Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

30 viewsAfter The Success of The Company's First Two Months, Santana Rey Continues To Operate Business Solutions. The November 30, 2015, Unadjusted Trial Balance of Business Solutions (Reflecting Dec

After The Success of The Company's First Two Months, Santana Rey Continues To Operate Business Solutions. The November 30, 2015, Unadjusted Trial Balance of Business Solutions (Reflecting Dec

Uploaded by

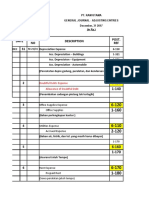

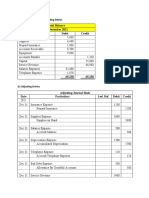

Jalaj GuptaThe document appears to be a record of transactions for a company from December 1-31. It includes debit and credit entries for various expense, revenue, and balance sheet accounts. On December 31st, closing entries were made for expenses and revenues to zero out those accounts and debit retained earnings for the net income amount. Dividends of $7200 were also declared and paid out, reducing retained earnings.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- Lembar Kerja UD. Mudah HasilDocument41 pagesLembar Kerja UD. Mudah HasilRoni NNo ratings yet

- Assesment 2 Reham Hajeeh 202000394Document32 pagesAssesment 2 Reham Hajeeh 202000394api-586476688No ratings yet

- Assignment AJE 3 PDFDocument10 pagesAssignment AJE 3 PDFJalaj GuptaNo ratings yet

- Acct Project Question 3Document14 pagesAcct Project Question 3grace100% (1)

- Acr4 3Document22 pagesAcr4 3rhyayuli0% (1)

- PARTNERSHIPDocument2 pagesPARTNERSHIPMaryanne0% (1)

- GL, TB - D. MaputimDocument11 pagesGL, TB - D. MaputimJasmine Acta67% (3)

- W. W. Grainger, Inc., Is A Leading Supplier of Maintenance, Repair, and Operating (MRO) Products To Businesses and Institutions in The UnitedDocument3 pagesW. W. Grainger, Inc., Is A Leading Supplier of Maintenance, Repair, and Operating (MRO) Products To Businesses and Institutions in The UnitedJalaj GuptaNo ratings yet

- China Trade, Inc. Journal Entries: Date GL Number Description Debit CreditDocument7 pagesChina Trade, Inc. Journal Entries: Date GL Number Description Debit CreditJalaj GuptaNo ratings yet

- Ch. 3 HW ExplanationDocument7 pagesCh. 3 HW ExplanationJalaj GuptaNo ratings yet

- This Study Resource Was: Adjust CreditDocument4 pagesThis Study Resource Was: Adjust CreditJalaj GuptaNo ratings yet

- ACC 101 Chapter 2 Test (5Document5 pagesACC 101 Chapter 2 Test (5Ammarrylee R. Williams0% (2)

- Summarizing (Trial Balance) : (Go Through The Reference Books For Details)Document6 pagesSummarizing (Trial Balance) : (Go Through The Reference Books For Details)sujitNo ratings yet

- Assignment 2Document12 pagesAssignment 2Geetu SharmaNo ratings yet

- Sandpaper Project ProfileDocument15 pagesSandpaper Project ProfileTekeba Birhane100% (3)

- KietPHMSS170832 ACC101 Individual AssignmentDocument17 pagesKietPHMSS170832 ACC101 Individual AssignmentMinh Kiet Pham HuuNo ratings yet

- Essay AccDocument1 pageEssay AccHoang Dieu Linh QP2505No ratings yet

- VoidDocument8 pagesVoidAn Phi Ngoc HuyNo ratings yet

- Chapter 1 - Ex SolutionDocument9 pagesChapter 1 - Ex SolutionNguyễn Đức MinhNo ratings yet

- 02 B Jane MangrobangDocument14 pages02 B Jane MangrobangCharlotte PlazosNo ratings yet

- General Journal Date Particulars PR Debit CreditDocument10 pagesGeneral Journal Date Particulars PR Debit CreditLeonilaEnriquezNo ratings yet

- 1942510Document6 pages1942510mohitgaba19No ratings yet

- ACCT1008 SP2 2020 Assignment Part A - FINALDocument16 pagesACCT1008 SP2 2020 Assignment Part A - FINALkakuNo ratings yet

- Solution Accrual and Prepayment (Tutorial in Class 23 May 2023)Document9 pagesSolution Accrual and Prepayment (Tutorial in Class 23 May 2023)mardhiahNo ratings yet

- Kunci Jawaban Sesi 3Document29 pagesKunci Jawaban Sesi 3Egi Rianto100% (1)

- Waltham Oil and Lube Center: Journal SN Date Particulars Ledger File DebitDocument7 pagesWaltham Oil and Lube Center: Journal SN Date Particulars Ledger File DebitAbhishek TomarNo ratings yet

- Daftar Akun PT GKDocument4 pagesDaftar Akun PT GKHerlangga AnggaNo ratings yet

- Financial StatmentDocument17 pagesFinancial StatmentJerickho JNo ratings yet

- Chap3 B MergedDocument26 pagesChap3 B Mergedjamel008No ratings yet

- Quiz 4 - Problem 1Document2 pagesQuiz 4 - Problem 1KyleRhayneDiazCaliwagNo ratings yet

