Professional Documents

Culture Documents

QUIZ

QUIZ

Uploaded by

Crissa Mae Falsis0 ratings0% found this document useful (0 votes)

801 views2 pagesThe document discusses key concepts regarding the preparation of consolidated financial statements, including that all goodwill associated with a subsidiary should be recognized on the consolidated balance sheet, consolidated statements eliminate the subsidiary's owners' equity accounts, and worksheet eliminations are not posted to the financial records of the subsidiary or parent.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses key concepts regarding the preparation of consolidated financial statements, including that all goodwill associated with a subsidiary should be recognized on the consolidated balance sheet, consolidated statements eliminate the subsidiary's owners' equity accounts, and worksheet eliminations are not posted to the financial records of the subsidiary or parent.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

801 views2 pagesQUIZ

QUIZ

Uploaded by

Crissa Mae FalsisThe document discusses key concepts regarding the preparation of consolidated financial statements, including that all goodwill associated with a subsidiary should be recognized on the consolidated balance sheet, consolidated statements eliminate the subsidiary's owners' equity accounts, and worksheet eliminations are not posted to the financial records of the subsidiary or parent.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

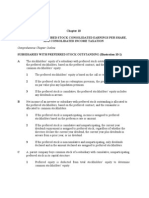

All supporters of the economic unit concept believe that the entire goodwill

associated with the subsidiary (regardless of the percentage ownership)

should be recognized on the consolidated balance sheet. - T

Consolidated financial statements are prepared for a parent company and

all subsidiaries under control of the parent company. - T

When consolidating multiple financial statements, worksheet eliminations

are never posted to the retained earnings account in the balance sheet. - F

Bargain purchase gain exists when the price pair to acquire a subsidiary is

less than the net appraised market value of the identifiable assets and

liabilities. - T

When less than 100 percent of a subsidiary’s stock is acquired during the

period, the peso amount of preacquisition earnings recognized on the

acquisition date consolidated income statement is the parent company’s

ownership interest in the subsidiary’s net income at the acquisition date. - F

At the date of acquisition, purchase differentials can only be assigned to

tangible assets. - F

The purchase differential that exists at the date a subsidiary is acquired is

allocated to all assets in equal amounts. - F

The subsidiary’s owners’ equity accounts are eliminating when preparing

consolidated financial statements because the consolidated statements are

prepared for the parent company stockholders and the parent’s net worth is

equal to the parent’s net assets, including the Investment in Subsidiary. - T

The parent company often pays an acquisition price equal to the subsidiary

corporation’s book value. - F

The noncontrolling interest has a voice in management of the parent

company because the parent company controls the subsidiary - T

Push-down accounting is required to be applied any time a subsidiary is

acquired. - T

Consolidated financial statements allow the user to see more detailed

information than does the parent company financial statements under the

equity method. - F

Worksheet eliminations are not posted to the financial records of the

subsidiary or the parent - T

The reason the parent’s Investment in Subsidiary account is eliminated

when preparing a consolidation worksheet is that no one cares what the

parent paid for the subsidiary’s stock - F

Individual accounts on the consolidated balance sheet at the date of

acquisition always reflects the parent’s book value plus the subsidiary’s

book value. - F

You might also like

- CH 06Document23 pagesCH 06Ahmed Al EkamNo ratings yet

- Afar ProblemsDocument17 pagesAfar ProblemsCrissa Mae Falsis100% (1)

- BusCom AssetAcquisitionDocument5 pagesBusCom AssetAcquisitionDanna Claire0% (1)

- Aa2 Chap 16 OquizDocument4 pagesAa2 Chap 16 OquizAdrienne Mae ReyesNo ratings yet

- Chapter 4Document12 pagesChapter 4Crissa Mae FalsisNo ratings yet

- Chapter 4 SalosagcolDocument3 pagesChapter 4 SalosagcolElvie Abulencia-BagsicNo ratings yet

- Decasa, Erica J. CBET 01 401E The Philippine Finacial SystemDocument4 pagesDecasa, Erica J. CBET 01 401E The Philippine Finacial SystemErica DecasaNo ratings yet

- Quiz 18: Use The Following Information For Questions 3 To 5Document4 pagesQuiz 18: Use The Following Information For Questions 3 To 5CrisNo ratings yet

