Professional Documents

Culture Documents

M/S. M/S. Sai Internet and Services

M/S. M/S. Sai Internet and Services

Uploaded by

Akhil JamadarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

M/S. M/S. Sai Internet and Services

M/S. M/S. Sai Internet and Services

Uploaded by

Akhil JamadarCopyright:

Available Formats

M/s. M/S.

SAI INTERNET AND SERVICES

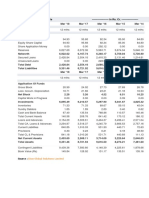

PROJECTIONS OF PROFITABILITY STATEMENT

RUPEES IN LAKHS

YEARS

S.NO PARTICULARS 2019 2020 2021 2022 2022

GROSS INCOME

1 13.10 14.04 14.97 15.91 16.84

Gross Receipts

TOTAL 13.10 14.04 14.97 15.91 16.84

2 EXPENDITURE

Purchases & Consumables 1.95 2.09 2.23 2.37 2.51

Salary A/c 0.96 1.03 1.10 1.17 1.23

Electricity Charges 0.22 0.24 0.25 0.27 0.28

Repairs & Maintainance 0.42 0.45 0.48 0.51 0.54

Sundry Expenses 0.32 0.34 0.37 0.39 0.41

Rent 0.60 0.64 0.69 0.73 0.77

Other Expenses 0.36 0.39 0.41 0.44 0.46

TOTAL 4.83 5.18 5.52 5.87 6.21

3 FINANCIAL CHARGES

Interest on Term Loan 1.68 1.34 1.01 0.67 0.34

Int. Working Cap Loan 0.00 0.00 0.00 0.00 0.00

1.68 1.34 1.01 0.67 0.34

4 SELLING & DIST'N EXPENSES

Sales Promotion Expenses 0.15 0.16 0.17 0.18 0.19

5 DEPRECIATION 1.87 1.60 1.37 1.17 1.00

TOTAL (2+3+4+5) 8.53 8.28 8.07 7.89 7.74

NET PROFIT B/F TAX 4.57 5.76 6.90 8.02 9.10

INCOME TAX 0.08 0.12 0.20 0.25 0.32

PROFIT AFTER TAX 4.49 5.64 6.70 7.77 8.78

M/s. M/S. SAI INTERNET AND SERVICES

PROJECTED CASH FLOW/ FUNDFLOW STATEMENT

RUPEES IN LAKHS

YEARS

S.NO PARTICULARS 2019 2020 2021 2022 2022

1 SOURCES OF FUNDS

a Net Profit before Tax 4.57 5.76 6.90 8.02 9.10

b Depreciation 1.87 1.60 1.37 1.17 1.00

c Own Contribution 1.00

d Bank Loans

Term Loan 12.00

Working Capital Loan 0.00

e Sundry Creditors 0.42 0.45 0.48 0.51 0.54

TOTAL (A) 19.86 7.81 8.75 9.70 10.64

2 APPLICATION OF FUNDS

Capital Expenditure 13.00 0.00 0.00 0.00 0.00

Term Loan Repayment 2.40 2.40 2.40 2.40 2.40

Increase in Stock 0.15 0.02 0.02 0.02 0.02

Increase in Debtors 0.15 0.02 0.02 0.02 0.02

Income Tax 0.08 0.12 0.20 0.25 0.32

Drawings 1.30 1.39 1.49 1.58 1.67

Investments 0.00 0.00 0.00 0.00 0.00

TOTAL (B) 17.08 3.94 4.12 4.26 4.43

