Professional Documents

Culture Documents

02 Handout 1

02 Handout 1

Uploaded by

Zednem JhenggOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

02 Handout 1

02 Handout 1

Uploaded by

Zednem JhenggCopyright:

Available Formats

BM2008

INTERNAL CONTROL CONSIDERATION AND BUSINESS TRANSACTION CYCLES

Internal Control Consideration

The auditor should obtain an understanding of the internal control sufficient to plan the audit and develop

an effective audit approach. The auditor this understanding to identify types of potential misstatements,

consider factors that affect the risks of material misstatement, and design the nature, timing, and extent

of further audit procedures (Asuncion et al., 2018).

Internal Control

Internal control is a process, effected by those charged with governance, management, and other

personnel, designed to provide reasonable assurance regarding the achievement of objectives in the

following categories:

1. Effectiveness and efficiency of operations;

2. Reliability of financial reporting; and

3. Compliance with applicable laws and regulations.

Inherent Limitations of Internal Control

The internal control can only provide reasonable assurance because of inherent limitations that may affect

the effectiveness of internal controls. Such limitations include:

1. Management usual requirement that a control be cost-effective (cost-benefit consideration);

2. The possibility that a person responsible for exercising control could abuse that responsibility

(management overriding the control);

3. The possibility of circumvention of controls through collusion with parties outside the entity or

with employees of the entity;

4. The possibility that procedures may become inadequate due to changes in condition and

compliance with procedures may deteriorate;

5. The potential for human error due to carelessness, distraction, mistakes of judgment or the

misunderstanding of instructions; and

6. The fact that most controls tend to be directed at anticipated types (routine) of transactions and

not at unusual (non-routine) transactions.

Controls Relevant to the Audit

The auditor's risk assessment process relates to controls pertaining to the entity's objective of preparing

financial statements for external purposes and the management risk that may give rise to a material

misstatement in those financial statements.

It is a matter of professional judgment, subject to the requirements of PSA, whether a control, individually

or in combination with others, is relevant to the auditor's considerations in assessing the risks of material

misstatement. In exercising that judgment, the auditor considers the applicable component and factors

such as the following:

1. The auditor's judgment about materiality;

2. The size of the entity;

3. The nature of the entity's business, including its organization and ownership characteristics;

4. The diversity and complexity of the entity's operations;

5. Applicable legal and regulatory requirements; and

6. The nature and complexity of the systems that are part of the entity's internal control, including

the use of service organizations.

02 Handout 1 *Property of STI

student.feedback@sti.edu Page 1 of 15

BM2008

Components of Internal Control (Philippine Standard on Auditing 315 (Redrafted), 2009)

Internal control, as discussed in PSA 315 (Redrafted), consists of the following components:

1. Control Environment

The control environment includes the governance and management functions and the attitudes,

awareness, and actions of those charged with governance and management concerning the

entity's internal control and its importance in the entity.

2. Entity's Risk Assessment Process

An entity's risk assessment process is the process of identifying and responding to business risks

and the results thereof.

For financial reporting purposes, the entity's risk assessment process includes how management

identifies risks relevant to the preparation of financial statements that are presented fairly, in all

material respects in accordance with the entity's applicable financial reporting framework,

estimates their significance, assesses the likelihood of their occurrence, and decides upon actions

to manage them.

The auditor shall obtain an understanding of whether the entity has a process for:

a. Identifying business risks relevant to financial reporting objectives

b. Assessing the significance of risks and the likelihood of their occurrence

c. Deciding how to manage those risks

3. Information and Communication Systems

An information system consists of:

a. Infrastructure (physical and hardware components);

b. Software (processes and procedures;

c. People,

d. Input or data, and

e. Output or meaningful information.

The information system relevant to financial reporting objectives, such as the financial reporting

system, consists of the procedures and records established to initiate, record, process, and report

entity transactions (as well as events and conditions) and to maintain accountability for the

related assets, liabilities, and equity.

4. Control Activities

Control activities are the policies and procedures to help ensure that management directives are

carried out. Examples of control activities include those relating to the following:

a. Authorization

b. Performance reviews (actual performance versus budget, forecasts, and prior period

performance)

c. Information processing (from initiation up to the eventual inclusion of transaction in

financial reports)

d. Physical controls (for both assets and documents)

e. Segregation of duties. To achieve optimum segregation of responsibilities, the following

functions should be performed by different employees:

i. Independent checks

ii. Custody of assets

iii. Authorization of transactions

02 Handout 1 *Property of STI

student.feedback@sti.edu Page 2 of 15

BM2008

iv. Recording of transactions

v. Execution of transactions

5. Monitoring of Controls

Monitoring is the process of assessing the quality of internal control performance over time. It

involves assessing the design and operations of controls on a timely basis and taking necessary

corrective actions.

Monitoring can be accomplished through:

a. Ongoing monitoring activities (performed by persons within the same line function)

b. Separate evaluations (performed by internal auditors, audit committee, and/or external

auditors

c. Combination of the two.

Responses to Assessed Risks

The auditor shall design and implement overall responses to address the assessed risks of material

misstatement at the financial statement level. Moreover, the auditor shall design and perform further

audit procedures whose nature, timing, and extent are based on and are responsive to the assessed risks

of material misstatement at the assertion level. In designing the further audit procedures to be performed,

the auditor shall:

1. Consider the reasons for the assessment given to the risk of material misstatement at the assertion

level for each class of transactions, account balance, and disclosure, including:

a. The likelihood of material misstatement due to the particular characteristics of the relevant

class of transactions, account balance, or disclosure (i.e., the inherent risk); and

b. Whether the risk assessment takes account of relevant controls (i.e., the control risk), thereby

requiring the auditor to obtain audit evidence to determine whether the controls are

operating effectively i.e.,

i. the auditor intends to rely on the operating effectiveness of controls in determining

the nature, timing and extent of substantive procedures); and

ii. Obtain more persuasive audit evidence, the higher the auditor's assessment of risk.

