Professional Documents

Culture Documents

Advanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part M)

Advanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part M)

Uploaded by

John Carlos DoringoCopyright:

Available Formats

You might also like

- Fundamental Accounting Principles Volume 2 Canadian 15th Edition Larson Solutions ManualDocument10 pagesFundamental Accounting Principles Volume 2 Canadian 15th Edition Larson Solutions ManualDonald Cacioppo100% (42)

- AIS Chapter 1 Question and Answer (Set B)Document2 pagesAIS Chapter 1 Question and Answer (Set B)John Carlos Doringo100% (2)

- Quicksheet FRM Part IIDocument7 pagesQuicksheet FRM Part IITheodoros NikolaidisNo ratings yet

- (Set D) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersDocument2 pages(Set D) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersJohn Carlos DoringoNo ratings yet

- Cortez Practice Set JanuaryDocument5 pagesCortez Practice Set JanuaryChristian LapidNo ratings yet

- Edney Company Employs A Standard Cost System For Product CostingDocument2 pagesEdney Company Employs A Standard Cost System For Product CostingAmit PandeyNo ratings yet

- Investingunplugged PDFDocument225 pagesInvestingunplugged PDFWilliam MercerNo ratings yet

- Chapter 18Document16 pagesChapter 18Faisal AminNo ratings yet

- Tugas ALK Chapter 7Document8 pagesTugas ALK Chapter 7Alief AmbyaNo ratings yet

- Advanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part I)Document1 pageAdvanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part I)John Carlos DoringoNo ratings yet

- Advanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part J)Document1 pageAdvanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part J)John Carlos DoringoNo ratings yet

- CPAR CompilationDocument49 pagesCPAR CompilationMarjorie ParaynoNo ratings yet

- CPAR Deductions (Batch 89) HandoutDocument26 pagesCPAR Deductions (Batch 89) HandoutlllllNo ratings yet

- Week 8 PreTest AFARDocument27 pagesWeek 8 PreTest AFARCale HenituseNo ratings yet

- Auditing Theory Notes RA 9298Document5 pagesAuditing Theory Notes RA 9298Honeylyne PlazaNo ratings yet

- P 1Document13 pagesP 1Ryan Joseph Agluba DimacaliNo ratings yet

- Autumn Company Has A Single Product Called Kyoto. ...Document2 pagesAutumn Company Has A Single Product Called Kyoto. ...Princes IsorenaNo ratings yet

- Afar NotesDocument20 pagesAfar NotesChristian James Umali BrionesNo ratings yet

- DagohoyDocument6 pagesDagohoylinkin soyNo ratings yet

- Intthry at Long Quiz 1 Answer Key 012718Document12 pagesIntthry at Long Quiz 1 Answer Key 012718Racel DelacruzNo ratings yet

- Week 5 Problem 15Document2 pagesWeek 5 Problem 15Rachelle RodriguezNo ratings yet

- UNIT 3 Accounts Receivable PDFDocument11 pagesUNIT 3 Accounts Receivable PDFVilma HermosadoNo ratings yet

- Chapter 26Document8 pagesChapter 26Mae Ciarie YangcoNo ratings yet

- RFBT 07 CorporationsDocument16 pagesRFBT 07 CorporationsMary Grace Galenzoga ButronNo ratings yet

- Dry RunDocument5 pagesDry RunMarc MagbalonNo ratings yet

- RFBT.3410 Insurance Labor SSS PDFDocument39 pagesRFBT.3410 Insurance Labor SSS PDFMonica GarciaNo ratings yet

- Acco 20133 - Unit Iii & Iv - CreateDocument35 pagesAcco 20133 - Unit Iii & Iv - CreateHarvey AguilarNo ratings yet

- AFAR B41 First Pre-Board Exams (Questions, Answers & Solutions) .Document24 pagesAFAR B41 First Pre-Board Exams (Questions, Answers & Solutions) .Prances ObiasNo ratings yet

- Activity Optimization TechniquesDocument2 pagesActivity Optimization TechniquesAliezaNo ratings yet

- Sol Manchapter 5 Corporate Liquidation Reorganizationacctg For Special Transactions PDF FreeDocument15 pagesSol Manchapter 5 Corporate Liquidation Reorganizationacctg For Special Transactions PDF FreeJane GavinoNo ratings yet

- Management Advisory Services - FinalDocument8 pagesManagement Advisory Services - FinalFrancis MateosNo ratings yet

