Professional Documents

Culture Documents

UE

UE

Uploaded by

fastslowerCopyright:

Available Formats

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Human Resources EnglishDocument11 pagesHuman Resources EnglishirstarworkNo ratings yet

- Employee Benefit 1 PDFDocument34 pagesEmployee Benefit 1 PDFbobo kaNo ratings yet

- (Use The Below Problem To Answers The Succeeding Four (4) Questions.)Document3 pages(Use The Below Problem To Answers The Succeeding Four (4) Questions.)admiral spongebobNo ratings yet

- L 1Document5 pagesL 1Elizabeth Espinosa ManilagNo ratings yet

- R4acads Finacc ExtraDocument5 pagesR4acads Finacc ExtraChristine Herico CurryNo ratings yet

- HRM Overview - Chapter 1 & 2 (Fisher, Schoenfeldt & Shaw)Document15 pagesHRM Overview - Chapter 1 & 2 (Fisher, Schoenfeldt & Shaw)Saif Hasan Jyoti100% (2)

- Module 31 Employee Benefits ProblemDocument2 pagesModule 31 Employee Benefits ProblemThalia UyNo ratings yet

- EMPLOYEE-BENEFITS AnswerkeyDocument6 pagesEMPLOYEE-BENEFITS AnswerkeyRiselle Ann Sanchez100% (2)

- ACCTG Employee-BenefitDocument2 pagesACCTG Employee-BenefitMicaela EncinasNo ratings yet

- Employee Benefits: Defined Benefit PlansDocument4 pagesEmployee Benefits: Defined Benefit PlansMHARTIN DAENNIELLE ORSALNo ratings yet

- AUDITING Material 2Document9 pagesAUDITING Material 2Blessy Zedlav LacbainNo ratings yet

- Quiz Employee Benifits Income TaxDocument2 pagesQuiz Employee Benifits Income TaxMonica MonicaNo ratings yet

- Acc 108 Emp BeneDocument4 pagesAcc 108 Emp BeneSam GallineroNo ratings yet

- Employees BenefitsDocument2 pagesEmployees BenefitsorillosachristoperjohnNo ratings yet

- Acctg 5Document6 pagesAcctg 5Charmane MatiasNo ratings yet

- Ho2-Employee Benefits and Share-Based Compensation (Student's Copy)Document10 pagesHo2-Employee Benefits and Share-Based Compensation (Student's Copy)Alliah ArrozaNo ratings yet

- Diara Po.Document7 pagesDiara Po.Rio Cyrel CelleroNo ratings yet

- (Use The Below Problem To Answers The Succeeding Four (4) Questions.)Document3 pages(Use The Below Problem To Answers The Succeeding Four (4) Questions.)Sitti Ayesha HasimanNo ratings yet

- Poem PoemDocument5 pagesPoem PoemElizabeth Espinosa ManilagNo ratings yet

- Employee Benefits 2 Employee Benefits 2Document4 pagesEmployee Benefits 2 Employee Benefits 2XNo ratings yet

- (Use The Below Problem To Answers The Succeeding Four (4) Questions.)Document3 pages(Use The Below Problem To Answers The Succeeding Four (4) Questions.)Janine LerumNo ratings yet

- 05 Comprehensive Income PDFDocument2 pages05 Comprehensive Income PDFMimi YayaNo ratings yet

- Activity 1.6.2Document1 pageActivity 1.6.2Stephen JohnNo ratings yet

- Ia2 QuestionsDocument6 pagesIa2 QuestionsSharjaaahNo ratings yet

- Acc 108 Emp Bene. Bonus Debt RestrDocument2 pagesAcc 108 Emp Bene. Bonus Debt Restrbrmo.amatorio.uiNo ratings yet

- Drill 3 AK FSUU AccountingDocument15 pagesDrill 3 AK FSUU AccountingRobert CastilloNo ratings yet

- ACC221Document5 pagesACC221Hilarie JeanNo ratings yet

- Q2 Employee Benefits Pt.2Document4 pagesQ2 Employee Benefits Pt.2francine del rosarioNo ratings yet