Test of Controls

The auditor should give adequate consideration to controls relevant to the audit. The quality of the

entity's internal control can have a significant impact in determining the nature, timing and extent of the

audit procedures in gathering audit evidence related to class of transactions, account balances and

disclosures.

The auditor shall design and perform tests of controls to obtain sufficient appropriate audit evidence as

to the operating effectiveness of relevant controls when:

1. The auditor's assessment of risks of material misstatement at the assertion level includes an

expectation that the controls are operating effectively i.e., the auditor intends to rely on the

operating effectiveness of controls in determining the nature, timing and extent of substantive

procedures); or

2. Substantive procedures alone cannot provide sufficient appropriate audit evidence at the

assertion level.

Tests of controls over the design of a policy or procedure include Inquiry, Observation Inspection,

Reperformance, and Walk-through tests.

02 Handout 1 *Property of STI

student.feedback@sti.edu Page 3 of 15

BM2008

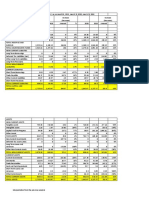

Assessing Impact of Result of Test of Controls

Control risk at a Perform

maximum level Substantive tests

Obtain an understanding

of the internal control Make a preliminary

focusing on the design assessment of

and implementation of Control Risk Control risk at a Perform Tests of

the controls below maximum controls

level

Perform Substantive tests Control risk at maximum

level

Make a

reassessment of

Control Risk

Perform Substantive tests Control risk at below

maximum level

Figure 1. Summary of Procedures Performed in Consideration of Internal Control

Source: Applied Auditing Book 1 of 2, 2018

Effect of Reassessment of Control Risk on the Audit Approach

Reassessment of Audit Approach Effect on Substantive Test

Control Risk (CR)

CR assessment remains Reliance approach • Less effective procedures

at Less than High • Interim testing may be appropriate

• Smaller sample size

CR assessment is Switch to no reliance • More effective procedures

changed to High approach • Tests nearer or at year-end

• Larger sample size

Documentation Requirements

Control Risk Understanding of Control Risk Basis for the Control

Assessment Internal Control Assessment Risk Assessment

High Yes Yes No

Less than high Yes Yes Yes

02 Handout 1 *Property of STI

student.feedback@sti.edu Page 4 of 15

BM2008

Overview of Business Transaction Cycles (Asuncion et al., 2018)

Transaction cycles are the means through which an accounting system processed transactions of related

activities such as sale of goods to customers, acquisition of merchandise and payment to vendors,

production of finished products for sale, and payment to employees for services they had rendered. A

transaction is an agreement between two entities to exchange goods or services or any other event that

can be measured in economic terms by an organization.

Categories of Transaction Cycles

These cycles can be categorized into five interrelated major cycles:

Category Inclusion

Revenue and receipt • sale of goods or services to customers

• collection of cash

Expenditure and • acquisition of goods and services

disbursement • payment for the goods and services acquired

Human resources and • acquisition of services from employees

payroll • payment for the services acquired

Production or conversion • production of entity's product for sale

Financing and investing • generation of capital funds from outside investors

• investment of capital funds to other profitable activities resources

Revenue and Receipt Cycle

The Revenue and Receipt Cycle have the following major functions:

1. Ensure that resources are distributed to customers in exchange for promises of future payments

2. Ensure that customers pay cash for resources distributed to them

The following accounts are usually used in this cycle:

1. Sales and related sales returns, allowances and discount

2. Receivable, allowance for bad debts and Bad debts expense

3. Cash

Forms or documents received, initiated and processed

Form Description Initiated by: Distributed to:

Sales order (order Contains the details of goods Sales department • Customers

slip; customer ordered (quantity, prices and • Credit

order) payment terms) • Shipping

• Billing

Shipping document Describes the goods to be Shipping • Carrier

(bill of lading or shipped and serves as contract department • Customers

delivery receipt) between the entity and carrier • Billing

Sales invoice (billing Describes the goods sold, Billing • Customers

statement) amount due and the terms of department • Accounting

payment

Remittance advice Intended to facilitate the Billing • Customers

accounting for cash collection department

Daily summaries Summarizes transactions Receivable and • General accounting

recorded during the day by the Treasury • Treasury and

different department Mail room Receivables

02 Handout 1 *Property of STI

student.feedback@sti.edu Page 5 of 15

BM2008

Important notes to forms or documents processed

1. The department that initiated the processing approves the form.

2. The department that initiated the processing is accountable for unused forms. Also, access to

those forms shall be limited to the said department

3. The notification of forms does not necessarily mean a hard copy shall be forwarded. Notification

can be done thru electronic mail.

4. The department that initiated, received or processed a form shall retain a copy for filing (not

necessarily a hard copy).