- MS Last Minute by HerculesDocument6 pagesMS Last Minute by HerculesFranklin ValdezNo ratings yet

- Module 3 - Partnership DissolutionDocument54 pagesModule 3 - Partnership DissolutionMaluDyNo ratings yet

- 03 ACCTNG-FOR-BUSINESS-COMBINATION-MERGER-AND-CONSOLIDATION-Problems-Part-1Document5 pages03 ACCTNG-FOR-BUSINESS-COMBINATION-MERGER-AND-CONSOLIDATION-Problems-Part-1Ma Jessa Kathryl Alar IINo ratings yet

- Civil SocietyDocument6 pagesCivil SocietyBethel DizonNo ratings yet

- Psa 550 FNDocument1 pagePsa 550 FNkristel-marie-pitogo-4419No ratings yet

- Sol. Man. - Chapter 11 - Partnership FormationDocument12 pagesSol. Man. - Chapter 11 - Partnership FormationpehikNo ratings yet

- 06 Activity 1 Renion-SenaDocument2 pages06 Activity 1 Renion-SenaGoose ChanNo ratings yet

- AFAR 2306 - Home Office, Branch & Agency AcctgDocument5 pagesAFAR 2306 - Home Office, Branch & Agency AcctgDzulija TalipanNo ratings yet

- ExperimentDocument37 pagesExperimentErica Joy EscopeteNo ratings yet

- 07audit of PPEDocument9 pages07audit of PPEJeanette FormenteraNo ratings yet

- Dayag - Chapter 5 PDFDocument25 pagesDayag - Chapter 5 PDFKen ZafraNo ratings yet

- Accounting For Labor 3Document13 pagesAccounting For Labor 3Charles Reginald K. HwangNo ratings yet

- Rmbe AfarDocument13 pagesRmbe AfarMiss FermiaNo ratings yet

- Bpo Quiz 1Document2 pagesBpo Quiz 1KaylaMae ZamoraNo ratings yet

- Afar SolutionsDocument8 pagesAfar Solutionspopsie tulalianNo ratings yet

- Afar 02 - Partnership DissolutionDocument8 pagesAfar 02 - Partnership DissolutionMarie GonzalesNo ratings yet

- Statement of Cash FlowsDocument2 pagesStatement of Cash FlowsMae MarinoNo ratings yet

- Assignment 3.1 Acctg020 - Arsoler (Costing System)Document3 pagesAssignment 3.1 Acctg020 - Arsoler (Costing System)Xyra ArsolerNo ratings yet

- AFST - Oct 17Document9 pagesAFST - Oct 17kimkimNo ratings yet

- ROMERO BSMA1E Standard Costing ExerciseDocument4 pagesROMERO BSMA1E Standard Costing ExerciseAliah Romero100% (1)

- 2 - Partnership OperationsDocument6 pages2 - Partnership OperationsAangela Del Rosario CorpuzNo ratings yet

- Ifrs 9 Debt Investment IllustrationDocument9 pagesIfrs 9 Debt Investment IllustrationVatchdemonNo ratings yet

- Long-Term Construction Contracts and FranchisingDocument16 pagesLong-Term Construction Contracts and FranchisingAlexis SosingNo ratings yet

- Installment Deferred Payment Method of Reporting IncomeDocument2 pagesInstallment Deferred Payment Method of Reporting IncomeJennifer RueloNo ratings yet

- Practical Accounting 2 - SolutionDocument5 pagesPractical Accounting 2 - SolutionjaysonNo ratings yet

- Group 4 - Assignment #7Document20 pagesGroup 4 - Assignment #7Rhad Lester C. MaestradoNo ratings yet

- Parcor TrainingDocument12 pagesParcor TrainingKarl ExacNo ratings yet

- Review and Discussion Questions Chapter TenDocument5 pagesReview and Discussion Questions Chapter TenDaniel DialinoNo ratings yet

- Practical Accounting 1: I ExamcoverageDocument12 pagesPractical Accounting 1: I ExamcoverageCharry Ramos0% (2)

- Summary Bonds Payable PDFDocument6 pagesSummary Bonds Payable PDFRovi PatinoNo ratings yet

- FAR.2950 - Interim Financial ReportingDocument3 pagesFAR.2950 - Interim Financial ReportingEdmark LuspeNo ratings yet

- Internal Control ProcessesDocument18 pagesInternal Control ProcessesKlaryz D. MirandillaNo ratings yet

