Professional Documents

Culture Documents

Smart Summary Equity Valuation Concepts and Basic Tools CFA

Smart Summary Equity Valuation Concepts and Basic Tools CFA

Uploaded by

Bhuvnesh KotharCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Smart Summary Equity Valuation Concepts and Basic Tools CFA

Smart Summary Equity Valuation Concepts and Basic Tools CFA

Uploaded by

Bhuvnesh KotharCopyright:

Available Formats

2015, Study Session # 14, Reading # 50

“EQUITY VALUATION: CONCEPTS AND BASIC TOOLS”

FCFE = Free Cash Flows to Equity IV = Intrinsic Value

WC = Working Capital MV = Market Value

50.a

EV = Enterprise Value DCF = Discounted Cash Flow

TA = Total Asset PV = Present Value

TL = Total Liabilities Intrinsic / fundamental value ⇒ rational value based on asset’s TV = Terminal Value

PS = Preferred Stock characteristics (derived through valuation models). FCinv = Fixed Capital Investment

GGM = Gordon Growth Model If IV ≠ MV, abnormal return is possible. DDM = Dividend Discount Model

RR = Retention Rate Perceived mispricing, appropriateness of valuation model & MDDM = Multistage Dividend

SGR = Sustainable Growth Rate inputs are important considerations in investment decision. Discount Model

MP = Market Price PMs = Price Multiples

FV = Fair Value

50.b Equity Valuation Models

DCF or PV Models Multiplier Models Asset-Based Models

DDM 1st Type IV of common stock = TA-TL &

preferred stock.

Stock value is PV of cash Ratio of stock to some

distributed to shareholders. fundamental (earnings, sales

BV, CF etc.).

FCFE Model 2nd Type

PV of cash available to Ratio of EV to EBITDA or

shareholders after capital sales.

expenditures & WC expense. EV = MV of all outstanding

securities – cash & short

term investment.

50.c DDM

One-year holding period DDM Multiple year holding periods DDM

1. Sum of the PV of estimated dividends over

= +

(1 + ) (1 + ) holding period & estimated TV.

2. For two year holding period

1 2

= + +

(1 + ) (1 + ) (1 + )

FCFE

3. It reflects firm’s capacity to pay dividends & also useful for firms not currently

paying dividends.

4. = + − ! − + " #$ $% & .

5. FCFE = CFO – FCinv + net borrowings (represent cash to equity holders after

meeting all obligations).

*+*,-

1. ( = ∑234. -

(./01 )

Where is obtained from CAPM or adding risk premium to publically traded

dRatio of EV to EBITDA or sales.

2. EV = MV of all outstanding securities – cash & short term investment.

3. ebt or govt bond yield.

Copyright © FinQuiz.com. All rights reserved.

2015, Study Session # 14, Reading # 50

50.d

PS usually has indefinite maturity & fixed dividend.

67

5 =

07

50.e

GGM ⇒ assumes annual dividend growth rate is constant &8 .

69

( = Where = cost of equity.

01 : ;<

Assumptions of GGM

Dividends are appropriate measure of shareholder

wealth.

&8 & never expected to change.

> &8

When difference b/w & &8 widens, value & vice versa.

Small changes in difference cause large changes in value.

Stock value due to dividend growth = stock value at 0%

growth rate – stock value at a positive growth rate.

Estimating Dividend Growth Rate

Use historical dividend growth rate. Median industry dividend growth rate. Sustainable growth rate

Rate at which equity earnings & dividends continue to

grow indefinitely.

Assumptions are constant ROE, dividend payout ratio &

no new equity is issued.

5=> = >> × >@ .

Firm may not be able to pay dividend currently due to

financial distress or higher reinvestment income.

Multistage Dividend Growth Models

If g > r this relationship can’t hold indefinitely (higher growth will attract competition).

Sustainable growth rate is more realistic assumption.

To determine MDDM;

Duration & size of high growth period should be projected.

Estimates of high growth period dividends & constant growth rate.

69 6A 6C DC

= + + ⋯ + +

(./01 ) (./01 )A (./01 )C (./01 )C

where

6C /.

2 =

01 :;<

50.f

GGM is appropriate for stable, mature & dividend-

paying firms with single growth rate.