Summary of Functions of Departments in the Revenue and Receipt Cycle

A. Sales Department

Primary objective: To increase entity's sales

Activities Possible Controls

1. Locates and encourages buyers Common controls adopted by different entities

2. Negotiates terms with buyers in this department include:

3. Accepts customer orders • Sales department has an exclusive

4. Prepares sales order and distribute function to communicate with the

copies to customers, credit, shipping customers

and billing • Entity maintains list of authorized

5. Retains copy in unfulfilled order file customers to minimize exposure to

6. Monitors the status of the order high-risk customers

7. Updates customers as to the status of • Entity maintains range of selling prices

the order for its products

B. Credit Department

Primary objective: To minimize exposure to high-risk customers

Activities Possible Controls

1. Receives and review sales order from sales Common controls adopted by

department different entities in this department

2. Conducts credit investigation include:

3. Approves credit request by preparing a memo or • Entities establish a credit

placing an “approved” mark in the sales order department that is

4. Notifies sales department as to the independent with the sales

approval/disapproval of the credit request department

5. Forwards the approved sales order to inventory • Credit department issues list

control of authorized customers

C. Inventory Control Department

Primary objective: To control transfers of inventory in and out of storage areas, monitor inventory

levels, and report slow-moving of damaged items

Activities Possible Controls

1. Reviews approved sales order received Common controls adopted by different

from credit department entities in this department include:

2. Monitors the availability of goods • Inventory control that provides

ordered access to sales department to

3. Authorizes the issuance of goods to the inventory levels

shipping department • Different inventory management

concepts which are applied to

02 Handout 1 *Property of STI

student.feedback@sti.edu Page 6 of 15

BM2008

4. Authorizes the issuance of goods to the provide reasonable assurance the

shipping department availability of goods when needed

5. Forwards the approved sales order to

shipping department

D. Shipping Department

Primary objective: To provide reasonable assurance that all shipments are authorized and customers

are billed

Activities Possible Controls

1. Compares sales order from sales department with Common controls adopted by

goods and approved sales order from inventory control different entities in this

2. Completes shipping documents and prepares goods for department include:

shipment • Shipping documents

3. Release goods to carrier and obtains receipt that are pre-numbered

4. Notifies sales department that goods have been and assure that related

shipped billings are made on a

5. Forwards the shipping documents and approved sales periodic basis

order to Billing department

E. Billing Department

Primary objective: To provide reasonable assurance that all billings are shipped

Activities Possible Controls

1. Compares the following documents: Common controls adopted by

a. Sales order from sales department different entities in this department

b. Approved sales order and shipping include:

document from shipping department • Pre-numbered sales invoice

2. Prepares sales invoice and send copies to customer • Shipping document must be

(thru the carrier) and to inventory accounting present before preparation

3. Prepares remittance advice and send copy to of sales invoice

customers (thru carrier)

F. Accounting Department

1. Inventory: Provides cost information on the goods sold to be forwarded to general accounting

and records transaction related to the cost of goods sold.

2. General: Records the sale and forward sales invoice and related documents to Accounts

receivable

3. Accounts Receivable: Updates subsidiary ledger related to customer's account.

Other Activities in the Revenue and Receipt Cycle

A. Uncollected accounts

1. Accounts receivable

a. Review individual customer accounts periodically as a check against credit limits

b. Prepare monthly accounts receivable trial balances for reconciliation with the general

ledgers

2. Authorized Personnel independent of Credit department

a. Review and age accounts receivable balances periodically

b. Authorized Personnel who reports to the treasurer and independent of recording

functions or Treasurer to authorize the write-off

c. In case of delinquent account, such account should be reviewed

02 Handout 1 *Property of STI

student.feedback@sti.edu Page 7 of 15

BM2008

d. If judged to be uncollectible, written authorization to write off should be sent to

Accounts receivable and General Accounting

B. Sales returns and allowances

1. Sales department

a. Reviews customer's request for returns and allowances

b. Grants sales returns and allowances and prepares credit memo which is forwarded to

customer, accounts receivable (for recording), and inventory control (for returns)

2. Inventory control

a. Compares goods received through the receiving department and credit memo

C. Accounting

1. Inventory: updates inventory records upon receipt of goods and prepare daily summaries to

be forwarded to general accounting

a. Accounts receivable: update records based on the credit memo received and

prepares daily summaries to be forwarded to general accounting

b. General: compares daily summaries from inventory and accounts receivable, then,

updates general ledgers.

Expenditure and Disbursement Cycle

The Expenditure and Disbursement Cycle have the following major functions:

1. Ensure that resources are acquired from vendors in exchange for obligations to pay

2. Ensure that entity pays cash to vendors and employees

The following accounts are usually used in this cycle:

1. Purchases (e.g. Inventory and Supplies)

2. Purchase returns, allowances and discount

3. Payables

4. Cash

Forms or documents received, initiated and processed

Form Description Initiated by: Distributed to:

Requisition slip Contains the details of the User department • Purchasing

(purchase user department’s request

requisition)

Purchase order Describes the goods to be Purchasing • Vendor

acquired (quantity and Department • User

description) • Receiving

• Accounts

payable

Receiving Describes the goods Receiving department • Purchasing

report received (quantity, • Accounts

description and condition) payable

Shipping Describes the goods to be Vendor (thru the • Receiving

document shipped and serves as carrier) department

contract between the entity

and carrier

Vendor invoice Describes the goods sold, Vendor • Accounts

amount due and the terms payable

of payment

02 Handout 1 *Property of STI

student.feedback@sti.edu Page 8 of 15

BM2008

Daily Summarizes transactions Accounts payable (for • General

summaries recorded during the day by purchases) Accounting

the different department Treasury (for payment)

Summary of Functions of Departments in Expenditure Cycle

A. User department

Primary objective: Prepares requisition slip to be forwarded to purchasing and accounts payable

departments

B. Purchasing (Procurement) department

Primary objective: To meet the specific needs of the user department at the least possible cost

Activities Possible Controls

1. Receives approved requisition slip from Common controls adopted by different entities

the user department in this department include:

2. Locates vendor and negotiates with • Purchasing department has an

terms exclusive function to communicate with

3. Prepares purchase orders and the vendor

distributes copies to vendor, receiving • Entity maintains list of authorized

and accounts payable vendors

4. Monitors the status of the order • Entity compares purchase price to

5. Updates customers as to the status of market prices

the order

C. Receiving department

Primary objective: To provide reasonable assurance that received goods are based on approved

purchase order

Activities Possible Controls

1. Files purchase orders until goods are received Common controls adopted by

2. Upon receipt, counts and checks the goods for different entities in this

appropriate quantity and condition department include:

