Professional Documents

Culture Documents

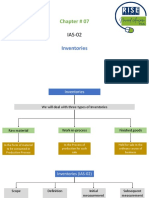

Chapter 2

Chapter 2

Uploaded by

Deniña Elaine Mae0 ratings0% found this document useful (0 votes)

12 views4 pagesThis document discusses the role of money and interest rates. It defines money and outlines its key characteristics and functions, including being a store of value, means of exchange, and unit of account. The document then covers the evolution and supply of money over time, from bartering to various forms like coins, notes, and digital currency. It also examines the demand for money, including transactional, precautionary, and speculative demands. Finally, it discusses how the supply and demand for money impacts interest rates and the economy.

Original Description:

Original Title

CHAPTER 2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses the role of money and interest rates. It defines money and outlines its key characteristics and functions, including being a store of value, means of exchange, and unit of account. The document then covers the evolution and supply of money over time, from bartering to various forms like coins, notes, and digital currency. It also examines the demand for money, including transactional, precautionary, and speculative demands. Finally, it discusses how the supply and demand for money impacts interest rates and the economy.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

12 views4 pagesChapter 2

Chapter 2

Uploaded by

Deniña Elaine MaeThis document discusses the role of money and interest rates. It defines money and outlines its key characteristics and functions, including being a store of value, means of exchange, and unit of account. The document then covers the evolution and supply of money over time, from bartering to various forms like coins, notes, and digital currency. It also examines the demand for money, including transactional, precautionary, and speculative demands. Finally, it discusses how the supply and demand for money impacts interest rates and the economy.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

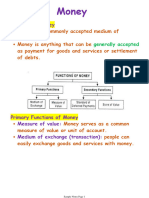

CHAPTER 2

INTRODUCING MONEY AND INTEREST RATES

I. ROLE OF MONEY IN THE ECONOMY

➢ Money is any item or product that is widely recognized as a form of

payment for goods and services or as a means of debt reduction and acts

as an asset to its owner.

➢ Money is the oil that keeps our world's machines going.

➢ For thousands of years, money has played this critical role.

➢ In the Philippines, the Banko Sentral ng Pilipinas is a well-established bank

and institution.

II. CHARACTERISTICS OF MONEY

➢ The word "valuable" refers to something that has monetary value or

worth.

➢ Durable means that it will last a long time without losing its consistency or

value.

➢ Portable and standard - capable of being carried or transferred and

having a uniform quality or state

➢ Divisible means that it can be broken down into smaller parts.

➢ Money has a cap of Limited Availability.

➢ To be usable, it must be able to be used for payment.

III. THE KEY FUNCTIONS OF MONEY

➢ Store of value

➢ Item of worth

➢ Means of exchange

➢ Unit of account

➢ Standard of deferred payment

IV. THE EVOLUTION OF MONEY

➢ Bartering was the original method of exchanging surplus goods with one

another. Money emerged as a realistic alternative to the challenges of

bartering hundreds of different items, even though the worth of each good

exchanged could be debated. Money has taken several forms over the

years, but regardless of its shape, whether as a coin, a note, or a digital

server, money still offers a fixed value to which any object can be compared.

➢ According to the law of supply and demand, as the price rises, the quantity

demanded decreases, and as the price falls, the quantity demanded rises.

The supply of a product is the single most important factor influencing its

price. Low supply will raise the price, while high supply will lower it.

V. THE SUPPLY AND DEMAND OF MONEY

➢ Key measures

▪ M1 is the smallest unit of the money supply. The use of money as a

medium of exchange

▪ M2: Money that is used as a store of value in addition to M1.

▪ M3: money used as a unit of account in addition to 2.

▪ L: This metric, in addition to M3, includes liquid and near-liquid

assets.

➢ The interest rate, and therefore the cost of borrowing money, would be

influenced by changes in the money supply. This would have an effect on

the economy's consumption and investment levels.

THE DEMAND OF MONEY

I. THE SOURCES OF DEMAND FOR MONEY

➢ Transaction Demand- the money we need to buy goods and services in our

daily lives.

➢ Precautionary Demand- the money we will need for unexpected purchases

or emergencies.

➢ Speculative Demand is the money we need to retain our money instead of

purchasing shares, assets, or risky investments.

II. THE IMPACT OF MONEY

➢ Interest- The amount of money you pay to borrow money or the amount

of money you earn as a result of lending money. The rate is expressed as

a percentage of the loan amount.

➢ A greater money supply reduces market interest rates, making borrowing

more affordable for consumers.

➢ Smaller money reserves tend to increase market interest rates, making

consumer loans more costly.

➢ If there is more money available, the interest rate is lower; if there is less

money, the interest rate is higher.

