Professional Documents

Culture Documents

Financial Planning Tools

Financial Planning Tools

Uploaded by

Abena, Kianne C.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Planning Tools

Financial Planning Tools

Uploaded by

Abena, Kianne C.Copyright:

Available Formats

SH1663

Financial Planning Tools

I. The Financial Planning Process

A. Introduction to Financial Planning

• Financial planning is important for several reasons:

o Financial planning helps the business assess the impact of a particular strategy on the

company’s financial position, its cash flows, its reported earnings, and its need for

external financing.

o When a business develops financial plans, the management is better able to react to any

changes in the market condition, such as when sales is slower than expected or there is

a reduction in the supply of raw materials.

o Creating a financial plan helps managers understand the trade-offs involved in its

investments and financial plans. For example, by developing a financial plan,

management is better able to understand the trade-off between having sufficient

inventory to satisfy customer demands and the need to finance the investment in

inventory.

B. Long-term Planning Process

• Forecast sales – Forecasting sales begins with an understanding of the industry the business

belongs to, knowing the target market, and ultimately forecasting the market share in terms

of sales from that segment. Forecasted sales may increase based on the target increase in

market share or due to the increase in the market itself.

A fundamental truth in business is that a business acquires assets to generate sales. If the

firm wants to increase sales, then it has to acquire more assets. If the business wants to

increase sales by 25%, the assets need to increase by 25% as well. To increase the assets

by 25%, the other side of the balance sheet (liabilities and equity) needs to increase and

keep the balance sheet equal.

• Compute the dividend pay-out ratio and plowback ratio – These ratios analyze the

relationship between net income and dividends.

o The pay-out ratio is computed by dividing the cash dividends by net income. It is

expressed as a percentage. For example, if the firm has a net income of P5M and a cash

dividend of P3M, the pay-out ratio is 60%. This means that 60% of the net income goes

to the stockholders.

o The plowback ratio is the opposite of the pay-out ratio. It is the portion of income that

does not get paid out as dividends. It is also known as the retention ratio.

o If the business does not pay any dividends, the plowback ratio is 100% and the pay-out

ratio is zero.

o These ratios indicate how much of the profits are retained for business growth. Younger

businesses tend to have higher plowback ratios; these fast-growing companies are more

focused on business development.

• Identify the sources of funds – The business must learn to identify the funds that can come from

normal business activities (sales).

• Use the percentage of sales approach to prepare the pro-forma financial statements – The

percentage of sales approach is based on the premise that most balance sheets and income

05 Handout 1 *Property of STI

Page 1 of 5

SH1663

statement accounts vary with sales. If the forecasted sales growth is 25%, the accounts in the

income statement and balance sheet will also increase by 25%.

• Calculate the external financing need (EFN) – EFN, also known as Additional Funds Needed

(AFN) and Discretionary Financing Needs (DFN), is the required additional financing. It is

acquired through the sales of stocks and bonds.

II. Budgeting

A. Budgeting

• A budget estimates the amount of revenues and expenses a company may incur over a

future period. Budgeting represents a business’ financial position, cash flows and goals. A

company’s budget is usually re-evaluated periodically, usually once per fiscal year,

depending on how the management wants to update the information. Budgeting creates a

baseline to compare actual results to determine how the results vary from the expected

performance.

• It is also a financial plan expressed in quantitative terms, prepared by the management in

advance for a forthcoming period. It is the financial expression of a business plan or target.

• The budget sets the targets of the company and is updated once a year. The budget is

compared to actual results to determine variances from expected performance.

B. Types of Budgets

• Capital Budget – This budget estimates all capital asset acquisitions and summarizes all

expenses and costs of major purchases for the next year. Capital assets include items that

have useful lives of more than 12 months, such as buildings, building improvements, land,

furniture, fixtures, equipment, and computers.

• Operating Budget - Operating budgets indicate the products and services a firm expects to

use in a budget period. It describes all the income-generating activities of a firm, including

production, sales, and inventories of finished goods. An operating budget typically has two

(2) distinct parts: the expense budget and the revenue budget. The expense budget indicates

all expected expenses of a firm for the coming year, while the revenue budget shows all

projected revenues for the coming year.

• Cash Budget - A cash budget projects all cash inflows and outflows for the next year. A

cash budget is important because it allows administrators to timely identify periods with

cash overages and shortages so they can take necessary remedial action.

• Sales Budget - Sales budgets indicate the sales a firm expects to make in units and money

for a budget year. They detail the quantities of products or services a firm expects to sell,

revenues incurred from those sales and all expenses accrued during selling. Sales budget

forecasts determine sales potential or the maximum number of sales a firm can make. This

information is then used to plan resource allocations to achieve those sales levels. Sales

budgets serve as benchmarks or yardsticks against which actual sales performance is

measured and variables such as sales volume, profitability, and selling expenses are

controlled.

