Professional Documents

Culture Documents

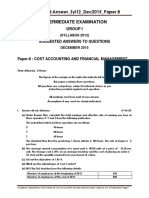

Quiz2 3

Quiz2 3

Uploaded by

Kervin Rey JacksonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz2 3

Quiz2 3

Uploaded by

Kervin Rey JacksonCopyright:

Available Formats

I.

THEORY QUESTIONS: This will help you indicate the classification of

cost.

Instructions: Answer the following questions and provide the necessary

requirements.

DIRECT OR INDIRECT COST (6 points)

Classify the following expenses as direct or indirect:

a) factory rental

b) insurance of machinery used for one product only

c) warehouse rental

d) insurance of office buildings

e) costs of a canteen for employees

f) Petrol for delivery vehicles.

II. PROBLEM SOLVING: This will help you develop your analytical

capabilities and judgment.

Instructions: Read each problem carefully and provide the necessary

requirements.

Problem 1. Classify each of the following costs of Bug Company in two ways:

(a) as variable (V) fixed costs (F); (b) as inventoriable costs (I) or period costs

(P): (20 points)

Example: Direct labor V I

1. Salary of company controller

2. Fire insurance on direct

materials

3. Property taxes on finished

goods held for sale

4. Direct materials used

5. Factory rent

6. Sales Commissions

7. Overtime premium of machine

operators

8. Straight-line depreciation of

Factory equipment

9. Straight-line depreciation of

trucks used for delivery

of sales to customers

10. Salary of factory supervisor

Problem 2 (20 points)

The financial statements of BBM Company included these items:

Marketing costs P160,000

Direct labor cost 245,000

Administrative costs 145,000

Direct materials used 285,000

Fixed factory overhead costs 175,000

Variable factory overhead costs 155,000

Compute and show the solutions:

Prime cost

Conversion cost

Total inventoriable/product cost

Total period cost

Problem 3 (10 points)

SahBong Corporation estimated its unit costs of producing and selling

12,000 units per month as follows:

Direct materials used P32.00

Direct labor 20.00

Variable manufacturing overhead 15.00

Fixed manufacturing overhead 6.00

Variable marketing costs 3.00

Fixed marketing costs 4.00

Estimated unit cost P80.00

Compute and show the solutions:

Total variable costs per month

Total fixed costs per month

Problem 4 (40 points)

Dutertz Ltd recorded the following costs for the past six months:

Month Activity Total

level cost

Units K’000

(000)

1 40 6,586

2 30 5,826

3 36 6,282

4 38 6,396

5 42 6,700

6 33 6,052

Required with SOLUTIONS:

A. Using High-Low Method and Least Square Method.

Estimate the fixed cost per month

Estimate the total costs for the following activity levels in a month 75 units

90 units

Problem 5 (10 points)

LacSott Company is preparing a flexible budget for the next year and requires a

breakdown of the factory maintenance cost into the fixed and variable elements.

The maintenance costs and machine hours (the selected cost driver) for the past six

months are as follows:

Maintenance Costs Machine Hours

January P15,500 1,800

February 10,720 1,230

March 15,100 1,740

April 15,840 2,190

May 14,800 1,602

June 10,600 1,590

Required with SOLUTIONS: Compute the following:

Estimated variable rate

Annual Fixed Costs

Problem 6 (15 points)

MoOng Company produces and sells rattan baskets. The number of units produced

and the corresponding total production costs for six months, which are representatives

for the year, are as follows:

Months Units Produced Production Costs

April 500 P4,000

May 700 8,000

June 900 6,000

July 600 7,500

August 800 8,500

September 550 7,250

Based on the given information and using least-squares method of computation , select the

best answer for each question, where:

Y= total monthly production costs

X= number of units produced per month

a= fixed production cost per moth

b= variable production cost per month

n= number of months

∑=summation

Required with SOLUTIONS: Compute the following:

Variable cost per unit

Monthly Fixed Cost per unit

Cost Function

Problem 7 (15 points)

PacSon Motors Co. makes motorcycles. Management wants to estimate overhead

costs to plan its operations. A recent trade publication revealed that overhead costs tend

to vary with machine hours. To check this, they collected the following data for the past 12

months.

