Professional Documents

Culture Documents

Tax Rates and Allowances

Tax Rates and Allowances

Uploaded by

Jong HannahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Rates and Allowances

Tax Rates and Allowances

Uploaded by

Jong HannahCopyright:

Available Formats

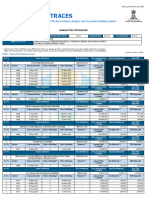

TAX RATES AND ALLOWANCES

The following tax rates, allowances and values are to be used in answering the questions.

Income tax rates for Assessment Year 2016

Chargeable Income Calculations (RM) Rate % Tax(RM)

0 - 5,000 On the First 2,500 0 0

On the First 5,000 0

5,001 - 20,000 Next 15,000 1 150

On the First 20,000 150

20,001 - 35,000 Next 15,000 5 750

On the First 35,000 900

35,001 - 50,000 Next 15,000 10 1,500

On the First 50,000 2,400

50,001 - 70,000 Next 20,000 16 3,200

On the First 70,000 5,600

70,001 - 100,000 Next 30,000 21 6,300

On the First 100,000 11,900

100,001 - 250,000 Next 150,000 24 36,000

On the First 250,000 47,900

250,001 - 400,000 Next 150,000 24.5 36,750

On the First 400,000 84,650

400,001 - 600,000 Next 200,000 25 50,000

On the First 600,000 134,650

600,001 - 1,000,000 Next 400,000 26 104,00

On the First 1,000,000 238,650

Exceeding 1,000,000 Next ringgit 28 ..........

Non-residents

Individual 28%

Personal reliefs and allowances 2016

RM

Self 9,000

Disabled self, additional 6,000

Medical expenses expended for parents (maximum) 5,000

Medical expenses expended on self, spouse or child with serious disease,

including up to RM500 for medical examination (maximum) 6,000

Basic supporting equipment for disabled self, spouse, child or parent (maximum) 6,000

Purchase of sports equipment (maximum) 300

Fees expended for skills or qualifications (maximum) 7,000

Expenses on books for personal use (maximum) 1,000

Spouse relief 4,000

Disabled spouse, additional 3,500

Child (each) 2,000

Child – higher rate (each) 8,000

Disabled child (each) 6,000

Disabled child, additional (each) 14,000

Life insurance premiums, contributions to approved provident funds (maximum) 6,000

Deferred annuity premiums (maximum) 3,000

Medical and/or educational insurance premiums for self, spouse or child (maximum) 3,000

Purchase of a personal computer (maximum) 3,000

Broadband subscription (maximum) NIL

Deposit for a child into the National Education Savings Scheme (maximum) 6,000

Parental care: Father (maximum) 1,500

Parental care: Mother (maximum) 1,500

Rebates

Chargeable income not exceeding RM35,000 RM

Spouse 400

Additional entitled to a deduction in respect of a spouse or a former wife claimed 400

Zakat/Fitrah (with receipts) Amount

incurred

Value of benefits in kind

Car scale

Cost of car Prescribed annual value of

(when new) private usage of car Fuel per

annum

RM RM RM

Up to 50,000 1,200 600

50,001 to 75,000 2,400 900

75,001 to 100,000 3,600 1,200

100,001 to 150,000 5,000 1,500

150,001 to 200,000 7,000 1,800

200,001 to 250,000 9,000 2,100

250,001 to 350,000 15,000 2,400

350,001 to 500,000 21,250 2,700

500,001 and above 25,000 3,000

The value of the car benefit equal to half the prescribed annual value (above) is taken if the car

provided is more than five (5) years old.

Where a driver is provided by the employer, the value of the benefit per month is fixed at

RM600.

Other benefits RM per month

Household furnishings, apparatus and appliances:

Semi-furnished with furniture in the lounge, dining room or bedroom 70

Semi-furnished with furniture as above plus air-conditioned and/or curtains and carpets 140

Fully furnished premises 280

Domestic help 400

Gardener 300

Capital allowances

Initial allowance Annual allowance

(IA) Rate % (AA) Rate %

Industrial buildings 10 3

Plant and machinery – general 20 14

Motor vehicles and heavy machinery 20 20

Office equipment, furniture and fittings 20 10

You might also like

- Substantive Tests of Receivables and SalesDocument4 pagesSubstantive Tests of Receivables and SalesKeith Joshua Gabiason100% (1)

- HO No. 1 - Financial Statements AnalysisDocument3 pagesHO No. 1 - Financial Statements AnalysisJOHANNANo ratings yet