3. Reviews and compares purchase orders from • To ensure that the

purchasing and shipping document from the carrier receiving department will

4. Prepares receiving reports to be forwarded to count and check the goods

purchasing and accounts payable accompanied by received, the purchasing

supporting documents (purchase orders from department sends a blank

purchasing and shipping document from the carrier) purchase order

D. Accounts (vouchers) payable department

Primary objective: To provide reasonable assurance that payments will only be made to shipments

received

Activities Possible Controls

1. Reviews and compares requisition slip, Common controls adopted by different entities

purchase order, receiving report and in this department include:

vendor invoice (3-way match) • Voucher should be supported by

2. Prepares voucher purchase order, receiving report and

3. Prepares voucher package (requisition supplies sales invoice or any other

slip, purchase order, receiving report, supporting documents

vendors invoice and voucher) and daily • Accounts payable department files

summary to be forwarded to the voucher package by due date so as to

02 Handout 1 *Property of STI

student.feedback@sti.edu Page 9 of 15

BM2008

treasury and general accounting, pay liability on time and take advantage

respectively of discounts, if any

E. Treasury Department

Activities Possible Controls

1. Reviews voucher Common controls adopted by different entities in this department

package received include:

2. Prepares check and • The person last signing the check cancels the voucher

have it signed by package by placing a mark such as “paid”, “cancelled” or

authorized check number

signatories • Entity may adopt any of the following in relation to issuance

3. Forwards checks to of checks

vendors o Check over a certain amount should have an

4. Prepares daily identified payee

summary which is o No checks shall be issued without an identified

to be forwarded to payee

general accounting o Checks should be signed by at least two authorized

persons

Human Resources and Payroll Cycle (Asuncion, Ngina, & Escala, 2018)

Human resources and payroll cycle is a continuation of the expenditure and disbursement cycle. This cycle

covers the entity's acquisition of services from its employees or personnel. The following are main reasons

why the auditor is concerned with this cycle.

1. Payroll include different categories of employee benefits (short-term; post-employment, other

long-term and retirement) that could significantly affect major elements of financial statements;

and

2. For most entities, significant amount of resources is incurred

The following accounts are usually used in this cycle:

1. Salaries and wages expense and payable

2. Premiums expense and payable

3. Withholding taxes payable

4. Inventories (for inventoriable salaries and wages)

5. Cash

Forms or documents received, initiated and processed

Form Description Initiated by: Distributed to:

HR records It contains all information related to HR department • Payroll

(Personnel entity’s employees from time they (limited to

records or are hired up to their eventual payroll

201 file) termination. It documents all actions related

taken by the employees or information

management on behalf of an only)

employee. Commonly, it also

documents salary rates, deductions,

and other payroll related information

Daily time Describes the number of hours User department • Payroll

record (DTR) worked by an employee during a

02 Handout 1 *Property of STI

student.feedback@sti.edu Page 10 of 15

BM2008

particular day covered by a pay

period

Payroll Shows all related payroll information Payroll • Treasury

register (gross payroll, all deductions, and net • General

pay) for each pay period accounting

Labor cost Shows payroll information which is Payroll • Inventory

summary capitalizable or can be attributed to a accounting

particular job or customer order

Employee Shows the cumulative year-to-date Payroll • Accounts

earnings summary of earnings and deductions payable

record of every employee

Daily Summarizes transactions recorded Payroll (for liability • General

summaries during the day by the different recognition) accounting

department Inventory (for

inventoriable labor

costs)

Treasury (for

payment)

Summary of Functions of Departments in Human Resource and Payroll Cycle

A. User department

Primary objective: To ensure that time records prepared by employees represent actual hours worked

during a pay period

Activities Possible Controls

1. Monitors and approves daily time Common controls adopted by different entities

records in this department include:

• Appropriate review activities shall be

*Note: However, due to introduction of made to ensure the validity of daily

computerized human resources systems, time time records prepared by employees

records are commonly tracked through • In case of computerized systems,

biometrics and access devices approval of any exceptions shall be

made by the user department head

B. Human Resources (HR) department

Primary objective: To ensure employees included in the payroll are rendering services to the entity

Activities Possible Controls

1. Initiates, updates and maintains HR records Common controls adopted by

2. Forwards payroll related information to payroll different entities in this department

department (e.g. salary and wage rates, bonuses, include:

overtime pays, and payroll deductions) • Access, including initiating

3. Determines terms of settlement (lump-sum or changes, to HR records shall

installment) in case of termination of employee/s be limited only to the HR

4. Immediately notify payroll department of department

terminated employee to avoid inclusions of these • Information not relevant to

employees in the subsequent payroll calculations payroll calculation shall not

be shared to other

departments

C. Payroll department

02 Handout 1 *Property of STI

student.feedback@sti.edu Page 11 of 15

BM2008

Primary objective: To provide reasonable assurance that the payroll calculation in every pay period is

valid

Activities Possible Controls

1. Receives and reviews relevant payroll Common controls adopted by different

related information from HR and user entities in this department include:

departments • Appropriate level of management

2. Considers any update on employees’ pay (preferably a member who is not

rates and deductions involved in payroll preparation)

3. Prepares payroll register reviews the payroll register for

4. Updates cumulative employee earnings accuracy and reasonableness

records • To assure adequacy of segregation

5. Identifies and submits to inventory of duties, payroll department

accounting capitalizable payroll in case of should be segregated from HR,

servicing and manufacturing companies Treasury and some user

with inventoriable labor costs departments.