Months Machine Hours Overhead Costs

1 175 P4,500

2 170 4225

3 160 4,321

4 190 5,250

5 175 4,800

6 200 5,100

7 160 4,450

8 150 4,200

9 210 5,475

10 180 4,760

11 170 4,325

12 145 3,975

Requirements with SOLUTIONS:

Use the High-low method to estimate the fixed and variable portion of overhead costs based on

machine hours.

If the plant is planning to operate at a level of 200 machine hours next period, what would be the

estimated overhead costs?

Use the method of Least-Squares to estimate the fixed and variable portion of overhead costs

Problem 8 (12 points)

based onGiven

machine

the hours.

following facts, complete the requirements

below: Sales price P200 per unit

Fixed costs:

Marketing and administrative 24,000 per period

Manufacturing overhead 30,000 per period

Variable costs:

Marketing and administrative 6 per unit

Manufacturing overhead 9 per unit

Direct labor 30 per unit

Direct Materials 60 per unit

Units produced and sold 1,200 per period

Compute and show the solutions:

Variable manufacturing cost per unit

Variable cost per unit

Full manufacturing cost per unit

Full cost to make and sell per unit

You might also like

- Question Bank For Ma 1.4Document25 pagesQuestion Bank For Ma 1.4Chitta LeeNo ratings yet

- Midterm Quiz 2 - Problem and Answer KeyDocument6 pagesMidterm Quiz 2 - Problem and Answer KeyRynette Flores100% (1)

- F.E. Campbell - Fetters Are Forever - HIT 180Document160 pagesF.E. Campbell - Fetters Are Forever - HIT 180HokusLocus63% (8)

- Quiz 2 Cost AccountingDocument1 pageQuiz 2 Cost AccountingRocel DomingoNo ratings yet

- Answer The Following Questions and Provide The Necessary RequirementsDocument11 pagesAnswer The Following Questions and Provide The Necessary RequirementsKervin Rey JacksonNo ratings yet

- Occupational Health and Safety ReportDocument6 pagesOccupational Health and Safety Reportخالد نسیمNo ratings yet

- Topic 2 Cost Concepts and Analysis HandoutsDocument5 pagesTopic 2 Cost Concepts and Analysis HandoutsJohn Kenneth ColarinaNo ratings yet

- Assignment No. 1 - Cost - Concepts and ClassificationsDocument3 pagesAssignment No. 1 - Cost - Concepts and ClassificationsDan RyanNo ratings yet

- Costs Concepts and ClassificationDocument14 pagesCosts Concepts and Classificationsheng100% (1)

- Strata Premid Prefi QUESDocument3 pagesStrata Premid Prefi QUESLablab MaanNo ratings yet

- Accounting Techniques For Decision MakingDocument24 pagesAccounting Techniques For Decision MakingRima PrajapatiNo ratings yet

- Mas Quizzer - Anaylysis 2021 Part 1Document6 pagesMas Quizzer - Anaylysis 2021 Part 1Ma Teresa B. CerezoNo ratings yet

- Tutorial 4Document6 pagesTutorial 4FEI FEINo ratings yet

- 2006 LCCI Cost Accounting Level 2 Series 4 Model AnswersDocument15 pages2006 LCCI Cost Accounting Level 2 Series 4 Model AnswersHon Loon SeumNo ratings yet

- Quiz2 3Document3 pagesQuiz2 3Kervin Rey JacksonNo ratings yet

- Types of DecisionsDocument9 pagesTypes of DecisionsEric AnakNo ratings yet

- 673 Quirino Highway, San Bartolome, Novaliches, Quezon CityDocument4 pages673 Quirino Highway, San Bartolome, Novaliches, Quezon CityRodolfo ManalacNo ratings yet

- Tutorial - FMA - Activity 4Document5 pagesTutorial - FMA - Activity 4Anonymous cdbGe8bFJoNo ratings yet

- New 2302 Exam2Document10 pagesNew 2302 Exam2Reanne Claudine LagunaNo ratings yet

