Professional Documents

Culture Documents

Capital Spending Recovery May Be Slow: Economic Outl K

Capital Spending Recovery May Be Slow: Economic Outl K

Uploaded by

Margaret McKenzieCopyright:

Available Formats

You might also like

- Project Report of Shed Net and Its Economics of Sri A Rajesh So. Praksh RaoDocument15 pagesProject Report of Shed Net and Its Economics of Sri A Rajesh So. Praksh Raorajesh rajesh0% (1)

- Living Trust Funding Worksheet - SingleDocument13 pagesLiving Trust Funding Worksheet - SingleRocketLawyer100% (3)

- Mega Camp 2015 - Market Update - MykwDocument31 pagesMega Camp 2015 - Market Update - MykwAmber TaufenNo ratings yet

- ABA Lending AnalysisDocument4 pagesABA Lending AnalysisFOXBusiness.comNo ratings yet

- 2020 Economic Transformation in Vietnam SMEs and Access To CreditDocument2 pages2020 Economic Transformation in Vietnam SMEs and Access To CreditWitri Fauziana UchyNo ratings yet

- Thesis On Loan DelinquencyDocument8 pagesThesis On Loan Delinquencysjfgexgig100% (2)

- Effectsof Loan Sharkingon Philippines MicroenterprisesDocument21 pagesEffectsof Loan Sharkingon Philippines MicroenterprisesChreazel RemigioNo ratings yet

- Deloitte Uk Cfo Survey q4 2022Document9 pagesDeloitte Uk Cfo Survey q4 2022qq1057300248No ratings yet

- 597-Article Text-1141-1-10-20171231Document14 pages597-Article Text-1141-1-10-20171231Estevao SalvadorNo ratings yet

- Credit Union Commercial Lending: Mitigating Risk Through Recording, Monitoring, and ReportingDocument56 pagesCredit Union Commercial Lending: Mitigating Risk Through Recording, Monitoring, and ReportingYosaphat YossmuddantNo ratings yet

- Supply Chain Construction OracleDocument10 pagesSupply Chain Construction Oracleshelarparesh10No ratings yet

- Financially Constrained Mortgage ServicersDocument21 pagesFinancially Constrained Mortgage ServicersHuijiezNo ratings yet

- The Interest You Pay On Your Mortgage Is Not Tax Deductible: Perdizo, Miljane P. Bsa IiiDocument5 pagesThe Interest You Pay On Your Mortgage Is Not Tax Deductible: Perdizo, Miljane P. Bsa IiijaneNo ratings yet

- Jan Us Changed Credit LandscapeDocument6 pagesJan Us Changed Credit LandscaperolandsudhofNo ratings yet

- Forecasts: Debt Woes Not As Bad As They LookDocument3 pagesForecasts: Debt Woes Not As Bad As They LookStock Writer100% (1)

- Empirical Model For Predicting Financial FailureDocument13 pagesEmpirical Model For Predicting Financial FailureMohammed JuveNo ratings yet

- 1 s2.0 S2590291123001572 MainDocument9 pages1 s2.0 S2590291123001572 Mainpuputaisyahh21No ratings yet

- Compass Financial - Lincoln Anderson Commentary - Bad Banking - July 22, 2008Document6 pagesCompass Financial - Lincoln Anderson Commentary - Bad Banking - July 22, 2008compassfinancialNo ratings yet

- Mishkin Econ13e PPT 11Document39 pagesMishkin Econ13e PPT 11hangbg2k3No ratings yet

- 7 Factors Affecting Loan RepaymentDocument10 pages7 Factors Affecting Loan Repaymentendeshaw yibetalNo ratings yet

- EtiopiaDocument17 pagesEtiopiaJose Pedro Montenegro SantosNo ratings yet

- Dewally 2014Document17 pagesDewally 2014Rafael G. MaciasNo ratings yet

- Nguyen 2019Document21 pagesNguyen 2019Nguyễn Thị Mỹ HằngNo ratings yet

- Determinants of The Accessibility of Vietnamese Enterprises To Capital From Banks and Credit InstitutionsDocument15 pagesDeterminants of The Accessibility of Vietnamese Enterprises To Capital From Banks and Credit InstitutionsYếnNo ratings yet

- Subcontractor PrequalificationsDocument2 pagesSubcontractor PrequalificationsMike KarlinsNo ratings yet

- The Influence of Commercial Banks in FinDocument6 pagesThe Influence of Commercial Banks in FinCarlos Alberto Martinez FloresNo ratings yet

- Paper 7 (UNDIP Uni Indonesia)Document11 pagesPaper 7 (UNDIP Uni Indonesia)ANUBHA SRIVASTAVA BUSINESS AND MANAGEMENT (BGR)No ratings yet

- Yildirim2013 230529 082700Document14 pagesYildirim2013 230529 082700Vijay ShanigarapuNo ratings yet

