Professional Documents

Culture Documents

ACC111 Activity 22

ACC111 Activity 22

Uploaded by

Triquesha Marriette Romero RabiCopyright:

Available Formats

You might also like

- Far Assignments Chapter 2Document12 pagesFar Assignments Chapter 2Vesenth May Magaro RubinosNo ratings yet

- Madelyn Rialubin Travel Agency Adjusting Entries AdjustedDocument5 pagesMadelyn Rialubin Travel Agency Adjusting Entries AdjustedJustine Almodiel100% (1)

- Questions - Accounting For DepreciationDocument1 pageQuestions - Accounting For DepreciationOmari100% (1)

- Solution Laubausa CateringDocument5 pagesSolution Laubausa Cateringjessamae gundan100% (6)

- Comprehensive Problem 23Document29 pagesComprehensive Problem 23Nicole Fidelson100% (2)

- Work Sheet Moises Dondoyano Information SystemDocument1 pageWork Sheet Moises Dondoyano Information SystemRJ DAVE DURUHA100% (5)

- Orca Share Media1583067447855Document6 pagesOrca Share Media1583067447855Zoya Romelle Besmonte100% (1)

- Module 4Document67 pagesModule 4Chicos tacos100% (3)

- Kareen Leon, Cpa Page No: - 1 - General JournalDocument4 pagesKareen Leon, Cpa Page No: - 1 - General JournalTayaban Van Gih100% (2)

- Illustrative Problem Worksheet ADocument6 pagesIllustrative Problem Worksheet AJoy Santos33% (3)

- Activity 24. in This Activity You Need To Identify The Adjusting Entry That Can BeDocument3 pagesActivity 24. in This Activity You Need To Identify The Adjusting Entry That Can BeTriquesha Marriette Romero RabiNo ratings yet

- This Study Resource Was: Jia T. Rañesis BSFT 3M2Document6 pagesThis Study Resource Was: Jia T. Rañesis BSFT 3M2Anonymous100% (1)

- Chapter 2 JournalizingDocument21 pagesChapter 2 Journalizingkakao100% (1)

- Problem-5 - AFCAR Chapter 3Document9 pagesProblem-5 - AFCAR Chapter 3kakao100% (1)

- Prob-1 - AFCAR Chapter 3Document2 pagesProb-1 - AFCAR Chapter 3kakao100% (1)

- Accounting HomeworkDocument6 pagesAccounting HomeworkGavin Ramos100% (2)

- General Journal: Date Account Titles and Explanation PR DebitDocument26 pagesGeneral Journal: Date Account Titles and Explanation PR DebitLaica Cardenio100% (3)

- MisUse of MonteCarlo Simulation in NPV Analysis-DavisDocument5 pagesMisUse of MonteCarlo Simulation in NPV Analysis-Davisminerito2211No ratings yet

- Case Study 41 - Mogen IncDocument15 pagesCase Study 41 - Mogen IncPat Cunningham100% (4)

- C3 - Problem 17 - Correcting A Trial BalanceDocument2 pagesC3 - Problem 17 - Correcting A Trial BalanceLorence John Imperial0% (1)

- Catherine Viesca Outdoor Ad Concepts Journal Entries January - December 2020Document4 pagesCatherine Viesca Outdoor Ad Concepts Journal Entries January - December 2020Jamycka Antolin100% (1)

- Travel Agency RubisomethingDocument12 pagesTravel Agency RubisomethingItsRenz YTNo ratings yet

- 4.3.2.5 Elaborate - Determining AdjustmentsDocument4 pages4.3.2.5 Elaborate - Determining AdjustmentsMa Fe Tabasa0% (1)

- General Journal: (To Purchase Equipment Paid With Cash and Account Payable For The Balance)Document7 pagesGeneral Journal: (To Purchase Equipment Paid With Cash and Account Payable For The Balance)Montibon El100% (1)

- Marichu Fornolles Novelties Transactions in December 2020: Date Particulars DebitDocument4 pagesMarichu Fornolles Novelties Transactions in December 2020: Date Particulars DebitHannah Pearl Flores Villar100% (1)

- EDocument17 pagesEMark Cyphrysse Masiglat67% (3)

- Chapter 2 DoneDocument30 pagesChapter 2 Doneellyzamae quiraoNo ratings yet

- Act3 StatDocument33 pagesAct3 StatAllecks Juel Luchana0% (1)

