Professional Documents

Culture Documents

Bonds Payable

Bonds Payable

Uploaded by

Joseph AsisOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bonds Payable

Bonds Payable

Uploaded by

Joseph AsisCopyright:

Available Formats

lOMoARcPSD|5671044

File - Lecture notes 1,3,7,10

Accounting (Ramon Magsaysay Memorial Colleges)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Mary Joy Asis (mariasis009@gmail.com)

lOMoARcPSD|5671044

Answer Key

Lecture 4 Bonds Payable Assignment

____ 1. On December 31, 2016 , Boheme Company reported a 9% bonds payable due December 31, 2021 with a

carrying amount of P15,405,000. The bonds were issued on December 31,2012 and had a face amount of

P15,000,000 with interest payable semiannually on June 30 and December 31 of each year .

On December 31, 2016 , the entity retired P5,000,000 of these bonds at 98.

What amount should be reported as gain or loss on the retirement of the bonds for 2016 ?

a. 235,000 gain c. 100,000 gain

b. 235,000 loss d. 100,000 loss

ANSWER : A

Carrying amount – Dec. 31, 2016 15,405,000

Multiplied by : 5/15

Carrying amount of retired bonds 5,135,000

Less: Retirement price (5M X.98) 4,900,000

Gain on early retirement 235,000 Gain

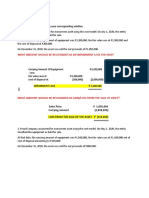

____ 2. On July 1, 2016 , Carr Company issued at 104 , five thousand of 10% P1,000 face value bonds. The bonds

were issue through an underwriter to whom the entity paid bond issue cost of P125,000.

On July 1, 2016 , what amount should be reported as bond liability ?

a. 4,875,000 c. 5,200,000

b. 5,075,000 d. 5,325,000

ANSWER : B

Face amount of Bonds (5,000 x P1,000) P5,000,000

Multiplied by : Issue price 104%

Issue price 5,200,000

Less: Bond issue cost (125,000)

Bond liability – carrying amount 5,075,000

____ 3. On December 31, 2016 , Marie Company reported bonds payable of P7,360,000 and accrued interest payable

of P200,000 . The bonds are retired on December 31, 2016 for P8,160,000, excluding accrued interest.

What amount should be reported as gain or loss on extinguishment of bonds payable ?

a. 800,000 gain c. 600,000 gain

b. 800,000 loss d. 600,000 loss

ANSWER : B

Carrying amount of retired bonds 7,360,000

Less: Retirement price (5M X.98) 8,160,000

Loss on early retirement 800,000 Loss

____ 4. Zola Company had the following long-term debt :

Bonds maturing in installments, secured by machinery 1,000,000

Bonds maturing on a single date, secured by realty 1,800,000

Downloaded by Mary Joy Asis (mariasis009@gmail.com)

lOMoARcPSD|5671044

Collateral trust bonds 2,000,000

What is the total amount of debenture bonds ?

a. 2,000,000 c. 1,800,000

b. 1,000,000 d. 0

ANSWER : D

A debenture is a type of bond that is unsecured by collateral .

All the bonds of Zola Company are secured. Hence , there is no debenture bonds.

____ 5. On March 1, 2015 , Cain Company issued at 103 plus accrued interest 4,000 of 9% , P1,000 face value bonds.

The bonds are dated January 1, 2015 and mature on January 1, 2025 . Interest is payable semiannually on

January 1 and July 1 . The entity paid bond issue cost of P200,000.

What is the net cash received from the bond issuance ?

a. 4,320,000 c. 4,120,000

b. 4,180,000 d. 3,980,000

ANSWER : D

Face amount of Bonds (4,000 x P1,000) P4,000,000

Multiplied by : Issue price 103%

Issue price received 4,120,000

Add: Accrued interest received (4M X 9% X 2/12) 60,000

(From January 1 to March 1)

Less: Bond issue cost paid (200,000)

Net cash received 3,980,000

____ 6. On January 31, 2015 , Beau Company issued P3,000,000 maturity value , 12% bonds for P3,000,000 cash.

The bonds are dated December 31, 2014 and mature on December 31, 2024. Interest is payable semianually

on June 30 and December 31.

