Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

16 viewsChapter 3: An Introduction To The Payments System I. Payment System

Chapter 3: An Introduction To The Payments System I. Payment System

Uploaded by

Deniña Elaine MaeThe document discusses the evolution of payment systems from relying on commodities like gold and silver coins to modern systems like paper money, checks, and electronic funds transfers. It outlines key aspects of checks and their role in transactions. Additionally, it examines desirable attributes for new payment technologies, including security, efficiency, speed, and facilitating international transactions. Examples provided are automated clearing house transactions, ATMs, e-money like PayPal, and blockchain which registers ownership of funds and goods on an encrypted distributed network.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Statement Jun, 2021Document4 pagesStatement Jun, 2021S RNo ratings yet

- Architectural Principles in The Age of Humanism PDFDocument4 pagesArchitectural Principles in The Age of Humanism PDFCemal TekinNo ratings yet

- December 2021 StatementDocument4 pagesDecember 2021 StatementCamila Alejandra Paredes CamposNo ratings yet

- Word/Phrase Part of Speech Ipa (Uk) Ipa (Usa) Sample SentenceDocument2 pagesWord/Phrase Part of Speech Ipa (Uk) Ipa (Usa) Sample SentenceTru CallingNo ratings yet

- Electronic Payment SystemDocument28 pagesElectronic Payment Systemnehapaspuleti4891100% (1)

- DefinitionDocument6 pagesDefinitionSaifur Rahman SteveNo ratings yet

- Unit 3Document23 pagesUnit 3Mahesh NannepaguNo ratings yet

- E Payment SystemsDocument8 pagesE Payment SystemsAlex MianoNo ratings yet

- Online Payment SystemDocument30 pagesOnline Payment SystemDjks YobNo ratings yet

- E Payments Modes and MethodsDocument52 pagesE Payments Modes and MethodsHarshithNo ratings yet

- E-Commerce - BUS426 - Topic 3Document44 pagesE-Commerce - BUS426 - Topic 3Atease ProductionNo ratings yet

- Kilonzo Electronic BankingDocument19 pagesKilonzo Electronic BankingbibijackyNo ratings yet

- Unit 5 Electronic Payment SystemDocument17 pagesUnit 5 Electronic Payment SystemSatyam RajNo ratings yet

- Chapter 3 - The Payment SystemDocument10 pagesChapter 3 - The Payment SystemJohn Mark LopezNo ratings yet

- Unit - 2 - Electronic Payment SystemDocument67 pagesUnit - 2 - Electronic Payment Systemvisdag100% (2)

- Cyber CashDocument13 pagesCyber CashDivya PorwalNo ratings yet

- Lesson 3 LectureDocument5 pagesLesson 3 LectureQueeny CuraNo ratings yet

- E Business Unit 4Document28 pagesE Business Unit 4balasriprasadNo ratings yet

- Banking Law Grup PresentationDocument7 pagesBanking Law Grup PresentationSALIM SHARIFUNo ratings yet

- Unit 4Document13 pagesUnit 4Vinayak SanbhadtiNo ratings yet

- E CashDocument9 pagesE CashGurpreet BansalNo ratings yet

- E. Comm Unit 3Document34 pagesE. Comm Unit 3Himanshu SahdevNo ratings yet

- 4 Electronic Payment SystemsDocument39 pages4 Electronic Payment SystemsYashasweeNo ratings yet

- Electronic Payment SystemDocument7 pagesElectronic Payment SystemThaKur TaRun RaNaNo ratings yet

- E Commerce Unit-II: Types of Electronic Payment SystemsDocument18 pagesE Commerce Unit-II: Types of Electronic Payment SystemsMunavalli Matt K SNo ratings yet

- Epayment SystemDocument5 pagesEpayment System20CS18 SISIR KUMARNo ratings yet

- VII.E Payment SystemDocument49 pagesVII.E Payment Systemroshan kcNo ratings yet

- Electronic Payment SystemsDocument8 pagesElectronic Payment SystemsAbhishek NayakNo ratings yet

- Topic Iii Payment SystemDocument29 pagesTopic Iii Payment SystemNoeline ParafinaNo ratings yet

- A Study On Payment and Settlement SystemDocument100 pagesA Study On Payment and Settlement SystemRoyal Projects100% (1)

