Professional Documents

Culture Documents

SSRN Id2728161

SSRN Id2728161

Uploaded by

aankur aaggarwalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SSRN Id2728161

SSRN Id2728161

Uploaded by

aankur aaggarwalCopyright:

Available Formats

IB May 2013:Layout 2 4/24/2013 11:53 AM Page 22

ARTICLE

Treasury Operations

in Indian Banks

Challenges in

Operational Risk Management

Arya Kumar and Akhilesh Tripathi

1. Introduction and challenges arising from various financial, business and

operational risks, where

Treasury department of a Bank or Financial Institution

(FI) bears the responsibility of managing substantial assets Financial risks include market risk, liquidity risk, and

and liabilities and plays an important role in improving the credit risk;

bottom line of their organisation (IASBC, 2010). Treasury

operations normally consist of activities related to Business risks include risk arising from macro-economic

investment and funds management with ultimate goal of changes such as interest rates, inflation, GDP rate,

optimising performance as per the business objectives of implementation of government programmes/directives

the organisation and in consonance with the regulatory (such as loan waiver scheme) and any other factors affecting

framework as well. In banking parlance, the classical role of banking environment; and

treasury and investment activities include meeting

regulatory requirements, managing liquidity, identifying and Operational risks include a range of threats from loss of

hedging foreign exchange exposures, mitigating key personnel, settlement failure, and compliance failure, to

counterparty risk etc. theft, systems failure and building damage etc.

In India, in addition to performing their prime duty of 2. Operational risks in treasury operations

statutory responsibilities, treasury department of a

bank’s/FI’s is expected to generate regular and consistent The banking industry has been facing a challenging

income and that too at a minimum operational cost. In the environment for the past few years. In the aftermath of the

last few years, bank’s/FI’s expectations and dependency on financial crisis of 2008, banking business has become far

generating income from investment banking activities have more sophisticated and complex and simultaneously risky

increased manifold because of, inter-alia, reduction in also. Banks are in the business of risk and perform a very

traditional remittances and collection based fee income. For critical function of risk transformation which results in

example, after starting of Real Time Gross Settlement warehousing of risks (Sinha 2012). The risk taking

(RTGS) of funds facility under core banking solutions, fee behaviour of banks contribute and amplify systemic risk

based income from remittances and collections have which have severe repercussions in financial and economic

disappeared virtually from the banking scenario. Similarly fragility which was witnessed during and in the aftermath of

there is a drastic reduction in the income from issuance of the latest global financial crisis.

guarantees and letter of credit because of stiff price

competition among the increasing number of branches of For treasury, the categories of risks, such as market risk

old, new, public, private and foreign banks. In the scenario, (exchange rate and interest rate risk), liquidity risk, and

banks have been compelled to concentrate on generating a credit risk are relatively well known, operational risk is not.

part of their income from their treasury and investment Post Liberalisation, Privatisation and Globalisation (LPG),

banking activities which is a herculean task. Experts believe operational risk has increasingly been considered as an

that treasury operations are the most vulnerable banking important financial risk and thanks to Basel Committee on

activities and exposed potentially to a wide range of risks Banking Supervision, popularly known as Basel Accord, it

22 The Indian Banker Vol VIII No. 5 - May 2013

Electronic copy available at: http://ssrn.com/abstract=2728161

IB May 2013:Layout 2 4/24/2013 11:53 AM Page 23

ARTICLE

has also gained cognizance similar to or more than market unintentional failure in adhering important stipulation,

risk and credit risk (Dutta et al, 2006). procedure, related to the functioning of treasury and

investment operations.

Operational risk has been defined by Basel Committee on

Banking Supervision (2004) as ‘the risk of loss resulting from Systems related risk control factors arise from

inadequate or failed internal processes, people and systems or from technological, networking and other systems related

external events, including legal risk, but excluding strategic and activities because of eg unintentional break down of

reputational risk’. computer systems / networking etc.

Process related risk factors emanate from absence or People related risks are considered as the large, existing,

deficiencies in the existing systems and procedures and/or potential and most important source of risk as these arise

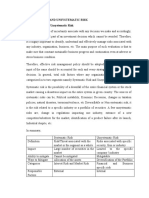

Table-1-Perceived Operational Risks in Treasury Operations

Vol VIII No. 5 - May 2013 The Indian Banker 23

Electronic copy available at: http://ssrn.com/abstract=2728161

IB May 2013:Layout 2 4/24/2013 11:53 AM Page 24

ARTICLE

from violation, manipulation and bypassing of internal • Preferential allocations of shares in the new Initial

policy guidelines, systems & procedures by the concerned Public Offerings (IPO), so-called ‘spinning’

staff members intentionally for personal benefits and gains.

• Inappropriate pricing of Mutual Funds

External events related risks include natural (earthquake,

storms, flood) mayhems and/ or humans’ actions (sudden • Inappropriate behaviour in interest rate auctions

change in government/ government policies, market

scenarios, etc). • introduction of new products and technologies into the

financial system eg derivatives

It may be added here that, in India, external events do not

influence treasury operations, as much as in the other • Fraudulent/improper activity on the part of one

countries because most of the treasury operations are person or group – primarily to protect bonuses

supervised and monitored by the regulatory bodies, Reserve

Bank of India (RBI), Securities and Exchange Board of • Trading in derivative securities – in particular ‘selling’

