Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

12 viewsCollege of Business and Accountancy

College of Business and Accountancy

Uploaded by

Mariam� AmilProblem III gives data for 10 additional cases involving inventory, purchases, cost of sales, sales, and other values. It requires determining the missing values based on the percentages or amounts

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Tugas 5.32 Product-Line Profitability PDFDocument1 pageTugas 5.32 Product-Line Profitability PDFjuniarNo ratings yet

- Summative Test-FABM2 2018-2019Document2 pagesSummative Test-FABM2 2018-2019Raul Soriano Cabanting88% (8)

- Auditing Problems3Document32 pagesAuditing Problems3Kimberly Milante100% (2)

- DR Lals FranchisingDocument25 pagesDR Lals FranchisingDivyam SanghviNo ratings yet

- Legal Feasibility: By:-Name - Rishi Kumar Gupta Stream - Int. BBA-MBA Reg No. - 161111017002Document6 pagesLegal Feasibility: By:-Name - Rishi Kumar Gupta Stream - Int. BBA-MBA Reg No. - 161111017002Brix ArriolaNo ratings yet

- Chapter 5Document8 pagesChapter 5minh ngocNo ratings yet

- FDNACCT - Mock Exam - Answer Key - 3 - Fill in The Blank Problems PDFDocument5 pagesFDNACCT - Mock Exam - Answer Key - 3 - Fill in The Blank Problems PDFJames de LeonNo ratings yet

- ACC 102 - QuizDocument11 pagesACC 102 - QuizSarah Mae EscutonNo ratings yet

- BE Chap 5Document3 pagesBE Chap 5TIÊN NGUYỄN LÊ MỸNo ratings yet

- Tugas 1 Product-LineDocument3 pagesTugas 1 Product-LinejuniarNo ratings yet

- Cash Flow ExercisesDocument12 pagesCash Flow ExercisesGaililian GerangayaNo ratings yet

- CHAPTER-7 Merchandising AnswerDocument24 pagesCHAPTER-7 Merchandising AnswersaphirejunelNo ratings yet

- Cash To Accrual BasisDocument5 pagesCash To Accrual BasisDo Reen ZaNo ratings yet

- ReviewerDocument9 pagesReviewerMarielle JoyceNo ratings yet

- 08.12.2017 Activity - Acfunda LabDocument2 pages08.12.2017 Activity - Acfunda LabPatOcampoNo ratings yet

- Ap-Problems - 2015Document20 pagesAp-Problems - 2015jayson100% (1)

- ASYNCHRONOUS ACTIVITY 4 WorksheetsDocument12 pagesASYNCHRONOUS ACTIVITY 4 WorksheetsAbejero Trisha Nicole A.No ratings yet

- From The Following Trial Balance, Prepare Trading and Profit & Loss AccountDocument2 pagesFrom The Following Trial Balance, Prepare Trading and Profit & Loss Accountyuvraj singhNo ratings yet

- Exercises On Closing Entries & Reversing EntriesDocument3 pagesExercises On Closing Entries & Reversing EntriesRoy BonitezNo ratings yet

- Inventories (Problems)Document6 pagesInventories (Problems)IAN PADAYOGDOGNo ratings yet

- Instructions: Amazon Seller Buys Printer Supplies For $29 With CashDocument1 pageInstructions: Amazon Seller Buys Printer Supplies For $29 With CashJorge FloresNo ratings yet

- Fabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyDocument3 pagesFabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyMounicha Ambayec100% (4)

- Fabm2 Statement of Comprehensive Income Practice Problems Answer KeyDocument3 pagesFabm2 Statement of Comprehensive Income Practice Problems Answer KeyMounicha Ambayec0% (1)

- UntitledDocument6 pagesUntitledJomar PenaNo ratings yet

- 2ND Year QualiDocument4 pages2ND Year QualiMark Domingo MendozaNo ratings yet

- Acctng 2 MerchandiseDocument2 pagesAcctng 2 MerchandiseDonald BugtongNo ratings yet

- Tutorial 10 Inventory SolutionsDocument6 pagesTutorial 10 Inventory SolutionsJen Hang WongNo ratings yet

- Inventories Exercises AnswersDocument12 pagesInventories Exercises AnswersAcads Purps100% (1)

