Professional Documents

Culture Documents

Mathematics Class-X: Chapter With Explaination

Mathematics Class-X: Chapter With Explaination

Uploaded by

rahul sugandhCopyright:

Available Formats

You might also like

- Mr. Labandero Journalizing Posting and Unadjusted Trial Balance ASSIGNMENT KEYDocument8 pagesMr. Labandero Journalizing Posting and Unadjusted Trial Balance ASSIGNMENT KEYMiguel Nieves67% (6)

- Single EntryDocument18 pagesSingle EntryFizzazubair rana33% (3)

- TK03 Aks Liana DamayantiDocument7 pagesTK03 Aks Liana DamayantiLiana DamayantiNo ratings yet

- Activity 3Document8 pagesActivity 3Angeline Gonzales PaneloNo ratings yet

- Cash Book ExercisesDocument2 pagesCash Book ExerciseshahaNo ratings yet

- Accountin 2 (6 Files Merged)Document8 pagesAccountin 2 (6 Files Merged)Arshad KhanNo ratings yet

- Single Entry System Assignment +1Document10 pagesSingle Entry System Assignment +1Gautam KhanwaniNo ratings yet

- Cash Budget Test 3Document2 pagesCash Budget Test 3Prince TshepoNo ratings yet

- Account NotesDocument92 pagesAccount NotesdivyamssarawatNo ratings yet

- 2015 Sep-Oct Fundamentals of AccountingDocument4 pages2015 Sep-Oct Fundamentals of Accountingsarianazneen147No ratings yet

- Budgeting Tute 01Document2 pagesBudgeting Tute 01Maithri Vidana KariyakaranageNo ratings yet

- Arief Siklus-AkuntansiDocument70 pagesArief Siklus-AkuntansiArief FadilahNo ratings yet

- Rent Statement - House/Shop/Godown No. P-231, Punjab Town, Karachi Tenant Name: Mr. Khadam Hussain, Phone: 0300-7032976 / 0334-3727976Document4 pagesRent Statement - House/Shop/Godown No. P-231, Punjab Town, Karachi Tenant Name: Mr. Khadam Hussain, Phone: 0300-7032976 / 0334-3727976Ummehamdan NasirNo ratings yet

- Marcellin Lab Accounting Assigment 4Document18 pagesMarcellin Lab Accounting Assigment 4MARCELLINO MARCELLINONo ratings yet

- Acc101 - 4Document14 pagesAcc101 - 4Nguyen Thi My Ngan (K17CT)No ratings yet

- Question 2 (22 Marks)Document1 pageQuestion 2 (22 Marks)Rax-Nguajandja KapuireNo ratings yet

- Jeneral JournalDocument12 pagesJeneral Journalaterefemelaku29No ratings yet

- Soal PraktikDocument9 pagesSoal Praktikm habiburrahman55No ratings yet

- Fabm-Peta 2Document2 pagesFabm-Peta 2Abegail RapsingNo ratings yet

- Class 11Document4 pagesClass 11Harshada satavNo ratings yet

- DateDocument7 pagesDateJules AguilarNo ratings yet

- 2018 11 Residential Real Estate Economic Issues Trends Forum Lawrence Yun Presentation Slides 11-02-2018Document65 pages2018 11 Residential Real Estate Economic Issues Trends Forum Lawrence Yun Presentation Slides 11-02-2018National Association of REALTORS®100% (4)

- AccountingDocument10 pagesAccountingRuffa Mae CabangunayNo ratings yet

- Activity 3 - Accounting EquationDocument7 pagesActivity 3 - Accounting EquationAhmed RazaNo ratings yet

- Accounting For EngineersDocument7 pagesAccounting For Engineerskanz ul emaanNo ratings yet

- Exampleson Additional Wage Ceiling ComputationDocument21 pagesExampleson Additional Wage Ceiling Computationcheezhen5047No ratings yet

- Government of Manipur Office of The District Industries Centre, ThoubalDocument2 pagesGovernment of Manipur Office of The District Industries Centre, ThoubalDIC THOUBALNo ratings yet

- Business Plan & Cash Flow Projections.Document7 pagesBusiness Plan & Cash Flow Projections.AimeeNo ratings yet

- Journal Entries in Merchandising OperationsDocument4 pagesJournal Entries in Merchandising OperationsArrabela PalmaNo ratings yet

- Tabular AnalysisDocument5 pagesTabular AnalysisjamesmakarioslabruscaNo ratings yet

