Professional Documents

Culture Documents

Lower of Cost and Net Realizable Value

Lower of Cost and Net Realizable Value

Uploaded by

Fe Valencia0 ratings0% found this document useful (0 votes)

36 views1 pageThis document discusses accounting for inventory at the lower of cost or net realizable value. Net realizable value is estimated selling price less completion and disposal costs. If cost is lower than net realizable value, inventory is recorded at cost; if net realizable value is lower than cost, inventory is recorded at net realizable value and the loss is recognized. There are two methods for accounting for writedowns to net realizable value: the direct method records inventory at the lower of cost or net realizable value, while the allowance method records inventory at cost with any loss accounted for separately.

Original Description:

notes

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses accounting for inventory at the lower of cost or net realizable value. Net realizable value is estimated selling price less completion and disposal costs. If cost is lower than net realizable value, inventory is recorded at cost; if net realizable value is lower than cost, inventory is recorded at net realizable value and the loss is recognized. There are two methods for accounting for writedowns to net realizable value: the direct method records inventory at the lower of cost or net realizable value, while the allowance method records inventory at cost with any loss accounted for separately.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

36 views1 pageLower of Cost and Net Realizable Value

Lower of Cost and Net Realizable Value

Uploaded by

Fe ValenciaThis document discusses accounting for inventory at the lower of cost or net realizable value. Net realizable value is estimated selling price less completion and disposal costs. If cost is lower than net realizable value, inventory is recorded at cost; if net realizable value is lower than cost, inventory is recorded at net realizable value and the loss is recognized. There are two methods for accounting for writedowns to net realizable value: the direct method records inventory at the lower of cost or net realizable value, while the allowance method records inventory at cost with any loss accounted for separately.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

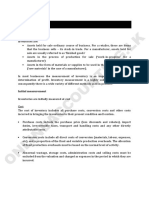

LOWER OF COST AND NET REALIZABLE VALUE - JOURNAL ENTRY (SAMPLE)

INVENTORY RECORDED @ COST

1. What is NET REALIZABLE VALUE?

DR. INVENTORY

- The ESTIMATED SELLING PRICE LESS

CR. INCOME SUMMARY

ESTIMATED COST OF COMPLETION &

INVENTORY RECORDED @ COST

ESTIMATED COST OF DISPOSAL

DR. LOSS ON INV. WRITEDOWN

- COST OF INVENTORIES ---- may NOT be

CR. ALL. FOR INV. WRITEDOWN

RECOVERABLE ** if the inventories are

NOTE:

DAMAGED --- if SELLING PRICE DECLINE

LOSS ON INV. WRITEDOWN is included in

the computation of COGS.

2. Measurement of inventory @ LOWER

LOSS > INCREASE INVENTORY

COST AND NET REALIZABLE VALUE.

GAIN > DECREASE INVENTORY

- NOT APPROPRIATE TO WRITE DOWN

INVENTORY BASED ON A

4. PURCHASE COMMITMENTS

CLASSIFICATION OF INVENTORY

- Obligations of entity to acquire goods

Example:

in the FUTURE @ fixed price &

Finished goods

quantities.

- If COST IS LOWER THAN NET

- PURCHASE ORDER – already been

REALIZABLE VALUE ---- INVENTORY is

made for the future delivery of goods

stated @ COST and the INCREASE in

in FIXED price and quantities

Value is not recognized.