What amount of accrued interest payable should be reported on September 30, 2015 ?

a. 270,000 c. 180,000

b. 240,000 d. 90,000

ANSWER : D

Accrued interest ( From June 30 – September 30) 3M X 12% x 3/12 90,000

____ 7. On January 1, 2015 , Wolf Company issued 10% bonds in the face amount of P5,000,000 , which mature on

January 1, 2025. The bonds were issued for P5,675,000 to yield 8%, resulting in bond premium of P675,000 .

The entity used the interest method of amortizing bond premium. Interest is payable annually on December

31.

On December 31, 2015 , what is the adjusted unamortized bond premium ?

a. 675,000 c. 607,500

b. 629,000 d. 507,500

ANSWER : B

Date Interest Paid Interest Expense Premium Carrying amount

(5M X 10%) (CA X 8%) Amortization

January 5,675,000

1, 2015

December 500,000 454,000 46,000* 5,629,000

31, 2015

Downloaded by Mary Joy Asis (mariasis009@gmail.com)

lOMoARcPSD|5671044

Journal entry to record premium amortization:

Premium on bonds payable 46,000

Interest Expense 46,000

Premium on bonds – January 1, 2015 675,000

Less: Amortization (46,000)

Premium on bonds – Dec. 31 629,000

Lecture 4 Bonds Payable Assignment

Answer Section

MULTIPLE CHOICE

1. ANS: A PTS: 1

2. ANS: B PTS: 1

3. ANS: B PTS: 1

4. ANS: D PTS: 1

5. ANS: D PTS: 1

6. ANS: D PTS: 1

7. ANS: B PTS: 1

Downloaded by Mary Joy Asis (mariasis009@gmail.com)

lOMoARcPSD|5671044

Downloaded by Mary Joy Asis (mariasis009@gmail.com)

You might also like

- Amfi Fully Solved 500 QuestionsDocument81 pagesAmfi Fully Solved 500 Questionspratiush0785% (105)

- Bonds PayableDocument9 pagesBonds PayableKayla MirandaNo ratings yet

- Project in Fin Acc Chester Gutierrez Project in Fin Acc Chester GutierrezDocument17 pagesProject in Fin Acc Chester Gutierrez Project in Fin Acc Chester GutierrezJoseph Asis50% (2)

- Intermediate Accounting 2 Quiz 2: You AnsweredDocument10 pagesIntermediate Accounting 2 Quiz 2: You AnsweredRayman MamakNo ratings yet

- Securities Operations PDFDocument7 pagesSecurities Operations PDFVenu MadhavNo ratings yet

- Problems - Bonds - RevisedDocument5 pagesProblems - Bonds - RevisedFake ManNo ratings yet

- C1 - M2 - Financial Assets - Fixed Income Securities+answer KeyDocument6 pagesC1 - M2 - Financial Assets - Fixed Income Securities+answer KeyVikaNo ratings yet

- Nism Series Ix Merchant Banking WorkbookDocument127 pagesNism Series Ix Merchant Banking Workbookalpha012550% (2)

- Financial Analysis Statement Solution IncompleteDocument9 pagesFinancial Analysis Statement Solution IncompleteJerome BaluseroNo ratings yet

- 064 PDFDocument9 pages064 PDFWe WNo ratings yet

- Angelica S. Rubios: Problem 10-19Document4 pagesAngelica S. Rubios: Problem 10-19Angel RubiosNo ratings yet

- Shareholder's Equity Shareholder's Equity: Accounting (Far Eastern University) Accounting (Far Eastern University)Document18 pagesShareholder's Equity Shareholder's Equity: Accounting (Far Eastern University) Accounting (Far Eastern University)nmdl123No ratings yet

- Accounting For Joint Arrangements Material 1Document5 pagesAccounting For Joint Arrangements Material 1Erika Mae BarizoNo ratings yet

- Debt RestructuringDocument1 pageDebt RestructuringSherri BonquinNo ratings yet

- Chapter 7 BelardoDocument8 pagesChapter 7 BelardoAndrea BelardoNo ratings yet

- MCQ Reviewers Ia 2Document13 pagesMCQ Reviewers Ia 2Angely MulaNo ratings yet

- Far 6660Document2 pagesFar 6660Glessy Anne Marie FernandezNo ratings yet

- Accrued Liabilities: Problem 3-1 (AICPA Adapted)Document15 pagesAccrued Liabilities: Problem 3-1 (AICPA Adapted)Nila FranciaNo ratings yet

