Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

56 viewsVAT Summary

VAT Summary

Uploaded by

banglauserThe document summarizes registration and enlistment requirements for value-added tax (VAT) in Mushak, including compulsory registration thresholds based on turnover, applicable forms, responsible administration, and requirements for changes to registered information. Registration is required if annual turnover exceeds 50 lakh or the business provides specially designated goods/services or participates in government tenders. Voluntary registrants must remain registered for at least one year.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- MA - Final Assignment 1Document5 pagesMA - Final Assignment 1helennguyen242004No ratings yet

- ATX Summary Notes Tax Year 2022 23Document45 pagesATX Summary Notes Tax Year 2022 23sheharyar.kgsNo ratings yet

- Financial Reporting First Take - Ron KingDocument340 pagesFinancial Reporting First Take - Ron KingYuan Fu100% (1)

- FAC3702 Question Bank 2015Document105 pagesFAC3702 Question Bank 2015Itumeleng KekanaNo ratings yet

- Accountant TestDocument3 pagesAccountant TestMax SuperNo ratings yet

- F6 SMART Notes FA20 Till March-2022 byDocument44 pagesF6 SMART Notes FA20 Till March-2022 byAshfaq Ul Haq OniNo ratings yet

- Txzaf 2019 Jun QDocument16 pagesTxzaf 2019 Jun QAyomideNo ratings yet

- Presentation of Financial StatementsDocument40 pagesPresentation of Financial StatementsQuinta NovitaNo ratings yet

- Taxation - Botswana (TX - Bwa) : Applied SkillsDocument20 pagesTaxation - Botswana (TX - Bwa) : Applied Skillsgajendra.naiduNo ratings yet

- Deferred Tax Silvia IFRSBoxDocument10 pagesDeferred Tax Silvia IFRSBoxteddy matendawafaNo ratings yet

- Prog: Bscac Level: 2.2: Year: 2016Document137 pagesProg: Bscac Level: 2.2: Year: 2016Zic Zac100% (1)

- Citn New Professional Syllabus - Income TaxDocument214 pagesCitn New Professional Syllabus - Income Taxtwweettybird100% (2)

- Financial Accounting and Reporting 02Document6 pagesFinancial Accounting and Reporting 02Nuah SilvestreNo ratings yet

- Journal List For AccountingDocument5 pagesJournal List For AccountingNikhil Chandra ShilNo ratings yet

- Fac 3703Document99 pagesFac 3703Nozipho MpofuNo ratings yet

- NPV Practice CompleteDocument5 pagesNPV Practice CompleteShakeel AslamNo ratings yet

- AAT ITAX Focus Notes FA2015 No. 1 - EXTERNAL TUTORDocument90 pagesAAT ITAX Focus Notes FA2015 No. 1 - EXTERNAL TUTORLindaBakóNo ratings yet

- Monetary or Non-Monetary - CPDbox - Making IFRS EasyDocument97 pagesMonetary or Non-Monetary - CPDbox - Making IFRS EasyRachelle Anne M PardeñoNo ratings yet

- VAT and SD Act 2012 EnglishDocument91 pagesVAT and SD Act 2012 EnglishMonjurul HassanNo ratings yet

- NFRS AuditDocument32 pagesNFRS AuditBidhan Sapkota100% (1)

- Icaew Cfab Pot 2019 SyllabusDocument10 pagesIcaew Cfab Pot 2019 SyllabusAnonymous ulFku1vNo ratings yet

- General Fin Reporting 2013 Exam W SolutionsDocument69 pagesGeneral Fin Reporting 2013 Exam W SolutionsTosha Lopez100% (1)

- TX ZWE Examinable Documents 2021Document3 pagesTX ZWE Examinable Documents 2021Tawanda Tatenda HerbertNo ratings yet

- Nust Tax Module Jan 2018Document180 pagesNust Tax Module Jan 2018Phebieon MukwenhaNo ratings yet

- Individual Assignment 2Document2 pagesIndividual Assignment 2Loveness NyakurimwaNo ratings yet

