Professional Documents

Culture Documents

AP 004 D.1 Audit If Investments Prob. 1

AP 004 D.1 Audit If Investments Prob. 1

Uploaded by

Loid Gumera LenchicoCopyright:

Available Formats

You might also like

- Statement of Financial Position Basic Problems Problem 1-1 (IFRS)Document18 pagesStatement of Financial Position Basic Problems Problem 1-1 (IFRS)student80% (5)

- Chapter 1 - Statement of Financial Position: Problem 1-1 (IFRS)Document38 pagesChapter 1 - Statement of Financial Position: Problem 1-1 (IFRS)Asi Cas Jav0% (1)

- Aguilan: Question No. 1 Answer BDocument82 pagesAguilan: Question No. 1 Answer BAnn Margarette Boco75% (4)

- 01 - FS AnalysisDocument17 pages01 - FS AnalysisRyzel Borja0% (1)

- Module 2: Corporate Liquidation: Integrated Review Ii: Advanced Financial Accounting and ReportingDocument4 pagesModule 2: Corporate Liquidation: Integrated Review Ii: Advanced Financial Accounting and ReportingDarren Joy CoronaNo ratings yet

- Martinez, Althea E. Bsais 1-A (Far - Activity #4)Document4 pagesMartinez, Althea E. Bsais 1-A (Far - Activity #4)Althea Escarpe MartinezNo ratings yet

- Chapter 4 IntaccDocument5 pagesChapter 4 IntaccJaneth Tamayo NavalesNo ratings yet

- Batch 19 2nd Preboard (P1)Document10 pagesBatch 19 2nd Preboard (P1)Jericho PedragosaNo ratings yet

- ACCTG 028 - MOD 5 Corporate LiquidationDocument4 pagesACCTG 028 - MOD 5 Corporate LiquidationAlliah Nicole RamosNo ratings yet

- Unit 4 Accounting For Investments: Topic 5 - Investment in PropertyDocument7 pagesUnit 4 Accounting For Investments: Topic 5 - Investment in PropertyRey HandumonNo ratings yet

- 2016 Vol 1 CH 8 AnswersDocument7 pages2016 Vol 1 CH 8 AnswersIsla PageNo ratings yet

- Mercader Cherry May LDocument8 pagesMercader Cherry May LKindred WolfeNo ratings yet

- Comprehensive Exercises On Equity InvestmentquestionaireDocument4 pagesComprehensive Exercises On Equity InvestmentquestionaireLilian LagrimasNo ratings yet

- BAM031 P3 Q2 CorporationsDocument26 pagesBAM031 P3 Q2 CorporationsMary Lyn DatuinNo ratings yet

- Revaluation Model, Impairment Loss, and Cash Generating UnitDocument6 pagesRevaluation Model, Impairment Loss, and Cash Generating UnitKlariza Paula Ng HuaNo ratings yet

- ABC CH1 SeatworkDocument3 pagesABC CH1 SeatworkMaurice AgbayaniNo ratings yet

- Chapter 15Document9 pagesChapter 15Coleen Joy Sebastian PagalingNo ratings yet

- Acctg 100C 25 PDFDocument2 pagesAcctg 100C 25 PDFQuid DamityNo ratings yet

- Pract 1 - Exam2Document2 pagesPract 1 - Exam2Sharmaine Rivera MiguelNo ratings yet

- Business CombinationDocument1 pageBusiness CombinationNicki Salcedo0% (2)

- Quiz in Investment AnswersDocument7 pagesQuiz in Investment AnswersLenny Ramos VillafuerteNo ratings yet

- Quiz in Investment AnswersDocument7 pagesQuiz in Investment AnswersElaine Fiona Villafuerte100% (1)

- Cfas Pfa 01Document194 pagesCfas Pfa 01Kimberly Claire Atienza100% (1)

- PDF 1st Long Quiz With Answers - CompressDocument5 pagesPDF 1st Long Quiz With Answers - CompressShaneen AdorableNo ratings yet

