Professional Documents

Culture Documents

Another Brillant CV

Another Brillant CV

Uploaded by

Shahzaib GulzarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Another Brillant CV

Another Brillant CV

Uploaded by

Shahzaib GulzarCopyright:

Available Formats

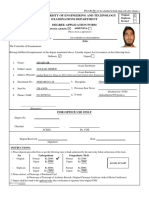

TOOBA MUSHTAQ AHMED

Position: Business Analyst | Transaction Advisory | Compliance Analyst | Credit Risk Analyst |

Finance Analyst | Accountant | Banking | AML – KYC Analyst |

Experience: Over 05 years | Educational Qualification: Masters in Business Administration (Finance)

Key Skills: Risk Assessment | Due Diligence | Financial Analysis | Data Analysis | VAT |

Commercial Banking | DFSA and FCA Regulations

Contact: +971 56 720 3206 | Email: toobamushtaqahmed@gmail.com | Location: Dubai | UAE

Visa Status: Visit Visa until Oct 14, 2021 | Availability: Immediately Available

Professional Summary

An active and result-oriented individual with over 05 years of diversified on-ground experience in all aspects of

economics, accounting, foreign trade finance, credit risk, compliance, and correspondent banking. Solid

planning and organizational skills in coordinating all phases of the project from inception through completion.

Well-disciplined with proven ability to manage multiple assignments efficiently under extreme pressure while

meeting tight deadline schedules.

Major Terms and Projects

▪ Led a role in achieving 95% targets of receiving Wolfsberg Questioner (Correspondent banking Due

Diligence Questioner) at a given deadline from FI (Financial Institution).

▪ Selected by the management considering successful completion of UAT of Swift Relationship Management

Application (RMA) plus also deployed it productively at Swift Live Environment.

▪ Implemented strategic changes in due diligence/KYC/EDD review of correspondents’ clients.

▪ Published article on Demutualization of Stock (2017)

Awards & Achievements

▪ Received Spot Awards for the Best Performance | Standard Chartered Bank | Nov 2016

▪ HBL Compliance Trainee Program Nov 2017 – Dec 2017.

Experiences

GSB Capital Ltd | Dubai, UAE May 2021 – Jun 2021

New Business Manager

Core Responsibilities

▪ Added and updated prospects clients and new clients on Wealthcraft (CRM application).

▪ Sent fact finds, risk questionnaires to prospective clients and prepared suitability reports for new clients.

▪ Sent new clients the GSB client contract for signature, collecting their compliance due diligence (CDD)

documents for KYC and completed provider paperwork for new business and top ups.

▪ Updated the Wealthcraft with business life cycle status for all new business and top-ups submitted.

▪ Submitted new business and top ups business to providers and following through with the providers to

business issue and reported new business on weekly and monthly basis.

Freelance | Pakistan Jan 2020 – Jan 2021

Analytical Research Writer

Core Responsibilities

▪ Wrote thesis on a study of the determinants of environmental disclosure: Evidence from the listed

companies in the United Arab Emirates.

▪ Composed a research paper on Mergers & Acquisition of IBM and Xerox.

▪ Analysed the Financial, Risk, and WACC (Weighted Average of Cost of Capital) of NVIDIA Corporation.

▪ Collaborated with graduate students to complete various parts of research projects.

Bank Al Habib Limited | Pakistan Aug 2018 - Dec 2019

Senior Financial Institution (F.I.) Compliance & Global Swift RMA Analyst

Core Responsibilities

▪ Developed relationship with foreign and local banks, including arrangements with new and existing

correspondents in a new destination to cater banks trade finance business requirements.

▪ Facilitated swift Relationship Management Application (RMA) administrator and FI compliance head with

all the correspondence banking activities with foreign and local banks along with their branches.

▪ Responded to all queries received via swift RMA module, swift messages, and email requests for the

establishment of a new swift RMA with Bank Al Habib Limited.

▪ Proceeded to address any request received for the establishment of a new correspondent relationship,

arrange to compile all the requisite documents from a correspondent bank as per the banks swift RMA SOP.

▪ Conducted due diligence/KYC/EDD review of bank’s correspondents’ clients in a timely scheduled

manner, credit analysed and reported any major changes.

▪ Reported weekly MIS of active swift RMA summary to head of departments and prepared letters, memos,

and other write-ups as and when required.