- Cortez Exam in Business FinanceDocument4 pagesCortez Exam in Business FinanceFranchesca CortezNo ratings yet

- InventoryDocument18 pagesInventoryAdam Cuenca100% (1)

- Chapter-2 Profit & Loss - Balance SheetDocument2 pagesChapter-2 Profit & Loss - Balance Sheetvihanjangid223No ratings yet

- Merchandising Lecture MRFDDocument59 pagesMerchandising Lecture MRFDMaria Louella MagadaNo ratings yet

- AccountingDocument6 pagesAccountingCharisse CruzNo ratings yet

- Test Bank Chapter 3 Cost Volume Profit ADocument4 pagesTest Bank Chapter 3 Cost Volume Profit AKarlo D. ReclaNo ratings yet

- Business Combination Problem 1 Upto 9Document8 pagesBusiness Combination Problem 1 Upto 9jhun nhixNo ratings yet

- WOODDocument12 pagesWOODJayson ReyesNo ratings yet

- Financial Statement of Merchandising BusinessDocument3 pagesFinancial Statement of Merchandising BusinessDina Rose SardumaNo ratings yet

- Midterm Review SolutionsDocument8 pagesMidterm Review SolutionsnamiyuartsNo ratings yet

- Acctg110 FinalsDocument21 pagesAcctg110 FinalsRoman Dominic LlanoNo ratings yet

- CPA 1 - Financial Accounting Dec 2021Document9 pagesCPA 1 - Financial Accounting Dec 2021Asaba GloriaNo ratings yet

- Act 202 - Financial Accounting QDocument3 pagesAct 202 - Financial Accounting QShebgatul MursalinNo ratings yet

- Projecct Accounting 2Document3 pagesProjecct Accounting 2Russell Von DomingoNo ratings yet

- The Answer For The Exercise of Trading Company The ABC StoreDocument6 pagesThe Answer For The Exercise of Trading Company The ABC StoreSajakul SornNo ratings yet

- Sample Problems For InventoryDocument3 pagesSample Problems For Inventorytough mamaNo ratings yet

- Aucap2 Unit 5Document6 pagesAucap2 Unit 5Sel BarrantesNo ratings yet

- Journal Entries Account Titles Debit CreditDocument5 pagesJournal Entries Account Titles Debit CreditRoschelle MiguelNo ratings yet

- Finals Online Quiz 1 2Document14 pagesFinals Online Quiz 1 2Gon FreecsNo ratings yet

- Far01 - The Financial Statements PresentationDocument10 pagesFar01 - The Financial Statements PresentationRNo ratings yet

- Income Statement - Bells Manufacturing Year Ending December 31, 2015Document12 pagesIncome Statement - Bells Manufacturing Year Ending December 31, 2015Elif TuncaNo ratings yet

- Chapter XIIIDocument3 pagesChapter XIIIRhea AlianzaNo ratings yet

- Introduction To Accounting An Integrated Approach 6Th Edition Ainsworth Solutions Manual Full Chapter PDFDocument41 pagesIntroduction To Accounting An Integrated Approach 6Th Edition Ainsworth Solutions Manual Full Chapter PDFstevenwhitextsngyadmk100% (14)

- Statement of Comprehensive IncomeDocument3 pagesStatement of Comprehensive IncomeENIDNo ratings yet

- Problems - Cash FlowDocument5 pagesProblems - Cash FlowKevin JoyNo ratings yet

- Cash and Accrual BasisDocument10 pagesCash and Accrual BasisNoeme LansangNo ratings yet

- Issued & Paid Up Capital: 14 Schedual of Fixed AssetsDocument6 pagesIssued & Paid Up Capital: 14 Schedual of Fixed AssetsShoukat KhaliqNo ratings yet

- Lux Teddy Student 2020Document6 pagesLux Teddy Student 2020ramya penmatsaNo ratings yet

- AC191 Autumn 2011 FINALDocument9 pagesAC191 Autumn 2011 FINALgerlaniamelgacoNo ratings yet

- Assignment Accounting Merchendising #2Document1 pageAssignment Accounting Merchendising #2NELVA QABLINANo ratings yet

