Professional Documents

Culture Documents

CAF-07 Assessment-1 Solution: Answer-1 A) Date Particular Dr. Cr. 2015

CAF-07 Assessment-1 Solution: Answer-1 A) Date Particular Dr. Cr. 2015

Uploaded by

Ali OptimisticOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CAF-07 Assessment-1 Solution: Answer-1 A) Date Particular Dr. Cr. 2015

CAF-07 Assessment-1 Solution: Answer-1 A) Date Particular Dr. Cr. 2015

Uploaded by

Ali OptimisticCopyright:

Available Formats

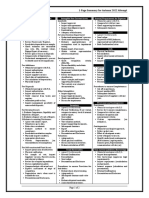

CAF-07 Assessment-1 Solution

Answer-1

a)

Date Particular Dr. Cr.

2015 ---------Rupees---------

15/08/15 Foreign Debtor 110,000

Sales (50,000 x 2.2) 110,000

(Sales to British Company) 0.25

15/08/15 Cost of Sale 40,000

Inventory 40,000

(Recording in inventory account) 0.25

31/10/15 Bank (25,000 x 2.65) 66,250

Exchange gain (bal.) 11,250

Foreign Debtor (25,000 x 2.2) 55,000

(Recording of receipt) 1

31/12/15 Foreign Debtor 5,000

Exchange gain 5,000

[(25,000 x 2.2) = 55,000 VS 60,000 (25,000 x 2.4)] 1

(Recording retranslation at year end)

2016

31/01/16 Bank (25,000 x 2.9) 72,500

Exchange gain (bal.) 12,500

Foreign Debtor (25,000 x 2.4) 60,000

(Recording of receipt) 1

b)

Date Particular Dr. Cr.

2015 ---------Rupees---------

25/08/15 Inventory 145,000

Creditor (100,000 x 1.45) 145,000

(Purchases from Malaysian company) 0.25

31/12/15 Bank 139,200

Sales 139,200

[(145,000 x 80%) = 116,000/ 100 x 120] 0.5

(Recording of sales)

31/12/15 Cost of Sale 116,000

Inventory (145,000 x 80%) 116,000

(Recording in inventory account) 0.25

31/12/15 Creditor 15,000

Exchange gain 15,000

[(100,000 x 1.3) = 130,000 VS 145,000 (100,000 x 1.45)] 1

(Recording retranslation at year end)

2016

31/01/16 Creditor (100,000 x 1.3) 130,000

Exchange gain (bal.) 5,000

Bank (100,000 x 1.25) 125,000

(Recording of payment) 1

Note:

When goods are shipped on a CIF basis (customs, insurance and freight), the risks and rewards of

ownership transfer on the date goods arrive safely at their destination. In this case, this means the

transaction date i.e. 25 August 2015.

Adnan Rauf, FCA Page 1

CAF-07 Assessment-1 Solution

c)

Date Particular Dr. Cr.

2015 ---------Rupees---------

01/07/15 Loan receivable 24,000

Bank 24,000 0.5

31/12/15 Loan receivable 599

Interest Income 599 0.5

31/12/15 Loan receivable 1,957

Exchange gain 1,957 0.5

2016

30/06/16 Loan receivable 685

Interest Income 685 0.5

30/06/16 Bank 3,750

Loan receivable 3,750 0.5

31/12/16 Loan receivable 668

Interest Income 668 0.5

31/12/16 Loan receivable 8,652

Exchange gain 8,652 0.5

(W-1) Amortisation Schedule in MYR

Date Installment Principal Interest Balance

01/07/15 20,000

30/06/16 2,500 1,644 856 18,356

30/06/17 2,500 1,714 786 16,642

1

(W-2) Exchange Gain/Loss on translation in Rupees

Dr. Loan receivable Cr.