3 CASH POSITION

Opening Balance 0.00 2.78 6.64 11.28 16.71

Surplus (Total A-B) 2.78 3.86 4.63 5.43 6.21

Closing Balance 2.78 6.64 11.28 16.71 22.92

M/s. M/S. SAI INTERNET AND SERVICES

PROJECTED BALANCE SHEETS

RUPEES IN LAKHS

YEARS

S.NO PARTICULARS 2019 2020 2021 2022 2022

Capital

Opening Balance 0.00 4.19 8.43 13.65 19.84

1

Add: Capital Introduced 1.00 0.00 0.00 0.00 0.00

Net Profit during the year 4.49 5.64 6.70 7.77 8.78

5.49 9.83 15.14 21.42 28.62

Less : Drawings 1.30 1.39 1.49 1.58 1.67

Closing Balance 4.19 8.43 13.65 19.84 26.95

2 Secured Loans

Term Loan 12.00 9.60 7.20 4.80 2.40

Working Capital Loan 0.00 0.00 0.00 0.00 0.00

3 Current Liabilities

Sundry Creditors 0.42 0.45 0.48 0.51 0.54

Income Tax 0.08 0.12 0.20 0.25 0.32

TOTAL 16.69 18.60 21.53 25.40 30.21

1 Assets

Fixed Assets

Gross Block 13.00 11.13 9.53 8.16 6.99

Less : Depreciation 1.87 1.60 1.37 1.17 1.00

Net Block 11.13 9.53 8.16 6.99 5.99

2 Deposits & Investments

Investmets 0.00 0.00 0.00 0.00 0.00

3 Current Assets

Stock in Trade 0.15 0.17 0.18 0.20 0.22

Sundry Debtors 0.15 0.17 0.18 0.20 0.22

Cash & Bank Balance 2.78 6.64 11.28 16.71 22.92

Other Assets 2.48 2.10 1.73 1.30 0.86

TOTAL 16.69 18.60 21.53 25.40 30.21

M/s. M/S. SAI INTERNET AND SERVICES

DEBT & EQUITY

30.00

25.00

20.00

15.00 Debt

Equity

10.00

5.00

0.00

1 2 3 4 5

Debt 12.00 9.60 7.20 4.80 2.40

Equity 4.19 8.43 13.65 19.84 26.95

M/s. M/S. SAI INTERNET AND SERVICES

TERM LOAN REPAYMENT SCHEDULE

1 AMOUNT OF LOAN 12.00 LAKHS

2 RATE OF INTEREST 14%

3 TERM OF LOAN 5 YEARS

YEAR OP. BALANCE INTEREST REPYAMENT CLO. BAL.

1 12.00 1.68 2.40 9.60

2 9.60 1.34 2.40 7.20

3 7.20 1.01 2.40 4.80

4 4.80 0.67 2.40 2.40

5 2.40 0.34 2.40 0.00

1. Machineries & Equipments LAKHS

COST OF AQUISITION 11.22

RATE OF DEPRECIATION 15%

METHOD OF DEPRECIATION WDV

YEAR OPENING BALANCE. DEPR'N CLOSING BALANCE.

1 11.22 1.68 9.54

2 9.54 1.43 8.11

3 8.11 1.22 6.89

4 6.89 1.03 5.86

5 5.86 0.88 4.98

1. FURNITURE & ELECTRIFICATION LAKHS

COST OF AQUISITION 1.88

RATE OF DEPRECIATION 10%

METHOD OF DEPRECIATION WDV

YEAR OPENING BALANCE. DEPR'N CLOSING BALANCE.