- Unit Number/ Heading: Intermediate Accounting Ii (Ae 16) Learning Material: Postemployment BenefitDocument3 pagesUnit Number/ Heading: Intermediate Accounting Ii (Ae 16) Learning Material: Postemployment BenefitSitti Ayesha HasimanNo ratings yet

- AA 4101 Midterm With AnswersDocument9 pagesAA 4101 Midterm With AnswersAlyssa AnnNo ratings yet

- Iac 11 Employee BenefitsDocument5 pagesIac 11 Employee BenefitsNacelleNo ratings yet

- Defined Benefit Plan (Exercises With Answers)Document3 pagesDefined Benefit Plan (Exercises With Answers)Jennifer AdvientoNo ratings yet

- FAR.2854 - Cash To Accrual.Document3 pagesFAR.2854 - Cash To Accrual.stephen ponciano100% (2)

- Discussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument3 pagesDiscussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNo ratings yet

- Appendix Ebleta MatsDocument17 pagesAppendix Ebleta MatsEl Yang0% (2)

- Problems Chapter 6-10Document15 pagesProblems Chapter 6-10u got no jams0% (1)

- This Study Resource Was: Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument8 pagesThis Study Resource Was: Identify The Letter of The Choice That Best Completes The Statement or Answers The Questionfufu pandaNo ratings yet

- Unit Iii Assessment ProblemsDocument8 pagesUnit Iii Assessment ProblemsChin Figura100% (1)

- C A R T: Practical Accounting IDocument1 pageC A R T: Practical Accounting IVel JuneNo ratings yet

- This Study Resource Was: Employee BenefitsDocument9 pagesThis Study Resource Was: Employee BenefitsElisabeth HenangerNo ratings yet

- LiabilitiesDocument5 pagesLiabilitiesmalaya negadNo ratings yet

- ACC 226 Statement of Financial Position - DRILLS - NoDocument5 pagesACC 226 Statement of Financial Position - DRILLS - Noj.dimaporo.540424No ratings yet

- Notes PayableDocument4 pagesNotes PayableShilla Mae BalanceNo ratings yet

- Exerc5se 2313Document5 pagesExerc5se 2313Chris tine Mae MendozaNo ratings yet

- Colegio de San Juan de Letran: Employee BenefitsDocument4 pagesColegio de San Juan de Letran: Employee BenefitsRed YuNo ratings yet

- LM-24 Intermediate AccountingDocument7 pagesLM-24 Intermediate AccountingMary Jane TalanNo ratings yet

- Financial Accounting and Reporting Final ExaminationDocument13 pagesFinancial Accounting and Reporting Final ExaminationBernardino PacificAce100% (1)

- Compiled By: Wenston Del Rosario ACCTGREV1 - 010: Employee BenefitsDocument2 pagesCompiled By: Wenston Del Rosario ACCTGREV1 - 010: Employee BenefitsJeremiah DavidNo ratings yet

- A. Fair Value of Plan Assets On December 31, 20x1Document9 pagesA. Fair Value of Plan Assets On December 31, 20x1MHARTIN DAENNIELLE ORSALNo ratings yet

- Sept. 1, 2020 Topic 1 - Employee Benefits (Closure Questions)Document4 pagesSept. 1, 2020 Topic 1 - Employee Benefits (Closure Questions)Lj Diane TuazonNo ratings yet

- FAR PROBLEMS - 1 FinalDocument9 pagesFAR PROBLEMS - 1 FinalLouise GazaNo ratings yet

- Retirement BenefitsDocument4 pagesRetirement BenefitsJona FranciscoNo ratings yet

- Acctg 100C 16 PDFDocument4 pagesAcctg 100C 16 PDFQuid DamityNo ratings yet

- Unit Iii Assessment ProblemsDocument8 pagesUnit Iii Assessment ProblemsWindie SisodNo ratings yet

- 102 Quiz 1 She 2020Document6 pages102 Quiz 1 She 2020Eunice MartinezNo ratings yet

- Manila MAY 5, 2022 Preweek Material: Management Advisory ServicesDocument25 pagesManila MAY 5, 2022 Preweek Material: Management Advisory ServicesJoris YapNo ratings yet

- Actual Amount P900,000 BDocument3 pagesActual Amount P900,000 BFerb CruzadaNo ratings yet