- BUSINESS COMBINATION - PTDocument13 pagesBUSINESS COMBINATION - PTSchool FilesNo ratings yet

- MC 789Document59 pagesMC 789Minh Nguyễn83% (6)

- Practice Problems AcctgDocument10 pagesPractice Problems AcctgRichard ColeNo ratings yet

- Cash 1. List The Five Primary Activities Involved in The Acquisition and Payment CycleDocument3 pagesCash 1. List The Five Primary Activities Involved in The Acquisition and Payment CycleJomer Fernandez100% (3)

- TB 5Document2 pagesTB 5Louiza Kyla AridaNo ratings yet

- Quiz 1 Graded 86.6Document11 pagesQuiz 1 Graded 86.6cochran123No ratings yet

- Problem 1: Books of Acquirer/AcquiringDocument6 pagesProblem 1: Books of Acquirer/Acquiringaleigna tan100% (1)

- Problem II A. 1. A. P87,725Document5 pagesProblem II A. 1. A. P87,725MckenzieNo ratings yet

- Chap 003Document37 pagesChap 003ChuyuZhang100% (2)

- Grace-AST Module 6Document2 pagesGrace-AST Module 6Devine Grace A. MaghinayNo ratings yet

- Chapter 16Document2 pagesChapter 16Jomer FernandezNo ratings yet

- Lecture NotesDocument25 pagesLecture NotesPrecious Diarez Pureza67% (3)

- Solution Chapter 9Document15 pagesSolution Chapter 9BobslaneLlenos0% (2)

- AFAR Chapter 1Document39 pagesAFAR Chapter 1Jewel CabigonNo ratings yet

- Follow-Up Problem SubsequentDocument4 pagesFollow-Up Problem SubsequentasdasdaNo ratings yet

- Business Combination-Lesson 1 Business Combination-Lesson 1Document11 pagesBusiness Combination-Lesson 1 Business Combination-Lesson 1heyheyNo ratings yet

- Name: Jean Rose T. Bustamante Bsma-3: Let's CheckDocument10 pagesName: Jean Rose T. Bustamante Bsma-3: Let's CheckJean Rose Tabagay BustamanteNo ratings yet

- MQ 1 Receivables and InventoryDocument4 pagesMQ 1 Receivables and Inventorymarygraceomac100% (2)

- Advanced Accounting 2-DayagDocument472 pagesAdvanced Accounting 2-DayagNazee Mohammad IsaNo ratings yet

- TheoriesDocument6 pagesTheoriesFhremond ApoleNo ratings yet

- Company A and Company B - Full and Partial Goodwill: RequiredDocument3 pagesCompany A and Company B - Full and Partial Goodwill: RequiredKristine Esplana ToraldeNo ratings yet

- Cla 10Document2 pagesCla 10Von Andrei MedinaNo ratings yet

- Define Business Combination, Identify Its ElementsDocument4 pagesDefine Business Combination, Identify Its ElementsAljenika Moncada GupiteoNo ratings yet

- Fin33 2ndDocument2 pagesFin33 2ndRonieOlarte100% (1)

- Business Com Chapter 23Document5 pagesBusiness Com Chapter 23Nino Joycelee TuboNo ratings yet

- Business Combinations - Net Asset AcquisitionDocument15 pagesBusiness Combinations - Net Asset AcquisitionLyca Mae CubangbangNo ratings yet

- Solution Chapter 14Document25 pagesSolution Chapter 14xxxxxxxxx100% (4)

- 13 Business Combination Pt3Document1 page13 Business Combination Pt3Riselle Ann Sanchez50% (2)

- Errors and Irregularities in The Transaction CycleDocument22 pagesErrors and Irregularities in The Transaction CycleVatchdemonNo ratings yet

- Chapter 2Document35 pagesChapter 2Ellah GedalanonNo ratings yet

- Part I: Installment Part I: Installment Sales (1-140) Sales (1-140)Document77 pagesPart I: Installment Part I: Installment Sales (1-140) Sales (1-140)Gale RasNo ratings yet

- Handouts ConsolidationComprehensive ExercisesDocument11 pagesHandouts ConsolidationComprehensive ExercisesAD ArconNo ratings yet

- Business Combination and Consolidation On Acquisition Date SummaryDocument6 pagesBusiness Combination and Consolidation On Acquisition Date SummaryWilmar Abriol100% (1)