- Trail Balance & LedgerDocument19 pagesTrail Balance & LedgerZeeshan ShaikhNo ratings yet

- Chapter 5 - JournalDocument32 pagesChapter 5 - JournalSimmi Khurana100% (1)

- Office of The Principal Accountant General (A & E) Odisha, BhubaneswarDocument2 pagesOffice of The Principal Accountant General (A & E) Odisha, Bhubaneswarsohalsingh1No ratings yet

- Financial Plan - Minute BurgerDocument6 pagesFinancial Plan - Minute BurgerEric Carlo B. ElpaNo ratings yet

- Ilaignar Report 2016-2017 FinalDocument4 pagesIlaignar Report 2016-2017 FinalsanNo ratings yet

- Practice Set For Journal AccountingDocument2 pagesPractice Set For Journal AccountingYawzyGyuNo ratings yet

- OU - Coe OU - Coe: Faculty of CommerceDocument10 pagesOU - Coe OU - Coe: Faculty of CommerceAMRITHANo ratings yet

- Assignment QuestionsDocument3 pagesAssignment QuestionsmaheeshNo ratings yet

- Maec2 Long Quiz 2Document5 pagesMaec2 Long Quiz 2Alyanna Grace OhimanNo ratings yet

- Tri-Bureau Credit Reports, 2017.09.20Document4 pagesTri-Bureau Credit Reports, 2017.09.20larry-612445No ratings yet

- Assignment 3 3.10Document3 pagesAssignment 3 3.10ehte19797177No ratings yet

- Accounts - First Half TestDocument4 pagesAccounts - First Half TestPeriyanan VNo ratings yet

- Banking Insurance Sem. I Choice Base R 2016 81301 Financial Accounting I Q.P.CODE 59346Document7 pagesBanking Insurance Sem. I Choice Base R 2016 81301 Financial Accounting I Q.P.CODE 59346Ali HassanNo ratings yet

- Que. 1 Given Below Are The Cash Transaction of M/sDocument5 pagesQue. 1 Given Below Are The Cash Transaction of M/sdeepika_naikNo ratings yet

- Questions BankingDocument10 pagesQuestions BankingRinnah JohnNo ratings yet

- Sales Journal Purcase Journal Cash Receipt Journal Cash Disbursement Journal General JournalDocument15 pagesSales Journal Purcase Journal Cash Receipt Journal Cash Disbursement Journal General JournalNathalia Alexandra PagulayanNo ratings yet

- Accounting Home Control Tasks Pham Viet Tung IFF18.3kDocument20 pagesAccounting Home Control Tasks Pham Viet Tung IFF18.3kvân TrầnNo ratings yet

- Fundamental of Partnership PDFDocument4 pagesFundamental of Partnership PDFBHUMIKA JAINNo ratings yet

- Accounting For Not-for-Profit Organisations: Expected QuestionsDocument6 pagesAccounting For Not-for-Profit Organisations: Expected QuestionsJASHAN ਗਰੇਵਾਲNo ratings yet

- 0438Document7 pages0438murtaza5500No ratings yet

- Journal EntriesDocument7 pagesJournal Entriesb20cs099No ratings yet

- Shaheed Rajpal DAV Public School: Accountancy Project 2021-22Document11 pagesShaheed Rajpal DAV Public School: Accountancy Project 2021-22Samriddhi SharmaNo ratings yet

- 60 TransactionsDocument14 pages60 TransactionsArman AhmedNo ratings yet

- Accounts Mock 2Document6 pagesAccounts Mock 2Aryan AggarwalNo ratings yet

- Cfastd Prelim ExamDocument4 pagesCfastd Prelim ExamJanine KateNo ratings yet

- Shirke Flat No 102 LedgerDocument2 pagesShirke Flat No 102 LedgerDikshant ChaudhariNo ratings yet

- Generated byDocument1 pageGenerated bychayanj royNo ratings yet

- 24 Aimen AFM Class ActivityDocument8 pages24 Aimen AFM Class ActivityArooj ArshadNo ratings yet

- Part 4 - AccountingDocument12 pagesPart 4 - AccountingAmr Youssef100% (1)

- Audit of NBFCDocument14 pagesAudit of NBFCTindu SNo ratings yet

- In Search of The Hybrid IdealDocument7 pagesIn Search of The Hybrid IdealHob DuNo ratings yet