- SM01 EmployeeBenefitsDocument1 pageSM01 EmployeeBenefitsJoan Rachel CalansinginNo ratings yet

- Abc 6Document4 pagesAbc 6Kath LeynesNo ratings yet

- Activity #2-Employee BenefitsDocument5 pagesActivity #2-Employee BenefitsJamaica DavidNo ratings yet

- FAR Material-2Document8 pagesFAR Material-2Blessy Zedlav LacbainNo ratings yet

- Short Notes On Important Central Labour Legislations: Juneja & AssociatesDocument36 pagesShort Notes On Important Central Labour Legislations: Juneja & AssociatesNaveen ChaudharyNo ratings yet

- Infosys Project 1Document62 pagesInfosys Project 1Shivam KanawadeNo ratings yet

- Hhofma3e Ch10 Tif TestgenDocument42 pagesHhofma3e Ch10 Tif TestgenjindjaanNo ratings yet

- 11 HR Trends For 2023 - Seizing The Window of Opportunity - AIHRDocument13 pages11 HR Trends For 2023 - Seizing The Window of Opportunity - AIHRfahiraNo ratings yet

- DONE Bigg's Inc. vs. Jay Boncacas Et Al. G.R. No. 200487. G.R. No. 200636, March 6, 2019Document2 pagesDONE Bigg's Inc. vs. Jay Boncacas Et Al. G.R. No. 200487. G.R. No. 200636, March 6, 2019Kathlene JaoNo ratings yet

- BH4702 Introduction To HRM - Article 1 For Problem Based ReportDocument20 pagesBH4702 Introduction To HRM - Article 1 For Problem Based ReportSarmad SultanNo ratings yet

- Denise Tyrrell Settlement AgreementDocument11 pagesDenise Tyrrell Settlement AgreementcalwatchNo ratings yet

- Labour Migration Colonial ZambiaDocument8 pagesLabour Migration Colonial Zambiamuna moono100% (1)

- Employment TrendsDocument9 pagesEmployment Trendsapi-607584974No ratings yet

- Chapter 4:organizing Lesson 2: Types of OrganizationDocument18 pagesChapter 4:organizing Lesson 2: Types of OrganizationMarilyn BaldicanasNo ratings yet

- Buchanan v. GenentechDocument24 pagesBuchanan v. GenentechNorthern District of California BlogNo ratings yet

- Azie Eco211 Chap 12007Document40 pagesAzie Eco211 Chap 12007Laila Fajriah0% (1)

- BM ContractDocument2 pagesBM ContractJames MukhwanaNo ratings yet

- TasksDocument1 pageTasksUnais_No ratings yet

- Support and Facilitate Implementation and Develop WHS PolicyDocument22 pagesSupport and Facilitate Implementation and Develop WHS PolicyPitaram PanthiNo ratings yet

- Analysis - Germany - Individual Taxation - IBFDDocument56 pagesAnalysis - Germany - Individual Taxation - IBFDbilgintalhaNo ratings yet

- Bcom 7 7Th Edition Lehman Solutions Manual Full Chapter PDFDocument44 pagesBcom 7 7Th Edition Lehman Solutions Manual Full Chapter PDFJessicaMitchelleokj100% (15)

- Entrep Module9Document12 pagesEntrep Module9jecille magalongNo ratings yet

- Module 5 Essay Prompt #1: What Is The Leadership Paradox (2 Points) ? Give Some Reasons Why You Think ADocument3 pagesModule 5 Essay Prompt #1: What Is The Leadership Paradox (2 Points) ? Give Some Reasons Why You Think Aapi-622068565No ratings yet

- BN Psychologicaltests Adv Ws 968319Document8 pagesBN Psychologicaltests Adv Ws 968319gkjw897hr4No ratings yet

- Types of MigrationDocument3 pagesTypes of MigrationAshley LoganNo ratings yet

- DT Chart BookDocument62 pagesDT Chart BookShagun Chandrakar100% (1)

- PSC Safety FlashlightsDocument4 pagesPSC Safety FlashlightsProject Sales CorpNo ratings yet

- PROJECT DISSERTATION IInd DraftDocument33 pagesPROJECT DISSERTATION IInd Draftkapil devNo ratings yet