LOSS on purchase commitment recognized

- If NET REALIZABLE IS LOWER THAN

NON-CANCELLABLE

COST ---- INVENTORY is measured @

GAIN on purchase commitment recognized

NRV and DECREASE IN VALUE is

MARKET PRICE RISES @ the time entity

recognized as EXPENSE

make purchase

3. TWO METHODS OF ACCOUNTING FOR

INVENTORY WRITEDOWN TO NRV.

a. DIRECT METHOD

- RECORDED: @ the LOWER COST OF

NRV

- Known as “COST OF GOODS SOLD”

method

Because ANY LOSS ON INVENTORY

WRITEDOWN is NOT ACCOUNTED FOR

SEPARATELY but “BURRIED” in COST OF

GOODS SOLD

- JOURNAL ENTRY (SAMPLE)

INVENTORY RECORDED @ THE LOWER

COST OR NRV

DR. INVENTORY

CR. INCOME SUMMARY

b. ALLOWANCE METHOD

- RECORDED: @ COST & ANY LOSS ON

INVENTORY WRITEDOWN is

ACCOUNTED SEPARATELY

- Known as “LOSS METHOD”

You might also like

- EXT - Lazada Sponsored Solutions Suite (Beginners Edition) - 3 Oct 22Document78 pagesEXT - Lazada Sponsored Solutions Suite (Beginners Edition) - 3 Oct 22Coleen Angel FowlNo ratings yet

- 2-4 Problems RevaluationDocument77 pages2-4 Problems RevaluationFe Valencia100% (2)

- YSEALI Seeds Budget TemplateDocument1 pageYSEALI Seeds Budget TemplateKievas CahyadiNo ratings yet

- Assignment 1 - Engineering EconomicsDocument15 pagesAssignment 1 - Engineering EconomicsDhiraj NayakNo ratings yet

- (Solved) - Save Lot Retailers The Following Table Shows Financial Data (Year... - (1 Answer) - TransDocument7 pages(Solved) - Save Lot Retailers The Following Table Shows Financial Data (Year... - (1 Answer) - Transkumar n0% (1)

- LCNRVDocument2 pagesLCNRVKent Raysil PamaongNo ratings yet

- Far 6813 - Inventory Cost Flow Lower of Cost or Net Realizable Value (LCNRV)Document2 pagesFar 6813 - Inventory Cost Flow Lower of Cost or Net Realizable Value (LCNRV)Kent Raysil PamaongNo ratings yet

- Inventory Cost FlowDocument2 pagesInventory Cost FlowFe ValenciaNo ratings yet

- Cfas Pas 1-16Document8 pagesCfas Pas 1-16Sagad KeithNo ratings yet

- Chapter 12 Lower of Cost and Net Realizable ValueDocument1 pageChapter 12 Lower of Cost and Net Realizable ValueDanielleNo ratings yet

- Valuation of An Acquisition: Oggy and The CockroachesDocument36 pagesValuation of An Acquisition: Oggy and The CockroachescristianoNo ratings yet

- Business Finance ReviewerDocument1 pageBusiness Finance Reviewercali kNo ratings yet

- Week 02 - Valuation of Stock - SDocument4 pagesWeek 02 - Valuation of Stock - STeresa ManNo ratings yet

- Chapter 8 IAS 2 InventoriesDocument7 pagesChapter 8 IAS 2 InventoriesClarissa BorbonNo ratings yet

- IntermedDocument1 pageIntermedEsther Oilynjoy MelendrezNo ratings yet

- Chap 12,13, and 14Document6 pagesChap 12,13, and 14Mary Claudette UnabiaNo ratings yet

- Comparison 7.5 ĐiểmDocument23 pagesComparison 7.5 Điểmtuân okNo ratings yet

- Summary of Lower of Cost and Net Realizable ValueDocument2 pagesSummary of Lower of Cost and Net Realizable Valueranielvillangca83No ratings yet

- Fundamentals of AccountingDocument6 pagesFundamentals of AccountingMJ Dela PenaNo ratings yet

- ACC 203 Module 4 PAS 2 Inventories PAS 41 Biological AssetsDocument15 pagesACC 203 Module 4 PAS 2 Inventories PAS 41 Biological AssetsKirsty SicamNo ratings yet

- Far Notes For QualiDocument10 pagesFar Notes For QualiMergierose DalgoNo ratings yet

- IND AS 2 InventoryDocument3 pagesIND AS 2 InventoryPavan Kumar PurohitNo ratings yet