1 1.88 0.19 1.69

2 1.69 0.17 1.52

3 1.52 0.15 1.37

4 1.37 0.14 1.23

5 1.23 0.12 1.11

M/s. M/S. SAI INTERNET AND SERVICES

DEBT SERVICE COVERAGE RATION

RUPEES IN LAKHS

YEARS

S.NO PARTICULARS 2019 2020 2021 2022 2022

SOURCES OF FUNDS

a Net Profit After Tax 4.49 5.64 6.70 7.77 8.78

b Depreciation 1.87 1.60 1.37 1.17 1.00

c Bank Interest on Term Loan 1.68 1.34 1.01 0.67 0.34

TOTAL (A) 8.04 8.58 9.08 9.61 10.12

Bank Loans

a Term Loan Instalment 2.40 2.40 2.40 2.40 2.40

b Term Loan Interest 1.68 1.34 1.01 0.67 0.34

TOTAL (B) 4.08 3.74 3.41 3.07 2.74

TOTAL (A/B) 1.97 2.29 2.66 3.13 3.70

13.75

AVERAGE DSCR 2.75

M/s. M/S. SAI INTERNET AND SERVICES

BREAK EVEN POINT

RUPEES IN LAKHS

YEARS

S.NO PARTICULARS 2019 2020 2021 2022 2022

FIXED EXPENSES

a Depreciation 1.87 1.60 1.37 1.17 1.00

c Bank Interest on Term Loan 1.68 1.34 1.01 0.67 0.34

TOTAL (A) 3.55 2.94 2.38 1.84 1.34

VARIABLE COST

a Purchases & Consumables 1.95 2.09 2.23 2.37 2.51

b Salary 0.96 1.03 1.10 1.17 1.23

c Electricity Charges 0.22 0.24 0.25 0.27 0.28

d Repairs & Maint. Machinery 0.42 0.45 0.48 0.51 0.54

e Sundry Expenses 0.32 0.34 0.37 0.39 0.41

f Rent 0.60 0.64 0.69 0.73 0.77

g Other Expenses 0.36 0.39 0.41 0.44 0.46

h Sales Promotion Exp. 0.15 0.16 0.17 0.18 0.19

TOTAL (B) 4.98 4.15 4.42 4.70 4.98

C GROSS RECEIPTS (C) 13.10 14.04 14.97 15.91 16.84

D CONTRIBUTION (C-B) 8.12 9.89 10.55 11.21 11.87

E B.E.P (D/C ) 0.62 0.70 0.70 0.70 0.70

3.44

F AVERAGE B.E.P 0.69

G B.E.P SALES 7.86 8.14 7.79 7.48 7.07

38.34

E AVERAGE B.E.P SALES 7.67

M/s. M/S. SAI INTERNET AND SERVICES

NOTES FORMING PART OF THE PROJECT REPORT.

1. PROJECTIONS OF SALES

Estimated Gross Receipts from Sales

shall be Rs.13.10Lakhs during the first year of Operation and Rs. 14.04 Lakhs, Rs. 14.97 Lakhs Rs. 15.91

Lakhs and Rs. 16.84 Lakhs for subsequent Years.

2. DEPRECIATION

Depreciation is provided at the rate of 15% on on Macheries & Equipments & 10 % on Furnitures.

& fixtures.

3. INCOME TAX

Income tax is provided on the applicable rate for the Asst. Year 2019-2020

4. TERM LOAN REPAYMENT

Interest rate calculated at 14%.

Repayment of loan on monthly installments basis.

6. ESTIMATED COST OF RAW MATERIALS & CONSUMABLES

Estimated cost of materials shall be 1.95 Lakhs during the first year of

Operation , Rs. 2.09 Lakhs, Rs.2.23 Lakhs, Rs. 2.37 Lakhs and Rs 2.51 Lakhs for the subsequent years.

7. STATEMENT OF NET CURRENT ASSETS.

PARTICULARS 2019 2020 2021 2022 2022

Stock in Trade 0.15 0.17 0.18 0.20 0.22

Sundry Debtors 0.15 0.17 0.18 0.20 0.22

Cash & Bank Balance 2.78 6.64 11.28 16.71 22.92

Other Current Assets 2.48 2.10 1.73 1.30 0.86

Investments 0.00 0.00 0.00 0.00 0.00

TOTAL 5.56 6.97 11.64 17.11 23.36

Sundry Creditors 0.42 0.45 0.48 0.51 0.54

Income Tax 0.08 0.12 0.20 0.25 0.32

TOTAL 0.50 0.57 0.68 0.76 0.86

NET CURRENT ASSETS 5.06 6.40 10.96 16.35 22.50

You might also like

- Reviewer Oblicon 1156 1304Document62 pagesReviewer Oblicon 1156 1304Jeff Cabalang100% (13)

- Financial Statements and Industry Structure, 2007: DescriptionDocument4 pagesFinancial Statements and Industry Structure, 2007: DescriptionFebriyani Tampubolon0% (1)

- Module 1 Homework - MadrazoDocument41 pagesModule 1 Homework - MadrazoJayann Danielle Madrazo80% (5)

