Professional Documents

Culture Documents

RMC No. 88-2021

RMC No. 88-2021

Uploaded by

Jogenn Karla GagarinOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RMC No. 88-2021

RMC No. 88-2021

Uploaded by

Jogenn Karla GagarinCopyright:

Available Formats

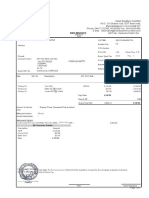

REPUBLIC OF THE PHILIPPINES

EITREA-u oFm;ilT

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

JUL 16

Quezon City

Ds MGr. olvrsrtril

June 29,2021

REvEr{uE MEMoRANDUM cTRCULAR No. 99' ne.t

SUBJECT Circularizing the Lists of Withholding Agents Required to Deduct and

Remit the loh or 2o/o Creditable Withholding Tax for the Purchase of

Goods and Services under Revenue Regulations No. 3l-2020.

TO All Revenue Officials, Employees and Others Concemed

In connection with the newly prescribed criteria set forth under Revenue Regulations

(RR) No. 3l-2020 in identifying the Top Withholding Agents (TWAs) of each Revenue

District Offices, this Circular is hereby issued to circularize the recently published lists of

withholding agents for inclusion to and deletion from the existing list of TWAs who are

required to deduct and remit either the one percent (1%) or two percent (2%) Creditable

Withholding Tax (CWT) from the income payments to their suppliers of goods and services,

respectively. Please visit the BIR's website at www.bir.gov.ph where the lists are posted and

provided with search facility for the convenience of all concemed.

Accordingly, the obligation to deduct and remit to this Bureau the 1o/o and 2oh CWT

shall continue. commence or cease, as the case may be, effective Aueust 1. 2021. Any taxpayer

not found in the published list of TWAs is deemed excluded and therefore not required to

deduct and remit the lo/o or 2Yo CWT pursuant to the abovementioned RR.

Moreover, for purposes of uniformity and in compliance with the policy of ease of

doing business with this Bureau, any written request by the taxpayers as a separate

documentary proof for being identified as TWAs, despite the publication in the newspaper of

general circulation being deemed sufficient, shall be filed with the Revenue District Office and

the corresponding Cerlification issued by its Revenue District Officer where the concerned

withholding agent is duly registered.

All revenue officers and employees are hereby enjoined to give this Circular as wide a

publicity as possible.

-/ffi\^4+1

CAESAR DULAY R.

Commissioner of Internal Revenue

J-5

044 0 4 S

9,L3c^

&

You might also like

- Bir 2303Document1 pageBir 2303Melissa Baday80% (5)

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- 11 - M. PH Pharmaceutical Marketing & ManagementDocument23 pages11 - M. PH Pharmaceutical Marketing & Managementmonita aryaNo ratings yet

- Peachtree Securities (B)Document26 pagesPeachtree Securities (B)Rufino Gerard MorenoNo ratings yet

- RMC No. 27-2022Document1 pageRMC No. 27-2022Shiela Marie MaraonNo ratings yet

- RMC No. 16-2021Document2 pagesRMC No. 16-2021Leichelle BautistaNo ratings yet

- RMC No. 92-102-2020Document5 pagesRMC No. 92-102-2020nathalie velasquezNo ratings yet

- RMC No. 28-2019Document2 pagesRMC No. 28-2019AmberlyNo ratings yet

- RMC No. 134-2019Document1 pageRMC No. 134-2019cris gerard trinidadNo ratings yet

- RMC No. 125-2020Document1 pageRMC No. 125-2020Raine Buenaventura-EleazarNo ratings yet

- March: Republic Philippines Department of Finance OI-RevenueDocument2 pagesMarch: Republic Philippines Department of Finance OI-Revenueantonio espirituNo ratings yet

- RMC No. 44-2021 RevisedDocument2 pagesRMC No. 44-2021 RevisedDessere Ann AnchetaNo ratings yet

- RMC No. 112-2020Document1 pageRMC No. 112-2020Tina Reyes-BattadNo ratings yet

- RMC No 56-2019.clarifies The Reckoning Period For The Payment of Documentary Stamp Tax On Original Issue of Shares of StocksDocument1 pageRMC No 56-2019.clarifies The Reckoning Period For The Payment of Documentary Stamp Tax On Original Issue of Shares of StockszooeyNo ratings yet

- RMC No 24-2019 Submission of Bir Form 2316Document2 pagesRMC No 24-2019 Submission of Bir Form 2316joelsy100100% (1)

- Rmo No.47-2019Document2 pagesRmo No.47-2019Sid CandelariaNo ratings yet

- Subject: Bureau RevenueDocument1 pageSubject: Bureau RevenueCliff DaquioagNo ratings yet

- Tw. - NSRZ: 1ffi - $&Ffi.'Ri A.T4Document1 pageTw. - NSRZ: 1ffi - $&Ffi.'Ri A.T4Lenin Rey PolonNo ratings yet