- Module 7 13 No 11Document6 pagesModule 7 13 No 11LEIGHANNE ZYRIL SANTOSNo ratings yet

- FINACC1 Inventories PDFDocument6 pagesFINACC1 Inventories PDFJerico DungcaNo ratings yet

- Subsequent Measurement of Property, Plant and Equipment: Cost ModelDocument6 pagesSubsequent Measurement of Property, Plant and Equipment: Cost ModelLorraine Dela CruzNo ratings yet

- Onlineaccounting - LK: Definition of InventoryDocument3 pagesOnlineaccounting - LK: Definition of InventoryayeshaNo ratings yet

- LCNRVDocument1 pageLCNRVJames Matthew BedayoNo ratings yet

- Item Number Conversative or Conventional or Lower Cost and Net Realizable Value Approach Average Cost ApproachDocument2 pagesItem Number Conversative or Conventional or Lower Cost and Net Realizable Value Approach Average Cost ApproachEarl BandalaNo ratings yet

- Intermediate AccountingDocument3 pagesIntermediate AccountingTrazy Jam BagsicNo ratings yet

- 2.1. Ind AS 2Document38 pages2.1. Ind AS 2Ajay JangirNo ratings yet

- Chapter 4 InventoriesDocument9 pagesChapter 4 InventoriesMushar AliNo ratings yet

- Inventories: Additional Issues: © 2013 The Mcgraw-Hill Companies, IncDocument37 pagesInventories: Additional Issues: © 2013 The Mcgraw-Hill Companies, IncCorey WangNo ratings yet

- Ias 2 - InventoriesDocument2 pagesIas 2 - Inventoriesangelinamaye99No ratings yet

- Inventory ValuationDocument16 pagesInventory ValuationKillari PadmasriNo ratings yet

- Scope: Allocation of Fixed Production OverheadsDocument8 pagesScope: Allocation of Fixed Production OverheadsjayveeNo ratings yet

- Pas 2 Inventories: Nature: DefinitionDocument3 pagesPas 2 Inventories: Nature: DefinitionKristalen ArmandoNo ratings yet

- Direct Method or Cost of Goods Sold MethodDocument2 pagesDirect Method or Cost of Goods Sold MethodNa Dem DolotallasNo ratings yet

- LCNRV 12Document3 pagesLCNRV 12gab camonNo ratings yet

- Northeastern College College of Accountancy & Business Administration Financial Accounting I Inventory ValuationDocument2 pagesNortheastern College College of Accountancy & Business Administration Financial Accounting I Inventory ValuationVel JuneNo ratings yet

- Chapter 3 - IND AS 2 InventoriesDocument18 pagesChapter 3 - IND AS 2 InventoriesAmbati Madhava ReddyNo ratings yet

- ch12 PDFDocument9 pagesch12 PDFEmma Mariz GarciaNo ratings yet

- IAS 2 Flow ChartDocument1 pageIAS 2 Flow ChartMaham MoinNo ratings yet

- LECTURE 10 & 11 Capital Budgeting Chapter Reference - CHP 9 & 10Document2 pagesLECTURE 10 & 11 Capital Budgeting Chapter Reference - CHP 9 & 10arzu tabassumNo ratings yet

- Land and BuildingDocument7 pagesLand and BuildingRose DepistaNo ratings yet

- Name: Khyla A. Diviagracia BSA III Audit On Ppe Concept MapDocument10 pagesName: Khyla A. Diviagracia BSA III Audit On Ppe Concept MapKhyla DivinagraciaNo ratings yet

- Property Plant and Equipment: Ricky Boy B. LeonardoDocument14 pagesProperty Plant and Equipment: Ricky Boy B. LeonardoRodel Novesteras ClausNo ratings yet

- Cost Concepts: Why Cost Is An Important Concept? 01Document3 pagesCost Concepts: Why Cost Is An Important Concept? 01mEOW SNo ratings yet