- T-Account: Date Amount Date AmountDocument8 pagesT-Account: Date Amount Date AmountAbdul MoeedNo ratings yet

- Practice Question (Accounting Cycle) With Solution v2Document17 pagesPractice Question (Accounting Cycle) With Solution v2Laiba ManzoorNo ratings yet

- 1000 Assets: Account # Account NameDocument25 pages1000 Assets: Account # Account NameAdnan AmjadNo ratings yet

- LK - Menyusun Lap. Keuangan - P1Document15 pagesLK - Menyusun Lap. Keuangan - P1rizeky putriNo ratings yet

- Tugas 6 - Azka Fadhilah N - 141010180043Document5 pagesTugas 6 - Azka Fadhilah N - 141010180043Nabilla FadiaNo ratings yet

- Ledger EntryDocument17 pagesLedger EntryJerickho JNo ratings yet

- Assignment AnsDocument6 pagesAssignment AnsVAIGESWARI A/P MANIAM STUDENTNo ratings yet

- Tugas 14 SepDocument5 pagesTugas 14 Sepmelvina siregar100% (1)

- 04 - Matching and AdjustmentDocument20 pages04 - Matching and AdjustmentMadelaine KienyNo ratings yet

- Full Set of Financial AccountingDocument8 pagesFull Set of Financial AccountingmaiNo ratings yet

- Ques 1Document2 pagesQues 1Sorowar SalauddinNo ratings yet

- Assignment 9 (DionDocument36 pagesAssignment 9 (DionMaxNo ratings yet

- Indotambangraya Megah ProposalDocument160 pagesIndotambangraya Megah ProposalAji ShorenkNo ratings yet

- 2010 DR CR December 1 Cash: Journal EntriesDocument14 pages2010 DR CR December 1 Cash: Journal EntriesRafe Alexis MiravillaNo ratings yet

- Crane Inc. Entered Into A Contract To Deliver One of Its Specialty Mowers To Kickapoo Landscaping CoDocument2 pagesCrane Inc. Entered Into A Contract To Deliver One of Its Specialty Mowers To Kickapoo Landscaping CoKailash KumarNo ratings yet

- Cash Flow Indirect MethodDocument3 pagesCash Flow Indirect MethodLusianaaNo ratings yet

- PT Cahaya Adjustment Entries December 31: Date Evidence Description ACC Debit Credit Number REF RP RPDocument16 pagesPT Cahaya Adjustment Entries December 31: Date Evidence Description ACC Debit Credit Number REF RP RPIvankaNo ratings yet

- AsTea Drinks Limited Current Year Trial Balance Apr2020Document6 pagesAsTea Drinks Limited Current Year Trial Balance Apr2020Abdul Basit FarooqiNo ratings yet

- Accounting Past YearsDocument32 pagesAccounting Past YearsPushpa ValliNo ratings yet

- SamuelDocument12 pagesSamuelEhtisham Ul HaqNo ratings yet

- FR ExamDocument18 pagesFR ExamRizkiNurEtikasariNo ratings yet

- Assignment 2 - Lab Acct - ELEONORA VINESSA ARIANTODocument7 pagesAssignment 2 - Lab Acct - ELEONORA VINESSA ARIANTOEleonora VinessaNo ratings yet

- Adjusting EntriesDocument10 pagesAdjusting EntriesQuoc Anh HaNo ratings yet

- ACCT 6010 Assignment #1Document15 pagesACCT 6010 Assignment #1patel avaniNo ratings yet

- Basic Accounting Quiz 2.0Document4 pagesBasic Accounting Quiz 2.0Jensen Rowie PasngadanNo ratings yet

- Comprehensive Problem Excel SpreadsheetDocument23 pagesComprehensive Problem Excel Spreadsheetapi-237864722100% (3)

- Adowa Peachtree Class ExcerciseDocument4 pagesAdowa Peachtree Class ExcerciseAbel Hailu100% (1)

- M170-18 - Section C - Assignment 2Document16 pagesM170-18 - Section C - Assignment 2VallabhRemaniNo ratings yet

- Trial Balance Account Tittles Dr. CR.: P4-1A/a. Work Sheet of Wareen Roofing For The Month Ended March 31,2017Document40 pagesTrial Balance Account Tittles Dr. CR.: P4-1A/a. Work Sheet of Wareen Roofing For The Month Ended March 31,2017Nguyễn Ngọc Phương HằngNo ratings yet

- Closing Accounts - Exercise 2020 2Document1 pageClosing Accounts - Exercise 2020 2Linh Tam Vu NgocNo ratings yet

- S13 7 Com D Chart of Accounts EngDocument3 pagesS13 7 Com D Chart of Accounts EngndieniNo ratings yet

- Adjusting Entries Class Problem 2 (Class-4)Document9 pagesAdjusting Entries Class Problem 2 (Class-4)Mahmudul HasanNo ratings yet

- AJP RM MUBARAK-dikonversiDocument1 pageAJP RM MUBARAK-dikonversiBulan julpi suwellyNo ratings yet