- 05 Quiz 1Document3 pages05 Quiz 1Goose ChanNo ratings yet

- Philippine Framework For Assurance EngagementsDocument6 pagesPhilippine Framework For Assurance Engagementsjoyce KimNo ratings yet

- Quantity Schedule: Cost Accounted For As FollowsDocument5 pagesQuantity Schedule: Cost Accounted For As FollowsJoshua CabinasNo ratings yet

- Advanced-Accounting-Part 2-Dayag-2015-Chapter-15Document31 pagesAdvanced-Accounting-Part 2-Dayag-2015-Chapter-15allysa amping100% (1)

- Beltran v. Samson, 53 Phil. 570Document5 pagesBeltran v. Samson, 53 Phil. 570John Carlos DoringoNo ratings yet

- AIS Multiple Choice Question and Answer (Chapter 2 - Set B)Document2 pagesAIS Multiple Choice Question and Answer (Chapter 2 - Set B)John Carlos Doringo67% (3)

- Galman v. Pamaran, 138 SCRA 294Document72 pagesGalman v. Pamaran, 138 SCRA 294John Carlos DoringoNo ratings yet

- AIS Chapter 1 Question and Answer (Set E)Document3 pagesAIS Chapter 1 Question and Answer (Set E)John Carlos DoringoNo ratings yet

- AIS Chapter 1 Question and Answer (Set D)Document4 pagesAIS Chapter 1 Question and Answer (Set D)John Carlos DoringoNo ratings yet

- AIS Chapter 1 Question and Answer (Set C)Document2 pagesAIS Chapter 1 Question and Answer (Set C)John Carlos Doringo100% (1)

- AIS Multiple Choice Question and Answer (Chapter 2 - Set D)Document2 pagesAIS Multiple Choice Question and Answer (Chapter 2 - Set D)John Carlos Doringo100% (1)

- AIS Multiple Choice Question and Answer (Chapter 2 - Set F)Document2 pagesAIS Multiple Choice Question and Answer (Chapter 2 - Set F)John Carlos Doringo100% (1)

- Advanced Accounting - Dayag 2015 - Chapter 8 - Problems IXDocument2 pagesAdvanced Accounting - Dayag 2015 - Chapter 8 - Problems IXJohn Carlos DoringoNo ratings yet

- AIS Multiple Choice Question and Answer (Chapter 2 - Set E)Document3 pagesAIS Multiple Choice Question and Answer (Chapter 2 - Set E)John Carlos DoringoNo ratings yet

- Set D (True or False), Question and Answers Chapter 20 - BudgetingDocument2 pagesSet D (True or False), Question and Answers Chapter 20 - BudgetingJohn Carlos DoringoNo ratings yet

- Set E (MC), Question and Answers Chapter 20 - BudgetingDocument3 pagesSet E (MC), Question and Answers Chapter 20 - BudgetingJohn Carlos DoringoNo ratings yet

- Set D (MC), Question and Answers Chapter 20 - BudgetingDocument4 pagesSet D (MC), Question and Answers Chapter 20 - BudgetingJohn Carlos DoringoNo ratings yet

- Set B Multiple Choice, Chapter 24 - Capital Investment AnalysisDocument2 pagesSet B Multiple Choice, Chapter 24 - Capital Investment AnalysisJohn Carlos DoringoNo ratings yet

- (Set E) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersDocument2 pages(Set E) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersJohn Carlos DoringoNo ratings yet

- (Set E) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersDocument2 pages(Set E) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersJohn Carlos DoringoNo ratings yet

- (Set F) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersDocument4 pages(Set F) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersJohn Carlos DoringoNo ratings yet

- IFRS 9 Financial Instruments - v2Document93 pagesIFRS 9 Financial Instruments - v2Emil John SughuNo ratings yet

- Article FMGGDocument17 pagesArticle FMGGErmi ManNo ratings yet

- Format of Holding of Specified Securities Network18 Media & Investments LimitedDocument6 pagesFormat of Holding of Specified Securities Network18 Media & Investments LimitedDigvijayNo ratings yet

- Contact Session 2 Slides - ACN100 Second Semester-1Document42 pagesContact Session 2 Slides - ACN100 Second Semester-1Ronald RamorokaNo ratings yet

- Chapter 17 MCQDocument3 pagesChapter 17 MCQAhmed GemyNo ratings yet

- Answers To Mcqs TutorialDocument30 pagesAnswers To Mcqs TutorialDuy TrịnhNo ratings yet