- Consumer Reports - December 2020Document66 pagesConsumer Reports - December 2020lcfNo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (2)

- ACCA Strategic Business Reporting (SBR) Achievement Ladder Step 8 Questions & AnswersDocument22 pagesACCA Strategic Business Reporting (SBR) Achievement Ladder Step 8 Questions & AnswersAdam MNo ratings yet

- AhujaDocument7 pagesAhujaShashikant Pandit RajnikantNo ratings yet

- Basis and Presumption of The ProjectDocument11 pagesBasis and Presumption of The ProjectVijay HemwaniNo ratings yet

- CMADocument12 pagesCMADhruv ChandwaniNo ratings yet

- Project Report - RAJESHWARDocument17 pagesProject Report - RAJESHWARVIRAT SAXENANo ratings yet

- Cma DataDocument9 pagesCma Datapk9079885245No ratings yet

- Rdy Mad e Pmegp 10 LacsDocument13 pagesRdy Mad e Pmegp 10 LacssyedNo ratings yet

- Project ReportDocument5 pagesProject ReportHarshit ChiraniaNo ratings yet

- ProjectDocument5 pagesProjectHarshit ChiraniaNo ratings yet

- Sagar CementsDocument33 pagesSagar Cementssarbjeetk21No ratings yet

- Cost of Project & Means of Finance Annexure-1Document12 pagesCost of Project & Means of Finance Annexure-1Siddharth RanaNo ratings yet

- RP Infra Cma ReportDocument12 pagesRP Infra Cma ReportJitendra NikhareNo ratings yet

- Financial Projections (Part 3)Document7 pagesFinancial Projections (Part 3)Mohit JainNo ratings yet

- Financial Projections (Part 3)Document7 pagesFinancial Projections (Part 3)Mohit JainNo ratings yet

- Chappan Bhog 26.11.2018Document6 pagesChappan Bhog 26.11.2018PRAHARSHITANo ratings yet

- Particulars Upto To Be Incurred Total Amount Rs. Amount Rs. Amount Rs. I Cost of ProjectDocument11 pagesParticulars Upto To Be Incurred Total Amount Rs. Amount Rs. Amount Rs. I Cost of ProjectAnand H LuharNo ratings yet

- Particulars Year 1 Year 2 Year 3Document6 pagesParticulars Year 1 Year 2 Year 3Kuljeet SinghNo ratings yet

- Rafeeqa Begum (DPR)Document13 pagesRafeeqa Begum (DPR)syedNo ratings yet

- Candle Project Report6Document6 pagesCandle Project Report6arshaNo ratings yet

- Final ProjectionsDocument6 pagesFinal ProjectionsMohit JainNo ratings yet

- SHABNAMKHANDocument20 pagesSHABNAMKHANVijay HemwaniNo ratings yet

- Financials SaharaDocument19 pagesFinancials SaharaJitendra NikhareNo ratings yet

- Balance Sheet - in Rs. Cr.Document3 pagesBalance Sheet - in Rs. Cr.jelsiya100% (1)

- Balance Sheet of Empee DistilleriesDocument4 pagesBalance Sheet of Empee DistilleriesArun PandiyanNo ratings yet

- SultanaDocument12 pagesSultanaMAHAVEER SOLUTIONNo ratings yet

- Project ReportDocument8 pagesProject Reportsukhdev bhattarNo ratings yet

- Balance Sheet of Indiabulls - in Rs. Cr.Document3 pagesBalance Sheet of Indiabulls - in Rs. Cr.MubeenNo ratings yet

- Accounting For ManagementDocument26 pagesAccounting For Managementdheivayani kNo ratings yet

- Three Statement Model (Beauty of Our FM - ADF) - CompletedDocument9 pagesThree Statement Model (Beauty of Our FM - ADF) - CompletedAnkit SharmaNo ratings yet

- Balance Sheet (In Crores) - MSN LABORATARIESDocument3 pagesBalance Sheet (In Crores) - MSN LABORATARIESnawazNo ratings yet