- Transcom Worldwide Philippines, Inc.: Taxable Income DetailsDocument1 pageTranscom Worldwide Philippines, Inc.: Taxable Income DetailsarbyjamesNo ratings yet

- Practice Question: Recognition and MeasurementDocument2 pagesPractice Question: Recognition and MeasurementJong HannahNo ratings yet

- F6mys 2009 Dec QDocument10 pagesF6mys 2009 Dec QDave Loh Chong HowNo ratings yet

- F6-Dec 2007 PYQDocument16 pagesF6-Dec 2007 PYQTan Wan ChingNo ratings yet

- CIPM Exam Pass Question - Insurance - Pensions MGTDocument7 pagesCIPM Exam Pass Question - Insurance - Pensions MGTVictory M. DankardNo ratings yet

- Business Registration and Other Legal Requirements of Each Form of Business Organization in The Philippines 1. Sole ProprietorhsipDocument5 pagesBusiness Registration and Other Legal Requirements of Each Form of Business Organization in The Philippines 1. Sole Proprietorhsipfrancis dungcaNo ratings yet

- Tax Rates and AllowancesDocument3 pagesTax Rates and AllowancesChing Seen WongNo ratings yet

- F6mys QPDocument14 pagesF6mys QPTenny LeeNo ratings yet

- Taxation (Malaysia) : September/December 2016 - Sample QuestionsDocument12 pagesTaxation (Malaysia) : September/December 2016 - Sample QuestionsGary Danny Galiyang100% (1)

- Taxation (Malaysia) : March/June 2017 - Sample QuestionsDocument12 pagesTaxation (Malaysia) : March/June 2017 - Sample QuestionsIntan SyuhadaNo ratings yet

- F6mys 2010 Dec QDocument12 pagesF6mys 2010 Dec QJeejuNo ratings yet

- Taxation (Malaysia) : Specimen Exam Applicable From December 2015Document22 pagesTaxation (Malaysia) : Specimen Exam Applicable From December 2015cytan828No ratings yet

- Taxation (Malaysia) : Tuesday 3 June 2014Document12 pagesTaxation (Malaysia) : Tuesday 3 June 2014Chan HF PktianNo ratings yet

- Taxation (Malaysia) : March/June 2018 - Sample QuestionsDocument13 pagesTaxation (Malaysia) : March/June 2018 - Sample QuestionsTeneswari RadhaNo ratings yet

- F6MYS 2013 Dec QuestionDocument14 pagesF6MYS 2013 Dec QuestionChoo LeeNo ratings yet

- Foundations in Taxation (Malaysia)Document20 pagesFoundations in Taxation (Malaysia)ShazwanieSazaliNo ratings yet

- Taxation Malaysia Home Acca GlobalDocument12 pagesTaxation Malaysia Home Acca GlobalLee Yee Mei100% (1)

- J15 F6mys Q PDFDocument20 pagesJ15 F6mys Q PDFAgyeiNo ratings yet

- Taxation - Malaysia (TX - Mys) : Applied SkillsDocument16 pagesTaxation - Malaysia (TX - Mys) : Applied SkillsPrincess GonzalesNo ratings yet

- Taxation (Malaysia) : Tuesday 2 December 2014Document12 pagesTaxation (Malaysia) : Tuesday 2 December 2014cartoon anime انمي100% (1)

- F6mys Jun 2011 QuDocument10 pagesF6mys Jun 2011 Qutoushiga100% (1)

- Advanced Taxation (Malaysia) : March/June 2017 - Sample QuestionsDocument12 pagesAdvanced Taxation (Malaysia) : March/June 2017 - Sample QuestionsKiyong TanNo ratings yet

- F6mys 2017 Sept Dec QDocument12 pagesF6mys 2017 Sept Dec QMuhammad ZabhaNo ratings yet

- m20 ATX MYS QPDocument13 pagesm20 ATX MYS QPizzahderhamNo ratings yet

- Atx June 2016 (Q)Document15 pagesAtx June 2016 (Q)amy najatNo ratings yet

- P6mys 2017 Sep Dec QDocument12 pagesP6mys 2017 Sep Dec QstacyyauNo ratings yet

- PT1 Sept 2022 Exams Question Paper G1, G2, G3 22 July 2022Document13 pagesPT1 Sept 2022 Exams Question Paper G1, G2, G3 22 July 2022stacyyauNo ratings yet

- P6mys 2015 Dec QDocument13 pagesP6mys 2015 Dec QMERINANo ratings yet

- Income Tax Rates YA2016Document4 pagesIncome Tax Rates YA2016Kelvin LeongNo ratings yet