India (SEBI) whose meticulous compliance for adhering to options in volatile markets

various norms and directives, save treasuries from internal

and global market implications, particularly negative • Non-adherence to critical policies and procedures, in

implications. This apart, the geographical location of India particular trade confirmation and

also plays an important role in preventing implications of

external events, especially from natural calamities and • an aberrant ‘corporate culture’ which not only failed to

havocs, as India is better located from her many Asian, encourage questioning the concerned persons about the

American and European counterparts. Against this risks being taken, but encouraged imprudent risk taking

backdrop, the discussions on external events have been behaviour and that too for making higher profits.

repudiated in our paper and we have concentrated only on

the remaining three major risk factors- people, process and Experts believe that many similar unethical practices,

systems. wrongdoings, if not downright illegal, inherited from greed,

misdeeds, moral meltdown and rogue trading are still

In Table-1 we furnish an overview of such major risks, persisting albeit unearthed and managed efficiently. The

challenges and incidents, embedded into day-to-day persons attached with the treasury and investment business

treasury operations. line of various banks and financial institutions across the

globe are aware and realise that there are black sheep who

Understanding of above major perceived operational risks manipulate the systems and procedures for their personal

in treasury operations is necessary to develop risk benefits and gains in the cote of technological

understanding and risk culture within treasury. Across the advancement, complex banking and financial products,

globe, experts are realising that many losses earlier occurred intrigue risk modelling etc. Despite stringent actions and

due to failed operational or internal processes and wrongly strict guidelines from the regulators of respective countries,

accredited to credit risk or market risk failure, were in fact ‘these rouge traders’ still by pass and manipulate the

operational risk faults (Wei, 2006, Cummins et al, 2006). process easily and perpetrate damage to their organisations.

Samad Ali Khan et al (2009) go a step further and opine Major operational risk contributing factors, attached to the

that during the past 20-25 years, every catastrophic financial functioning of treasury and investment activities are given

loss2 eg of Barings Bank, Long Term Capital Management, in the following Figure-1.

Allied Irish Bank-All First, Société Générale, Bear Stearns,

Lehman Brothers, American Insurance Group,National 3. Dimensions in treasury operations

Australia Bank,WorldCom, Enron, etc. should

unquestionably be attributed to operational risks failures A treasury is involved in many activities. A brief overview

and mismanagement. Mehra (2010) supplements, stating of its various operations is detailed in the Figure-2.

the root cause for all such incidences being not ‘new’ or so-

called ‘unknown risks’ arising from derivatives or Functioning of treasury operations necessitates clear and

collateralised debt obligations etc but meltdown in core transparent functional distinction, demarcation and

ethical values across the banking and financial institutions. separation of duties/responsibilities of various

Experts analyse a few prominent reasons behind these functionaries attached to it. In India, various regulatory and

financial losses and crisis as – statutory bodies, RBI, SEBI, FEDAI (Foreign Exchange

Dealers Association of India), and FIMMDA (Fixed

• Inappropriate use of Investment Research Income Money Market and Derivatives Association) put

24 The Indian Banker Vol VIII No. 5 - May 2013

IB May 2013:Layout 2 4/24/2013 11:53 AM Page 25

ARTICLE

Figure -1- Operational risk factors affecting A) Front office activities are undertaken by the

treasury operations traders and dealers to conduct three component of

treasury operations in a banking organisation-

domestic, which cover inland treasury operations to

meet statutory requirements viz maintaining

Statutory Liquidity Ratio (SLR), Cash Reserve Ratio

(CRR), and liquidity management- borrowing and

lending money in call money market etc. In Forex

category of business activities, deals are undertaken,

in other than domestic currency, to meet

organisation’s proprietary and its customers’

requirements as well. Trading segment of treasury

activities include both domestic and foreign

exchange segment of treasury operations and are

undertaken by the traders to meet proprietary as

well as customers’ demands and normally with a

short term horizon in both domestic capital and

money markets and foreign exchange market as well.

Brief overview of these functional segregations and

demarcations are given in Figure-3.

Challenges associated with front office

activities3

Primarily, front office undertakes deals in domestic

market in local currency and in Forex market in

foreign currency. Normally an organisation has

different dealers for undertaking these activities. For

example, in a mid-sized treasury of a banking

organisation/financial institution, have separate

dealers for call money market, fixed income

securities, equity trading and investment, derivatives

(options, futures) etc. These dealers may undertake

deals according to the bank’s/FI’s investment policy,

forth guidelines in three layers/stages/phases for

demarcation of treasury activities– Figure-2- Dimensions in Treasury Operations

a. Front Office activities,

b. Mid Office activities, and

c. Back Office activities

A banking organisation/financial institution mitigate

operational risks of its treasury operations by implementing

procedures that separate clearly and visibly the front office

(trading), middle office, and back office activities.

Bank’s/FI’s segregate treasury functions by assigning

specific job role to the respective functionaries and ensure

non-overlapping of their assignments/activities. This

demarcation of activities/job roles in these three separate

layers/compartment/cells ensures, inter-alia, avoidance of

interrelated clashes of functions. We detail hereunder a

brief overview on these functional segregations and

demarcations:

Vol VIII No. 5 - May 2013 The Indian Banker 25

IB May 2013:Layout 2 4/24/2013 11:53 AM Page 26

ARTICLE

Figure-3- Front Office Activities

guidelines, systems and procedures and ensure meticulous (iii) Proprietary trading and customers’ trading - In

adherence to the various statutory and regulatory proprietary trading a bank/FI trades stocks, bonds,

guidelines. A few challenges related to these activities are - options, commodities, derivatives or similar financial

instruments for its own account ie for its own profit

(i) Price discovery-which is the process by which rather than trading on behalf of its customers. In

buyers and sellers interact to determine the fair simple terms, in a proprietary trading, the trading desk

market price of an asset. Trading in the financial of bank/FI, carries out trades in various instruments

markets is about obtaining prices. In efficient using its own funds. It involves taking active position

financial market, prices reflect the future risk and the with a view to capital gain. Proprietary trading entails

return associated with a security. Trading decisions substantial risks as securities are bought, held and sold

also impact how prices will move and trading in the expectation of profits from changes in market

activities continuously feed new information into prices. Banks involved in this form of trading with

market prices. the aim to directly benefit from the market rather

than through the commissions they might earn from

(ii) Rate reasonability which relates to a mechanism or processing trades on behalf of their customers. There

process for checking that the rate entered by a dealer are a number of ways in which proprietary trading

that is likely and reasonable, based on the expected can create conflicts of interest between a trader's

daily fluctuations possibilities in that rate. For interests and those of customers of their

example under normal circumstances interest rates organisation. One such activity is ‘front running’ of a

and exchange rates will move within a certain daily customers’ order- where the proprietary desk trader

range and a rate reasonability check will flag any rates knowingly purchases shares ahead of the customers’

that are outside that boundary. trades, so as to benefit from the price increases that

26 The Indian Banker Vol VIII No. 5 - May 2013

IB May 2013:Layout 2 4/24/2013 11:53 AM Page 27

ARTICLE

could result when the customers’ deals are processed. to day monitoring of various front and back office

This results in profits for the proprietary desk at the operations of a treasury department, mid office personnel

cost of the banks’ customers who end up paying are normally based either at the treasury department itself

higher prices for their trades. Similar example may be or near to the treasury department, which is headed by a

bank staff encouraging customers to buy particular functionary, responsible for front office and back office

securities, performing poorly, after the proprietary functions also. This proximity of location and the

traders have bought them for the bank. So the ownership interest of head of the department, influence,

challenge is how to avoid conflicts of interest or sometimes, mid office functionaries’ decisions. Hence the

situations where the proprietary desk’s trades could most important challenge for mid office people is how to

harm the bank’s customers’ interests.as well as how to function effectively without being influenced by the

ensure that proprietary trading desks function in powerful dealers and senior functionaries of the treasury

isolation from those processing trades on behalf of department. A few similar challenges are associated with –

the banks clients

• Establishment of effective interaction with the front

B) Mid office activities – play an important role in office, back office and other department functionaries

establishing effective interaction with the front office

and back office. It ensures that treasury operations are • Examining roles of key treasury personnel attached

in control with reference to decisions strategy, with front office, back office, and other treasury

execution, delivery, counterparties, business process, operations and ensuring non-overlapping

reporting and accounting. Mid office activities are

undertaken for ensuring performance monitoring and • Acquaintance with the knowledge and techniques

conducting review exercise of treasury operations. required to effectively support and supervise the risk

Mid office activities ensure risk control through profile of dealers’ positions, in line with internal and

adherence of various tolerance limits viz stop loss external risk management and regulatory guidelines

limits, currency limits, broker limits, exposure limits

etc. All these activities are undertaken through various • Monitoring deal life cycle - from consummation to

risk management exercises such as Liquidity Risk post-settlement reconciliation

Analysis, Interest Rate Risk Analysis, Scenario

Analysis, VaR, Duration, Modified Duration etc. The • Monitoring and updating the benchmarks used in

following Figure -4 depict interrelationship among pricing etc.

these assessment tools

Figure-4- Mid Office Activities Assessment Tools

As may be observed, all these risk

monitoring and management

exercises are inter related and

attract many challenges in their

smooth functioning and

monitoring. A few of these are

detailed hereunder.

Challenges associated with mid

office activities

A mid-office ought to report

independently to the risk

management department of the

organisation, which in turn is

responsible to its risk committee.

Ideally a mid-office should

function as an independent,

separate unit and not be linked to

any profitability targets. But

practically it does not happen.

Since most of the mid offices

activities are attached with the day

Vol VIII No. 5 - May 2013 The Indian Banker 27

IB May 2013:Layout 2 4/24/2013 11:53 AM Page 28

ARTICLE

• Measuring exposures on daily basis or Mark to Market Business events related challenges which include -

(MTM) Currency convertibility risk, shift in credit rating, reputation

risk, legal risk, taxation risk, disaster risk, wars, collapse/

• Monitoring and controlling of risk limits and reporting suspension of market

credit exposures and excesses to the higher

management without any biasness Regulatory related challenges which include - Breaching

capital requirements, regulatory changes etc.

• Introduction, support and systematic approach to risk

control for all products of new products In a nut shell, challenges associated with back office

activities are shown in the following Figure-5

• Application of best practice techniques for mitigating

market, credit, and operational risk management Operational risks management

• Conducting VaR, stress testing, and scenario analysis Importance of segregation of duties

and putting up their results in non-technical language to

the higher management Based on these statures, organisations ensure segregation of

various treasury activities and assign specific job role to the

• Implementation of necessary legal, documentary and respective functionaries. The demarcation of activities/job

regulatory framework and effective accounting and roles in these three front office, mid office and back office,

reporting MIS separate layers/compartment/cells also ensures, inter-alia,

avoidance of interrelated clashes of functions/deals along

Challenges associated with back office activities with real time risk control and risk monitoring as well. For

example, front office activities, mainly consisting of buying

Back office activities include mainly transaction and and selling of securities, are checked by back office and

settlement related issues, emanating from front office and mid office which ensure that in case a front office person

effectively leading to making of an actual payment/receipt. commits a mistake to the extent of blunder (advertently or