- Chapter 1 The Problem and Its BackgroundDocument7 pagesChapter 1 The Problem and Its BackgroundRY ANNo ratings yet

- Addressing Workers' Rights in The Textile and Apparel Industries: Consequences For The Bangladesh EconomyDocument15 pagesAddressing Workers' Rights in The Textile and Apparel Industries: Consequences For The Bangladesh EconomyAmna AroojNo ratings yet

- MpebDocument5 pagesMpebSumit AnandNo ratings yet

- Nri Parental Care IndiaDocument9 pagesNri Parental Care Indianriparental careNo ratings yet

UE

UE

Uploaded by

fastslowerOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UE

UE

Uploaded by

fastslowerCopyright:

Available Formats

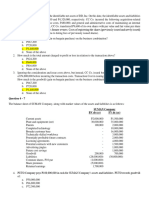

1. Jessie co. sponsors a defined benefit pension plan.

n. For the current year ended December 31, the following information relevant

to the plan has been accumulated:

Defined benefit obligation, 1/1 P10,000,000

Fair value of plan assets, 1/1 9,000,000

Current service cost 3,000,000

Gain on settlement 500,000

Actual return on plan assets 630,000

Increase in defined benefit obligation due to changes in 800,000

actuarial assumptions

Market yield on high corporate bonds 6%

Yield on bonds issued by the entity 8%

Expected return on plan assets 9%

Calculate the amount that Jessie Co. would recognize in profit or loss for the year in accordance with the revised PAS 19.

A. P2,560,000 B. P2,570,000 C. 2,580,000 D. P2,590,000

2. Platon Company’s defined benefit plan has the following information:

January 1 December 31

Fair value of plan assets 10,000,000 12,000,000

Defined benefit obligation 8,000,000 9,000,000

Discount rate 10% 10%

Present value of available future refunds and reduction in future contributions 1,600,000 2,000,000

In relation to the asset ceiling, the amount that the entity would recognize in other comprehensive income for the year 2020

should be

A. P1,000,000 B. P960,000 C. P600,000 D. P560,000

Use the following information for the next four (4) questions:

An entity provided the following information during the current year:

January 1 December 31

Fair value of plan assets P6,000,000 P9,000,000

Projected benefit obligations 4,500,000 5,000,000

Prepaid/accrued benefit cost – surplus P1,500,000 P4,000,000

Asset ceiling 1,000,000 2,500,000

Effect of asset ceiling P500,000 P1,500,000

During the year, the entity recognized current service cost P2,000,000, actual return on plan assets P400,000, and contribution to the

plan P4,550,000 and benefits paid P1,950,000. The discount rate is 10%.

3. What is the employee benefit expense for the current year?

A. P1,900,000 B. P1,850,000 C. P1,800,000 D. P2,000,000

4. What is the net remeasurement loss for the current year?

A. P1,150,000 B. P800,000 C. P750,000 D. P1,200,000

5. What is the defined benefit cost?

A. P3,050,000 B. P3,100,000 C. P4,550,000 D. P3,000,000

6. What amount of prepaid benefit cost should be reported on December 31?

A. P4,000,000 B. P2,500,000 C. P1,000,000 D. P1,500,000

Use the following information for the next two (2) questions:

An entity is committed to close a factory in 10 months and shall terminate the employment of all the remaining employees of the

factory. Under the termination plan, an employee leaving before closure of factory shall receive on termination date a cash

payment of P20,000. However, an employee that renders service until closure of the factory shall receive P60,000. There are

120 employees at the factory. The entity expects 100 employees to leave before closure and 20 employees to render service until

closure.

7. What amount should be recognized as termination benefit?

A. P2,400,000 B. P6,400,000 C. P2,000,000 D. P4,000,000

8. What amount should be recognized as short-term benefit?

A. P3,200,000 B. P1,200,000 C. P2,000,000 D. P800,000

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Human Resources EnglishDocument11 pagesHuman Resources EnglishirstarworkNo ratings yet

- Employee Benefit 1 PDFDocument34 pagesEmployee Benefit 1 PDFbobo kaNo ratings yet

- (Use The Below Problem To Answers The Succeeding Four (4) Questions.)Document3 pages(Use The Below Problem To Answers The Succeeding Four (4) Questions.)admiral spongebobNo ratings yet