- Solutions To ProblemsDocument4 pagesSolutions To ProblemslorraineNo ratings yet

- QuestionsDocument12 pagesQuestionsDolliejane MercadoNo ratings yet

- The Brandgym: A Practical Workout for Boosting Brand and BusinessFrom EverandThe Brandgym: A Practical Workout for Boosting Brand and BusinessNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Intrinsic Valuation DCF Model TATA MOTORS LTD 1699087548Document13 pagesIntrinsic Valuation DCF Model TATA MOTORS LTD 1699087548WtransfastNo ratings yet

- MICROECONOMICS ch07ANNEXDocument6 pagesMICROECONOMICS ch07ANNEXSabrina GoNo ratings yet

- Tax Campus Hire - Job Description - FY22Document3 pagesTax Campus Hire - Job Description - FY22AkshathNo ratings yet

- HDFC BankDocument8 pagesHDFC BankKRIZMAL TRADING SOLUTIONS PVT LTDNo ratings yet

- Fixed VS Variable CostsDocument5 pagesFixed VS Variable Costssonia100% (1)

- Edexcel As Economics Unit 1 Revision GuideDocument28 pagesEdexcel As Economics Unit 1 Revision GuideWillNo ratings yet

- Unit 4 Accounting For LabourDocument18 pagesUnit 4 Accounting For LabourAayushi KothariNo ratings yet

- XH-IAS 40 Investment Properties - SV-Out-of-class practice-EN NewDocument6 pagesXH-IAS 40 Investment Properties - SV-Out-of-class practice-EN NewHà Mai VõNo ratings yet

- West Coast Paper MillsDocument72 pagesWest Coast Paper Millsvinodkumar_vicky67% (3)

- Griffin 9e IM CH 2 - EditedDocument26 pagesGriffin 9e IM CH 2 - EditedHo Hong Duc (FU HN)No ratings yet

- DHL Glo DGF Gogreen Solutions BrochureDocument8 pagesDHL Glo DGF Gogreen Solutions Brochurehappiest1100% (1)

- Adnan ThesisDocument51 pagesAdnan ThesisMohammad Naveed Hashmi100% (1)

- APUSH Industrialization EssayDocument6 pagesAPUSH Industrialization EssayChristopherNo ratings yet

- Handloom Export Promotion CouncilDocument12 pagesHandloom Export Promotion CouncilHarika ReddyNo ratings yet

- Relaxo Footwear-Analyst Meet Update-25 September 2014Document6 pagesRelaxo Footwear-Analyst Meet Update-25 September 2014Gogul RajaNo ratings yet

- Basmati Rice Export From IndiaDocument7 pagesBasmati Rice Export From IndiaMayankNo ratings yet

- Finance Affiliate ProgramsDocument121 pagesFinance Affiliate ProgramsAhmad Ali0% (1)

- 53rd-55th BPSC Combined Competitive (Main) Exam GENERAL STUDIES Question Paper 2012Document2 pages53rd-55th BPSC Combined Competitive (Main) Exam GENERAL STUDIES Question Paper 2012mevrick_guyNo ratings yet

- OF FTP 2015-2020 1 April, 2015 - 31 March, 2020: (Appendices and Aayat Niryat Forms)Document466 pagesOF FTP 2015-2020 1 April, 2015 - 31 March, 2020: (Appendices and Aayat Niryat Forms)Megha BepariNo ratings yet

- RRC Sample: Contractor ManagementDocument8 pagesRRC Sample: Contractor Managementleah nyamasveNo ratings yet

- Lease StructureDocument1 pageLease StructureAdhiraj KalitaNo ratings yet

- The Definition of MarketingDocument3 pagesThe Definition of Marketingluckyg1122No ratings yet

- Activity Based Costing ExamplesDocument23 pagesActivity Based Costing ExamplesPinkal PatelNo ratings yet

- Inoperative Account DefinitionDocument1 pageInoperative Account Definitionmkumar.itNo ratings yet

- Economics of Poultry Broiler Farming: Techno Economic ParametersDocument2 pagesEconomics of Poultry Broiler Farming: Techno Economic ParametersBrijesh SrivastavaNo ratings yet