- Atx Mock QDocument12 pagesAtx Mock QstacyyauNo ratings yet

- Tax267 AppendixDocument4 pagesTax267 AppendixJasne OczyNo ratings yet

- Q-Atxmys-2019-Marjun Sample-Q PDFDocument11 pagesQ-Atxmys-2019-Marjun Sample-Q PDFkok kuan wongNo ratings yet

- Taxation (Mock Exam)Document16 pagesTaxation (Mock Exam)shahirah rahimNo ratings yet

- PYQ AT Sep-Dec2018 PDFDocument11 pagesPYQ AT Sep-Dec2018 PDF炜伦林No ratings yet

- Taxation (Malaysia) : Monday 7 June 2010Document10 pagesTaxation (Malaysia) : Monday 7 June 2010Saayesha RamNo ratings yet

- Atx PTDocument15 pagesAtx PTamy najatNo ratings yet

- Tax FinalDocument8 pagesTax FinalAssignments HelperNo ratings yet

- Inland Revenue Board of Malaysia: Eng MalDocument6 pagesInland Revenue Board of Malaysia: Eng Malathirah jamaludinNo ratings yet

- Test 1Document6 pagesTest 1khowcatherine2000No ratings yet

- Test 2Document7 pagesTest 2khowcatherine2000No ratings yet

- Income Tax PlanningDocument4 pagesIncome Tax PlanningFatihaaroslanNo ratings yet

- Chap 6 Relief and RebateDocument15 pagesChap 6 Relief and RebateKelvin OngNo ratings yet

- F6mys 2008 Jun QDocument9 pagesF6mys 2008 Jun QNik NasuhaNo ratings yet

- Remittance Summary: Offering Code Offering NameDocument4 pagesRemittance Summary: Offering Code Offering NameEliceo Choque AndradeNo ratings yet

- Example Tax PlanningDocument16 pagesExample Tax PlanningHAZIQ ZIKRI BAHARUDDINNo ratings yet

- TaxationDocument11 pagesTaxationkhowcatherine2000No ratings yet

- 07 DEC QuestionDocument9 pages07 DEC QuestionkhengmaiNo ratings yet

- Taxation Question 2018 MarchDocument17 pagesTaxation Question 2018 MarchNg Grace100% (1)

- Taxation Question 2017 SeptemberDocument16 pagesTaxation Question 2017 Septemberzezu zazaNo ratings yet

- TOPIC 1-Tax LesgislationDocument23 pagesTOPIC 1-Tax LesgislationNURUL NUHA BINTI AZIZ HILMI / UPMNo ratings yet

- TableOfIncomeTaxable EPF SOCSO EISDocument7 pagesTableOfIncomeTaxable EPF SOCSO EISMohd ShamNo ratings yet

- PT Mekar Jaya Work Sheet Per 31 Dec 2017Document14 pagesPT Mekar Jaya Work Sheet Per 31 Dec 2017Putudevi FebriadnyaniNo ratings yet

- Taxation Question 2019 MarchDocument13 pagesTaxation Question 2019 MarchAlice DesiraeeNo ratings yet

- Latihan Perpetual PT CEMERLANGDocument28 pagesLatihan Perpetual PT CEMERLANGSamsul PangestuNo ratings yet

- Account Titles Trial Balance Adjustment Dr. Cr. Dr. CRDocument4 pagesAccount Titles Trial Balance Adjustment Dr. Cr. Dr. CRplaylist erikyoongNo ratings yet

- Income Tax Calculator FY 2018-19 (AY 2019-20) : Head DescriptionDocument4 pagesIncome Tax Calculator FY 2018-19 (AY 2019-20) : Head DescriptionEr Amit JambhulkarNo ratings yet

- SSS Contribution:: Salary Contribution MOS StaffDocument3 pagesSSS Contribution:: Salary Contribution MOS StaffCarlos Miguel AndojarNo ratings yet

- Projected Broiler Farm (20,000)Document1 pageProjected Broiler Farm (20,000)Eean KicapNo ratings yet

- Maternity Benefit CalculatorDocument5 pagesMaternity Benefit CalculatorJoanna KarlaNo ratings yet

- Minwaly Trading & Consultancy PLC Rak Bakery Contrct Workers Payroll For The Month of Hidar 2009 E.CDocument2 pagesMinwaly Trading & Consultancy PLC Rak Bakery Contrct Workers Payroll For The Month of Hidar 2009 E.CABDELLA ALINo ratings yet

