Professional Documents

Culture Documents

Case Study 1 Solution

Case Study 1 Solution

Uploaded by

drashteeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Study 1 Solution

Case Study 1 Solution

Uploaded by

drashteeCopyright:

Available Formats

Mr.

T Kumar

12-month Profit Plan

Sales Rs.598,500

Cost of goods sold

Components Rs.197,000

Mfg payroll 145,000

Other Mfg. 62,000

Depreciation 8,500 412,500

Gross margin Rs.186,000

Selling, general and

Administration 63,000

Patent 20,000

Redesign costs 25,000

Incorporation costs 2,500

Operating profit Rs.75,500

Interest 500

Profit before taxes Rs.75,000

Tax expense 22,500

Net Income Rs.52,500

Notes 1:

* Beginning component parts inventory Rs.0 **Component parts used Rs.197,000

Purchases 212,100 Manufacturing payroll 145,000

Total available 212,100 Other manufacturing costs 62,000

Ending component parts inventory 15,100 Depreciation 8,500

Components parts used 197,000 Cost of goods sold 412,500

Mr. T Kumar

Projected Year-end Balance Sheet

Assets* Liabilities*

Cash Rs.78,400 Taxes payable Rs.22,500

Components inventory 15,100 Current liabilities Rs.22,500

Current assets Rs.93,500

Equipment (net) 76,500 Owner’s Equity

Patent (net) 100,000 Capital stock Rs.200,000

___ Retained earnings 47,500

Rs.270,000 Rs.270,000

*Taken from an US case study, so assets and liabilities are on reverse sides. Donot bother

about these.

GIM FAM PGDM FT (AY 2021-22) Prof. Ranjan DasGupta

Notes 2:

Mr. T Kumar

Change in Retained Earnings

Beginning retained earnings Rs.0

Net income 52,500

Dividends (5,000)

Ending retained earnings Rs.47,500

Notes 3:

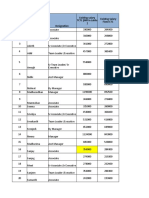

Mr. T Kumar

Cash Reconciliation

Receipts Disbursements

New equity capital Rs.80,000

Incorporation Rs.2,500

Equipment 85,000

Redesign 25,000

Component parts 212,100

Bank loan 30,000

Bank loan 30,000

Loan interest 500

Manufacturing payroll 145,000

Other manufacturing 62,000

SG&A 63,000

Sales 598,500

Dividend 5,000

Total Rs.708,500 Rs.630,100

Cash Reconciliation

Receipts $708,500

Disbursements 630,100

Ending Balance $78,400

GIM FAM PGDM FT (AY 2021-22) Prof. Ranjan DasGupta

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hispanic Market Guide 2023 1Document145 pagesHispanic Market Guide 2023 1mnbmqNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ISO 22301.2012.eng PDFDocument34 pagesISO 22301.2012.eng PDFMauro Mendes86% (14)

- Cost Manager CV - Pawan KumarDocument2 pagesCost Manager CV - Pawan KumarAbhishekKumarNo ratings yet

- EVM Formulas For Exam PDFDocument1 pageEVM Formulas For Exam PDFwfelicescNo ratings yet

- RM - LT - Group 3Document18 pagesRM - LT - Group 3drashteeNo ratings yet

- FM 2 - 1Document10 pagesFM 2 - 1drashteeNo ratings yet

- FM 2 - 2Document8 pagesFM 2 - 2drashteeNo ratings yet

- ModifyBrand Q2Document1 pageModifyBrand Q2drashteeNo ratings yet

- FM 2 - 3Document12 pagesFM 2 - 3drashteeNo ratings yet

- CBDocument24 pagesCBdrashteeNo ratings yet

- OpenSalesOffice Q2Document10 pagesOpenSalesOffice Q2drashteeNo ratings yet

- Report ICI AC 210921 63803862Document19 pagesReport ICI AC 210921 63803862drashteeNo ratings yet

- CostOfProduction Q2Document2 pagesCostOfProduction Q2drashteeNo ratings yet

- Be - Unit - Types of BusinessDocument40 pagesBe - Unit - Types of BusinessdrashteeNo ratings yet

- ProFormaDivisionProfitability Q2Document2 pagesProFormaDivisionProfitability Q2drashteeNo ratings yet

- Be - Unit 2 - Political & Legal EnvironmentDocument75 pagesBe - Unit 2 - Political & Legal EnvironmentdrashteeNo ratings yet