- A. Ud Buana 2Document11 pagesA. Ud Buana 2Ayu FebriyantiNo ratings yet

- Incomplete Records MTQDocument5 pagesIncomplete Records MTQqas4476pubNo ratings yet

- Group - C: DA 4104 - Computer Based AccountingDocument10 pagesGroup - C: DA 4104 - Computer Based AccountinghemacrcNo ratings yet

- Mickley Company's Plantwide Predetermined Overhead Rate IsDocument1 pageMickley Company's Plantwide Predetermined Overhead Rate IsJalaj GuptaNo ratings yet

- Fanelli Corporation, A Merchandising CompanyDocument2 pagesFanelli Corporation, A Merchandising CompanyJalaj GuptaNo ratings yet

- Izabela Cullumber Opened A Medical Office Under The Name Izabela CullumberDocument4 pagesIzabela Cullumber Opened A Medical Office Under The Name Izabela CullumberJalaj GuptaNo ratings yet

- P 81Document3 pagesP 81Jalaj GuptaNo ratings yet

- Phelps Corporation Received A Charter Granting The Right To IssueDocument3 pagesPhelps Corporation Received A Charter Granting The Right To IssueJalaj GuptaNo ratings yet

- Chapter 1 - Text ExercisesDocument35 pagesChapter 1 - Text ExercisesJalaj GuptaNo ratings yet

- This Study Resource Was: Award: 10.00 PointsDocument4 pagesThis Study Resource Was: Award: 10.00 PointsJalaj GuptaNo ratings yet

- Trout Inc. Prepared The Following Production Report-Weighted AverageDocument4 pagesTrout Inc. Prepared The Following Production Report-Weighted AverageJalaj GuptaNo ratings yet

- This Study Resource Was: Award: 10.00 PointsDocument4 pagesThis Study Resource Was: Award: 10.00 PointsJalaj GuptaNo ratings yet

- Winslow Inc. Manufactures and Sells Three Types of Shoes. TDocument3 pagesWinslow Inc. Manufactures and Sells Three Types of Shoes. TJalaj GuptaNo ratings yet

- Milano Pizza Is A Small Neighborhood PizzeriaDocument3 pagesMilano Pizza Is A Small Neighborhood PizzeriaJalaj GuptaNo ratings yet

- This Study Resource Was: Problem 21-6A (Part Level Submission)Document3 pagesThis Study Resource Was: Problem 21-6A (Part Level Submission)Jalaj GuptaNo ratings yet

- Fidelity Engineering Reported Pretax Accounting IncomeDocument2 pagesFidelity Engineering Reported Pretax Accounting IncomeJalaj GuptaNo ratings yet

- Chapter 12 Testbank PDFDocument76 pagesChapter 12 Testbank PDFJalaj GuptaNo ratings yet

- Date General Journal Debit CreditDocument14 pagesDate General Journal Debit CreditJalaj GuptaNo ratings yet

- Journal Entries in The Books of Santana Rey Date Particulars Debit CreditDocument12 pagesJournal Entries in The Books of Santana Rey Date Particulars Debit CreditJalaj GuptaNo ratings yet

- Pam Corporation Paid $170,000 For An 80 Percent Interest in Sun CorporationDocument3 pagesPam Corporation Paid $170,000 For An 80 Percent Interest in Sun CorporationJalaj GuptaNo ratings yet

- On January 1, Year 4, Grant Corporation BoughtDocument4 pagesOn January 1, Year 4, Grant Corporation BoughtJalaj GuptaNo ratings yet

- Solution Ch04Document146 pagesSolution Ch04Harmanjot 03No ratings yet

- Instant Download Ebook PDF Financial and Managerial Accounting 6th Edition by Ken Shaw PDF ScribdDocument41 pagesInstant Download Ebook PDF Financial and Managerial Accounting 6th Edition by Ken Shaw PDF Scribdmaurice.nesbit229100% (47)

- Revenue Regulations No. 19-86: Taxation of Leases All Internal Revenue Officers and Others Concerned PurposeDocument23 pagesRevenue Regulations No. 19-86: Taxation of Leases All Internal Revenue Officers and Others Concerned PurposeyakyakxxNo ratings yet

- Project Planning Template (Version 3.0)Document17 pagesProject Planning Template (Version 3.0)VrajNo ratings yet

- Biodegradable Disposable Plastic Cutlery-643528 PDFDocument39 pagesBiodegradable Disposable Plastic Cutlery-643528 PDFMusheer BashaNo ratings yet

- Financial Reporting For School Organizations: "Learning How To Prepare Your Financial Reports The Proper Way."Document19 pagesFinancial Reporting For School Organizations: "Learning How To Prepare Your Financial Reports The Proper Way."AJ CresmundoNo ratings yet

- Payslip February-2023Document1 pagePayslip February-2023kashif shaikhNo ratings yet

- FABM 1 - Contextualized LAS - Week 4Document7 pagesFABM 1 - Contextualized LAS - Week 4Sheila Marie Ann Magcalas-GaluraNo ratings yet