• Personnel Budget – This budget is also known as salary and wage budget. They are cost

estimations related to labor. They include the costs of recruitment, hiring, training,

assignment, salaries, overtime costs, additional benefits, and retirement.

05 Handout 1 *Property of STI

Page 2 of 5

SH1663

C. Preparing the Cash Budget

• The primary tool in short-term financial planning is the cash budget. It plots the business’

cash inflow and outflow. It is typically done monthly and is used to cover a year’s time.

• It is divided into three (3) parts: cash receipts, cash disbursements, and excess cash balance

(or required total financing). An example of a cash budget is shown below:

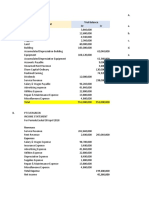

Cash Budget

Jan Feb Mar

Cash Receipts

Less: Cash Disbursements

Net Cash Flow

Add: Beginning Cash

Ending Cash

Less: Minimum Cash Balance

Required Total Financing

Excess Cash Balance

• Preparing the cash budget can be summarized in these steps:

o Forecast the business’ monthly sales. This can be done using historical figures.

o Forecast the sales and the credit sales from the projected monthly sales. Cash sales are

preferable to credit sales. If sales are made on credit, estimate when the receivables

would be collected.

o Consider all the other cash receipts. Other cash receipts are sources of cash other than

sales, such as interest payment received.

o Sum up the total cash receipts.

o Forecast the business’ monthly purchases.

o Forecast the business’ cash purchases and the credit purchases from the projected

monthly purchases. If purchases are made on credit, forecast when those debts will be

paid.

o Take into account other cash disbursements. These include wages and salaries, taxes,

capital expenditures, rent, and interest payments.

o Sum up the total cash disbursements.

o Subtract the total cash disbursements from the total cash receipts to get the net cash

flow.

o Add the beginning cash balance to the net cash flow to get ending cash balance. The

ending cash balance of the previous month will be the beginning cash balance of the

next month.

o Subtract the minimum cash balance from the ending cash balance. The minimum cash

balance, also known as the target cash balance, is the minimum cash balance the

business needs to have on hand to conduct its day to day operations. If the minimum

cash balance is greater than the ending cash balance, then short-term financing is

required. If the minimum cash balance is less than ending cash balance, the business

has excess cash.

05 Handout 1 *Property of STI

Page 3 of 5

SH1663

• Part 1 of the Cash Budget: Cash Receipts (Steps 1-4)

Sales Forecast JAN FEB MAR APR MAY

150,000 220,000 380,000 340,000 295,000

Cash Sales (15%) 22,500 33,000

Accounts Receivable Collections

1-month debt 82,500

2-month debt

Other Cash Receipts 150,000 150,000 150,000 150,000 150,000

Total Cash Receipts 172,500 265,500

• Part 2 of the Cash Budget: Cash Disbursements (Steps 5-8)

Sales Forecast JAN FEB MAR APR MAY

Purchases 120,000 176,000

Cash purchases 6,000 8,800

Accounts payable payment

1-month debt 96,000

2-month debt

Rent payments 15,000 15,000 15,000 15,000 15,000

Wages and salaries 19,500 23,000

Tax payments 40,000

Fixed asset outlay 200,000

Interest payment 110,000 110,000 110,000 110,000 110,000

Principal payments 150,000

Total cash disbursements 150,500 252,800

• Part 3 of the Cash Budget: Excess Cash Balance / Required Total Financing (Steps 9-11)

Sales Forecast JAN FEB MAR APR MAY

Cash Receipts 172,500 265,500

Less: Cash Disbursements 150,500 252,800

Net Cash Flow 22,000 12,700

Add: Beginning Cash

Ending Cash 70,000

Less: Minimum Cash

Balance

Required Total Financing

Excess Cash Balance

05 Handout 1 *Property of STI

Page 4 of 5

SH1663

III. Forecasting

A. Forecasting

• A forecast is an estimation of future trends and outcomes, based on past and present

data. It is a prediction of the upcoming events or trends in business, on the basis of

present business conditions. There is no target included in a forecast.

• Forecasting estimates a company’s future financial outcomes by examining historical

data. Companies use financial forecasting to determine how they should allocate their

budgets for a future period. Unlike budgeting, financial forecasting does not analyze

the variances between financial forecasts and actual performance. Financial forecasts

are updated regularly when there is a change in operations, inventory, and business

plan.