- VICTORINODocument6 pagesVICTORINODenise Ortiz Manolong100% (2)

- Adjusting EntriesDocument5 pagesAdjusting Entriesdatu puti33% (3)

- Rosalie Balhag CleanersDocument1 pageRosalie Balhag CleanersDominique Abrajano100% (1)

- Aguhob FireworksDocument2 pagesAguhob FireworksAndrea Tugot60% (5)

- FAR ReviewerDocument3 pagesFAR ReviewerPASCUA, ROWENA V.No ratings yet

- Total: Adjusting EntriesDocument8 pagesTotal: Adjusting EntriesLj BesaNo ratings yet

- Midterm-Examination Reynaldo Gulane CleanersDocument4 pagesMidterm-Examination Reynaldo Gulane CleanersNicole Sarmiento83% (6)

- Of The Account Would Be Recorded.: Instructions. Identify The Manner in Which The Each of The Increases or DecreasesDocument5 pagesOf The Account Would Be Recorded.: Instructions. Identify The Manner in Which The Each of The Increases or DecreasesLoriNo ratings yet

- Chapter 8-Problem 3Document3 pagesChapter 8-Problem 3kakao100% (1)

- Conceptual Framework First ProblemDocument12 pagesConceptual Framework First ProblemJohn JosephNo ratings yet

- Jose Rizal Heavy BombersDocument10 pagesJose Rizal Heavy BombersClaud NineNo ratings yet

- ACCA101 Leah May SantiagoDocument9 pagesACCA101 Leah May SantiagoNicole FidelsonNo ratings yet

- Balance SheetDocument2 pagesBalance SheetzavriaNo ratings yet

- Dr. Nick Marasigan AccountsDocument11 pagesDr. Nick Marasigan AccountsNicole SarmientoNo ratings yet

- Accounting For A Service BusinessDocument7 pagesAccounting For A Service BusinessAndrea Joy ReyNo ratings yet

- Elegant Home Decors Worksheet For The Year Ended December 31,20ADocument8 pagesElegant Home Decors Worksheet For The Year Ended December 31,20AChloe CatalunaNo ratings yet

- Chapter 8-Problem 9Document4 pagesChapter 8-Problem 9kakaoNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument4 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Journal Entries: Edgar DetoyaDocument17 pagesJournal Entries: Edgar DetoyaAntonNo ratings yet

- Reynaldo Adjusment EntryDocument5 pagesReynaldo Adjusment EntryAra HasanNo ratings yet

- UntitledDocument7 pagesUntitledKit BalagapoNo ratings yet

- Notes BfarDocument4 pagesNotes BfarJoyce Ramos100% (2)

- 9 Problems After Accounting Cycle Book1Document7 pages9 Problems After Accounting Cycle Book1Efi of the IsleNo ratings yet

- Acctgchap 2Document15 pagesAcctgchap 2Anjelika ViescaNo ratings yet

- ACTIVITY NO1and2Document5 pagesACTIVITY NO1and2Patricia Nicole Barrios100% (1)

- Henri Emanuel Reforba - Learning Task #2Document6 pagesHenri Emanuel Reforba - Learning Task #2Rhea BernabeNo ratings yet

- Guzon Book Distributors General Journal Date Particulars PR Debit CreditDocument8 pagesGuzon Book Distributors General Journal Date Particulars PR Debit CreditNermeen C. AlapaNo ratings yet

- On June 1, 2019, ELENO BURAY, JR. Forest Products Sol Sold Merchandise With A P120,000 List PriceDocument63 pagesOn June 1, 2019, ELENO BURAY, JR. Forest Products Sol Sold Merchandise With A P120,000 List PriceDachell Chiva SantiagoNo ratings yet

- Problem #3: Teresita Nacion Publishers Trial BalanceDocument4 pagesProblem #3: Teresita Nacion Publishers Trial BalanceRhea Sismo-anNo ratings yet

- Recording On T Account and Preparing Trial BalanceDocument8 pagesRecording On T Account and Preparing Trial BalanceLala BoraNo ratings yet

- Capter 9, Problem 7Document8 pagesCapter 9, Problem 7John JosephNo ratings yet

- Corazon Tabaranza Worksheet For The Month Ended December 31, 20ADocument9 pagesCorazon Tabaranza Worksheet For The Month Ended December 31, 20AHaries Vi Traboc MicolobNo ratings yet