- L 1Document5 pagesL 1Elizabeth Espinosa ManilagNo ratings yet

- R4acads Finacc ExtraDocument5 pagesR4acads Finacc ExtraChristine Herico CurryNo ratings yet

- HRM Overview - Chapter 1 & 2 (Fisher, Schoenfeldt & Shaw)Document15 pagesHRM Overview - Chapter 1 & 2 (Fisher, Schoenfeldt & Shaw)Saif Hasan Jyoti100% (2)

- Module 31 Employee Benefits ProblemDocument2 pagesModule 31 Employee Benefits ProblemThalia UyNo ratings yet

- EMPLOYEE-BENEFITS AnswerkeyDocument6 pagesEMPLOYEE-BENEFITS AnswerkeyRiselle Ann Sanchez100% (2)

- ACCTG Employee-BenefitDocument2 pagesACCTG Employee-BenefitMicaela EncinasNo ratings yet

- Employee Benefits: Defined Benefit PlansDocument4 pagesEmployee Benefits: Defined Benefit PlansMHARTIN DAENNIELLE ORSALNo ratings yet

- AUDITING Material 2Document9 pagesAUDITING Material 2Blessy Zedlav LacbainNo ratings yet

- Quiz Employee Benifits Income TaxDocument2 pagesQuiz Employee Benifits Income TaxMonica MonicaNo ratings yet

- Acc 108 Emp BeneDocument4 pagesAcc 108 Emp BeneSam GallineroNo ratings yet

- Employees BenefitsDocument2 pagesEmployees BenefitsorillosachristoperjohnNo ratings yet

- Acctg 5Document6 pagesAcctg 5Charmane MatiasNo ratings yet

- Ho2-Employee Benefits and Share-Based Compensation (Student's Copy)Document10 pagesHo2-Employee Benefits and Share-Based Compensation (Student's Copy)Alliah ArrozaNo ratings yet

- Diara Po.Document7 pagesDiara Po.Rio Cyrel CelleroNo ratings yet

- (Use The Below Problem To Answers The Succeeding Four (4) Questions.)Document3 pages(Use The Below Problem To Answers The Succeeding Four (4) Questions.)Sitti Ayesha HasimanNo ratings yet

- Poem PoemDocument5 pagesPoem PoemElizabeth Espinosa ManilagNo ratings yet

- Employee Benefits 2 Employee Benefits 2Document4 pagesEmployee Benefits 2 Employee Benefits 2XNo ratings yet

- (Use The Below Problem To Answers The Succeeding Four (4) Questions.)Document3 pages(Use The Below Problem To Answers The Succeeding Four (4) Questions.)Janine LerumNo ratings yet

- 05 Comprehensive Income PDFDocument2 pages05 Comprehensive Income PDFMimi YayaNo ratings yet

- Activity 1.6.2Document1 pageActivity 1.6.2Stephen JohnNo ratings yet

- Ia2 QuestionsDocument6 pagesIa2 QuestionsSharjaaahNo ratings yet

- Acc 108 Emp Bene. Bonus Debt RestrDocument2 pagesAcc 108 Emp Bene. Bonus Debt Restrbrmo.amatorio.uiNo ratings yet

- Drill 3 AK FSUU AccountingDocument15 pagesDrill 3 AK FSUU AccountingRobert CastilloNo ratings yet

- ACC221Document5 pagesACC221Hilarie JeanNo ratings yet

- Q2 Employee Benefits Pt.2Document4 pagesQ2 Employee Benefits Pt.2francine del rosarioNo ratings yet

- Unit Number/ Heading: Intermediate Accounting Ii (Ae 16) Learning Material: Postemployment BenefitDocument3 pagesUnit Number/ Heading: Intermediate Accounting Ii (Ae 16) Learning Material: Postemployment BenefitSitti Ayesha HasimanNo ratings yet

- AA 4101 Midterm With AnswersDocument9 pagesAA 4101 Midterm With AnswersAlyssa AnnNo ratings yet

- Iac 11 Employee BenefitsDocument5 pagesIac 11 Employee BenefitsNacelleNo ratings yet

- Defined Benefit Plan (Exercises With Answers)Document3 pagesDefined Benefit Plan (Exercises With Answers)Jennifer AdvientoNo ratings yet