- Bond and Equity Trading Strategies UZ Assignment 2Document15 pagesBond and Equity Trading Strategies UZ Assignment 2Milton ChinhoroNo ratings yet

- Chapter 11 ExercisesDocument2 pagesChapter 11 ExercisesAreeba QureshiNo ratings yet

- Chapter 25. Tool Kit For Mergers, Lbos, Divestitures, and Holding CompaniesDocument22 pagesChapter 25. Tool Kit For Mergers, Lbos, Divestitures, and Holding CompaniesPrashantKNo ratings yet

- Tutorial 1. FA2Document11 pagesTutorial 1. FA2bolaemil20No ratings yet

- Financial Accounting (Bbaw2103)Document10 pagesFinancial Accounting (Bbaw2103)tachaini2727No ratings yet

- Gland Pharma LimitedDocument316 pagesGland Pharma LimitedPranav WarneNo ratings yet

- Capital Budgeting TechniquesDocument60 pagesCapital Budgeting Techniquesaxl11No ratings yet

- Annexure 10Document4 pagesAnnexure 10Tushar AhujaNo ratings yet

- Financial Statements, Taxes and Cash Flow: Prepared by Jason Wong, MBA, CPA, CMADocument34 pagesFinancial Statements, Taxes and Cash Flow: Prepared by Jason Wong, MBA, CPA, CMASukh MakkarNo ratings yet

- Notes-Unit-3-Final Accounts - (Partial)Document12 pagesNotes-Unit-3-Final Accounts - (Partial)happy lifeNo ratings yet

- 5 Brickfields L AGM 2020Document3 pages5 Brickfields L AGM 2020Sooriapraba VanugopalNo ratings yet

- Average Score: Perdana Petroleum (Perdana-Ku)Document11 pagesAverage Score: Perdana Petroleum (Perdana-Ku)Zhi Ming CheahNo ratings yet

- Azam in 30 DuaDocument3 pagesAzam in 30 DuafaizaninNo ratings yet

- PRE - BOARD - 2 (2023-2024) : Grade: 12 Marks: 80 Subject: Accountancy Time: 3HRS General InstructionsDocument12 pagesPRE - BOARD - 2 (2023-2024) : Grade: 12 Marks: 80 Subject: Accountancy Time: 3HRS General InstructionsKaustav DasNo ratings yet

- FA1 BPP Chapter 2 Assets, Liabilities & Accounting EquationDocument19 pagesFA1 BPP Chapter 2 Assets, Liabilities & Accounting EquationS RaihanNo ratings yet

- Microsoft Word - Nigerian Bottling Company PLC FinalDocument20 pagesMicrosoft Word - Nigerian Bottling Company PLC FinalAkindeyi AnuNo ratings yet

- Ukk 2023 P2-Kunci Jawaban RevDocument47 pagesUkk 2023 P2-Kunci Jawaban RevSaepul RohmanNo ratings yet

- Bajaj FinanceDocument10 pagesBajaj FinanceJeniffer RayenNo ratings yet

- FM Assignment N0.1Document4 pagesFM Assignment N0.1Hafiz Usman ShariefNo ratings yet

Advanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part M)

Advanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part M)

Uploaded by

John Carlos DoringoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part M)

Advanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part M)

Uploaded by

John Carlos DoringoCopyright:

Available Formats

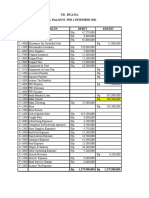

Chapter 17

Multiple Choice Problems

73. c

Cost of Sales

P Company 196,000

S Company _112,000

Total 308,000

Less: Intercompany sales 140,000

Add: Unrealized profit in EI of S Co.

[P140,000 x 60% = P84,000 x (140 - 112)/140] _16,800

Consolidated 184,800

74. a or e - if full goodwill method.

Non-controlling interest (partial-goodwill), December 31, 20x4

Common stock – S Company, December 31, 20x4…… P 140,000

Retained earnings – S Company, December 31, 20x4

Retained earnings – S Company, January 1, 20x4 P210,000

Add: Net income of S for 20x4 154,000

Total P364,000

Less: Dividends paid – 20x4 0 364,000

Stockholders’ equity – S Company, December 31, 20x4 P 504,000

Adjustments to reflect fair value - (over) undervaluation of assets and

liabilities, date of acquisition (January 1, 20x4) 35,000

Amortization of allocated excess (refer to amortization above) :

20x5 (P35,000/7 years) ( 5,000)