Settlement related challenges arise when after having sent inadvertently) or manipulate prices of securities, exchange

the payment/receipt instructions, there is a delay in rates, dealing positions, mismatches etc. for his own benefit

receiving the payment or the payment is not made at all, ie (eg Nick Leeson- Barings Bank), (s)he will be caught hold

there is a default. A few related challenges include - of by the Back Office. Back office ensures correctness of

execution error, product complexity, booking error, deals, their follow-up with counter parties, settlement,

commodity delivery risk, documentary/ contract risk. reconciliation, and accounting, recording and reporting to

higher authorities. Mid office plays its role as of a checker

Similar others are- and risk manager and ensures adherence to various

procedures and systems, accounting policies through

Systems related challenges which include- Programming management information systems (MIS), risk management

error, model/methodology error, IT systems failure, and other control systems tools. However, the major and

telecommunications failure foremast risk attached to the treasury operations is its

Figure-5- Back Office Activities Challenges

28 The Indian Banker Vol VIII No. 5 - May 2013

IB May 2013:Layout 2 4/24/2013 11:53 AM Page 29

ARTICLE

conduct of operations and management by a small group professional experience, severity of processes, controls,

of persons, who possess powers, by dint of their job role technology lacunae etc which cannot be captured by

and hierarchy, to influence the situations for their own traditional quantitative statistical tools (Scandizzo, 2005).

gains and repeat the subprime type aftermaths any time.

Data based analysis does not help much in predicting the

Assessment issues in treasury operations humans behaviour. Unlike market and credit risks, there is

no direct and clear link between the exposure and the

For the past 2-3 decades, organisations across the globe, likelihood or size of losses in OR assessment. For example,

particularly banks/financial institutions are facing teething two banks with identical assets and liabilities portfolios,

problems in managing operational risks. For successful counterparties and instruments, will exhibit exactly the

Operational Risk Management (ORM), proper analysis, same Market Risk (MR) and Credit Risk (CR) but may

assessment and measurement are a must. But this is not differ significantly in their Operational Risk assessment

easy because of, inter-alia, unavailability of proper and (Holmes 2003). Similarly loss data exercises undertaken to

appropriate tools. Compared to Market Risk Management ascertain OR exposure state only the reasons for OR

(MRM) and Credit Risk Management (CRM), ORM is a failures not the real sources of such incidences (Holmes

new concept. Experts generally apply MR/CR assessment 2003). Buchelt and Unteregger (2004) argue that whether a

tools for OR analysis because of their familiarity and loss event is to be classified as an operational loss event or

acquaintance with such tools. But these tools fail to capture not, since OR is determined by the causes rather than the

the unique characteristics of operational risks and do not consequences of the event. Imad A Moosa (2007) argues

show results in the desired manner (Scandizzo, 2005). that the factor between pure market and credit losses and

Analysis of MR and CR is data based where those linked to operational risk must be the cause. In fact,

quantitative/statistical tools help in understanding the rules as pointed out by Scandizzo (2005), there is no

of the past trend to predict the future. mathematical model that can rigorously link the

occurrence of a particular OR factor to the market value of

Most of the market and credit risk assessment tools, such a financial institution or with the amount of loss which

as Betas, VaR for market risk and Credit Rating method actually took place.

and Vasicek model for credit risk are based on quantitative

and statistical analysis and involve huge data. On the other For each area of risk, an assessment is to be made as to the

hand, operational risks contain many qualitative and likelihood of the risk occurring, the potential

subjective factors such as human aspects, training, consequences, and the approaches to manage the risks.

Figure-6- A MODELORM FRAMEWORK

Vol VIII No. 5 - May 2013 The Indian Banker 29

IB May 2013:Layout 2 4/24/2013 11:53 AM Page 30

ARTICLE

A model framework for treasury operations understand the risks but also the mitigation techniques in

an environment that is constantly changing. Addressing

Banks operate on the foundation of public confidence and operational risks in an effective manner is important for

any small breach in that confidence can lead to a run on business continuity and sustainability of an organisation, as

the bank and to its eventual failure (Sinha 2012). Hence experts believe, these have final impact on the market value

consistent and continuous evaluation of risk contributing of a firm. For the framework to succeed, it is extremely

factors is necessary. Risk management is a process and a important to develop a culture of risk awareness across

business model for sound risk management system is treasury and ensure that all staff is involved in developing

essential for successful and fruitful assessment, and implementing the framework. Treasury activities are

measurement and management of risks in treasury and important and premier income generator of a bank/FI and

investment activities. it is very difficult for them to produce revenue growth and

improve earnings without active and consistence positive

An ideal ORM framework should be appropriate to the involvement of treasury operations.

range, nature and its operating environment of treasury

operations in an organisation. The framework should lay References

down the principles of how operational risks are to be

identified, assessed, monitored, and controlled or mitigated. 1. Source- Technical Notes and Manuals on Operational Risk Management and

Senior management in treasury should own the Business Continuity Planning for Modern State Treasuries, Prepared by Ian Storkey,

responsibility of implementing the ORM framework. The International Monetary Fund, November 2011,pp-14

framework should be consistently implemented throughout

all treasury operations, and all levels of staff should 2. http://money.butjazz.com/top-finance-

understand their responsibilities with respect to ORM. scandals;http://www.caclubindia.com/forum/top-10-financial-scandals-91487.asp

Senior management should also ensure that before new

activities, processes, and systems are introduced or 3. Based on the excerpts from the contents available at

undertaken, the operational risks inherent in them is

subject to adequate assessment and managed appropriately. httbp//financetrainingcourse.com/education/ category/finance/