- Airline-Inventory MidtermshortDocument3 pagesAirline-Inventory MidtermshortMaryam LoayonNo ratings yet

- Lower of Cost Net Realizable ValueDocument1 pageLower of Cost Net Realizable ValueYami HeatherNo ratings yet

- Double Entry SystemDocument5 pagesDouble Entry SystemCurtison ScotlandNo ratings yet

- Material NDocument3 pagesMaterial NSoumodip ParuiNo ratings yet

- Intangible AssetsDocument3 pagesIntangible Assetsgreat angelNo ratings yet

- Pas 2Document2 pagesPas 2Ella MaeNo ratings yet

- Lower of Cost or Net Realizable ValueDocument2 pagesLower of Cost or Net Realizable ValueZeeNo ratings yet

- Inventories ThoeryDocument10 pagesInventories ThoeryAltessa Lyn ContigaNo ratings yet

- Reflection 3 (Anchal)Document5 pagesReflection 3 (Anchal)Abhishek mudaliarNo ratings yet

- PDF Warren SM ch07 Final - CompressDocument20 pagesPDF Warren SM ch07 Final - CompressBerliana MustikasariNo ratings yet

- Variable and Absorption CostingDocument3 pagesVariable and Absorption CostingAnna Pamela MarianoNo ratings yet

- Business Plan Business Presentation in Blue Yellow White Corporate Geometric StyleDocument9 pagesBusiness Plan Business Presentation in Blue Yellow White Corporate Geometric StyleYash GargNo ratings yet

- Assets PrintingDocument7 pagesAssets PrintingIrtiza AbbasNo ratings yet

- Known As: Applied Overhead, Factory BeDocument1 pageKnown As: Applied Overhead, Factory BeKhaledNo ratings yet

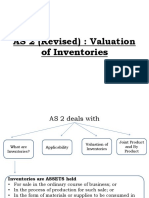

- AS 2 (Revised) : Valuation of InventoriesDocument13 pagesAS 2 (Revised) : Valuation of InventoriesAkshay PatilNo ratings yet

- LOGISTICSDocument3 pagesLOGISTICSWeda Maicel MollanedaNo ratings yet

- 2305 InventoryDocument6 pages2305 InventoryDexterNo ratings yet

- Business Ratios and Formulas: A Comprehensive GuideFrom EverandBusiness Ratios and Formulas: A Comprehensive GuideRating: 3 out of 5 stars3/5 (1)

- 2 4 RevaluationDocument29 pages2 4 RevaluationFe ValenciaNo ratings yet

- Inventory Cost FlowDocument2 pagesInventory Cost FlowFe ValenciaNo ratings yet

- Introduction To Financial Markets and Institutions NotesDocument11 pagesIntroduction To Financial Markets and Institutions NotesFe ValenciaNo ratings yet

- Role of The BSPDocument25 pagesRole of The BSPFe ValenciaNo ratings yet

- Money Markets Vs Capital Markets: By: Louiecille Larcia-Basas, MBA, AFPDocument19 pagesMoney Markets Vs Capital Markets: By: Louiecille Larcia-Basas, MBA, AFPFe ValenciaNo ratings yet

- The Philippine Financial System FullDocument35 pagesThe Philippine Financial System FullFe ValenciaNo ratings yet

- Financial Markets Prelim Track Module 3 Money Market and Money Market SecuritiesDocument8 pagesFinancial Markets Prelim Track Module 3 Money Market and Money Market SecuritiesFe ValenciaNo ratings yet

- Finmark Notes Overview of Financial Systems Financial InstrumentsDocument7 pagesFinmark Notes Overview of Financial Systems Financial InstrumentsFe ValenciaNo ratings yet

- Quiz #2 - CH 4 & 5: Question 1 (48 Marks)Document2 pagesQuiz #2 - CH 4 & 5: Question 1 (48 Marks)JamNo ratings yet