D. Treasury department (Disbursement)

Primary objective: To provide reasonable assurance that all payroll cash disbursements are based

upon a recognized liability or actual services rendered by employees

Activities Possible Controls

1. Reviews payroll register received Common controls adopted by different entities in

2. Prepares check and have it signed by this department include:

authorized signatories* • Separate bank account should be

3. Distributes checks to employees maintained exclusively for payroll

4. Prepares daily summary which is to disbursements

be forwarded to general accounting • On a surprise basis, an employee

independent from payroll and user

*Note: Most companies disburse payroll departments may distribute paychecks.

through bank fund transfers from company’s The purpose of this is to identify whether

payroll fund to individual employees’ payroll or not fictitious employees exist.

account. In this case, the treasury • Unclaimed payroll checks shall be re-

department should be the one authorizing deposited to the bank.

the bank transfer.

E. Accounting department

Primary objective: To provide reasonable assurance that items related to payroll are appropriately

classified and recorded in correct accounting period at appropriate amounts

1. Inventory: Records inventoriable labor costs to appropriate jobs or customers account and

forward a daily summary to general accounting

2. General: Reviews daily summaries and documents received from Payroll, Treasury and

Inventory departments. It records the recognition of payroll related expenses and liabilities in

the general journal.

Production and Conversion Cycle

Production or conversion cycle covers the production of entity's product for sale. It is where materials,

labor and overhead are converted into finished goods.

The primary objective of this cycle is the proper valuation of inventories and cost of goods sold. Such

objective encompasses the proper allocation of costs to each run made by the production department. In

02 Handout 1 *Property of STI

student.feedback@sti.edu Page 12 of 15

BM2008

order to attain this, the production department uses inputs from the expenditure and disbursement cycle

and provides resources and information to revenue and receipt cycle.

The following accounts are usually used in this cycle:

1. Raw Materials Inventories

2. Work-In-Progress Inventories

3. Finished Goods Inventories

4. Expenditure Cycle Related Accounts

5. Revenue Cycle Related Accounts

The focus of this discussion will be purely on controls over custody of resources involved, authorization of

activities, and recording of transactions.

Summary of control-related duties and responsibilities

Duties and Person/s assigned to perform the Procedures performed by

responsibilities function auditor

Custody Physical custody of materials and labor Auditor observes physical count

documents is normally held by the and reconciles the result of such

production department. count to entity’s records.

Since most of the assets here are highly If held by other parties, auditor

susceptible to theft and may send confirmation requests

misappropriation, adequate physical to the custodian (e.g. consignees,

control must be implemented. agents, or branches)

Authorization The production department is Auditor reviews production

authorized to make normal production orders and related documents

runs. supporting production runs made

However, in case of special runs (to by the department to determine

meet a special order), authorization whether it bears necessary

must come from the board of directors authorization.

or its authorized representative.

Recording Transactions are recorded by the cost Auditor normally reviews the:

accounting. Daily summaries are then ✓ Competency of the

prepared and forwarded to general individuals making

accounting for recoding and posting in journal entries

the general journal and ledger, ✓ Reconciliation of the

respectively. general ledger

Finance and Investment Cycle (Asuncion, Ngina, & Escala, 2018)

Finance and investment cycle generally involve three major categories of transactions: investments, long-

term debts, and shareholders' equity. It covers complicated processes such as accounting for investments,

mergers, long-term liabilities, and equity transactions.

This cycle normally involves few but significant amounts of resources. Thus, employs substantive testing

to gather sufficient appropriate evidence. However, it must be noted that prior to designing of substantive

test procedures, control-related duties and responsibilities is one of the major considerations of the

auditor.

With this, similar with the production or conversion cycle, the focus of this discussion note will be on the

different controls over custody, authorization, and recording of the different transactions covered by this

cycle.

02 Handout 1 *Property of STI

student.feedback@sti.edu Page 13 of 15

BM2008

Summary of control-related duties and responsibilities

A. Finance cycle

Duties and Person/s assigned to perform the Procedures performed by auditor

responsibilities function

Custody Unissued equity and debt certificates Auditor inquires directly to assigned

must be kept by appropriate internal custodians.

official (e.g. Corporate Secretary) or

independent external custodian. If held internally, auditor observes the

accounting of unissued certificates

Authorization As mentioned, transactions covered Auditor reviews minutes of the board of

in this cycles involve large amounts of directors meeting.

cash or other resources. With this,

transactions shall be approved by the

board of directors.

Recording Transactions are recorded in the Auditor normally reviews the:

general journal by personnel in the ✓ Competency of the individuals

general accounting. making journal entries

✓ Reconciliation of the subsidiary

and general ledgers

Important notes:

1. In case of settlement of equity or debt securities previously issued, the certificate is cancelled

thru perforation (e.g. the certificate is shredded). The purpose of this is to avoid duplicate

payments. The supporting records and documents are then kept as audit trail of the

transactions.

2. In case of debt instruments, the general accounting shall appropriately monitor any accruing

interests from the liabilities.

B. Investment cycle

Duties and Person/s assigned to perform the function Procedures performed by

responsibilities auditor

Custody Generally, investment certificates are kept as Auditor inquires directly to

follows: assigned custodians thru

• Negotiable certificates – brokerage sending of confirmation

account requests.

• Titles to real estate – may be kept in a

safe with the entity or bank safe deposit If held internally, auditor

observes the accounting for

certificates held.

Authorization As mentioned, transactions covered in this cycle Auditor reviews minutes of the

involve large amounts of cash or other resources. board of directors meeting.

With this, transactions shall be approved by the

board of directors or by an investment

committee.