- P3 2A AnswerDocument2 pagesP3 2A AnswerMinh NhậtNo ratings yet

- Chapter 21 - LeasingDocument87 pagesChapter 21 - LeasingCorey Sobers-Smith100% (1)

- Corporate Social Responsibility Policy: Page 1 of 9Document9 pagesCorporate Social Responsibility Policy: Page 1 of 9Darshan KannurNo ratings yet

- Accounting Part 2 Test 1st HalfDocument3 pagesAccounting Part 2 Test 1st HalfAyman ChishtyNo ratings yet

- Cost of Goods Sold and Inventory PDFDocument69 pagesCost of Goods Sold and Inventory PDFThành Steven100% (1)

- Ho2-Employee Benefits and Share-Based Compensation (Student's Copy)Document10 pagesHo2-Employee Benefits and Share-Based Compensation (Student's Copy)Alliah ArrozaNo ratings yet

- Budgeting Quiz Answer KeyDocument5 pagesBudgeting Quiz Answer KeyDeniseNo ratings yet

- New SchemeDocument452 pagesNew Schememynameislakhan2122No ratings yet

- AccountingDocument50 pagesAccountingAshyanna UletNo ratings yet

- Reporting The Statement of Cash Flows: QuestionsDocument58 pagesReporting The Statement of Cash Flows: QuestionsMohamed AfzalNo ratings yet

- Financalfeasibilitystudy 180726141644Document52 pagesFinancalfeasibilitystudy 180726141644derejeabebeNo ratings yet

- Module-Accounting For Income TaxDocument13 pagesModule-Accounting For Income TaxJohn Mark FernandoNo ratings yet

- Soal Latihan Cash Flow Fix Dan JawabanDocument6 pagesSoal Latihan Cash Flow Fix Dan JawabanInggil Subhan100% (1)

- Jawaban Lab Pengantar AkuntansiDocument71 pagesJawaban Lab Pengantar AkuntansiWida Nurul AeniNo ratings yet

- CTFP Unit 2 PGBPDocument43 pagesCTFP Unit 2 PGBPKshitishNo ratings yet

- Accounting Assumptions: Introduction To Basic AccountingDocument6 pagesAccounting Assumptions: Introduction To Basic AccountingJon Nell Laguador Bernardo100% (1)

- Auditor's Cup Questions-2Document8 pagesAuditor's Cup Questions-2VtgNo ratings yet

- Process AccountDocument37 pagesProcess Accountsneha9121100% (1)

- Brave Brands AccountingDocument6 pagesBrave Brands AccountingNgoni MukukuNo ratings yet

After The Success of The Company's First Two Months, Santana Rey Continues To Operate Business Solutions. The November 30, 2015, Unadjusted Trial Balance of Business Solutions (Reflecting Dec

After The Success of The Company's First Two Months, Santana Rey Continues To Operate Business Solutions. The November 30, 2015, Unadjusted Trial Balance of Business Solutions (Reflecting Dec

Uploaded by

Jalaj Gupta0 ratings0% found this document useful (0 votes)

30 views3 pagesThe document appears to be a record of transactions for a company from December 1-31. It includes debit and credit entries for various expense, revenue, and balance sheet accounts. On December 31st, closing entries were made for expenses and revenues to zero out those accounts and debit retained earnings for the net income amount. Dividends of $7200 were also declared and paid out, reducing retained earnings.

Original Description:

n

Original Title

After the success of the company's first two months, Santana Rey continues to operate Business Solutions. The November 30, 2015, unadjusted trial balance of Business Solutions (reflecting dec

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document appears to be a record of transactions for a company from December 1-31. It includes debit and credit entries for various expense, revenue, and balance sheet accounts. On December 31st, closing entries were made for expenses and revenues to zero out those accounts and debit retained earnings for the net income amount. Dividends of $7200 were also declared and paid out, reducing retained earnings.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

30 views3 pagesAfter The Success of The Company's First Two Months, Santana Rey Continues To Operate Business Solutions. The November 30, 2015, Unadjusted Trial Balance of Business Solutions (Reflecting Dec

After The Success of The Company's First Two Months, Santana Rey Continues To Operate Business Solutions. The November 30, 2015, Unadjusted Trial Balance of Business Solutions (Reflecting Dec

Uploaded by

Jalaj GuptaThe document appears to be a record of transactions for a company from December 1-31. It includes debit and credit entries for various expense, revenue, and balance sheet accounts. On December 31st, closing entries were made for expenses and revenues to zero out those accounts and debit retained earnings for the net income amount. Dividends of $7200 were also declared and paid out, reducing retained earnings.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 3