An ideal ORM framework for treasury operations should

follow a five step process as outlines in Figure - 6. http://lexicon.ft.com/Term?term=proprietary-trading

Once an ORM framework is firmly established, it should http://freerisk.org/wiki/index.php/Proprietary_trading

be assessed and examined consistently, continuously and at

frequent intervals, by the internal as well as external http://en.wikipedia.org/wiki/Proprietary_trading

auditors and experts to identify the loopholes and vetting

the KRIs. It should also be ensured that framework 4. Arora, Diksha and Agarwal Ravi, ‘Banking Risk Management in India and RBI

coordinates well with the bank’s corporate strategy, Supervision’ 2009, pp. 5-22, Electronic copy available from:

regulatory directives and best global practices. Step by step http://ssrn.com/abstract=1446264

follow up of above process would lead to a better

governed organisation with effective internal control 5. Buchelt, R. and Unteregger, S., ‘Cultural Risk And Risk Culture: Operational

environment. Risk keeps on changing over time. Risk After Basel II’, Financial Stability Report, 2004, available from

Identification of KRIs and determination of level of risk http://www.oenb.at/en/img/fsr_06_cultural_risk_tcm16-9495.pdf.

through performance monitoring and reporting structure

keep the situation under control. 6. Cummins, J. D., and P. Embrecht, ‘Introduction: Special Section on Operational

Risk.’ Journal of Banking and Finance, 2006, Vol. 30, No.10, pp. 2599–2604.

Conclusion Electronic copy available from: http://www.sciencedirect.com/science/article/b6vcy-

4k5hwgg-1/2/3af8833ad8dc781b4f33e6cb7a1ddfb5

For the past 2-3 decades, Operational Risk Management

(ORM) is acquiring new credibility as a roadmap to add 7. Holmes, M. ‘Measuring Operational Risk: A Reality Check’. Risk 16, no. 8,

value to the banking business. Day by day, it is attracting September, 2003. Electronic copy available from -http://www.risk.net/risk-

more and more attention from regulators, financial magazine/feature/1506603/measuring-operational-risk-reality-check

institutions and other stakeholders. Operational risk is

embedded everywhere and its assessment, at most of the 8. IASBC, Internal Audit Standards Board Committee ‘Technical Guide on Internal

occasions, is subjective because operational risks are mainly Audit of Treasury Function in Banks’, The Institute of Chartered Accountants of

entrenched to ‘work in progress’ and difficult to quantify. India, New Delhi, January, 2010

Developing an ORM framework is an evolutionary process

and takes time and efforts to not only identify and 9. Indian banking Fraud Survey-2012, Navigating the Challenging Environment

30 The Indian Banker Vol VIII No. 5 - May 2013

IB May 2013:Layout 2 4/24/2013 11:53 AM Page 31

ARTICLE

Deloitte, Available from- http://www.deloitte.com/assets/Dcom- India/Local%2 0Ass Management Section, Society of Actuaries, Canadian Institute of Actuaries Casualty

s/Docu ments/Tho ughtware/ India_Banking_Fraud_Survey_2012.pdf Actuarial Society, 2009, pp.3-10, Electronic copy available from:

http://www.soa.org/research/research-projects/risk-management/research-new-

10. Mehra, Yogieta S. ‘Operational Risk Management in Indian Banks: Impact of approach.aspx

Ownership and Size on Range of Practices for Implementation of Advanced

Measurement Approach.’ 2010, Electronic copy available from: http://www.igidr.ac 15. Scandizzo, S. ‘Risk Mapping and Key Rate Indicators in Operational Risk

.in/money/operational%20risk%20management%20in% 20indian%20banks.pdf. Management’. Economic Notes, Banca Monte dei Paschi di Siena SpA, 2005, Vol.34,

No.2.

11. Moosa, I.A. , ‘Misconceptions about Operational Risk’,. Journal of Operational

Risk, 2007, Vol. 1, No. 4, pp. 97-104. 16. Sinha, Anand, Deputy Governor, Reserve Bank of India speech addressed on

“Perspectives on Risk and Governance”, at the Risk & Governance Summit organised

12. Moremi Marwa ,A study on the Role of Treasury Management on Currency Risk by the Indian School of Business, Hyderabad and Deloitte at Mumbai on August 23,

Management: The Case of Selected Commercial Banks in Tanzania, Available from 2012, electronic copy available from http://rbi.org.in/scripts/

http://www.tanzaniabankers.org/TBA%20- BS_SpeechesView.aspx?Id=720

%20Currency%20Risk%20Management.pdf

17. Technical Notes and Manuals on Operational Risk Management and Business

13. R. Vasudevan ,Audit of Treasury Operations of Banks, The Chartered Continuity Planning for Modern State Treasuries, Ian Storkey, Fiscal Affairs

Accountant April 2006, pp-1462-1474, Available from- Department, November ,2011. Available from http://www.i

http://www.icai.org/resource_file/102601462-1474.pdf mf.org/external/pubs/ft/tnm/2011/tnm1105.pdf

14. Samad Ali Khan, Sabyasachi Guharay, Barry Franklin,Bradley Fischtro, Mark 18. Wei, R. "Quantification of Operational Losses using Firm-Specific

Scanlon, Prakash Shimpi, ‘A New Approach for Managing Operational Risk, Information and External Database." The Journal of Operational risk,2006, vol 4,

Addressing the Issues Underlying the 2008 Global Financial Crisis’, Joint Risk pp. 3-34.