Recording Transactions are recorded in the general journal Auditor normally reviews the:

by personnel in the general accounting. ✓ Competency of the

individuals making

journal entries

02 Handout 1 *Property of STI

student.feedback@sti.edu Page 14 of 15

BM2008

Moreover, most companies monitor transactions ✓ Periodic reconciliation

in the investment cycle through a subsidiary of the subsidiary and

ledger/s maintained by the treasury department general ledgers

Important notes:

1. Regardless of the manner of safekeeping, access to these certificates is given to at least two high-

ranking officers (e.g. President, Treasurer, CEO, COO, CFO, or Chairman of the board). This control

is sometimes called dual control or joint custody.

2. The auditor normally requests for the conduct of securities count in the financial institutions

holding the client's certificates.

References

Asuncion, D. J., Ngina, M. A., & Escala, R. F. (2018). Applied Auditing Book 1 of 2. Baguio: Real Excellence

Publishing.

Philippine Standard on Auditing 315 (Redrafted). (2009). Identifying and Assessing the Risks of Material

Misstatement through Understanding the Entity and its Environment.

02 Handout 1 *Property of STI

student.feedback@sti.edu Page 15 of 15

You might also like

- Comprehensive Manual of Internal Audit Practice and Guide: The Most Practical Guide to Internal Auditing PracticeFrom EverandComprehensive Manual of Internal Audit Practice and Guide: The Most Practical Guide to Internal Auditing PracticeRating: 5 out of 5 stars5/5 (1)

- Audit Planning and Risk Assessment New SlidesDocument38 pagesAudit Planning and Risk Assessment New SlidesAdeel AhmadNo ratings yet

- Psa 315 (Part 1)Document47 pagesPsa 315 (Part 1)LisaNo ratings yet

- Information Systems Auditing: The IS Audit Testing ProcessFrom EverandInformation Systems Auditing: The IS Audit Testing ProcessRating: 1 out of 5 stars1/5 (1)

- 22 How To Solve Difficult Adjustments and Journal Entries in Financial AccountsDocument43 pages22 How To Solve Difficult Adjustments and Journal Entries in Financial AccountsKushal D Kale79% (33)

- Risk of Material MisstatementDocument3 pagesRisk of Material Misstatementbobo kaNo ratings yet

- Aud 1.3Document12 pagesAud 1.3Marjorie BernasNo ratings yet

- Module 1.3 Understanding The Entity and Its Environment Including IC - For POSTINGDocument12 pagesModule 1.3 Understanding The Entity and Its Environment Including IC - For POSTINGMae Gamit LaglivaNo ratings yet

- AU 9 Consideration of ICDocument11 pagesAU 9 Consideration of ICJb MejiaNo ratings yet

- Answer-Internal ControlDocument5 pagesAnswer-Internal ControlKathlene BalicoNo ratings yet

- Sulaiha Wati - Chapter 8 NewDocument6 pagesSulaiha Wati - Chapter 8 Newsulaiha watiNo ratings yet

- Auditing Theory Review HO4: Psa 300 (Rev.) Planning An Audit of Financial Statements PSA 315Document4 pagesAuditing Theory Review HO4: Psa 300 (Rev.) Planning An Audit of Financial Statements PSA 315Leigh GaranchonNo ratings yet

- AT 05 Planning An Audit of FS and PSA 315Document4 pagesAT 05 Planning An Audit of FS and PSA 315Princess Mary Joy LadagaNo ratings yet

- Risk Assessment and Internal Control: CA Inter - Auditing and Assurance Additional Questions For Practice (Chapter 4)Document4 pagesRisk Assessment and Internal Control: CA Inter - Auditing and Assurance Additional Questions For Practice (Chapter 4)Annu DuaNo ratings yet

- TO: Belverd E. Needles, JR., PH.D., CPA, CMA From: Melanie Patton Date: May 9, 2013 SUBJECT: Evaluation of Comptronix CorporationDocument6 pagesTO: Belverd E. Needles, JR., PH.D., CPA, CMA From: Melanie Patton Date: May 9, 2013 SUBJECT: Evaluation of Comptronix CorporationjasminekalraNo ratings yet

- Risk AsssesmentDocument13 pagesRisk Asssesmentutkarsh agarwalNo ratings yet

- At.3508 - Considering Internal Controls and Assessing Control RiskDocument9 pagesAt.3508 - Considering Internal Controls and Assessing Control RiskJohn MaynardNo ratings yet

- (At) 03 PlanningDocument14 pages(At) 03 PlanningCykee Hanna Quizo LumongsodNo ratings yet

- The Auditor'S Consideration AND Understanding of The Entity'S Internal ControlDocument66 pagesThe Auditor'S Consideration AND Understanding of The Entity'S Internal ControlbrepoyoNo ratings yet

- Chapter 2 Risk Assessments and Internal ControlDocument16 pagesChapter 2 Risk Assessments and Internal ControlSteffany RoqueNo ratings yet

- Chapter 6Document10 pagesChapter 6BảoNgọcNo ratings yet

- 05GeneralInternalControl NotesDocument13 pages05GeneralInternalControl NotesMussaNo ratings yet

- Internal ControlDocument18 pagesInternal ControlJohn Cesar PaunatNo ratings yet

- PSA315Document6 pagesPSA315Klo MonNo ratings yet

- Chapter 11 Consideration of Internal ControlDocument30 pagesChapter 11 Consideration of Internal ControlPam IntruzoNo ratings yet

- Accounting 412 Chapter 6 Homework SolutionsDocument5 pagesAccounting 412 Chapter 6 Homework SolutionsxxxjungxzNo ratings yet

- Chapter 1 - CISDocument5 pagesChapter 1 - CISChristian De LeonNo ratings yet

- AUD 0 Finals MergedDocument41 pagesAUD 0 Finals MergedBea MallariNo ratings yet

- CONSIDERATIONS OF ENTITY'S INTERNAL CONTROL Red Sirug Lecture NoteDocument7 pagesCONSIDERATIONS OF ENTITY'S INTERNAL CONTROL Red Sirug Lecture NoteMikaNo ratings yet