- Answer Key To Fundamentals of Financial Accounting and Reporting CDCDocument3 pagesAnswer Key To Fundamentals of Financial Accounting and Reporting CDCAprile Margareth HidalgoNo ratings yet

- Jay Cesar System Developer Worksheet DECEMBER 31 2019 Unadjusted Trial Balance REFDocument4 pagesJay Cesar System Developer Worksheet DECEMBER 31 2019 Unadjusted Trial Balance REFAdam CuencaNo ratings yet

- UAS Pengantar AkuntansiDocument16 pagesUAS Pengantar Akuntansikanisa.agustinapnNo ratings yet

- DeceVid Company Final Worksheet PDFDocument1 pageDeceVid Company Final Worksheet PDFAngel Nhova Pepito OmalayNo ratings yet

- ACC111 - Activity 15Document5 pagesACC111 - Activity 15Triquesha Marriette Romero RabiNo ratings yet

- ACC111 - Activity19&20Document2 pagesACC111 - Activity19&20Triquesha Marriette Romero RabiNo ratings yet

- Let'S Check: Crediting Retained Earnings Debiting IncomeDocument1 pageLet'S Check: Crediting Retained Earnings Debiting IncomeTriquesha Marriette Romero RabiNo ratings yet

- Executive SummaryDocument23 pagesExecutive SummaryLois RazonNo ratings yet

- 43 X 603 CWCRX 70 RDocument37 pages43 X 603 CWCRX 70 Rfaisal.rasel1No ratings yet

- Chapter 1-What Is MarketingDocument15 pagesChapter 1-What Is MarketingMohd AnwarshahNo ratings yet

- Functions of State Bank of IndiaDocument7 pagesFunctions of State Bank of IndiaMitali Pardhiye64% (11)

- LogisticaDocument5 pagesLogisticalaura rNo ratings yet

- Considerations For Entrepreneurs Entering The Recreational Marijuana IndustryDocument15 pagesConsiderations For Entrepreneurs Entering The Recreational Marijuana IndustryRay RodriguezNo ratings yet

- CH - 03financial Statement Analysis Solution Manual CH - 03Document63 pagesCH - 03financial Statement Analysis Solution Manual CH - 03OktarinaNo ratings yet

- Day 1 v. Transport Strategy 5.6.Document29 pagesDay 1 v. Transport Strategy 5.6.Boris PrelčecNo ratings yet

- COC 2021 - ROY - Finance OfficerDocument2 pagesCOC 2021 - ROY - Finance OfficerJillian V. RoyNo ratings yet

- Indian Institute of Management Kozhikode Executive Post Graduate Programme in ManagementDocument3 pagesIndian Institute of Management Kozhikode Executive Post Graduate Programme in Managementreva_radhakrish1834No ratings yet

- Application of Extended Marketing Mix For Marketing FSDocument8 pagesApplication of Extended Marketing Mix For Marketing FSDimple RathodNo ratings yet

- An Introduction To Portfolio OptimizationDocument55 pagesAn Introduction To Portfolio OptimizationMarlee123100% (1)

- Resume - Rajeev Sharma UpdatedDocument4 pagesResume - Rajeev Sharma UpdatedLeshop0% (1)

- Cie LKPDocument9 pagesCie LKPRajiv HandaNo ratings yet

- Management-A Study On Inventory-Nandini RavichandranDocument14 pagesManagement-A Study On Inventory-Nandini RavichandranBESTJournalsNo ratings yet

- 2 Effective and Nominal RateDocument19 pages2 Effective and Nominal RateKelvin BarceLonNo ratings yet

- Building Cross-Cultural Leadership Competence: An Interview With Carlos GhosnDocument3 pagesBuilding Cross-Cultural Leadership Competence: An Interview With Carlos GhosnPRIYANKA BATRANo ratings yet

- Customer Centricity in McDonaldsDocument8 pagesCustomer Centricity in McDonaldsabhigoldyNo ratings yet

- Online BankingDocument39 pagesOnline Bankingsumit sharma100% (1)

- Ifrs 10 Consolidated Financial Statements SnapshotDocument2 pagesIfrs 10 Consolidated Financial Statements SnapshotangaNo ratings yet

- Market Structure in BangladeshDocument15 pagesMarket Structure in BangladeshTalukder Riman80% (5)