- Fintech Barometer - Report by DLAI and CRIFDocument37 pagesFintech Barometer - Report by DLAI and CRIFsalgiashrenikNo ratings yet

- BTC OptionsDocument15 pagesBTC OptionsJoana CostaNo ratings yet

- Tarsons Products LimitedDocument6 pagesTarsons Products LimitedRAROLINKSNo ratings yet

- HW 3 SolutionsDocument4 pagesHW 3 SolutionsJohn SmithNo ratings yet

- Banking & Finance SectorDocument4 pagesBanking & Finance SectorOMM GOPAL EXIMNo ratings yet

- Corporatre ValuationDocument46 pagesCorporatre ValuationVipin MehtaNo ratings yet

- Liquiloans Statement 2022-04-01 To 2022-04-15Document1 pageLiquiloans Statement 2022-04-01 To 2022-04-15raghuraman1511No ratings yet

- ToA.1823 Share-Based Payment OnlineDocument2 pagesToA.1823 Share-Based Payment OnlineJolina Mancera0% (1)

- AP SetupDocument7 pagesAP SetupRizwan Jaffer SultanNo ratings yet

- Report 20230520163354Document23 pagesReport 20230520163354Akhil KumarNo ratings yet

- Financing CycleDocument4 pagesFinancing CycleYzah CariagaNo ratings yet

- Overview of Russian EconomyDocument5 pagesOverview of Russian EconomyYbrantSachinNo ratings yet

- Chapter 1 5 Slides Master Class TaxationDocument64 pagesChapter 1 5 Slides Master Class TaxationMohammad GalibNo ratings yet

- Indianoil Citibank Platinum Credit CardDocument4 pagesIndianoil Citibank Platinum Credit CardraunakgokhaleNo ratings yet

- Bank of Madura Chettiar Chettinad Mercantile Bank Illanji BankDocument4 pagesBank of Madura Chettiar Chettinad Mercantile Bank Illanji BankJitendra GoyalNo ratings yet

- (H) 5th Sem. Unit-1st Monetary Theories and InstitutionDocument22 pages(H) 5th Sem. Unit-1st Monetary Theories and Institutionabhayvermaji1998No ratings yet

- Project Investment Evaluation: Chethan S.GowdaDocument70 pagesProject Investment Evaluation: Chethan S.GowdaTodesa HinkosaNo ratings yet

- Axis Bank - FE - East India - Online Auction - 05th-January-2019Document18 pagesAxis Bank - FE - East India - Online Auction - 05th-January-2019Biju PerinkottilNo ratings yet

- Extra Reading For Further Comprehension: Net Present Value (NPV)Document27 pagesExtra Reading For Further Comprehension: Net Present Value (NPV)widedbenmoussaNo ratings yet

- 1 Installment SalesDocument26 pages1 Installment SalesSameer Hussain100% (2)

- Gov. Bruce Rauner's 2018 Statement of Economic InterestDocument11 pagesGov. Bruce Rauner's 2018 Statement of Economic InterestMitch ArmentroutNo ratings yet

- Corporation Tax CT41G-DciDocument1 pageCorporation Tax CT41G-DciHenry HarrodNo ratings yet

- April 2023 Coventry University London: 4008AFE Examination The Economic Environment of BusinessDocument7 pagesApril 2023 Coventry University London: 4008AFE Examination The Economic Environment of BusinessSalai SivagnanamNo ratings yet

- SLF103 ApplicationRefundExcessOverpaymentSTL V02Document1 pageSLF103 ApplicationRefundExcessOverpaymentSTL V02Kristoffer John AmbueguiaNo ratings yet

- Principles of Corporate Finance Brealey 11th Edition Solutions ManualDocument24 pagesPrinciples of Corporate Finance Brealey 11th Edition Solutions ManualShelly JonesNo ratings yet

- QA Accounting For DepreciationDocument7 pagesQA Accounting For DepreciationAbdul KabirNo ratings yet

- AIMK Fees Structure MBA 27 - 0Document1 pageAIMK Fees Structure MBA 27 - 0Amzad khanNo ratings yet

- SAP S - 4HANA Central Finance 1610 - Quick Tips (Summary) - LinkedInDocument4 pagesSAP S - 4HANA Central Finance 1610 - Quick Tips (Summary) - LinkedInjsphdvdNo ratings yet

Mathematics Class-X: Chapter With Explaination

Mathematics Class-X: Chapter With Explaination

Uploaded by

rahul sugandhOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mathematics Class-X: Chapter With Explaination

Mathematics Class-X: Chapter With Explaination

Uploaded by

rahul sugandhCopyright:

Available Formats

Mathematics 2015-2016

Class-X

CHAPTER WITH EXPLAINATION

BANKING

Bank - A financial institution where money is deposited by the public for future use. Bank also

accepts money from public.

