Professional Documents

Culture Documents

Life Insurance Needs Analysis: Protec Tion Solutions

Life Insurance Needs Analysis: Protec Tion Solutions

Uploaded by

Debdeep KarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Life Insurance Needs Analysis: Protec Tion Solutions

Life Insurance Needs Analysis: Protec Tion Solutions

Uploaded by

Debdeep KarCopyright:

Available Formats

Protec tion Solutions

Life insurance needs analysis

Date

(DD/MM/YYYY)

A B

Client name

Assets to be converted at death

Savings accounts

Tax-free savings account

After-tax value of registered investments

After-tax value of non-registered investments

Principal residence

After-tax value of other real estate

(cottage, etc.)

After-tax value of business/farm assets

Tot al life insurance 1

CPP/QPP death benefit

Other assets

Total assets available $ a $ a

Liabilities

Mortgage(s)

Loan(s) and other debts

Final expenses 2

Total liabilities $ b $ b

Cash needs at death for survivors

1 Total life insurance Education fund

includes

personal insurance, group Readjustment costs 3

insurance, mortgage

Other cash needs 4

insurance, credit insurance.

2 Final expense includes Total cash needs $ c $ c

funeral expenses, final taxes,

Total liabilities and cash needs (b + c) $ d $ d

probate fees, legal and

executor fees, etc. Income for survivors (gross, annual and beginning of period values)

Readjustment costs include Income required after death

3

$e$e

advance payment of (70% of total family income is suggested)

rent,

leave without pay, trip,

etc.

Partner’s/Spouse’s employment income

4 Other cash needs include

CPP/QPP survivor/orphan income benefits

child and home

care

expenses, emergency fund, Other income

bequest, etc.

Income available $ f $ f

The person who is preparing

Income shortage/surplus

this simplified Needs Analysis

(if negative, enter 0) (e - f) $ g $ g

is an independent Factor selected (refer to reverse hh

contractor.

Neither The Standard Life side)

Assurance Company of Amount needed

Canada nor any of its affiliates to cover income shortage (g x h) $ i $ i

(hereinafter Standard Life) Total insurance needs (d + i) $ j $ j

will

be supervising the activity(ies)

of your representative and

you should not rely on

Additional life insurance

Standard Life for any review of

required

(if negative, enter 0) (j - a) $ $

this Needs Analysis. Standard Client A signature Date

Life will not be liable to (DD/MM/YYYY)

you

for any errors or omissions as Client B signature Date

a result of any activity(ies) or (DD/MM/YYYY)

service(s) performed by your

Advisor signature Date

representative. (DD/MM/YYYY)

Factor for the calculation of the capital needed to cover the income shortage

Interest rate*

1% 2% 3% 4% 5% 6% 7% 8%

Capital 5 years 4.90 4.81 4.72 4.63 4.55 4.47 4.39 4.31

depletion 10 years 9.57 9.16 8.79 8.44 8.11 7.80 7.52 7.25

15 years 14.00 13.11 12.30 11.56 10.90 10.29 9.75 9.24

20 years 18.23 16.68 15.32 14.13 13.09 12 .16 11. 34 10.60

25 years 22.24 19.91 17. 94 16.25 14.80 13.55 12.47 11.53

30 years 26.07 22.84 20.19 17.98 16.14 14.59 13.28 12.16

35 years 29.70 25.50 22.13 19.41 17.19 15.37 13.85 12.59

40 years 33.16 27.90 23.81 20.58 18.02 15.95 14.26 12.88

45 years 36.46 30.08 25.25 21.55 18.66 16.38 14.56 13.08

50 years 39.59 32.05 26.50 22.34 19 .17 16.71 14.77 13.21

Capital preservation 101.00 51.00 34.33 26.00 21.00 17. 67 15.29 13.50

* To account for inflation, you may use a net interest rate equal to interest rate minus inflation rate.

www.standardlife.c

a

Standard Life Assurance Company of Canada

Standard Life Assurance Limited

P C 65 4 9-0 7-2 0 09

You might also like

- SERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKFrom EverandSERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKNo ratings yet