- Master Questions, Advance Level Questions and Additional Questions-Chapter 4Document18 pagesMaster Questions, Advance Level Questions and Additional Questions-Chapter 4manmeet0001No ratings yet

- Buscom 3Document4 pagesBuscom 3dmangiginNo ratings yet

- Accounting 1 FinalsDocument5 pagesAccounting 1 FinalsJohn Rey Bantay RodriguezNo ratings yet

- Problems Chapter 6-10Document15 pagesProblems Chapter 6-10u got no jams0% (1)

- AA 4101 Midterm With AnswersDocument9 pagesAA 4101 Midterm With AnswersAlyssa AnnNo ratings yet

- 01 02. Capital GainsDocument4 pages01 02. Capital GainscamellNo ratings yet

- Financial Accounting Reviewer - Chapter 64Document11 pagesFinancial Accounting Reviewer - Chapter 64Coursehero PremiumNo ratings yet

- Cpa Review School of The Philippines ManilaDocument3 pagesCpa Review School of The Philippines ManilaAljur SalamedaNo ratings yet

- Baf2104 Financial Management CatDocument4 pagesBaf2104 Financial Management Catcyrus100% (1)

- Sol. Man. - Chapter 20 - Investment Property - Ia Part 1bDocument7 pagesSol. Man. - Chapter 20 - Investment Property - Ia Part 1bMiguel AmihanNo ratings yet

- ACC3201Document6 pagesACC3201natlyhNo ratings yet

- Solutions-IAS 40Document7 pagesSolutions-IAS 40Blitz KaizerNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaJustine CruzNo ratings yet

- Chapter22 BuenaventuraDocument4 pagesChapter22 BuenaventuraAnonnNo ratings yet

- CFASDocument4 pagesCFASAlyssa Janette SantosNo ratings yet

- Chapter 20 - Teacher's Manual - Far Part 1BDocument8 pagesChapter 20 - Teacher's Manual - Far Part 1BPacifico HernandezNo ratings yet

- Inventories, Investments, Intangibles, & Property, Plant and Equipment - Quiz MaterialDocument5 pagesInventories, Investments, Intangibles, & Property, Plant and Equipment - Quiz MaterialMimiNo ratings yet

- Chap 14 1-2Document4 pagesChap 14 1-2Buenaventura, Lara Jane T.No ratings yet

- BusCom Seatwork - 05 15 2021Document4 pagesBusCom Seatwork - 05 15 2021Joshua UmaliNo ratings yet

- Statement of Financial Position Basic Problems Problem 1-1 (IFRS)Document18 pagesStatement of Financial Position Basic Problems Problem 1-1 (IFRS)Marjorie PalmaNo ratings yet

- Question 75: Basic Consolidation: Profit For The Year 9,000 3,000Document5 pagesQuestion 75: Basic Consolidation: Profit For The Year 9,000 3,000Lidya Abera100% (1)

- Business Combination Exercises StudentDocument7 pagesBusiness Combination Exercises StudentDenise RoqueNo ratings yet

- Chapter 19 22 With Answer PDFDocument14 pagesChapter 19 22 With Answer PDFEmmanuel AgpasaNo ratings yet

- Ap-Problems - 2015Document20 pagesAp-Problems - 2015jayson100% (1)

- Discussion Problems: FAR.2924-Other Investments OCTOBER 2020Document3 pagesDiscussion Problems: FAR.2924-Other Investments OCTOBER 2020Wynona Balandra0% (1)

- Assignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedDocument10 pagesAssignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedJason MablesNo ratings yet

- Statement of CashflowDocument2 pagesStatement of CashflowAna Marie IllutNo ratings yet

- Exercise 13 Statement of Cash Flows - 054924Document2 pagesExercise 13 Statement of Cash Flows - 054924Hoyo VerseNo ratings yet

- Bus Com Handout 1 Bus CombinationDocument9 pagesBus Com Handout 1 Bus CombinationChristine RepuldaNo ratings yet

