the remitting period and

the employer portion (1.4 times the employees' premiums, unless the employer has a

reduced EI premium rate, in which case the reduced premium rate would apply)

employee federal and non-Québec provincial income tax deductions withheld in the

remitting period (Québec provincial income tax remittances will be discussed later in

the material)

To calculate the amount to be remitted to the CRA, add the employee and employer amounts

for CPP contributions and EI premiums and the employee income taxes for each pay date in

the remitting period.

Example:

The payroll register for the first pay of the year shows the following totals:

EMPLOYER EI PROVINCIAL

PAY EMPLOYEE EMPLOYER FEDERAL

EMPLOYEE EI (UNREDUCED TAX (NON- TOTAL

PERIOD CPP CPP TAX

RATE) QUÉBEC)

1 25,000.00 25,000.00 10,000.00 14,000.00 75,000.00 40,000.00 189,000.00

The remittance to the Receiver General for this pay is calculated by totaling the employee

and employer CPP contributions and EI premiums and the employee income taxes.

Employee CPP contributions $25,000.00

Employer CPP contributions 25,000.00

Employee EI premiums 10,000.00

Employer EI premiums 14,000.00

Employee federal income tax 75,000.00

Employee provincial income tax 40,000.00

$189,000.00

© The Canadian Payroll Association – Payroll Fundamentals 2 2-22

Chapter 2

Federal Remittances and Reconciliations

When there is more than one pay period in a remitting period, a spreadsheet can be used to

calculate the total remittance owing to the Receiver General.

Example:

The totals of the payroll registers for the pays dated March 16 and 30 are:

EMPLOYER EI PROVINCIAL

PAY EMPLOYEE EMPLOYER FEDERAL

EMPLOYEE EI (UNREDUCED TAX (NON- TOTAL

PERIOD CPP CPP TAX

RATE) QUÉBEC)

6 2,850.00 2,850.00 1,000.00 1,400.00 7,500.00 4,000.00 19,600.00

7 2,200.00 2,200.00 800.00 1,120.00 7,000.00 3,500.00 16,820.00

Total 5,050.00 5,050.00 1,800.00 2,520.00 14,500.00 7,500.00 36,420.00

The employer is an accelerated threshold 1 remitter; the remittance is due April 10.

The remittance to the Receiver General for these two pays is calculated as follows:

Employee CPP contributions $5,050.00

Employer CPP contributions 5,050.00

Employee EI premiums 1,800.00

Employer EI premiums 2,520.00

Employee federal income tax 14,500.00

Employee provincial income tax 7,500.00

$36,420.00

© The Canadian Payroll Association – Payroll Fundamentals 2 2-23

Chapter 2

Federal Remittances and Reconciliations

Content Review

Employers are responsible for remitting the following employee statutory deductions

to the Canada Revenue Agency (CRA):

o Canada Pension Plan (CPP) contributions

o Employment Insurance (EI) premiums

o Federal and provincial (non-Québec) income tax

Employers are responsible for remitting the following employer portions to the

Canada Revenue Agency:

o Canada Pension Plan matching contributions

o Employment Insurance premiums (1.4 times the employees’ premiums, unless

the employer receives a reduced Employment Insurance premium rate)

To calculate the amount to be remitted to the CRA, add the employee and employer

amounts for CPP contributions and EI premiums and employee income taxes for each

pay date in the remitting period.

© The Canadian Payroll Association – Payroll Fundamentals 2 2-24

Chapter 2

Federal Remittances and Reconciliations

Review Questions

6. Employee contributions for Canada Pension Plan are matched by the employer at a rate

of:

a. 100%

b. 200%

c. 1.4%

d. 50%

7. Employee premiums for Employment Insurance are matched by the employer at a non-

reduced rate of:

a. 100%

b. 1.4 times the employees’ premium

c. 1.4%

d. 1.257 times the employees’ premium

8. True or False. Provincial income tax deductions for all provinces are remitted to the

Canada Revenue Agency.