III. THE QUANTITY THEORY OF MONEY

➢ How interest rates are determined

▪ Investors- demand funds in order to fund capital assets that they hope

can boost performance and benefit.

▪ Customers- loanable funds with a positive rate of time preference are

in high demand. They would rather have earlier access.

▪ Lenders- provides lenders with an opportunity to cut back on their

current spending so that borrowers can spend or consume beyond their

means.

➢ Investment Funds- is a pool of money that many private investors

contribute to and use to invest in stocks and bonds collectively.

➢ A liquid asset is something you own that can be turned into cash

efficiently and easily while maintaining its market value.

➢ The rate at which the quantity of money demanded equals the quantity

of money supplied is known as equilibrium interest.

➢ People's willingness to retain capital for various reasons is known as

liquidity preferences.

➢ The nominal or money rate corresponds to the interest rate before

inflation is taken into account.

➢ The real rate of interest is calculated to exclude the influence of inflation

and represents the true value of a bond or loan.

➢ The rate at which the value of a currency falls and, as a result, the

overall cost of prices for goods and services rises is known as inflation.

➢ 3 components of money rate of interest on loan

• The real price of earlier availability is the pure interest

component.

• The component of a necessary return that compensates for

inflation risk is known as the inflationary premium

component.

• The extra yield above the risk-free rate that investors earn as

reward for investing in volatile assets is known as the risk-

premium component.

You might also like

- ICT MENTORSHIP Month 3Document71 pagesICT MENTORSHIP Month 3Aleepha Lelana92% (12)

- Chapter 11Document3 pagesChapter 11aaryanrjainNo ratings yet

- Financial Economics ReviewerDocument12 pagesFinancial Economics ReviewerMary Clarence BalasabasNo ratings yet

- CH07 Money and Prices OnlineDocument45 pagesCH07 Money and Prices OnlineNickNo ratings yet

- Overview of The Study On Money, Banking and Financial MarketsDocument36 pagesOverview of The Study On Money, Banking and Financial MarketsFarapple24No ratings yet

- Tema 1 IfimDocument29 pagesTema 1 Ifimacaroie13364No ratings yet

- Module 3Document20 pagesModule 3Itisha SinghNo ratings yet

- Market Structuremoney and InflationDocument29 pagesMarket Structuremoney and InflationHans de la PeñaNo ratings yet

- FinMan 4 Group 2 - 20240220 - 222159 - 0000Document44 pagesFinMan 4 Group 2 - 20240220 - 222159 - 0000SILVESTRE, NelsonNo ratings yet

- International Economics II Chapter 2Document29 pagesInternational Economics II Chapter 2Härêm ÔdNo ratings yet

- 1 MoneyDocument31 pages1 MoneyJayaMadhavNo ratings yet

- MONEY AND BANKING Notes PDFDocument20 pagesMONEY AND BANKING Notes PDFJames LusibaNo ratings yet

- Wk10 MoneyDocument62 pagesWk10 MoneyaaaNo ratings yet

- Chapter 11 MoneyDocument22 pagesChapter 11 MoneySV Saras DewiNo ratings yet

- MPCB 2Document26 pagesMPCB 2John Mark CabrejasNo ratings yet

- 1 - Money, Banking, and The Financial SectorDocument138 pages1 - Money, Banking, and The Financial SectorMacNo ratings yet

- What Is MoneyDocument33 pagesWhat Is Moneyد.عيد عشريNo ratings yet

- Null 4Document29 pagesNull 4pridegwatidzo2No ratings yet

- Chapter 2. Money and The Payment SystemDocument6 pagesChapter 2. Money and The Payment SystemAngelica Hialario PaezNo ratings yet

- English for Banking and FinanceDocument34 pagesEnglish for Banking and FinanceAmandaNo ratings yet

- Chapter 1 & 2Document5 pagesChapter 1 & 2rog67558No ratings yet

- Sample NotesDocument20 pagesSample NotesKenpin EteNo ratings yet

- Chapter 8 PDFDocument48 pagesChapter 8 PDFNrAfqh MzlnNo ratings yet

- Ecodev: Economic Development: Money, Monetary System and InflationDocument34 pagesEcodev: Economic Development: Money, Monetary System and InflationJane Clarisse SantosNo ratings yet

- Nature and Value of MoneyDocument33 pagesNature and Value of MoneyRuthie Jill PendonNo ratings yet

- Economics Section 3 NotesDocument37 pagesEconomics Section 3 NotesDhrisha GadaNo ratings yet

- Macroeconomics Notes Unit 3Document30 pagesMacroeconomics Notes Unit 3Eshaan GuruNo ratings yet