01/07/15 Bank (20,000 x 1.2) 24,000

31/12/15 Interest income (*428 x 1.4) 599

31/12/15 Exchange gain (bal.) 1,957 31/12/15 c/d (20,428 x 1.3) 26,556

01/01/16 b/d 26,556

30/06/16 Interest income (428 x 1.6) 685 30/06/16 Bank (2,500 x 1.5) 3,750

31/12/16 Interest income 668

(**393 x 1.7)

31/12/16 Exchange gain (bal.) 8,652

- 31/12/16 c/d (18,749 x 1.75) 32,811

4

*856/2 = 428

**786/2 = 393

Adnan Rauf, FCA Page 2

CAF-07 Assessment-1 Solution

Answer-2

a)

Opening balance of deferred tax liability as on 1st January 1995 (W-1) Rs. 8,600. 0.5

b)

Calculation of current tax

1996 1995

Profit before tax 8,740 8,775

Add: Accounting depreciation (W-3) 7,800 4,800 0.5

Fines and penalties 700 700 0.5

Charitable donations 350 500 0.5

Healthcare benefits expense 1,000 2,000 0.5

Amortisation on development expenditures (1,250/5 years) 250 250 0.5

10,100 8,250

Less: Tax depreciation (W-4) 11,850 8,100 0.5

(11,850) (8,100)

Taxable profit 6,990 8,925

Current tax @ 40% 2,796 3,570 0.5

c) 1996 1995

Deferred tax expense 1,120 420 0.5

(W-1) Calculation of deferred tax - as on December 31, 1994

Carrying T.T.D/ D.T.L/

amount Tax Base (D.T.D) (D.T.A)

P,P&E (-):(W-4) 36,000 15,000 21,000 0.5

Development costs 500 - 500 0.5

21,500

Deferred tax liability (21,500 x 40%) 8,600 0.5

Calculation of deferred tax - as on December 31, 1995

Carrying T.T.D/ D.T.L/

amount Tax Base (D.T.D) (D.T.A)

P,P&E (-):(W-4) 37,200 12,900 24,300 0.5

Fine payable (W-8) 700 700 - 0.5

Development costs 250 - 250 0.5

Liability for healthcare benefits 2,000 - (2,000) 0.5

22,550

Deferred tax liability (22,550 x 40%) 9,020 0.5

Adnan Rauf, FCA Page 3

CAF-07 Assessment-1 Solution

Calculation of deferred tax - as on December 31, 1996

Carrying T.T.D/ D.T.L/

amount Tax Base (D.T.D) (D.T.A)

P,P&E (-):(W-4) 44,400 16,050 28,350 0.5

Fine payable (W-8) 1,400 1,400 - 0.5

Development costs - - -

Liability for healthcare benefits 3,000 - (3,000) 0.5

25,350

Deferred tax liability (25,350 x 40%) 10,140 0.5

(W-2)

Dr. Deferred tax liability /asset Cr.

b/d (1/1/95) (W-1) 8,600

c/d (31/12/95) (W-1) 9,020 Deferred tax expense (bal.) 420 2

b/d (1/1/96) 9,020

c/d (31/12/96) (W-1) 10,140 Deferred tax expense (bal.) 1,120 2

(W-3)

Dr. Property, Plant & Equipment-BV (accounting rules) Cr.

b/d (1/1/95) 36,000 Dep. (bal.) 4,800

Additions 6,000 c/d (31/12/95) 37,200 1

b/d (1/1/96) 37,200 Dep. (bal.) 7,800

Additions 15,000 c/d (31/12/96) 44,400 1

(W-4)

Dr. Property, Plant & Equipment(as per tax) Cr.

b/d (1/1/95) 15,000 Dep. (W-5)(W-6) (5,600+2,500) 8,100

(50,000-40,000)+(10,000-5,000)