- F 1040 SeDocument2 pagesF 1040 SeseihnNo ratings yet

- ACCA F5 Tuition Mock June 2012 QUESTIONS Version 3 FINAL at 23rd April 2012Document9 pagesACCA F5 Tuition Mock June 2012 QUESTIONS Version 3 FINAL at 23rd April 2012Hannah NazirNo ratings yet

- Chapter 2 Analysis of Solvency, Liquidity, and Financial FlexibilityDocument19 pagesChapter 2 Analysis of Solvency, Liquidity, and Financial FlexibilityYusuf Abdurrachman100% (1)

College of Business and Accountancy

College of Business and Accountancy

Uploaded by

Mariam� Amil0 ratings0% found this document useful (0 votes)

12 views2 pagesProblem III gives data for 10 additional cases involving inventory, purchases, cost of sales, sales, and other values. It requires determining the missing values based on the percentages or amounts

Original Description:

Original Title

AC 101 MIDTERM (1)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentProblem III gives data for 10 additional cases involving inventory, purchases, cost of sales, sales, and other values. It requires determining the missing values based on the percentages or amounts

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

12 views2 pagesCollege of Business and Accountancy

College of Business and Accountancy

Uploaded by

Mariam� AmilProblem III gives data for 10 additional cases involving inventory, purchases, cost of sales, sales, and other values. It requires determining the missing values based on the percentages or amounts

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

College of Business and Accountancy

Problem I.

The BSA-WS Co. buys and sell agricultural products. In November 2019, the following

merchandise transactions were incurred.

a. Merchandise purchase on credit P 300,000.

Purchase 300,000

Account payable 300,000

b. Merchandise sold on account P 560,000.

Account receivable 560,000

Sales 560,000

c. Cash purchases P 120,000.

Purchases 120,000

Cash 120,000

d. Cash sales P 310,000.

Cash 310,000

Sales 310,000

e. Defective goods returned to cash supplies P 10,000.

Sales return and Allowances 10,000

Account receivable 10,000

f. Defective goods returned to account supplier P 8,000.

Sales Discount 8,000

Account Receivable 8,000

g. Credit memo received by the seller from cash customers P 12,000.

Cash 12,000

Sales 12,000

h. Credit memo received by the seller from credit customers P 5,000.

Account Receivable 5,000

Sales 5,000

i. Payment to merchandise creditors within the discount, P 290,000 after deducting a

discount of P 10,000.

Account Payable 300,000

Purchase Discount 10,000

Cash 290,000

j. Collections from credit customers of P 400,000 less discount of P 8,000.

Cash 392,000

Sales Discount 8,000

Account Receivable 400,000

Requirements: Prepare journal entries after each transaction.

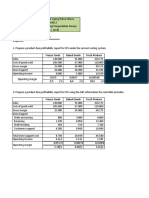

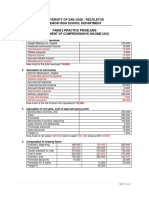

Problem II.

Compute the missing amounts

Case 1 Case 2 Case 3 Case 4

Sales 1,244,325 2,468,540 1,425,360 1,302,410

Cost of sales 825,450 1,727,970 991,490 875,890

Gross Profit 2,069,775 4,196,510 433,870 426,520

Operating Expense 245,330 3,968,175 301,320 301,320

Net Profit 1,824,445 210,335 132,550 125,200

Case 5 Case 6 Case 7 Case 8

Inventory beginning 125,750 87,985 55,780 68,990

Purchases 775,350 822,500 514,740 695,220

Total Goods Available for Sale 901,100 901,485 570,520 764,210

Inventory Ending 87,755 151,150 45,230 91,245

Cost of Sales 988,855 750,335 615,750 855,455

Case 9 Case 10

Sales 125,000 100%

Beginning Inventory 22,000 10%

Purchases 76,000 45%

Ending Inventory 24,000 15%

Cost of Sales 74,000 50%

Gross Profit 51,000 60%

Operating Expenses 39,000 10%

Net Income 12,000 40%

You might also like

- Tugas 5.32 Product-Line Profitability PDFDocument1 pageTugas 5.32 Product-Line Profitability PDFjuniarNo ratings yet

- Summative Test-FABM2 2018-2019Document2 pagesSummative Test-FABM2 2018-2019Raul Soriano Cabanting88% (8)