9. The payroll register for Parker Flooring shows the following employee withholdings for

the month of February. The company has a reduced Employment Insurance premium rate

of 1.257. The employer is an accelerated threshold 2 remitter.

i) Calculate the remittance total for each pay period and the total amount remitted for

the month.

ii) The pay date for pay period 3 is February 2; the pay date for pay period 4 is February

16. Using the current year calendar provided in the chapter, when are these

remittances due to the Canada Revenue Agency?

Remittance due date for pay period 3:

Remittance due date for pay period 4:

PROVINCIAL

PAY EMPLOYEE EMPLOYER EMPLOYEE EMPLOYER FEDERAL

TAX (NON- TOTAL

PERIOD CPP CPP EI EI TAX

QUÉBEC)

3 15,000.00 18,000.00 95,000.00 45,000.00

4 22,000.00 21,000.00 102,000.00 53,000.00

Total

© The Canadian Payroll Association – Payroll Fundamentals 2 2-25

Chapter 2

Federal Remittances and Reconciliations

Reconciling the Canada Revenue Agency

Account

As discussed, the Canada Revenue Agency (CRA) issues the Statement of Account for

Current Source Deductions. This form is used for both remitting and tracking the payments

made to the CRA. It summarizes any payments made since the previous statement. Any

discrepancies between the employer’s records and the CRA’s statement that cannot be

resolved internally should be reported to the tax services office or tax centre immediately.

The payroll register totals, or an internally developed summary spreadsheet, can be used to

verify that all the statutory deductions withheld from the employees’ pay, along with any

employer portion, have been accurately remitted to the Receiver General by the appropriate

due dates and for the correct business number or payroll program account number.

The amounts reported in the account summary and remittance account balance sections as

being received, should be the same as the amounts for CPP contributions, EI premiums and

income tax remitted for the calendar year to date, according to the employer’s records. These

totals will be used to balance the year-end information slips and summaries.

By reconciling the organization’s payroll remittance totals to the statements on a monthly

basis or at the end of each remitting period, employers will find any discrepancies as they

occur and resolve them in a timely manner.

Note:

The statement should also be checked for errors in the posting date which could result in a

late payment charge.

© The Canadian Payroll Association – Payroll Fundamentals 2 2-26

Chapter 2

Federal Remittances and Reconciliations

Example:

This organization remits to the CRA under two separate payroll program account numbers,

23451 6789 RP0001 and 12345 6780 RP0001. The payroll summaries for each account

number are below.

BN 23451 6789 RP0001 payroll summary report

PROVINCIAL

EMPLOYER EI

PAY EMPLOYEE EMPLOYER EMPLOYEE FEDERAL TAX

(UNREDUCED TOTAL

PERIOD CPP CPP EI TAX (NON-

RATE)

QUÉBEC)

1 25,000.00 25,000.00 10,000.00 14,000.00 75,000.00 40,000.00 189,000.00

2 22,000.00 22,000.00 8,000.00 11,200.00 70,000.00 35,000.00 168,200.00

3 22,000.00 22,000.00 8,000.00 11,200.00 70,000.00 35,000.00 168,200.00

Total 69,000.00 69,000.00 26,000.00 36,400.00 215,000.00 110,000.00 525,400.00

BN 12345 6780 RP0001 payroll summary report

PROVINCIAL

EMPLOYER EI

PAY EMPLOYEE EMPLOYER EMPLOYEE FEDERAL TAX

(UNREDUCED TOTAL

PERIOD CPP CPP EI TAX (NON-

RATE)

QUÉBEC)

1 35,000.00 35,000.00 13,000.00 18,200.00 120,000.00 80,000.00 301,200.00

2 32,000.00 32,000.00 12,000.00 16,800.00 100,000.00 70,000.00 262,800.00

Total 67,000.00 67,000.00 25,000.00 35,000.00 220,000.00 150,000.00 564,000.00

When the PD7A for 23451 6789 RP0001 was received it reported the balance on the last

statement as $490,200.00. On reviewing the payroll summary reports, it was determined that

the $301,200.00 from pay period 1 for 12345 6780 RP0001 was remitted together with the

$189,000.00 from pay period 1 for 23451 6789 RP0001, totaling a remittance of $490,200.00

made to 23451 6789 RP0001. The last statement was not reconciled to the employer’s

payroll summary reports.