- 2B MismatchDocument65 pages2B Mismatchshubhamburnwal213No ratings yet

- Dwnload Full Microeconomics 12th Edition Michael Parkin Solutions Manual PDFDocument36 pagesDwnload Full Microeconomics 12th Edition Michael Parkin Solutions Manual PDFrademakernelsons100% (9)

- Sophia Antipolis Case Study Balan Felicia TabitaDocument3 pagesSophia Antipolis Case Study Balan Felicia TabitaTabitha BălanNo ratings yet

- Nature Fruit Juice Processing Enterprise - EditedDocument21 pagesNature Fruit Juice Processing Enterprise - EditedbruktawitNo ratings yet

- Intermediate Accounting 3 Part 1: Cash Flows Objectives of Cash Flow StatementDocument19 pagesIntermediate Accounting 3 Part 1: Cash Flows Objectives of Cash Flow StatementAG VenturesNo ratings yet

- Engineering Economy Lecture Notes 1Document4 pagesEngineering Economy Lecture Notes 1warlockeNo ratings yet

ACC111 Activity 22

ACC111 Activity 22

Uploaded by

Triquesha Marriette Romero RabiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACC111 Activity 22

ACC111 Activity 22

Uploaded by

Triquesha Marriette Romero RabiCopyright:

Available Formats

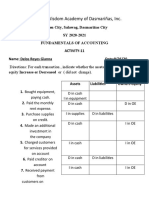

Activity 22.

You are required to: 1. Prepare the worksheet

2. Prepare Financial Statements (Income Statement, Statement of Financial Position, and Statement of

Changes in Equity).

ADJUSTING JOURNAL ENTRIES

a. Office Supplies on hand as of Dec. 31, 2019 is 21,000

Office Supplies Expense 42,000

Office Supplies 42,000

To recognize the expense portion

b. Three-fourth of the unearned revenues is applicable to the next accounting period.

Unearned Revenue 112,500

Service Revenue 112,500

To recognized the earned portion

c. Depreciation for the year as follows: Building - 38,000; Equipment - 123,000

Depreciation Expense 161,000

Accumulated Depreciation - Building 38,000

Accumulated Depreciation - Equipment 123,000

To provide for the depreciation of building and equipment

d. Salaries in the amount of 14,000 have accrued at year-end

Salaries Expense 14,000

Accrued Salaries Payable 14,000

To recognize the unpaid salaries

e. The notes receivable was accepted from several customers. The notes were issued on Sept. 1, 2019 and will settled together

with the 20% interest on May 31, 2020

Interest Receivable 32,000

Interest Income 32,000

To recognized accrued interest on notes receivable

f. 5% of the accounts receivable is doubtful of collection.

Doubtful Account Expense 7,800

Allowance for Doubtful Account 7,800

Provision for the allowance for doubtful accounts.