Additions 6,000 c/d (31/12/95) (bal.) 12,900 0.75

b/d (1/1/96) 12,900 Dep. (W-5)(W-6) (5,600+6,250) 11,850

Additions 15,000 c/d (31/12/96) (bal.) 16,050 0.75

(W-5) Calculation of tax depreciation on building

1995

On opening (50,000 x 10%) 5,000

On additions (6,000 x 10%) 600

5,600 0.5

1996

On openings (56,000 x 10%) 5,600 0.25

(W-6) Calculation of tax depreciation on vehicles

1995

On opening (10,000 x 25%) 2,500 0.25

1996

On openings (10,000 x 25%) 2,500

On additions (15,000 x 25%) 3,750

6,250 0.5

Adnan Rauf, FCA Page 4

CAF-07 Assessment-1 Solution

(W-7)

Dr. Provision (Liability for health care benefits) Cr.

b/d (1/1/95) 0

c/d (31/12/95) 2,000 Expense 2,000

b/d (1/1/96) 2,000

c/d (31/12/96) 3,000 Expense 1,000

(W-8)

Dr. Fine expense Cr.

b/d (1/1/95) 0

c/d (31/12/95) 700 Expense 700

b/d (1/1/96) 700

c/d (31/12/96) 1,400 Expense 700

Adnan Rauf, FCA Page 5

You might also like

- Orthopedic Hospital PlanningDocument7 pagesOrthopedic Hospital Planningሀይደር ዶ.ርNo ratings yet

- Substantive Procedures (1-Page Summary)Document2 pagesSubstantive Procedures (1-Page Summary)Ali OptimisticNo ratings yet

- LAB - 04 Bscs Fall 2018: Introduction To ComputingDocument5 pagesLAB - 04 Bscs Fall 2018: Introduction To ComputingAli OptimisticNo ratings yet

- Confidential 1 AC/TEST MAY 2021/FAR270Document5 pagesConfidential 1 AC/TEST MAY 2021/FAR270Lampard AimanNo ratings yet

- f1 Cima Workbook Q & A PDFDocument276 pagesf1 Cima Workbook Q & A PDFYounus KhanNo ratings yet

- DocDocument5 pagesDocPham TrangNo ratings yet

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- Dryrun Practice QuestionsDocument6 pagesDryrun Practice QuestionsAli Optimistic0% (1)

- Additional Cases Ch08Document4 pagesAdditional Cases Ch08amanraajNo ratings yet

- Multiple Choice Problems Chapter 6Document7 pagesMultiple Choice Problems Chapter 6Dieter LudwigNo ratings yet

- ACC311 Chapter 7 Review Notes and Practice Problems SODocument7 pagesACC311 Chapter 7 Review Notes and Practice Problems SOfatimalghaisNo ratings yet

- Accountancy Answer Key - II Puc Annual Exam March 2019Document8 pagesAccountancy Answer Key - II Puc Annual Exam March 2019Akash kNo ratings yet

- PPE - Part - 2. CHAPTER16Document36 pagesPPE - Part - 2. CHAPTER16Ms Vampire100% (1)

- Tut 3 Practice Solutions Not in TextbookDocument10 pagesTut 3 Practice Solutions Not in TextbookThridev MaharajhNo ratings yet

- Subsidiary Ledgers and Special JournalsDocument11 pagesSubsidiary Ledgers and Special JournalsMohamed ZakyNo ratings yet

- Test Your Knowledge - 7Document2 pagesTest Your Knowledge - 7narangdiya602No ratings yet

- Multiple Choice ProblemsDocument7 pagesMultiple Choice ProblemsTawan VihokratanaNo ratings yet

- Journal Entries For 2005: ' (P720,000/1,800 Shares)Document6 pagesJournal Entries For 2005: ' (P720,000/1,800 Shares)Dreiu EsmeleNo ratings yet

- Commerce Paathshaala: Pu-Ii Annual Examination April-May-2022 Accountancy Key Answers Section A (1 Mark Answers)Document12 pagesCommerce Paathshaala: Pu-Ii Annual Examination April-May-2022 Accountancy Key Answers Section A (1 Mark Answers)Ashok dore Ashok doreNo ratings yet