If left uncorrected, the organization would have an under-remittance of $301,200.00 in 12345

6780 RP0001, and an over-remittance of the same amount in 23451 6789 RP0001. The CRA

should be contacted, in writing, through My Business Account, or by phone immediately to

report the error and request that the monies are transferred to the correct account.

This discrepancy would have been more difficult to identify had the payroll summaries and

statements been left unreconciled over a number of months. A reconciliation of government

remittances should be processed on a monthly basis or at the end of each remitting period.

Remitting Error

If you discover that you made an error when remitting your source deductions, you should

remit any underpayment as soon as possible using another remittance form, or by sending a

short letter with the payment to the CRA, stating your payroll program account number and

the pay period for which the payment applies. If your remittance is late, the CRA may apply

a penalty. An over-remittance discovered in the same calendar year can be corrected by

reducing the next remittance by the amount of the overpayment.

© The Canadian Payroll Association – Payroll Fundamentals 2 2-27

Chapter 2

Federal Remittances and Reconciliations

Content Review

Any discrepancies between the employer’s records and the Canada Revenue

Agency’s statement that cannot be resolved internally should be reported to the tax

services office or tax centre immediately in writing, through My Business Account, or

by phone.

The payroll register totals, or an internally developed summary spreadsheet, can be

used to verify that all the statutory deductions withheld from the employees’ pay,

along with any employer portion, have been accurately remitted to the Receiver

General by the appropriate due dates and for the correct business number or payroll

program account number.

© The Canadian Payroll Association – Payroll Fundamentals 2 2-28

Chapter 2

Federal Remittances and Reconciliations

Review Questions

10. What is the purpose of reconciling the Canada Revenue Agency account?

11. After reconciling their Canada Revenue Agency account in May, an employer realizes

that they have overpaid their account by $10,000.00. How can they correct this?

© The Canadian Payroll Association – Payroll Fundamentals 2 2-29

Chapter 2

Federal Remittances and Reconciliations

Chapter Review Questions and Answers

1. How is an organization’s remittance frequency determined?

The organization’s remittance frequency depends on the amount of its average

monthly withholding amount for the second preceding calendar year.

2. Complete the following chart:

REMITTER TYPE DEFINITION

For employers whose average monthly withholding amount

Accelerated threshold 1

is from $25,000.00 to $99,999.99

For employers whose average monthly withholding amount

Quarterly

is less than $3,000.00

For employers whose average monthly withholding amount

Accelerated threshold 2

is $100,000.00 or more

For employers whose average monthly withholding amount

Regular

is from $3,000.00 to $24,999.99

For new employers who have a monthly remittance of less

Quarterly

than $1,000.00 and perfect compliance history

3. True or false. Deadlines for remitting the federal statutory deductions are based on the

actual date of the payroll cheque/deposit, not on the pay period ending date.

True.

© The Canadian Payroll Association – Payroll Fundamentals 2 2-30

Chapter 2

Federal Remittances and Reconciliations

4. Complete the following chart with the remittance due date using the current year calendar

provided at the beginning of this chapter.

PAY PERIOD REMITTANCE

PAY DATE REMITTER TYPE

ENDING DATE DUE DATE

January 12 January 19 Quarterly April 16

February 23 March 2 Accelerated threshold 1 March 26

March 15 March 15 Regular April 16

June 29 June 29 Accelerated threshold 1 July 10

July 13 July 20 Accelerated threshold 2 July 25

August 31 September 7 Regular October 15

September 14 September 14 Accelerated threshold 2 September 19

October 31 October 31 Quarterly January 15

(following year)

November 9 November 16 Accelerated threshold 2 November 26

November 9 November 16 Regular December 17

5. What are the reporting choices for an employer with no remittance due for the remitting

period?