Fair value of stockholders’ equity of S, December 31, 20x5…… P 534,000

Multiplied by: Non-controlling Interest percentage…………... 20

Non-controlling interest (partial goodwill)………………………………….. P 106,800

Add: NCI on full-goodwill (P70,000 – P56,000) 14,000

Non-controlling interest (full- goodwill)………………………………….. P 120,800

Partial-goodwill

Fair value of Subsidiary (80%)

Consideration transferred……………………………….. P 364,000

Less: Book value of stockholders’ equity of S:

Common stock (P140,000 x 80%)……………………. P112,000

Retained earnings (P210,000 x 80%)………………... 168,000 280,000

Allocated excess (excess of cost over book value)….. P 84,000

Less: Over/under valuation of assets and liabilities:

Increase in equipment (P35,000 x 80%) ___28,000

Positive excess: Partial-goodwill (excess of cost over

fair value)………………………………………………... P 56,000

Full-goodwill

Fair value of Subsidiary (100%)

Consideration transferred: Cash (P364,000/80%) P 455,000

Less: Book value of stockholders’ equity of S (P350,000 x 100%) __350,000

Allocated excess (excess of cost over book value)….. P 105,000

Add (deduct): (Over) under valuation of assets and liabilities

Increase in equipment P35,000 x 100% 35,000

Positive excess: Full-goodwill (excess of cost over

fair value)………………………………………………... P 70,000

75. d

Equipment

P Company 616,000

S Company 420,000

Total 1,036,000

Add: Undervalued equipment 35,000

Less: Depreciation on undervalued equipment (P35,000/7 years) 7,000

Consolidated 1,064,000

You might also like

- Fundamental Accounting Principles Volume 2 Canadian 15th Edition Larson Solutions ManualDocument10 pagesFundamental Accounting Principles Volume 2 Canadian 15th Edition Larson Solutions ManualDonald Cacioppo100% (42)

- AIS Chapter 1 Question and Answer (Set B)Document2 pagesAIS Chapter 1 Question and Answer (Set B)John Carlos Doringo100% (2)

- Quicksheet FRM Part IIDocument7 pagesQuicksheet FRM Part IITheodoros NikolaidisNo ratings yet

- (Set D) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersDocument2 pages(Set D) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersJohn Carlos DoringoNo ratings yet

- Cortez Practice Set JanuaryDocument5 pagesCortez Practice Set JanuaryChristian LapidNo ratings yet

- Edney Company Employs A Standard Cost System For Product CostingDocument2 pagesEdney Company Employs A Standard Cost System For Product CostingAmit PandeyNo ratings yet

- Investingunplugged PDFDocument225 pagesInvestingunplugged PDFWilliam MercerNo ratings yet

- Chapter 18Document16 pagesChapter 18Faisal AminNo ratings yet

- Tugas ALK Chapter 7Document8 pagesTugas ALK Chapter 7Alief AmbyaNo ratings yet

- Advanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part I)Document1 pageAdvanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part I)John Carlos DoringoNo ratings yet

- Advanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part J)Document1 pageAdvanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part J)John Carlos DoringoNo ratings yet

- CPAR CompilationDocument49 pagesCPAR CompilationMarjorie ParaynoNo ratings yet

- CPAR Deductions (Batch 89) HandoutDocument26 pagesCPAR Deductions (Batch 89) HandoutlllllNo ratings yet

- Week 8 PreTest AFARDocument27 pagesWeek 8 PreTest AFARCale HenituseNo ratings yet

- Auditing Theory Notes RA 9298Document5 pagesAuditing Theory Notes RA 9298Honeylyne PlazaNo ratings yet

- P 1Document13 pagesP 1Ryan Joseph Agluba DimacaliNo ratings yet

- Autumn Company Has A Single Product Called Kyoto. ...Document2 pagesAutumn Company Has A Single Product Called Kyoto. ...Princes IsorenaNo ratings yet

- Afar NotesDocument20 pagesAfar NotesChristian James Umali BrionesNo ratings yet

- DagohoyDocument6 pagesDagohoylinkin soyNo ratings yet

- Intthry at Long Quiz 1 Answer Key 012718Document12 pagesIntthry at Long Quiz 1 Answer Key 012718Racel DelacruzNo ratings yet

- Week 5 Problem 15Document2 pagesWeek 5 Problem 15Rachelle RodriguezNo ratings yet

- UNIT 3 Accounts Receivable PDFDocument11 pagesUNIT 3 Accounts Receivable PDFVilma HermosadoNo ratings yet