- FAR.2854 - Cash To Accrual.Document3 pagesFAR.2854 - Cash To Accrual.stephen ponciano100% (2)

- Discussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument3 pagesDiscussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNo ratings yet

- Appendix Ebleta MatsDocument17 pagesAppendix Ebleta MatsEl Yang0% (2)

- Problems Chapter 6-10Document15 pagesProblems Chapter 6-10u got no jams0% (1)

- This Study Resource Was: Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument8 pagesThis Study Resource Was: Identify The Letter of The Choice That Best Completes The Statement or Answers The Questionfufu pandaNo ratings yet

- Unit Iii Assessment ProblemsDocument8 pagesUnit Iii Assessment ProblemsChin Figura100% (1)

- C A R T: Practical Accounting IDocument1 pageC A R T: Practical Accounting IVel JuneNo ratings yet

- This Study Resource Was: Employee BenefitsDocument9 pagesThis Study Resource Was: Employee BenefitsElisabeth HenangerNo ratings yet

- LiabilitiesDocument5 pagesLiabilitiesmalaya negadNo ratings yet

- ACC 226 Statement of Financial Position - DRILLS - NoDocument5 pagesACC 226 Statement of Financial Position - DRILLS - Noj.dimaporo.540424No ratings yet

- Notes PayableDocument4 pagesNotes PayableShilla Mae BalanceNo ratings yet

- Exerc5se 2313Document5 pagesExerc5se 2313Chris tine Mae MendozaNo ratings yet

- Colegio de San Juan de Letran: Employee BenefitsDocument4 pagesColegio de San Juan de Letran: Employee BenefitsRed YuNo ratings yet

- LM-24 Intermediate AccountingDocument7 pagesLM-24 Intermediate AccountingMary Jane TalanNo ratings yet

- Financial Accounting and Reporting Final ExaminationDocument13 pagesFinancial Accounting and Reporting Final ExaminationBernardino PacificAce100% (1)

- Compiled By: Wenston Del Rosario ACCTGREV1 - 010: Employee BenefitsDocument2 pagesCompiled By: Wenston Del Rosario ACCTGREV1 - 010: Employee BenefitsJeremiah DavidNo ratings yet

- A. Fair Value of Plan Assets On December 31, 20x1Document9 pagesA. Fair Value of Plan Assets On December 31, 20x1MHARTIN DAENNIELLE ORSALNo ratings yet

- Sept. 1, 2020 Topic 1 - Employee Benefits (Closure Questions)Document4 pagesSept. 1, 2020 Topic 1 - Employee Benefits (Closure Questions)Lj Diane TuazonNo ratings yet

- FAR PROBLEMS - 1 FinalDocument9 pagesFAR PROBLEMS - 1 FinalLouise GazaNo ratings yet

- Retirement BenefitsDocument4 pagesRetirement BenefitsJona FranciscoNo ratings yet

- Acctg 100C 16 PDFDocument4 pagesAcctg 100C 16 PDFQuid DamityNo ratings yet

- Unit Iii Assessment ProblemsDocument8 pagesUnit Iii Assessment ProblemsWindie SisodNo ratings yet

- 102 Quiz 1 She 2020Document6 pages102 Quiz 1 She 2020Eunice MartinezNo ratings yet

- Manila MAY 5, 2022 Preweek Material: Management Advisory ServicesDocument25 pagesManila MAY 5, 2022 Preweek Material: Management Advisory ServicesJoris YapNo ratings yet

- Actual Amount P900,000 BDocument3 pagesActual Amount P900,000 BFerb CruzadaNo ratings yet

- SM01 EmployeeBenefitsDocument1 pageSM01 EmployeeBenefitsJoan Rachel CalansinginNo ratings yet

- Abc 6Document4 pagesAbc 6Kath LeynesNo ratings yet

- Activity #2-Employee BenefitsDocument5 pagesActivity #2-Employee BenefitsJamaica DavidNo ratings yet

- FAR Material-2Document8 pagesFAR Material-2Blessy Zedlav LacbainNo ratings yet

- Short Notes On Important Central Labour Legislations: Juneja & AssociatesDocument36 pagesShort Notes On Important Central Labour Legislations: Juneja & AssociatesNaveen ChaudharyNo ratings yet