- 2017 23-August Part-4 MemorandumDocument7 pages2017 23-August Part-4 MemorandumLucky NetshamutavhaNo ratings yet

- Accounting English Medium: Paper Based Revision Programme Marking Guide - Revision Paper - 34Document6 pagesAccounting English Medium: Paper Based Revision Programme Marking Guide - Revision Paper - 34Malar SrirengarajahNo ratings yet

- Comprehensive Audit of Balance Sheet and Income Statement AccountsDocument25 pagesComprehensive Audit of Balance Sheet and Income Statement AccountsLuigi Enderez Balucan100% (1)

- IAS 36 Impairment of Assets (QB - S)Document16 pagesIAS 36 Impairment of Assets (QB - S)Johannes MoyoNo ratings yet

- 2 96 Finacial 04Document55 pages2 96 Finacial 04earespNo ratings yet

- 72222bos58192 P1aDocument11 pages72222bos58192 P1aSufiyan MominNo ratings yet

- 2023 Regular and SOLDocument24 pages2023 Regular and SOLtreasurebts19No ratings yet

- Task 2012Document2 pagesTask 2012МФФ 4-1No ratings yet

- 14 - Accounting 4 DepreciationDocument22 pages14 - Accounting 4 DepreciationKAMAL POKHRELNo ratings yet

- Inj 1058 Answer FM Mumbai 12-06-2016Document7 pagesInj 1058 Answer FM Mumbai 12-06-2016nnj247896No ratings yet

- 47246mtpbosicai Sa p1 Sr2Document13 pages47246mtpbosicai Sa p1 Sr2AnsariMohammedShoaibNo ratings yet

- CA Foundation Accounts A MTP 2 Dec 2022Document11 pagesCA Foundation Accounts A MTP 2 Dec 2022shagana212005No ratings yet

- MIT2 96F12 Lec05Document43 pagesMIT2 96F12 Lec05BishwoNo ratings yet

- Mark Scheme: Accounting 5121Document14 pagesMark Scheme: Accounting 5121SaadArshadNo ratings yet

- Chapter19 BuenaventuraIntermediate Accounting1Document13 pagesChapter19 BuenaventuraIntermediate Accounting1AnonnNo ratings yet

- Tutorial On Ratio AnalysisDocument4 pagesTutorial On Ratio AnalysisRajyaLakshmiNo ratings yet

- 4 LiquidationDocument9 pages4 LiquidationNIKHIL MITTALNo ratings yet

- Ans. Chapter-9Document6 pagesAns. Chapter-9upscmindworksNo ratings yet

- Accounting AssignmentDocument13 pagesAccounting AssignmentPetrinaNo ratings yet

- Genuime Company Required 1 Debit CreditDocument15 pagesGenuime Company Required 1 Debit CreditAnonnNo ratings yet

- ACCT101 YUNLEE SOLUTIONS Ch05Document19 pagesACCT101 YUNLEE SOLUTIONS Ch05KO YANG JINNo ratings yet

- Balanço e RazãoDocument11 pagesBalanço e RazãoRonaldo NascimentoNo ratings yet

- 5.cpbe - Xii Accts - MSDocument18 pages5.cpbe - Xii Accts - MScommerce12onlineclassesNo ratings yet

- Solution Far610 - Jan 2018Document10 pagesSolution Far610 - Jan 2018E-cHa PineappleNo ratings yet

- Solved Pu 2 Annual QP Accountancy 2024Document10 pagesSolved Pu 2 Annual QP Accountancy 2024tommyvercetti880055No ratings yet

- Problem 5-3 Requirement 1 2020Document7 pagesProblem 5-3 Requirement 1 2020Adyagila Ecarg NelehNo ratings yet