- Unit 4 MoneyDocument39 pagesUnit 4 MoneyTARAL PATELNo ratings yet

- Forms: 3.1 Money and Its Importance DefinitionDocument26 pagesForms: 3.1 Money and Its Importance DefinitionBereket MekonnenNo ratings yet

- Unit 1: Money and BankingDocument48 pagesUnit 1: Money and BankingAbhikaam SharmaNo ratings yet

- Financial Markets: & The Special Case of MoneyDocument53 pagesFinancial Markets: & The Special Case of MoneyannsaralondeNo ratings yet

- Lesson 1: Concept and Functions of MoneyDocument31 pagesLesson 1: Concept and Functions of MoneyFind DeviceNo ratings yet

- 2021financial Analysis Lecture 2 (Money)Document22 pages2021financial Analysis Lecture 2 (Money)Vivian BaoNo ratings yet

- Money and Commercial BankingDocument8 pagesMoney and Commercial BankingMH SahirNo ratings yet

- Money Market Unit I The Concept of Money Demand Important TheoriesDocument26 pagesMoney Market Unit I The Concept of Money Demand Important Theoriesbalaji 2004No ratings yet

- Chapter 2 M & BankingDocument66 pagesChapter 2 M & BankingBarkhad HassanNo ratings yet

- Money and Banking Ss and DDDocument10 pagesMoney and Banking Ss and DDNyaramba DavidNo ratings yet

- General Lecture 7Document18 pagesGeneral Lecture 7Shantie PittNo ratings yet

- MONEYDocument1 pageMONEYRIZZA MAE OLANONo ratings yet

- The Unit-Of-Account Function of Money Is Crucial To The Operation of An Economy For Several ReasonsDocument13 pagesThe Unit-Of-Account Function of Money Is Crucial To The Operation of An Economy For Several Reasonstunvir abdullahNo ratings yet

- Money and The Banking SystemDocument6 pagesMoney and The Banking SystemRovie John CordovaNo ratings yet

- Demand For MoneyDocument4 pagesDemand For MoneyHadhi MubarakNo ratings yet

- Money and Banking PDFDocument19 pagesMoney and Banking PDFMOTIVATION ARENANo ratings yet

- Money and BankingDocument53 pagesMoney and BankingSamruddhi PatilNo ratings yet

- The Monetary SystemDocument7 pagesThe Monetary SystemJhoanna SandigNo ratings yet

- Functions of MoneyDocument7 pagesFunctions of MoneyShayan YasirNo ratings yet

- 18300038,14th, Mid-Term Assignment 1Document8 pages18300038,14th, Mid-Term Assignment 1Md RifatNo ratings yet

- Lesson 1 MONETARY POLICYDocument4 pagesLesson 1 MONETARY POLICYStephane Jade LapacNo ratings yet

- Presentation 1 - Introduction To Money, Credit, and BankingDocument28 pagesPresentation 1 - Introduction To Money, Credit, and BankingNigel N. SilvestreNo ratings yet

- Group 11: Money Supply: Group 11.group Members Number Name Reg - NumberDocument23 pagesGroup 11: Money Supply: Group 11.group Members Number Name Reg - NumberFelistaNo ratings yet

- Introduction To Finance II-1Document30 pagesIntroduction To Finance II-1mojeedsodiq0No ratings yet

- Money NotesDocument6 pagesMoney NotesNavya AgarwalNo ratings yet

- Money and BankingDocument40 pagesMoney and BankingWASSWA ALEXNo ratings yet

- Financial MarketDocument14 pagesFinancial MarketFel Salazar JapsNo ratings yet

- Chapter 1: MoneyDocument46 pagesChapter 1: MoneyFrozt ChrisNo ratings yet

- Economic Project On MoneyDocument14 pagesEconomic Project On MoneyAshutosh RathiNo ratings yet

- Macroeconomics - Unit V - Lecture 1Document3 pagesMacroeconomics - Unit V - Lecture 1Dyuti SinhaNo ratings yet

- Lecture Notes - Topic 4 - Money Banking and Financial SectorDocument8 pagesLecture Notes - Topic 4 - Money Banking and Financial SectorMadavaan KrisnamurthyNo ratings yet

- Money: Building Economics Assignment 1Document20 pagesMoney: Building Economics Assignment 1Anchal SharmaNo ratings yet

- Bba NotesDocument103 pagesBba Noteschaubeyjivarun301No ratings yet

- IntroductionDocument1 pageIntroductionDeniña Elaine MaeNo ratings yet

- Final PastiliciouslyDocument90 pagesFinal PastiliciouslyDeniña Elaine MaeNo ratings yet