- Group 1 - Chapter 16Document8 pagesGroup 1 - Chapter 16Cherie Soriano AnanayoNo ratings yet

- De Leon Solman 2014 2 CostDocument95 pagesDe Leon Solman 2014 2 CostJohn Laurence Loplop0% (1)

- IA2 Quiz 1 QuestionsDocument6 pagesIA2 Quiz 1 QuestionsJames Daniel SwintonNo ratings yet

- Gbermic 11-12Document13 pagesGbermic 11-12Paolo Niel ArenasNo ratings yet

- The Amount To Be Capitalized by Lessee To Right of Use AssetDocument1 pageThe Amount To Be Capitalized by Lessee To Right of Use Assetmax pNo ratings yet

- Mahusay Acc227 Module 4Document4 pagesMahusay Acc227 Module 4Jeth MahusayNo ratings yet

- Problem 1: Use The Following Data For The Next (2) Two QuestionsDocument13 pagesProblem 1: Use The Following Data For The Next (2) Two QuestionscpamakerfilesNo ratings yet

- LiabilitiesDocument8 pagesLiabilitiesGerald F. SalasNo ratings yet

- Acc 224L 1st Laboratory ExamDocument13 pagesAcc 224L 1st Laboratory ExamJuziel Rosel PadilloNo ratings yet

- Unit Iv Assessment ProblemsDocument9 pagesUnit Iv Assessment ProblemsChin FiguraNo ratings yet

- Easy Problem Chapter 5Document5 pagesEasy Problem Chapter 5Natally LangfeldtNo ratings yet

- Apply Your Knowledge: Case Study 1Document3 pagesApply Your Knowledge: Case Study 1Queen ValleNo ratings yet

- New Microsoft Office Excel WorksheetDocument26 pagesNew Microsoft Office Excel WorksheetMac Ferds100% (1)

- Local Media271226407970108268Document17 pagesLocal Media271226407970108268Jana Rose PaladaNo ratings yet

- Transaction Price - Problems (1) - Sarmiento, Jefferson D.Document3 pagesTransaction Price - Problems (1) - Sarmiento, Jefferson D.jefferson sarmientoNo ratings yet

- Ia 2Document23 pagesIa 2Gelo OwssNo ratings yet

- MAS 4 TOPIC 1 Threats and Safeguards in The Practice of AccountancyDocument20 pagesMAS 4 TOPIC 1 Threats and Safeguards in The Practice of AccountancyKezNo ratings yet

- ch3 Not EditedDocument14 pagesch3 Not EditedDM MontefalcoNo ratings yet

- 221 ExamsDocument10 pages221 ExamsElla Mae AgoniaNo ratings yet

- PDF Info 1 DLDocument28 pagesPDF Info 1 DLEdrickLouise DimayugaNo ratings yet

- Standard Costing and Analysis of VarianceDocument13 pagesStandard Costing and Analysis of VarianceRuby P. Madeja100% (1)

- This Study Resource Was: F-ACADL-01Document8 pagesThis Study Resource Was: F-ACADL-01Marjorie PalmaNo ratings yet

- A Citizen and Resident of The Philippines Died Leaving The Following Properties and RightsDocument1 pageA Citizen and Resident of The Philippines Died Leaving The Following Properties and RightsAmie Jane MirandaNo ratings yet

- Defined Benefit Plan-Midnight CompanyDocument2 pagesDefined Benefit Plan-Midnight CompanyDyenNo ratings yet

- Accounting On Business Combination Quiz 2: Multiple ChoiceDocument13 pagesAccounting On Business Combination Quiz 2: Multiple ChoiceTokkiNo ratings yet

- Intermediate Accounting 2 Finals SolvingsDocument24 pagesIntermediate Accounting 2 Finals SolvingsColeen BiocalesNo ratings yet

- This Study Resource Was: Assessment Task 3Document5 pagesThis Study Resource Was: Assessment Task 3maria evangelistaNo ratings yet