• The forecast is typically limited to major revenue and expense line items. There is

usually no forecast for financial position, though cash flows may be forecasted.

• The forecast may be used for short-term operational considerations, such as adjustments

to staffing, inventory levels, and the production plan.

B. Types of forecasts

• Financial Forecast - A financial plan that projects income and expenses, future sales,

future demand for a product, or anything that is expected to happen in the future.

• Cash Flow Forecast – Projects cash inflow (sources of cash) and cash outflow (uses of

cash).

• Investment Forecast – This forecast details where to put investments to get maximum

return.

• Projected Financial Statements – These show a summary of revenue and expense

projections for the budget period. They are prepared to guide managers on how to attain

their objectives.

References:

Benito, P. P., Chan Pao, T. P., & Yumang, K. (2016). Exploring small business and personal finance

in senior high. Quezon City: Phoenix Publishing House.

Bragg, S. (28, March 2013). What is the difference between a budget and a forecast? Retrieved from

Accounting Tools: http://www.accountingtools.com/questions-and-answers/what-is-the-

difference-between-a-budget-and-a-forecast.html

Gilani, N. (n.d.). Five different types of budgets. Retrieved from The Finance base website:

http://thefinancebase.com/five-different-types-budgets-3736.html

Lane, M. A. (2016). Percentage of sales method. Retrieved from Business Finance Online Site:

http://www.zenwealth.com/businessfinanceonline/FF/PercentageOfSales.html

Lopez-Mariano, N. D. (2014). Elements of finance. Quezon City: Rex Book Store.

Nickolas, S. (2015, April 22). What's the difference between budgeting and financial forecasting?

Retrieved from Investopedia website:

http://www.investopedia.com/ask/answers/042215/whats-difference-between-budgeting-and-

financial-forecasting.asp

S, S. (2016, January 22). Difference between budget and forecast. Retrieved from Key Differences

website : http://keydifferences.com/difference-between-budget-and-forecast.html

05 Handout 1 *Property of STI

Page 5 of 5

You might also like

- ExamDocument16 pagesExamyuzx5200% (1)

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- CH 14Document61 pagesCH 14arif nugraha100% (1)

- Financial Planning and ForecastingDocument28 pagesFinancial Planning and ForecastingSara Ghulam Muhammed SheikhaNo ratings yet

- 05 Handout 110Document7 pages05 Handout 110MaemiNo ratings yet

- Lesson 4 Part 1 Budget PreparationDocument19 pagesLesson 4 Part 1 Budget PreparationmariannedakilaNo ratings yet

- Planning and Working Capital Management Part 1Document31 pagesPlanning and Working Capital Management Part 1Michelle RotairoNo ratings yet

- Financial Planning and ForecastingDocument24 pagesFinancial Planning and ForecastingsadikiNo ratings yet

- CHAPTER 3 Financial PlanningDocument7 pagesCHAPTER 3 Financial Planningflorabel parana0% (1)

- Financial ManagementDocument26 pagesFinancial ManagementHILLARY SHINGIRAI MAPIRANo ratings yet

- Financial Planning & Forecasting FinalDocument47 pagesFinancial Planning & Forecasting FinalRogelyn BalberdeNo ratings yet

- Financial: ForecastingDocument75 pagesFinancial: ForecastingAlanNo ratings yet

- The Financial Planning ProcessDocument42 pagesThe Financial Planning Processlaiba.rashid954No ratings yet

- Chapter 10 - The Financial Plan PDFDocument21 pagesChapter 10 - The Financial Plan PDFzulkifli alimuddinNo ratings yet

- Advance Financial Management - MBADocument50 pagesAdvance Financial Management - MBADaniella LampteyNo ratings yet

- BudgetingDocument9 pagesBudgetingGAMBOA, LIEZEL G.No ratings yet

- Financial ManagementDocument50 pagesFinancial ManagementLEO FRAGGERNo ratings yet

- MBA 207 - Reporting PDFDocument50 pagesMBA 207 - Reporting PDFDaniella LampteyNo ratings yet

- Cash Budget (FM 2024)Document13 pagesCash Budget (FM 2024)jescataryNo ratings yet

- Budgets and Projected Financial Statements PreparationDocument26 pagesBudgets and Projected Financial Statements PreparationAngelNo ratings yet

- Ch.13 Managing Small Business FinanceDocument5 pagesCh.13 Managing Small Business FinanceBaesick MoviesNo ratings yet

- Lecture 12 EntrepreneurshipDocument23 pagesLecture 12 EntrepreneurshipKomal RahimNo ratings yet

- Financial Projections-TextDocument5 pagesFinancial Projections-TextFarid UddinNo ratings yet