▪ Testified, and return inward foreign remittances, weekly reconciliation as per instruction central bank

circular with compliance division.

Habib Bank Limited | Pakistan Nov 2017 - Mar 2018

Assistant Manager (Compliance AML, Sanctions Screening & Advisory)

Core Responsibilities

▪ Analysed alerts generated through the company's various economic sanctions / OFAC (Office of Foreign

Assets Control) filtering applications.

▪ Sanctioned screening, suspicious activity, and transactions reported to the Anti-Money Laundering (AML)

Financial Monetary Unit (FMU) with group sanctions policy and procedures.

▪ Conducted due diligence screening on wire transfers and inward payment transfers.

▪ Highlighted system gaps or issues to unit manager for necessary action and ensured quality time is spent

when alerts are investigated and updated into the sanction screening process.

Standard Chartered Bank Limited |Pakistan Nov 2015 - Apr 2017

Foreign Trade Finance Analyst

Core Responsibilities

▪ Monitored trade finance dashboard on regular basis attended to clear export letter of credit (LC) advising

transactions in the queue.

▪ Processed export LC advising (issuance, amendment, miscellaneous steps, and transfer/confirmation),

export documents under contract (EBC), and bank credit line transfers.

▪ Prepared swift messages/ queries responses for issuing bank; monitored and reconciled of Nostro account

pertains to export LC advising only.

▪ Ensured due care diligence is exercised on day-to-day operational matters relating to Money Laundering

and KYC, accruing relevant knowledge and training; thus providing support to superiors and subordinates.

▪ Functioned as a backup for Assistant Manager Export and complied with group money laundering

prevention policy and procedures to the extent applicable, reported all suspicious dealings including

transactions having red flag alerts AML approvers.

Education

Master’s in Business Administration Majors Finance (Equivalence to MPhil) 2012-2015 | CGPA 3.39

Iqra University | Pakistan

Bachelors in Commerce | University of Karachi 2010 – 2011| Division 1st

Certifications

▪ Received the CFA Institute Investment Foundations certificate.

▪ Completed J.P. Morgan Commercial Banking Virtual Experience

▪ Writing Skills for Bankers - 2019

▪ Anti-Money Laundering and Counter Financing of Terrorism (AML/CFT) - 2017

▪ Advance Diploma in Information Technology (ADIT 1st Module) (Jan to July, 2012)

Technical Skills

▪ Microsoft ▪ Excel Dashboard ▪ Financial ▪ Forecasting

Dynamics 365 Modelling Financial Statements

▪ Data Analysis ▪ Block Chain ▪ FinTech ▪ Swift

▪ QuickBooks ▪ SPSS ▪ Project Management ▪ Tableau

Software

▪ Python ▪ SQL ▪ Safe Watch ▪ Mantas

Personal Details

▪ Gender Female ▪ Marital Status Single

▪ Nationality Pakistani ▪ Language English & Urdu

You might also like

- Far Aicpa Questions 2020Document54 pagesFar Aicpa Questions 2020Jon100% (1)

- Quality Toolkit For Managers PDFDocument38 pagesQuality Toolkit For Managers PDFMBA EngineerNo ratings yet

- Angela Corporation A Private Company Acquired All of The OutstandingDocument2 pagesAngela Corporation A Private Company Acquired All of The OutstandingAmit PandeyNo ratings yet

- Regina Rivera AlcaideDocument3 pagesRegina Rivera AlcaideEvans CorpNo ratings yet

- Problem Set ADocument14 pagesProblem Set ADyenNo ratings yet

- Regional Operations General Manager in Baton Rouge LA Resume Roy HenryDocument3 pagesRegional Operations General Manager in Baton Rouge LA Resume Roy HenryRoyHenryNo ratings yet

- Executive Summary: Analysis of Marketing Opportunities For WebtelDocument39 pagesExecutive Summary: Analysis of Marketing Opportunities For WebtelHarish KumarNo ratings yet

- Customer Service Representative: About Me ContactDocument2 pagesCustomer Service Representative: About Me ContactAfter SchoolNo ratings yet

- Week 4 - Lecture 4 Practitioner Statement Jan 2018Document15 pagesWeek 4 - Lecture 4 Practitioner Statement Jan 2018ProlificNo ratings yet