Date Accounts Debit Credit

2-Dec Advertising expense 965

cash 965

3-Dec Repairs expense-Computer 500

cash 500

4-Dec Cash 4350

Accounts receivable 4350

10-Dec Wages expense 600

cash 600

14-Dec Cash 2300

Unearned computer service revenue 2300

15-Dec Computer supplies 1700

Accounts payable 1700

16-Dec no entry

20-Dec cash 6125

Computer service revenue 6125

28-Dec cash 3200

Accounts receivable 3200

29-Dec Mileage expense 145

cash 145

31-Dec Dividends 1200

cash 1200

31-Dec Computer supplies expense 3765

computer supplies 3765

31-Dec Insurance expense 540

Prepaid insurance 540

31-Dec Wages expense 400

Wages payable 400

31-Dec Depreciation expense-Computer equipment 1350

Accumulated depreciation-Computer Equipment 1350

31-Dec Depreciation expense-Office equipment 425

Accumulated depreciation-Office Equipment 425

31-Dec Rent expense 2310

Prepaid rent 2310

Cash Accumulated depreciation-Office Equipment

Date Debit credit Balance Date Debit credit Balance

1-Dec 38964 1-Dec 0

2-Dec 965 37999 31-Dec 425 425

3-Dec 500 37499

4-Dec 4350 41849 Accumulated depreciation-Computer Equipment

10-Dec 600 41249 Date Debit credit Balance

14-Dec 2300 43549 1-Dec 0

20-Dec 6125 49674 31-Dec 1350 1350

28-Dec 3200 52874

29-Dec 145 52729 Accounts payable

31-Dec 1200 51529 Date Debit credit Balance

1-Dec 0

Accounts receivable 15-Dec 1700 1700

Date Debit credit Balance

1-Dec 13418 Wages payable

4-Dec 4350 9068 Date Debit credit Balance

28-Dec 3200 5868 1-Dec 0

31-Dec 400 400

Computer supplies

Date Debit credit Balance Unearned computer service revenue

1-Dec 2645 Date Debit credit Balance

15-Dec 1700 4345 1-Dec 0

31-Dec 3765 580 14-Dec 2300 2300

Prepaid insurance Common stock

Date Debit credit Balance Date Debit credit Balance

1-Dec 2160 1-Dec 64000

31-Dec 540 1620

Retained earnings

Prepaid Rent Date Debit credit Balance

Date Debit credit Balance 1-Dec 0

1-Dec 3080 31-Dec 27492 27492

31-Dec 2310 770 31-Dec 7200 20292

Office equipment Computer service revenues

Date Debit credit Balance Date Debit credit Balance

1-Dec 8500 1-Dec 38279

20-Dec 6125 44404

Computer equipment 31-Dec 44404 0

Date Debit credit Balance

1-Dec 21600 Depreciation expense-Office equipment

Date Debit credit Balance

Dividends 1-Dec 0

Date Debit credit Balance 31-Dec 425 425

1-Dec 6000 31-Dec 425 0

1-Dec 1200 7200

1-Dec 7200 0 Depreciation expense-Computer equipment

Date Debit credit Balance

Wages expense 1-Dec 0

Date Debit credit Balance 31-Dec 1350 1350

1-Dec 2575 31-Dec 1350 0

10-Dec 600 3175

31-Dec 400 3575 Insurance expense

31-Dec 3575 0 Date Debit credit Balance

1-Dec 0

Rent expense 31-Dec 540 540

Date Debit credit Balance 31-Dec 540 0

1-Dec 0

31-Dec 2310 2310 Computer supplies expense

31-Dec 2310 0 Date Debit credit Balance

1-Dec 0

Advertising expense 31-Dec 3765 3765

Date Debit credit Balance 31-Dec 3765 0

1-Dec 1728

2-Dec 965 2693 Mileage expense

31-Dec 2693 0 Date Debit credit Balance

1-Dec 634

Miscellaneous expense 29-Dec 145 779

Date Debit credit Balance 31-Dec 779 0

1-Dec 250

29-Dec 250 0 Repairs expense-computer

Date Debit credit Balance

Income summary 1-Dec 725

Date Debit credit Balance 3-Dec 500 1225

1-Dec 44404 44404 31-Dec 1225 0

14-Dec 16912 27492

14-Dec 27492 0

You might also like

- Lembar Kerja UD. Mudah HasilDocument41 pagesLembar Kerja UD. Mudah HasilRoni NNo ratings yet

- Assesment 2 Reham Hajeeh 202000394Document32 pagesAssesment 2 Reham Hajeeh 202000394api-586476688No ratings yet

- Assignment AJE 3 PDFDocument10 pagesAssignment AJE 3 PDFJalaj GuptaNo ratings yet

- Acct Project Question 3Document14 pagesAcct Project Question 3grace100% (1)

- Acr4 3Document22 pagesAcr4 3rhyayuli0% (1)

- PARTNERSHIPDocument2 pagesPARTNERSHIPMaryanne0% (1)

- GL, TB - D. MaputimDocument11 pagesGL, TB - D. MaputimJasmine Acta67% (3)

- W. W. Grainger, Inc., Is A Leading Supplier of Maintenance, Repair, and Operating (MRO) Products To Businesses and Institutions in The UnitedDocument3 pagesW. W. Grainger, Inc., Is A Leading Supplier of Maintenance, Repair, and Operating (MRO) Products To Businesses and Institutions in The UnitedJalaj GuptaNo ratings yet

- China Trade, Inc. Journal Entries: Date GL Number Description Debit CreditDocument7 pagesChina Trade, Inc. Journal Entries: Date GL Number Description Debit CreditJalaj GuptaNo ratings yet

- Ch. 3 HW ExplanationDocument7 pagesCh. 3 HW ExplanationJalaj GuptaNo ratings yet

