Professional Documents

Culture Documents

Tapasya Degree College Banking and Financial Services Important Questions

Tapasya Degree College Banking and Financial Services Important Questions

Uploaded by

Udaykiran BheemaganiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tapasya Degree College Banking and Financial Services Important Questions

Tapasya Degree College Banking and Financial Services Important Questions

Uploaded by

Udaykiran BheemaganiCopyright:

Available Formats

TAPASYA DEGREE COLLEGE

BANKING AND FINANCIAL SERVICES

IMPORTANT QUESTIONS

Long answer questions:

UNIT-1

1. List out the different types of banks

2. Explain the different functions of commercial banks?

3. What are the various emerging trends in commercial banking?

4. What are the functions and objectives of RBI?

5. What are the functions and objectives of NABARD?

6. What are the functions and objectives of SIDBI?

UNIT-2

1. Define banker and customer? Discuss the relationship between Banker and customer?

2. Explain the procedure of opening of bank account?

3. Discuss the different special types of customers to the bank?

4. What is KYC? Explain its elements?

UNIT-3

1. Explain the types of negotiable instruments?

2. Define paying banker? What are the duties and responsibilities of paying banker?

3. Define collecting banker? What are the duties and responsibilities of collecting

banker?

4. What are the circumstances under which a banker can refuse the payment of cheques?

5. What are the consequences of wrongful dishonor of cheques?

UNIT-4

1. Define Financial services? Explain its functions and classify its types?

2. Discuss the scope of financial services.

3. List out the new financial products and service sectors in India?

4. Explain the challenges facing the financial services sector in India?

UNIT-5

1. Define Merchant Banking? Explain its problems and scope in India?

2. Define factoring? Explain its merits and demerits?

3. Define lease? Discuss the types and steps involved in leasing process?

4. Define venture capital? Explain its features and scope in Indian market?

5. Define Bill discounting? Explain its advantages and limitations?

Short answer questions

1. Objectives of bank

2. Bank assurance

3. Banking OMBUDSMAN

4. Cash reserve ratio (CRR)

5. Statutory liquidity ratio (SLR)

6. District co-operative central banks

7. Repo/reverse repo rate

8. Features of RRB

9. KYC norms

10. Special type of customers(all)

11. Classification of Loans and Advances

12. Document of Title of Goods

13. Paying banker

14. Collecting banker

15. Financial services

16. Fund based activities

17. Non-Fund based activities

18. New financial products and services

19. Parties in factoring

20. Parties in Forfeiting

21. Costs of forfeiting

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ca Inter Advanced Accounts Imp Questions BookletDocument112 pagesCa Inter Advanced Accounts Imp Questions BookletUdaykiran BheemaganiNo ratings yet

- I Sem BOM Important QuestionsDocument4 pagesI Sem BOM Important QuestionsUdaykiran BheemaganiNo ratings yet

- Paper - 3: Cost and Management Accounting: © The Institute of Chartered Accountants of IndiaDocument24 pagesPaper - 3: Cost and Management Accounting: © The Institute of Chartered Accountants of IndiaUdaykiran BheemaganiNo ratings yet

- FCRA (PPT Notes)Document26 pagesFCRA (PPT Notes)Udaykiran Bheemagani100% (1)

- MAY 21/NOV 21: Mock Test Solutions Upto Deduction From Gross Total IncomeDocument19 pagesMAY 21/NOV 21: Mock Test Solutions Upto Deduction From Gross Total IncomeUdaykiran BheemaganiNo ratings yet

- Ii Sem Imp Questions of B.lawDocument3 pagesIi Sem Imp Questions of B.lawUdaykiran BheemaganiNo ratings yet

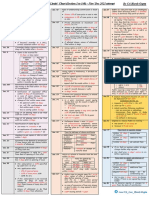

- Company Law Limits - Nov 2021Document3 pagesCompany Law Limits - Nov 2021Udaykiran BheemaganiNo ratings yet

- 2 Material PracticleDocument13 pages2 Material PracticleUdaykiran BheemaganiNo ratings yet

- 65431bos52762 Inter p1Document16 pages65431bos52762 Inter p1Udaykiran BheemaganiNo ratings yet

- Essential Elements of A Valid ContractDocument3 pagesEssential Elements of A Valid ContractUdaykiran BheemaganiNo ratings yet