- ĐỀ CƯƠNG TỰ LUẬN CUỐI KỲ EBANKINGDocument11 pagesĐỀ CƯƠNG TỰ LUẬN CUỐI KỲ EBANKINGminhanhtran.chubbNo ratings yet

- E-Business For Hospitality 5Document20 pagesE-Business For Hospitality 5Tsea CaronNo ratings yet

- E - Commerce Unit 2 RGPV SylabbusDocument22 pagesE - Commerce Unit 2 RGPV SylabbusDeepak Kumar RajakNo ratings yet

- MIS ReportDocument17 pagesMIS Reportzaber chowdhuryNo ratings yet

- Payment SystemsDocument32 pagesPayment SystemsNamyenya MaryNo ratings yet

- Ilovepdf MergedDocument91 pagesIlovepdf Mergedirfan khanNo ratings yet

- Chapter One 1.0Document16 pagesChapter One 1.0Eet's Marve RichyNo ratings yet

- E ChequeDocument5 pagesE ChequedeivaramNo ratings yet

- Types of Electronic Payment SystemsDocument20 pagesTypes of Electronic Payment SystemsRushyanth VattikondaNo ratings yet

- Crypto Coin-Overview of Basic Transaction: January 2017Document6 pagesCrypto Coin-Overview of Basic Transaction: January 2017Cristian S.No ratings yet

- E Payment 120927112113 Phpapp02Document38 pagesE Payment 120927112113 Phpapp02sagarg94gmailcomNo ratings yet

- Unit-V Indian PerspectiveDocument105 pagesUnit-V Indian PerspectiveSachin gollapalliNo ratings yet

- Unit-III: Types of Electronic Payment SystemsDocument8 pagesUnit-III: Types of Electronic Payment SystemsUmam AfzalNo ratings yet

- E-COMMERCE - Unit-2Document19 pagesE-COMMERCE - Unit-2Kalyan KumarNo ratings yet

- Rag Bfi 3Document4 pagesRag Bfi 3Bhebz Erin MaeNo ratings yet

- Communication BbaDocument33 pagesCommunication BbaParmeet KaurNo ratings yet

- FinalONLINE TRANSACTION INDEXDocument2 pagesFinalONLINE TRANSACTION INDEXLaraya, Roy MatthewNo ratings yet

- ECOM Unit 3Document29 pagesECOM Unit 3kunchala_veniNo ratings yet

- E CashDocument33 pagesE CashVijay Krishna BoppanaNo ratings yet

- Week 2Document36 pagesWeek 2FARYAL FATIMANo ratings yet

- Electronic Payment SystemDocument20 pagesElectronic Payment SystemThe PaletteNo ratings yet

- Unit III Final ECOMDocument17 pagesUnit III Final ECOMsar leeNo ratings yet

- E Cash Payment System PaperDocument37 pagesE Cash Payment System Paperakash0% (1)

- Electronic Cash: Energy Efficient SystemsDocument12 pagesElectronic Cash: Energy Efficient SystemsAkshay GattawarNo ratings yet

- Financial Markets (Chapter 3)Document1 pageFinancial Markets (Chapter 3)Kyla DayawonNo ratings yet

- Unit-5 E-Commerce Electronic Payment System SRGDocument33 pagesUnit-5 E-Commerce Electronic Payment System SRGLuitel ShaneNo ratings yet

- Epayments BCH ECommerceDocument14 pagesEpayments BCH ECommerceNeha BhandariNo ratings yet

- BBA-108 - E-Commerce Unit THREE & FOURDocument34 pagesBBA-108 - E-Commerce Unit THREE & FOURA1cyb CafeNo ratings yet

- Topic 7Document31 pagesTopic 7LucyChanNo ratings yet

- Digital Payments: Blockchain Based Security Concerns and FutureDocument7 pagesDigital Payments: Blockchain Based Security Concerns and Futuresayedahmed alishahNo ratings yet

- Web Payment SystemsDocument39 pagesWeb Payment SystemsBrightkofi OtchereNo ratings yet

- Electronic ChequesDocument4 pagesElectronic ChequesAtharvaNo ratings yet

- Digicash CybercashDocument20 pagesDigicash CybercashAnshul GargNo ratings yet

- Intro To Crypto: The Ultimate Beginners Guide To Cryptocurrency and Its TechnologiesFrom EverandIntro To Crypto: The Ultimate Beginners Guide To Cryptocurrency and Its TechnologiesNo ratings yet