- 7 MMMMMMMMDocument12 pages7 MMMMMMMMTetianaNo ratings yet

- Fonseca Wang 2022 - How Much Do Small Businesses Rely On Personal CreditDocument51 pagesFonseca Wang 2022 - How Much Do Small Businesses Rely On Personal CreditsreedharbharathNo ratings yet

- Q 5 and 6 of EthicsDocument4 pagesQ 5 and 6 of EthicskundanNo ratings yet

- Managing The Liquidity CrisisDocument8 pagesManaging The Liquidity CrisisRusdi RuslyNo ratings yet

- The Impact of Smes' Lending and Credit Guarantee On Bank Efficiency in South KoreaDocument8 pagesThe Impact of Smes' Lending and Credit Guarantee On Bank Efficiency in South KoreaLucky PrasetyoNo ratings yet

- Oliver Wyman 2012 State of The Financial Services Industry ReportDocument28 pagesOliver Wyman 2012 State of The Financial Services Industry ReportsidharthNo ratings yet

- Loan Delinquency: Some Determining Factors: Risk and Financial ManagementDocument7 pagesLoan Delinquency: Some Determining Factors: Risk and Financial ManagementRuona GbinijeNo ratings yet

- Strategic Management Journal - 2021 - Flammer - Strategic Management During The Financial Crisis How Firms Adjust TheirDocument24 pagesStrategic Management Journal - 2021 - Flammer - Strategic Management During The Financial Crisis How Firms Adjust TheirPragya patelNo ratings yet

- Do Small Businesses Get The Credit They Need?: Michaël Dewally, PH.DDocument4 pagesDo Small Businesses Get The Credit They Need?: Michaël Dewally, PH.DAnonymous Feglbx5No ratings yet

- 1 s2.0 S0304405X17302131 MainDocument19 pages1 s2.0 S0304405X17302131 MainNIAMATNo ratings yet

- Cibil Link - Volume I, Issue X, Oct - Dec 06Document4 pagesCibil Link - Volume I, Issue X, Oct - Dec 06Rajeev RathNo ratings yet

- Transforming Banking For The Next GenerationDocument13 pagesTransforming Banking For The Next GenerationccmehtaNo ratings yet

- C12-Bond MarketDocument46 pagesC12-Bond Marketsales11.stoneNo ratings yet

- Syndicated Loan Spreads and The Composition of The SyndicateDocument25 pagesSyndicated Loan Spreads and The Composition of The Syndicatechen zhenyuNo ratings yet

- MARCH 2017: A Shankar IAS Academy InitiativeDocument30 pagesMARCH 2017: A Shankar IAS Academy InitiativeLaxmi Prasad IndiaNo ratings yet

- Determinants of Loan Repayment The CaseDocument16 pagesDeterminants of Loan Repayment The Casebisrat.redaNo ratings yet

- Five Things Investors Have Learned This YearDocument1 pageFive Things Investors Have Learned This YearGloria GloriaNo ratings yet

- Debt Management Challenges Facing Small Business Holders of Kaneshie Market, Accra-GhanaDocument19 pagesDebt Management Challenges Facing Small Business Holders of Kaneshie Market, Accra-GhanaHambeca PHNo ratings yet

- S&P BielarskiDocument2 pagesS&P Bielarskiryan turbeville100% (1)

- A Theory of Discouraged Borrowers - Kon2003Document13 pagesA Theory of Discouraged Borrowers - Kon2003dungngoviNo ratings yet

- Surety Forecast Septermber 2011 - FinalDocument6 pagesSurety Forecast Septermber 2011 - FinaltomsantoniNo ratings yet

- Case Study Banking DNA Fintech-1710441885780Document26 pagesCase Study Banking DNA Fintech-1710441885780prabhatkumararjunNo ratings yet

- Freddie Mac and Fannie Mae: An Exit Strategy For The Taxpayer, Cato Briefing Paper No. 106Document8 pagesFreddie Mac and Fannie Mae: An Exit Strategy For The Taxpayer, Cato Briefing Paper No. 106Cato Institute100% (1)

- Transaction Trends Mag Article 9-2002Document7 pagesTransaction Trends Mag Article 9-2002Chintan PatelNo ratings yet

- Understanding The Impact of Zambias Growing Debt On Different StakeholdersDocument10 pagesUnderstanding The Impact of Zambias Growing Debt On Different StakeholdersDavid TaongaNo ratings yet

- 5 - IB Exam Financial CrisisDocument9 pages5 - IB Exam Financial Crisismatthew erNo ratings yet

- Rebuilding Operating Model Credit Card CompaniesDocument4 pagesRebuilding Operating Model Credit Card CompaniesapluNo ratings yet

- Jurnl Akber Sap 9Document8 pagesJurnl Akber Sap 9Gunk Alit Part IINo ratings yet

- Your Credit Score: What It Means To You As A Prospective Home BuyerDocument5 pagesYour Credit Score: What It Means To You As A Prospective Home BuyerRyan5Cents100% (2)