About the Authors

Prof Arya Kumar is presently Dean Student Welfare Division and Chief Entrepreneurship Development & IPR Unit

BITS, Pilani. He is also coordinating the activities of Technology Business Incubator and Center for Entrepreneurial

Leadership at BITS, Pilani. He is an MA (Hons.) Economics and PhD from BITS-Pilani in the area of Financial

Management of Higher Education in India. He has a diversified experience for more than 33 years of serving in

educational institutions, research organisations, banks and financial institutions. He served as chief general

manager and zonal head of Delhi Zone in Industrial Investment Bank of India till July 2003 where he was actively

involved in Corporate Planning, Project Financing, Investment Banking, and Reconstruction of Ailing Units. His basic

interests lie in Entrepreneurship, Strategic Management, Values in Management and Financial Management. He

has co-authored four books in the area of Entrepreneurship, General Management, Ethics in Management, and Grassroots

Entrepreneurship.

Prof Kumar has contributed many research articles in National Journals and Economic Dailies in the area of entrepreneurship,

management and economics. He has been serving as Guest Faculty with number of leading management institutions and colleges of

various Banks. He has presented and got published many papers in national/international conferences in India and aboard. He has

also examined and guided many PhD candidates He has delivered more than 32 invited talks/chaired sessions during last 6 years,

especially in the area of entrepreneurship, finance, banking and economic development. He has to his credit three vital research

projects that have been funded by NSTMIS, DST, Govt of India, and National Entrepreneurship Network, Wadhwani Foundation, Aditya

Birla Group. He can be reached at aryakum@gmail.com; aryakumar@bits-pilani.ac.in.

Akhilesh Tripathi, is presently chief manager in State Bank of Bikaner & Jaipur and possess a vast and varied

experience in wide spectra of banking operations and administration ranging from Branch operations, Credit

Management, Investment Management, Treasury Management, Risk Management, Change Management,

Relationship Banking to Economic Research and Equity Analysis. He is also guest faculty to staff training centre of

his bank as well to few other professional courses imparting institutions. He had conducted workshops and

seminars on change management for junior, middle and senior management cadre of officers of his bank. He has

worked as a Faculty Guide to students for carrying out Student Internship Projects. His academic credentials include

a basic degree education in commerce, an MBA, a CAIIB and a few certificate courses in the area of banking,

treasury and risk management. He is alumnus of Indian Institute of Management, Indore and Birla Institute of Technology and Science

(BITS), Pilani. He is also member of PRMIA, GARP, ISACA and Indian Institute of Banking and Finance (IIBF), Mumbai. He can be

reached at akhilesh@sbbj.co.in; aktakhil@gmail.com.

Vol VIII No. 5 - May 2013 The Indian Banker 31

You might also like

- DR Matthias Rath Victory Over Cancer Ebook PDF (Pauling-Rath Therapy Protocol: Vitamin C / Lysine)Document194 pagesDR Matthias Rath Victory Over Cancer Ebook PDF (Pauling-Rath Therapy Protocol: Vitamin C / Lysine)Anonymous Jap77xvqPK100% (4)

- Behind the Swap: The Broken Infrastructure of Risk Management and a Framework for a Better ApproachFrom EverandBehind the Swap: The Broken Infrastructure of Risk Management and a Framework for a Better ApproachNo ratings yet

- Operational RiskDocument26 pagesOperational RiskmmkattaNo ratings yet

- SynopsisDocument17 pagesSynopsisHarini Bhandaru100% (1)

- Basel NormsDocument66 pagesBasel NormsShanmathiNo ratings yet

- Chapter 4Document6 pagesChapter 4fredadjareNo ratings yet

- The Importance of Operational Risk Management in Insurance IndustryDocument18 pagesThe Importance of Operational Risk Management in Insurance IndustrySadi SonmezNo ratings yet

- Aripo Bank Risk ManagementDocument10 pagesAripo Bank Risk ManagementTinasheNo ratings yet

- Operational RiskDocument7 pagesOperational RiskBOBBY212No ratings yet

- 3c. - Pillars of CapitalDocument30 pages3c. - Pillars of Capitalonly.oranda.goldfishNo ratings yet

- Operational Risk in Financial Services-2017-Yuqian-XuDocument21 pagesOperational Risk in Financial Services-2017-Yuqian-XuDunya NassirNo ratings yet

- Asiapacific Vol2 Article3Document19 pagesAsiapacific Vol2 Article3Jayaraman M.vNo ratings yet

- Managing It-Related Operational Risks: Ana SavićDocument22 pagesManaging It-Related Operational Risks: Ana SavićasifsubhanNo ratings yet

- Jiblr 2005 20 10 535-540Document6 pagesJiblr 2005 20 10 535-540Santanu RoyNo ratings yet

- Chapter OneDocument7 pagesChapter OnefredadjareNo ratings yet

- SSRN Id3549526Document39 pagesSSRN Id3549526FaithNo ratings yet

- Stockmarket Reaction To Operational Risk EventsDocument15 pagesStockmarket Reaction To Operational Risk EventsWaqar HassanNo ratings yet

- Overview of Operational RiskDocument7 pagesOverview of Operational RiskPamela DubeNo ratings yet

- Operational Risk Management in Indian BanksDocument34 pagesOperational Risk Management in Indian BanksManish JangidNo ratings yet

- Chapter 3Document6 pagesChapter 3fredadjareNo ratings yet

- RR-Operational Risk Assessment,Febr 2023-24.Document14 pagesRR-Operational Risk Assessment,Febr 2023-24.amangirma86No ratings yet