Employers with no remittance due can file using My Business Account, TeleReply

or mail in the form or a letter indicating nil remittance. Employers who use My

Business Account or TeleReply do not forward the form but keep a copy on file for

future reference.

6. Employee contributions for Canada Pension Plan are matched by the employer at a rate

of:

a. 100%

b. 200%

c. 1.4%

d. 50%

7. Employee premiums for Employment Insurance are matched by the employer at a non-

reduced rate of:

a. 100%

b. 1.4 times the employees’ premium

c. 1.4%

d. 1.257 times the employees’ premium

© The Canadian Payroll Association – Payroll Fundamentals 2 2-31

Chapter 2

Federal Remittances and Reconciliations

8. True or False. Provincial income tax deductions for all provinces are remitted to the

Canada Revenue Agency.

False. Provincial income tax deductions for all provinces, except Québec, are

remitted to the Canada Revenue Agency.

9. The payroll register for Parker Flooring shows the following employee withholdings for

the month of February. The company has a reduced Employment Insurance premium rate

of 1.257. The employer is an accelerated threshold 2 remitter.

i) Calculate the remittance total for each pay period and the total amount remitted for

the month.

ii) The pay date for pay period 3 is February 2; the pay date for pay period 4 is February

16. Using the current year calendar provided in the chapter, when are these

remittances due to the Canada Revenue Agency?

Remittance due date for pay period 3: February 12

Remittance due date for pay period 4: February 26

PROVINCIAL

PAY EMPLOYEE EMPLOYER EMPLOYEE EMPLOYER FEDERAL

TAX TOTAL

PERIOD CPP CPP EI EI TAX

(NON-QUÉBEC)

3 15,000.00 15,000.00 18,000.00 22,626.00 95,000.00 45,000.00 210,626.00

4 22,000.00 22,000.00 21,000.00 26,397.00 102,000.00 53,000.00 246,397.00

Total 37,000.00 37,000.00 39,000.00 49,023.00 197,000.00 98,000.00 457,023.00

10. What is the purpose of reconciling the Canada Revenue Agency account?

The reconciliation is used to verify that all the statutory deductions withheld from

the employees’ pay, along with any employer portion, have been accurately remitted

to the Receiver General by the appropriate due dates and for the correct business

number or payroll program account number. By reconciling the organization’s

payroll remittance totals to the Statement of Account for Current Source Deductions

on a monthly basis or at the end of each remitting period, employers will find any

discrepancies as they occur and resolve them in a timely manner.

11. After reconciling their Canada Revenue Agency account in May, an employer realizes

that they have overpaid their account by $10,000.00. How can they correct this?

The employer can reduce their next remittance by the amount of the overpayment,

$10,000.00.

© The Canadian Payroll Association – Payroll Fundamentals 2 2-32

You might also like

- Electric Vehicle Loan CertificateDocument1 pageElectric Vehicle Loan Certificatejavedmonis0775% (16)

- Certified Payroll Professional (CPP) Exam Study GuideDocument20 pagesCertified Payroll Professional (CPP) Exam Study GuideMcRee Learning Center0% (3)

- pf1 Chap 1 en CaDocument42 pagespf1 Chap 1 en CaSaira Fazal0% (1)

- PCL Chap 1 en CaDocument42 pagesPCL Chap 1 en CaLaura100% (1)

- Payroll Compliance and LegislationDocument578 pagesPayroll Compliance and LegislationMujtaba Ahmed SyedNo ratings yet

- CPA Exam Regulation - Entity Comparison ChartDocument5 pagesCPA Exam Regulation - Entity Comparison ChartMelissa Abel100% (1)

- 2013 REG Last Minute Study Notes (Bonus)Document47 pages2013 REG Last Minute Study Notes (Bonus)olegscherbina100% (3)