- RR No. 23-2018Document2 pagesRR No. 23-2018nathalie velasquezNo ratings yet

- Zojd: A Key Cy Revenue EmployeesDocument1 pageZojd: A Key Cy Revenue EmployeesCliff DaquioagNo ratings yet

- BIR RMC No. 61-2020Document1 pageBIR RMC No. 61-2020pollyNo ratings yet

- Irr Lo: Revenue Memorandum YD 8Document1 pageIrr Lo: Revenue Memorandum YD 8Larry Tobias Jr.No ratings yet

- RR 10-2019Document2 pagesRR 10-2019Jackie PadasasNo ratings yet

- flg-20 ?RT: Republic Philippines Department of Finance InternalDocument1 pageflg-20 ?RT: Republic Philippines Department of Finance InternalJayvee OlayresNo ratings yet

- RMC No. 7-2021Document1 pageRMC No. 7-2021nathalie velasquezNo ratings yet

- Internal Revenue: Republic of Pfiilippines DepartmentDocument1 pageInternal Revenue: Republic of Pfiilippines DepartmentJohn RoeNo ratings yet

- RMC No. 70-2020Document1 pageRMC No. 70-2020lara.zestoNo ratings yet

- RMC No 58-2019Document1 pageRMC No 58-2019lara.zestoNo ratings yet

- Revenue Ctrcular: MemorandumDocument12 pagesRevenue Ctrcular: Memorandumnathalie velasquezNo ratings yet

- RMC No. 8-2022Document1 pageRMC No. 8-2022Shiela Marie MaraonNo ratings yet

- Memorandum Circular: InternalDocument1 pageMemorandum Circular: InternalJhenny Ann P. SalemNo ratings yet

- RMC No. 92-2020Document1 pageRMC No. 92-2020Brian TomasNo ratings yet

- RMC No 15-2018Document1 pageRMC No 15-2018jesieNo ratings yet

- RR No. 7-2018Document2 pagesRR No. 7-2018Rheneir MoraNo ratings yet

- RMC No. 124-2019Document1 pageRMC No. 124-2019Melody Lim DayagNo ratings yet

- RMC No. 93-2021Document2 pagesRMC No. 93-2021Jeorge VerbaNo ratings yet

- RMC No. 93-2021Document2 pagesRMC No. 93-2021Ron LopezNo ratings yet

- RMC No. 46-2021Document1 pageRMC No. 46-2021Joel SyNo ratings yet

- Rmo No.45-2019Document2 pagesRmo No.45-2019Earl PatrickNo ratings yet

- RMC No. 122 2019 PDFDocument2 pagesRMC No. 122 2019 PDFJoshua FortunoNo ratings yet

- BIR RMO No. 6-2021Document5 pagesBIR RMO No. 6-2021Earl PatrickNo ratings yet

- gL.,!IO2I.: RE) UBL/CO) T//E) ///L//,) /NES InternalDocument2 pagesgL.,!IO2I.: RE) UBL/CO) T//E) ///L//,) /NES InternalKe VinNo ratings yet

- RMC No. 45-2021Document1 pageRMC No. 45-2021Raffy AmosNo ratings yet

- Suspension of Audit - RMC 76-2022Document1 pageSuspension of Audit - RMC 76-2022ECMH ACCOUNTING AND CONSULTANCY SERVICESNo ratings yet

- RMC No 54-18 Interest and Penalty PDFDocument2 pagesRMC No 54-18 Interest and Penalty PDFGil PinoNo ratings yet

- RMC No 19-2019 PDFDocument2 pagesRMC No 19-2019 PDFRobea Marie GaspayNo ratings yet

- RMC No. 57-2021Document1 pageRMC No. 57-2021Enrryson SebastianNo ratings yet

- 4?' of For All: NO. AODocument1 page4?' of For All: NO. AOKythkatNo ratings yet

- RMC No 100-2017 PDFDocument1 pageRMC No 100-2017 PDFGLEMICH BUILDERS INCNo ratings yet

- RMO No. 1-2024Document3 pagesRMO No. 1-2024Anostasia NemusNo ratings yet

- Lirnu Ilfilicomqquret?irywl: 1ffao''-'! ) RDocument1 pageLirnu Ilfilicomqquret?irywl: 1ffao''-'! ) RAngelica AllanicNo ratings yet

- RMO No. 55-2016Document3 pagesRMO No. 55-2016kylebollozosNo ratings yet

- BIR RMO No. 13-2021Document2 pagesBIR RMO No. 13-2021Earl PatrickNo ratings yet

- Bir 2303Document1 pageBir 2303Gino Villeras IlustreNo ratings yet

- Operations Memorandum No. 2018-01-02 Final Tax On Withdrawal From Decedents AccountDocument1 pageOperations Memorandum No. 2018-01-02 Final Tax On Withdrawal From Decedents AccountBien Bowie A. CortezNo ratings yet

