Professional Documents

Culture Documents

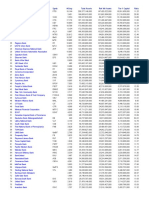

OverHead Supply

OverHead Supply

Uploaded by

LOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

OverHead Supply

OverHead Supply

Uploaded by

LCopyright:

Available Formats

174 Investing like a Professional

How to Read Charts like an Expert and Improve Your Stock Selection and Timing 175

ued the display and discussion of certain of these predepression era, mulation almost always show this symptom. The combination of tight-

failure-prone price patterns. ness in prices (daily or weekly price closes being very near each other)

Triple bottoms and head-and-shoulder bottoms are also structures and dried-up volume is generally quite constructive.

widely mentioned in several books on technical analysis. These we have

found to be weaker structures. A head-and-shoulders bottom may suc-

ceed in a few instances, but it has no strong prior uptrend, which is a How to Use Relative Strength

necessary element for most powerful market leaders. Correctly

While head-and-shoulder bottoms are not as sound as previous writers

have claimed, head-and-shoulder top price structures are one of the Many fundamental security analysts think technical analysis means buy-

more reliable price patterns signifying a top in a stock. But be careful— ing stocks with the strongest relative strength.

with just a little knowledge of charts, you can misinterpret what is a cor- You do not buy stocks that show the highest relative price strength on

rect head-and-shoulders top. Many professionals do not properly inter- some list of best performers. You buy stocks that are performing rela-

pret the price structure. tively stronger than the general market just as they are beginning to

emerge from a sound base-building period. The time to begin selling is

when the stock advances in price rapidly, is extended materially from its

base, and is showing extremely high relative strength.

Analysts have a great deal to leam if they believe all diat technical research

amounts to is the buying of high relative strength momentum stocks.

What Is Overhead Supply?

A critically important concept to learn in analyzing price movements is

the principle of overhead supply. It is really quite simple. If a stock

advances from $25 to $40, then declines back to $30, most of the people

who bought late in the upper $30s and at $40 will have a loss in the stock

unless they were quick to sell and cut their loss (which most people don't

do). Therefore, if the stock later increases in price back to the high $30s

Head-and-shoulders top price pattern

or $40 area, all the investors that had losses can now get out even.

Human nature is pretty much the same most of the time. So it is nor-

A triple bottom is a looser, weaker, and less-attractive base pattern mal that a number of these people will sell when they see a chance to

than a double bottom because the stock corrects and falls back sharply get their money back after having been down a significant amount.

to its absolute low three different times rather than twice, as with a dou- Good chartists (a typically tiny group of investors) know how to rec-

ble bottom, or one time, as in the strong cup with handle. ognize the price areas that represent heavy overhead supply. They will

never make the fatal mistake of buying a stock that has a large recent

amount of overhead supply. This is one type of serious mistake many

inexperienced fundamental analysts tend to make.

Look for Volume Dry Ups

On the other hand, if a stock is able to fight its way through all its

Near Lows of a Price Pattern

overhead supply, it may be safer to buy even though the price is a little

Nearly all proper bases will show a dramatic volume dry up for one or higher because the stock proved itself to have sufficient demand to

two weeks along the very low of the base pattern and in the low area of absorb the concentrated supply zone. Of course, a stock that has just

the handle. This means that all of the selling has dried up and there is broken out into new high ground for the first time has no overhead

no more stock coming into the marketplace. Healthy stocks under accu- supply to contend with, which adds to its appeal.

You might also like

- SMC Full Course (Fundfloat)Document27 pagesSMC Full Course (Fundfloat)igniteff41100% (19)

- Case StudyDocument5 pagesCase Studyganst64% (11)

- ICT HandbookDocument40 pagesICT HandbookAKASH PAL100% (2)

- Void's ICT HandbookDocument40 pagesVoid's ICT Handbookrao muhammad umar farooqNo ratings yet

- Richard Wyckoff False BreakoutsDocument4 pagesRichard Wyckoff False Breakoutsdaviduk95% (20)

- 100 To 1 in The Stock Market by Thomas Phelps - Novel InvestorDocument12 pages100 To 1 in The Stock Market by Thomas Phelps - Novel InvestortienbkNo ratings yet