- Internal ControlDocument2 pagesInternal Controlbobo kaNo ratings yet

- MODULE 4 Control FrameworkDocument9 pagesMODULE 4 Control FrameworkEric CauilanNo ratings yet

- At Handouts 3Document18 pagesAt Handouts 3Jake MandapNo ratings yet

- Psa 315Document6 pagesPsa 315arianasNo ratings yet

- (Bme 21) Psa 300, 315R & 330 PDFDocument9 pages(Bme 21) Psa 300, 315R & 330 PDFAngela YturzaitaNo ratings yet

- ACCT3101 期末双面notes (双面打印,每面8页,必须彩印)Document18 pagesACCT3101 期末双面notes (双面打印,每面8页,必须彩印)Stephanie XieNo ratings yet

- Internal ControlDocument6 pagesInternal ControlSumbul SammoNo ratings yet

- The Auditor and Internal ControlDocument10 pagesThe Auditor and Internal ControlNolan TitusNo ratings yet

- 04 Audit Planning and Risk AssessmentDocument12 pages04 Audit Planning and Risk AssessmentaibsNo ratings yet

- MODULE 7 - Internal Control System Evaluation QUIZZERDocument27 pagesMODULE 7 - Internal Control System Evaluation QUIZZERRufina B VerdeNo ratings yet

- Understanding The Entity and Its Environment and Assessing The Risks of MaterialDocument2 pagesUnderstanding The Entity and Its Environment and Assessing The Risks of MaterialElliot RichardNo ratings yet

- At.3209 - Internal Control ConsiderationsDocument12 pagesAt.3209 - Internal Control ConsiderationsDenny June CraususNo ratings yet

- LS 2.80A - PSA 315 Identifying and Assessing The Risk of Material MisstatementDocument6 pagesLS 2.80A - PSA 315 Identifying and Assessing The Risk of Material MisstatementSkye LeeNo ratings yet

- Auditing Lesson 4Document11 pagesAuditing Lesson 4Ruth KanaizaNo ratings yet

- Ais Chapter SixDocument6 pagesAis Chapter Sixtarekegn gezahegnNo ratings yet

- 965QG Volume 4 Auditing in An IT Environment 2Document53 pages965QG Volume 4 Auditing in An IT Environment 2Jerwin ParallagNo ratings yet

- Consideration of Internal ControlDocument38 pagesConsideration of Internal ControlMaria Paz GanotNo ratings yet

- Alan Fernandes (AUDIT EVIDENCE TO AUDIT REPORTING)Document28 pagesAlan Fernandes (AUDIT EVIDENCE TO AUDIT REPORTING)Alan FernandesNo ratings yet

- MGT 209 - CH 13 NotesDocument6 pagesMGT 209 - CH 13 NotesAmiel Christian MendozaNo ratings yet

- Chapter 6 HandoutDocument8 pagesChapter 6 HandoutKerr John GuilaranNo ratings yet

- At - (14) Internal ControlDocument13 pagesAt - (14) Internal ControlLorena Joy Aggabao100% (2)

- Topic 4 - Audit of Internal ControlsDocument91 pagesTopic 4 - Audit of Internal ControlsIanNo ratings yet

- Audit Note TOPIC 4Document47 pagesAudit Note TOPIC 4Tusiime Wa Kachope SamsonNo ratings yet

- Review Notes On PSA 2Document9 pagesReview Notes On PSA 2Barbie Saniel RamonesNo ratings yet

- Consideration of Internal ControlDocument4 pagesConsideration of Internal ControlFritzie Ann ZartigaNo ratings yet

- The Art and Science of Auditing: Principles, Practices, and InsightsFrom EverandThe Art and Science of Auditing: Principles, Practices, and InsightsNo ratings yet

- Information Systems Auditing: The IS Audit Study and Evaluation of Controls ProcessFrom EverandInformation Systems Auditing: The IS Audit Study and Evaluation of Controls ProcessRating: 3 out of 5 stars3/5 (2)

- Information Systems Auditing: The IS Audit Follow-up ProcessFrom EverandInformation Systems Auditing: The IS Audit Follow-up ProcessRating: 2 out of 5 stars2/5 (1)

- Audit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19From EverandAudit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19No ratings yet

- Mastering Internal Audit Fundamentals A Step-by-Step ApproachFrom EverandMastering Internal Audit Fundamentals A Step-by-Step ApproachRating: 4 out of 5 stars4/5 (1)

- Case Analysis Direction: Analyze The Case and Answer The: Generate Funds Internally From Current Business OperationsDocument2 pagesCase Analysis Direction: Analyze The Case and Answer The: Generate Funds Internally From Current Business OperationsZednem JhenggNo ratings yet

- Case Analysis Direction: Analyze The Case and Answer The Given QuestionsDocument2 pagesCase Analysis Direction: Analyze The Case and Answer The Given QuestionsZednem JhenggNo ratings yet

- Definition and Objective of AuditDocument7 pagesDefinition and Objective of AuditZednem JhenggNo ratings yet

- Case Analysis Direction: Analyze The Case and Answer The Given QuestionsDocument2 pagesCase Analysis Direction: Analyze The Case and Answer The Given QuestionsZednem JhenggNo ratings yet

- CAC Quiz 1Document2 pagesCAC Quiz 1Zednem JhenggNo ratings yet

- Case Analysis Direction: Analyze The Case and Answer The Given QuestionsDocument2 pagesCase Analysis Direction: Analyze The Case and Answer The Given QuestionsZednem JhenggNo ratings yet

- Often Destination of OFW: Taiwan 6 Qatar 7 Saudi Arabia 5 Hong Kong 6 Bahrain 2 United Kingdom 1 Singapore 3Document3 pagesOften Destination of OFW: Taiwan 6 Qatar 7 Saudi Arabia 5 Hong Kong 6 Bahrain 2 United Kingdom 1 Singapore 3Zednem JhenggNo ratings yet