- Statement Jun, 2021Document4 pagesStatement Jun, 2021S RNo ratings yet

- ACCT233 Tutorial 5 QuestionsDocument3 pagesACCT233 Tutorial 5 QuestionsDominic RobinsonNo ratings yet

- Yasmine-Khalaf - AF4S31 Strategic Financial Management - Assignemnt 2Document23 pagesYasmine-Khalaf - AF4S31 Strategic Financial Management - Assignemnt 2Yasmine A. Khalaf100% (5)

- M&a Case Study SolutionDocument3 pagesM&a Case Study SolutionSoufiane EddianiNo ratings yet

- Capital Budgeting 3MA3 MMD: Problem ADocument9 pagesCapital Budgeting 3MA3 MMD: Problem AShao BajamundeNo ratings yet

- Real Estate Investing 101Document32 pagesReal Estate Investing 101jituNo ratings yet

- LyndonBasc 0894220504221237Document7 pagesLyndonBasc 0894220504221237LyndonNo ratings yet

- CHAPTER 10 - AnswerDocument5 pagesCHAPTER 10 - Answernash100% (2)

- Personal FinanceDocument5 pagesPersonal Finance11222084No ratings yet

- Permanent TSB Standard Financial Statement PDFDocument12 pagesPermanent TSB Standard Financial Statement PDFHarshitShuklaNo ratings yet

- Inancial Lanning Orksheet: Statement of Net WorthDocument9 pagesInancial Lanning Orksheet: Statement of Net WorthKevin Baladad100% (1)

- Worksheet in S 11 - Robo - AdvisingDocument25 pagesWorksheet in S 11 - Robo - Advisingyogesh vaidyaNo ratings yet

- Barrick Enrollment Form Apr 2022Document3 pagesBarrick Enrollment Form Apr 2022jorge ordinolaNo ratings yet

- Com203 - Final Accounts of Insurance CompaniesDocument23 pagesCom203 - Final Accounts of Insurance CompaniesSanaullah M SultanpurNo ratings yet

- LIC's Bima Shiromani (T-947) : Benefit IllustrationDocument3 pagesLIC's Bima Shiromani (T-947) : Benefit IllustrationVivek SharmaNo ratings yet

- Project Cost: Item Price (Rs./Watt) AmountDocument10 pagesProject Cost: Item Price (Rs./Watt) AmountchanderNo ratings yet

- Accounts of Insurance Cos ProjectDocument14 pagesAccounts of Insurance Cos ProjectAditya SoodNo ratings yet

- Your Personal Financial Plan and Fact FindDocument6 pagesYour Personal Financial Plan and Fact FindDiana ParraoNo ratings yet

- Getting Started: Laura e Ramon - 20foxDocument20 pagesGetting Started: Laura e Ramon - 20foxlauraNo ratings yet

- Your Personal Balance Sheet - Afinal - 8759Document12 pagesYour Personal Balance Sheet - Afinal - 8759AndrewNo ratings yet

- Initial Documentation ChecklistDocument3 pagesInitial Documentation ChecklistDarnell WoodardNo ratings yet

- Smart WealthDocument8 pagesSmart WealthmilanNo ratings yet

- CH 2Document71 pagesCH 2Adilene AcostaNo ratings yet

- Benefit Name Sum A Ssured (In RS.) Benefit Term (Years) Premium Paying Term (Years) Premium (In RS.)Document3 pagesBenefit Name Sum A Ssured (In RS.) Benefit Term (Years) Premium Paying Term (Years) Premium (In RS.)Vasanth VasantNo ratings yet

- Trainer Business PlanDocument18 pagesTrainer Business PlanJean CharcNo ratings yet

- Benefit Name Sum A Ssured (In RS.) Benefit Term (Years) Premium Paying Term (Years) Premium (In RS.)Document3 pagesBenefit Name Sum A Ssured (In RS.) Benefit Term (Years) Premium Paying Term (Years) Premium (In RS.)Vasanth VasantNo ratings yet

- InsuranceDocument15 pagesInsurancekananguptaNo ratings yet

- Accounting AssignmentDocument15 pagesAccounting AssignmentYusef ShaqeelNo ratings yet