- 03-Slides - The Barangay Financial Statements and ReportsDocument22 pages03-Slides - The Barangay Financial Statements and ReportsCG Eusebio75% (4)

- Rayhan Tanvir's Curriculum VitaeDocument5 pagesRayhan Tanvir's Curriculum VitaeRayhan TanvirNo ratings yet

- Shoes Project by Usman AkramDocument30 pagesShoes Project by Usman Akramfdrz200887100% (1)

- Eamon Chiffey Marketing CVDocument2 pagesEamon Chiffey Marketing CVDavid HawkinsNo ratings yet

- RESUME (M.Pharm-Pharmaceutics) : Ashishkumar N. PanchalDocument3 pagesRESUME (M.Pharm-Pharmaceutics) : Ashishkumar N. PanchalAshish100% (1)

- AUDIT PLANNING On Beximco Pharmaceuticals LTDDocument25 pagesAUDIT PLANNING On Beximco Pharmaceuticals LTDNishat FarjanaNo ratings yet

- 2013-05-02 Distributor Evaluation Checklist For Account Managers (Ultimo)Document12 pages2013-05-02 Distributor Evaluation Checklist For Account Managers (Ultimo)Andrea MendezNo ratings yet

- Team 3 PDFDocument38 pagesTeam 3 PDFSinhaj NoorNo ratings yet

- Yamaha Import LogisticsDocument48 pagesYamaha Import LogisticsGeet ChauhanNo ratings yet

- Retail Store Manager Operations in Modesto CA Resume Catherine BaileyDocument1 pageRetail Store Manager Operations in Modesto CA Resume Catherine BaileyCatherineBaileyNo ratings yet

- Ohemaa Amoako-Atta AtuaheneDocument1 pageOhemaa Amoako-Atta Atuaheneohemaaatuahene180No ratings yet

- Asad Irfan CV For CSR TeraDataDocument3 pagesAsad Irfan CV For CSR TeraDataAsad IrfanNo ratings yet

- 2 Logistics Executive Resume Samples, Examples - Download Now! PDFDocument7 pages2 Logistics Executive Resume Samples, Examples - Download Now! PDFPiyushKumarNo ratings yet

- Logistics Sed Med Resume Jan.Document6 pagesLogistics Sed Med Resume Jan.sedrick_d_medfordNo ratings yet

- Key Responsibilities of The Position Include But Are Not Limited To The FollowingDocument2 pagesKey Responsibilities of The Position Include But Are Not Limited To The FollowingjoserturnerNo ratings yet

- Operations/Production Supervisor/ManagerDocument2 pagesOperations/Production Supervisor/Managerapi-77690777No ratings yet

- SAP Production Planning (PP) - Functional Consultant: ResponsibilitiesDocument2 pagesSAP Production Planning (PP) - Functional Consultant: ResponsibilitiesAmit MishraNo ratings yet

- Sales Manager Resume Template 1 PDFDocument2 pagesSales Manager Resume Template 1 PDFnothereforitNo ratings yet

- Deepthi Prakash: Logistic CoordinatorDocument4 pagesDeepthi Prakash: Logistic CoordinatorAbhishek aby5No ratings yet

- Square Textiles: Performance AppraisalDocument12 pagesSquare Textiles: Performance AppraisalFarheene Adeeba ChowdhuryNo ratings yet

- In-Process Quality Control: A Systematic Approach To Control Critical Steps in Finished Pharmaceutical ProductsDocument5 pagesIn-Process Quality Control: A Systematic Approach To Control Critical Steps in Finished Pharmaceutical Productsdian kurniaNo ratings yet

- Paper 59-Customer Value Proposition For e Commerce PDFDocument6 pagesPaper 59-Customer Value Proposition For e Commerce PDFSyifa AuliyaNo ratings yet

- Report Chenab Engineerig and Foundries FaisalabadDocument7 pagesReport Chenab Engineerig and Foundries FaisalabadKashif RazaNo ratings yet

- Quality Assurance Specialist in NJ NY Resume Fred PuchalaDocument2 pagesQuality Assurance Specialist in NJ NY Resume Fred PuchalaFredPuchalaNo ratings yet

- LVS-95XX Series Software Installation Guide M-95XX-3.0.9-B-1 PDFDocument46 pagesLVS-95XX Series Software Installation Guide M-95XX-3.0.9-B-1 PDFemailNo ratings yet

