Professional Documents

Culture Documents

FAR Acc111 Week 1-3 Definition Reviewer

FAR Acc111 Week 1-3 Definition Reviewer

Uploaded by

RIJANE MAE EMPLEO100%(1)100% found this document useful (1 vote)

117 views5 pagesAccounting involves identifying, measuring, and communicating financial information about economic entities. It is defined by various accounting bodies as a system that provides useful quantitative information for decision making. Accounting identifies transactions as accountable or non-accountable events and measures them according to generally accepted accounting principles (GAAP). It also communicates this financial information through periodic financial statements to allow users to evaluate business performance over time.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAccounting involves identifying, measuring, and communicating financial information about economic entities. It is defined by various accounting bodies as a system that provides useful quantitative information for decision making. Accounting identifies transactions as accountable or non-accountable events and measures them according to generally accepted accounting principles (GAAP). It also communicates this financial information through periodic financial statements to allow users to evaluate business performance over time.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

100%(1)100% found this document useful (1 vote)

117 views5 pagesFAR Acc111 Week 1-3 Definition Reviewer

FAR Acc111 Week 1-3 Definition Reviewer

Uploaded by

RIJANE MAE EMPLEOAccounting involves identifying, measuring, and communicating financial information about economic entities. It is defined by various accounting bodies as a system that provides useful quantitative information for decision making. Accounting identifies transactions as accountable or non-accountable events and measures them according to generally accepted accounting principles (GAAP). It also communicates this financial information through periodic financial statements to allow users to evaluate business performance over time.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 5

FAR Acc111

Terms and Definition (Theoretical)

Identifying the phase of accounting where transactions are

analyzed whether accountable or non-accountable

events.

Definition of Accounting

ASC (Accounting Accounting is a service activity,

Standard Council) financial in nature that provides quantitative

information about economic entities

intended to useful in making economic decisions.

FASB(Financial Accounting is an information

Accounting Standards system that measures, processes and

Board) communicates financial information about

economic entity

AICPA (American Accounting is the process of

Institute of CPAs) identifying, measuring and communication

economic information to permit informed

judgments and decision by users of the information.

AICPA (oldest definition Accounting is an art of

of accounting) recording, classifying, and summarizing in a

significant manner and in terms of money,

transactions and events which are, in part at least,

of a financial in character, and

interpreting the results thereof.

Accounting an information system that measures, processes

and communicates financial information about an

economic entity.

Types of Business Activity

Financing activity Company ABC obtained loan from Metrobank

company to finance plant expansion.

Mr. Reyes invested cash into his business to

engage in repair shop

Operating Activity Collected the accounts of the customer and

payment of account to supplier

Returned of defective items to the supplier

Paid salaries and taxes of the business

Investing activity Constructed a building for the factory

External Auditing It is an independent examination that ensures the

fairness and reliability of the reports that

management submits to users.

ASEAN An organization in Asia that envisioned a stable,

prosperous and highly competitive economic region

Code of Hammurabi An ancient law that requires merchants to give

buyers a sealed memorandum containing the

agreed price (in the present times this is the BIR

Code)

Scribe The accountant of primitive age

Amatino Manucci Invented the double-entry bookkeeping

Frater Luca Father of Accounting

Industrial Revolution Stage It is during this time where Corporations were

established and the factory system was used to

create products

Entities

Micro Entities Group of businessmen whose assets is P3m or less

Small Entities This refers to enterprises with assets of above P3.0

to P15Million and employ 10 to 99 workers.

Medium Entity Enterprises with assets of above P15Million to

P100Million and

employ 100 to 199 workers.

Materiality an accounting principle which states that omitting or

misstating this information could influence users of

the financial statements

Consistency An accounting principle that states that similar items

should receive a similar accounting treatment

Accounting changes are often made and the

monetary impact is reflected in the financial

statements of a company

Separate Entity Concept accounting concept that should be considered when

an owner of a business takes goods from inventory

for his personal use

The financial affairs of a firm and its owner are

always kept separate for the purpose of preparing

accounts

Historical Cost This is a principle in accounting that support the

practice of recording an asset based on the amount

actually paid and not what the management thinks

Assets are usually valued here.

Time Period/Periodicity Financial accounting process provides information

Concept about economic activities of an enterprise for a

specified accounting period that is shorter than the

life of the enterprise, this practice

A business which prepares financial statements

every year

Involves dividing the life of a business entity into

accounting periods of equal length thus enabling

the financial users to periodically evaluate the

results of business operations

The financial accounting process provides

information about economic activities of an

enterprise for a specified accounting period that is

shorter than the life of the enterprise.