MDDM can be two or three stages (growth, transition &

mature).

For non-dividend paying firms estimating future

dividend payments are speculative so FCFE is

appropriate.

Copyright © FinQuiz.com. All rights reserved.

2015, Study Session # 14, Reading # 50

50.g

DDM is very sensitive to inputs so price multiple approach (comparison

of stock price multiple to a benchmark value) is used by many analysts.

PMs are used in time series & cross sectional comparisons.

Critique ⇒ reflect only the past (often historical data is used).

Multiples based on comparables ⇒ compare multiple of the firm with

other firms based on MP.

Multiples based on fundamentals ⇒ what a multiple should be based on

some valuation models.

50.h Price Multiples

P/E Ratio P/S Ratio

EF I

GFH

ℎ

Widely used by analysts.

P/B Ratio P/CF Ratio

I ND

+* O P QRSTU

K $L M " ℎ

CF is CFO or free cash flow.

Multiples can be industry specific (e.g. cable industry

market cap is compared to number of subscribers).

Multiples

Fundamental Based Comparable Based

Z 9Y Compare multiple with benchmarks (historical avg, stocks & industry avg.) &

PW G9

Justified leading YE = (it is justified because we assume that inputs

. [:\ determine its valuation.

are correct & leading because it is based on next period expected earnings). Law of one price⇒ two identical assets should sell at same price.

P

This WYE serves as a benchmark at which stock should trade. Not applicable if firms are of different size, in different industries etc.

.

Very sensitive to inputs, (several sets of inputs for a range of justified P/E). P/S ratio is favored over P/E for cyclical firms (sales are less volatile).

D

Dividend payout .YE , g, k cause P/E.

.

Dividend displacement of earnings ⇒ dividend, growth so firm’s value

impact is ambiguous.

50.i

EV ⇒ total company value ⇒ cost to acquire the firm

EV = MV of common stock + MV of debt – cash & short term investments.

Acquirer’s cost for a firm is decreased by amount of target’s liquid assets (cash &

investments).

EV is appropriate for firms with different capital structure.

EBITDA is normally used as denominator of EV multiple (usually a positive number as

compared to NI & show both equity & debt owner’s earnings).

Disadvantage of EBITDA ⇒ non-cash revenue & expense.

If MV of debt is not available than comparable’s MV of debt or BV is used

Copyright © FinQuiz.com. All rights reserved.

2015, Study Session # 14, Reading # 50

50.j Asset-Based Valuation Models

Equity value = MV or FV of assets – MV or FV of liabilities.

Problematic if large amount of intangible assets.

More reliable when short term tangible assets, assets with ready MV or

when firm is liquidating.

Often used to value private companies but increasingly useful for public

companies (FV reporting on BS).

50.k DCF Models

Advantages Disadvantages

Strong base in finance theory (concept of Inputs must be estimated.

discounted PV). Value estimates are very sensitive to

Widely accepted in analyst community. inputs.

Comparable Based Valuation

Advantages Disadvantages

Useful for predicting stock returns. Not comparable across firms with different size, products &

Readily available & widely used by analysts. growth.

Can be used in time series & cross sectional. Lagging price multiples reflect the past.

EV/EBITDA is useful when comparing a firm’s value Cyclical firms greatly affected by eco conditions.

independent of capital structure, or when earnings are Stock may appear overvalued by comparables but undervalued

negative. by fundamental method & vice versa.

Different accounting methods distort comparability.

Negative denominator results in meaningless ratio.

Fundamental Based Valuation

Advantages Disadvantage

Based on theoretically sound valuation models. Very sensitive to inputs

Correspond to widely accepted value metrics.

Asset-Based Models

Advantages Disadvantages

Provide floor values. MVs are difficult to obtain & usually different than BV.

Reliable when short-term tangible assets, readily Inaccurate when higher proportion of intangible assets.

measurable MV assets & in liquidation. Assets can be difficult to value during hyperinflation.

Increasingly useful to value public firms that are reported

at FV.

Copyright © FinQuiz.com. All rights reserved.