- VELUNTA - Ass. in ASTDocument4 pagesVELUNTA - Ass. in ASTLiberty VeluntaNo ratings yet

- ACTG413 - Auditing in CIS Environment - Week 6 Systems Development and Program Change ActivitiesDocument18 pagesACTG413 - Auditing in CIS Environment - Week 6 Systems Development and Program Change ActivitiesMarilou Arcillas PanisalesNo ratings yet

- Home Office BranchDocument5 pagesHome Office BranchRodNo ratings yet

- Chapter 10Document9 pagesChapter 10chan.charanchan100% (1)

- MS Preweek QuizzerDocument23 pagesMS Preweek QuizzerJun Guerzon PaneloNo ratings yet

- AP.2901 Inventories.Document9 pagesAP.2901 Inventories.Alarich CatayocNo ratings yet

- Accounting For Legal Reorganizations and Liquidations: Multiple Choice QuestionsDocument121 pagesAccounting For Legal Reorganizations and Liquidations: Multiple Choice Questionsjana ayoubNo ratings yet

- Acc 310 - M004Document12 pagesAcc 310 - M004Edward Glenn BaguiNo ratings yet

- Basic Eps Praac Valix 2018pdf DDDocument20 pagesBasic Eps Praac Valix 2018pdf DDCaptain ObviousNo ratings yet

- Business CombinationsDocument17 pagesBusiness CombinationsBlairEmrallaf0% (1)

- AFAR Self Test - 9001Document5 pagesAFAR Self Test - 9001King MercadoNo ratings yet

- Practical Accounting 2 (P2)Document12 pagesPractical Accounting 2 (P2)Nico evansNo ratings yet

- Chapter 2 BuscomDocument92 pagesChapter 2 BuscomMariel EstañaNo ratings yet

- True or False-Conceptual Framework and Accounting StandardsDocument3 pagesTrue or False-Conceptual Framework and Accounting StandardsSaeym SegoviaNo ratings yet

- Chapter Four: Mcgraw-Hill/Irwin 4-1Document18 pagesChapter Four: Mcgraw-Hill/Irwin 4-1John SnowNo ratings yet

- Chap 4 Consolidated Financial Statements and Outside OwnershipDocument13 pagesChap 4 Consolidated Financial Statements and Outside OwnershipEunice AngNo ratings yet

- Subsidiary Preferred Stock Consolidated Earnings Per Share, and Consolidated Income TaxationDocument16 pagesSubsidiary Preferred Stock Consolidated Earnings Per Share, and Consolidated Income TaxationAnzas Rustamaji PratamaNo ratings yet

- Advanced Financial Accounting Christensen 10th Edition Solutions ManualDocument42 pagesAdvanced Financial Accounting Christensen 10th Edition Solutions ManualMariaDaviesqrbg100% (44)

- Fundamentals of Advanced Accounting 5th Edition Hoyle Solutions Manual 1Document46 pagesFundamentals of Advanced Accounting 5th Edition Hoyle Solutions Manual 1michael100% (50)

- Chap 004Document61 pagesChap 004Nesya Augustari AngreNo ratings yet

- CH09MANDocument42 pagesCH09MANBudi KurniajiNo ratings yet

- Theories QuizDocument9 pagesTheories QuizCrissa Mae FalsisNo ratings yet

- Law 9Document2 pagesLaw 9Crissa Mae Falsis100% (1)

- Quiz 2 AuditingDocument4 pagesQuiz 2 AuditingCrissa Mae Falsis100% (1)

- This Study Resource WasDocument6 pagesThis Study Resource WasCrissa Mae FalsisNo ratings yet

- Obligations - Diagnostic Exercises TEST I - MULTIPLE CHOICE. Select The Best Answer by Writing The Letter of Your ChoiceDocument83 pagesObligations - Diagnostic Exercises TEST I - MULTIPLE CHOICE. Select The Best Answer by Writing The Letter of Your ChoiceCrissa Mae FalsisNo ratings yet

- Chapter 4 TheoriesDocument10 pagesChapter 4 TheoriesCrissa Mae FalsisNo ratings yet

- Auditing Acctng DailyDocument3 pagesAuditing Acctng DailyCrissa Mae FalsisNo ratings yet

- Chapter 1 TheoryDocument14 pagesChapter 1 TheoryCrissa Mae FalsisNo ratings yet