JAY CESAR SYSTEM DEVELOPER

WORKSHEET

DECEMBER 31, 2019

UNAJUSTED TRIAL BALANCE REF ADJUSMENTS ADJUSTED TRIAL BALANCE INCOME STATEMENT BALANCE SHEET

DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT

CASH 45,000 45,000 45,000

NOTES RECEIVABLE 360,000 360,000 360,000

ACCOUNTS RECEIVABLE 156,000 156,000 156,000

OFFICE SUPPLIES 63,000 A. 42,000 21,000 21,000

LAND 300,000 300,000 300,000

BUILDING 1,590,000 1,590,000 1,590,000

ACCUM. DEPRECIATION-BLDG 254,000 C. 38,000 292,000 292,000

EQUIPMENT 2,150,000 2,150,000 2,150,000

ACCUM. DEPRECIATION-EQUIPMENT 612,000 C. 123,000 735,000 735,000

ACCOUNTS PAYABLE 213,000 213,000 213,000

UNEARNED REVENUE 450,000 B. 112,500 337,000 337,000

JAY CAPITAL 2,655,000 2,655,000 2,655,000

JAY WITHDRAWAL 600,000 600,000 600,000

SERVICE REVENUE 2,108,000 B. 112,500 2,220,500 2,220,500

SALARIES EXPENSE 875,000 D. 14,000 889,000 889,000

REPAIRS EXPENSE 116,000 116,000 116,000

MISCELLANEOUS EXPENSE 37,000 37,000 37,000

TOTAL 6,292,000 6,292,000

OFFICE SUPPLIES EXPENSE A. 42,000 42,000 42,000

DEPRECIATION EXPENSE C. 161,000 161,000 161,000

SALARIES PAYABLE D. 14,000 14,000 14,000

INTEREST RECEIVBLE E. 32,000 32,000 32,000

INTEREST INCOME E. 32,000 32,000 32,000

DOUBTFUL ACCOUNT EXPENSE F. 7,800 7,800 7,800

ALLOWANCE FOR DOUBTFUL ACCOUNT F. 7,800 7,800 7,800

TOTAL 369,300 369,300 6,506,800 6,506,800 1,252,800 2,252,500 5,254,000 4,254,300

NET INCOME 999,700 0 999,700

TOTAL 2,252,500 2,252,500 5,254,000 5,254,000

JAY CESAR SYSTEM DEVELOPER

INCOME STATEMENT

FOR THE YEAR ENDED DECEMBER 31, 2019

Revenues:

SERVICE REVENUE P 2,220,500

INTEREST INCOME 32,000

Operating Expenses:

P 889,000

SALARIES EXPENSE

REPAIRS EXPENSE 116,000

37,000

MISCELLANEOUS EXPENSE

OFFICE SUPPLIES EXPENSE 42,000

DEPRECIATION EXPENSE 161,000

DOUBTFUL ACCOUNT EXPENSE 7,800 1,252,800

NET INCOME P 999,700

JAY CESAR SYSTEM DEVELOPER

STATEMENT OF FINANCIAL POSITION

AS OF DECEMBER 31, 2019

ASSET

Current Assets

CASH P 45,000

360,000

NOTES RECEIVABLE

32,000

INTEREST RECEIVBLE

156,000

ACCOUNTS RECEIVABLE

OFFICE SUPPLIES 21,000

LESS: ALLOWANCE FOR DOUBTFUL ACCOUNT (7,800)

Total Current Asset P 606,200

Non-Current Assets

300,000

LAND

BUILDING 1,590,000

(292,000)

LESS: ACCUM. DEPRECIATION-BLDG

2,150,000

EQUIPMENT

(735,000)

LESS: ACCUM. DEPRECIATION-EQUIPMENT

NET BOOK VALUE 3,013,000

Total Non-Current Asset P 3,013,000

TOTAL ASSETS P 3,619,200

LIABILITIES AND OWNER’S EQUITY

LIABILITIES

Current Liabilities

ACCOUNTS PAYABLE P 213,000

SALARIES PAYABLE 14,000

UNEARNED REVENUE 337,500

TOTAL CURRENT LIABILITY P 564,500

OWNER’S EQUITY

JAY, CAPITAL P 2,655,000

ADD: NET INCOME 999,700

TOTAL P 3,654,700

LESS: JAY, DRAWING (600,000)

Equity balance end P 3,054,700

TOTAL LIABILITY AND OWNER’S EQUITY P 3,619,200

JAY CESAR SYSTEM DEVELOPER

STATEMENT OF CHANGES IN OWNER’S EQUITY

FOR THE YEAR ENDED DECEMBER 31, 2019

JAY CAPITAL P 2,655,000

ADD: ADDITIONAL INVESTMENT P

NET INCOME 999,700 999,700

TOTAL P 3,654,700

LESS: JAY, DRAWING 600,000

JAY, ENDING CAPITAL-DEC 31, 2019 P 3,054,700

You might also like

- Far Assignments Chapter 2Document12 pagesFar Assignments Chapter 2Vesenth May Magaro RubinosNo ratings yet

- Madelyn Rialubin Travel Agency Adjusting Entries AdjustedDocument5 pagesMadelyn Rialubin Travel Agency Adjusting Entries AdjustedJustine Almodiel100% (1)

- Questions - Accounting For DepreciationDocument1 pageQuestions - Accounting For DepreciationOmari100% (1)

- Solution Laubausa CateringDocument5 pagesSolution Laubausa Cateringjessamae gundan100% (6)

- Comprehensive Problem 23Document29 pagesComprehensive Problem 23Nicole Fidelson100% (2)

- Work Sheet Moises Dondoyano Information SystemDocument1 pageWork Sheet Moises Dondoyano Information SystemRJ DAVE DURUHA100% (5)