- Audit of Financial StatementsDocument4 pagesAudit of Financial StatementsMark Anthony TibuleNo ratings yet

- Far Eastern University - Makati: Discussion ProblemsDocument2 pagesFar Eastern University - Makati: Discussion ProblemsMarielle SidayonNo ratings yet

- PDF May 2017 - CompressDocument7 pagesPDF May 2017 - Compresscasual viewerNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Getting Started in Real Estate Investment TrustsFrom EverandGetting Started in Real Estate Investment TrustsRating: 3 out of 5 stars3/5 (1)

- Lecture - (22 and 23)Document3 pagesLecture - (22 and 23)Raiyan RabbaniNo ratings yet

- Kuliah I Akl 191121Document40 pagesKuliah I Akl 191121tutiNo ratings yet

- Oracle Corporation: Employee Stock Purchase Plan (ESPP)Document4 pagesOracle Corporation: Employee Stock Purchase Plan (ESPP)vijaykotianNo ratings yet

- GoharDocument329 pagesGoharStathis NteskosNo ratings yet

- The 2011 J. P. Morgan Global ETF HandbookDocument48 pagesThe 2011 J. P. Morgan Global ETF HandbooklgfinanceNo ratings yet

- Legal and Taxation AspectsDocument113 pagesLegal and Taxation AspectsMikaNo ratings yet

- Establish and Maintain Cash Based Accounting SystemDocument31 pagesEstablish and Maintain Cash Based Accounting SystemTegene Tesfaye100% (1)

- E - Interim Report 2020Document166 pagesE - Interim Report 2020New KabisaNo ratings yet

- Ratio Analysis: (Ans: Gross Profit: RS, 81, 000, Gross Profit Ratio: 45%)Document55 pagesRatio Analysis: (Ans: Gross Profit: RS, 81, 000, Gross Profit Ratio: 45%)Harika SriNo ratings yet

- 31 Top Finance Cheat Sheets 1693854197Document33 pages31 Top Finance Cheat Sheets 1693854197AyaNo ratings yet

- Tafriq Al Halal 'An Al Haram TheoryDocument17 pagesTafriq Al Halal 'An Al Haram TheoryhasnasafarinaNo ratings yet

- Stock Market Training by WcaDocument2 pagesStock Market Training by WcavsnagarjunreddyNo ratings yet

- Secondary Market: What Is It?Document6 pagesSecondary Market: What Is It?Vaibhav SinghviNo ratings yet

- KVSS 2022 Financial StatementDocument36 pagesKVSS 2022 Financial StatementKristofer PlonaNo ratings yet

- TAX 702 - Income Tax Rates CorporationsDocument6 pagesTAX 702 - Income Tax Rates CorporationsJuan Miguel UngsodNo ratings yet

- The Relevance of Factors Affecting Real Estate Investment DecisionsDocument16 pagesThe Relevance of Factors Affecting Real Estate Investment DecisionsMariaNo ratings yet

- Accounting Ch. 10Document48 pagesAccounting Ch. 10Cheryl LynnNo ratings yet

- UC General Endowment Pool Bond PortfolioDocument62 pagesUC General Endowment Pool Bond PortfolioSpotUsNo ratings yet

- Diluted Earnings Per Share ReportingDocument20 pagesDiluted Earnings Per Share Reportingroaaa0261No ratings yet

- Module 4 Equity SecuritiesDocument82 pagesModule 4 Equity SecuritiesKrazy ButterflyNo ratings yet

- All About Stock Market - Read ItDocument44 pagesAll About Stock Market - Read ItShekhar SumanNo ratings yet

- What Is Synergy?: Why Is There A Large Difference Between Share Value and Stockholders' Equity?Document71 pagesWhat Is Synergy?: Why Is There A Large Difference Between Share Value and Stockholders' Equity?vinodhategirlsNo ratings yet

- 3rd Sem AccountsDocument67 pages3rd Sem Accountsharamilanda2004No ratings yet

- VPlan Infotech PVT - LTDDocument18 pagesVPlan Infotech PVT - LTDVj EnthiranNo ratings yet