- This Study Resource Was: Adjust CreditDocument4 pagesThis Study Resource Was: Adjust CreditJalaj GuptaNo ratings yet

- ACC 101 Chapter 2 Test (5Document5 pagesACC 101 Chapter 2 Test (5Ammarrylee R. Williams0% (2)

- Summarizing (Trial Balance) : (Go Through The Reference Books For Details)Document6 pagesSummarizing (Trial Balance) : (Go Through The Reference Books For Details)sujitNo ratings yet

- Assignment 2Document12 pagesAssignment 2Geetu SharmaNo ratings yet

- Sandpaper Project ProfileDocument15 pagesSandpaper Project ProfileTekeba Birhane100% (3)

- KietPHMSS170832 ACC101 Individual AssignmentDocument17 pagesKietPHMSS170832 ACC101 Individual AssignmentMinh Kiet Pham HuuNo ratings yet

- Essay AccDocument1 pageEssay AccHoang Dieu Linh QP2505No ratings yet

- VoidDocument8 pagesVoidAn Phi Ngoc HuyNo ratings yet

- Chapter 1 - Ex SolutionDocument9 pagesChapter 1 - Ex SolutionNguyễn Đức MinhNo ratings yet

- 02 B Jane MangrobangDocument14 pages02 B Jane MangrobangCharlotte PlazosNo ratings yet

- General Journal Date Particulars PR Debit CreditDocument10 pagesGeneral Journal Date Particulars PR Debit CreditLeonilaEnriquezNo ratings yet

- 1942510Document6 pages1942510mohitgaba19No ratings yet

- ACCT1008 SP2 2020 Assignment Part A - FINALDocument16 pagesACCT1008 SP2 2020 Assignment Part A - FINALkakuNo ratings yet

- Solution Accrual and Prepayment (Tutorial in Class 23 May 2023)Document9 pagesSolution Accrual and Prepayment (Tutorial in Class 23 May 2023)mardhiahNo ratings yet

- Kunci Jawaban Sesi 3Document29 pagesKunci Jawaban Sesi 3Egi Rianto100% (1)

- Waltham Oil and Lube Center: Journal SN Date Particulars Ledger File DebitDocument7 pagesWaltham Oil and Lube Center: Journal SN Date Particulars Ledger File DebitAbhishek TomarNo ratings yet

- Daftar Akun PT GKDocument4 pagesDaftar Akun PT GKHerlangga AnggaNo ratings yet

- Financial StatmentDocument17 pagesFinancial StatmentJerickho JNo ratings yet

- Chap3 B MergedDocument26 pagesChap3 B Mergedjamel008No ratings yet

- Quiz 4 - Problem 1Document2 pagesQuiz 4 - Problem 1KyleRhayneDiazCaliwagNo ratings yet

- T-Account: Date Amount Date AmountDocument8 pagesT-Account: Date Amount Date AmountAbdul MoeedNo ratings yet

- Practice Question (Accounting Cycle) With Solution v2Document17 pagesPractice Question (Accounting Cycle) With Solution v2Laiba ManzoorNo ratings yet

- 1000 Assets: Account # Account NameDocument25 pages1000 Assets: Account # Account NameAdnan AmjadNo ratings yet

- LK - Menyusun Lap. Keuangan - P1Document15 pagesLK - Menyusun Lap. Keuangan - P1rizeky putriNo ratings yet

- Tugas 6 - Azka Fadhilah N - 141010180043Document5 pagesTugas 6 - Azka Fadhilah N - 141010180043Nabilla FadiaNo ratings yet

- Ledger EntryDocument17 pagesLedger EntryJerickho JNo ratings yet

- Assignment AnsDocument6 pagesAssignment AnsVAIGESWARI A/P MANIAM STUDENTNo ratings yet

- Tugas 14 SepDocument5 pagesTugas 14 Sepmelvina siregar100% (1)

- 04 - Matching and AdjustmentDocument20 pages04 - Matching and AdjustmentMadelaine KienyNo ratings yet

- Full Set of Financial AccountingDocument8 pagesFull Set of Financial AccountingmaiNo ratings yet

- Ques 1Document2 pagesQues 1Sorowar SalauddinNo ratings yet

- Assignment 9 (DionDocument36 pagesAssignment 9 (DionMaxNo ratings yet

- Indotambangraya Megah ProposalDocument160 pagesIndotambangraya Megah ProposalAji ShorenkNo ratings yet

- 2010 DR CR December 1 Cash: Journal EntriesDocument14 pages2010 DR CR December 1 Cash: Journal EntriesRafe Alexis MiravillaNo ratings yet

- Crane Inc. Entered Into A Contract To Deliver One of Its Specialty Mowers To Kickapoo Landscaping CoDocument2 pagesCrane Inc. Entered Into A Contract To Deliver One of Its Specialty Mowers To Kickapoo Landscaping CoKailash KumarNo ratings yet

- Cash Flow Indirect MethodDocument3 pagesCash Flow Indirect MethodLusianaaNo ratings yet