- PCL Chap 4 en CaDocument70 pagesPCL Chap 4 en CaRenso Ramirez100% (1)

- Garden and Landscaping EmporiumDocument7 pagesGarden and Landscaping EmporiumNatalie DaguiamNo ratings yet

- 2015UniformEvaluation PaperIII PDFDocument26 pages2015UniformEvaluation PaperIII PDFAdayyat M.No ratings yet

- Premium Receipt - 008927742 - 131423Document2 pagesPremium Receipt - 008927742 - 131423Vignesh MahadevanNo ratings yet

- pcl14 Chap 1 en CaDocument41 pagespcl14 Chap 1 en CaNAOMI0% (1)

- PCL Chap 2 en Ca PDFDocument45 pagesPCL Chap 2 en Ca PDFRenso Ramirez JimenezNo ratings yet

- Ike Petrov Started A Tour Company Tour Along On October 1Document1 pageIke Petrov Started A Tour Company Tour Along On October 1Hassan JanNo ratings yet

- Chapter 11 - Computation of Taxable Income and TaxDocument22 pagesChapter 11 - Computation of Taxable Income and TaxMichelle Tan100% (1)

- Reg Notes CPADocument1 pageReg Notes CPAAdam JamesNo ratings yet

- Canada Pension PlanDocument9 pagesCanada Pension PlanclaokerNo ratings yet

- PCL Chap 4 en CaDocument69 pagesPCL Chap 4 en CaMitchieNo ratings yet

- PF1 Chapter 2 - Employment Income - Regular EarningsDocument55 pagesPF1 Chapter 2 - Employment Income - Regular EarningsNamie NamieNo ratings yet

- pf2 Chap 1 en CaDocument77 pagespf2 Chap 1 en CaAnonymous nuACn5NJ2bNo ratings yet

- 655 Week 12 Notes PDFDocument63 pages655 Week 12 Notes PDFsanaha786No ratings yet

- pf1 Chap 4 en CaDocument67 pagespf1 Chap 4 en CaRenso RamirezNo ratings yet

- pf1 Chap 4 en CaDocument61 pagespf1 Chap 4 en CaSaira Fazal100% (1)

- 2023 PCL Chapter 3 CPP Ei RequirementsDocument59 pages2023 PCL Chapter 3 CPP Ei RequirementsSkyNo ratings yet

- PF1 Chapter 3 - Employment Income - Allowances, Expenses and BenefitsDocument84 pagesPF1 Chapter 3 - Employment Income - Allowances, Expenses and BenefitsNamie NamieNo ratings yet

- PF1 Chapter 8 SlidesDocument47 pagesPF1 Chapter 8 SlidesNamie Namie100% (1)

- Payroll Fundamentals: RequiredDocument6 pagesPayroll Fundamentals: RequiredJoel Christian MascariñaNo ratings yet

- Payroll Interview QuestionsDocument2 pagesPayroll Interview Questionssevllass359No ratings yet

- Payroll Study SheetsDocument2 pagesPayroll Study SheetsNatalie DeLazzari VerberkNo ratings yet

- Principle of Accounting 2 - Unit 6Document24 pagesPrinciple of Accounting 2 - Unit 6Asmamaw50% (2)

- Notes Chapter 4 REGDocument7 pagesNotes Chapter 4 REGcpacfa100% (7)

- Notes Chapter 2 REGDocument7 pagesNotes Chapter 2 REGcpacfa100% (10)

- Notes Chapter 3 REGDocument7 pagesNotes Chapter 3 REGcpacfa90% (10)

- Notes Chapter 7 REGDocument9 pagesNotes Chapter 7 REGcpacfa100% (6)

- Frequently Asked Tax Questions 2015sdaDocument8 pagesFrequently Asked Tax Questions 2015sdaVikram VickyNo ratings yet

- Far Final ReviewDocument13 pagesFar Final ReviewFutureMsCPA100% (1)