- Amin Khan Store Supervisor CVDocument5 pagesAmin Khan Store Supervisor CVArif KhanNo ratings yet

- F249Document4 pagesF249Chura HariNo ratings yet

- Comparative Analysis of Section CA 2013 & CA 1956Document28 pagesComparative Analysis of Section CA 2013 & CA 1956Navneet BatthNo ratings yet

- STMT CASH 001 CAKZ005793 Nov2022Document8 pagesSTMT CASH 001 CAKZ005793 Nov2022Monique GarzaNo ratings yet

- Ms 202301 Business U1Document27 pagesMs 202301 Business U1张查No ratings yet

AP 004 D.1 Audit If Investments Prob. 1

AP 004 D.1 Audit If Investments Prob. 1

Uploaded by

Loid Gumera LenchicoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AP 004 D.1 Audit If Investments Prob. 1

AP 004 D.1 Audit If Investments Prob. 1

Uploaded by

Loid Gumera LenchicoCopyright:

Available Formats

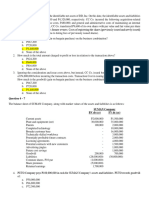

AP-004-C.

1 (Audit of Investments) Problem 1:

You were assigned to audit the ACHIEVEIT Corporation’s list of securities and other assets that may qualify as investment. In

studying the list, you came across a partial list of the accounts and ending account balance taken from the post-closing trial balance

of ACHIEVEIT Corporation on December 31, 2017 and shown as follows:

Transactions Amount

1) Equity securities of another neither company where neither control nor significant

influence exist. The corporation elected to report gains or losses in the

profits/losses P 100,000

2) Equity securities of another neither company where neither control nor significant

influence exist. The corporation elected to report gains or losses in the other

comprehensive income/losses 150,000

3) 20% equity securities of another company quoted in an active market 500,000

4) 51% equity securities of another company quoted in an active market 1,400,000

5) Equity securities of the corporation quoted in an active market reacquired with an

intention of reissuance in latter period for short-term profit

500,000

6) Debt security of another company quoted in an active market. Business model of

the corporation has an objective to hold debt securities for short-term profits

100,000

7) Debt security of another company quoted in an active market. Business model of

the corporation has an objective of collecting contractual cash flows from the

bonds which are primarily in the form of interests and principal

500,000

8) Real property held for resale in the ordinary course of business 500,000

9) Real property held for speculation purposes 700,000

10) Real property held as a current factory site 1,000,000

11) Real property of a manufacturing business being leased out to another party under

operating lease 900,000

12) Land held for undetermined future use 800,000

13) Land held to be used as a future plant site 400,000

14) Real property being developed as an investment property 300,000

Required:

1) Financial asset at fair value through profit or losses?

a) P0 c) P200,000

b) P100,000 d) P500,000

2) Financial asset at fair value through other comprehensive income?

a) P150,000 c) P200,000

b) P180,000 d) P350,000

3) Investment at amortized cost?

a) P0 c) P600,000

b) P500,000 d) P750,000

4) Investment in associate?

a) P0 c) P600,000

b) P500,000 d) P700,000

5) Investment in subsidiary?

a) P0 c) P1,200,000

b) P1,000,000 d) P1,400,000

6) Investment property?

a) P2,400,000 c) P2,800,000

b) P2,700,000 d) P3,100,000

You might also like

- Statement of Financial Position Basic Problems Problem 1-1 (IFRS)Document18 pagesStatement of Financial Position Basic Problems Problem 1-1 (IFRS)student80% (5)

- Chapter 1 - Statement of Financial Position: Problem 1-1 (IFRS)Document38 pagesChapter 1 - Statement of Financial Position: Problem 1-1 (IFRS)Asi Cas Jav0% (1)

- Aguilan: Question No. 1 Answer BDocument82 pagesAguilan: Question No. 1 Answer BAnn Margarette Boco75% (4)

