Professional Documents

Culture Documents

MS Acccounting Express Task-Based Simulation

MS Acccounting Express Task-Based Simulation

Uploaded by

Miles SantosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MS Acccounting Express Task-Based Simulation

MS Acccounting Express Task-Based Simulation

Uploaded by

Miles SantosCopyright:

Available Formats

Microsoft Accounting Express 2009; Performance Task

ABC Co., a service-oriented entity and a VAT-registered entity, had the following accounts on its

balance sheet at the end of the calendar year period ended December 31, 2020:

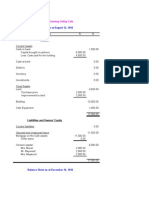

ASSETS

Cash 2,357,200.23

Accounts receivable 536,421.89

Deferred input tax carry-over 36,125.56

Deferred MCIT charges 23,125.65

Property and equipment 32,258,632.52

Less: Accumulated depreciation (2,541,652.21)

TOTAL ASSETS 32,669,853.64

LIABILITIES AND EQUITY

Accounts payable 324,852.64

Income tax payable 32,850.21

Loans payable 15,000,000.00

Total liabilities 15,357,702.85

Outstanding capital stock 8,000,000.00

Retained earnings – appropriated 7,800,000.00

Retained earnings - unappropriated 1,512,150.79

Total equity 17,312,150.79

TOTAL LIABILITIES AND EQUITY 32,669,853.64

For the first month of 2021, the company has the following transactions:

Jan 3 The company received service fee amounting 754,230.22 from clients. All of the

company’s clients are withholding tax agents. The gross amount of services is

767,943.50.

Jan 13 The company purchased a total amount 321,526.31. 75% of which are purchased from

VAT-registered entities while the rest are not qualified for input tax credit. 50% of these

purchases are only paid. Utilities accounted for the 25% non-VAT purchases.

Telecommunications accounted as the 50% of the 75% of the VATable transactions.

The rest is supplies.

Jan 30 The bank statement shows a debit charge amounting to 81,250. This is the monthly

interest auto-debit payment from the related loans payable. An additional 5% of this

amount which represents the gross receipts tax (GRT) is likewise debited from the

company’s account.

Jan 30 The entity paid the monthly salaries of the employees in the amount of 102,500, net of

withholding tax and employee’s share in the mandatory contributions. The total

premiums payable is 18,700 in which 9,700 is the share of the employer. The withheld

tax from compensation amounts to 8,500.

Jan 31 The entity recorded a monthly depreciation of 179,214.63.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- College of St. John - Roxas: Flexible Learning Plan Course Syllabus A.Y 2020-2021Document6 pagesCollege of St. John - Roxas: Flexible Learning Plan Course Syllabus A.Y 2020-2021Miles Santos100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- ACCT402 Auditing and Assurance Concepts and Application 1Document9 pagesACCT402 Auditing and Assurance Concepts and Application 1Miles SantosNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- SANTOS - Case Digest in StatConDocument5 pagesSANTOS - Case Digest in StatConMiles Santos100% (1)

- Smokey Valley CafeDocument3 pagesSmokey Valley CafeSreenath SukumaranNo ratings yet

- San MiguelDocument9 pagesSan MiguelAngel Buitizon100% (1)

- Auditing Theory and Principles Thanks GuysDocument51 pagesAuditing Theory and Principles Thanks GuysrenoNo ratings yet

- Legal Ethics - Jan 26 Class AssignmentDocument8 pagesLegal Ethics - Jan 26 Class AssignmentMiles SantosNo ratings yet

- M S Feliciano The Law Library Revisiting Traditional LegalDocument14 pagesM S Feliciano The Law Library Revisiting Traditional LegalMiles SantosNo ratings yet

- Accounts Receivable and Estimating Doubtful AccountsDocument7 pagesAccounts Receivable and Estimating Doubtful AccountsMiles SantosNo ratings yet

- ACCT403: Auditing and Assurance: Specialized Industries Final ExaminationDocument4 pagesACCT403: Auditing and Assurance: Specialized Industries Final ExaminationMiles SantosNo ratings yet

- The Philippine Government 123Document32 pagesThe Philippine Government 123Miles SantosNo ratings yet

- College of St. John - Roxas: Flexible Learning Plan Course Syllabus A.Y 2021-2022Document6 pagesCollege of St. John - Roxas: Flexible Learning Plan Course Syllabus A.Y 2021-2022Miles SantosNo ratings yet

- ACCT403: Auditing and Assurance: Specialized Industries Final ExaminationDocument4 pagesACCT403: Auditing and Assurance: Specialized Industries Final ExaminationMiles SantosNo ratings yet

- G.R. No. 150723 Manaban Vs CA and People of The Phils (Justifying Circumstances)Document9 pagesG.R. No. 150723 Manaban Vs CA and People of The Phils (Justifying Circumstances)Miles SantosNo ratings yet

- Notes Receivable - Measurement and Determination of Interest ExpenseDocument6 pagesNotes Receivable - Measurement and Determination of Interest ExpenseMiles SantosNo ratings yet

- ACCT202 Accounting For Business CombinationsDocument8 pagesACCT202 Accounting For Business CombinationsMiles SantosNo ratings yet

- College of St. John - Roxas: Member: Association of LASSSAI Accredited Superschools (ALAS)Document4 pagesCollege of St. John - Roxas: Member: Association of LASSSAI Accredited Superschools (ALAS)Miles SantosNo ratings yet