You might also like

- Deca Role Play ExamplesDocument329 pagesDeca Role Play ExamplesEmma EshoNo ratings yet

- Finance Cheat SheetDocument2 pagesFinance Cheat SheetMarc MNo ratings yet

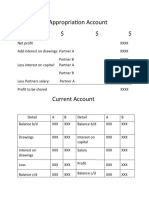

- Accounting-Formats For Cambridge IGCSEDocument11 pagesAccounting-Formats For Cambridge IGCSEmuhtasim kabir100% (9)

- Data Science Career Track: Technical Skills Survey: Overview and Sample QuestionsDocument6 pagesData Science Career Track: Technical Skills Survey: Overview and Sample QuestionsSaif AliNo ratings yet

- PMP Cheat Sheet 6 PagesDocument6 pagesPMP Cheat Sheet 6 PagesSergio Alves92% (12)

- Notes To Financial Statement - Non VATDocument2 pagesNotes To Financial Statement - Non VATCrispaYojSalvaneraCabanas100% (1)

- BEP - CRSSPT 1Document2 pagesBEP - CRSSPT 1Grace SimonNo ratings yet

- Electronic Payment Systems For E-Commerce (2002)Document360 pagesElectronic Payment Systems For E-Commerce (2002)Trà MộcNo ratings yet

- Sources of Big DataDocument3 pagesSources of Big DataHari HaranNo ratings yet

- Titanium Dioxide ExhibitsDocument7 pagesTitanium Dioxide Exhibitssanjayhk7No ratings yet

- How To Break The Bad Habits: RememberDocument1 pageHow To Break The Bad Habits: RememberRod NajarroNo ratings yet

- Al Berunis IndiaDocument41 pagesAl Berunis IndiaAnsari SalmanNo ratings yet

- 10 Mudras For Amazing Health BenefitsDocument4 pages10 Mudras For Amazing Health Benefitsvinod5590No ratings yet

- Cpba Exam BlueprintDocument8 pagesCpba Exam BlueprintVenu Gopal NNo ratings yet

- Laura Beckman: Contact Work ExperienceDocument2 pagesLaura Beckman: Contact Work Experienceapi-614547772No ratings yet

- Agile and Scrum Tip Sheet From Vitality Chicago Inc April 2020Document1 pageAgile and Scrum Tip Sheet From Vitality Chicago Inc April 2020Lee SpadiniNo ratings yet

- Book ListDocument1 pageBook ListSaurabh SalunkheNo ratings yet

- How To Save Your MoneyDocument27 pagesHow To Save Your MoneyYield Financial PlanningNo ratings yet

- Syllabus CFA Level 2Document2 pagesSyllabus CFA Level 2Phi AnhNo ratings yet

- School of Educators: Thinking, Thinking and More Thinking! A Summary of Many Thinking StrategiesDocument14 pagesSchool of Educators: Thinking, Thinking and More Thinking! A Summary of Many Thinking StrategiesshaimaaNo ratings yet

- Azure Solutions Architect Learning Path (April 2019)Document1 pageAzure Solutions Architect Learning Path (April 2019)Yero CiyNo ratings yet

- CSE-Machine Learning & Big Data - WSS Source BookDocument181 pagesCSE-Machine Learning & Big Data - WSS Source BookGOWTHAM SNo ratings yet

- Preview PDFDocument65 pagesPreview PDFjoy margaNo ratings yet

- Elements of Programming InterviewsDocument1 pageElements of Programming InterviewsAnand Prakash0% (1)

- Think and Grow RichDocument19 pagesThink and Grow RichAnjali GuptaNo ratings yet

- Dealing With Peer PressureDocument9 pagesDealing With Peer PressureMuhammad Ramzan NoorNo ratings yet

- SAS Compliance Solutions 7.1 Fundamentals For Consultants: The IndustryDocument33 pagesSAS Compliance Solutions 7.1 Fundamentals For Consultants: The IndustryBea Palomar100% (1)

- Non-Fiction: Current Rank Status Rank Last Week Weeks On List Title Author Publisher PriceDocument3 pagesNon-Fiction: Current Rank Status Rank Last Week Weeks On List Title Author Publisher PriceKaran DattNo ratings yet

- Scala Cheat Sheet AmreshDocument2 pagesScala Cheat Sheet AmreshBitCoin MiningNo ratings yet

- The Winds of PythonDocument308 pagesThe Winds of PythonIzan MajeedNo ratings yet