- PT Cahaya Adjustment Entries December 31: Date Evidence Description ACC Debit Credit Number REF RP RPDocument16 pagesPT Cahaya Adjustment Entries December 31: Date Evidence Description ACC Debit Credit Number REF RP RPIvankaNo ratings yet

- AsTea Drinks Limited Current Year Trial Balance Apr2020Document6 pagesAsTea Drinks Limited Current Year Trial Balance Apr2020Abdul Basit FarooqiNo ratings yet

- Accounting Past YearsDocument32 pagesAccounting Past YearsPushpa ValliNo ratings yet

- SamuelDocument12 pagesSamuelEhtisham Ul HaqNo ratings yet

- FR ExamDocument18 pagesFR ExamRizkiNurEtikasariNo ratings yet

- Assignment 2 - Lab Acct - ELEONORA VINESSA ARIANTODocument7 pagesAssignment 2 - Lab Acct - ELEONORA VINESSA ARIANTOEleonora VinessaNo ratings yet

- Adjusting EntriesDocument10 pagesAdjusting EntriesQuoc Anh HaNo ratings yet

- ACCT 6010 Assignment #1Document15 pagesACCT 6010 Assignment #1patel avaniNo ratings yet

- Basic Accounting Quiz 2.0Document4 pagesBasic Accounting Quiz 2.0Jensen Rowie PasngadanNo ratings yet

- Comprehensive Problem Excel SpreadsheetDocument23 pagesComprehensive Problem Excel Spreadsheetapi-237864722100% (3)

- Adowa Peachtree Class ExcerciseDocument4 pagesAdowa Peachtree Class ExcerciseAbel Hailu100% (1)

- M170-18 - Section C - Assignment 2Document16 pagesM170-18 - Section C - Assignment 2VallabhRemaniNo ratings yet

- Trial Balance Account Tittles Dr. CR.: P4-1A/a. Work Sheet of Wareen Roofing For The Month Ended March 31,2017Document40 pagesTrial Balance Account Tittles Dr. CR.: P4-1A/a. Work Sheet of Wareen Roofing For The Month Ended March 31,2017Nguyễn Ngọc Phương HằngNo ratings yet

- Closing Accounts - Exercise 2020 2Document1 pageClosing Accounts - Exercise 2020 2Linh Tam Vu NgocNo ratings yet

- S13 7 Com D Chart of Accounts EngDocument3 pagesS13 7 Com D Chart of Accounts EngndieniNo ratings yet

- Adjusting Entries Class Problem 2 (Class-4)Document9 pagesAdjusting Entries Class Problem 2 (Class-4)Mahmudul HasanNo ratings yet

- AJP RM MUBARAK-dikonversiDocument1 pageAJP RM MUBARAK-dikonversiBulan julpi suwellyNo ratings yet

- A. Ud Buana 2Document11 pagesA. Ud Buana 2Ayu FebriyantiNo ratings yet

- Incomplete Records MTQDocument5 pagesIncomplete Records MTQqas4476pubNo ratings yet

- Group - C: DA 4104 - Computer Based AccountingDocument10 pagesGroup - C: DA 4104 - Computer Based AccountinghemacrcNo ratings yet

- Mickley Company's Plantwide Predetermined Overhead Rate IsDocument1 pageMickley Company's Plantwide Predetermined Overhead Rate IsJalaj GuptaNo ratings yet

- Fanelli Corporation, A Merchandising CompanyDocument2 pagesFanelli Corporation, A Merchandising CompanyJalaj GuptaNo ratings yet

- Izabela Cullumber Opened A Medical Office Under The Name Izabela CullumberDocument4 pagesIzabela Cullumber Opened A Medical Office Under The Name Izabela CullumberJalaj GuptaNo ratings yet

- P 81Document3 pagesP 81Jalaj GuptaNo ratings yet

- Phelps Corporation Received A Charter Granting The Right To IssueDocument3 pagesPhelps Corporation Received A Charter Granting The Right To IssueJalaj GuptaNo ratings yet

- Chapter 1 - Text ExercisesDocument35 pagesChapter 1 - Text ExercisesJalaj GuptaNo ratings yet

- This Study Resource Was: Award: 10.00 PointsDocument4 pagesThis Study Resource Was: Award: 10.00 PointsJalaj GuptaNo ratings yet

- Trout Inc. Prepared The Following Production Report-Weighted AverageDocument4 pagesTrout Inc. Prepared The Following Production Report-Weighted AverageJalaj GuptaNo ratings yet

- This Study Resource Was: Award: 10.00 PointsDocument4 pagesThis Study Resource Was: Award: 10.00 PointsJalaj GuptaNo ratings yet

- Winslow Inc. Manufactures and Sells Three Types of Shoes. TDocument3 pagesWinslow Inc. Manufactures and Sells Three Types of Shoes. TJalaj GuptaNo ratings yet

- Milano Pizza Is A Small Neighborhood PizzeriaDocument3 pagesMilano Pizza Is A Small Neighborhood PizzeriaJalaj GuptaNo ratings yet

- This Study Resource Was: Problem 21-6A (Part Level Submission)Document3 pagesThis Study Resource Was: Problem 21-6A (Part Level Submission)Jalaj GuptaNo ratings yet