- Balance Sheet: StandaloneDocument9 pagesBalance Sheet: StandaloneKabita BuragohainNo ratings yet

- DPR Shuttering MixerDocument17 pagesDPR Shuttering MixersyedNo ratings yet

- FSA-Case Study QuestionDocument2 pagesFSA-Case Study QuestionaKSHAT sHARMANo ratings yet

- Group 1 Adani PortsDocument12 pagesGroup 1 Adani PortsshreechaNo ratings yet

- Al Fajar Ply Board Factory OrgDocument22 pagesAl Fajar Ply Board Factory OrgFINAC GROUPNo ratings yet

- Rdy Mad e Pmegp 5lacsDocument12 pagesRdy Mad e Pmegp 5lacssyedNo ratings yet

- Project Report Hatwal JiDocument14 pagesProject Report Hatwal JiCA Manoj BoraNo ratings yet

- KMC Balance Sheet Stand Alone NewDocument2 pagesKMC Balance Sheet Stand Alone NewOmkar GadeNo ratings yet

- FINACIALDocument1 pageFINACIALPrakash GuptaNo ratings yet

- Ahmed Abd ElmoneimDocument13 pagesAhmed Abd Elmoneimmohamed ashorNo ratings yet

- Annexure III IVDocument9 pagesAnnexure III IVADVISE WISENo ratings yet

- ECG Canara Bank Term Loan - 5 LakhsDocument11 pagesECG Canara Bank Term Loan - 5 Lakhsanil kumar thota AssociatesNo ratings yet

- ULTJ 2022 AUDIT - PJLSN Prbhan LBH DR 20persenDocument3 pagesULTJ 2022 AUDIT - PJLSN Prbhan LBH DR 20persenzhugeNo ratings yet

- CRDocument19 pagesCRVijay HemwaniNo ratings yet

- Arvind - Profit & Loss Account - Textiles - Denim - Profit & Loss Account of Arvind - BSE - 500101, NSE - ARVINDDocument2 pagesArvind - Profit & Loss Account - Textiles - Denim - Profit & Loss Account of Arvind - BSE - 500101, NSE - ARVINDAjay CharlesNo ratings yet

- Common Size Balance Sheet: Equity and LiabilityDocument6 pagesCommon Size Balance Sheet: Equity and LiabilityAbimanyu ShenilNo ratings yet

- WC 4.5 TL .50 WalnutDocument13 pagesWC 4.5 TL .50 WalnutsyedNo ratings yet

- SGMEDICOSEDocument12 pagesSGMEDICOSEVijay HemwaniNo ratings yet

- Income Latest: Financials (Standalone)Document3 pagesIncome Latest: Financials (Standalone)Vishwavijay ThakurNo ratings yet

- Sambal Owner of ZeeDocument2 pagesSambal Owner of Zeesagar naikNo ratings yet

- Profit & Loss: Mar 10E Mar 11E Mar 12EDocument15 pagesProfit & Loss: Mar 10E Mar 11E Mar 12Ebhavesh_mankani7373No ratings yet

- Financial Analysis of NBFCDocument14 pagesFinancial Analysis of NBFCPKNo ratings yet

- Apollo Hospitals Enterprise LimitedDocument4 pagesApollo Hospitals Enterprise Limitedpaigesh1No ratings yet

- Profit and Loss: Rs. CR IncomeDocument2 pagesProfit and Loss: Rs. CR IncomeRavi KumarNo ratings yet

- Annexure IIDocument1 pageAnnexure IIsreedev sureshbabuNo ratings yet

- Balance SheeetDocument3 pagesBalance SheeetHiren VagadiyaNo ratings yet

- Eicher Motors BSDocument2 pagesEicher Motors BSVaishnav SunilNo ratings yet

- ABB India: PrintDocument2 pagesABB India: PrintAbhay Kumar SinghNo ratings yet

- Solution To Mini Case (SAPM)Document8 pagesSolution To Mini Case (SAPM)Snigdha IndurtiNo ratings yet

- Module 4 - Credit, Its Uses, Classifications and Risks PDFDocument17 pagesModule 4 - Credit, Its Uses, Classifications and Risks PDFRodel Novesteras Claus0% (1)