- Test CasesDocument3 pagesTest CasesPraveen DhawanNo ratings yet

- Sample Email Letter of Application (Text Version) : Subject: Colleen Warren - Web Content Manager PositionDocument4 pagesSample Email Letter of Application (Text Version) : Subject: Colleen Warren - Web Content Manager PositionOSM ERPNo ratings yet

- Final Report ManagementDocument15 pagesFinal Report Managementrahil viraniNo ratings yet

- Ramesh Chandra Bajpai: Carrier ObjectiveDocument3 pagesRamesh Chandra Bajpai: Carrier ObjectivebajpairameshNo ratings yet

- CVDocument1 pageCVsaji133No ratings yet

- IVS Profile PDFDocument11 pagesIVS Profile PDFMohan RamalingamNo ratings yet

- Drop Shipping: Here Is Where This Template BeginsDocument15 pagesDrop Shipping: Here Is Where This Template BeginsĐỗ TúNo ratings yet

- Asma CVDocument4 pagesAsma CVAsma MasoodNo ratings yet

- Rigoberto Rodriguez ResumeDocument3 pagesRigoberto Rodriguez Resumeapi-624171458No ratings yet

- 2020 BusinessPlanTemplateDocument21 pages2020 BusinessPlanTemplatefariya baigNo ratings yet

- PORTFOLIODocument8 pagesPORTFOLIOHussein CostelloNo ratings yet

- Marketing CV AnilDocument3 pagesMarketing CV AnilAnil PalimkarNo ratings yet

- CMMI n2 n3 Comparison Iso 9001 2000Document9 pagesCMMI n2 n3 Comparison Iso 9001 2000jgonzalezsanz8914No ratings yet

- Vice President Quality Operations in Greater Chicago IL Resume Kevin FredrichDocument2 pagesVice President Quality Operations in Greater Chicago IL Resume Kevin FredrichKevin Fredrich1No ratings yet

- CV Ware HouseDocument2 pagesCV Ware Housealkaffv1No ratings yet

- Aniqa CV LatestDocument1 pageAniqa CV LatestAna MalikNo ratings yet

- Minitab-2003-Software ValidationDocument11 pagesMinitab-2003-Software ValidationGonzalo_Rojas_VerenzNo ratings yet

- Balaji Resume - DeLOITTEDocument3 pagesBalaji Resume - DeLOITTETerence LewisNo ratings yet

- Semester Project: Software EngineeringDocument42 pagesSemester Project: Software EngineeringfaisyNo ratings yet

- IPQA A Beginner's GuideDocument170 pagesIPQA A Beginner's GuideGoran MickoNo ratings yet

- Questionnaire For Sales and Distribution Part 1Document6 pagesQuestionnaire For Sales and Distribution Part 1Sastry Voruganti100% (1)

- Using Cloud Storage Services For Data Exchange Between Terminalsmt5Document11 pagesUsing Cloud Storage Services For Data Exchange Between Terminalsmt5nobodikNo ratings yet

- Jeffrey Anaya: The Center For The Next Generation, San Francisco CADocument2 pagesJeffrey Anaya: The Center For The Next Generation, San Francisco CAJeff AnayaNo ratings yet

- Technical Product Marketing Manager in Atlanta GA Resume Jonathan CohenDocument2 pagesTechnical Product Marketing Manager in Atlanta GA Resume Jonathan CohenJonathanCohen2No ratings yet

- Good Distribution Practices A Complete Guide - 2021 EditionFrom EverandGood Distribution Practices A Complete Guide - 2021 EditionNo ratings yet

- Resume - Mohammad Rezaul KarimDocument3 pagesResume - Mohammad Rezaul KarimRezaul Karim0% (1)

- Ganesh Naidu CVDocument2 pagesGanesh Naidu CVMukeshNo ratings yet

- Asad AbbasDocument3 pagesAsad AbbasRizviNo ratings yet

- Your Communication Preferences: Page 1 of 3Document3 pagesYour Communication Preferences: Page 1 of 3Shahzaib GulzarNo ratings yet

- Maira Siddiqui: EducationDocument1 pageMaira Siddiqui: EducationShahzaib GulzarNo ratings yet

- Degree AffidavitDocument1 pageDegree AffidavitShahzaib GulzarNo ratings yet

- Degree FormDocument1 pageDegree FormShahzaib GulzarNo ratings yet

- Play List Name: Done DueDocument1 pagePlay List Name: Done DueShahzaib GulzarNo ratings yet