- Chapter 26Document8 pagesChapter 26Mae Ciarie YangcoNo ratings yet

- RFBT 07 CorporationsDocument16 pagesRFBT 07 CorporationsMary Grace Galenzoga ButronNo ratings yet

- Dry RunDocument5 pagesDry RunMarc MagbalonNo ratings yet

- RFBT.3410 Insurance Labor SSS PDFDocument39 pagesRFBT.3410 Insurance Labor SSS PDFMonica GarciaNo ratings yet

- Acco 20133 - Unit Iii & Iv - CreateDocument35 pagesAcco 20133 - Unit Iii & Iv - CreateHarvey AguilarNo ratings yet

- AFAR B41 First Pre-Board Exams (Questions, Answers & Solutions) .Document24 pagesAFAR B41 First Pre-Board Exams (Questions, Answers & Solutions) .Prances ObiasNo ratings yet

- Activity Optimization TechniquesDocument2 pagesActivity Optimization TechniquesAliezaNo ratings yet

- Sol Manchapter 5 Corporate Liquidation Reorganizationacctg For Special Transactions PDF FreeDocument15 pagesSol Manchapter 5 Corporate Liquidation Reorganizationacctg For Special Transactions PDF FreeJane GavinoNo ratings yet

- Management Advisory Services - FinalDocument8 pagesManagement Advisory Services - FinalFrancis MateosNo ratings yet

- MS Last Minute by HerculesDocument6 pagesMS Last Minute by HerculesFranklin ValdezNo ratings yet

- Module 3 - Partnership DissolutionDocument54 pagesModule 3 - Partnership DissolutionMaluDyNo ratings yet

- 03 ACCTNG-FOR-BUSINESS-COMBINATION-MERGER-AND-CONSOLIDATION-Problems-Part-1Document5 pages03 ACCTNG-FOR-BUSINESS-COMBINATION-MERGER-AND-CONSOLIDATION-Problems-Part-1Ma Jessa Kathryl Alar IINo ratings yet

- Civil SocietyDocument6 pagesCivil SocietyBethel DizonNo ratings yet

- Psa 550 FNDocument1 pagePsa 550 FNkristel-marie-pitogo-4419No ratings yet

- Sol. Man. - Chapter 11 - Partnership FormationDocument12 pagesSol. Man. - Chapter 11 - Partnership FormationpehikNo ratings yet

- 06 Activity 1 Renion-SenaDocument2 pages06 Activity 1 Renion-SenaGoose ChanNo ratings yet

- AFAR 2306 - Home Office, Branch & Agency AcctgDocument5 pagesAFAR 2306 - Home Office, Branch & Agency AcctgDzulija TalipanNo ratings yet

- ExperimentDocument37 pagesExperimentErica Joy EscopeteNo ratings yet

- 07audit of PPEDocument9 pages07audit of PPEJeanette FormenteraNo ratings yet

- Dayag - Chapter 5 PDFDocument25 pagesDayag - Chapter 5 PDFKen ZafraNo ratings yet

- Accounting For Labor 3Document13 pagesAccounting For Labor 3Charles Reginald K. HwangNo ratings yet

- Rmbe AfarDocument13 pagesRmbe AfarMiss FermiaNo ratings yet

- Bpo Quiz 1Document2 pagesBpo Quiz 1KaylaMae ZamoraNo ratings yet

- Afar SolutionsDocument8 pagesAfar Solutionspopsie tulalianNo ratings yet

- Afar 02 - Partnership DissolutionDocument8 pagesAfar 02 - Partnership DissolutionMarie GonzalesNo ratings yet

- Statement of Cash FlowsDocument2 pagesStatement of Cash FlowsMae MarinoNo ratings yet

- Assignment 3.1 Acctg020 - Arsoler (Costing System)Document3 pagesAssignment 3.1 Acctg020 - Arsoler (Costing System)Xyra ArsolerNo ratings yet

- AFST - Oct 17Document9 pagesAFST - Oct 17kimkimNo ratings yet

- ROMERO BSMA1E Standard Costing ExerciseDocument4 pagesROMERO BSMA1E Standard Costing ExerciseAliah Romero100% (1)

- 2 - Partnership OperationsDocument6 pages2 - Partnership OperationsAangela Del Rosario CorpuzNo ratings yet

- Ifrs 9 Debt Investment IllustrationDocument9 pagesIfrs 9 Debt Investment IllustrationVatchdemonNo ratings yet