- AUDITING-AND-ASSURANCE-2HOMEWORK1 (Mendez)Document1 pageAUDITING-AND-ASSURANCE-2HOMEWORK1 (Mendez)Zednem JhenggNo ratings yet

- Journal, Ledger, Subsidiary Books and Trial BalanceDocument16 pagesJournal, Ledger, Subsidiary Books and Trial Balancetmenterprise cbeNo ratings yet

- Balance Sheet: Alexei Alvarez Drobush, CFA, FRM Fabricio Chala, CFA, FRMDocument43 pagesBalance Sheet: Alexei Alvarez Drobush, CFA, FRM Fabricio Chala, CFA, FRMJhonatan Perez VillanuevaNo ratings yet

- I) Increase in Utilities Expense J) Decrease in LandDocument3 pagesI) Increase in Utilities Expense J) Decrease in LandRosendo Bisnar Jr.No ratings yet

- Online PPT Lesson 4 Continuation of Corporation TopicsDocument19 pagesOnline PPT Lesson 4 Continuation of Corporation TopicsKimberly Claire AtienzaNo ratings yet

- S.S. Mota Singh Sr. Sec Model School, Janakpuri Class Xi Accountancy First Term Exam 2021-22 Maximum Marks: 40 Time Allowed: 90 Minutes General InstructionsDocument10 pagesS.S. Mota Singh Sr. Sec Model School, Janakpuri Class Xi Accountancy First Term Exam 2021-22 Maximum Marks: 40 Time Allowed: 90 Minutes General InstructionsSatish agggarwalNo ratings yet

- Xparcoac Prelims ReviewerDocument4 pagesXparcoac Prelims ReviewerPauline ValdezNo ratings yet

- CHINA BANKING CORPORATION-Letter BrainDocument2 pagesCHINA BANKING CORPORATION-Letter BrainJessa J Carungay JuntillaNo ratings yet

- Chand Shocker Works Haryana Ggurugram Auction Date 17 Feb 23Document2 pagesChand Shocker Works Haryana Ggurugram Auction Date 17 Feb 23AJEET KUMARNo ratings yet

- Finacct Mock Exam 1Document7 pagesFinacct Mock Exam 1Joseph Gerald M. ArcegaNo ratings yet

- Liabilities, Provisions and Contingent Liabilities & Notes and Bonds PayableDocument5 pagesLiabilities, Provisions and Contingent Liabilities & Notes and Bonds PayableAmanda MarieNo ratings yet

- Student Financial Statement: Enrolment and Financial Details For The SemesterDocument3 pagesStudent Financial Statement: Enrolment and Financial Details For The Semesterziyu haoNo ratings yet

- AFFIDAVIT OF John Henry Doe RE CREDITORDocument6 pagesAFFIDAVIT OF John Henry Doe RE CREDITORlauren100% (5)

- The Accounting Process: Adjusting The Accounts Cash Versus Accrual Basis of AccountingDocument12 pagesThe Accounting Process: Adjusting The Accounts Cash Versus Accrual Basis of AccountingKim Patrick Victoria100% (1)

- Intermediate Accounting1 - PrelimDocument38 pagesIntermediate Accounting1 - PrelimEscalante, Alliah S.No ratings yet

- Identifying Opportunities For M&A-Buy Side and Sell SideDocument19 pagesIdentifying Opportunities For M&A-Buy Side and Sell SideJithu JoseNo ratings yet

- Nickel AsiaDocument2 pagesNickel AsiaEvelyn ArjonaNo ratings yet

- Financial Accounting 1: Chapter 2 Preparation of Journal, Ledger and Trail BalanceDocument21 pagesFinancial Accounting 1: Chapter 2 Preparation of Journal, Ledger and Trail BalanceCabdiraxmaan GeeldoonNo ratings yet

- NEF Personal Statement of Assets LiabilitiesDocument2 pagesNEF Personal Statement of Assets LiabilitiesgururajuNo ratings yet

- Computation 2022-23Document2 pagesComputation 2022-23DKINGNo ratings yet

- Plan de Conturi Engleza 2016 PDFDocument4 pagesPlan de Conturi Engleza 2016 PDFMadalina BogdanNo ratings yet

- CLASS 12 Accountancy-PQDocument27 pagesCLASS 12 Accountancy-PQSanjay PanickerNo ratings yet

- ch05 ptg01Document18 pagesch05 ptg01Tran Kim NganNo ratings yet

- Trading and Profit and Loss Account Format: DR CRDocument14 pagesTrading and Profit and Loss Account Format: DR CRHarshini AkilandanNo ratings yet

- Vinati OrganicsDocument6 pagesVinati OrganicsNeha NehaNo ratings yet

- Submitted in Partial Fulfillment of The Requirements For The Award of The Degree ofDocument96 pagesSubmitted in Partial Fulfillment of The Requirements For The Award of The Degree ofGeorge EliasNo ratings yet

- Assignment Financial Analysis Chapter 2.Document2 pagesAssignment Financial Analysis Chapter 2.Shaimaa MuradNo ratings yet

- Finance Research Letters: Rocco Caferra, David Vidal-Tom AsDocument9 pagesFinance Research Letters: Rocco Caferra, David Vidal-Tom AsamarluckNo ratings yet

- Advantages and Disadvantages of Credit CardsDocument3 pagesAdvantages and Disadvantages of Credit CardsAsif AliNo ratings yet

- Duterte's Build3x Plan (Reaction Paper)Document10 pagesDuterte's Build3x Plan (Reaction Paper)Reymark Alciso EspinozaNo ratings yet