Private Accounting An accountant employed by a particular business

firm or not-for-profit organization, perhaps as chief

accountant, controller or financial vice president

Forms of Businesses

-Cooperative A business organization is owned by people called

members

-Sole Proprietorship Wendelove sari-sari store buys goods at NCCC

department store and sells these goods in the

neighborhood. The store is owned by Ms.

Wendelove Ceniza.

-Partnership a form of organization whose owners are personally

liable for the debts incurred by the business.

-Corporation a form of business organization whose owners are

not liable for debts of the business.

Type of business organization owned by

shareholders

Form of business organization is characterized by

limited liability

Professional competence and Carrying out professional responsibilities diligently

due care and in accordance with applicable technical and

professional standards

Carrying out professional responsibilities diligently

and in accordance with applicable technical and

professional standard

Integrity A professional accountant should be straightforward

and honest in all professional and business

relationships

FRSC This is an organization whose main function is to

establish and improve accounting standards that

will be GAAP.

The main function is to establish and improve

accounting standards that will be generally

accepted in the Philippines.

Stable monetary unit concept Accountant do not recognize that the value of the

peso changes over time

The financial statements should be stated in terms

of a common financial denominator.

GAAP The set of guidelines and procedures that constitute

acceptable accounting practice at a given time

They encompass the conventions, rules and

procedures necessary to define what is accepted

accounting practice

Accountants should possess General Knowledge

these knowledge Organizational and business knowledge

Accounting knowledge

IT knowledge

Financial Accounting A branch in accounting that concern with the

preparation and publish of complete financial

statements to intended users

General- purpose reports on financial position and

financial performance

Financial Management Area in accounting that is tasked to manage

financial resources of the business

Confidentiality Violation when a CPA without any permission

divulge an information about an entity under audit

This term means that a CPA should not disclosed

information acquired as a result of professional and

business relationships without proper and specific

authority or unless there is a legal or professional

right or duty to disclose.

Adequate An information that is relevant but not captured on

disclosure/completeness the face of the financial statements is normally

reflected in the notes to financial statement

Relevance criteria of GAAP that supports the practice of

preparing financial statements on time so that it can

be used in making a decision

Revenue recognition principle Accrual accounting of income

Expense recognition principle Accrual accounting of expense

Professional Behavior Basic ethical principle requires that CPA must

adhere to relevant laws and regulation and should

avoid acts that discredit the profession

Financial Statements

-Income Statement/ Statement This is a report where the entity’s financial

of Comprehensive Income performance.

Information about the financial performance of an

entity is required in order to assess potential

changes in the economic resources that is likely to

control in the future. This information is primarily

provided in the

-Statement of Financial This is a report where the entity’s financial stability,

Position liquidity and profitability is reflected.

-Statement of Changes in presents a summary of changes in

Equity (SCE) capital such as initial investments of owner,

additional investments of owner,

profit or loss from business operations and

withdrawals of owner during a

specific period.

- Statement of Cash flows presents the cash flows of cash received

(SCF) (Cash inflow) and disbursed (cash outflow) during

the period categorize as

Investing, Financing and Operating Activities.

Management Accounting branch of accounting includes financial and non-

financial data from various sources and utilized it for

specific decision

Bookkeeping This area involves collection of financial data and

entering these data in the books of accounts

This is a branch of accounting which involves a

mechanical task involving the collection of basic

financial data. Bookkeeping is normally involve of

entering data in the books of accounts, classify or

sort the data, extract balances and summarized in

the form of SPF and SCI and cash flows.

Accrual Basis An assumption which recognizes income when

earned and expenses when incurred

Going Concern The ability of an entity to continue in operation for

the foreseeable future

The concept assumes that the business has an

indefinite economic life.

Managerial Accounting Developing accounting information for use within an

entity

Cost Principle The records of properties acquired and services

availed of by a business

Financial Accounting Area of accounting are generally accepted

accounting principles primarily relevant

Unit of Measure Stating assets and liabilities and changes in them in

terms of a common financial denominator is a

prerequisite in measuring financial position and

periodic net income.

Intellectual Skill This skill requires that a CPA can demonstrate

analytical, problem solving and critical thinking skills

at all times.