- International Acc QuizletDocument4 pagesInternational Acc Quizlet수지No ratings yet

- Notes PayableDocument1 pageNotes Payablehae1234No ratings yet

- Lobrigas Unit3 Topic2 AssessmentDocument6 pagesLobrigas Unit3 Topic2 AssessmentClaudine LobrigasNo ratings yet

- Petite Company Reported The Following Current Assets On December 31Document1 pagePetite Company Reported The Following Current Assets On December 31Katrina Dela CruzNo ratings yet

- Capital Budgeting ExercisesDocument16 pagesCapital Budgeting ExercisesMhel EspanoNo ratings yet

- Current Liability - DiamonDocument1 pageCurrent Liability - DiamonMa Teresa B. CerezoNo ratings yet

- 3rd ActivityDocument2 pages3rd Activitydar •No ratings yet

- IA3 Chapter 15 AnswersDocument1 pageIA3 Chapter 15 AnswersBea TumulakNo ratings yet

- Requirement: Determine The Financial Liabilities To Be Disclosed in The NotesDocument4 pagesRequirement: Determine The Financial Liabilities To Be Disclosed in The NotesInvisible CionNo ratings yet

- Direct Financing Lease Bafacr4x OnlineglimpsenujpiaDocument4 pagesDirect Financing Lease Bafacr4x OnlineglimpsenujpiaAga Mathew MayugaNo ratings yet

- Employee Benefit Expense 1,650,000Document14 pagesEmployee Benefit Expense 1,650,000Jud Rossette ArcebesNo ratings yet

- Umuc Acc311 - Acc 311 Quiz 1 2015Document5 pagesUmuc Acc311 - Acc 311 Quiz 1 2015teacher.theacestudNo ratings yet

- Exercise - Part 3Document10 pagesExercise - Part 3lois martinNo ratings yet

- Accounting 106: Quiz On Forwards, Futures, Options, and Foreign CurrencyDocument5 pagesAccounting 106: Quiz On Forwards, Futures, Options, and Foreign CurrencyLee SuarezNo ratings yet

- Learning Resource 12 Lesson 3Document7 pagesLearning Resource 12 Lesson 3Vianca Marella SamonteNo ratings yet

- Year Sales Actual Warranty ExpendituresDocument5 pagesYear Sales Actual Warranty ExpendituresMinie KimNo ratings yet

- Accounting 132Document2 pagesAccounting 132Anne Marieline BuenaventuraNo ratings yet

- Aeecd4ce 1592190070352 PDFDocument2 pagesAeecd4ce 1592190070352 PDFcykenNo ratings yet

- Management Advisory Services by Agamata Answer KeydocDocument11 pagesManagement Advisory Services by Agamata Answer KeydocAnnalyn ArnaldoNo ratings yet

- Compound Financial Instruments and Note PayableDocument4 pagesCompound Financial Instruments and Note PayablePaula Rodalyn MateoNo ratings yet

- Notes Payable and Debt Restructuring (Ruma, Jamaica)Document14 pagesNotes Payable and Debt Restructuring (Ruma, Jamaica)Jamaica RumaNo ratings yet

- Pre-Week Notes: Labor LawDocument112 pagesPre-Week Notes: Labor LawJoseph AsisNo ratings yet

- Seatwork #4: What Amount Should Be Recognized As An Impairment Loss For 2020?Document4 pagesSeatwork #4: What Amount Should Be Recognized As An Impairment Loss For 2020?Joseph AsisNo ratings yet

- Mockboard 1Document100 pagesMockboard 1Joseph AsisNo ratings yet

- Presentation of Data: Tables and Graphs: Table Construction Using WordDocument7 pagesPresentation of Data: Tables and Graphs: Table Construction Using WordJoseph AsisNo ratings yet

- Mary Joy Asis QUIZ 1Document6 pagesMary Joy Asis QUIZ 1Joseph AsisNo ratings yet

- Partnership Questions Problems With Answers PDF FreeDocument11 pagesPartnership Questions Problems With Answers PDF FreeJoseph AsisNo ratings yet

- Graphs and Tables 07 and 10Document7 pagesGraphs and Tables 07 and 10Joseph AsisNo ratings yet