The types of deposites are :

i. Saving Bank account

ii. Current Bank Account

iii. Fixed deposits

iv. Recurring deposits

We shall deal with saving bank account and recurring deposits.

Saving Bank Account

This account is opened in a bank with minimum amount of Rs.500 or Rs.1000 (for cheque

facility).

Calculation of interest in a saving bank account:-

i. Minimum balance between 10th and last day of each month is written.

ii. Minimum balance is converted as a multiple of Rs.10. For example balance between

Rs.510 to 515 is rounded to Rs.510 and Rs.15.01 to Rs.520 to Rs.320

iii. All the minimum balance is added.

iv. The simple interest for one month is calculated on the given rate of interest.

v. No interest is paid for the month if minimum balance is Rs.5 or less.

vi. The interest of B less than rupee 1 (one) is neglected.

vii. No interest is paid for the month in which account is closed.

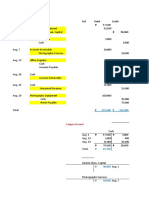

Example - 1. Mr. Ashok has account in the Central Bank of India. The following entries

are from his pass book:-

Withdrawal Rs.

Date Particular Deposite Rs. P Balance Rs. P

P

01 - 01 - 05 B/F 1200.00

07 - 01 - 05 By cash 500.00 1700.00

17 - 01 - 05 To cheque 400.00 1300.00

10 - 02 - 05 By cash 800.00 2100.00

25 - 02 - 05 To cheque 500.00 1600.00

20 - 09 - 05 By cash 700.00 2300.00

21 – 11 - 05 To cheque 600.00 1700.00

05 - 12 - 05 By cash 300.00 2000.00

Be positive and constructive.

Sudheer Gupta . Page 1

Mathematics 2015-2016

Class-X

viii. If Mr. Ashok gets Rs.83.75 as interest at the end of the year where the interest is

compounded annually, calculate the rate of interest paid by the bank in his saving bank

account on 31st December, 2005.

ix. Solution :

Balance During Minimum Qualifying

Month Balance on 10th

the month Balance Balance

Jan 1700, 1300 1700 1300 1300

Feb 2100, 1600 2100 1600 1600

March 1600 1600 1600 1600

April 1600 1600 1600 1600

May 1600 1600 1600 1600

June 1600 1600 1600 1600

July 1600 1600 1600 1600

August 1600 1600 1600 1600

September 1600, 2300 1600 1600 1600

Oct 2300 2300 2300 2300

Nov 2300, 1700 1700 1700 1700

Dec 2000 2000 2000 2000

Total 20100

x. Let rate of interest be r

xi. P = 20100, T = 1 month = 1/12 years

xii. I = 83.75

xiii.

xiv.

xv.

Be positive and constructive.

Sudheer Gupta . Page 2

Mathematics 2015-2016

Class-X

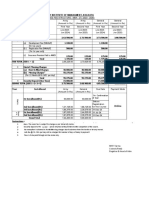

xvi. Example – 2. Given below the entries in a saving bank account pass book

Date Particular Withdrawal Deposite Balance

Feb 8 B/F Rs. 8,500.00

Feb 18 To self Rs. 4,000.00

April 12 By cash Rs. 2,238,00

June 15 To self Rs. 5,000,00

July 8 By cash Rs. 6,000.00

xvii. Calculate the interest for the six months February to July, at p.a. on minimum

balance on or after the 10th day of each month.

xviii. Solution :

Balance During Minimum Qualifying

Month Balance on 10th

the month Balance Balance

Feb 8500, 4500 8500 4500 4500

March 4500 4500 4500 4500

April 4500, 6738 4500 4500 4500

May 6738 6738 6738 6740

June 6738, 1738 6738 1738 1740

July 7738 7738 7738 7740

Total 29729

xix.

Be positive and constructive.

Sudheer Gupta . Page 3

Mathematics 2015-2016

Class-X

RECURRING DEPOSITS

To save a certain sum of money an individual is allowed to open an account of recurring

deposited in any bank. The amount is deposited monthly in a multiple of 10 for a period of 3

months to 10 years. The depositer has to deposit the monthly instalment on or before due date to

get maximum benefit of the interest.