- VSA DbphoenixDocument69 pagesVSA DbphoenixIes BécquerNo ratings yet

- DBPhoenix BookDocument23 pagesDBPhoenix Booktoneranger100% (1)

- Cogent Partners Secondary Pricing Analysis, Interim Update, Summer 2009Document9 pagesCogent Partners Secondary Pricing Analysis, Interim Update, Summer 2009Erin Griffith100% (1)

- Summary of Five-Year Eurobond Terms Available To R.J. ReynoldsDocument8 pagesSummary of Five-Year Eurobond Terms Available To R.J. ReynoldsRyan Putera Pratama ManafeNo ratings yet

- Price Action PDFDocument450 pagesPrice Action PDFSiddartha Krishna100% (7)

- Tybaf Black BookDocument80 pagesTybaf Black BookArun Patel100% (3)

- Short SqueezeDocument6 pagesShort Squeezealphatrends100% (1)

- Stock Market SecretDocument6 pagesStock Market SecretARJ UN100% (1)

- The Great Divide Over Market EfficicnecyDocument10 pagesThe Great Divide Over Market EfficicnecynamgapNo ratings yet

- Demand SupplyDocument11 pagesDemand SupplyAnonymous L4GY7kqNo ratings yet

- Adam Grimes - Relative StrengthDocument4 pagesAdam Grimes - Relative StrengthRemmy TaasNo ratings yet

- The New Market Wizards - Conversations With America's Top TradersDocument7 pagesThe New Market Wizards - Conversations With America's Top TradersFrancisco Bertoldi NetoNo ratings yet

- How To Validate and Score A LevelDocument13 pagesHow To Validate and Score A LevelCharisNo ratings yet

- Slingshot StrangleDocument3 pagesSlingshot Strangleprivatelogic100% (1)

- Mastering The Markets (143-184)Document42 pagesMastering The Markets (143-184)Fabi GomesNo ratings yet

- Mastering Stock Market LeadMagnet PDFDocument11 pagesMastering Stock Market LeadMagnet PDFSushant DumbreNo ratings yet

- Stock Market Basic TeachingsDocument4 pagesStock Market Basic TeachingscutiebeeeNo ratings yet

- IBDD How To Buy Stocks InfographicDocument1 pageIBDD How To Buy Stocks InfographicIouNo ratings yet

- High Tight Flags With Dolan V. Kent - by Kay KlingsonDocument15 pagesHigh Tight Flags With Dolan V. Kent - by Kay KlingsonpksNo ratings yet

- VSA Crib SheetDocument9 pagesVSA Crib SheetSelwyn Lim100% (1)

- Technical TradingDocument9 pagesTechnical Tradingviníciusg_65No ratings yet

- The Delta Report Guide To Technical AnalysisDocument18 pagesThe Delta Report Guide To Technical AnalysisKene NnajiNo ratings yet

- En 71 140Document70 pagesEn 71 140Vitaliy KlimenkoNo ratings yet

- Kaufman Short-Term Patterns - V39 - C01 - 168KAUFDocument13 pagesKaufman Short-Term Patterns - V39 - C01 - 168KAUFJoseph WestNo ratings yet

- Phoenix Commodities Webinar Synopsis & Trading SetupDocument15 pagesPhoenix Commodities Webinar Synopsis & Trading Setupvinayak sontakkeNo ratings yet

- Vsa Basics From MTMDocument32 pagesVsa Basics From MTMHafeezah Ausar100% (3)

- Prime Selling Pointers by William O NeillDocument2 pagesPrime Selling Pointers by William O NeillNikki YuNo ratings yet

- Volatilityii: Bull Call SpreadDocument3 pagesVolatilityii: Bull Call Spreadsan MunNo ratings yet

- Smart Money Concept Cryptocurrency Day Trading For A LivingDocument27 pagesSmart Money Concept Cryptocurrency Day Trading For A LivingZack Ming67% (3)

- An Introduction To Japanese Candlestick ChartingDocument14 pagesAn Introduction To Japanese Candlestick ChartingRomelu MartialNo ratings yet

- Candlesticks BookDocument14 pagesCandlesticks BookLoose100% (1)

- Specialists Movements Within The Market by Richard NeyDocument5 pagesSpecialists Movements Within The Market by Richard Neyaddqdaddqd100% (3)