- EY Funding Challenges in The Oil and Gas SectorDocument8 pagesEY Funding Challenges in The Oil and Gas SectorAkunne6No ratings yet

- Capital Structure and Financial Sustainability: Stakes of Microfinance Institutions in Bamenda, CameroonDocument10 pagesCapital Structure and Financial Sustainability: Stakes of Microfinance Institutions in Bamenda, CameroonskambaleNo ratings yet

- Down But Not Out: Private Student Lenders Face Regulatory and Competitive Risks, But Profits Should Hold UpDocument8 pagesDown But Not Out: Private Student Lenders Face Regulatory and Competitive Risks, But Profits Should Hold Upapi-227433089No ratings yet

- Project Finance Model For Small Contractors in USADocument18 pagesProject Finance Model For Small Contractors in USACynthia MoranNo ratings yet

- Hong Kong HolidayDocument1 pageHong Kong HolidayMargaret McKenzieNo ratings yet

- PDN Jefferson County Edition, 9/3/12Document1 pagePDN Jefferson County Edition, 9/3/12Margaret McKenzieNo ratings yet

- PDN Clallam County Edition, 9/3/12Document1 pagePDN Clallam County Edition, 9/3/12Margaret McKenzieNo ratings yet

- Blood of Her Blood, Part IIDocument1 pageBlood of Her Blood, Part IIMargaret McKenzieNo ratings yet

- A Hop, Skip and A Jump To NowhereDocument1 pageA Hop, Skip and A Jump To NowhereMargaret McKenzieNo ratings yet

- PDN Clallam County Edition, 9/4/12Document1 pagePDN Clallam County Edition, 9/4/12Margaret McKenzieNo ratings yet

- PDN Jefferson County Edition, 5/1/12Document1 pagePDN Jefferson County Edition, 5/1/12Margaret McKenzieNo ratings yet

- PB Post, Train Jumping, Page 4Document1 pagePB Post, Train Jumping, Page 4Margaret McKenzieNo ratings yet

- PB Post Train Jumping, Page 2Document1 pagePB Post Train Jumping, Page 2Margaret McKenzieNo ratings yet

- PB Post, Train Jumping, Page 3Document1 pagePB Post, Train Jumping, Page 3Margaret McKenzieNo ratings yet

- TRL TRL 0904-A-H@7.kDocument1 pageTRL TRL 0904-A-H@7.kMargaret McKenzieNo ratings yet

- Front Page Layout, DBRDocument1 pageFront Page Layout, DBRMargaret McKenzieNo ratings yet

- Blood of Her BloodDocument1 pageBlood of Her BloodMargaret McKenzieNo ratings yet

- TRL TRL 0904-A-H@4.kDocument1 pageTRL TRL 0904-A-H@4.kMargaret McKenzieNo ratings yet

- McKenzie Aasfe 1st Place Division2Document23 pagesMcKenzie Aasfe 1st Place Division2Margaret McKenzieNo ratings yet

- P2 QuizDocument7 pagesP2 QuizJay Mark DimaanoNo ratings yet

- Credit Transactions Digested Cases ConsolidatedDocument190 pagesCredit Transactions Digested Cases ConsolidatedWilbert ChongNo ratings yet

- GR CACDocument41 pagesGR CACAnna Lyssa BatasNo ratings yet

- Chapter3E2010 PDFDocument20 pagesChapter3E2010 PDFsubash1111@gmail.comNo ratings yet

- Tripura Land Revenue and Land Reforms Act, 1960Document51 pagesTripura Land Revenue and Land Reforms Act, 1960Latest Laws TeamNo ratings yet

- Industrial Development Bank of India (IDBI)Document10 pagesIndustrial Development Bank of India (IDBI)Tejpratap VishwakarmaNo ratings yet

- Janata Bank ProcessDocument5 pagesJanata Bank ProcessMahbubur RahmanNo ratings yet

- Secured - San Beda ReviewerDocument33 pagesSecured - San Beda ReviewerAmalia G. BalosNo ratings yet

- Economic Scene in Pune Under The Rule of Peshwas - (18th Century)Document2 pagesEconomic Scene in Pune Under The Rule of Peshwas - (18th Century)Anamika Rai PandeyNo ratings yet

- Atif R. Mian: ULY UNE N Leave ULY UNEDocument7 pagesAtif R. Mian: ULY UNE N Leave ULY UNEhamza saleemNo ratings yet

- Cahayag Vs CCCDocument3 pagesCahayag Vs CCCara100% (1)

- HASSAN MOHAMED MUDEY - HD324COO559882015 FinalDocument36 pagesHASSAN MOHAMED MUDEY - HD324COO559882015 FinalmudeyNo ratings yet

- Product Booklet English VersionDocument88 pagesProduct Booklet English VersionUday Gopal100% (2)

- Lic Jeevan Umang PlanDocument3 pagesLic Jeevan Umang PlanRAVINDRA SINGHNo ratings yet