Account Titles

Owner’s Drawing This is temporary account used to record withdrawal of

cash or other assets made by the owner of the entity

Interest expense Used to record the interest on borrowed funds and also

called finance charges

Doubtful Accounts Account title used to record the estimated amount of

receivables that is doubtful of collection and is charged

to expense during an accounting period.

Prepaid Salaries This is the account title used for the salaries and wages

of employees that has remained unpaid at the end of

the reporting period.

Cash Used for unrestricted cash on hand, cash in bank

(those deposited in banks in savings, or demand

deposits and fund for current purpose such as petty

cash fund and payroll fund

Prepaid Rent Expense This is the account used for rent which is paid in

advance and not yet consumed at the reporting date

PPE Accumulated depreciation-office building

Accumulated interest Liability

Income

Prepaid insurance expense Current Asset

Accrued interest expense Current liability

Accrued interest income asset

Unearned service income Liability

Cost of sales Expense

Wages and compensation G&A

expense

Drawing OE

Accrued rent income TOR

Misc Income Income

Notes receivable TOR

Building SPF

Customer’s deposit SPF

Capital beginning SOCE

Medical fees income IS

Petty cash fund SPF

Accounts payable SPF

Operating cycle the time between the acquisition of assets for

processing and their realization in cash or cash

equivalents. When the entity's normal operating cycle

is not clearly identifiable, it is assumed to be twelve

months.

Asset an economic resource owned or controlled by the entity

as a result of past events

You might also like

- Intermediate Accounting: IFRS Edition: Dedicated ToDocument62 pagesIntermediate Accounting: IFRS Edition: Dedicated ToBos Kedok100% (8)

- Test Bank For Advanced Accounting 7th Edition Debra C Jeter Paul K ChaneyDocument3 pagesTest Bank For Advanced Accounting 7th Edition Debra C Jeter Paul K ChaneyNathan Cook100% (40)

- Ge 4 - Examination Answer SheetDocument1 pageGe 4 - Examination Answer SheetNicole Joy FidelesNo ratings yet

- Reflection-Paper Chapter 1 International ManagementDocument2 pagesReflection-Paper Chapter 1 International ManagementJouhara G. San JuanNo ratings yet

- FABM Assignment WS FS P C TB 1Document34 pagesFABM Assignment WS FS P C TB 1memae0044No ratings yet

- Cpa Review School of The Philippines Manila Financial Accounting and Reforting Theory Valix Siy Valix Escala Revised Conceptual FrameworkDocument43 pagesCpa Review School of The Philippines Manila Financial Accounting and Reforting Theory Valix Siy Valix Escala Revised Conceptual FrameworkRichard BorjaNo ratings yet

- PAS 1 With Notes - Pres of FS PDFDocument75 pagesPAS 1 With Notes - Pres of FS PDFFatima Ann GuevarraNo ratings yet

- Final Examination Advice ACC3200 T2 2020 Date of Exam: 11 November 2020 Time: 4 PM - 7 PM (3 Hours) - Part A: Multiple Choice Questions (50 Marks)Document10 pagesFinal Examination Advice ACC3200 T2 2020 Date of Exam: 11 November 2020 Time: 4 PM - 7 PM (3 Hours) - Part A: Multiple Choice Questions (50 Marks)Hariprasad KSNo ratings yet

- ACCBP100 - ULOcdefg Lets Check ActivityDocument2 pagesACCBP100 - ULOcdefg Lets Check ActivityWennonah Vallerie LabeNo ratings yet

- BSMA1 ACC 124 Conceptual Framework and Intermediate Accounting 1 Rev. 1 1st Sem SY 2021 2022Document15 pagesBSMA1 ACC 124 Conceptual Framework and Intermediate Accounting 1 Rev. 1 1st Sem SY 2021 2022Trisha AlmiranteNo ratings yet

- Diaz - Journal EntriesDocument4 pagesDiaz - Journal EntriesPangitkaNo ratings yet

- Merchandising Accounting (Erlinda See Chua)Document1 pageMerchandising Accounting (Erlinda See Chua)Shaira Nicole VasquezNo ratings yet

- Science, Technology, and Society - Outcome-Based Module (E-Book)Document1 pageScience, Technology, and Society - Outcome-Based Module (E-Book)Angel MueñoNo ratings yet

- Set 7Document11 pagesSet 7Gil Diane AlcontinNo ratings yet

- Output Fabm1 Ladera Rhealyn Patan Ao Bsa I PDFDocument9 pagesOutput Fabm1 Ladera Rhealyn Patan Ao Bsa I PDFHaries Vi Traboc Micolob100% (1)