- IntroductionDocument1 pageIntroductionDeniña Elaine MaeNo ratings yet

- Final PastiliciouslyDocument90 pagesFinal PastiliciouslyDeniña Elaine MaeNo ratings yet

- General AssemblyDocument3 pagesGeneral AssemblyDeniña Elaine MaeNo ratings yet

- Pricing DecisionDocument4 pagesPricing DecisionDeniña Elaine MaeNo ratings yet

- Chapter 2Document4 pagesChapter 2Deniña Elaine MaeNo ratings yet

- Abstract IIIDocument14 pagesAbstract IIIDeniña Elaine MaeNo ratings yet

- General Ledger To Trial Balance 2Document5 pagesGeneral Ledger To Trial Balance 2Carpenters ForeverNo ratings yet

- Cash BookDocument11 pagesCash BookSoumendra RoyNo ratings yet

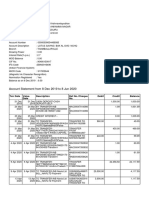

- Account Statement From 8 Dec 2019 To 8 Jun 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument6 pagesAccount Statement From 8 Dec 2019 To 8 Jun 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceMUTHYALA NEERAJANo ratings yet

- Ev Charging AppDocument2 pagesEv Charging AppVs TextilesNo ratings yet

- Doc1544 9849Document1 pageDoc1544 9849georgebates1979No ratings yet

- ProductDocument1 pageProductydaimNo ratings yet

- Transaction MaintenanceDocument4 pagesTransaction MaintenancedonbabaNo ratings yet

- English 5 Q1W1Document34 pagesEnglish 5 Q1W1Chiara Margarita Dogos RosaNo ratings yet

- Take Home Examination Bdfa1103Document7 pagesTake Home Examination Bdfa1103zul arifNo ratings yet

- Confessions of A ShopaholicDocument6 pagesConfessions of A Shopaholiccharles akendoNo ratings yet

- 02 - Duties of An Accounts ClerkDocument12 pages02 - Duties of An Accounts ClerkJaripNo ratings yet

- Topic 4: Source Documents, Books of Prime Entry and Trial BalanceDocument51 pagesTopic 4: Source Documents, Books of Prime Entry and Trial Balancevickramravi16No ratings yet

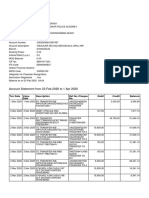

- Account Statement From 23 Feb 2020 To 1 Apr 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 23 Feb 2020 To 1 Apr 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceShyamNo ratings yet

- Rezaul System Zone LLC (Ask My Accountant Query List)Document3 pagesRezaul System Zone LLC (Ask My Accountant Query List)Md. Munir HossainNo ratings yet

- Ohma BB - T StatementsDocument7 pagesOhma BB - T StatementsJohn BeanNo ratings yet

- Merchant Services Ingenico User GuideDocument48 pagesMerchant Services Ingenico User Guidemarcusada21No ratings yet

- R0404 BD040722 QuippDocument5 pagesR0404 BD040722 QuippLovely Jane MorenoNo ratings yet

- Overall Customers: BDO Finds Ways To Satisfy BDO Merchants' Needs by Providing The FollowingDocument3 pagesOverall Customers: BDO Finds Ways To Satisfy BDO Merchants' Needs by Providing The FollowingMichael John LunaNo ratings yet

- Acctg 102 Assignment 1 CceDocument3 pagesAcctg 102 Assignment 1 CceAYAME MALINAO BSA19No ratings yet

- Script For Front Office Services NC IiDocument8 pagesScript For Front Office Services NC IiJC SensieNo ratings yet

- Corporate Accounting: 3 Semester DBADocument54 pagesCorporate Accounting: 3 Semester DBAMaaz RaheelNo ratings yet

- BSF InstructionsDocument2 pagesBSF InstructionsSurya Pratap PatraNo ratings yet

- Invoice 1333881675 I0133P2212134882Document1 pageInvoice 1333881675 I0133P2212134882Silambarasan PanneerselvamNo ratings yet