- College of St. John - Roxas: Flexible Learning Plan Course Syllabus A.Y 2020-2021Document4 pagesCollege of St. John - Roxas: Flexible Learning Plan Course Syllabus A.Y 2020-2021Miles SantosNo ratings yet

- AEP101 Accounting Enhancement Program Financial Accounting and ReportingDocument6 pagesAEP101 Accounting Enhancement Program Financial Accounting and ReportingMiles SantosNo ratings yet

- ACCT201: Accounting For Special Transactions: Without Solutions Shall Not Merit PointsDocument2 pagesACCT201: Accounting For Special Transactions: Without Solutions Shall Not Merit PointsMiles SantosNo ratings yet

- ACCT201 Accounting For Special TransactionsDocument7 pagesACCT201 Accounting For Special TransactionsMiles SantosNo ratings yet

- Amalgamation Pooling of Interest MethodDocument16 pagesAmalgamation Pooling of Interest Methodvairamuthu2000No ratings yet

- Fina Sample ReportsDocument61 pagesFina Sample ReportsqNo ratings yet

- ICAEW Financial Accounting Questions March 2015 To March 2016 (SPirate)Document49 pagesICAEW Financial Accounting Questions March 2015 To March 2016 (SPirate)Ahmed Raza Mir100% (4)

- Test Papers: Intermediate Group IDocument57 pagesTest Papers: Intermediate Group Iavthasveer78No ratings yet

- 2019 Audit Report (Separate)Document86 pages2019 Audit Report (Separate)tasnimaNo ratings yet

- Statement of Financial PositionDocument14 pagesStatement of Financial PositionManuel Panotes ReantazoNo ratings yet

- Final Exam AC 1 2 Answer KeyDocument7 pagesFinal Exam AC 1 2 Answer KeyBill VilladolidNo ratings yet

- School of Business Administration ACC 2301: Accounting Principle I Semester: Summer 2019 Course SyllabusDocument6 pagesSchool of Business Administration ACC 2301: Accounting Principle I Semester: Summer 2019 Course SyllabusAmine NaitlhoNo ratings yet

- Activity - Preparation of Financial StatementsDocument4 pagesActivity - Preparation of Financial StatementsJoy ValenciaNo ratings yet

- Segmental AnalysisDocument2 pagesSegmental AnalysisEsmeldo MicasNo ratings yet

- CH 1 PPT Financial Reporting and AnalysisDocument11 pagesCH 1 PPT Financial Reporting and AnalysisSamantha LaiNo ratings yet

- AMPATUA, Sittie Aisah L. PAS 22 Financial Instrument Assignment! QuestionsDocument2 pagesAMPATUA, Sittie Aisah L. PAS 22 Financial Instrument Assignment! QuestionsSittie Aisah AmpatuaNo ratings yet

- Using Dupont Analysis To Assess The Financial Performance of The Selected Companies in The Plastic Industry in IndiaDocument21 pagesUsing Dupont Analysis To Assess The Financial Performance of The Selected Companies in The Plastic Industry in IndiaMukesh D.MNo ratings yet

- Brahma Et Al. - 2020 - Board Gender Diversity and Firm Performance The UDocument16 pagesBrahma Et Al. - 2020 - Board Gender Diversity and Firm Performance The URMADVNo ratings yet

- Midterm Fin Oo4Document82 pagesMidterm Fin Oo4patricia gunio100% (1)

- NM de 08102016Document16 pagesNM de 08102016Md Rasel Uddin ACMANo ratings yet

- Intermediate Accounting Vol 1 Canadian 3rd Edition Lo Solutions Manual 1Document35 pagesIntermediate Accounting Vol 1 Canadian 3rd Edition Lo Solutions Manual 1anthony100% (51)

- A Summer Training Project Report ON "Cash Flow Management of BSNL"Document51 pagesA Summer Training Project Report ON "Cash Flow Management of BSNL"Neha VidhaniNo ratings yet

- FR Amendments From Edition 6 To 7Document86 pagesFR Amendments From Edition 6 To 7reyanshvishwaksettyNo ratings yet

- Capital StructureDocument7 pagesCapital StructurePrashanth MagadumNo ratings yet

- Amalgamation VS AbsorptionDocument7 pagesAmalgamation VS AbsorptionAbhinav RandevNo ratings yet

- Translation of A Foreign Entitys Financial StatementsDocument24 pagesTranslation of A Foreign Entitys Financial StatementsGhita Tria MeitinaNo ratings yet

- Book 02Document377 pagesBook 02tazimNo ratings yet

- Kraft Australia HoldingsDocument9 pagesKraft Australia HoldingsVarun GuptaNo ratings yet

- FIC Guidelines On Acquisition of Interests Mergers & Take OversDocument14 pagesFIC Guidelines On Acquisition of Interests Mergers & Take OversSiti AisyahNo ratings yet

- NHDE - TRAC NGHIEM - B02050 - B02080 - B02082 - B03027 - CUOI KY - G I L PDocument30 pagesNHDE - TRAC NGHIEM - B02050 - B02080 - B02082 - B03027 - CUOI KY - G I L PTrân LêNo ratings yet

- LBA Auditing Financial PlanDocument24 pagesLBA Auditing Financial PlanwillieNo ratings yet