- 05-Introduction To Payroll PDFDocument32 pages05-Introduction To Payroll PDFHetinawati HarahapNo ratings yet

- CH 3 PeyrollDocument9 pagesCH 3 PeyrollChalachew Eyob100% (1)

- Payroll DeductionsDocument63 pagesPayroll Deductionsishu1707No ratings yet

- BEC NotesDocument17 pagesBEC NotescsugroupNo ratings yet

- CPA Regulation Notes - ChapDocument23 pagesCPA Regulation Notes - ChapSteve DolphNo ratings yet

- Payroll Deductions-The Basics For An Employer - BDC - CaDocument3 pagesPayroll Deductions-The Basics For An Employer - BDC - CaIgor MirandaNo ratings yet

- Accounting For Liability Categories Payable, Accrued and Estimated Liabilities - WrittenReportDocument18 pagesAccounting For Liability Categories Payable, Accrued and Estimated Liabilities - WrittenReportCaren ReasNo ratings yet

- Financial 12. UnitDocument17 pagesFinancial 12. UnitBener GüngörNo ratings yet

- Income Tax Practical FAQDocument4 pagesIncome Tax Practical FAQHasidul Islam ImranNo ratings yet

- Employee Tax Withholding GuideDocument355 pagesEmployee Tax Withholding GuideCassie JaysonNo ratings yet

- Chapter 9 - NPA PDFDocument98 pagesChapter 9 - NPA PDFSuraj ChauhanNo ratings yet

- Module 1Document31 pagesModule 1Jiane SanicoNo ratings yet

- Revenue Recognition PDFDocument6 pagesRevenue Recognition PDFObilesu RekatlaNo ratings yet

- Payroll Accounting Edited For StudentsDocument12 pagesPayroll Accounting Edited For StudentsMc Gregour LoretoNo ratings yet

- Basic Concepts of TaxationDocument9 pagesBasic Concepts of TaxationAyush BholeNo ratings yet

- Unit 1 AnswersDocument119 pagesUnit 1 AnswersSafaetplayzNo ratings yet

- Paychex Reference Guide For Accountants: 2015 Year-End 2016 TaxbriefDocument24 pagesPaychex Reference Guide For Accountants: 2015 Year-End 2016 TaxbriefnaguficoNo ratings yet

- COVID-19 Relief HandbookDocument19 pagesCOVID-19 Relief HandbookVo DanhNo ratings yet

- SPECIALIZED FABM2 Module 03 Week 03 - Statement of Financial Position Part 2Document9 pagesSPECIALIZED FABM2 Module 03 Week 03 - Statement of Financial Position Part 2lams.ronaldsunigaNo ratings yet

- 2023 PF2 Chapter 3 - Year End - FederalDocument111 pages2023 PF2 Chapter 3 - Year End - Federalxiahq163No ratings yet

- BHFL Customer Awareness On Loan Repayment.Document2 pagesBHFL Customer Awareness On Loan Repayment.Kathir AmuthanNo ratings yet

- 2023 PCL Chapter 4 Income TaxDocument67 pages2023 PCL Chapter 4 Income TaxSkyNo ratings yet

- Module 2 Slides - Employment TaxesDocument30 pagesModule 2 Slides - Employment Taxesjciy4No ratings yet

- Cash PolicyDocument6 pagesCash PolicyMazhar Ali JoyoNo ratings yet

- The CARES Act and The Benefits For Small Businesses - March 31 2020Document30 pagesThe CARES Act and The Benefits For Small Businesses - March 31 2020Jonathan FoxNo ratings yet

- FRS 102 - Employee BenefitsDocument3 pagesFRS 102 - Employee BenefitsArogundade kamaldeenNo ratings yet

- Income Tax May23 Free ResourcesDocument321 pagesIncome Tax May23 Free ResourcesPurna PatelNo ratings yet

- MCOM Direct Tax Laws 01 (1) - Merged-MinDocument464 pagesMCOM Direct Tax Laws 01 (1) - Merged-MinAlexis ParrisNo ratings yet