- BankruptcyDocument44 pagesBankruptcyhugh_jackomanNo ratings yet

- LGR Combo Ch5Document37 pagesLGR Combo Ch5jc100% (2)

- Development Bank of The Philippines V CA 1998Document2 pagesDevelopment Bank of The Philippines V CA 1998Thea P PorrasNo ratings yet

- Citibank v. SabenianoDocument2 pagesCitibank v. SabenianolividNo ratings yet

- ACFE FinTech Fraud Summit PresentationDocument16 pagesACFE FinTech Fraud Summit PresentationCrowdfundInsider100% (1)

- Types of BondsDocument11 pagesTypes of BondsAnthony John Santidad100% (1)

- Commercial Real Estate Case StudyDocument2 pagesCommercial Real Estate Case StudyKirk SummaTime Henry100% (1)

- A Guide To Appealing Rural Housing Service Rural Development DecisionsDocument10 pagesA Guide To Appealing Rural Housing Service Rural Development DecisionsLen PageNo ratings yet

- Reviewed: The Latest in The Twilight Series: Breaking Dawn Part OneDocument40 pagesReviewed: The Latest in The Twilight Series: Breaking Dawn Part OneCity A.M.No ratings yet

- Loan Amortization Schedule3Document9 pagesLoan Amortization Schedule3devanand bhawNo ratings yet

- Money Doesn't Grow On Trees: A Farmer's Point of View Amanda OuDocument16 pagesMoney Doesn't Grow On Trees: A Farmer's Point of View Amanda OuAmanda OuNo ratings yet

- RA - One Pager PDFDocument1 pageRA - One Pager PDFSURAJ PATILNo ratings yet

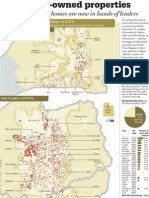

- Foreclosure REOs MapDocument1 pageForeclosure REOs MapThe Salt Lake TribuneNo ratings yet

Capital Spending Recovery May Be Slow: Economic Outl K

Capital Spending Recovery May Be Slow: Economic Outl K

Uploaded by

Margaret McKenzieOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Spending Recovery May Be Slow: Economic Outl K

Capital Spending Recovery May Be Slow: Economic Outl K

Uploaded by

Margaret McKenzieCopyright:

Available Formats

ECONOMIC OUTL K by MIKE sEEMUTH

A20 dailybusinessreview.com

FRIDAY, SEPTEMBER 10, 2010

capital spending recovery may be slow

B

‘‘

usiness investment in equipment Companies that cut capital spending are unavailable.

and facilities may be headed in the first half from last year’s level in- A recovery in capital spending is likely

higher, but many companies in cluded Fort Lauderdale-based software to be slow because “busi-

South Floirda are likely to keep conserv- Florida now leads the vendor Citrix Systems, Miami-based con- ness confidence is quite

ing cash because the direction of the nation in bank failures – the sulting firm Hackett Group and Mednax, low right now. There’s

economy is unclear. banks based here are very, very a provider of pediatric physician care not a whole lot of positive

An informal survey of 20 nonfinancial conservative in their [loan] headquartered in Sunrise. outlook,” said Ken Thomas,

public companies based in Miami-Dade, underwriting.” Liquidity is still a priority. Among the a Miami-based economist

Broward and Palm Beach counties re- 20 companies surveyed, 12 had more and bank consultant.

veals that 15 of them put more cash into ken thomas cash at the end of June than a year ear- “Instead of talking about

capital spending during the first half of lier, and one reported virtually no change Thomas recovery, we’re talking

the year than in the same period last bank consultant over the year. about what? Double-dip recession.”

year. Nationwide, capital spending flattened A spate of community bank failures

Capital spending at Boca Raton-based after the U.S. recession started about has done little to expand credit availabil-

Office Depot, for example, rose to $83.2 tal spending in the first half were Fort three years ago. ity for capital spending.

million in the January-June period from Lauderdale-based vehicle retailer After four consecutive annual increas- “Florida now leads the nation in bank

$53.7 million in the first half of 2009, a AutoNation, Wellington-based aircraft es, capital spending by non-farm U.S. failures,” Thomas said, and because of

55 percent increase. furnishings manufacturer B/E Aerospace businesses was virtually unchanged from increased regulatory scrutiny, “the banks

Among the other South Florida and specialty construction contractor 2007 to 2008. based here are very, very conservative in

companies that increased their capi- MasTec in Miami. Comparable data for 2009 and 2010 their [loan] underwriting.”

Student loan defaults could

spread if economy stays weak

S

tudent loan defaults may become more

common if good jobs for graduates of by the numbers

universities, colleges and trade schools

remain scarce. 8.7 %

Credit bureau TransUnion reported that

out of the entire country last year, the state Student loan default rate at Broward College

that had the highest delinquency rate for in the 2007 fiscal year.

private loans to students — with 9.44 per-

cent of these loans 90 days or more past 7%

Manpower finds slight due — was Florida.