- 01 - FS AnalysisDocument17 pages01 - FS AnalysisRyzel Borja0% (1)

- Module 2: Corporate Liquidation: Integrated Review Ii: Advanced Financial Accounting and ReportingDocument4 pagesModule 2: Corporate Liquidation: Integrated Review Ii: Advanced Financial Accounting and ReportingDarren Joy CoronaNo ratings yet

- Martinez, Althea E. Bsais 1-A (Far - Activity #4)Document4 pagesMartinez, Althea E. Bsais 1-A (Far - Activity #4)Althea Escarpe MartinezNo ratings yet

- Chapter 4 IntaccDocument5 pagesChapter 4 IntaccJaneth Tamayo NavalesNo ratings yet

- Batch 19 2nd Preboard (P1)Document10 pagesBatch 19 2nd Preboard (P1)Jericho PedragosaNo ratings yet

- ACCTG 028 - MOD 5 Corporate LiquidationDocument4 pagesACCTG 028 - MOD 5 Corporate LiquidationAlliah Nicole RamosNo ratings yet

- Unit 4 Accounting For Investments: Topic 5 - Investment in PropertyDocument7 pagesUnit 4 Accounting For Investments: Topic 5 - Investment in PropertyRey HandumonNo ratings yet

- 2016 Vol 1 CH 8 AnswersDocument7 pages2016 Vol 1 CH 8 AnswersIsla PageNo ratings yet

- Mercader Cherry May LDocument8 pagesMercader Cherry May LKindred WolfeNo ratings yet

- Comprehensive Exercises On Equity InvestmentquestionaireDocument4 pagesComprehensive Exercises On Equity InvestmentquestionaireLilian LagrimasNo ratings yet

- BAM031 P3 Q2 CorporationsDocument26 pagesBAM031 P3 Q2 CorporationsMary Lyn DatuinNo ratings yet

- Revaluation Model, Impairment Loss, and Cash Generating UnitDocument6 pagesRevaluation Model, Impairment Loss, and Cash Generating UnitKlariza Paula Ng HuaNo ratings yet

- ABC CH1 SeatworkDocument3 pagesABC CH1 SeatworkMaurice AgbayaniNo ratings yet

- Chapter 15Document9 pagesChapter 15Coleen Joy Sebastian PagalingNo ratings yet

- Acctg 100C 25 PDFDocument2 pagesAcctg 100C 25 PDFQuid DamityNo ratings yet

- Pract 1 - Exam2Document2 pagesPract 1 - Exam2Sharmaine Rivera MiguelNo ratings yet

- Business CombinationDocument1 pageBusiness CombinationNicki Salcedo0% (2)

- Quiz in Investment AnswersDocument7 pagesQuiz in Investment AnswersLenny Ramos VillafuerteNo ratings yet

- Quiz in Investment AnswersDocument7 pagesQuiz in Investment AnswersElaine Fiona Villafuerte100% (1)

- Cfas Pfa 01Document194 pagesCfas Pfa 01Kimberly Claire Atienza100% (1)

- PDF 1st Long Quiz With Answers - CompressDocument5 pagesPDF 1st Long Quiz With Answers - CompressShaneen AdorableNo ratings yet

- Master Questions, Advance Level Questions and Additional Questions-Chapter 4Document18 pagesMaster Questions, Advance Level Questions and Additional Questions-Chapter 4manmeet0001No ratings yet

- Buscom 3Document4 pagesBuscom 3dmangiginNo ratings yet

- Accounting 1 FinalsDocument5 pagesAccounting 1 FinalsJohn Rey Bantay RodriguezNo ratings yet

- Problems Chapter 6-10Document15 pagesProblems Chapter 6-10u got no jams0% (1)

- AA 4101 Midterm With AnswersDocument9 pagesAA 4101 Midterm With AnswersAlyssa AnnNo ratings yet