- Tut 4 Practice Solutions Not in TextbookDocument6 pagesTut 4 Practice Solutions Not in TextbookThridev MaharajhNo ratings yet

- Adobe Scan Mar 16, 2023Document20 pagesAdobe Scan Mar 16, 2023Renalyn Ps MewagNo ratings yet

- Accountancy 12 - DS2 - Set - 1Document15 pagesAccountancy 12 - DS2 - Set - 1Deepa Saravana KumarNo ratings yet

- Pembahasan LabAkun 16-17Document6 pagesPembahasan LabAkun 16-17sepuluh 10No ratings yet

- Chapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Document12 pagesChapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Shane KimNo ratings yet

- PRACTICE CLASS 3, 4 and 5Document6 pagesPRACTICE CLASS 3, 4 and 5Zain JamilNo ratings yet

- AF210 Final Exam SolutionsDocument17 pagesAF210 Final Exam SolutionsSmriti LalNo ratings yet

- Problem 1 Summary 35 Problem 1 Solution 21 Problem 2 Jes 60 Problem 2 Worksheet 116 Grand TotalDocument23 pagesProblem 1 Summary 35 Problem 1 Solution 21 Problem 2 Jes 60 Problem 2 Worksheet 116 Grand TotalAngelica DizonNo ratings yet

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- Danica Reign C. Figueroa Financial Accounting and Reporting Bsa 1C Problem 14Document4 pagesDanica Reign C. Figueroa Financial Accounting and Reporting Bsa 1C Problem 14Danica Reign FigueroaNo ratings yet

- Paper 5-Financial Accounting: Answer To MTP - Intermediate - Syllabus 2012 - June2016 - Set 2Document13 pagesPaper 5-Financial Accounting: Answer To MTP - Intermediate - Syllabus 2012 - June2016 - Set 2pirates123No ratings yet

- Unit - II Module IIIDocument7 pagesUnit - II Module IIIpltNo ratings yet

- Chapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Document11 pagesChapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Kathrina RoxasNo ratings yet

- Depreciation Question and Answers 2Document2 pagesDepreciation Question and Answers 2AMIN BUHARI ABDUL KHADERNo ratings yet

- Compute The Correct Amount of Inventory:: Problem 10-1 Amiable CompanyDocument83 pagesCompute The Correct Amount of Inventory:: Problem 10-1 Amiable CompanyIrish SungcangNo ratings yet

- RTP Group IDocument202 pagesRTP Group Iravi_bansal85No ratings yet

- Income Taxes - Moments LTD Rupert LTD MemoDocument5 pagesIncome Taxes - Moments LTD Rupert LTD Memoandiswa zuluNo ratings yet

- Credit Derivatives Pricing Models: Models, Pricing and ImplementationFrom EverandCredit Derivatives Pricing Models: Models, Pricing and ImplementationRating: 2 out of 5 stars2/5 (1)

- Impacts of Adverse Macro Environment On AuditDocument7 pagesImpacts of Adverse Macro Environment On AuditAli OptimisticNo ratings yet

- Test 5-ConsolidationDocument3 pagesTest 5-ConsolidationAli OptimisticNo ratings yet

- Assessment IDocument2 pagesAssessment IAli OptimisticNo ratings yet

- 5.consolidated SOCI - AAFRDocument11 pages5.consolidated SOCI - AAFRAli OptimisticNo ratings yet

- IAS-12 Lecture NotesDocument11 pagesIAS-12 Lecture NotesAli OptimisticNo ratings yet

- CH 6 - Activity Based Costing UpdatedDocument16 pagesCH 6 - Activity Based Costing UpdatedAli OptimisticNo ratings yet

- Final FAR-2 Mock Q. PaperDocument6 pagesFinal FAR-2 Mock Q. PaperAli OptimisticNo ratings yet

- IFRS 16 - by Zubair SaleemDocument34 pagesIFRS 16 - by Zubair SaleemAli OptimisticNo ratings yet