- PDF Created With Pdffactory Trial VersionDocument8 pagesPDF Created With Pdffactory Trial Versionlaozi222No ratings yet

- Active Trader Magazine - Linda Bradford Raschke - The Rituals of Trading PDFDocument7 pagesActive Trader Magazine - Linda Bradford Raschke - The Rituals of Trading PDFDan100% (3)

- Nick Train The King of Buy and Hold PDFDocument13 pagesNick Train The King of Buy and Hold PDFJohn Hadriano Mellon FundNo ratings yet

- The Stoic Investor: Possessed by Your PossessionsDocument6 pagesThe Stoic Investor: Possessed by Your PossessionspadmaniaNo ratings yet

- Volume Studies 14MDocument8 pagesVolume Studies 14MrfnNo ratings yet

- BoomDocument2 pagesBoomBrian AnhawNo ratings yet

- DWA Point Figure Basics - 0 PDFDocument8 pagesDWA Point Figure Basics - 0 PDFwillNo ratings yet

- HTTP WWW - Tradingmarkets.c..8Document5 pagesHTTP WWW - Tradingmarkets.c..8pderby1No ratings yet

- The All-Time High Stock System: Profit With WinnersDocument4 pagesThe All-Time High Stock System: Profit With WinnersFacuNo ratings yet

- Failure Confirmation IntroductionDocument15 pagesFailure Confirmation IntroductionamanryzeNo ratings yet

- How Can A Strategy Still Work If Everyone Knows About ItDocument7 pagesHow Can A Strategy Still Work If Everyone Knows About ItgreyistariNo ratings yet

- Charting SessionDocument18 pagesCharting SessionteamgenzfashionNo ratings yet

- Advanced Trader CourseDocument73 pagesAdvanced Trader CourseFrancisco Santos100% (1)

- The Support and Resistance ThreadDocument8 pagesThe Support and Resistance Thread严墨No ratings yet

- Pinbar StrategyDocument7 pagesPinbar Strategycryslaw100% (1)

- Chart PatternDocument7 pagesChart PatternKrish BulaniNo ratings yet

- Chart PatternsDocument100 pagesChart Patternsmz889375% (4)

- How To Trade With Market StructureDocument8 pagesHow To Trade With Market Structureaprilyn jabonilloNo ratings yet

- Markets in Profile 部分22Document5 pagesMarkets in Profile 部分22xufdddNo ratings yet

- Fundamental and Technical Analysis of Portfolio Management.Document17 pagesFundamental and Technical Analysis of Portfolio Management.Deven RathodNo ratings yet

- 4 Questions and Answers About Value InvestingDocument3 pages4 Questions and Answers About Value Investingambasyapare1No ratings yet

- Options Installment Strategies: Long-Term Spreads for Profiting from Time DecayFrom EverandOptions Installment Strategies: Long-Term Spreads for Profiting from Time DecayNo ratings yet

- Taming the Bear: The Art of Trading a Choppy MarketFrom EverandTaming the Bear: The Art of Trading a Choppy MarketRating: 3.5 out of 5 stars3.5/5 (2)

- From Wikipedia, The Free Encyclopedia: Irrational Exuberance, 2d EdDocument1 pageFrom Wikipedia, The Free Encyclopedia: Irrational Exuberance, 2d EdLNo ratings yet

- Tier 1 Capital - All BanksDocument1 pageTier 1 Capital - All BanksLNo ratings yet

- Tier 1 Capital - All Banks1Document1 pageTier 1 Capital - All Banks1LNo ratings yet

- 101 Things Everyone Should Know About Economics 1Document1 page101 Things Everyone Should Know About Economics 1LNo ratings yet

- Tier 1 Capital - All BanksDocument3 pagesTier 1 Capital - All BanksL100% (1)

- Mark Minervini Stage 2 Uptrend and Trend TemplateDocument1 pageMark Minervini Stage 2 Uptrend and Trend TemplateL100% (1)

- Hat-Trick-3 Easy-Entry-Exit Strategies9Document1 pageHat-Trick-3 Easy-Entry-Exit Strategies9LNo ratings yet

- Hat-Trick-3 Easy-Entry-Exit Strategies6Document1 pageHat-Trick-3 Easy-Entry-Exit Strategies6LNo ratings yet

- Hat-Trick-3 Easy-Entry-Exit Strategies8Document1 pageHat-Trick-3 Easy-Entry-Exit Strategies8LNo ratings yet