- 01 02. Capital GainsDocument4 pages01 02. Capital GainscamellNo ratings yet

- Financial Accounting Reviewer - Chapter 64Document11 pagesFinancial Accounting Reviewer - Chapter 64Coursehero PremiumNo ratings yet

- Cpa Review School of The Philippines ManilaDocument3 pagesCpa Review School of The Philippines ManilaAljur SalamedaNo ratings yet

- Baf2104 Financial Management CatDocument4 pagesBaf2104 Financial Management Catcyrus100% (1)

- Sol. Man. - Chapter 20 - Investment Property - Ia Part 1bDocument7 pagesSol. Man. - Chapter 20 - Investment Property - Ia Part 1bMiguel AmihanNo ratings yet

- ACC3201Document6 pagesACC3201natlyhNo ratings yet

- Solutions-IAS 40Document7 pagesSolutions-IAS 40Blitz KaizerNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaJustine CruzNo ratings yet

- Chapter22 BuenaventuraDocument4 pagesChapter22 BuenaventuraAnonnNo ratings yet

- CFASDocument4 pagesCFASAlyssa Janette SantosNo ratings yet

- Chapter 20 - Teacher's Manual - Far Part 1BDocument8 pagesChapter 20 - Teacher's Manual - Far Part 1BPacifico HernandezNo ratings yet

- Inventories, Investments, Intangibles, & Property, Plant and Equipment - Quiz MaterialDocument5 pagesInventories, Investments, Intangibles, & Property, Plant and Equipment - Quiz MaterialMimiNo ratings yet

- Chap 14 1-2Document4 pagesChap 14 1-2Buenaventura, Lara Jane T.No ratings yet

- BusCom Seatwork - 05 15 2021Document4 pagesBusCom Seatwork - 05 15 2021Joshua UmaliNo ratings yet

- Statement of Financial Position Basic Problems Problem 1-1 (IFRS)Document18 pagesStatement of Financial Position Basic Problems Problem 1-1 (IFRS)Marjorie PalmaNo ratings yet

- Question 75: Basic Consolidation: Profit For The Year 9,000 3,000Document5 pagesQuestion 75: Basic Consolidation: Profit For The Year 9,000 3,000Lidya Abera100% (1)

- Business Combination Exercises StudentDocument7 pagesBusiness Combination Exercises StudentDenise RoqueNo ratings yet

- Chapter 19 22 With Answer PDFDocument14 pagesChapter 19 22 With Answer PDFEmmanuel AgpasaNo ratings yet

- Ap-Problems - 2015Document20 pagesAp-Problems - 2015jayson100% (1)

- Discussion Problems: FAR.2924-Other Investments OCTOBER 2020Document3 pagesDiscussion Problems: FAR.2924-Other Investments OCTOBER 2020Wynona Balandra0% (1)

- Assignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedDocument10 pagesAssignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedJason MablesNo ratings yet

- Statement of CashflowDocument2 pagesStatement of CashflowAna Marie IllutNo ratings yet

- Exercise 13 Statement of Cash Flows - 054924Document2 pagesExercise 13 Statement of Cash Flows - 054924Hoyo VerseNo ratings yet

- Bus Com Handout 1 Bus CombinationDocument9 pagesBus Com Handout 1 Bus CombinationChristine RepuldaNo ratings yet

- Audit of Financial StatementsDocument4 pagesAudit of Financial StatementsMark Anthony TibuleNo ratings yet

- Far Eastern University - Makati: Discussion ProblemsDocument2 pagesFar Eastern University - Makati: Discussion ProblemsMarielle SidayonNo ratings yet

- PDF May 2017 - CompressDocument7 pagesPDF May 2017 - Compresscasual viewerNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Getting Started in Real Estate Investment TrustsFrom EverandGetting Started in Real Estate Investment TrustsRating: 3 out of 5 stars3/5 (1)

- Lecture - (22 and 23)Document3 pagesLecture - (22 and 23)Raiyan RabbaniNo ratings yet