- Auditing Problems3Document32 pagesAuditing Problems3Kimberly Milante100% (2)

- DR Lals FranchisingDocument25 pagesDR Lals FranchisingDivyam SanghviNo ratings yet

- Legal Feasibility: By:-Name - Rishi Kumar Gupta Stream - Int. BBA-MBA Reg No. - 161111017002Document6 pagesLegal Feasibility: By:-Name - Rishi Kumar Gupta Stream - Int. BBA-MBA Reg No. - 161111017002Brix ArriolaNo ratings yet

- Chapter 5Document8 pagesChapter 5minh ngocNo ratings yet

- FDNACCT - Mock Exam - Answer Key - 3 - Fill in The Blank Problems PDFDocument5 pagesFDNACCT - Mock Exam - Answer Key - 3 - Fill in The Blank Problems PDFJames de LeonNo ratings yet

- ACC 102 - QuizDocument11 pagesACC 102 - QuizSarah Mae EscutonNo ratings yet

- BE Chap 5Document3 pagesBE Chap 5TIÊN NGUYỄN LÊ MỸNo ratings yet

- Tugas 1 Product-LineDocument3 pagesTugas 1 Product-LinejuniarNo ratings yet

- Cash Flow ExercisesDocument12 pagesCash Flow ExercisesGaililian GerangayaNo ratings yet

- CHAPTER-7 Merchandising AnswerDocument24 pagesCHAPTER-7 Merchandising AnswersaphirejunelNo ratings yet

- Cash To Accrual BasisDocument5 pagesCash To Accrual BasisDo Reen ZaNo ratings yet

- ReviewerDocument9 pagesReviewerMarielle JoyceNo ratings yet

- 08.12.2017 Activity - Acfunda LabDocument2 pages08.12.2017 Activity - Acfunda LabPatOcampoNo ratings yet

- Ap-Problems - 2015Document20 pagesAp-Problems - 2015jayson100% (1)

- ASYNCHRONOUS ACTIVITY 4 WorksheetsDocument12 pagesASYNCHRONOUS ACTIVITY 4 WorksheetsAbejero Trisha Nicole A.No ratings yet

- From The Following Trial Balance, Prepare Trading and Profit & Loss AccountDocument2 pagesFrom The Following Trial Balance, Prepare Trading and Profit & Loss Accountyuvraj singhNo ratings yet

- Exercises On Closing Entries & Reversing EntriesDocument3 pagesExercises On Closing Entries & Reversing EntriesRoy BonitezNo ratings yet

- Inventories (Problems)Document6 pagesInventories (Problems)IAN PADAYOGDOGNo ratings yet

- Instructions: Amazon Seller Buys Printer Supplies For $29 With CashDocument1 pageInstructions: Amazon Seller Buys Printer Supplies For $29 With CashJorge FloresNo ratings yet

- Fabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyDocument3 pagesFabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyMounicha Ambayec100% (4)

- Fabm2 Statement of Comprehensive Income Practice Problems Answer KeyDocument3 pagesFabm2 Statement of Comprehensive Income Practice Problems Answer KeyMounicha Ambayec0% (1)

- UntitledDocument6 pagesUntitledJomar PenaNo ratings yet

- 2ND Year QualiDocument4 pages2ND Year QualiMark Domingo MendozaNo ratings yet

- Acctng 2 MerchandiseDocument2 pagesAcctng 2 MerchandiseDonald BugtongNo ratings yet

- Tutorial 10 Inventory SolutionsDocument6 pagesTutorial 10 Inventory SolutionsJen Hang WongNo ratings yet

- Inventories Exercises AnswersDocument12 pagesInventories Exercises AnswersAcads Purps100% (1)

- Cortez Exam in Business FinanceDocument4 pagesCortez Exam in Business FinanceFranchesca CortezNo ratings yet

- InventoryDocument18 pagesInventoryAdam Cuenca100% (1)

- Chapter-2 Profit & Loss - Balance SheetDocument2 pagesChapter-2 Profit & Loss - Balance Sheetvihanjangid223No ratings yet

- Merchandising Lecture MRFDDocument59 pagesMerchandising Lecture MRFDMaria Louella MagadaNo ratings yet