- Generic Financial Statement Form PersonalDocument3 pagesGeneric Financial Statement Form PersonalMantasha Financial servicesNo ratings yet

- SWG Joint Life BrochureDocument19 pagesSWG Joint Life BrochureHardik BajajNo ratings yet

- Benefit Illustration For Your Policy EQuote Number 520040229470Document2 pagesBenefit Illustration For Your Policy EQuote Number 520040229470Shobha RaniNo ratings yet

- Personal Financial StatementDocument3 pagesPersonal Financial StatementIPS SAINSA SASNo ratings yet

- Benefit IllustrationDocument3 pagesBenefit Illustrationanon_315406837No ratings yet

- Form 2Document2 pagesForm 2api-383904539No ratings yet

- Insurance Fraud: Atty. Dennis B. FunaDocument47 pagesInsurance Fraud: Atty. Dennis B. FunaShie La Ma RieNo ratings yet

- Variable Life Insurance ProposalDocument7 pagesVariable Life Insurance ProposalAljunBaetiongDiazNo ratings yet

- Personal Finance StatmentDocument3 pagesPersonal Finance StatmentDarnellNo ratings yet

- TUT Macro Unit 2 (Answer)Document5 pagesTUT Macro Unit 2 (Answer)张宝琪No ratings yet

- Lecture 1 - Fundamentals and Accounting CycleDocument3 pagesLecture 1 - Fundamentals and Accounting CyclecoyNo ratings yet

- Personal Financial Statement (SBA Form 413D)Document4 pagesPersonal Financial Statement (SBA Form 413D)fsfsfNo ratings yet

- Account List FormatDocument4 pagesAccount List Formatranayati21No ratings yet

- Inancial Lanning Orksheet: Statement of Net WorthDocument8 pagesInancial Lanning Orksheet: Statement of Net WorthDu Baladad Andrew MichaelNo ratings yet

- TAX-01 Chapter 12 - DeductionsDocument29 pagesTAX-01 Chapter 12 - DeductionsJovince Daño DoceNo ratings yet

- Financial Information Form WordDocument1 pageFinancial Information Form WordAfshin SarbazNo ratings yet

- IllustrationDocument4 pagesIllustrationInvest Aaj for kal Life insuranceNo ratings yet

- Loan Application FormDocument9 pagesLoan Application FormrohitNo ratings yet

- Tally Ledger List: Group Name Ledger Name All Types of Purchase Accounts LikeDocument6 pagesTally Ledger List: Group Name Ledger Name All Types of Purchase Accounts Likeramu100% (1)

- Variable Life Insurance ProposalDocument12 pagesVariable Life Insurance ProposalRoumel GalvezNo ratings yet

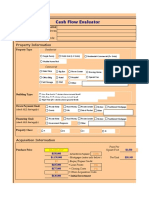

- 2011 Cash Flow EvaluatorDocument42 pages2011 Cash Flow EvaluatorEddie AyalaNo ratings yet

- Fna Loss of Independance - 05041e06 (06-07)Document2 pagesFna Loss of Independance - 05041e06 (06-07)AndrewNo ratings yet

- FIP501 WInter 2021 Time Value of Money Calculations Summary SheetDocument2 pagesFIP501 WInter 2021 Time Value of Money Calculations Summary Sheetharsh shahNo ratings yet

- Long Range Financial Forecast For G G The City of Alameda 2009 - 2019Document34 pagesLong Range Financial Forecast For G G The City of Alameda 2009 - 2019Action Alameda NewsNo ratings yet

- Gross Profit Net Profit/ EBIT: Return On Capital EmployesDocument9 pagesGross Profit Net Profit/ EBIT: Return On Capital Employesshekhar371No ratings yet

- Kie Loan Applilcation FormDocument6 pagesKie Loan Applilcation Formemyw42No ratings yet

- Module 2 Slides - Intro To Income TaxDocument37 pagesModule 2 Slides - Intro To Income Taxjciy4No ratings yet

- Notes:: Deduction Individuals Estates Trusts Corp. PartnershipsDocument19 pagesNotes:: Deduction Individuals Estates Trusts Corp. PartnershipsDamdam AlunanNo ratings yet