- Vegetable Crops: Create by Nadia GulzarDocument41 pagesVegetable Crops: Create by Nadia GulzarShahzaib GulzarNo ratings yet

- Scholarship of ChinaDocument4 pagesScholarship of ChinaShahzaib GulzarNo ratings yet

- Mohammad Ubaid: Chemical EngineerDocument1 pageMohammad Ubaid: Chemical EngineerShahzaib GulzarNo ratings yet

- Practice Handout of Ias 36: Example 1Document5 pagesPractice Handout of Ias 36: Example 1noor ul anumNo ratings yet

- CH 7 TQDocument15 pagesCH 7 TQManuel Urda Rodriguez0% (1)

- Fabm1 q3 Mod8 Postingtransactionsintheledger FinalDocument32 pagesFabm1 q3 Mod8 Postingtransactionsintheledger FinalAdonis Zoleta Aranillo33% (3)

- General Banking UBLDocument61 pagesGeneral Banking UBLaslammalg100% (1)

- Facebook Inc. (FB) : 2 - AttractiveDocument6 pagesFacebook Inc. (FB) : 2 - AttractiveCarlos TresemeNo ratings yet

- Reading 22 Slides - Understanding Balance SheetsDocument41 pagesReading 22 Slides - Understanding Balance SheetstamannaakterNo ratings yet

- CFAS Module Week 3-4Document13 pagesCFAS Module Week 3-4Yamit, Angel Marie A.No ratings yet

- Chapter 4 Liquidation of Companies TYBAFDocument4 pagesChapter 4 Liquidation of Companies TYBAFvikax90927No ratings yet

- Asset, Liabilities and Capital (Owners Equity) Accounts and Account TilesDocument20 pagesAsset, Liabilities and Capital (Owners Equity) Accounts and Account TilesMajessa BongueNo ratings yet

- Ifric 7Document6 pagesIfric 7Cryptic LollNo ratings yet

- Classification of SharesDocument3 pagesClassification of SharesIvan BernardNo ratings yet

- Question Responses (2022-10-13)Document4 pagesQuestion Responses (2022-10-13)Amira SamirNo ratings yet

- FIN2704 Tutorial 1 Question 3 SolutionDocument5 pagesFIN2704 Tutorial 1 Question 3 SolutionAndrew TungNo ratings yet

- Midterm Exam EntrepDocument4 pagesMidterm Exam EntrepEricson C UngriaNo ratings yet

- Module 1-1 Cost Accounting FundamentalsDocument9 pagesModule 1-1 Cost Accounting FundamentalsClaire BarbaNo ratings yet

- Fact2003 Sec2Document8 pagesFact2003 Sec2fdsfasdfNo ratings yet

- Far660 - Special Feb 2020 QuestionDocument5 pagesFar660 - Special Feb 2020 QuestionHanis ZahiraNo ratings yet

- Your Division Is Considering Two Projects Its Wacc Is 10Document1 pageYour Division Is Considering Two Projects Its Wacc Is 10Amit PandeyNo ratings yet

- Working Capital Management and Profitability: A Study On Cement Industry in BangladeshDocument12 pagesWorking Capital Management and Profitability: A Study On Cement Industry in BangladeshSudip BaruaNo ratings yet

- Kepco Philippines v. CIRDocument4 pagesKepco Philippines v. CIRamareia yapNo ratings yet

- Chapter 10 and 12 GitmanDocument32 pagesChapter 10 and 12 GitmanLBL_LowkeeNo ratings yet

- Cost and Managment Accounting PDFDocument142 pagesCost and Managment Accounting PDFNaveen NaviNo ratings yet

- Error Correction Sample ProblemsDocument42 pagesError Correction Sample ProblemsKatie BarnesNo ratings yet

- Financial Analysis Power PointDocument14 pagesFinancial Analysis Power Pointapi-643732098No ratings yet

- Q4 G11-ABM - L03 Analysis & Interpretation of Financial Statements PDFDocument50 pagesQ4 G11-ABM - L03 Analysis & Interpretation of Financial Statements PDFFatricia MedinaNo ratings yet

- FRSA Practice Questions For AssignmentDocument8 pagesFRSA Practice Questions For AssignmentSrikar WuppalaNo ratings yet