- AccountingDocument6 pagesAccountingCharisse CruzNo ratings yet

- Test Bank Chapter 3 Cost Volume Profit ADocument4 pagesTest Bank Chapter 3 Cost Volume Profit AKarlo D. ReclaNo ratings yet

- Business Combination Problem 1 Upto 9Document8 pagesBusiness Combination Problem 1 Upto 9jhun nhixNo ratings yet

- WOODDocument12 pagesWOODJayson ReyesNo ratings yet

- Financial Statement of Merchandising BusinessDocument3 pagesFinancial Statement of Merchandising BusinessDina Rose SardumaNo ratings yet

- Midterm Review SolutionsDocument8 pagesMidterm Review SolutionsnamiyuartsNo ratings yet

- Acctg110 FinalsDocument21 pagesAcctg110 FinalsRoman Dominic LlanoNo ratings yet

- CPA 1 - Financial Accounting Dec 2021Document9 pagesCPA 1 - Financial Accounting Dec 2021Asaba GloriaNo ratings yet

- Act 202 - Financial Accounting QDocument3 pagesAct 202 - Financial Accounting QShebgatul MursalinNo ratings yet

- Projecct Accounting 2Document3 pagesProjecct Accounting 2Russell Von DomingoNo ratings yet

- The Answer For The Exercise of Trading Company The ABC StoreDocument6 pagesThe Answer For The Exercise of Trading Company The ABC StoreSajakul SornNo ratings yet

- Sample Problems For InventoryDocument3 pagesSample Problems For Inventorytough mamaNo ratings yet

- Aucap2 Unit 5Document6 pagesAucap2 Unit 5Sel BarrantesNo ratings yet

- Journal Entries Account Titles Debit CreditDocument5 pagesJournal Entries Account Titles Debit CreditRoschelle MiguelNo ratings yet

- Finals Online Quiz 1 2Document14 pagesFinals Online Quiz 1 2Gon FreecsNo ratings yet

- Far01 - The Financial Statements PresentationDocument10 pagesFar01 - The Financial Statements PresentationRNo ratings yet

- Income Statement - Bells Manufacturing Year Ending December 31, 2015Document12 pagesIncome Statement - Bells Manufacturing Year Ending December 31, 2015Elif TuncaNo ratings yet

- Chapter XIIIDocument3 pagesChapter XIIIRhea AlianzaNo ratings yet

- Introduction To Accounting An Integrated Approach 6Th Edition Ainsworth Solutions Manual Full Chapter PDFDocument41 pagesIntroduction To Accounting An Integrated Approach 6Th Edition Ainsworth Solutions Manual Full Chapter PDFstevenwhitextsngyadmk100% (14)

- Statement of Comprehensive IncomeDocument3 pagesStatement of Comprehensive IncomeENIDNo ratings yet

- Problems - Cash FlowDocument5 pagesProblems - Cash FlowKevin JoyNo ratings yet

- Cash and Accrual BasisDocument10 pagesCash and Accrual BasisNoeme LansangNo ratings yet

- Issued & Paid Up Capital: 14 Schedual of Fixed AssetsDocument6 pagesIssued & Paid Up Capital: 14 Schedual of Fixed AssetsShoukat KhaliqNo ratings yet

- Lux Teddy Student 2020Document6 pagesLux Teddy Student 2020ramya penmatsaNo ratings yet

- AC191 Autumn 2011 FINALDocument9 pagesAC191 Autumn 2011 FINALgerlaniamelgacoNo ratings yet

- Assignment Accounting Merchendising #2Document1 pageAssignment Accounting Merchendising #2NELVA QABLINANo ratings yet

- Solutions To ProblemsDocument4 pagesSolutions To ProblemslorraineNo ratings yet

- QuestionsDocument12 pagesQuestionsDolliejane MercadoNo ratings yet

- The Brandgym: A Practical Workout for Boosting Brand and BusinessFrom EverandThe Brandgym: A Practical Workout for Boosting Brand and BusinessNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Intrinsic Valuation DCF Model TATA MOTORS LTD 1699087548Document13 pagesIntrinsic Valuation DCF Model TATA MOTORS LTD 1699087548WtransfastNo ratings yet