- 4 N-LDLG: To ForDocument2 pages4 N-LDLG: To ForNash FloresNo ratings yet

- RMC No. 3-2022Document2 pagesRMC No. 3-2022Shiela Marie MaraonNo ratings yet

- RMC No. 90-2020Document1 pageRMC No. 90-2020Jestine FerraerNo ratings yet

- RMC No. 9-2024Document1 pageRMC No. 9-2024Anostasia NemusNo ratings yet

- RMC No. 117-2020-MergedDocument15 pagesRMC No. 117-2020-Mergednathalie velasquezNo ratings yet

- RMC No. 89-2021Document1 pageRMC No. 89-2021Jai HoNo ratings yet

- Bureau of Internal Revenue: Republic of The Philippines Department of FinanceDocument2 pagesBureau of Internal Revenue: Republic of The Philippines Department of Financelantern san juanNo ratings yet

- Angelo A. Blanco: Career ProfileDocument2 pagesAngelo A. Blanco: Career ProfileJogenn Karla GagarinNo ratings yet

- United States Securities and Exchange Commission Form 8-KDocument4 pagesUnited States Securities and Exchange Commission Form 8-KJogenn Karla GagarinNo ratings yet

- Legal and Taxation AspectDocument33 pagesLegal and Taxation AspectJogenn Karla Gagarin100% (2)

- DianeDocument2 pagesDianeJogenn Karla GagarinNo ratings yet

- Optimal Capital StructureDocument13 pagesOptimal Capital StructureScarlet SalongaNo ratings yet

- Galgotias University: Bba+Llb (Hons) Section-B Semester-VthDocument11 pagesGalgotias University: Bba+Llb (Hons) Section-B Semester-VthTannu guptaNo ratings yet

- Updated ResumeDocument3 pagesUpdated ResumeBhasker RamachandraNo ratings yet

- Message 1Document7 pagesMessage 1Zyad UziNo ratings yet

- Auto Secure - Private Car Package Policy: Sincerely, For Tata AIG General Insurance Company LimitedDocument4 pagesAuto Secure - Private Car Package Policy: Sincerely, For Tata AIG General Insurance Company Limitedismail02984No ratings yet

- 19Document3 pages19Kristine Arsolon100% (2)

- Hedge Fund StrategiesDocument2 pagesHedge Fund StrategiesPradnya Kulal0% (1)

- Prudential Bank v. Martinez - DigestDocument3 pagesPrudential Bank v. Martinez - DigestcinfloNo ratings yet

- Theoretical Foundations For Quantitative Finance 9813202475 9789813202474 - CompressDocument222 pagesTheoretical Foundations For Quantitative Finance 9813202475 9789813202474 - CompressLynaNo ratings yet

- Answer Scheme TUTORIAL CHAPTER 4Document13 pagesAnswer Scheme TUTORIAL CHAPTER 4niklynNo ratings yet

- Micro Finance in India FinalDocument90 pagesMicro Finance in India Finalswatibhardwaaj100% (1)

- Invoice CT-2237144Document2 pagesInvoice CT-2237144ABALUNo ratings yet

- Mutual Fund Pass4sureDocument394 pagesMutual Fund Pass4surerohini.flyasiaNo ratings yet

- Shakeeb Resume1Document3 pagesShakeeb Resume1Shakeeb AshaiNo ratings yet

- Mitul - 151479254Document3 pagesMitul - 151479254asdasdNo ratings yet

- List of Payment Purpose Code KRDocument10 pagesList of Payment Purpose Code KRあいうえおかきくけこNo ratings yet

- MBA-Nayak PPT 1Document15 pagesMBA-Nayak PPT 1Anveshak PardhiNo ratings yet

- The Banking and Financial Institutions Act, 1989Document7 pagesThe Banking and Financial Institutions Act, 1989efekahNo ratings yet

- Unit 4Document8 pagesUnit 4Saniya HashmiNo ratings yet

- SQLDocument3 pagesSQLcoke911111No ratings yet

- TAX2601 SummaryDocument14 pagesTAX2601 SummaryGhairunisa Harris50% (2)

- Sub: Intimation Under Regulation 39 (3) of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015Document2 pagesSub: Intimation Under Regulation 39 (3) of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015Jasmatbhai patelNo ratings yet

- Ram BillDocument1 pageRam BillHarish Babu N KNo ratings yet

- RCA 204, Innovation & Entrepreneurship: Unit Iv: (8 HRS)Document12 pagesRCA 204, Innovation & Entrepreneurship: Unit Iv: (8 HRS)Anonymous MhCdtwxQINo ratings yet

- Love School of Business CheckseetDocument1 pageLove School of Business Checkseetapi-283792537No ratings yet

- Islamic Economy: ObjectivesDocument6 pagesIslamic Economy: ObjectivesIntiser RockteemNo ratings yet

- PRTC-FINAL PB - Answer Key 10.21 PDFDocument38 pagesPRTC-FINAL PB - Answer Key 10.21 PDFLuna VNo ratings yet

- Republic Act No.10881 - Amendments On Investment RestrictionsDocument3 pagesRepublic Act No.10881 - Amendments On Investment Restrictionsdefaens8053No ratings yet