- Focus Writing On Agent Banking in BangladeshDocument3 pagesFocus Writing On Agent Banking in BangladeshTonmoyNo ratings yet

- 1.3.2.3 M1 - Case Study 1 - You Are A Financial PlannerDocument3 pages1.3.2.3 M1 - Case Study 1 - You Are A Financial PlannerJohann Gabriel Ballesteros NatalarayNo ratings yet

- Unit One Introduction To Federal Government of Ethiopia Accounting and Financial ManagementDocument24 pagesUnit One Introduction To Federal Government of Ethiopia Accounting and Financial ManagementTIZITAW MASRESHANo ratings yet

Chapter 3: An Introduction To The Payments System I. Payment System

Chapter 3: An Introduction To The Payments System I. Payment System

Uploaded by

Deniña Elaine Mae0 ratings0% found this document useful (0 votes)

16 views2 pagesThe document discusses the evolution of payment systems from relying on commodities like gold and silver coins to modern systems like paper money, checks, and electronic funds transfers. It outlines key aspects of checks and their role in transactions. Additionally, it examines desirable attributes for new payment technologies, including security, efficiency, speed, and facilitating international transactions. Examples provided are automated clearing house transactions, ATMs, e-money like PayPal, and blockchain which registers ownership of funds and goods on an encrypted distributed network.

Original Description:

Original Title

CHAPTER 3

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the evolution of payment systems from relying on commodities like gold and silver coins to modern systems like paper money, checks, and electronic funds transfers. It outlines key aspects of checks and their role in transactions. Additionally, it examines desirable attributes for new payment technologies, including security, efficiency, speed, and facilitating international transactions. Examples provided are automated clearing house transactions, ATMs, e-money like PayPal, and blockchain which registers ownership of funds and goods on an encrypted distributed network.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

16 views2 pagesChapter 3: An Introduction To The Payments System I. Payment System

Chapter 3: An Introduction To The Payments System I. Payment System

Uploaded by

Deniña Elaine MaeThe document discusses the evolution of payment systems from relying on commodities like gold and silver coins to modern systems like paper money, checks, and electronic funds transfers. It outlines key aspects of checks and their role in transactions. Additionally, it examines desirable attributes for new payment technologies, including security, efficiency, speed, and facilitating international transactions. Examples provided are automated clearing house transactions, ATMs, e-money like PayPal, and blockchain which registers ownership of funds and goods on an encrypted distributed network.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

CHAPTER 3: AN INTRODUCTION TO THE PAYMENTS SYSTEM

I. PAYMENT SYSTEM

➢ A payment system is a mechanism for carrying out certain transactions.

The payment system has changed over time, from relying on gold and silver

coins to paper money and checks written on bank accounts to electronic

funds transfers.

➢ Commodities money is a term that refers to a product that has value

apart from its usage as money.

➢ Fiat money- is money that has no value other than its use as money, such

as paper currency.

➢ Consumers and businesses accept paper money because they believe that

once they accept it, they will be able to pass it over to someone else when

they need to purchase products and services.

II. Checks and Their Significance

➢ Checks are guarantees that a bank or other financial institution will pay

demand money deposited with them. They can be written for any number,

and using them to settle transactions is simple.

III. New Technology and the Payments System

➢ Five most desirable outcomes for a payments system:

• Security – Episodes in which hackers broke into store credit networks and other

aspects of the payment system have sparked security questions.

• Efficiency- Resources allocated to the preparation of paper checks or other

elements of processing payments are withdrawn from the production of other

products and services.

• Speed-fast settlement of payment facilities transactions between households and

businesses alike.

• Smooth international transactions – the growing number of cross-border

transactions will be facilitated if transfers can be made easily and conveniently.

• A successful collaboration between system participants – Payment schemes need

to include states, financial institutions, such as banks, and other companies around

the world effectively.

➢ Automated Clearing House (ACH) transactions include direct deposits of

payroll checks on employers' accounts and electronic payments on vehicle

loans, and mortgages, where payments are sent electronically from the

borrower's account and deposited in the borrower's account.

➢ Automated Teller Machines (ATMs) help you to carry out the same

transactions at your bank whenever it is most convenient for you.

➢ E-Money, Bitcoin, and Blockchain

E-money or electrical money, digital cash, is used by people to buy goods

and services. One of the most known types of e-money is PayPal.