- CHAPTER5Document6 pagesCHAPTER5fredadjareNo ratings yet

- Systematic and Unsystematic Risk 4.1 Systematic and Unsystematic RiskDocument7 pagesSystematic and Unsystematic Risk 4.1 Systematic and Unsystematic RiskSanjeev JayaratnaNo ratings yet

- 6learning Outcome 6Document19 pages6learning Outcome 6Indu MathyNo ratings yet

- What Is Basel IIDocument3 pagesWhat Is Basel IIStinkyLinkyNo ratings yet

- "Operational Risk Analysis in Bank'S": Major Research Project OnDocument36 pages"Operational Risk Analysis in Bank'S": Major Research Project OnHemant Singh SisodiyaNo ratings yet

- Unit 5 - FinalDocument12 pagesUnit 5 - FinalVibhaNo ratings yet

- The Effect of Risk Profile (Credit, Operational, Liquidity and Market Risk) On The Firm Value of Banking Sector Companies Listed On The Indonesia Stock Exchange in 2017-2021Document7 pagesThe Effect of Risk Profile (Credit, Operational, Liquidity and Market Risk) On The Firm Value of Banking Sector Companies Listed On The Indonesia Stock Exchange in 2017-2021International Journal of Innovative Science and Research TechnologyNo ratings yet

- Operational Risk: Prepared By:-Dr Gunjan BahetiDocument9 pagesOperational Risk: Prepared By:-Dr Gunjan BahetiTwinkal chakradhariNo ratings yet

- Methods of Quantifying Operational Risk in Banks: Theoretical ApproachesDocument7 pagesMethods of Quantifying Operational Risk in Banks: Theoretical ApproachesAJER JOURNALNo ratings yet

- Complete ProjectDocument99 pagesComplete ProjectDANJUMA ADAMUNo ratings yet

- Risk Management ManualDocument72 pagesRisk Management ManualEron Man100% (2)

- Operational Risk: Risk Management in BankingDocument14 pagesOperational Risk: Risk Management in BankingMinelaSNo ratings yet

- Operation Risk Management PDFDocument13 pagesOperation Risk Management PDFANKUR PUROHITNo ratings yet

- 225 ArticleText 554 1 10 20200318Document30 pages225 ArticleText 554 1 10 20200318Shri Venkateswara TrustNo ratings yet

- Risk Management in Banking Sector - An Empirical Study: Thirupathi Kanchu M. Manoj KumarDocument9 pagesRisk Management in Banking Sector - An Empirical Study: Thirupathi Kanchu M. Manoj KumarKunTal MoNdalNo ratings yet

- Global Asset Management: An Introduction To Its Processes and Costs 1Document4 pagesGlobal Asset Management: An Introduction To Its Processes and Costs 1Lintang UtomoNo ratings yet

- Research Papers On Risk Management in Banking SectorDocument5 pagesResearch Papers On Risk Management in Banking SectoraflbtjgluNo ratings yet

- Operational Risk NewDocument22 pagesOperational Risk NewMahdi MaahirNo ratings yet

- The Significant Transformation of The Banking Industry in India Is Clearly EvidentDocument69 pagesThe Significant Transformation of The Banking Industry in India Is Clearly EvidentJayesh BhanushaliNo ratings yet

- Risk Management-Indian BankingDocument15 pagesRisk Management-Indian BankingSachin GhagareNo ratings yet

- Risk Protection and MitigationDocument114 pagesRisk Protection and MitigationomoyegunNo ratings yet

- Aristotle PG College: Indiabulls Securities LTDDocument15 pagesAristotle PG College: Indiabulls Securities LTDMohmmedKhayyumNo ratings yet

- Operational Risk Management NCBA&E MultanDocument43 pagesOperational Risk Management NCBA&E MultanAstro RiaNo ratings yet

- Research Project AssignmentDocument27 pagesResearch Project AssignmentSam CleonNo ratings yet

- Tma 2 Project ManagmentDocument5 pagesTma 2 Project Managment1990fitsumNo ratings yet

- Adjusted Risk Management Assignment GRP 2Document24 pagesAdjusted Risk Management Assignment GRP 2john wambuaNo ratings yet

- OMBID - Risk Management in The Banking SectorDocument2 pagesOMBID - Risk Management in The Banking SectorJace LuhenceNo ratings yet

- Ali Usman IRM AssignmentDocument15 pagesAli Usman IRM AssignmentAyat KhanNo ratings yet

- Accounting FraudDocument23 pagesAccounting FraudAgung BudiNo ratings yet

- Jurnal Mete FeridunDocument11 pagesJurnal Mete Feridunnadha niyafahNo ratings yet

- Risk Management in Indian Banks: Some Emerging Issues: Dr. Krishn A.Goyal, Int. Eco. J. Res., 2010 1 (1) 102-109Document8 pagesRisk Management in Indian Banks: Some Emerging Issues: Dr. Krishn A.Goyal, Int. Eco. J. Res., 2010 1 (1) 102-109Shukla JineshNo ratings yet

- Chapter 30Document10 pagesChapter 30Mark ConnerNo ratings yet

- Research Papers On Risk Management in BanksDocument4 pagesResearch Papers On Risk Management in Bankstitamyg1p1j2100% (1)

- Q VXTKa BSAFYw NR ROTDQi 3 Uj 5 BH LQ0 y BPG Yk F0 ItyDocument8 pagesQ VXTKa BSAFYw NR ROTDQi 3 Uj 5 BH LQ0 y BPG Yk F0 Ityaniket singhNo ratings yet