- CoursePresentation AZ900 AzureFundamentalsDocument196 pagesCoursePresentation AZ900 AzureFundamentalsNavin PatleNo ratings yet

- Knowledge of IndiaDocument32 pagesKnowledge of IndiaPrajwal D'SouzaNo ratings yet

- Product ManangementDocument341 pagesProduct ManangementsatyarthgaurNo ratings yet

- Ude My For Business Course List NewDocument64 pagesUde My For Business Course List NewAbhishekGuptaSarmaNo ratings yet

- Starter Guide Visual Basic RCXDocument150 pagesStarter Guide Visual Basic RCXGuillermo NietoNo ratings yet

- Business IntelligenceDocument210 pagesBusiness IntelligencePAULA ALONSO P. COOMONTENo ratings yet

- Fundamentals of Cloud ComputingDocument14 pagesFundamentals of Cloud ComputingGlobal Edge Software100% (1)

- Interview Questions For Finance StudentsDocument12 pagesInterview Questions For Finance Studentsradhika1991No ratings yet

- Governemnt Schemes Comprehensive Part 1Document213 pagesGovernemnt Schemes Comprehensive Part 1amitNo ratings yet

- Power List 2017: Sponsored byDocument34 pagesPower List 2017: Sponsored byCrowdfundInsider100% (1)

- Dynamics GP Reference PDFDocument192 pagesDynamics GP Reference PDFGustav BlackNo ratings yet

- Investment of Rs 500000Document29 pagesInvestment of Rs 5000009824534642No ratings yet

- Modern Approaches and Innovation in PsychologyDocument206 pagesModern Approaches and Innovation in Psychologykohinoorncmaip67% (3)

- Toppers' Secrets For CAT and XAT PDFDocument30 pagesToppers' Secrets For CAT and XAT PDFSubhash HandaNo ratings yet

- Everything Is Out of Syllabus Varun Duggirala 2022 Annas Archive Libgenrs NF 3352737Document164 pagesEverything Is Out of Syllabus Varun Duggirala 2022 Annas Archive Libgenrs NF 3352737abhilashNo ratings yet

- Analyzing The Logic of Sun Tzu in "The Art of War", Using Mind MapsDocument416 pagesAnalyzing The Logic of Sun Tzu in "The Art of War", Using Mind MapsRini MaulidaNo ratings yet

- Scenario Segmentation Anomaly Detection Models 107495Document12 pagesScenario Segmentation Anomaly Detection Models 107495xavo_27No ratings yet

- T3 India - November 2018Document100 pagesT3 India - November 2018vvpvarunNo ratings yet

- Dcap606 Business IntelligenceDocument208 pagesDcap606 Business Intelligenceragh KNo ratings yet

- Agius - FMV Cheat Sheet (Class of 22D)Document2 pagesAgius - FMV Cheat Sheet (Class of 22D)Mradul Raj JainNo ratings yet

- Cheat SheetDocument4 pagesCheat Sheetppxxdd666No ratings yet

- Acf2 2024Document30 pagesAcf2 2024rodrigo.felix17012002No ratings yet

- Formula Sheet: Pay Back PeriodDocument3 pagesFormula Sheet: Pay Back PeriodtejaswiNo ratings yet

- ValuationhandbookDocument30 pagesValuationhandbooksoumyakumarNo ratings yet

- Fnce 100 Final Cheat SheetDocument3 pagesFnce 100 Final Cheat Sheethung TranNo ratings yet

- Session 3 & 4 (CH 2 - Approaches To Valuation - DCF & RV)Document44 pagesSession 3 & 4 (CH 2 - Approaches To Valuation - DCF & RV)Arun KumarNo ratings yet

- Outline: Investment AnalysisDocument15 pagesOutline: Investment AnalysisYe TunNo ratings yet

- Managerial Economics: PV FV IDocument9 pagesManagerial Economics: PV FV IKang ChulNo ratings yet

- CA5102 Q1 FORMULA SHEETDocument12 pagesCA5102 Q1 FORMULA SHEETDyra Mae OmegaNo ratings yet

- Zrive IB 1Q23 Intro To Valuation Methods Up2Document9 pagesZrive IB 1Q23 Intro To Valuation Methods Up2Luis Soldevilla MorenoNo ratings yet