- Mary Joy Asis - RevalidaDocument16 pagesMary Joy Asis - RevalidaJoseph AsisNo ratings yet

- QUIZ 2 Cae 12Document9 pagesQUIZ 2 Cae 12Joseph AsisNo ratings yet

- Book 1Document4 pagesBook 1Joseph AsisNo ratings yet

- Mary Joy Asis - ASSIGNMENTDocument3 pagesMary Joy Asis - ASSIGNMENTJoseph AsisNo ratings yet

- Debt Management: Presented by Faresh Haroon Issac KoshyDocument18 pagesDebt Management: Presented by Faresh Haroon Issac KoshyFaresh HaroonNo ratings yet

- Chapter 1 - Capital Market in India: IntroductionDocument56 pagesChapter 1 - Capital Market in India: IntroductionNikhil ThakurNo ratings yet

- Thai Commercial Banks One Decade After The CrisisDocument39 pagesThai Commercial Banks One Decade After The CrisisAl IhsanNo ratings yet

- Karvy ProjectDocument19 pagesKarvy ProjectKrishnaNo ratings yet

- 2-CHMSC FinMgt2-FinMar. Module 1Document4 pages2-CHMSC FinMgt2-FinMar. Module 1Christopher ApaniNo ratings yet

- Bond Market - How It WorksDocument18 pagesBond Market - How It WorksZain GuruNo ratings yet

- GeneralMathematics (SHS) Q2 Mod10 MarketIndicesForStocksAndBonds V1Document26 pagesGeneralMathematics (SHS) Q2 Mod10 MarketIndicesForStocksAndBonds V1Rachael OrtizNo ratings yet

- ECON F312: Money, Banking and Financial Markets I Semester 2020-21Document23 pagesECON F312: Money, Banking and Financial Markets I Semester 2020-21AKSHIT JAINNo ratings yet

- Financial Markets Finals FinalsDocument6 pagesFinancial Markets Finals FinalsAmie Jane MirandaNo ratings yet

- Activity 11 AnswersDocument3 pagesActivity 11 AnswersJOHИ ТΛЯUƆΛИNo ratings yet

- Training 2.1Document17 pagesTraining 2.1Sarah MadhiNo ratings yet

- FI AssignmentDocument7 pagesFI AssignmentsuggestionboxNo ratings yet

- Asia Credit Compendium 2014 04 12 13 05 19Document500 pagesAsia Credit Compendium 2014 04 12 13 05 19BerezaNo ratings yet

- Asset Management PresentationDocument27 pagesAsset Management PresentationSamer KahilNo ratings yet

- Strategic Analysis of SBIMFDocument19 pagesStrategic Analysis of SBIMF26amitNo ratings yet

- JPM Insurance PrimerDocument104 pagesJPM Insurance Primerdamon_enola3313No ratings yet

- Function & Structure of FIMDocument24 pagesFunction & Structure of FIMAniket GuptaNo ratings yet

- RateSheet January 2024 ReviewedDocument1 pageRateSheet January 2024 Revieweddonovansaunders058No ratings yet

- Topic 1 Introduction - Fixed Income Market Overview 2021 s1Document64 pagesTopic 1 Introduction - Fixed Income Market Overview 2021 s1jason leeNo ratings yet

- Nism 5 A - Mutual Fund Exam - Practice Test 6 - Copy - PDF (Secured) - Adobe ReaderDocument28 pagesNism 5 A - Mutual Fund Exam - Practice Test 6 - Copy - PDF (Secured) - Adobe ReaderNithin Varghzz100% (2)

- Chapter 1 Nature and Scope of International FinanceDocument67 pagesChapter 1 Nature and Scope of International FinanceRahul GhosaleNo ratings yet

- Amfi Quiz Modified Version1Document301 pagesAmfi Quiz Modified Version1Amit RajaNo ratings yet

- Bloomberg Barclays Methodology1Document126 pagesBloomberg Barclays Methodology1Edwin ChanNo ratings yet

- 3 - Introduction To Fixed Income Valuation-UnlockedDocument53 pages3 - Introduction To Fixed Income Valuation-UnlockedAditya NugrohoNo ratings yet

- Public Shariah MFR February 2018Document42 pagesPublic Shariah MFR February 2018ieda1718No ratings yet