- Text of PCN Speech at CIMA Symposium Colombo 080215Document13 pagesText of PCN Speech at CIMA Symposium Colombo 080215Raj KumarNo ratings yet

- Financial Risk and Financial Performance A Critical Analysis of Commercial Banks Listed in Rwanda Stock ExchangeDocument12 pagesFinancial Risk and Financial Performance A Critical Analysis of Commercial Banks Listed in Rwanda Stock ExchangeEditor IJTSRDNo ratings yet

- Risk and Operational Management Practices of Manufacturing Companies in GhanaDocument9 pagesRisk and Operational Management Practices of Manufacturing Companies in GhanaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Nashrah Alam FMA Assignment 1Document9 pagesNashrah Alam FMA Assignment 1Nashrah AlamNo ratings yet

- BstatDocument49 pagesBstatLeonard KimuliNo ratings yet

- Crafting A Community Extension Program Proposal Lecture NotesDocument32 pagesCrafting A Community Extension Program Proposal Lecture NotesDarlyn Denise PruebasNo ratings yet

- Development Plans 2018-2019Document2 pagesDevelopment Plans 2018-2019Madonna B. Bartolome91% (22)

- Community Assessment MethodsDocument8 pagesCommunity Assessment Methodsta CNo ratings yet

- Nischay Baghel BioassayDocument19 pagesNischay Baghel BioassayManish TandanNo ratings yet

- Euroforecaster 2017 NewsletterDocument46 pagesEuroforecaster 2017 NewsletterpanNo ratings yet

- Proctor & Gamble Using Marketing Research To Build BrandsDocument7 pagesProctor & Gamble Using Marketing Research To Build BrandsMd. AsifNo ratings yet

- The Development of The Academic Performance Rating Scale: School Psychology Review June 1991Document18 pagesThe Development of The Academic Performance Rating Scale: School Psychology Review June 1991mohaddisaNo ratings yet

- Introducing Communication Research Paths of Inquiry 3rd Edition Treadwell Test BankDocument10 pagesIntroducing Communication Research Paths of Inquiry 3rd Edition Treadwell Test Bankhilary100% (32)

- Phi Coefficient Example Power Point 97-03Document14 pagesPhi Coefficient Example Power Point 97-03Rineeta BanerjeeNo ratings yet

- Effect of Stator Segmentation and Manufacturing Degradation On The Performance of Ipm Machines, Using Icare Electrical SteelsDocument11 pagesEffect of Stator Segmentation and Manufacturing Degradation On The Performance of Ipm Machines, Using Icare Electrical SteelsAnonymous utxGVB5VyNo ratings yet

- Vishal Arora: Profile SummaryDocument3 pagesVishal Arora: Profile SummaryhsaifNo ratings yet

- Kelompok 1 - Kelas H - Estimation of OGIP in A Water Drive Gas Reservoir Coupling Dynamic Material Balance and Fetkovich Aquifer ModelDocument11 pagesKelompok 1 - Kelas H - Estimation of OGIP in A Water Drive Gas Reservoir Coupling Dynamic Material Balance and Fetkovich Aquifer ModelJassen EstefanNo ratings yet

- Metacognitive Awareness Inventory MAIDocument4 pagesMetacognitive Awareness Inventory MAIAngela MacailaoNo ratings yet

- Identifying Community Assets and ResourcesDocument22 pagesIdentifying Community Assets and ResourcesChan ReyNo ratings yet

- AfricaRice Annual Report 2018 Highlights Work On Sustainable Rice Production in The Face of Climate EmergencyDocument32 pagesAfricaRice Annual Report 2018 Highlights Work On Sustainable Rice Production in The Face of Climate EmergencyAfrica Rice CenterNo ratings yet

- Pantaloon Evolving HR Issues in Pantaloon Retail India Ltd. With Case StudyDocument69 pagesPantaloon Evolving HR Issues in Pantaloon Retail India Ltd. With Case StudyH. Phani Krishna Kant0% (1)

- VIADO PortfolioDocument97 pagesVIADO PortfolioROANN MAE VIADONo ratings yet

- Connelly - 2007 - Obesity ReviewDocument8 pagesConnelly - 2007 - Obesity ReviewNicolas BavarescoNo ratings yet

- Relationships Between Job Stress and Worker Perceived Responsibilities and Job CharacteristicsDocument10 pagesRelationships Between Job Stress and Worker Perceived Responsibilities and Job CharacteristicsArun MaxwellNo ratings yet

- ResumeDocument1 pageResumeapi-272668216No ratings yet

- Thesis Statement On Mexican ImmigrationDocument7 pagesThesis Statement On Mexican ImmigrationBuyCollegePaperOnlineUK100% (2)

- Place Reminder TechnologyDocument11 pagesPlace Reminder TechnologyPraveen Kumar MetriNo ratings yet

- (Tesis) Thermal and Geolelectric Properties of Geomaterials PDFDocument195 pages(Tesis) Thermal and Geolelectric Properties of Geomaterials PDFkikimixplusNo ratings yet

- Improving Fall Risk Assessment and Documentation - A QI ProjectDocument31 pagesImproving Fall Risk Assessment and Documentation - A QI Projecttahani tttNo ratings yet

- MAESP 202 Detection & Estimation TheoryDocument4 pagesMAESP 202 Detection & Estimation TheoryRashi JainNo ratings yet

- Life Cycle of Indonesian Family BusinessDocument20 pagesLife Cycle of Indonesian Family BusinesstypNo ratings yet

- Computational ThinkingDocument15 pagesComputational Thinkingwidy100% (1)