- ACC 124 - Week 1-3 QuizDocument14 pagesACC 124 - Week 1-3 QuizJaneth BarreteNo ratings yet

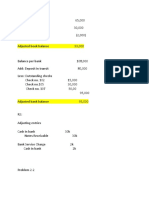

- Bank ReconciliationDocument6 pagesBank Reconciliationclarisse jaramillaNo ratings yet

- Big Picture in Focus: Ulob. Prepare Worksheet and Financial Statements MetalanguageDocument16 pagesBig Picture in Focus: Ulob. Prepare Worksheet and Financial Statements Metalanguageemem resuentoNo ratings yet

- Date Account Titles and Explanation PR Debit Credit: Quiz Module 6Document16 pagesDate Account Titles and Explanation PR Debit Credit: Quiz Module 6fabyunaaaNo ratings yet

- PT BaDocument18 pagesPT BaJasmine Merthel Masmila ObstaculoNo ratings yet

- ACEFIAR Quiz No. 7Document2 pagesACEFIAR Quiz No. 7Marriel Fate CullanoNo ratings yet

- Foa p1 Module 2 For Bsa & Bsais StudentsDocument64 pagesFoa p1 Module 2 For Bsa & Bsais StudentsMiquel VillamarinNo ratings yet

- Ex 7-AdjustingDocument15 pagesEx 7-AdjustingyeshaNo ratings yet

- Economic Development PRELIM EXAMDocument5 pagesEconomic Development PRELIM EXAMadie2thalesNo ratings yet

- Chapter 5 (Estimation of Doubtful Accounts)Document8 pagesChapter 5 (Estimation of Doubtful Accounts)Joan LeonorNo ratings yet

- ACC 121 Answer Key Account ClassificationDocument10 pagesACC 121 Answer Key Account ClassificationKerby Gail RulonaNo ratings yet

- Accounting Assumptions: Introduction To Basic AccountingDocument6 pagesAccounting Assumptions: Introduction To Basic AccountingJon Nell Laguador Bernardo100% (1)

- This Study Resource WasDocument2 pagesThis Study Resource WasErika Repedro0% (1)

- Output Fabm1 Ladera, Rhealyn Patan-Ao Bsa-IDocument9 pagesOutput Fabm1 Ladera, Rhealyn Patan-Ao Bsa-IRhealyn Patan-ao LaderaNo ratings yet

- Exercise 4Document17 pagesExercise 4LoyalNamanAko LLNo ratings yet

- Supplemental Module 1: Citizen Participation in Election: What Is The Right of Suffrage?Document15 pagesSupplemental Module 1: Citizen Participation in Election: What Is The Right of Suffrage?Toshi CodmNo ratings yet

- Bank Reconciliation PDFDocument3 pagesBank Reconciliation PDFEunjina MoNo ratings yet

- Business Transactions and Worksheet (Froilan Labausa)Document1 pageBusiness Transactions and Worksheet (Froilan Labausa)UnknownNo ratings yet

- Lesson 2 Journal Entries AccountingDocument1 pageLesson 2 Journal Entries AccountingKyle Bueno100% (1)

- NSTP 2 Stewardship StewardshipDocument18 pagesNSTP 2 Stewardship StewardshipLieeeNo ratings yet

- Problem 3 ACCA101Document3 pagesProblem 3 ACCA101Nicole FidelsonNo ratings yet

- Accounting Cycle 1 768 290 Worksheet BSDocument27 pagesAccounting Cycle 1 768 290 Worksheet BSKylene Edelle LeonardoNo ratings yet

- Lapasan, Cagayan de Oro Profile - PhilAtlasDocument4 pagesLapasan, Cagayan de Oro Profile - PhilAtlasJohn Edenson VelonoNo ratings yet

- Assignment Module 5Document2 pagesAssignment Module 5Hazel Jane MejiaNo ratings yet

- RR Diaz 1CED - CW Local and GlobalDocument2 pagesRR Diaz 1CED - CW Local and GlobalJr DiazNo ratings yet

- Worksheet AssignmentDocument2 pagesWorksheet AssignmentLyca MaeNo ratings yet

- AtelengDocument2 pagesAtelengGarp BarrocaNo ratings yet

- Chapter 09Document12 pagesChapter 09Dan ChuaNo ratings yet

- Accounting For A Service CompanyDocument9 pagesAccounting For A Service CompanyAnnie RapanutNo ratings yet