➢ Blockchain is technically a distributed book or an online network that

registers the ownership of funds, securities, or any other goods, including

movies and songs. Blockchain enables individuals and enterprises all over

the world to quickly and safely settle transactions on an encrypted site.

You might also like

- Statement Jun, 2021Document4 pagesStatement Jun, 2021S RNo ratings yet

- Architectural Principles in The Age of Humanism PDFDocument4 pagesArchitectural Principles in The Age of Humanism PDFCemal TekinNo ratings yet

- December 2021 StatementDocument4 pagesDecember 2021 StatementCamila Alejandra Paredes CamposNo ratings yet

- Word/Phrase Part of Speech Ipa (Uk) Ipa (Usa) Sample SentenceDocument2 pagesWord/Phrase Part of Speech Ipa (Uk) Ipa (Usa) Sample SentenceTru CallingNo ratings yet

- Electronic Payment SystemDocument28 pagesElectronic Payment Systemnehapaspuleti4891100% (1)

- DefinitionDocument6 pagesDefinitionSaifur Rahman SteveNo ratings yet

- Unit 3Document23 pagesUnit 3Mahesh NannepaguNo ratings yet

- E Payment SystemsDocument8 pagesE Payment SystemsAlex MianoNo ratings yet

- Online Payment SystemDocument30 pagesOnline Payment SystemDjks YobNo ratings yet

- E Payments Modes and MethodsDocument52 pagesE Payments Modes and MethodsHarshithNo ratings yet

- E-Commerce - BUS426 - Topic 3Document44 pagesE-Commerce - BUS426 - Topic 3Atease ProductionNo ratings yet

- Kilonzo Electronic BankingDocument19 pagesKilonzo Electronic BankingbibijackyNo ratings yet

- Unit 5 Electronic Payment SystemDocument17 pagesUnit 5 Electronic Payment SystemSatyam RajNo ratings yet

- Chapter 3 - The Payment SystemDocument10 pagesChapter 3 - The Payment SystemJohn Mark LopezNo ratings yet

- Unit - 2 - Electronic Payment SystemDocument67 pagesUnit - 2 - Electronic Payment Systemvisdag100% (2)

- Cyber CashDocument13 pagesCyber CashDivya PorwalNo ratings yet

- Lesson 3 LectureDocument5 pagesLesson 3 LectureQueeny CuraNo ratings yet

- E Business Unit 4Document28 pagesE Business Unit 4balasriprasadNo ratings yet

- Banking Law Grup PresentationDocument7 pagesBanking Law Grup PresentationSALIM SHARIFUNo ratings yet

- Unit 4Document13 pagesUnit 4Vinayak SanbhadtiNo ratings yet

- E CashDocument9 pagesE CashGurpreet BansalNo ratings yet

- E. Comm Unit 3Document34 pagesE. Comm Unit 3Himanshu SahdevNo ratings yet

- 4 Electronic Payment SystemsDocument39 pages4 Electronic Payment SystemsYashasweeNo ratings yet

- Electronic Payment SystemDocument7 pagesElectronic Payment SystemThaKur TaRun RaNaNo ratings yet

- E Commerce Unit-II: Types of Electronic Payment SystemsDocument18 pagesE Commerce Unit-II: Types of Electronic Payment SystemsMunavalli Matt K SNo ratings yet

- Epayment SystemDocument5 pagesEpayment System20CS18 SISIR KUMARNo ratings yet

- VII.E Payment SystemDocument49 pagesVII.E Payment Systemroshan kcNo ratings yet

- Electronic Payment SystemsDocument8 pagesElectronic Payment SystemsAbhishek NayakNo ratings yet

- Topic Iii Payment SystemDocument29 pagesTopic Iii Payment SystemNoeline ParafinaNo ratings yet

- A Study On Payment and Settlement SystemDocument100 pagesA Study On Payment and Settlement SystemRoyal Projects100% (1)

- ĐỀ CƯƠNG TỰ LUẬN CUỐI KỲ EBANKINGDocument11 pagesĐỀ CƯƠNG TỰ LUẬN CUỐI KỲ EBANKINGminhanhtran.chubbNo ratings yet

- E-Business For Hospitality 5Document20 pagesE-Business For Hospitality 5Tsea CaronNo ratings yet