- 1-Final Account Disclosures Rev (110822)Document20 pages1-Final Account Disclosures Rev (110822)Ali OptimisticNo ratings yet

- Institute of Chartered Accountants of PakistanDocument5 pagesInstitute of Chartered Accountants of PakistanAli OptimisticNo ratings yet

- Multimedia Presentation: Presented By: Samaika Santosh Class: Vi Roll No: 20Document6 pagesMultimedia Presentation: Presented By: Samaika Santosh Class: Vi Roll No: 20Ali OptimisticNo ratings yet

- Institute of Chartered Accountants of PakistanDocument7 pagesInstitute of Chartered Accountants of PakistanAli OptimisticNo ratings yet

- Answers of Modal Paper AFC-3 (Quantitative Techniques) Prepared by DAWOOD SHAHIDDocument1 pageAnswers of Modal Paper AFC-3 (Quantitative Techniques) Prepared by DAWOOD SHAHIDAli OptimisticNo ratings yet

- Blaw Mock Spring 19Document5 pagesBlaw Mock Spring 19Ali OptimisticNo ratings yet

- Test 4Document2 pagesTest 4Ali OptimisticNo ratings yet

- 2013 Paper F8 Mnemonics and Charts Sample Download v1Document71 pages2013 Paper F8 Mnemonics and Charts Sample Download v1Ali OptimisticNo ratings yet

- 03 Afc QM MP 2013Document9 pages03 Afc QM MP 2013Ali OptimisticNo ratings yet

- Introduction To Computing:: Dead Line For Assignment Submission: 2 November 2018 11:55pmDocument2 pagesIntroduction To Computing:: Dead Line For Assignment Submission: 2 November 2018 11:55pmAli OptimisticNo ratings yet

- Adverb QuizDocument9 pagesAdverb QuizAli OptimisticNo ratings yet

- Test 9 (QP) Income & Expenditure + Changes in EquityDocument2 pagesTest 9 (QP) Income & Expenditure + Changes in EquityAli OptimisticNo ratings yet

- Assessment 1 (QP) IAS 16 + 23Document2 pagesAssessment 1 (QP) IAS 16 + 23Ali Optimistic100% (1)

- Assignment 3 Part 2: Input Case 1: Input Case 2Document2 pagesAssignment 3 Part 2: Input Case 1: Input Case 2Ali OptimisticNo ratings yet

- Assignment 3 Part 1Document2 pagesAssignment 3 Part 1Ali OptimisticNo ratings yet

- Introduction To Computing Lab # 2: C++ Tool LearningDocument1 pageIntroduction To Computing Lab # 2: C++ Tool LearningAli OptimisticNo ratings yet

- 2017 2016 2015 2014 2013 2012 Gross Carrying AmountDocument3 pages2017 2016 2015 2014 2013 2012 Gross Carrying AmountAli OptimisticNo ratings yet

- Term Test 1 (QP) IAS 16 + 36 + 23 + 40 + 20 + Single EntryDocument3 pagesTerm Test 1 (QP) IAS 16 + 36 + 23 + 40 + 20 + Single EntryAli OptimisticNo ratings yet

- Term Test 2 (QP)Document4 pagesTerm Test 2 (QP)Ali OptimisticNo ratings yet

- Air PollutionDocument35 pagesAir PollutionNur HazimahNo ratings yet

- UNIT VI Government Grants Borrowing CostsDocument4 pagesUNIT VI Government Grants Borrowing CostsJi Eun VinceNo ratings yet

- Bringing Big Ideas To Life: NSW Innovation StrategyDocument14 pagesBringing Big Ideas To Life: NSW Innovation StrategyNG-FM KPMGNo ratings yet

- Thyrotronic Rectifier ManualDocument3 pagesThyrotronic Rectifier ManualUsama SheikhNo ratings yet