Chicago-based TransUnion estimates

that about 20 percent of the student loans

Student loan default rate at Broward College

in 2006.

improvement in hiring in the United States are underwritten by

private lenders, and about 80 percent are

backed by the federal government.

6.7%

Student loan default rate at Broward College

A

quarterly survey by tem- About two-thirds of area em- Borrower default rates in 2005.

porary staffing agency ployers said they will keep their may be higher for govern-

Manpower shows minor staff sizes unchanged during ment-backed student loans

improvement in the fourth-quar- the fourth quarter. Many South than for private ones. since 2009.

ter hiring outlook among South Florida businesses are in a pay- According to the U.S. The South Florida unemployment rate

Florida employers. roll holding pattern because “their Department of Education, was 12.1 percent in July, compared with

“There is a slight increase” in budget is not expanding, as of yet, even before the national the annual average rates of 10.2 percent in

the fourth-quarter staffing plans and they’re not adding to head economic recession began 2009 and 6.1 percent in 2008.

of South Florida employers, said count,” Alvarez said. in 2007, at least 10 South Labor force expansion is propping up

Vitner South Florida’s unemployment rate.

Cecilia Alvarez, the Miami branch Nevertheless, this year’s stale- Florida universities, colleges

manager of Manpower. “It’s not mate is progress compared to and trade schools reported a growing num- Wells Fargo senior economist Mark

significant.” last year’s stagnation. A year ago, ber of students who were defaulting on U.S. Vitner believes that one reason for the

Manpower found that 17 per- the Manpower survey of South government-backed loans. recent growth in the number of South

cent of employers in Miami-Dade, Florida employers found a more For example, at Broward College, the Floridians looking for work is due to an

Broward and Palm Beach coun- pessimistic hiring outlook for the percentage of students who obtained gov- increase in the number of people who are

ties plan to hire more workers in fourth-quarter of 2009, with 8 ernment-backed loans during the federal re-entering the labor force after exiting to

the final three months of the year percent planning to add employ- government’s 2007 fiscal year, and who de- learn new skills.

while 15 percent said they plan ees and 15 percent planning to faulted before the end of the following year Further deterioration of student loan

to eliminate jobs in the October- eliminate jobs.hey are staying a totaled 8.7 percent. quality could lead to

December period. night or two.” This compared with regulatory sanctions

7 percent in fiscal for certain post-sec-

2006 and 6.7 per- ondary schools.

cent in fiscal 2005. Universities, col-

leges and trade

Preview The reason?

Rising unemploy- schools that enroll

ment rates may be too many delin-

SALES, INVENTORIES: The Census Labor Statistics will release its August in- exacerbating this quent borrowers

Bureau will report the August volume of dex of producer prices on Thursday. class of credit dete- could be barred

retail sales and the July level of business INFLATION, SENTIMENT: On Sept. 17, rioration by limiting from participation in

inventories on Tuesday. the Bureau of Labor Statistics will release job opportunities the Federal Family

FACTORY OUTPUT: The Federal its August index of consumer prices, for those South Education Loan and

Reserve will release its September esti- and the University of Michigan and the Floridians who may the William D. Ford

mate of industrial production and capac- Thomson Reuters information service have earned aca- JOHN MICHAEL RINDO Federal Direct Loan

ity utilization on Wednesday. will report their September index of con- demic degrees and Florida students are defaulting at a higher rate on programs, among

PRODUCTION COSTS: The Bureau of sumer sentiment. training certificates their government loans than the rest of the nation. others.

You might also like

- Project Report of Shed Net and Its Economics of Sri A Rajesh So. Praksh RaoDocument15 pagesProject Report of Shed Net and Its Economics of Sri A Rajesh So. Praksh Raorajesh rajesh0% (1)

- Living Trust Funding Worksheet - SingleDocument13 pagesLiving Trust Funding Worksheet - SingleRocketLawyer100% (3)

- Mega Camp 2015 - Market Update - MykwDocument31 pagesMega Camp 2015 - Market Update - MykwAmber TaufenNo ratings yet

- ABA Lending AnalysisDocument4 pagesABA Lending AnalysisFOXBusiness.comNo ratings yet

- 2020 Economic Transformation in Vietnam SMEs and Access To CreditDocument2 pages2020 Economic Transformation in Vietnam SMEs and Access To CreditWitri Fauziana UchyNo ratings yet

- Thesis On Loan DelinquencyDocument8 pagesThesis On Loan Delinquencysjfgexgig100% (2)

- Effectsof Loan Sharkingon Philippines MicroenterprisesDocument21 pagesEffectsof Loan Sharkingon Philippines MicroenterprisesChreazel RemigioNo ratings yet

- Deloitte Uk Cfo Survey q4 2022Document9 pagesDeloitte Uk Cfo Survey q4 2022qq1057300248No ratings yet

- 597-Article Text-1141-1-10-20171231Document14 pages597-Article Text-1141-1-10-20171231Estevao SalvadorNo ratings yet