- Introduction To Marginal CostingDocument29 pagesIntroduction To Marginal CostingUdaya ChoudaryNo ratings yet

- Quiz 2 Cost AccountingDocument1 pageQuiz 2 Cost AccountingRocel DomingoNo ratings yet

- Answer The Following Questions and Provide The Necessary RequirementsDocument11 pagesAnswer The Following Questions and Provide The Necessary RequirementsKervin Rey JacksonNo ratings yet

- Relevant CostingDocument58 pagesRelevant CostingAlexanderJacobVielMartinezNo ratings yet

- Assignment Exercisefor Prmaelimtobesubmittedon Dec 05Document42 pagesAssignment Exercisefor Prmaelimtobesubmittedon Dec 05Shane LAnuzaNo ratings yet

- Bcom 5 Sem Cost Accounting 1 21100106 Feb 2021Document4 pagesBcom 5 Sem Cost Accounting 1 21100106 Feb 2021sandrabiju7510No ratings yet

- Decision Making QuestionsDocument3 pagesDecision Making QuestionsOsama RiazNo ratings yet

- 7e Extra QDocument72 pages7e Extra QNur AimyNo ratings yet

- QP December 2006Document10 pagesQP December 2006Simon ChawingaNo ratings yet

- Model Paper-I: Sri Balaji Society PGDM (Finance) Ii Semester Examination BATCH: 2010 - 2012Document10 pagesModel Paper-I: Sri Balaji Society PGDM (Finance) Ii Semester Examination BATCH: 2010 - 2012kalpitgupta786No ratings yet

- Module Code: PMC Module Name: Performance Measurement & Control Programme: MSC FinanceDocument9 pagesModule Code: PMC Module Name: Performance Measurement & Control Programme: MSC FinanceRenato WilsonNo ratings yet

- 0405 MAS Preweek QuizzerDocument22 pages0405 MAS Preweek QuizzerSol Guimary60% (10)

- Exam 19111Document6 pagesExam 19111atallah97No ratings yet

- Answer The Following Questions and Provide The Necessary RequirementsDocument12 pagesAnswer The Following Questions and Provide The Necessary RequirementsKervin Rey JacksonNo ratings yet

- Intermediate Examination: Suggested Answer - Syl12 - Dec2015 - Paper 8Document15 pagesIntermediate Examination: Suggested Answer - Syl12 - Dec2015 - Paper 8JOLLYNo ratings yet

- Section C QuestionsDocument133 pagesSection C QuestionsmostafanourallahNo ratings yet

- Assignment 6Document2 pagesAssignment 6Geoff MacarateNo ratings yet

- ACCA F5 Tuition MockDocument8 pagesACCA F5 Tuition MockUmer FarooqNo ratings yet

- JC and BP SeatworkDocument4 pagesJC and BP SeatworkJhoana HernandezNo ratings yet

- 32qaqDocument8 pages32qaqAlebachew KebretNo ratings yet

- ALl Questions According To TopicsDocument11 pagesALl Questions According To TopicsHassan KhanNo ratings yet

- Session 4 A - Product Mix Constraints LP - Canvas - TeachingDocument37 pagesSession 4 A - Product Mix Constraints LP - Canvas - Teaching長長No ratings yet

- ABC CostingDocument5 pagesABC CostingMike RobmonNo ratings yet

- 202E03Document29 pages202E03Ariz Joelee ArthaNo ratings yet

- April 2012Document3 pagesApril 2012Derick cheruyotNo ratings yet

- Act 6010 C Fall 2022 Final Sem ExaminationsDocument5 pagesAct 6010 C Fall 2022 Final Sem ExaminationsSimon JosiahNo ratings yet

- A.Y. 2020-2021 2 Semester: School of Accountancy Long Quiz 3 ExaminationDocument3 pagesA.Y. 2020-2021 2 Semester: School of Accountancy Long Quiz 3 ExaminationCrizhae OconNo ratings yet

- Quiz For Finals For PrintingDocument4 pagesQuiz For Finals For PrintingPopol KupaNo ratings yet