- Long-Term Construction Contracts and FranchisingDocument16 pagesLong-Term Construction Contracts and FranchisingAlexis SosingNo ratings yet

- Installment Deferred Payment Method of Reporting IncomeDocument2 pagesInstallment Deferred Payment Method of Reporting IncomeJennifer RueloNo ratings yet

- Practical Accounting 2 - SolutionDocument5 pagesPractical Accounting 2 - SolutionjaysonNo ratings yet

- Group 4 - Assignment #7Document20 pagesGroup 4 - Assignment #7Rhad Lester C. MaestradoNo ratings yet

- Parcor TrainingDocument12 pagesParcor TrainingKarl ExacNo ratings yet

- Review and Discussion Questions Chapter TenDocument5 pagesReview and Discussion Questions Chapter TenDaniel DialinoNo ratings yet

- Practical Accounting 1: I ExamcoverageDocument12 pagesPractical Accounting 1: I ExamcoverageCharry Ramos0% (2)

- Summary Bonds Payable PDFDocument6 pagesSummary Bonds Payable PDFRovi PatinoNo ratings yet

- FAR.2950 - Interim Financial ReportingDocument3 pagesFAR.2950 - Interim Financial ReportingEdmark LuspeNo ratings yet

- Internal Control ProcessesDocument18 pagesInternal Control ProcessesKlaryz D. MirandillaNo ratings yet

- 05 Quiz 1Document3 pages05 Quiz 1Goose ChanNo ratings yet

- Philippine Framework For Assurance EngagementsDocument6 pagesPhilippine Framework For Assurance Engagementsjoyce KimNo ratings yet

- Quantity Schedule: Cost Accounted For As FollowsDocument5 pagesQuantity Schedule: Cost Accounted For As FollowsJoshua CabinasNo ratings yet

- Advanced-Accounting-Part 2-Dayag-2015-Chapter-15Document31 pagesAdvanced-Accounting-Part 2-Dayag-2015-Chapter-15allysa amping100% (1)

- Beltran v. Samson, 53 Phil. 570Document5 pagesBeltran v. Samson, 53 Phil. 570John Carlos DoringoNo ratings yet

- AIS Multiple Choice Question and Answer (Chapter 2 - Set B)Document2 pagesAIS Multiple Choice Question and Answer (Chapter 2 - Set B)John Carlos Doringo67% (3)

- Galman v. Pamaran, 138 SCRA 294Document72 pagesGalman v. Pamaran, 138 SCRA 294John Carlos DoringoNo ratings yet

- AIS Chapter 1 Question and Answer (Set E)Document3 pagesAIS Chapter 1 Question and Answer (Set E)John Carlos DoringoNo ratings yet

- AIS Chapter 1 Question and Answer (Set D)Document4 pagesAIS Chapter 1 Question and Answer (Set D)John Carlos DoringoNo ratings yet

- AIS Chapter 1 Question and Answer (Set C)Document2 pagesAIS Chapter 1 Question and Answer (Set C)John Carlos Doringo100% (1)

- AIS Multiple Choice Question and Answer (Chapter 2 - Set D)Document2 pagesAIS Multiple Choice Question and Answer (Chapter 2 - Set D)John Carlos Doringo100% (1)

- AIS Multiple Choice Question and Answer (Chapter 2 - Set F)Document2 pagesAIS Multiple Choice Question and Answer (Chapter 2 - Set F)John Carlos Doringo100% (1)

- Advanced Accounting - Dayag 2015 - Chapter 8 - Problems IXDocument2 pagesAdvanced Accounting - Dayag 2015 - Chapter 8 - Problems IXJohn Carlos DoringoNo ratings yet

- AIS Multiple Choice Question and Answer (Chapter 2 - Set E)Document3 pagesAIS Multiple Choice Question and Answer (Chapter 2 - Set E)John Carlos DoringoNo ratings yet

- Set D (True or False), Question and Answers Chapter 20 - BudgetingDocument2 pagesSet D (True or False), Question and Answers Chapter 20 - BudgetingJohn Carlos DoringoNo ratings yet

- Set E (MC), Question and Answers Chapter 20 - BudgetingDocument3 pagesSet E (MC), Question and Answers Chapter 20 - BudgetingJohn Carlos DoringoNo ratings yet

- Set D (MC), Question and Answers Chapter 20 - BudgetingDocument4 pagesSet D (MC), Question and Answers Chapter 20 - BudgetingJohn Carlos DoringoNo ratings yet