- Arce - Chan Accounting FirmDocument38 pagesArce - Chan Accounting FirmshaneNo ratings yet

- Unadjusted Trial Balance Adjustments Account Titles Debit Credit DebitDocument6 pagesUnadjusted Trial Balance Adjustments Account Titles Debit Credit DebitAllen CarlNo ratings yet

- Foa p1 Module For Bsa & Bsais StudentsDocument41 pagesFoa p1 Module For Bsa & Bsais StudentsMiquel VillamarinNo ratings yet

- Problem 1 Accrual of Interest ExpenseDocument1 pageProblem 1 Accrual of Interest ExpenseJhanin BuenavistaNo ratings yet

- Chapter 1 & 2Document13 pagesChapter 1 & 2Ali100% (1)

- Merchandising ExampleDocument6 pagesMerchandising ExampleMarie Ann JoNo ratings yet

- Department of Accounting Education ACCBP 100 - Course SyllabusDocument13 pagesDepartment of Accounting Education ACCBP 100 - Course SyllabusKristine Joy EbradoNo ratings yet

- Accounting For Merchandising Operation With Special JournalsDocument33 pagesAccounting For Merchandising Operation With Special JournalsJasmine ActaNo ratings yet

- Lesson 3 Activity 06 (Weighing The Market)Document2 pagesLesson 3 Activity 06 (Weighing The Market)Geron Erl Rubia50% (2)

- Causes and Effects of Stronger and Weakened Peso in The Philippine EconomyDocument8 pagesCauses and Effects of Stronger and Weakened Peso in The Philippine EconomyReliza Salva Regana67% (3)

- RBA Chapter 7 PostingDocument10 pagesRBA Chapter 7 PostingReiner GGayNo ratings yet

- Laurente Cleaning Services LedgerDocument3 pagesLaurente Cleaning Services LedgerAriel Palay100% (1)

- Financial Transaction Worksheet, Luca ProblemDocument3 pagesFinancial Transaction Worksheet, Luca ProblemFeiya LiuNo ratings yet

- Chart of Accounts Assets Liabilities Owner'S Equity Income ExpensesDocument2 pagesChart of Accounts Assets Liabilities Owner'S Equity Income ExpensesErika Bucao100% (1)

- Module 2Document4 pagesModule 2Its Nico & SandyNo ratings yet

- 02 Lesson 1 - Introduction To Management ScienceDocument16 pages02 Lesson 1 - Introduction To Management ScienceHoney MayNo ratings yet

- Group B Teresita Buenaflor ShoesDocument38 pagesGroup B Teresita Buenaflor ShoesAlexandrea San Buenaventura BaayNo ratings yet

- CONTEMPO - SHIT Converted 1Document12 pagesCONTEMPO - SHIT Converted 1Joshua LimbagaNo ratings yet

- Adjusting Entries Asnwer Key - in A NutshellDocument9 pagesAdjusting Entries Asnwer Key - in A NutshellKimberly G. EtangNo ratings yet

- Fundamentals of AccountingDocument26 pagesFundamentals of AccountingSofia Naraine OnilongoNo ratings yet

- Cyberlibel.17 EssayDocument2 pagesCyberlibel.17 EssayRIJANE MAE EMPLEONo ratings yet

- Langugae 6Document21 pagesLangugae 6RIJANE MAE EMPLEONo ratings yet

- Case Studies EntrepDocument2 pagesCase Studies EntrepRIJANE MAE EMPLEONo ratings yet

- Eapp Activity 2Document2 pagesEapp Activity 2RIJANE MAE EMPLEONo ratings yet

- Talk Together:: One Reason Is It Can Cause Us To Wrongly Interpret What Is Happening in Another Person's LifeDocument2 pagesTalk Together:: One Reason Is It Can Cause Us To Wrongly Interpret What Is Happening in Another Person's LifeRIJANE MAE EMPLEONo ratings yet

- Compare and ContrastDocument2 pagesCompare and ContrastRIJANE MAE EMPLEONo ratings yet

- Jonah 3:1-10 3 Then The Word of The Lord Came To Jonah A Second Time: 2 "Go ToDocument5 pagesJonah 3:1-10 3 Then The Word of The Lord Came To Jonah A Second Time: 2 "Go ToRIJANE MAE EMPLEONo ratings yet