- Financial Appraisals 12-1-2012Document5 pagesFinancial Appraisals 12-1-2012Muhammad ShakirNo ratings yet

- Finance ReviewerDocument17 pagesFinance ReviewerLenard TaberdoNo ratings yet

- BAFINMAX Handout Financial Planning and ForecastingDocument5 pagesBAFINMAX Handout Financial Planning and ForecastingDeo CoronaNo ratings yet

- Finance Reflection Group 5Document3 pagesFinance Reflection Group 5katheakimanjie.sanandresNo ratings yet

- Cash Budget PDFDocument13 pagesCash Budget PDFsaran_1650% (2)

- Financial Project Appraisal and Cash Flow AnalysisDocument16 pagesFinancial Project Appraisal and Cash Flow AnalysisGemechis BekeleNo ratings yet

- Week6 - PresentationDocument10 pagesWeek6 - PresentationFarhan ThaibNo ratings yet

- Topic 3 Budgetary Process of An OrganisationDocument57 pagesTopic 3 Budgetary Process of An OrganisationMaryam MalieNo ratings yet

- Summarized Topics in EntrepreneurshipDocument24 pagesSummarized Topics in EntrepreneurshipMarian AlfonsoNo ratings yet

- Cash Flow BudgetingDocument6 pagesCash Flow BudgetingManoj kumar MNo ratings yet

- Financial PlanningDocument7 pagesFinancial PlanningJabid Al BasherNo ratings yet

- BUSFIN 6a FINACIAL PLANNING TOOLS AND CONCEPTDocument14 pagesBUSFIN 6a FINACIAL PLANNING TOOLS AND CONCEPTRenz AbadNo ratings yet

- Financial Plan: ReferencesDocument24 pagesFinancial Plan: ReferencesSonam GulzarNo ratings yet

- Assignment of Management of Working Capital: Topic: Cash BudgetDocument10 pagesAssignment of Management of Working Capital: Topic: Cash BudgetDavinder Singh BanssNo ratings yet

- Placement Preparation FinanceDocument73 pagesPlacement Preparation FinanceTopsy KreateNo ratings yet

- Theory AnswerDocument10 pagesTheory Answersrijana pathakNo ratings yet

- Financing Planning and Forecasting: Financial Plans (Budgets) Operating Plan Strategic PlanDocument5 pagesFinancing Planning and Forecasting: Financial Plans (Budgets) Operating Plan Strategic PlanhemamamaNo ratings yet

- Differences Between Cash and Master BudgetsDocument2 pagesDifferences Between Cash and Master BudgetsMathew Justin RajuNo ratings yet

- Chapter 4 Financial ManagementDocument39 pagesChapter 4 Financial Managementmanthan212No ratings yet

- Financial Planning and ToolsDocument41 pagesFinancial Planning and ToolsShalom BuenafeNo ratings yet

- Smart Task 2 OF Project Finance by (Vardhan Consulting Engineers)Document8 pagesSmart Task 2 OF Project Finance by (Vardhan Consulting Engineers)devesh bhattNo ratings yet

- BusinessPLan ManagementDocument6 pagesBusinessPLan ManagementPrashant KumarNo ratings yet

- Financial PlanDocument23 pagesFinancial PlanHassan JulkipliNo ratings yet

- SHS Business Finance Chapter 3Document17 pagesSHS Business Finance Chapter 3Ji BaltazarNo ratings yet

- Cash Flow StatementDocument39 pagesCash Flow StatementBollu TulasiNo ratings yet

- Financial Planning and ForecastingDocument15 pagesFinancial Planning and ForecastingGeofrey RiveraNo ratings yet

- Chapter 8 IzmerDocument20 pagesChapter 8 IzmerMOHAMAD NAIM FAHMI BIN MOHAMAD YASIR STUDENTNo ratings yet

- Financial Planning and BudgetingDocument45 pagesFinancial Planning and BudgetingRafael BensigNo ratings yet

- Env 8 - PPTDocument49 pagesEnv 8 - PPTDeeksha HRNo ratings yet

- Financial Plan - Cash Budget, Working CapitalDocument14 pagesFinancial Plan - Cash Budget, Working CapitalMAYANK KUMAR0% (1)

- Chapter 13 To 15Document13 pagesChapter 13 To 15Cherry Mae GecoNo ratings yet

- Debabrata Chatterjee (FM)Document8 pagesDebabrata Chatterjee (FM)Hritwik ChatterjeeNo ratings yet

- BSBFIN601 Manage Organisational Finances: Presentation 1Document15 pagesBSBFIN601 Manage Organisational Finances: Presentation 1Gabriel Jay LasamNo ratings yet