- Set B Multiple Choice, Chapter 24 - Capital Investment AnalysisDocument2 pagesSet B Multiple Choice, Chapter 24 - Capital Investment AnalysisJohn Carlos DoringoNo ratings yet

- (Set E) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersDocument2 pages(Set E) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersJohn Carlos DoringoNo ratings yet

- (Set E) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersDocument2 pages(Set E) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersJohn Carlos DoringoNo ratings yet

- (Set F) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersDocument4 pages(Set F) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersJohn Carlos DoringoNo ratings yet

- IFRS 9 Financial Instruments - v2Document93 pagesIFRS 9 Financial Instruments - v2Emil John SughuNo ratings yet

- Article FMGGDocument17 pagesArticle FMGGErmi ManNo ratings yet

- Format of Holding of Specified Securities Network18 Media & Investments LimitedDocument6 pagesFormat of Holding of Specified Securities Network18 Media & Investments LimitedDigvijayNo ratings yet

- Contact Session 2 Slides - ACN100 Second Semester-1Document42 pagesContact Session 2 Slides - ACN100 Second Semester-1Ronald RamorokaNo ratings yet

- Chapter 17 MCQDocument3 pagesChapter 17 MCQAhmed GemyNo ratings yet

- Answers To Mcqs TutorialDocument30 pagesAnswers To Mcqs TutorialDuy TrịnhNo ratings yet

- Bond and Equity Trading Strategies UZ Assignment 2Document15 pagesBond and Equity Trading Strategies UZ Assignment 2Milton ChinhoroNo ratings yet

- Chapter 11 ExercisesDocument2 pagesChapter 11 ExercisesAreeba QureshiNo ratings yet

- Chapter 25. Tool Kit For Mergers, Lbos, Divestitures, and Holding CompaniesDocument22 pagesChapter 25. Tool Kit For Mergers, Lbos, Divestitures, and Holding CompaniesPrashantKNo ratings yet

- Tutorial 1. FA2Document11 pagesTutorial 1. FA2bolaemil20No ratings yet

- Financial Accounting (Bbaw2103)Document10 pagesFinancial Accounting (Bbaw2103)tachaini2727No ratings yet

- Gland Pharma LimitedDocument316 pagesGland Pharma LimitedPranav WarneNo ratings yet

- Capital Budgeting TechniquesDocument60 pagesCapital Budgeting Techniquesaxl11No ratings yet

- Annexure 10Document4 pagesAnnexure 10Tushar AhujaNo ratings yet

- Financial Statements, Taxes and Cash Flow: Prepared by Jason Wong, MBA, CPA, CMADocument34 pagesFinancial Statements, Taxes and Cash Flow: Prepared by Jason Wong, MBA, CPA, CMASukh MakkarNo ratings yet

- Notes-Unit-3-Final Accounts - (Partial)Document12 pagesNotes-Unit-3-Final Accounts - (Partial)happy lifeNo ratings yet

- 5 Brickfields L AGM 2020Document3 pages5 Brickfields L AGM 2020Sooriapraba VanugopalNo ratings yet

- Average Score: Perdana Petroleum (Perdana-Ku)Document11 pagesAverage Score: Perdana Petroleum (Perdana-Ku)Zhi Ming CheahNo ratings yet

- Azam in 30 DuaDocument3 pagesAzam in 30 DuafaizaninNo ratings yet

- PRE - BOARD - 2 (2023-2024) : Grade: 12 Marks: 80 Subject: Accountancy Time: 3HRS General InstructionsDocument12 pagesPRE - BOARD - 2 (2023-2024) : Grade: 12 Marks: 80 Subject: Accountancy Time: 3HRS General InstructionsKaustav DasNo ratings yet

- FA1 BPP Chapter 2 Assets, Liabilities & Accounting EquationDocument19 pagesFA1 BPP Chapter 2 Assets, Liabilities & Accounting EquationS RaihanNo ratings yet

- Microsoft Word - Nigerian Bottling Company PLC FinalDocument20 pagesMicrosoft Word - Nigerian Bottling Company PLC FinalAkindeyi AnuNo ratings yet

- Ukk 2023 P2-Kunci Jawaban RevDocument47 pagesUkk 2023 P2-Kunci Jawaban RevSaepul RohmanNo ratings yet

- Bajaj FinanceDocument10 pagesBajaj FinanceJeniffer RayenNo ratings yet

- FM Assignment N0.1Document4 pagesFM Assignment N0.1Hafiz Usman ShariefNo ratings yet