- Fidelity Engineering Reported Pretax Accounting IncomeDocument2 pagesFidelity Engineering Reported Pretax Accounting IncomeJalaj GuptaNo ratings yet

- Chapter 12 Testbank PDFDocument76 pagesChapter 12 Testbank PDFJalaj GuptaNo ratings yet

- Date General Journal Debit CreditDocument14 pagesDate General Journal Debit CreditJalaj GuptaNo ratings yet

- Journal Entries in The Books of Santana Rey Date Particulars Debit CreditDocument12 pagesJournal Entries in The Books of Santana Rey Date Particulars Debit CreditJalaj GuptaNo ratings yet

- Pam Corporation Paid $170,000 For An 80 Percent Interest in Sun CorporationDocument3 pagesPam Corporation Paid $170,000 For An 80 Percent Interest in Sun CorporationJalaj GuptaNo ratings yet

- On January 1, Year 4, Grant Corporation BoughtDocument4 pagesOn January 1, Year 4, Grant Corporation BoughtJalaj GuptaNo ratings yet

- Solution Ch04Document146 pagesSolution Ch04Harmanjot 03No ratings yet

- Instant Download Ebook PDF Financial and Managerial Accounting 6th Edition by Ken Shaw PDF ScribdDocument41 pagesInstant Download Ebook PDF Financial and Managerial Accounting 6th Edition by Ken Shaw PDF Scribdmaurice.nesbit229100% (47)

- Revenue Regulations No. 19-86: Taxation of Leases All Internal Revenue Officers and Others Concerned PurposeDocument23 pagesRevenue Regulations No. 19-86: Taxation of Leases All Internal Revenue Officers and Others Concerned PurposeyakyakxxNo ratings yet

- Project Planning Template (Version 3.0)Document17 pagesProject Planning Template (Version 3.0)VrajNo ratings yet

- Biodegradable Disposable Plastic Cutlery-643528 PDFDocument39 pagesBiodegradable Disposable Plastic Cutlery-643528 PDFMusheer BashaNo ratings yet

- Financial Reporting For School Organizations: "Learning How To Prepare Your Financial Reports The Proper Way."Document19 pagesFinancial Reporting For School Organizations: "Learning How To Prepare Your Financial Reports The Proper Way."AJ CresmundoNo ratings yet

- Payslip February-2023Document1 pagePayslip February-2023kashif shaikhNo ratings yet

- FABM 1 - Contextualized LAS - Week 4Document7 pagesFABM 1 - Contextualized LAS - Week 4Sheila Marie Ann Magcalas-GaluraNo ratings yet

- P3 2A AnswerDocument2 pagesP3 2A AnswerMinh NhậtNo ratings yet

- Chapter 21 - LeasingDocument87 pagesChapter 21 - LeasingCorey Sobers-Smith100% (1)

- Corporate Social Responsibility Policy: Page 1 of 9Document9 pagesCorporate Social Responsibility Policy: Page 1 of 9Darshan KannurNo ratings yet

- Accounting Part 2 Test 1st HalfDocument3 pagesAccounting Part 2 Test 1st HalfAyman ChishtyNo ratings yet

- Cost of Goods Sold and Inventory PDFDocument69 pagesCost of Goods Sold and Inventory PDFThành Steven100% (1)

- Ho2-Employee Benefits and Share-Based Compensation (Student's Copy)Document10 pagesHo2-Employee Benefits and Share-Based Compensation (Student's Copy)Alliah ArrozaNo ratings yet

- Budgeting Quiz Answer KeyDocument5 pagesBudgeting Quiz Answer KeyDeniseNo ratings yet

- New SchemeDocument452 pagesNew Schememynameislakhan2122No ratings yet

- AccountingDocument50 pagesAccountingAshyanna UletNo ratings yet

- Reporting The Statement of Cash Flows: QuestionsDocument58 pagesReporting The Statement of Cash Flows: QuestionsMohamed AfzalNo ratings yet

- Financalfeasibilitystudy 180726141644Document52 pagesFinancalfeasibilitystudy 180726141644derejeabebeNo ratings yet

- Module-Accounting For Income TaxDocument13 pagesModule-Accounting For Income TaxJohn Mark FernandoNo ratings yet

- Soal Latihan Cash Flow Fix Dan JawabanDocument6 pagesSoal Latihan Cash Flow Fix Dan JawabanInggil Subhan100% (1)

- Jawaban Lab Pengantar AkuntansiDocument71 pagesJawaban Lab Pengantar AkuntansiWida Nurul AeniNo ratings yet

- CTFP Unit 2 PGBPDocument43 pagesCTFP Unit 2 PGBPKshitishNo ratings yet

- Accounting Assumptions: Introduction To Basic AccountingDocument6 pagesAccounting Assumptions: Introduction To Basic AccountingJon Nell Laguador Bernardo100% (1)

- Auditor's Cup Questions-2Document8 pagesAuditor's Cup Questions-2VtgNo ratings yet

- Process AccountDocument37 pagesProcess Accountsneha9121100% (1)

- Brave Brands AccountingDocument6 pagesBrave Brands AccountingNgoni MukukuNo ratings yet