- E - Commerce Unit 2 RGPV SylabbusDocument22 pagesE - Commerce Unit 2 RGPV SylabbusDeepak Kumar RajakNo ratings yet

- MIS ReportDocument17 pagesMIS Reportzaber chowdhuryNo ratings yet

- Payment SystemsDocument32 pagesPayment SystemsNamyenya MaryNo ratings yet

- Ilovepdf MergedDocument91 pagesIlovepdf Mergedirfan khanNo ratings yet

- Chapter One 1.0Document16 pagesChapter One 1.0Eet's Marve RichyNo ratings yet

- E ChequeDocument5 pagesE ChequedeivaramNo ratings yet

- Types of Electronic Payment SystemsDocument20 pagesTypes of Electronic Payment SystemsRushyanth VattikondaNo ratings yet

- Crypto Coin-Overview of Basic Transaction: January 2017Document6 pagesCrypto Coin-Overview of Basic Transaction: January 2017Cristian S.No ratings yet

- E Payment 120927112113 Phpapp02Document38 pagesE Payment 120927112113 Phpapp02sagarg94gmailcomNo ratings yet

- Unit-V Indian PerspectiveDocument105 pagesUnit-V Indian PerspectiveSachin gollapalliNo ratings yet

- Unit-III: Types of Electronic Payment SystemsDocument8 pagesUnit-III: Types of Electronic Payment SystemsUmam AfzalNo ratings yet

- E-COMMERCE - Unit-2Document19 pagesE-COMMERCE - Unit-2Kalyan KumarNo ratings yet

- Rag Bfi 3Document4 pagesRag Bfi 3Bhebz Erin MaeNo ratings yet

- Communication BbaDocument33 pagesCommunication BbaParmeet KaurNo ratings yet

- FinalONLINE TRANSACTION INDEXDocument2 pagesFinalONLINE TRANSACTION INDEXLaraya, Roy MatthewNo ratings yet

- ECOM Unit 3Document29 pagesECOM Unit 3kunchala_veniNo ratings yet

- E CashDocument33 pagesE CashVijay Krishna BoppanaNo ratings yet

- Week 2Document36 pagesWeek 2FARYAL FATIMANo ratings yet

- Electronic Payment SystemDocument20 pagesElectronic Payment SystemThe PaletteNo ratings yet

- Unit III Final ECOMDocument17 pagesUnit III Final ECOMsar leeNo ratings yet

- E Cash Payment System PaperDocument37 pagesE Cash Payment System Paperakash0% (1)

- Electronic Cash: Energy Efficient SystemsDocument12 pagesElectronic Cash: Energy Efficient SystemsAkshay GattawarNo ratings yet

- Financial Markets (Chapter 3)Document1 pageFinancial Markets (Chapter 3)Kyla DayawonNo ratings yet

- Unit-5 E-Commerce Electronic Payment System SRGDocument33 pagesUnit-5 E-Commerce Electronic Payment System SRGLuitel ShaneNo ratings yet

- Epayments BCH ECommerceDocument14 pagesEpayments BCH ECommerceNeha BhandariNo ratings yet

- BBA-108 - E-Commerce Unit THREE & FOURDocument34 pagesBBA-108 - E-Commerce Unit THREE & FOURA1cyb CafeNo ratings yet

- Topic 7Document31 pagesTopic 7LucyChanNo ratings yet

- Digital Payments: Blockchain Based Security Concerns and FutureDocument7 pagesDigital Payments: Blockchain Based Security Concerns and Futuresayedahmed alishahNo ratings yet

- Web Payment SystemsDocument39 pagesWeb Payment SystemsBrightkofi OtchereNo ratings yet

- Electronic ChequesDocument4 pagesElectronic ChequesAtharvaNo ratings yet

- Digicash CybercashDocument20 pagesDigicash CybercashAnshul GargNo ratings yet

- Intro To Crypto: The Ultimate Beginners Guide To Cryptocurrency and Its TechnologiesFrom EverandIntro To Crypto: The Ultimate Beginners Guide To Cryptocurrency and Its TechnologiesNo ratings yet

- IntroductionDocument1 pageIntroductionDeniña Elaine MaeNo ratings yet

- Final PastiliciouslyDocument90 pagesFinal PastiliciouslyDeniña Elaine MaeNo ratings yet