- Credit Union Commercial Lending: Mitigating Risk Through Recording, Monitoring, and ReportingDocument56 pagesCredit Union Commercial Lending: Mitigating Risk Through Recording, Monitoring, and ReportingYosaphat YossmuddantNo ratings yet

- Supply Chain Construction OracleDocument10 pagesSupply Chain Construction Oracleshelarparesh10No ratings yet

- Financially Constrained Mortgage ServicersDocument21 pagesFinancially Constrained Mortgage ServicersHuijiezNo ratings yet

- The Interest You Pay On Your Mortgage Is Not Tax Deductible: Perdizo, Miljane P. Bsa IiiDocument5 pagesThe Interest You Pay On Your Mortgage Is Not Tax Deductible: Perdizo, Miljane P. Bsa IiijaneNo ratings yet

- Jan Us Changed Credit LandscapeDocument6 pagesJan Us Changed Credit LandscaperolandsudhofNo ratings yet

- Forecasts: Debt Woes Not As Bad As They LookDocument3 pagesForecasts: Debt Woes Not As Bad As They LookStock Writer100% (1)

- Empirical Model For Predicting Financial FailureDocument13 pagesEmpirical Model For Predicting Financial FailureMohammed JuveNo ratings yet

- 1 s2.0 S2590291123001572 MainDocument9 pages1 s2.0 S2590291123001572 Mainpuputaisyahh21No ratings yet

- Compass Financial - Lincoln Anderson Commentary - Bad Banking - July 22, 2008Document6 pagesCompass Financial - Lincoln Anderson Commentary - Bad Banking - July 22, 2008compassfinancialNo ratings yet

- Mishkin Econ13e PPT 11Document39 pagesMishkin Econ13e PPT 11hangbg2k3No ratings yet

- 7 Factors Affecting Loan RepaymentDocument10 pages7 Factors Affecting Loan Repaymentendeshaw yibetalNo ratings yet

- EtiopiaDocument17 pagesEtiopiaJose Pedro Montenegro SantosNo ratings yet

- Dewally 2014Document17 pagesDewally 2014Rafael G. MaciasNo ratings yet

- Nguyen 2019Document21 pagesNguyen 2019Nguyễn Thị Mỹ HằngNo ratings yet

- Determinants of The Accessibility of Vietnamese Enterprises To Capital From Banks and Credit InstitutionsDocument15 pagesDeterminants of The Accessibility of Vietnamese Enterprises To Capital From Banks and Credit InstitutionsYếnNo ratings yet

- Subcontractor PrequalificationsDocument2 pagesSubcontractor PrequalificationsMike KarlinsNo ratings yet

- The Influence of Commercial Banks in FinDocument6 pagesThe Influence of Commercial Banks in FinCarlos Alberto Martinez FloresNo ratings yet

- Paper 7 (UNDIP Uni Indonesia)Document11 pagesPaper 7 (UNDIP Uni Indonesia)ANUBHA SRIVASTAVA BUSINESS AND MANAGEMENT (BGR)No ratings yet

- Yildirim2013 230529 082700Document14 pagesYildirim2013 230529 082700Vijay ShanigarapuNo ratings yet

- 7 MMMMMMMMDocument12 pages7 MMMMMMMMTetianaNo ratings yet

- Fonseca Wang 2022 - How Much Do Small Businesses Rely On Personal CreditDocument51 pagesFonseca Wang 2022 - How Much Do Small Businesses Rely On Personal CreditsreedharbharathNo ratings yet

- Q 5 and 6 of EthicsDocument4 pagesQ 5 and 6 of EthicskundanNo ratings yet

- Managing The Liquidity CrisisDocument8 pagesManaging The Liquidity CrisisRusdi RuslyNo ratings yet

- The Impact of Smes' Lending and Credit Guarantee On Bank Efficiency in South KoreaDocument8 pagesThe Impact of Smes' Lending and Credit Guarantee On Bank Efficiency in South KoreaLucky PrasetyoNo ratings yet

- Oliver Wyman 2012 State of The Financial Services Industry ReportDocument28 pagesOliver Wyman 2012 State of The Financial Services Industry ReportsidharthNo ratings yet

- Loan Delinquency: Some Determining Factors: Risk and Financial ManagementDocument7 pagesLoan Delinquency: Some Determining Factors: Risk and Financial ManagementRuona GbinijeNo ratings yet

- Strategic Management Journal - 2021 - Flammer - Strategic Management During The Financial Crisis How Firms Adjust TheirDocument24 pagesStrategic Management Journal - 2021 - Flammer - Strategic Management During The Financial Crisis How Firms Adjust TheirPragya patelNo ratings yet

- Do Small Businesses Get The Credit They Need?: Michaël Dewally, PH.DDocument4 pagesDo Small Businesses Get The Credit They Need?: Michaël Dewally, PH.DAnonymous Feglbx5No ratings yet

- 1 s2.0 S0304405X17302131 MainDocument19 pages1 s2.0 S0304405X17302131 MainNIAMATNo ratings yet