- MICROECONOMICS ch07ANNEXDocument6 pagesMICROECONOMICS ch07ANNEXSabrina GoNo ratings yet

- Tax Campus Hire - Job Description - FY22Document3 pagesTax Campus Hire - Job Description - FY22AkshathNo ratings yet

- HDFC BankDocument8 pagesHDFC BankKRIZMAL TRADING SOLUTIONS PVT LTDNo ratings yet

- Fixed VS Variable CostsDocument5 pagesFixed VS Variable Costssonia100% (1)

- Edexcel As Economics Unit 1 Revision GuideDocument28 pagesEdexcel As Economics Unit 1 Revision GuideWillNo ratings yet

- Unit 4 Accounting For LabourDocument18 pagesUnit 4 Accounting For LabourAayushi KothariNo ratings yet

- XH-IAS 40 Investment Properties - SV-Out-of-class practice-EN NewDocument6 pagesXH-IAS 40 Investment Properties - SV-Out-of-class practice-EN NewHà Mai VõNo ratings yet

- West Coast Paper MillsDocument72 pagesWest Coast Paper Millsvinodkumar_vicky67% (3)

- Griffin 9e IM CH 2 - EditedDocument26 pagesGriffin 9e IM CH 2 - EditedHo Hong Duc (FU HN)No ratings yet

- DHL Glo DGF Gogreen Solutions BrochureDocument8 pagesDHL Glo DGF Gogreen Solutions Brochurehappiest1100% (1)

- Adnan ThesisDocument51 pagesAdnan ThesisMohammad Naveed Hashmi100% (1)

- APUSH Industrialization EssayDocument6 pagesAPUSH Industrialization EssayChristopherNo ratings yet

- Handloom Export Promotion CouncilDocument12 pagesHandloom Export Promotion CouncilHarika ReddyNo ratings yet

- Relaxo Footwear-Analyst Meet Update-25 September 2014Document6 pagesRelaxo Footwear-Analyst Meet Update-25 September 2014Gogul RajaNo ratings yet

- Basmati Rice Export From IndiaDocument7 pagesBasmati Rice Export From IndiaMayankNo ratings yet

- Finance Affiliate ProgramsDocument121 pagesFinance Affiliate ProgramsAhmad Ali0% (1)

- 53rd-55th BPSC Combined Competitive (Main) Exam GENERAL STUDIES Question Paper 2012Document2 pages53rd-55th BPSC Combined Competitive (Main) Exam GENERAL STUDIES Question Paper 2012mevrick_guyNo ratings yet

- OF FTP 2015-2020 1 April, 2015 - 31 March, 2020: (Appendices and Aayat Niryat Forms)Document466 pagesOF FTP 2015-2020 1 April, 2015 - 31 March, 2020: (Appendices and Aayat Niryat Forms)Megha BepariNo ratings yet

- RRC Sample: Contractor ManagementDocument8 pagesRRC Sample: Contractor Managementleah nyamasveNo ratings yet

- Lease StructureDocument1 pageLease StructureAdhiraj KalitaNo ratings yet

- The Definition of MarketingDocument3 pagesThe Definition of Marketingluckyg1122No ratings yet

- Activity Based Costing ExamplesDocument23 pagesActivity Based Costing ExamplesPinkal PatelNo ratings yet

- Inoperative Account DefinitionDocument1 pageInoperative Account Definitionmkumar.itNo ratings yet

- Economics of Poultry Broiler Farming: Techno Economic ParametersDocument2 pagesEconomics of Poultry Broiler Farming: Techno Economic ParametersBrijesh SrivastavaNo ratings yet

- F 1040 SeDocument2 pagesF 1040 SeseihnNo ratings yet

- ACCA F5 Tuition Mock June 2012 QUESTIONS Version 3 FINAL at 23rd April 2012Document9 pagesACCA F5 Tuition Mock June 2012 QUESTIONS Version 3 FINAL at 23rd April 2012Hannah NazirNo ratings yet

- Chapter 2 Analysis of Solvency, Liquidity, and Financial FlexibilityDocument19 pagesChapter 2 Analysis of Solvency, Liquidity, and Financial FlexibilityYusuf Abdurrachman100% (1)