- Carta de La JSV Del 19 de Mayo de 2023Document12 pagesCarta de La JSV Del 19 de Mayo de 2023El Nuevo DíaNo ratings yet

- Econ 202: Macroeconomics The Measurement and Structure of The National Economy - 1/3Document19 pagesEcon 202: Macroeconomics The Measurement and Structure of The National Economy - 1/3Anubhav ChoudharyNo ratings yet

- Oracle Fusion Cloud Financials R13Document12 pagesOracle Fusion Cloud Financials R13n ganeshNo ratings yet

- Week 2 Notes From AssignmentsDocument11 pagesWeek 2 Notes From AssignmentsTamMaxNo ratings yet

- Yambot ECommerceLAB4 PDFDocument6 pagesYambot ECommerceLAB4 PDFYan YanNo ratings yet

- Imports With Letter of Credit in SAP ERPDocument8 pagesImports With Letter of Credit in SAP ERPMohamed QamarNo ratings yet

- COPQ KPI How To MeasureDocument2 pagesCOPQ KPI How To MeasureNguyễn Tiến Dũng100% (1)

- Tai Lieu On Thi Vol 7 - SV - Bu I 2Document168 pagesTai Lieu On Thi Vol 7 - SV - Bu I 2hacongtinh19902000No ratings yet

- Consumers' Challenges and RightsDocument2 pagesConsumers' Challenges and RightsMaria ElizabethNo ratings yet

- Oracle IFRS 17 BlueprintDocument4 pagesOracle IFRS 17 BlueprintMegan CastilloNo ratings yet

- School of Commerce Cost Accounting Unit-2-Material and Cost Control Material and Cost ControlDocument10 pagesSchool of Commerce Cost Accounting Unit-2-Material and Cost Control Material and Cost ControlHarish gowdaNo ratings yet

- Layout For Aquaculture ProjectDocument10 pagesLayout For Aquaculture ProjectBhushan ParalkarNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)NAGARJUNANo ratings yet

- 3218 Uyen Nguyen My 10210652 ULC A1.1 14923 1514468528Document33 pages3218 Uyen Nguyen My 10210652 ULC A1.1 14923 1514468528Uyên Nguyễn MỹNo ratings yet

- Test Bank For International Trade 4th Edition Robert C FeenstraDocument28 pagesTest Bank For International Trade 4th Edition Robert C Feenstraquyroyp25dmNo ratings yet

- SALIHIN Malaysia Budget 2024 BulletinDocument25 pagesSALIHIN Malaysia Budget 2024 Bulletinhekate.yantraNo ratings yet

- HR Activities in MNCDocument13 pagesHR Activities in MNCmariamfirdusNo ratings yet

- Mine PlanningDocument138 pagesMine PlanningGiovanni AstudilloNo ratings yet

- Options Basics - How To Pick The Right Strike PriceDocument14 pagesOptions Basics - How To Pick The Right Strike PricealokNo ratings yet

- Comarco Group Presentation (Comp) - Jun 2020 (V9) - Read-Only-compressedDocument30 pagesComarco Group Presentation (Comp) - Jun 2020 (V9) - Read-Only-compressedkhaidarov.ziaNo ratings yet

- (Sample) Ecommerce & Google Ads DashboardDocument1 page(Sample) Ecommerce & Google Ads DashboardHassnae HassnaeNo ratings yet

- GROUP 1 - PetE 3306 - Final Requirement in Engineering EconomicsDocument12 pagesGROUP 1 - PetE 3306 - Final Requirement in Engineering Economicskevin alidoNo ratings yet

- 149-Article Text-293-1-10-20200211Document7 pages149-Article Text-293-1-10-20200211Hanike Fresnalika PutriNo ratings yet

- Unit 3-Financial Statement AnalysisDocument55 pagesUnit 3-Financial Statement AnalysisGizaw BelayNo ratings yet

- Invoice 953263Document1 pageInvoice 953263kozinohenNo ratings yet