At the expiry of the period i.e. the maturity period, the depositer is paid the total amount

deposited by him and the interest. These two types of amount is called maturity value. The rate

of interest is fixed by Reserve bank and is revised from time to time.

Example - 1. Mohan deposits Rs.80 per mouth in a cumulative deposite account for six years.

Find the amount payable to him on maturity, if the rate of interest is 6% per annum.

Solution : The bank keeps first instalment for 72 months

The bank keeps 2nd instalment for 71months

The bank keeps 3rd instalment for 70 months

--------------------------------------

--------------------------------------

Total amount deposited in 6 years = 6 X 12 X Rs. 80

= Rs. 5760

Total amount received after maturity = Rs. 5760 + Rs. 1051.20

= Rs. 6811.20

Be positive and constructive.

Sudheer Gupta . Page 4

Mathematics 2015-2016

Class-X

Example - 2. Mr. Kumar deposits Rs.600 per month in a recurring deposite account for 12

months. Find the amount he will receive at the lime of maturity at the rate of 6% per annum.

Solution : In this account the amount Rs.600 deposited in 1st month will remain in the bank for

12 month and it will earn interest for 12 months. The amount Rs.600 deposited in the 2nd month

will earn interest for 11 months and so on.

Hence

Rs.600 for 12 months = Rs.7200 for 1 month

Rs.600 for 11 months = Rs.6600 for 1 month

Rs.600 for 10 months = Rs.6000 for 1 month

Rs.600 for 9 months = Rs.5400 for 1 month

Rs.600 for 8 months = Rs.4800 for 1 month

Rs.600 for 7 months = Rs.4200 for 1 month

Rs.600 for 6 months = Rs.3600 for 1 month

Rs.600 for 5 months = Rs.3000 for 1 month

Rs.600 for 4 months = Rs.2400 for 1 month

Rs.600 for 3 months = Rs.1800 for 1 month

Rs.600 for 2 months = Rs.1200 for 1 month

Rs.600 for 1 months = Rs.600 for 1 month

Total principal for = 7200 + 6600 + 6000 + 5400 + 4800 + 4200 + 3600 + 3000 + 2400 + 1800

1 month + 1200 + 600

= (7200 + 600) + (6600 + 1200) + (6000 + 1800) + (5400 + 2400) + (4800 +

3000) + (4200 + 3600)

= 6 X 7800

= Rs.46800

Interest of Rs.46800 for 1 month at 6% p.a.

= Rs.46800 X 1/12 X 6/100

= Rs.234

Total amount on maturity

= Rs. (600 X 12) + Rs.234

= Rs.7200 + Rs.234

= Rs.7434

Example – 3. Jaya wants to receive Rs.41490 at the end of 5 years by depositing a certain sum

of money on a monthly basis in a bank paying 6% simple interest p.a. what is the monthly

instalment?

Solution : Let the monthly instalment be P

Here, t = 5 years = 60 months r = 6%

Total deposited money in the bank = 60 P

Be positive and constructive.

Sudheer Gupta . Page 5

Mathematics 2015-2016

Class-X

The amount due = 60 P + 9.15 P = 69.15 P

69.15 P = 41490

P = (41490) / (69.15)

= 600

Example - 4. Mr. Kalara invests Rs.500 every month for 24 months in a bank and collects

Rs.12750 at the end of the term. Find the rate of simple interest paid by the bank on this

recurring deposit.

Solution : Let rate of interest be r %

P = Rs.500, n = 24 months

Amount deposited with the bank = Rs.500 X 24

= Rs.12000

12000 + 125 r = 12750

Or, 125 r = 750

r = 750/125

=6

Example - 5. Which is the better investment Rs. 20000 in a saving deposit with a bank for 3

years the interest being compounded half – yearly at the rate of 6% or Rs. 600 per month in a

recurring deposit with a bank paying simple interest at 6% p.a. for 3 years?

Solution : For saving deposit, p = 20,000

t = 3 years, n = 6 half years

r = 6% p.a. = 3% per half year

Be positive and constructive.