- Answer The Following Questions and Provide The Necessary RequirementsDocument12 pagesAnswer The Following Questions and Provide The Necessary RequirementsKervin Rey JacksonNo ratings yet

- Exercise Set #1Document5 pagesExercise Set #1Mikhail Aron GorreNo ratings yet

- Advanced Management Accounting RTPDocument25 pagesAdvanced Management Accounting RTPSamir Raihan ChowdhuryNo ratings yet

- Malaysia) Past Paper Series 2 2010Document7 pagesMalaysia) Past Paper Series 2 2010Fong Yee JeeNo ratings yet

- CMA QN November 2017Document7 pagesCMA QN November 2017Goremushandu MungarevaniNo ratings yet

- Cordillera Career Development College College of Accountancy Buyagan, Poblacion, La Trinidad, Benguet Acctg 154-Strategic Cost Management Final ExamsDocument3 pagesCordillera Career Development College College of Accountancy Buyagan, Poblacion, La Trinidad, Benguet Acctg 154-Strategic Cost Management Final ExamsMichelle BayacsanNo ratings yet

- Management Accounting Level 3: LCCI International QualificationsDocument17 pagesManagement Accounting Level 3: LCCI International QualificationsHein Linn Kyaw100% (2)

- Between The Brackets Write (T) If The Statement Is TRUE or (F) If The Statement IsDocument5 pagesBetween The Brackets Write (T) If The Statement Is TRUE or (F) If The Statement IsAhmed EltayebNo ratings yet

- The Valuation of Digital Intangibles: Technology, Marketing and InternetFrom EverandThe Valuation of Digital Intangibles: Technology, Marketing and InternetNo ratings yet

- Statistical Thinking: Improving Business PerformanceFrom EverandStatistical Thinking: Improving Business PerformanceRating: 4 out of 5 stars4/5 (1)

- Account-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueFrom EverandAccount-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueRating: 1 out of 5 stars1/5 (1)

- The Data Science Workshop: A New, Interactive Approach to Learning Data ScienceFrom EverandThe Data Science Workshop: A New, Interactive Approach to Learning Data ScienceNo ratings yet

- Optimizing Factory Performance: Cost-Effective Ways to Achieve Significant and Sustainable ImprovementFrom EverandOptimizing Factory Performance: Cost-Effective Ways to Achieve Significant and Sustainable ImprovementNo ratings yet

- This Study Resource WasDocument8 pagesThis Study Resource WasKervin Rey JacksonNo ratings yet

- Global SustainabilityDocument16 pagesGlobal SustainabilityKervin Rey JacksonNo ratings yet

- Activity 3 Key PDFDocument5 pagesActivity 3 Key PDFKervin Rey JacksonNo ratings yet

- Compre Quali GuidelinesDocument3 pagesCompre Quali GuidelinesKervin Rey JacksonNo ratings yet

- Unit 1 - ConpworDocument20 pagesUnit 1 - ConpworKervin Rey JacksonNo ratings yet

- Revised Cef-1: Republic of The Philippines Commission On ElectionsDocument10 pagesRevised Cef-1: Republic of The Philippines Commission On ElectionsKervin Rey JacksonNo ratings yet

- Globalization of Economic RelationsDocument17 pagesGlobalization of Economic RelationsKervin Rey JacksonNo ratings yet

- Revised Cef-1: Republic of The Philippines Commission On ElectionsDocument7 pagesRevised Cef-1: Republic of The Philippines Commission On ElectionsKervin Rey JacksonNo ratings yet

- Revised Cef-1: Republic of The Philippines Commission On ElectionsDocument7 pagesRevised Cef-1: Republic of The Philippines Commission On ElectionsKervin Rey JacksonNo ratings yet

- Jackson Kervin Rey G. Intacc 189 Activity 1 Unit 4 1Document8 pagesJackson Kervin Rey G. Intacc 189 Activity 1 Unit 4 1Kervin Rey JacksonNo ratings yet

- Law On PartnershipDocument10 pagesLaw On PartnershipKervin Rey JacksonNo ratings yet