- Kuliah I Akl 191121Document40 pagesKuliah I Akl 191121tutiNo ratings yet

- Oracle Corporation: Employee Stock Purchase Plan (ESPP)Document4 pagesOracle Corporation: Employee Stock Purchase Plan (ESPP)vijaykotianNo ratings yet

- GoharDocument329 pagesGoharStathis NteskosNo ratings yet

- The 2011 J. P. Morgan Global ETF HandbookDocument48 pagesThe 2011 J. P. Morgan Global ETF HandbooklgfinanceNo ratings yet

- Legal and Taxation AspectsDocument113 pagesLegal and Taxation AspectsMikaNo ratings yet

- Establish and Maintain Cash Based Accounting SystemDocument31 pagesEstablish and Maintain Cash Based Accounting SystemTegene Tesfaye100% (1)

- E - Interim Report 2020Document166 pagesE - Interim Report 2020New KabisaNo ratings yet

- Ratio Analysis: (Ans: Gross Profit: RS, 81, 000, Gross Profit Ratio: 45%)Document55 pagesRatio Analysis: (Ans: Gross Profit: RS, 81, 000, Gross Profit Ratio: 45%)Harika SriNo ratings yet

- 31 Top Finance Cheat Sheets 1693854197Document33 pages31 Top Finance Cheat Sheets 1693854197AyaNo ratings yet

- Tafriq Al Halal 'An Al Haram TheoryDocument17 pagesTafriq Al Halal 'An Al Haram TheoryhasnasafarinaNo ratings yet

- Stock Market Training by WcaDocument2 pagesStock Market Training by WcavsnagarjunreddyNo ratings yet

- Secondary Market: What Is It?Document6 pagesSecondary Market: What Is It?Vaibhav SinghviNo ratings yet

- KVSS 2022 Financial StatementDocument36 pagesKVSS 2022 Financial StatementKristofer PlonaNo ratings yet

- TAX 702 - Income Tax Rates CorporationsDocument6 pagesTAX 702 - Income Tax Rates CorporationsJuan Miguel UngsodNo ratings yet

- The Relevance of Factors Affecting Real Estate Investment DecisionsDocument16 pagesThe Relevance of Factors Affecting Real Estate Investment DecisionsMariaNo ratings yet

- Accounting Ch. 10Document48 pagesAccounting Ch. 10Cheryl LynnNo ratings yet

- UC General Endowment Pool Bond PortfolioDocument62 pagesUC General Endowment Pool Bond PortfolioSpotUsNo ratings yet

- Diluted Earnings Per Share ReportingDocument20 pagesDiluted Earnings Per Share Reportingroaaa0261No ratings yet

- Module 4 Equity SecuritiesDocument82 pagesModule 4 Equity SecuritiesKrazy ButterflyNo ratings yet

- All About Stock Market - Read ItDocument44 pagesAll About Stock Market - Read ItShekhar SumanNo ratings yet

- What Is Synergy?: Why Is There A Large Difference Between Share Value and Stockholders' Equity?Document71 pagesWhat Is Synergy?: Why Is There A Large Difference Between Share Value and Stockholders' Equity?vinodhategirlsNo ratings yet

- 3rd Sem AccountsDocument67 pages3rd Sem Accountsharamilanda2004No ratings yet

- VPlan Infotech PVT - LTDDocument18 pagesVPlan Infotech PVT - LTDVj EnthiranNo ratings yet

- Amin Khan Store Supervisor CVDocument5 pagesAmin Khan Store Supervisor CVArif KhanNo ratings yet

- F249Document4 pagesF249Chura HariNo ratings yet

- Comparative Analysis of Section CA 2013 & CA 1956Document28 pagesComparative Analysis of Section CA 2013 & CA 1956Navneet BatthNo ratings yet

- STMT CASH 001 CAKZ005793 Nov2022Document8 pagesSTMT CASH 001 CAKZ005793 Nov2022Monique GarzaNo ratings yet

- Ms 202301 Business U1Document27 pagesMs 202301 Business U1张查No ratings yet