Sudheer Gupta . Page 6

Mathematics 2015-2016

Class-X

log A = log 20000 + 6 log (1.03)

= 4.3010 + 6 (0.0128)

= 4.3010 + 0.0768

= 4.3778

A = antilog (4.3778)

= 23870

Maturity value = Rs. 23,870

For recurring deposit,

P = 600, t = 3 years, n = 36 months

r = 6%

Amount deposited in the bank = 36 X 600

= 21,600

Maturity value = 21600 + 1998

= Rs.23598

The former is better.

Be positive and constructive.

Sudheer Gupta . Page 7

You might also like

- Mr. Labandero Journalizing Posting and Unadjusted Trial Balance ASSIGNMENT KEYDocument8 pagesMr. Labandero Journalizing Posting and Unadjusted Trial Balance ASSIGNMENT KEYMiguel Nieves67% (6)

- Single EntryDocument18 pagesSingle EntryFizzazubair rana33% (3)

- TK03 Aks Liana DamayantiDocument7 pagesTK03 Aks Liana DamayantiLiana DamayantiNo ratings yet

- Activity 3Document8 pagesActivity 3Angeline Gonzales PaneloNo ratings yet

- Cash Book ExercisesDocument2 pagesCash Book ExerciseshahaNo ratings yet

- Accountin 2 (6 Files Merged)Document8 pagesAccountin 2 (6 Files Merged)Arshad KhanNo ratings yet

- Single Entry System Assignment +1Document10 pagesSingle Entry System Assignment +1Gautam KhanwaniNo ratings yet

- Cash Budget Test 3Document2 pagesCash Budget Test 3Prince TshepoNo ratings yet

- Account NotesDocument92 pagesAccount NotesdivyamssarawatNo ratings yet

- 2015 Sep-Oct Fundamentals of AccountingDocument4 pages2015 Sep-Oct Fundamentals of Accountingsarianazneen147No ratings yet

- Budgeting Tute 01Document2 pagesBudgeting Tute 01Maithri Vidana KariyakaranageNo ratings yet

- Arief Siklus-AkuntansiDocument70 pagesArief Siklus-AkuntansiArief FadilahNo ratings yet

- Rent Statement - House/Shop/Godown No. P-231, Punjab Town, Karachi Tenant Name: Mr. Khadam Hussain, Phone: 0300-7032976 / 0334-3727976Document4 pagesRent Statement - House/Shop/Godown No. P-231, Punjab Town, Karachi Tenant Name: Mr. Khadam Hussain, Phone: 0300-7032976 / 0334-3727976Ummehamdan NasirNo ratings yet

- Marcellin Lab Accounting Assigment 4Document18 pagesMarcellin Lab Accounting Assigment 4MARCELLINO MARCELLINONo ratings yet

- Acc101 - 4Document14 pagesAcc101 - 4Nguyen Thi My Ngan (K17CT)No ratings yet

- Question 2 (22 Marks)Document1 pageQuestion 2 (22 Marks)Rax-Nguajandja KapuireNo ratings yet

- Jeneral JournalDocument12 pagesJeneral Journalaterefemelaku29No ratings yet

- Soal PraktikDocument9 pagesSoal Praktikm habiburrahman55No ratings yet

- Fabm-Peta 2Document2 pagesFabm-Peta 2Abegail RapsingNo ratings yet

- Class 11Document4 pagesClass 11Harshada satavNo ratings yet

- DateDocument7 pagesDateJules AguilarNo ratings yet

- 2018 11 Residential Real Estate Economic Issues Trends Forum Lawrence Yun Presentation Slides 11-02-2018Document65 pages2018 11 Residential Real Estate Economic Issues Trends Forum Lawrence Yun Presentation Slides 11-02-2018National Association of REALTORS®100% (4)

- AccountingDocument10 pagesAccountingRuffa Mae CabangunayNo ratings yet

- Activity 3 - Accounting EquationDocument7 pagesActivity 3 - Accounting EquationAhmed RazaNo ratings yet

- Accounting For EngineersDocument7 pagesAccounting For Engineerskanz ul emaanNo ratings yet

- Exampleson Additional Wage Ceiling ComputationDocument21 pagesExampleson Additional Wage Ceiling Computationcheezhen5047No ratings yet

- Government of Manipur Office of The District Industries Centre, ThoubalDocument2 pagesGovernment of Manipur Office of The District Industries Centre, ThoubalDIC THOUBALNo ratings yet

- Business Plan & Cash Flow Projections.Document7 pagesBusiness Plan & Cash Flow Projections.AimeeNo ratings yet

- Journal Entries in Merchandising OperationsDocument4 pagesJournal Entries in Merchandising OperationsArrabela PalmaNo ratings yet