- Cibil Link - Volume I, Issue X, Oct - Dec 06Document4 pagesCibil Link - Volume I, Issue X, Oct - Dec 06Rajeev RathNo ratings yet

- Transforming Banking For The Next GenerationDocument13 pagesTransforming Banking For The Next GenerationccmehtaNo ratings yet

- C12-Bond MarketDocument46 pagesC12-Bond Marketsales11.stoneNo ratings yet

- Syndicated Loan Spreads and The Composition of The SyndicateDocument25 pagesSyndicated Loan Spreads and The Composition of The Syndicatechen zhenyuNo ratings yet

- MARCH 2017: A Shankar IAS Academy InitiativeDocument30 pagesMARCH 2017: A Shankar IAS Academy InitiativeLaxmi Prasad IndiaNo ratings yet

- Determinants of Loan Repayment The CaseDocument16 pagesDeterminants of Loan Repayment The Casebisrat.redaNo ratings yet

- Five Things Investors Have Learned This YearDocument1 pageFive Things Investors Have Learned This YearGloria GloriaNo ratings yet

- Debt Management Challenges Facing Small Business Holders of Kaneshie Market, Accra-GhanaDocument19 pagesDebt Management Challenges Facing Small Business Holders of Kaneshie Market, Accra-GhanaHambeca PHNo ratings yet

- S&P BielarskiDocument2 pagesS&P Bielarskiryan turbeville100% (1)

- A Theory of Discouraged Borrowers - Kon2003Document13 pagesA Theory of Discouraged Borrowers - Kon2003dungngoviNo ratings yet

- Surety Forecast Septermber 2011 - FinalDocument6 pagesSurety Forecast Septermber 2011 - FinaltomsantoniNo ratings yet

- Case Study Banking DNA Fintech-1710441885780Document26 pagesCase Study Banking DNA Fintech-1710441885780prabhatkumararjunNo ratings yet

- Freddie Mac and Fannie Mae: An Exit Strategy For The Taxpayer, Cato Briefing Paper No. 106Document8 pagesFreddie Mac and Fannie Mae: An Exit Strategy For The Taxpayer, Cato Briefing Paper No. 106Cato Institute100% (1)

- Transaction Trends Mag Article 9-2002Document7 pagesTransaction Trends Mag Article 9-2002Chintan PatelNo ratings yet

- Understanding The Impact of Zambias Growing Debt On Different StakeholdersDocument10 pagesUnderstanding The Impact of Zambias Growing Debt On Different StakeholdersDavid TaongaNo ratings yet

- 5 - IB Exam Financial CrisisDocument9 pages5 - IB Exam Financial Crisismatthew erNo ratings yet

- Rebuilding Operating Model Credit Card CompaniesDocument4 pagesRebuilding Operating Model Credit Card CompaniesapluNo ratings yet

- Jurnl Akber Sap 9Document8 pagesJurnl Akber Sap 9Gunk Alit Part IINo ratings yet

- Your Credit Score: What It Means To You As A Prospective Home BuyerDocument5 pagesYour Credit Score: What It Means To You As A Prospective Home BuyerRyan5Cents100% (2)

- EY Funding Challenges in The Oil and Gas SectorDocument8 pagesEY Funding Challenges in The Oil and Gas SectorAkunne6No ratings yet

- Capital Structure and Financial Sustainability: Stakes of Microfinance Institutions in Bamenda, CameroonDocument10 pagesCapital Structure and Financial Sustainability: Stakes of Microfinance Institutions in Bamenda, CameroonskambaleNo ratings yet

- Down But Not Out: Private Student Lenders Face Regulatory and Competitive Risks, But Profits Should Hold UpDocument8 pagesDown But Not Out: Private Student Lenders Face Regulatory and Competitive Risks, But Profits Should Hold Upapi-227433089No ratings yet

- Project Finance Model For Small Contractors in USADocument18 pagesProject Finance Model For Small Contractors in USACynthia MoranNo ratings yet

- Hong Kong HolidayDocument1 pageHong Kong HolidayMargaret McKenzieNo ratings yet

- PDN Jefferson County Edition, 9/3/12Document1 pagePDN Jefferson County Edition, 9/3/12Margaret McKenzieNo ratings yet

- PDN Clallam County Edition, 9/3/12Document1 pagePDN Clallam County Edition, 9/3/12Margaret McKenzieNo ratings yet

- Blood of Her Blood, Part IIDocument1 pageBlood of Her Blood, Part IIMargaret McKenzieNo ratings yet

- A Hop, Skip and A Jump To NowhereDocument1 pageA Hop, Skip and A Jump To NowhereMargaret McKenzieNo ratings yet

- PDN Clallam County Edition, 9/4/12Document1 pagePDN Clallam County Edition, 9/4/12Margaret McKenzieNo ratings yet

- PDN Jefferson County Edition, 5/1/12Document1 pagePDN Jefferson County Edition, 5/1/12Margaret McKenzieNo ratings yet