- Empleo, Joanna Grace M.: Certificate of ParticipationDocument7 pagesEmpleo, Joanna Grace M.: Certificate of ParticipationRIJANE MAE EMPLEONo ratings yet

- 1 Camacop Smd-Virtual VBS: PartnersDocument18 pages1 Camacop Smd-Virtual VBS: PartnersRIJANE MAE EMPLEONo ratings yet

- Camacop Stewardship Management: 1. The Local Church Is The Basic Ministry Unit of CAMACOP Administered by TheDocument4 pagesCamacop Stewardship Management: 1. The Local Church Is The Basic Ministry Unit of CAMACOP Administered by TheRIJANE MAE EMPLEONo ratings yet

- GE2 Week 6Document6 pagesGE2 Week 6RIJANE MAE EMPLEONo ratings yet

- Short Answer Questions: 1. in Your Opinion Can Accounting Be Value Free'? ExplainDocument13 pagesShort Answer Questions: 1. in Your Opinion Can Accounting Be Value Free'? ExplainQiangmei TianNo ratings yet

- Working Capital at Zuari Cement: Working Capital Management Is One of The Key Areas of Financial DecisionDocument5 pagesWorking Capital at Zuari Cement: Working Capital Management Is One of The Key Areas of Financial DecisionVardhan BujjiNo ratings yet

- Acww Funding Guidelines (Pre Application Information) 2017Document5 pagesAcww Funding Guidelines (Pre Application Information) 2017Hunu-boafo Senyo-innocentNo ratings yet

- A Study On Financial Statement Analysis in Tirumala Milk Products Pvt. LTD., PalamanerDocument7 pagesA Study On Financial Statement Analysis in Tirumala Milk Products Pvt. LTD., Palamanersree anugraphicsNo ratings yet

- Fundamentals of Accounting 1Document241 pagesFundamentals of Accounting 1kedge100% (2)

- Chap 003Document89 pagesChap 003kwathom1100% (2)

- Financial Statements: Business InsightDocument25 pagesFinancial Statements: Business InsightRF EnggNo ratings yet

- National University MBA Regulations & Syllabus (Final-2019)Document45 pagesNational University MBA Regulations & Syllabus (Final-2019)Md Rakibul AzadNo ratings yet

- Understanding Financial StatementsDocument36 pagesUnderstanding Financial StatementsDurga PrasadNo ratings yet

- Trend AnlysisDocument7 pagesTrend AnlysisPradnya HingeNo ratings yet

- Pre-Assessment Test For Auditing TheoryDocument13 pagesPre-Assessment Test For Auditing TheoryPrecious mae BarrientosNo ratings yet

- Hilton6e SM08Document70 pagesHilton6e SM08Eych MendozaNo ratings yet

- BALIC Annual ReportDocument143 pagesBALIC Annual ReportGopal Krishan MithraniNo ratings yet

- Chapter 1 DraftDocument10 pagesChapter 1 DraftAndrew Miguel SantosNo ratings yet

- en1599740610-PRACTICING BY LAWS 2017Document11 pagesen1599740610-PRACTICING BY LAWS 2017Gregory MabinaNo ratings yet

- Standard Chart of AccountsDocument20 pagesStandard Chart of Accountshungryniceties100% (1)

- Financial Accounting 2A Test MemoDocument9 pagesFinancial Accounting 2A Test MemoMapsipiexNo ratings yet

- ch03, Accounting PrinciplesDocument78 pagesch03, Accounting PrinciplesH.R. Robin100% (2)

- Fundamentals of Accounting IDocument213 pagesFundamentals of Accounting IBereket Desalegn100% (3)

- Aleksa Santic Aleksa Santic JSCDocument16 pagesAleksa Santic Aleksa Santic JSCzeljko_shredNo ratings yet

- Expand Your Critical ThinkingDocument5 pagesExpand Your Critical ThinkingISLAM KHALED ZSCNo ratings yet

- Business Planning 1: (BP-1) Introduction To The Business PlanDocument26 pagesBusiness Planning 1: (BP-1) Introduction To The Business PlanwhingchayNo ratings yet

- Accounting Standard ResumeDocument7 pagesAccounting Standard ResumeIvana YustitiaNo ratings yet

- Risk of Material Misstatement - How To AssessDocument6 pagesRisk of Material Misstatement - How To AssessKenny Christony NugrohoNo ratings yet

- 1 Chapter One Govt and NFPDocument27 pages1 Chapter One Govt and NFPantex nebyu100% (1)