- Tabular AnalysisDocument5 pagesTabular AnalysisjamesmakarioslabruscaNo ratings yet

- Trail Balance & LedgerDocument19 pagesTrail Balance & LedgerZeeshan ShaikhNo ratings yet

- Chapter 5 - JournalDocument32 pagesChapter 5 - JournalSimmi Khurana100% (1)

- Office of The Principal Accountant General (A & E) Odisha, BhubaneswarDocument2 pagesOffice of The Principal Accountant General (A & E) Odisha, Bhubaneswarsohalsingh1No ratings yet

- Financial Plan - Minute BurgerDocument6 pagesFinancial Plan - Minute BurgerEric Carlo B. ElpaNo ratings yet

- Ilaignar Report 2016-2017 FinalDocument4 pagesIlaignar Report 2016-2017 FinalsanNo ratings yet

- Practice Set For Journal AccountingDocument2 pagesPractice Set For Journal AccountingYawzyGyuNo ratings yet

- OU - Coe OU - Coe: Faculty of CommerceDocument10 pagesOU - Coe OU - Coe: Faculty of CommerceAMRITHANo ratings yet

- Assignment QuestionsDocument3 pagesAssignment QuestionsmaheeshNo ratings yet

- Maec2 Long Quiz 2Document5 pagesMaec2 Long Quiz 2Alyanna Grace OhimanNo ratings yet

- Tri-Bureau Credit Reports, 2017.09.20Document4 pagesTri-Bureau Credit Reports, 2017.09.20larry-612445No ratings yet

- Assignment 3 3.10Document3 pagesAssignment 3 3.10ehte19797177No ratings yet

- Accounts - First Half TestDocument4 pagesAccounts - First Half TestPeriyanan VNo ratings yet

- Banking Insurance Sem. I Choice Base R 2016 81301 Financial Accounting I Q.P.CODE 59346Document7 pagesBanking Insurance Sem. I Choice Base R 2016 81301 Financial Accounting I Q.P.CODE 59346Ali HassanNo ratings yet

- Que. 1 Given Below Are The Cash Transaction of M/sDocument5 pagesQue. 1 Given Below Are The Cash Transaction of M/sdeepika_naikNo ratings yet

- Questions BankingDocument10 pagesQuestions BankingRinnah JohnNo ratings yet

- Sales Journal Purcase Journal Cash Receipt Journal Cash Disbursement Journal General JournalDocument15 pagesSales Journal Purcase Journal Cash Receipt Journal Cash Disbursement Journal General JournalNathalia Alexandra PagulayanNo ratings yet

- Accounting Home Control Tasks Pham Viet Tung IFF18.3kDocument20 pagesAccounting Home Control Tasks Pham Viet Tung IFF18.3kvân TrầnNo ratings yet

- Fundamental of Partnership PDFDocument4 pagesFundamental of Partnership PDFBHUMIKA JAINNo ratings yet

- Accounting For Not-for-Profit Organisations: Expected QuestionsDocument6 pagesAccounting For Not-for-Profit Organisations: Expected QuestionsJASHAN ਗਰੇਵਾਲNo ratings yet

- 0438Document7 pages0438murtaza5500No ratings yet

- Journal EntriesDocument7 pagesJournal Entriesb20cs099No ratings yet

- Shaheed Rajpal DAV Public School: Accountancy Project 2021-22Document11 pagesShaheed Rajpal DAV Public School: Accountancy Project 2021-22Samriddhi SharmaNo ratings yet

- 60 TransactionsDocument14 pages60 TransactionsArman AhmedNo ratings yet

- Accounts Mock 2Document6 pagesAccounts Mock 2Aryan AggarwalNo ratings yet

- Cfastd Prelim ExamDocument4 pagesCfastd Prelim ExamJanine KateNo ratings yet

- Shirke Flat No 102 LedgerDocument2 pagesShirke Flat No 102 LedgerDikshant ChaudhariNo ratings yet

- Generated byDocument1 pageGenerated bychayanj royNo ratings yet

- 24 Aimen AFM Class ActivityDocument8 pages24 Aimen AFM Class ActivityArooj ArshadNo ratings yet

- Part 4 - AccountingDocument12 pagesPart 4 - AccountingAmr Youssef100% (1)

- Audit of NBFCDocument14 pagesAudit of NBFCTindu SNo ratings yet

- In Search of The Hybrid IdealDocument7 pagesIn Search of The Hybrid IdealHob DuNo ratings yet