- Infosys Project 1Document62 pagesInfosys Project 1Shivam KanawadeNo ratings yet

- Hhofma3e Ch10 Tif TestgenDocument42 pagesHhofma3e Ch10 Tif TestgenjindjaanNo ratings yet

- 11 HR Trends For 2023 - Seizing The Window of Opportunity - AIHRDocument13 pages11 HR Trends For 2023 - Seizing The Window of Opportunity - AIHRfahiraNo ratings yet

- DONE Bigg's Inc. vs. Jay Boncacas Et Al. G.R. No. 200487. G.R. No. 200636, March 6, 2019Document2 pagesDONE Bigg's Inc. vs. Jay Boncacas Et Al. G.R. No. 200487. G.R. No. 200636, March 6, 2019Kathlene JaoNo ratings yet

- BH4702 Introduction To HRM - Article 1 For Problem Based ReportDocument20 pagesBH4702 Introduction To HRM - Article 1 For Problem Based ReportSarmad SultanNo ratings yet

- Denise Tyrrell Settlement AgreementDocument11 pagesDenise Tyrrell Settlement AgreementcalwatchNo ratings yet

- Labour Migration Colonial ZambiaDocument8 pagesLabour Migration Colonial Zambiamuna moono100% (1)

- Employment TrendsDocument9 pagesEmployment Trendsapi-607584974No ratings yet

- Chapter 4:organizing Lesson 2: Types of OrganizationDocument18 pagesChapter 4:organizing Lesson 2: Types of OrganizationMarilyn BaldicanasNo ratings yet

- Buchanan v. GenentechDocument24 pagesBuchanan v. GenentechNorthern District of California BlogNo ratings yet

- Azie Eco211 Chap 12007Document40 pagesAzie Eco211 Chap 12007Laila Fajriah0% (1)

- BM ContractDocument2 pagesBM ContractJames MukhwanaNo ratings yet

- TasksDocument1 pageTasksUnais_No ratings yet

- Support and Facilitate Implementation and Develop WHS PolicyDocument22 pagesSupport and Facilitate Implementation and Develop WHS PolicyPitaram PanthiNo ratings yet

- Analysis - Germany - Individual Taxation - IBFDDocument56 pagesAnalysis - Germany - Individual Taxation - IBFDbilgintalhaNo ratings yet

- Bcom 7 7Th Edition Lehman Solutions Manual Full Chapter PDFDocument44 pagesBcom 7 7Th Edition Lehman Solutions Manual Full Chapter PDFJessicaMitchelleokj100% (15)

- Entrep Module9Document12 pagesEntrep Module9jecille magalongNo ratings yet

- Module 5 Essay Prompt #1: What Is The Leadership Paradox (2 Points) ? Give Some Reasons Why You Think ADocument3 pagesModule 5 Essay Prompt #1: What Is The Leadership Paradox (2 Points) ? Give Some Reasons Why You Think Aapi-622068565No ratings yet

- BN Psychologicaltests Adv Ws 968319Document8 pagesBN Psychologicaltests Adv Ws 968319gkjw897hr4No ratings yet

- Types of MigrationDocument3 pagesTypes of MigrationAshley LoganNo ratings yet

- DT Chart BookDocument62 pagesDT Chart BookShagun Chandrakar100% (1)

- PSC Safety FlashlightsDocument4 pagesPSC Safety FlashlightsProject Sales CorpNo ratings yet

- PROJECT DISSERTATION IInd DraftDocument33 pagesPROJECT DISSERTATION IInd Draftkapil devNo ratings yet

- Chapter 1 The Problem and Its BackgroundDocument7 pagesChapter 1 The Problem and Its BackgroundRY ANNo ratings yet

- Addressing Workers' Rights in The Textile and Apparel Industries: Consequences For The Bangladesh EconomyDocument15 pagesAddressing Workers' Rights in The Textile and Apparel Industries: Consequences For The Bangladesh EconomyAmna AroojNo ratings yet

- MpebDocument5 pagesMpebSumit AnandNo ratings yet

- Nri Parental Care IndiaDocument9 pagesNri Parental Care Indianriparental careNo ratings yet