- L 2 Ss 5 Los 16Document5 pagesL 2 Ss 5 Los 16Edgar LayNo ratings yet

- Slide 8Document13 pagesSlide 8Akash SinghNo ratings yet

- Accounting ProblemsDocument9 pagesAccounting ProblemsMukta MattaNo ratings yet

- Accounting - Is - The - Language - Thread - by - Brianferoldi - May 2, 23 - From - Rattibha PDFDocument18 pagesAccounting - Is - The - Language - Thread - by - Brianferoldi - May 2, 23 - From - Rattibha PDFSantoshNo ratings yet

- Problems On Retained EarningsDocument2 pagesProblems On Retained EarningsDecereen Pineda RodriguezaNo ratings yet

- Perpetual Answer KeyDocument11 pagesPerpetual Answer KeyRichelle Janine Dela CruzNo ratings yet

- Annual Audit Report Naic 2017Document103 pagesAnnual Audit Report Naic 2017RNJNo ratings yet

- Cima E1 2019 Notes Managing Finance in A Digital WorldDocument91 pagesCima E1 2019 Notes Managing Finance in A Digital Worldumarfarooque869No ratings yet

- Equitymaster-Knowledge Centre-Intelligent Investing PDFDocument176 pagesEquitymaster-Knowledge Centre-Intelligent Investing PDFarif420_999No ratings yet

- Baggayao WACC PDFDocument7 pagesBaggayao WACC PDFMark John Ortile BrusasNo ratings yet

- 4291785Document9 pages4291785mohitgaba19No ratings yet

- Cost Volume Profit AnalysisDocument13 pagesCost Volume Profit Analysiskishorej19No ratings yet

- NCAT Financial Record TemplatesDocument11 pagesNCAT Financial Record TemplatesPitu WoluNo ratings yet

- Chapter 20Document5 pagesChapter 20Rahila RafiqNo ratings yet

- Responsibility Accounting and Transfer PricingDocument25 pagesResponsibility Accounting and Transfer Pricingjustine reine cornicoNo ratings yet

- (Final) Report Konsol DMMX - 31 Des 2020Document124 pages(Final) Report Konsol DMMX - 31 Des 2020Bunga LophitaNo ratings yet

- Competency Based Questions - 05-02-24Document2 pagesCompetency Based Questions - 05-02-24Kulvirkuljitharmeet singhNo ratings yet

- Intangible Non - Current AssetDocument4 pagesIntangible Non - Current AssetNguyễn Đức TháiNo ratings yet

- The Changing Role of Managerial Accounting in A Dynamic Business EnvironmentDocument56 pagesThe Changing Role of Managerial Accounting in A Dynamic Business EnvironmentKatherine Cabading InocandoNo ratings yet

- 1.2 Responsibility Accounting Theory AnswersDocument11 pages1.2 Responsibility Accounting Theory AnswersAsnarizah PakinsonNo ratings yet

- Entel 2Q22Document21 pagesEntel 2Q22fioreb12No ratings yet

- Acca Strategic Business Reporting (International) Mock Examination 4Document22 pagesAcca Strategic Business Reporting (International) Mock Examination 4Asad MuhammadNo ratings yet

- Incremental Analysis: Summary of Questions by Objectives and Bloom'S Taxonomy True-False StatementsDocument43 pagesIncremental Analysis: Summary of Questions by Objectives and Bloom'S Taxonomy True-False StatementsMarcus MonocayNo ratings yet

- Marginal and Absorption CostingDocument21 pagesMarginal and Absorption Costingkelvin mboyaNo ratings yet

- LTCCDocument7 pagesLTCCgenevieve sicatNo ratings yet

- Accounting For SMEs QuestionnaireDocument4 pagesAccounting For SMEs QuestionnaireGirlie Sison100% (1)

- ACCOUNTING P1 GR11 ANSWER BOOK NOVEMBER 2020 - EnglishDocument8 pagesACCOUNTING P1 GR11 ANSWER BOOK NOVEMBER 2020 - Englishlindort00No ratings yet

- Kanesha SmithDocument23 pagesKanesha Smithalicewilliams83nNo ratings yet