- Orca Share Media1583067447855Document6 pagesOrca Share Media1583067447855Zoya Romelle Besmonte100% (1)

- Module 4Document67 pagesModule 4Chicos tacos100% (3)

- Kareen Leon, Cpa Page No: - 1 - General JournalDocument4 pagesKareen Leon, Cpa Page No: - 1 - General JournalTayaban Van Gih100% (2)

- Illustrative Problem Worksheet ADocument6 pagesIllustrative Problem Worksheet AJoy Santos33% (3)

- Activity 24. in This Activity You Need To Identify The Adjusting Entry That Can BeDocument3 pagesActivity 24. in This Activity You Need To Identify The Adjusting Entry That Can BeTriquesha Marriette Romero RabiNo ratings yet

- This Study Resource Was: Jia T. Rañesis BSFT 3M2Document6 pagesThis Study Resource Was: Jia T. Rañesis BSFT 3M2Anonymous100% (1)

- Chapter 2 JournalizingDocument21 pagesChapter 2 Journalizingkakao100% (1)

- Problem-5 - AFCAR Chapter 3Document9 pagesProblem-5 - AFCAR Chapter 3kakao100% (1)

- Prob-1 - AFCAR Chapter 3Document2 pagesProb-1 - AFCAR Chapter 3kakao100% (1)

- Accounting HomeworkDocument6 pagesAccounting HomeworkGavin Ramos100% (2)

- General Journal: Date Account Titles and Explanation PR DebitDocument26 pagesGeneral Journal: Date Account Titles and Explanation PR DebitLaica Cardenio100% (3)

- MisUse of MonteCarlo Simulation in NPV Analysis-DavisDocument5 pagesMisUse of MonteCarlo Simulation in NPV Analysis-Davisminerito2211No ratings yet

- Case Study 41 - Mogen IncDocument15 pagesCase Study 41 - Mogen IncPat Cunningham100% (4)

- C3 - Problem 17 - Correcting A Trial BalanceDocument2 pagesC3 - Problem 17 - Correcting A Trial BalanceLorence John Imperial0% (1)

- Catherine Viesca Outdoor Ad Concepts Journal Entries January - December 2020Document4 pagesCatherine Viesca Outdoor Ad Concepts Journal Entries January - December 2020Jamycka Antolin100% (1)

- Travel Agency RubisomethingDocument12 pagesTravel Agency RubisomethingItsRenz YTNo ratings yet

- 4.3.2.5 Elaborate - Determining AdjustmentsDocument4 pages4.3.2.5 Elaborate - Determining AdjustmentsMa Fe Tabasa0% (1)

- General Journal: (To Purchase Equipment Paid With Cash and Account Payable For The Balance)Document7 pagesGeneral Journal: (To Purchase Equipment Paid With Cash and Account Payable For The Balance)Montibon El100% (1)

- Marichu Fornolles Novelties Transactions in December 2020: Date Particulars DebitDocument4 pagesMarichu Fornolles Novelties Transactions in December 2020: Date Particulars DebitHannah Pearl Flores Villar100% (1)

- EDocument17 pagesEMark Cyphrysse Masiglat67% (3)

- Chapter 2 DoneDocument30 pagesChapter 2 Doneellyzamae quiraoNo ratings yet

- Act3 StatDocument33 pagesAct3 StatAllecks Juel Luchana0% (1)

- VICTORINODocument6 pagesVICTORINODenise Ortiz Manolong100% (2)

- Adjusting EntriesDocument5 pagesAdjusting Entriesdatu puti33% (3)

- Rosalie Balhag CleanersDocument1 pageRosalie Balhag CleanersDominique Abrajano100% (1)

- Aguhob FireworksDocument2 pagesAguhob FireworksAndrea Tugot60% (5)

- FAR ReviewerDocument3 pagesFAR ReviewerPASCUA, ROWENA V.No ratings yet

- Total: Adjusting EntriesDocument8 pagesTotal: Adjusting EntriesLj BesaNo ratings yet

- Midterm-Examination Reynaldo Gulane CleanersDocument4 pagesMidterm-Examination Reynaldo Gulane CleanersNicole Sarmiento83% (6)

- Of The Account Would Be Recorded.: Instructions. Identify The Manner in Which The Each of The Increases or DecreasesDocument5 pagesOf The Account Would Be Recorded.: Instructions. Identify The Manner in Which The Each of The Increases or DecreasesLoriNo ratings yet