- General AssemblyDocument3 pagesGeneral AssemblyDeniña Elaine MaeNo ratings yet

- Pricing DecisionDocument4 pagesPricing DecisionDeniña Elaine MaeNo ratings yet

- Chapter 2Document4 pagesChapter 2Deniña Elaine MaeNo ratings yet

- Abstract IIIDocument14 pagesAbstract IIIDeniña Elaine MaeNo ratings yet

- General Ledger To Trial Balance 2Document5 pagesGeneral Ledger To Trial Balance 2Carpenters ForeverNo ratings yet

- Cash BookDocument11 pagesCash BookSoumendra RoyNo ratings yet

- Account Statement From 8 Dec 2019 To 8 Jun 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument6 pagesAccount Statement From 8 Dec 2019 To 8 Jun 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceMUTHYALA NEERAJANo ratings yet

- Ev Charging AppDocument2 pagesEv Charging AppVs TextilesNo ratings yet

- Doc1544 9849Document1 pageDoc1544 9849georgebates1979No ratings yet

- ProductDocument1 pageProductydaimNo ratings yet

- Transaction MaintenanceDocument4 pagesTransaction MaintenancedonbabaNo ratings yet

- English 5 Q1W1Document34 pagesEnglish 5 Q1W1Chiara Margarita Dogos RosaNo ratings yet

- Take Home Examination Bdfa1103Document7 pagesTake Home Examination Bdfa1103zul arifNo ratings yet

- Confessions of A ShopaholicDocument6 pagesConfessions of A Shopaholiccharles akendoNo ratings yet

- 02 - Duties of An Accounts ClerkDocument12 pages02 - Duties of An Accounts ClerkJaripNo ratings yet

- Topic 4: Source Documents, Books of Prime Entry and Trial BalanceDocument51 pagesTopic 4: Source Documents, Books of Prime Entry and Trial Balancevickramravi16No ratings yet

- Account Statement From 23 Feb 2020 To 1 Apr 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 23 Feb 2020 To 1 Apr 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceShyamNo ratings yet

- Rezaul System Zone LLC (Ask My Accountant Query List)Document3 pagesRezaul System Zone LLC (Ask My Accountant Query List)Md. Munir HossainNo ratings yet

- Ohma BB - T StatementsDocument7 pagesOhma BB - T StatementsJohn BeanNo ratings yet

- Merchant Services Ingenico User GuideDocument48 pagesMerchant Services Ingenico User Guidemarcusada21No ratings yet

- R0404 BD040722 QuippDocument5 pagesR0404 BD040722 QuippLovely Jane MorenoNo ratings yet

- Overall Customers: BDO Finds Ways To Satisfy BDO Merchants' Needs by Providing The FollowingDocument3 pagesOverall Customers: BDO Finds Ways To Satisfy BDO Merchants' Needs by Providing The FollowingMichael John LunaNo ratings yet

- Acctg 102 Assignment 1 CceDocument3 pagesAcctg 102 Assignment 1 CceAYAME MALINAO BSA19No ratings yet

- Script For Front Office Services NC IiDocument8 pagesScript For Front Office Services NC IiJC SensieNo ratings yet

- Corporate Accounting: 3 Semester DBADocument54 pagesCorporate Accounting: 3 Semester DBAMaaz RaheelNo ratings yet

- BSF InstructionsDocument2 pagesBSF InstructionsSurya Pratap PatraNo ratings yet

- Invoice 1333881675 I0133P2212134882Document1 pageInvoice 1333881675 I0133P2212134882Silambarasan PanneerselvamNo ratings yet

- Focus Writing On Agent Banking in BangladeshDocument3 pagesFocus Writing On Agent Banking in BangladeshTonmoyNo ratings yet

- 1.3.2.3 M1 - Case Study 1 - You Are A Financial PlannerDocument3 pages1.3.2.3 M1 - Case Study 1 - You Are A Financial PlannerJohann Gabriel Ballesteros NatalarayNo ratings yet

- Unit One Introduction To Federal Government of Ethiopia Accounting and Financial ManagementDocument24 pagesUnit One Introduction To Federal Government of Ethiopia Accounting and Financial ManagementTIZITAW MASRESHANo ratings yet