- PDF 70294786 1694423867565Document8 pagesPDF 70294786 1694423867565Niteshwar Nath [Sales]No ratings yet

- The Pace Makers-4Document38 pagesThe Pace Makers-4TULI MODAKNo ratings yet

- Test Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsDocument11 pagesTest Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsAnshul JainNo ratings yet

- Ita Uk 2007Document773 pagesIta Uk 2007Nabilah ShahidanNo ratings yet

- Income Tax A.Y. 2023-24Document6 pagesIncome Tax A.Y. 2023-24sandeepsbiradar100% (3)

- Taxation Semester VI T. Y. B. ComDocument265 pagesTaxation Semester VI T. Y. B. ComSushant kawade100% (1)

- CBDT Circular 5 of 2016 - 29.02.2016 - No TDS Ad Agency PaymentsDocument1 pageCBDT Circular 5 of 2016 - 29.02.2016 - No TDS Ad Agency PaymentsSubramanyam SettyNo ratings yet

- Shashi BekalDocument6 pagesShashi BekalAdvocateNitinsharmaNo ratings yet

- Manappuram Finance Limited: SR - NoDocument5 pagesManappuram Finance Limited: SR - NoRajesh KumarNo ratings yet

- Taxation SyllabusDocument2 pagesTaxation SyllabusAmanNo ratings yet

- Ram Baan - Direct Tax MAY - 23: Ca Vikram BiyaniDocument179 pagesRam Baan - Direct Tax MAY - 23: Ca Vikram Biyanigirish bhattNo ratings yet

- 5254 - Tax Regime - 2024 - 240408 - 212256Document3 pages5254 - Tax Regime - 2024 - 240408 - 212256sunil78No ratings yet

- Income Tax Return AMANDocument35 pagesIncome Tax Return AMANNadeem ChoudharyNo ratings yet

- LDC Tax Practice Notes 2024 MasikaDocument20 pagesLDC Tax Practice Notes 2024 Masikamasika fauziahNo ratings yet

- CA Final Direct Tax Suggested Answer Nov 2020 OldDocument25 pagesCA Final Direct Tax Suggested Answer Nov 2020 OldBhumeeka GargNo ratings yet

- Income Tax MeaningDocument11 pagesIncome Tax Meaningrishabhp804No ratings yet

- 62294bos50449 Mod2 cp9Document17 pages62294bos50449 Mod2 cp9monicabhat96No ratings yet

- AIR Online - Search Legal Citations For FreeDocument15 pagesAIR Online - Search Legal Citations For FreeAditya Kumar UpadhyayNo ratings yet

- Tax Sybba FinanceDocument9 pagesTax Sybba FinancemayurNo ratings yet

- IT AE 36 G05 Comprehensive Guide To The ITR12 Income Tax Return For Individuals External GuideDocument114 pagesIT AE 36 G05 Comprehensive Guide To The ITR12 Income Tax Return For Individuals External GuideMario BorgesNo ratings yet

- Tax Nov 21 RTPDocument25 pagesTax Nov 21 RTPShailjaNo ratings yet

- 74792bos60498 cp1Document104 pages74792bos60498 cp1Ankita DebtaNo ratings yet

- Byrd and Chens Canadian Tax Principles 2011 2012 Edition Canadian 1st Edition Byrd Test BankDocument59 pagesByrd and Chens Canadian Tax Principles 2011 2012 Edition Canadian 1st Edition Byrd Test BankDavidRobertsdszbc100% (14)

- DIT v. Jyoti Foundation (2013) 357 ITR 388 (Del.)Document5 pagesDIT v. Jyoti Foundation (2013) 357 ITR 388 (Del.)madhusudhan u aNo ratings yet

- Chapter - Non Resident TaxationDocument162 pagesChapter - Non Resident TaxationsayanghoshNo ratings yet

- Basic Concepts of TaxDocument6 pagesBasic Concepts of TaxAshutosh Dubey AshuNo ratings yet