- Be - Unit 3 - Socio-Cultural & Technological EnvironmentDocument53 pagesBe - Unit 3 - Socio-Cultural & Technological EnvironmentdrashteeNo ratings yet

- Be - Unit 1 - Introduction To BeDocument42 pagesBe - Unit 1 - Introduction To BedrashteeNo ratings yet

- Services Marketing Assignment: Critical Analysis 1Document10 pagesServices Marketing Assignment: Critical Analysis 1drashteeNo ratings yet

- Goa Institute of Management: Recruitment & SelectionDocument6 pagesGoa Institute of Management: Recruitment & SelectiondrashteeNo ratings yet

- Group 4 - Compensation and BenefitDocument27 pagesGroup 4 - Compensation and BenefitdrashteeNo ratings yet

- Uv7161 PDF EngDocument3 pagesUv7161 PDF EngdrashteeNo ratings yet

- What A Star-What A Jerk: HBR Case StudyDocument4 pagesWhat A Star-What A Jerk: HBR Case StudydrashteeNo ratings yet

- r2 Cipl - BTR 044-3 QingdaoDocument4 pagesr2 Cipl - BTR 044-3 Qingdaoananda hanaNo ratings yet

- Nippon Paint (India) PVT - Ltd. BangaloreDocument31 pagesNippon Paint (India) PVT - Ltd. BangaloreP K Senthil KumarNo ratings yet

- Material HandlingDocument51 pagesMaterial HandlingRaeedi PullaraoNo ratings yet

- 1200 4404 1 PBDocument9 pages1200 4404 1 PBNaufal FarhanNo ratings yet

- Instruction Manual: 5801H0066 EN Rev.01Document48 pagesInstruction Manual: 5801H0066 EN Rev.01Wagner MenezesNo ratings yet

- Jit Key ElementDocument35 pagesJit Key ElementshfqshaikhNo ratings yet

- Bcs-Nme1a - SyllabusDocument7 pagesBcs-Nme1a - SyllabusjeganrajrajNo ratings yet

- 1-1. Value Chain and Value Creation-Part 1Document10 pages1-1. Value Chain and Value Creation-Part 1Thanh DươngNo ratings yet

- Pembukuan BarangDocument478 pagesPembukuan BarangAKMAL THAYEBNo ratings yet

- 1b Team Expectations Template p2Document5 pages1b Team Expectations Template p2api-686124613No ratings yet

- BHM and BACA 2022-23 Batch Orientation Program BrochureDocument7 pagesBHM and BACA 2022-23 Batch Orientation Program BrochureVivekNo ratings yet

- SAP User Guide - Single ReportDocument28 pagesSAP User Guide - Single ReportJoão ArmandoNo ratings yet

- Denise Nelson Operates Interiors by Denise An Interior Design ConsultingDocument2 pagesDenise Nelson Operates Interiors by Denise An Interior Design ConsultingAmit PandeyNo ratings yet

- 0422云途物流海外企业画册 (TH)Document18 pages0422云途物流海外企业画册 (TH)Khanh TranNo ratings yet

- Benefits of Erp SystemsDocument2 pagesBenefits of Erp SystemsMuskan HazraNo ratings yet

- Apply 5s ProcedureDocument35 pagesApply 5s ProcedureBiniam Hunegnaw BitewNo ratings yet

- Bac0n1b Prelim ReviewerDocument2 pagesBac0n1b Prelim ReviewerAprel Praise Morada TravenioNo ratings yet

- Ati A17a Dec2011 (Ar 2011 Amended)Document103 pagesAti A17a Dec2011 (Ar 2011 Amended)cuonghienNo ratings yet

- Case 7A FRC M. Gerry Naufal 29123123Document5 pagesCase 7A FRC M. Gerry Naufal 29123123m.gerryNo ratings yet

- Taylor Musslewhite ResumeDocument3 pagesTaylor Musslewhite Resumeapi-682080968No ratings yet

- Business PlanDocument18 pagesBusiness PlanParon MarNo ratings yet

- Loss Company ReceiptDocument1 pageLoss Company ReceiptEDMC PAYMENT CENTERNo ratings yet

- Application of Business Intelligence in FMCG SectorDocument16 pagesApplication of Business Intelligence in FMCG SectorShweta SethNo ratings yet

- Ilovepdf Merged PDFDocument666 pagesIlovepdf Merged PDFchandraNo ratings yet

- Request For Quotation1Document3 pagesRequest For Quotation1Geneva DulaganNo ratings yet

- Audit 2 Test About MaterilaityDocument5 pagesAudit 2 Test About MaterilaityShewanes GetiyeNo ratings yet