- ACC203 Summary 2Document45 pagesACC203 Summary 2patriciajacob211No ratings yet

- Sps. Juico vs. China Banking CorporationDocument1 pageSps. Juico vs. China Banking CorporationVian O.No ratings yet

- Current Issue Assgn 1 and 4Document11 pagesCurrent Issue Assgn 1 and 4Sathys Waran JaganathanNo ratings yet

- PartnershipDocument18 pagesPartnershipMary Rica DublonNo ratings yet

- Thesis On Cash Flow ManagementDocument6 pagesThesis On Cash Flow Managementpamelacalusonewark100% (2)

- VAT Administration and Overseas AspectDocument21 pagesVAT Administration and Overseas AspectashfaqNo ratings yet

- T6Q RCA22020 Business IncomeDocument2 pagesT6Q RCA22020 Business IncomeHaananth SubramaniamNo ratings yet

- Kirloskar Pneumatic Co-Ltd 505283 D 10 Rs.531.2 Rs. 563/348: Stock DataDocument5 pagesKirloskar Pneumatic Co-Ltd 505283 D 10 Rs.531.2 Rs. 563/348: Stock DataForceFieldNo ratings yet

- Numerical On Credit RiskDocument4 pagesNumerical On Credit RiskLeo SaimNo ratings yet

- Lat TakeDocument8 pagesLat TakeCamila Gail GumbanNo ratings yet

- Accounting For Banking Institutions: February 2020Document46 pagesAccounting For Banking Institutions: February 2020Folegwe FolegweNo ratings yet

- MBAT 401 - Project Management - Unit-3 Part 1Document32 pagesMBAT 401 - Project Management - Unit-3 Part 1Sheikh IrfanNo ratings yet

- UNIT 4 Class Problems Chapter 6Document11 pagesUNIT 4 Class Problems Chapter 6eduland2004No ratings yet

- Revised Corporation Code of The Philippines Sec. 1-3Document2 pagesRevised Corporation Code of The Philippines Sec. 1-3Nicki Lyn Dela Cruz100% (1)

- Intermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldDocument76 pagesIntermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldĐức Huy100% (1)

- J 2014 SCC OnLine Bom 309 2014 2 Bom CR 769 2014 3 A Library2 Duaassociatescom 20200825 183421 1 12Document12 pagesJ 2014 SCC OnLine Bom 309 2014 2 Bom CR 769 2014 3 A Library2 Duaassociatescom 20200825 183421 1 12aridaman raghuvanshiNo ratings yet

- Bank ReconciliationAND - FsanalysisDocument14 pagesBank ReconciliationAND - FsanalysisElixirNo ratings yet

- Intermediate Accounting - ReviewerDocument29 pagesIntermediate Accounting - ReviewerEthelyn Cailly R. ChenNo ratings yet

- Promissory Note Ver 1.2 2021 With VersionDocument2 pagesPromissory Note Ver 1.2 2021 With Versionlilibeth padernaNo ratings yet

- Account Opening Form - Gilanis Distributors LTD UpdatedDocument6 pagesAccount Opening Form - Gilanis Distributors LTD UpdatedkevinNo ratings yet

- Divorce Papers 1Document5 pagesDivorce Papers 1Abdelaziz SultanNo ratings yet

- Government Accounting: Accounting For Non-Profit OrganizationsDocument22 pagesGovernment Accounting: Accounting For Non-Profit OrganizationsHazel Kaye Espelita67% (3)

- SBR 2020-21 MCQ Progress Test 2 AnswersDocument11 pagesSBR 2020-21 MCQ Progress Test 2 AnswersA JamelNo ratings yet

- Long-Term Liabilities: True-FalseDocument43 pagesLong-Term Liabilities: True-Falsespur iousNo ratings yet

- Multiple Choice Questions 1 Halifax Corporation Has A December 31 FiscalDocument1 pageMultiple Choice Questions 1 Halifax Corporation Has A December 31 FiscalLet's Talk With HassanNo ratings yet