- Income From Salary..adDocument7 pagesIncome From Salary..adduch mangNo ratings yet

- Practice Question - Statement of Cashflow Bull LTD Statement of Cash Flow For The Year Ended 31 March 2021Document2 pagesPractice Question - Statement of Cashflow Bull LTD Statement of Cash Flow For The Year Ended 31 March 2021Jong HannahNo ratings yet

- Personal Reliefs and RebatesDocument3 pagesPersonal Reliefs and RebatesJong HannahNo ratings yet

- Tutorial 1 - Topic 4 - OAR - QDocument6 pagesTutorial 1 - Topic 4 - OAR - QJong HannahNo ratings yet

- Quiz 1:resident Status: Year of Assessment Period of Stay No. of Days Resident Status Pursuant To SectionDocument3 pagesQuiz 1:resident Status: Year of Assessment Period of Stay No. of Days Resident Status Pursuant To SectionJong HannahNo ratings yet

- Banking & Insurance: Project On HDFC BankDocument36 pagesBanking & Insurance: Project On HDFC Bankvrathi87No ratings yet

- Financial Ratio AnalysisDocument80 pagesFinancial Ratio AnalysisAppleCorpuzDelaRosaNo ratings yet

- 2021 08 13 Dial - M - For - MarketDocument11 pages2021 08 13 Dial - M - For - MarketXavier StraussNo ratings yet

- Cambridge IGCSE (9-1) : ACCOUNTING 0985/22Document20 pagesCambridge IGCSE (9-1) : ACCOUNTING 0985/22Adityo Sandhy PutraNo ratings yet

- 1231 ISV ListDocument2 pages1231 ISV Listtest123No ratings yet

- Revival of Sick CompaniesDocument18 pagesRevival of Sick CompaniesCfaVishalGautamNo ratings yet

- Abu Dhabi Real Estate GuideDocument16 pagesAbu Dhabi Real Estate Guidemoustafagad92No ratings yet

- NEQAS Enrollment Form V7.0 PDFDocument2 pagesNEQAS Enrollment Form V7.0 PDFMyline CampoamorNo ratings yet

- Form 26ASDocument10 pagesForm 26ASdhaval.shahNo ratings yet

- Asset Management PrepDocument6 pagesAsset Management PrepCharlotte HoNo ratings yet

- 0456 Business TaxationDocument4 pages0456 Business Taxationpsycho_bhoot86No ratings yet

- SIP As A Stability Builder For A Retail InvestorDocument84 pagesSIP As A Stability Builder For A Retail InvestorprathamNo ratings yet

- The Manual of Ideas Arnold Van Den Berg 201409Document12 pagesThe Manual of Ideas Arnold Van Den Berg 201409narang.gp5704No ratings yet

- Money (Part II) Please Go Over The Following Terms and Their DefinitionsDocument4 pagesMoney (Part II) Please Go Over The Following Terms and Their DefinitionsDelia LupascuNo ratings yet

- University of Rajasthan, Jaipur: ExaminationDocument1 pageUniversity of Rajasthan, Jaipur: ExaminationGodra English ClassesNo ratings yet

- Capital Budgeting ContentDocument3 pagesCapital Budgeting ContentRobin ThomasNo ratings yet

- Additional TaxDocument3 pagesAdditional TaxMel ManatadNo ratings yet

- Hindustan Oil Exploration Company LimitedDocument20 pagesHindustan Oil Exploration Company LimitedBhunesh VaswaniNo ratings yet

- Sources and Allocation of Funds of Charitable Institutions in The First District of Rizal - Chapter 1-4Document98 pagesSources and Allocation of Funds of Charitable Institutions in The First District of Rizal - Chapter 1-4Dan Joseph Sta AnaNo ratings yet

- Special Commercial Law Lecture Notes Philord Aranda Letters of CreditDocument8 pagesSpecial Commercial Law Lecture Notes Philord Aranda Letters of CreditFiels GamboaNo ratings yet

- Syllabus 6th Sem TYBMSDocument9 pagesSyllabus 6th Sem TYBMSVinay RaghavendranNo ratings yet

- Acct Statement - XX5780 - 29052023Document2 pagesAcct Statement - XX5780 - 29052023priya dubeyNo ratings yet

- Managing Your Card With CareDocument33 pagesManaging Your Card With CareLipsin LeeNo ratings yet

- Business M-J-18 P1Document2 pagesBusiness M-J-18 P1AdeenaNo ratings yet

- Branch and Offices DetailsDocument78 pagesBranch and Offices DetailsJay JayavarapuNo ratings yet