- Fintech Barometer - Report by DLAI and CRIFDocument37 pagesFintech Barometer - Report by DLAI and CRIFsalgiashrenikNo ratings yet

- BTC OptionsDocument15 pagesBTC OptionsJoana CostaNo ratings yet

- Tarsons Products LimitedDocument6 pagesTarsons Products LimitedRAROLINKSNo ratings yet

- HW 3 SolutionsDocument4 pagesHW 3 SolutionsJohn SmithNo ratings yet

- Banking & Finance SectorDocument4 pagesBanking & Finance SectorOMM GOPAL EXIMNo ratings yet

- Corporatre ValuationDocument46 pagesCorporatre ValuationVipin MehtaNo ratings yet

- Liquiloans Statement 2022-04-01 To 2022-04-15Document1 pageLiquiloans Statement 2022-04-01 To 2022-04-15raghuraman1511No ratings yet

- ToA.1823 Share-Based Payment OnlineDocument2 pagesToA.1823 Share-Based Payment OnlineJolina Mancera0% (1)

- AP SetupDocument7 pagesAP SetupRizwan Jaffer SultanNo ratings yet

- Report 20230520163354Document23 pagesReport 20230520163354Akhil KumarNo ratings yet

- Financing CycleDocument4 pagesFinancing CycleYzah CariagaNo ratings yet

- Overview of Russian EconomyDocument5 pagesOverview of Russian EconomyYbrantSachinNo ratings yet

- Chapter 1 5 Slides Master Class TaxationDocument64 pagesChapter 1 5 Slides Master Class TaxationMohammad GalibNo ratings yet

- Indianoil Citibank Platinum Credit CardDocument4 pagesIndianoil Citibank Platinum Credit CardraunakgokhaleNo ratings yet

- Bank of Madura Chettiar Chettinad Mercantile Bank Illanji BankDocument4 pagesBank of Madura Chettiar Chettinad Mercantile Bank Illanji BankJitendra GoyalNo ratings yet

- (H) 5th Sem. Unit-1st Monetary Theories and InstitutionDocument22 pages(H) 5th Sem. Unit-1st Monetary Theories and Institutionabhayvermaji1998No ratings yet

- Project Investment Evaluation: Chethan S.GowdaDocument70 pagesProject Investment Evaluation: Chethan S.GowdaTodesa HinkosaNo ratings yet

- Axis Bank - FE - East India - Online Auction - 05th-January-2019Document18 pagesAxis Bank - FE - East India - Online Auction - 05th-January-2019Biju PerinkottilNo ratings yet

- Extra Reading For Further Comprehension: Net Present Value (NPV)Document27 pagesExtra Reading For Further Comprehension: Net Present Value (NPV)widedbenmoussaNo ratings yet

- 1 Installment SalesDocument26 pages1 Installment SalesSameer Hussain100% (2)

- Gov. Bruce Rauner's 2018 Statement of Economic InterestDocument11 pagesGov. Bruce Rauner's 2018 Statement of Economic InterestMitch ArmentroutNo ratings yet

- Corporation Tax CT41G-DciDocument1 pageCorporation Tax CT41G-DciHenry HarrodNo ratings yet

- April 2023 Coventry University London: 4008AFE Examination The Economic Environment of BusinessDocument7 pagesApril 2023 Coventry University London: 4008AFE Examination The Economic Environment of BusinessSalai SivagnanamNo ratings yet

- SLF103 ApplicationRefundExcessOverpaymentSTL V02Document1 pageSLF103 ApplicationRefundExcessOverpaymentSTL V02Kristoffer John AmbueguiaNo ratings yet

- Principles of Corporate Finance Brealey 11th Edition Solutions ManualDocument24 pagesPrinciples of Corporate Finance Brealey 11th Edition Solutions ManualShelly JonesNo ratings yet

- QA Accounting For DepreciationDocument7 pagesQA Accounting For DepreciationAbdul KabirNo ratings yet

- AIMK Fees Structure MBA 27 - 0Document1 pageAIMK Fees Structure MBA 27 - 0Amzad khanNo ratings yet

- SAP S - 4HANA Central Finance 1610 - Quick Tips (Summary) - LinkedInDocument4 pagesSAP S - 4HANA Central Finance 1610 - Quick Tips (Summary) - LinkedInjsphdvdNo ratings yet