- PB Post, Train Jumping, Page 4Document1 pagePB Post, Train Jumping, Page 4Margaret McKenzieNo ratings yet

- PB Post Train Jumping, Page 2Document1 pagePB Post Train Jumping, Page 2Margaret McKenzieNo ratings yet

- PB Post, Train Jumping, Page 3Document1 pagePB Post, Train Jumping, Page 3Margaret McKenzieNo ratings yet

- TRL TRL 0904-A-H@7.kDocument1 pageTRL TRL 0904-A-H@7.kMargaret McKenzieNo ratings yet

- Front Page Layout, DBRDocument1 pageFront Page Layout, DBRMargaret McKenzieNo ratings yet

- Blood of Her BloodDocument1 pageBlood of Her BloodMargaret McKenzieNo ratings yet

- TRL TRL 0904-A-H@4.kDocument1 pageTRL TRL 0904-A-H@4.kMargaret McKenzieNo ratings yet

- McKenzie Aasfe 1st Place Division2Document23 pagesMcKenzie Aasfe 1st Place Division2Margaret McKenzieNo ratings yet

- P2 QuizDocument7 pagesP2 QuizJay Mark DimaanoNo ratings yet

- Credit Transactions Digested Cases ConsolidatedDocument190 pagesCredit Transactions Digested Cases ConsolidatedWilbert ChongNo ratings yet

- GR CACDocument41 pagesGR CACAnna Lyssa BatasNo ratings yet

- Chapter3E2010 PDFDocument20 pagesChapter3E2010 PDFsubash1111@gmail.comNo ratings yet

- Tripura Land Revenue and Land Reforms Act, 1960Document51 pagesTripura Land Revenue and Land Reforms Act, 1960Latest Laws TeamNo ratings yet

- Industrial Development Bank of India (IDBI)Document10 pagesIndustrial Development Bank of India (IDBI)Tejpratap VishwakarmaNo ratings yet

- Janata Bank ProcessDocument5 pagesJanata Bank ProcessMahbubur RahmanNo ratings yet

- Secured - San Beda ReviewerDocument33 pagesSecured - San Beda ReviewerAmalia G. BalosNo ratings yet

- Economic Scene in Pune Under The Rule of Peshwas - (18th Century)Document2 pagesEconomic Scene in Pune Under The Rule of Peshwas - (18th Century)Anamika Rai PandeyNo ratings yet

- Atif R. Mian: ULY UNE N Leave ULY UNEDocument7 pagesAtif R. Mian: ULY UNE N Leave ULY UNEhamza saleemNo ratings yet

- Cahayag Vs CCCDocument3 pagesCahayag Vs CCCara100% (1)

- HASSAN MOHAMED MUDEY - HD324COO559882015 FinalDocument36 pagesHASSAN MOHAMED MUDEY - HD324COO559882015 FinalmudeyNo ratings yet

- Product Booklet English VersionDocument88 pagesProduct Booklet English VersionUday Gopal100% (2)

- Lic Jeevan Umang PlanDocument3 pagesLic Jeevan Umang PlanRAVINDRA SINGHNo ratings yet

- BankruptcyDocument44 pagesBankruptcyhugh_jackomanNo ratings yet

- LGR Combo Ch5Document37 pagesLGR Combo Ch5jc100% (2)

- Development Bank of The Philippines V CA 1998Document2 pagesDevelopment Bank of The Philippines V CA 1998Thea P PorrasNo ratings yet

- Citibank v. SabenianoDocument2 pagesCitibank v. SabenianolividNo ratings yet

- ACFE FinTech Fraud Summit PresentationDocument16 pagesACFE FinTech Fraud Summit PresentationCrowdfundInsider100% (1)

- Types of BondsDocument11 pagesTypes of BondsAnthony John Santidad100% (1)

- Commercial Real Estate Case StudyDocument2 pagesCommercial Real Estate Case StudyKirk SummaTime Henry100% (1)

- A Guide To Appealing Rural Housing Service Rural Development DecisionsDocument10 pagesA Guide To Appealing Rural Housing Service Rural Development DecisionsLen PageNo ratings yet

- Reviewed: The Latest in The Twilight Series: Breaking Dawn Part OneDocument40 pagesReviewed: The Latest in The Twilight Series: Breaking Dawn Part OneCity A.M.No ratings yet

- Loan Amortization Schedule3Document9 pagesLoan Amortization Schedule3devanand bhawNo ratings yet

- Money Doesn't Grow On Trees: A Farmer's Point of View Amanda OuDocument16 pagesMoney Doesn't Grow On Trees: A Farmer's Point of View Amanda OuAmanda OuNo ratings yet

- RA - One Pager PDFDocument1 pageRA - One Pager PDFSURAJ PATILNo ratings yet

- Foreclosure REOs MapDocument1 pageForeclosure REOs MapThe Salt Lake TribuneNo ratings yet