- Chapter 8-Problem 3Document3 pagesChapter 8-Problem 3kakao100% (1)

- Conceptual Framework First ProblemDocument12 pagesConceptual Framework First ProblemJohn JosephNo ratings yet

- Jose Rizal Heavy BombersDocument10 pagesJose Rizal Heavy BombersClaud NineNo ratings yet

- ACCA101 Leah May SantiagoDocument9 pagesACCA101 Leah May SantiagoNicole FidelsonNo ratings yet

- Balance SheetDocument2 pagesBalance SheetzavriaNo ratings yet

- Dr. Nick Marasigan AccountsDocument11 pagesDr. Nick Marasigan AccountsNicole SarmientoNo ratings yet

- Accounting For A Service BusinessDocument7 pagesAccounting For A Service BusinessAndrea Joy ReyNo ratings yet

- Elegant Home Decors Worksheet For The Year Ended December 31,20ADocument8 pagesElegant Home Decors Worksheet For The Year Ended December 31,20AChloe CatalunaNo ratings yet

- Chapter 8-Problem 9Document4 pagesChapter 8-Problem 9kakaoNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument4 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Journal Entries: Edgar DetoyaDocument17 pagesJournal Entries: Edgar DetoyaAntonNo ratings yet

- Reynaldo Adjusment EntryDocument5 pagesReynaldo Adjusment EntryAra HasanNo ratings yet

- UntitledDocument7 pagesUntitledKit BalagapoNo ratings yet

- Notes BfarDocument4 pagesNotes BfarJoyce Ramos100% (2)

- 9 Problems After Accounting Cycle Book1Document7 pages9 Problems After Accounting Cycle Book1Efi of the IsleNo ratings yet

- Acctgchap 2Document15 pagesAcctgchap 2Anjelika ViescaNo ratings yet

- ACTIVITY NO1and2Document5 pagesACTIVITY NO1and2Patricia Nicole Barrios100% (1)

- Henri Emanuel Reforba - Learning Task #2Document6 pagesHenri Emanuel Reforba - Learning Task #2Rhea BernabeNo ratings yet

- Guzon Book Distributors General Journal Date Particulars PR Debit CreditDocument8 pagesGuzon Book Distributors General Journal Date Particulars PR Debit CreditNermeen C. AlapaNo ratings yet

- On June 1, 2019, ELENO BURAY, JR. Forest Products Sol Sold Merchandise With A P120,000 List PriceDocument63 pagesOn June 1, 2019, ELENO BURAY, JR. Forest Products Sol Sold Merchandise With A P120,000 List PriceDachell Chiva SantiagoNo ratings yet

- Problem #3: Teresita Nacion Publishers Trial BalanceDocument4 pagesProblem #3: Teresita Nacion Publishers Trial BalanceRhea Sismo-anNo ratings yet

- Recording On T Account and Preparing Trial BalanceDocument8 pagesRecording On T Account and Preparing Trial BalanceLala BoraNo ratings yet

- Capter 9, Problem 7Document8 pagesCapter 9, Problem 7John JosephNo ratings yet

- Corazon Tabaranza Worksheet For The Month Ended December 31, 20ADocument9 pagesCorazon Tabaranza Worksheet For The Month Ended December 31, 20AHaries Vi Traboc MicolobNo ratings yet

- Answer Key To Fundamentals of Financial Accounting and Reporting CDCDocument3 pagesAnswer Key To Fundamentals of Financial Accounting and Reporting CDCAprile Margareth HidalgoNo ratings yet

- Jay Cesar System Developer Worksheet DECEMBER 31 2019 Unadjusted Trial Balance REFDocument4 pagesJay Cesar System Developer Worksheet DECEMBER 31 2019 Unadjusted Trial Balance REFAdam CuencaNo ratings yet

- UAS Pengantar AkuntansiDocument16 pagesUAS Pengantar Akuntansikanisa.agustinapnNo ratings yet

- DeceVid Company Final Worksheet PDFDocument1 pageDeceVid Company Final Worksheet PDFAngel Nhova Pepito OmalayNo ratings yet

- ACC111 - Activity 15Document5 pagesACC111 - Activity 15Triquesha Marriette Romero RabiNo ratings yet

- ACC111 - Activity19&20Document2 pagesACC111 - Activity19&20Triquesha Marriette Romero RabiNo ratings yet