- Managing The Finances of The Enterprise What Is Finance? People Seem To Either Love or Hate Finance, But The Fact IsDocument8 pagesManaging The Finances of The Enterprise What Is Finance? People Seem To Either Love or Hate Finance, But The Fact IsDavy RoseNo ratings yet

- Businesss Finance Module 2 Financial Planning Tools and ConceptsDocument56 pagesBusinesss Finance Module 2 Financial Planning Tools and ConceptsAlexia Bien NuludNo ratings yet

- Prepare Cash BudgetsDocument20 pagesPrepare Cash BudgetsEphraim PryceNo ratings yet

- CH7 BudgetingDocument51 pagesCH7 BudgetingYMNo ratings yet

- MANAGING SMALL WPS OfficeDocument6 pagesMANAGING SMALL WPS Officecristine beaNo ratings yet

- The Sarasota Cuban Ballet School Inc-ReportDocument12 pagesThe Sarasota Cuban Ballet School Inc-ReportnompanemNo ratings yet

- Accounting Cheat SheetsDocument4 pagesAccounting Cheat SheetsGreg BealNo ratings yet

- ManipalDocument3 pagesManipalTejesh KumarNo ratings yet

- Microsoft MSFT Stock Valuation Calculator SpreadsheetDocument15 pagesMicrosoft MSFT Stock Valuation Calculator SpreadsheetOld School Value100% (1)

- Accounting A LevelDocument16 pagesAccounting A LevelNipuni PereraNo ratings yet

- Consolidated Financial StatementDocument36 pagesConsolidated Financial StatementArt KingNo ratings yet

- Far FPBDocument16 pagesFar FPBMae Marcos SaguipedNo ratings yet

- Cine MexDocument6 pagesCine MexDhruv MishraNo ratings yet

- Accrual AccountingDocument7 pagesAccrual AccountingMUHAMMAD ARIF BASHIRNo ratings yet

- Questions and AnswersDocument27 pagesQuestions and AnswersAmalia BejenariuNo ratings yet

- Accounting For Assets in The Extractive Industry: Week 5 TutorialDocument18 pagesAccounting For Assets in The Extractive Industry: Week 5 TutorialAngela Au0% (1)

- Collier Park Golf Course Business Plan V3 June 2010x1Document14 pagesCollier Park Golf Course Business Plan V3 June 2010x1donhar58No ratings yet

- MGT101 Mega Solved MCQs File For Mid Term ExamDocument85 pagesMGT101 Mega Solved MCQs File For Mid Term ExamObaidNo ratings yet

- Financial & Managerial Accounting: Information For DecisionsDocument120 pagesFinancial & Managerial Accounting: Information For DecisionsmalihaNo ratings yet

- Franchising 2Document10 pagesFranchising 2Leslie Ann Elazegui UntalanNo ratings yet

- Chapter 1 NumericalsDocument10 pagesChapter 1 NumericalsPradeep GautamNo ratings yet

- Acraiissample CCFP 201207Document6 pagesAcraiissample CCFP 201207Minh Nguyen VanNo ratings yet

- Control and Bank Performance: Lawrence Fogelberg and John M. GriffithDocument7 pagesControl and Bank Performance: Lawrence Fogelberg and John M. GriffithArie ToddopuliNo ratings yet

- CA Audit 1Document217 pagesCA Audit 1yanfong1003No ratings yet

- Bab 4 Soal 4Document4 pagesBab 4 Soal 4Abel AbdallahNo ratings yet

- Chapter 1 - Introduction To Financial AccountingDocument9 pagesChapter 1 - Introduction To Financial AccountingJon garcia100% (1)

- A4 Special Issues in AccountsDocument22 pagesA4 Special Issues in AccountsThasveer AvNo ratings yet

- Primary LienDocument11 pagesPrimary LienNeeron KatieNo ratings yet

- Ar Best 2016Document146 pagesAr Best 2016Meivi UlfaNo ratings yet

- Corporate Financial Reporting: Session 4 & 5: IIMC-PGP 2020-21 Accounting MechanicsDocument53 pagesCorporate Financial Reporting: Session 4 & 5: IIMC-PGP 2020-21 Accounting MechanicsMansi aggarwal 171050No ratings yet

- Pflugerville 2011 227904a1Document172 pagesPflugerville 2011 227904a1ChrisNo ratings yet

- Financing National Government ExpendituresDocument34 pagesFinancing National Government Expendituresgilberthufana446877No ratings yet

- Financial Statement AnalysisDocument80 pagesFinancial Statement AnalysisSujatha SusannaNo ratings yet