- ATR Trailing Stop2Document1 pageATR Trailing Stop2LNo ratings yet

- What Is An ATR Trailing Stop?: New Trader UDocument1 pageWhat Is An ATR Trailing Stop?: New Trader ULNo ratings yet

- Problem Solving questions-IFTDocument18 pagesProblem Solving questions-IFTPiyush KothariNo ratings yet

- Basic Accounting For CorporationDocument12 pagesBasic Accounting For CorporationBrian Christian VillaluzNo ratings yet

- Intermediate Accounting Exam 3Document2 pagesIntermediate Accounting Exam 3BLACKPINKLisaRoseJisooJennieNo ratings yet

- Chapter 6: Beta Estimation and The Cost of EquityDocument2 pagesChapter 6: Beta Estimation and The Cost of EquityMukul KadyanNo ratings yet

- Reaction Paper About Stock MarketDocument2 pagesReaction Paper About Stock MarketWarly BarcumaNo ratings yet

- Client Wise Detail Report: As On 31 Oct 2023Document2 pagesClient Wise Detail Report: As On 31 Oct 2023smitaghike23No ratings yet

- 4201 SyllabusDocument5 pages4201 Syllabuszahir2020No ratings yet

- Cost of CapitalDocument15 pagesCost of CapitalShainaNo ratings yet

- Jyoti CNC Automation Limited: History and Certain Corporate MattersDocument388 pagesJyoti CNC Automation Limited: History and Certain Corporate MattersRAJAMANICKAMNo ratings yet

- European Steel Industry - Separating Fact From FictionDocument8 pagesEuropean Steel Industry - Separating Fact From Fictionpipat .sNo ratings yet

- FM120 ActivityDocument3 pagesFM120 ActivityMarjonNo ratings yet

- Capitals and LiabilitiesDocument13 pagesCapitals and LiabilitiesVandita KhudiaNo ratings yet

- Adobe Scan 13 Feb 2022Document10 pagesAdobe Scan 13 Feb 2022pallavi mishraNo ratings yet

- Strategic Accounting Issues in Multinational Corporations: Mcgraw-Hill/Irwin Rights ReservedDocument32 pagesStrategic Accounting Issues in Multinational Corporations: Mcgraw-Hill/Irwin Rights ReservedChuckNo ratings yet

- Rate of Return Analysis: Week 11Document25 pagesRate of Return Analysis: Week 11Sonia FausaNo ratings yet

- Fiori ListsDocument1,220 pagesFiori ListsAnonymous idAkaGNo ratings yet

- A Study On Investment Behavior of Women InvestorsDocument1 pageA Study On Investment Behavior of Women InvestorsMegha PatelNo ratings yet

- BuscomDocument2 pagesBuscomAliezaNo ratings yet

- Question Bank Answer: UNIT 4: Company FormationDocument5 pagesQuestion Bank Answer: UNIT 4: Company Formationameyk89No ratings yet

- TravelCenters of AmericaDocument14 pagesTravelCenters of AmericaAman Kumar JhaNo ratings yet

- 5 Intercompany Gain - PpeDocument33 pages5 Intercompany Gain - PpeElla Mae TuratoNo ratings yet

- Ownership Sorting ExerciseDocument1 pageOwnership Sorting ExerciseWerda Rashid EkhlasNo ratings yet

- Eviews Analysis : Determinants of Return Stock Company Real Estate and Property Located in Indonesia Stock Exchange (Idx) Fauzie Bustami and Jerry HeikalDocument21 pagesEviews Analysis : Determinants of Return Stock Company Real Estate and Property Located in Indonesia Stock Exchange (Idx) Fauzie Bustami and Jerry HeikalGSA publishNo ratings yet

- 4 - Trading Strategies Slope and Convexity RestrictionsDocument39 pages4 - Trading Strategies Slope and Convexity RestrictionsKim_Sehun_5753100% (1)

- Merger of ING Vysya Bank Ltd. With Kotak Mahindra Bank Ltd.Document20 pagesMerger of ING Vysya Bank Ltd. With Kotak Mahindra Bank Ltd.Prasad JoshiNo ratings yet

- The Buyback OptionDocument7 pagesThe Buyback OptionsabijagdishNo ratings yet