- General AssemblyDocument3 pagesGeneral AssemblyDeniña Elaine MaeNo ratings yet

- Pricing DecisionDocument4 pagesPricing DecisionDeniña Elaine MaeNo ratings yet

- Chapter 3: An Introduction To The Payments System I. Payment SystemDocument2 pagesChapter 3: An Introduction To The Payments System I. Payment SystemDeniña Elaine MaeNo ratings yet

- Abstract IIIDocument14 pagesAbstract IIIDeniña Elaine MaeNo ratings yet

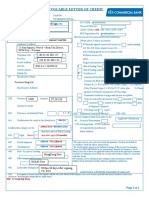

- AP #: 1900135531 Request For Payment: 2020-0169733: Status: TransmitDocument1 pageAP #: 1900135531 Request For Payment: 2020-0169733: Status: TransmitIlove music096No ratings yet

- Keynes On The SlumpDocument70 pagesKeynes On The SlumpRob JulianNo ratings yet

- Exercises and Problems - Merchandising BusinessDocument4 pagesExercises and Problems - Merchandising BusinessNems PsycheNo ratings yet

- Binary Trading Option Higher, Lower.Document8 pagesBinary Trading Option Higher, Lower.stefan Michaelson100% (1)

- AplDocument4 pagesAplAmeya RegeNo ratings yet

- CHAPTER 13 PROB 1-2 - GOZUNKAYE - XLSX - Sheet1Document10 pagesCHAPTER 13 PROB 1-2 - GOZUNKAYE - XLSX - Sheet1kaye gozunNo ratings yet

- ODR Vednor SQLDocument48 pagesODR Vednor SQLbalasukNo ratings yet

- Yuan To Usd - Google SearchDocument1 pageYuan To Usd - Google SearchHasnain AsifNo ratings yet

- What Is MoneyDocument2 pagesWhat Is MoneycandyNo ratings yet

- A South Asian Perspective: Marketing Management, 12/eDocument26 pagesA South Asian Perspective: Marketing Management, 12/ePreetam JainNo ratings yet

- Essay INFLATIONDocument4 pagesEssay INFLATIONWaseem IncrediblNo ratings yet

- Banking and FinanceDocument74 pagesBanking and FinancekimmheanNo ratings yet

- Periodic Date Acc TitleDocument6 pagesPeriodic Date Acc TitleJeluMVNo ratings yet

- CH # 07 To 10 RevisionDocument61 pagesCH # 07 To 10 RevisionAbdul SalamNo ratings yet

- Factors That Influence Entry Mode Choice in Foreign Markets V2011novDocument13 pagesFactors That Influence Entry Mode Choice in Foreign Markets V2011novYing Kaw100% (2)

- Junk Iron Sales Contract: 1. Commodity and SpecificationDocument4 pagesJunk Iron Sales Contract: 1. Commodity and SpecificationNgân ThuỳNo ratings yet

- MODULE-2 Life and Works of RizalDocument7 pagesMODULE-2 Life and Works of RizalDanna Jean Halican CoedNo ratings yet

- Hup Seng IndustryDocument4 pagesHup Seng IndustryMuhamad Uzayr Syahmi RohaizamNo ratings yet

- The Contemporary WorldDocument39 pagesThe Contemporary Worldnina soNo ratings yet

- Balance Sheet of Tata MotorsDocument6 pagesBalance Sheet of Tata Motorsnehanayaka25No ratings yet

- Module 3 Working Capital Management Handout For LMS 2020Document17 pagesModule 3 Working Capital Management Handout For LMS 2020sandeshNo ratings yet

- Reviewer ContempotemporaryDocument5 pagesReviewer ContempotemporaryEloisa Espino GabonNo ratings yet

- C03 Krugman 12e AccessibleDocument92 pagesC03 Krugman 12e Accessiblesong neeNo ratings yet

- Application For Irrevocable Letter of Credit: NH GhiDocument2 pagesApplication For Irrevocable Letter of Credit: NH GhiNguyễn Ngọc Phương LiêmNo ratings yet

- 3439 11203 1 PBDocument13 pages3439 11203 1 PBdion sitepuNo ratings yet

- CH 4 TransportationDocument11 pagesCH 4 Transportationassefa horaNo ratings yet

- An Ottoman-English Merchant in Tanzimat Era Henry James Hanson and His Position in Ottoman Commercial LifeDocument24 pagesAn Ottoman-English Merchant in Tanzimat Era Henry James Hanson and His Position in Ottoman Commercial LifeHalim KılıçNo ratings yet

- Spillover Effect - Traditional Financial MarketDocument6 pagesSpillover Effect - Traditional Financial MarketAsma ChihiNo ratings yet

- SocSci 2018the Contemporary World 1Document13 pagesSocSci 2018the Contemporary World 1Joseph Rhey GestosoNo ratings yet