- Bhum103l - Micro-Economics - TH - 1.0 - 71 - Bhum103l - 66 AcpDocument2 pagesBhum103l - Micro-Economics - TH - 1.0 - 71 - Bhum103l - 66 AcpDarshilNo ratings yet

- QCSH MCQ QCSH MCQDocument15 pagesQCSH MCQ QCSH MCQchutiyahu787No ratings yet

- Analysis of Audible Noise and Magnetic Fields: Vollmer Substation and Transmission Line ProjectDocument20 pagesAnalysis of Audible Noise and Magnetic Fields: Vollmer Substation and Transmission Line ProjecteNo ratings yet

- 70-130 Autocreaser Pro 50 Parts Manual REV.7Document29 pages70-130 Autocreaser Pro 50 Parts Manual REV.7Peter GaluszkaNo ratings yet

- Dahua DVR 5104C/5408C/5116C Especificaciones: M Odel DH-DVR5104C-V2 DH-DVR5108C DH-DVR5116C SystemDocument1 pageDahua DVR 5104C/5408C/5116C Especificaciones: M Odel DH-DVR5104C-V2 DH-DVR5108C DH-DVR5116C Systemomar mejiaNo ratings yet

- After Cooler InspectionAE3Document1 pageAfter Cooler InspectionAE3boy qsiNo ratings yet

- Ali CVDocument1 pageAli CVAli EidNo ratings yet

- Risk-Isaca PDFDocument7 pagesRisk-Isaca PDFashwin2005No ratings yet

- DS-7204/7208HVI-SH Series DVR Technical SpecificationDocument10 pagesDS-7204/7208HVI-SH Series DVR Technical Specificationandres alberto figueroa foreroNo ratings yet

- Critically Analyse The Recruitment and Selection Process That An Organisation Should Adopt in Today's Business Context - Nitish Roy PertaubDocument4 pagesCritically Analyse The Recruitment and Selection Process That An Organisation Should Adopt in Today's Business Context - Nitish Roy Pertaubayushsoodye01No ratings yet

- Literature Review Early Childhood EducationDocument10 pagesLiterature Review Early Childhood Educationafmzzulfmzbxet100% (1)

- Helamin 906 HDocument2 pagesHelamin 906 HWong Peng ChiongNo ratings yet

- DSST (SDT) SDS Igniter - ZPP - EN4.2Document6 pagesDSST (SDT) SDS Igniter - ZPP - EN4.2Rom PhothisoontornNo ratings yet

- Design IIDocument16 pagesDesign IIPrasant0% (1)

- LPS1666 Issue Direct Low Pressure Application Fire Suppression System StandardDocument27 pagesLPS1666 Issue Direct Low Pressure Application Fire Suppression System StandardPaul MerrickNo ratings yet

- Abdul Rauf Alias CV 2023Document4 pagesAbdul Rauf Alias CV 2023Rauf AliasNo ratings yet

- Bid Doc PrintingSolutionDocument61 pagesBid Doc PrintingSolutionAbdul RehmanNo ratings yet

- Exam 2019 Questions and AnswersDocument19 pagesExam 2019 Questions and AnswersĐạt NguyễnNo ratings yet

- Allwinner H3 Datasheet V1.1Document616 pagesAllwinner H3 Datasheet V1.1Daniel Trejo0% (1)

- Eng Cressi Manu 03842Document7 pagesEng Cressi Manu 03842Marin PintarNo ratings yet

- Biography Hatta RajasaDocument2 pagesBiography Hatta RajasaEvanNo ratings yet

- Bai Tap Unit 2Document4 pagesBai Tap Unit 2Vinh BéoNo ratings yet

- Internal Communication, Towards WWF's Brand EngagementDocument10 pagesInternal Communication, Towards WWF's Brand EngagementOcta Ramayana0% (1)

- Security Threats To E-Business: BIT Noida 1Document73 pagesSecurity Threats To E-Business: BIT Noida 1Kanishk GuptaNo ratings yet