- DeductionsDocument29 pagesDeductionsJohnallenson DacosinNo ratings yet

- FIS and Audit Statement TemplateDocument4 pagesFIS and Audit Statement Templateissam jendoubiNo ratings yet

- 0000 Template - PCCDocument2 pages0000 Template - PCCRose Cano-AmbuloNo ratings yet

- Your Proposed Financial Solution: ProtectionDocument6 pagesYour Proposed Financial Solution: ProtectionElie DiabNo ratings yet

- Glossary of French Banking Terms French English CommentsDocument2 pagesGlossary of French Banking Terms French English CommentsKhob ThaiNo ratings yet

- IllustrationDocument5 pagesIllustrationabhayNo ratings yet

- MYM FormsDocument20 pagesMYM FormsFaisal AlimNo ratings yet

- 10.cashflows AAFR NotesDocument10 pages10.cashflows AAFR Notesmehdi.jjh313No ratings yet

- Ubaf 1Document6 pagesUbaf 1ivecita27No ratings yet

- Banking Regulation Act, 1949Document25 pagesBanking Regulation Act, 1949rkaran22No ratings yet

- Statement Chase Ismosis o CarloDocument4 pagesStatement Chase Ismosis o CarloYoel CabreraNo ratings yet

- Handouts 04.04 - Part 3Document3 pagesHandouts 04.04 - Part 3John Ray RonaNo ratings yet

- The Investment Environment: Bodie, Kane and MarcusDocument25 pagesThe Investment Environment: Bodie, Kane and Marcusvphuc1984No ratings yet

- Temporary Receipt 1Document1 pageTemporary Receipt 1tanudansavingsandlendingcoopNo ratings yet

- I3investor - A Free and Independent Stock Investors PortalDocument3 pagesI3investor - A Free and Independent Stock Investors PortalleekiangyenNo ratings yet

- Fundamentals of Accounting II, Chapter 4Document71 pagesFundamentals of Accounting II, Chapter 4Mohammed AbdulselamNo ratings yet

- WC MGMT Draft 1Document9 pagesWC MGMT Draft 1api-311798551No ratings yet

- Geometric GradientDocument20 pagesGeometric GradientDarkie DrakieNo ratings yet

- 11Document11 pages11Maria G. BernardinoNo ratings yet

- 15.1 Illustrative Problems For Ncahfs and DoDocument4 pages15.1 Illustrative Problems For Ncahfs and DoStefany M. SantosNo ratings yet

- Gold Not Oil InflationDocument8 pagesGold Not Oil Inflationpderby1No ratings yet

- Great LearningDocument32 pagesGreat LearningQKNo ratings yet

- Earnings Per ShareDocument19 pagesEarnings Per ShareDanica Austria DimalibotNo ratings yet

- Chapter SolutionsDocument7 pagesChapter SolutionsFakhir ZaidiNo ratings yet

- Bond ValuatioDocument66 pagesBond ValuatioKanishka SinghNo ratings yet

- Chapter 5 Solutions Chap 5 SolutionDocument9 pagesChapter 5 Solutions Chap 5 Solutiontuanminh2048No ratings yet

- Solution Manual For Financial Institutions Managementa Risk Management Approach Saunders Cornett 8th EditionDocument17 pagesSolution Manual For Financial Institutions Managementa Risk Management Approach Saunders Cornett 8th EditionAmandaMartinxdwj100% (43)

- Compound InterestDocument2 pagesCompound InterestEllen Mae OlaguerNo ratings yet

- Mutual Funds Price ListDocument6 pagesMutual Funds Price ListMohammad Nowaiser MaruhomNo ratings yet

- Phillips PLL 6e Chap03Document39 pagesPhillips PLL 6e Chap03snsahaNo ratings yet

- Macroeconomics - Introduction and Goals Lecture 1Document32 pagesMacroeconomics - Introduction and Goals Lecture 1enigmaticansh100% (1)

- Aaicp3718k 2023Document9 pagesAaicp3718k 2023Kamlesh KumarNo ratings yet

- Kid Deriv CFD Synthetic IndicesDocument5 pagesKid Deriv CFD Synthetic IndicesSamir Ciro Acosta100% (1)