- Let'S Check: Crediting Retained Earnings Debiting IncomeDocument1 pageLet'S Check: Crediting Retained Earnings Debiting IncomeTriquesha Marriette Romero RabiNo ratings yet

- Executive SummaryDocument23 pagesExecutive SummaryLois RazonNo ratings yet

- 43 X 603 CWCRX 70 RDocument37 pages43 X 603 CWCRX 70 Rfaisal.rasel1No ratings yet

- Chapter 1-What Is MarketingDocument15 pagesChapter 1-What Is MarketingMohd AnwarshahNo ratings yet

- Functions of State Bank of IndiaDocument7 pagesFunctions of State Bank of IndiaMitali Pardhiye64% (11)

- LogisticaDocument5 pagesLogisticalaura rNo ratings yet

- Considerations For Entrepreneurs Entering The Recreational Marijuana IndustryDocument15 pagesConsiderations For Entrepreneurs Entering The Recreational Marijuana IndustryRay RodriguezNo ratings yet

- CH - 03financial Statement Analysis Solution Manual CH - 03Document63 pagesCH - 03financial Statement Analysis Solution Manual CH - 03OktarinaNo ratings yet

- Day 1 v. Transport Strategy 5.6.Document29 pagesDay 1 v. Transport Strategy 5.6.Boris PrelčecNo ratings yet

- COC 2021 - ROY - Finance OfficerDocument2 pagesCOC 2021 - ROY - Finance OfficerJillian V. RoyNo ratings yet

- Indian Institute of Management Kozhikode Executive Post Graduate Programme in ManagementDocument3 pagesIndian Institute of Management Kozhikode Executive Post Graduate Programme in Managementreva_radhakrish1834No ratings yet

- Application of Extended Marketing Mix For Marketing FSDocument8 pagesApplication of Extended Marketing Mix For Marketing FSDimple RathodNo ratings yet

- An Introduction To Portfolio OptimizationDocument55 pagesAn Introduction To Portfolio OptimizationMarlee123100% (1)

- Resume - Rajeev Sharma UpdatedDocument4 pagesResume - Rajeev Sharma UpdatedLeshop0% (1)

- Cie LKPDocument9 pagesCie LKPRajiv HandaNo ratings yet

- Management-A Study On Inventory-Nandini RavichandranDocument14 pagesManagement-A Study On Inventory-Nandini RavichandranBESTJournalsNo ratings yet

- 2 Effective and Nominal RateDocument19 pages2 Effective and Nominal RateKelvin BarceLonNo ratings yet

- Building Cross-Cultural Leadership Competence: An Interview With Carlos GhosnDocument3 pagesBuilding Cross-Cultural Leadership Competence: An Interview With Carlos GhosnPRIYANKA BATRANo ratings yet

- Customer Centricity in McDonaldsDocument8 pagesCustomer Centricity in McDonaldsabhigoldyNo ratings yet

- Online BankingDocument39 pagesOnline Bankingsumit sharma100% (1)

- Ifrs 10 Consolidated Financial Statements SnapshotDocument2 pagesIfrs 10 Consolidated Financial Statements SnapshotangaNo ratings yet

- Market Structure in BangladeshDocument15 pagesMarket Structure in BangladeshTalukder Riman80% (5)

- 2B MismatchDocument65 pages2B Mismatchshubhamburnwal213No ratings yet

- Dwnload Full Microeconomics 12th Edition Michael Parkin Solutions Manual PDFDocument36 pagesDwnload Full Microeconomics 12th Edition Michael Parkin Solutions Manual PDFrademakernelsons100% (9)

- Sophia Antipolis Case Study Balan Felicia TabitaDocument3 pagesSophia Antipolis Case Study Balan Felicia TabitaTabitha BălanNo ratings yet

- Nature Fruit Juice Processing Enterprise - EditedDocument21 pagesNature Fruit Juice Processing Enterprise - EditedbruktawitNo ratings yet

- Intermediate Accounting 3 Part 1: Cash Flows Objectives of Cash Flow StatementDocument19 pagesIntermediate Accounting 3 Part 1: Cash Flows Objectives of Cash Flow StatementAG VenturesNo ratings yet

- Engineering Economy Lecture Notes 1Document4 pagesEngineering Economy Lecture Notes 1warlockeNo ratings yet