- Histtory and Importance of HadithDocument31 pagesHisttory and Importance of HadithAbdullah AhsanNo ratings yet

- Gurrea V LezamaDocument2 pagesGurrea V LezamaEdward Kenneth Kung100% (1)

- AFC Asian Cup China 2023 Qualifiers Final Round Match ScheduleDocument6 pagesAFC Asian Cup China 2023 Qualifiers Final Round Match ScheduleretalintoNo ratings yet

- Mobilia Products, Inc. v. Umezawa, 452 SCRA 736Document15 pagesMobilia Products, Inc. v. Umezawa, 452 SCRA 736JNo ratings yet

- Alternative Dispute Resolution Syllabus LLMDocument5 pagesAlternative Dispute Resolution Syllabus LLMprernaNo ratings yet

- Lecture 03 - ECO 209 - W2013 PDFDocument69 pagesLecture 03 - ECO 209 - W2013 PDF123No ratings yet

- ExampleDocument3 pagesExampleAhad nasserNo ratings yet

- Florida Et Al v. Dept. of Health & Human Services Et AlDocument304 pagesFlorida Et Al v. Dept. of Health & Human Services Et AlDoug MataconisNo ratings yet

- I Nyoman Trikasudha Gamayana - 2201541145 (ASSIGNMENT 2)Document3 pagesI Nyoman Trikasudha Gamayana - 2201541145 (ASSIGNMENT 2)trikaNo ratings yet

- Oisd STD 235Document110 pagesOisd STD 235naved ahmed100% (5)

- Module MAPEH 8 4thDocument21 pagesModule MAPEH 8 4thEdnell VelascoNo ratings yet

- E-Commerce Assignment For MISDocument11 pagesE-Commerce Assignment For MISIrfan Amin100% (1)

- 4 Slides Value Stream MappingDocument13 pages4 Slides Value Stream MappingRanjan Raj Urs100% (2)

- M B ADocument98 pagesM B AGopuNo ratings yet

- Khelo India Event Wise Bib ListDocument20 pagesKhelo India Event Wise Bib ListSudhit SethiNo ratings yet

- UBX Cloud - VEEAM Cloud Backup SlickDocument2 pagesUBX Cloud - VEEAM Cloud Backup SlickmohamedalihashNo ratings yet

- MLCFDocument27 pagesMLCFMuhammad HafeezNo ratings yet

- Review of ApplicationDocument6 pagesReview of ApplicationPrabath ChinthakaNo ratings yet

- Chiquita Motion To Dismiss For Forum Non ConveniensDocument59 pagesChiquita Motion To Dismiss For Forum Non ConveniensPaulWolfNo ratings yet

- ScarletLetter StudyGuideDocument8 pagesScarletLetter StudyGuidejongambiaNo ratings yet

- S R S M: Arah Owell and Cott AckenzieDocument7 pagesS R S M: Arah Owell and Cott AckenzieEduardo MBNo ratings yet

- Week 1, Hebrews 1:1-14 HookDocument9 pagesWeek 1, Hebrews 1:1-14 HookDawit ShankoNo ratings yet

- SavitaDocument1 pageSavitaSDM GurugramNo ratings yet

- Commodity Management and Erp 141112025450 Conversion Gate02 PDFDocument9 pagesCommodity Management and Erp 141112025450 Conversion Gate02 PDFBülent DeğirmencioğluNo ratings yet

- The Danube 3D: Europeity and EuropeismDocument14 pagesThe Danube 3D: Europeity and EuropeismcursantcataNo ratings yet

- Theory, Culture & Society: The AestheticDocument8 pagesTheory, Culture & Society: The AestheticJaime UtrerasNo ratings yet

- International Journal of Bank Marketing: Article InformationDocument32 pagesInternational Journal of Bank Marketing: Article Informationrohil qureshiNo ratings yet

- Born Again of The People: Luis Taruc and Peasant Ideology in Philippine Revolutionary PoliticsDocument43 pagesBorn Again of The People: Luis Taruc and Peasant Ideology in Philippine Revolutionary PoliticsThania O. CoronicaNo ratings yet