- Ifrs 8Document3 pagesIfrs 8Samantha IslamNo ratings yet

- 2023 VAT - 1 - Administration 1Document62 pages2023 VAT - 1 - Administration 1Zance JordaanNo ratings yet

- IFRS 15 QuestionsDocument6 pagesIFRS 15 QuestionsSahilPatelNo ratings yet

- IPSAS 19 - Provisions and ContingenciesDocument38 pagesIPSAS 19 - Provisions and ContingenciesShafii SigeraNo ratings yet

- FR Tutorials 2022 - Some Theory Question SolutionDocument26 pagesFR Tutorials 2022 - Some Theory Question SolutionLaud Listowell100% (2)

- Auditing: Cpa Exam ReviewDocument9 pagesAuditing: Cpa Exam ReviewShruti SrivastavaNo ratings yet

- Tutorial Letter 101/3/2015: General Financial ReportingDocument45 pagesTutorial Letter 101/3/2015: General Financial Reportingemila_moodleyNo ratings yet

- Thông tư 200/2014 (Tiếng Anh) Circular 200/2014 (English-Free)Document367 pagesThông tư 200/2014 (Tiếng Anh) Circular 200/2014 (English-Free)Kent PhamNo ratings yet

- Audit All Past Suggested Paper ICANDocument280 pagesAudit All Past Suggested Paper ICANMichael AdhikariNo ratings yet

- I Cap If Rs QuestionsDocument34 pagesI Cap If Rs QuestionsUsmän MïrżäNo ratings yet

- MAC3701 Question Bank 2016Document65 pagesMAC3701 Question Bank 2016Blessings MunkuliNo ratings yet

- P2 MindmapsDocument49 pagesP2 MindmapsPui Fun LeoNo ratings yet

- Workshop On Deferred TaxationDocument21 pagesWorkshop On Deferred TaxationYusuf KhanNo ratings yet

- Applying IFRS Revenue From Contracts With CustomersDocument76 pagesApplying IFRS Revenue From Contracts With CustomersDhe SagalaNo ratings yet

- An Overview of SingerBDDocument19 pagesAn Overview of SingerBDEmon Hossain100% (1)

- Accounting RatiosDocument42 pagesAccounting RatiosApollo Institute of Hospital AdministrationNo ratings yet

- ISA 315 - MGT AssertionsDocument5 pagesISA 315 - MGT AssertionsAwaisQureshiNo ratings yet

- DRC VAT Training CAs Day 1-2Document40 pagesDRC VAT Training CAs Day 1-2iftekharul alam100% (1)

- AC2091 Financial Reporting: Session 4Document40 pagesAC2091 Financial Reporting: Session 4NadiaIssabellaNo ratings yet

- MACC 709 GROUP 3 ASSIGNMENT GROSS INCOME 2020 (2) Final SolutionDocument8 pagesMACC 709 GROUP 3 ASSIGNMENT GROSS INCOME 2020 (2) Final SolutionFadzai MhepoNo ratings yet

- UntitledDocument21 pagesUntitleddhirajpironNo ratings yet

- Additional Deferred Tax Examples.2Document3 pagesAdditional Deferred Tax Examples.2milton1986100% (1)

- AUE3761 - Y - 2023 - Test - 1 - Solution With Comments For StudentsDocument9 pagesAUE3761 - Y - 2023 - Test - 1 - Solution With Comments For Studentsmandisanomzamo72No ratings yet

- Smart Notes Acca f6 2015 (35 Pages)Document38 pagesSmart Notes Acca f6 2015 (35 Pages)SrabonBarua100% (2)

- 2016 Icaz Cta Unisa Taxation Tutorial 102 PDFDocument70 pages2016 Icaz Cta Unisa Taxation Tutorial 102 PDFArtwell ZuluNo ratings yet

- KPMG Analysis of The Finance Act 2021 - FinalDocument47 pagesKPMG Analysis of The Finance Act 2021 - FinalNirvan MaudhooNo ratings yet

- Accounting II SyllabusDocument4 pagesAccounting II SyllabusRyan Busch100% (2)

- Financial Management and ControlDocument18 pagesFinancial Management and ControlcrystalNo ratings yet

- Chapter 18 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document10 pagesChapter 18 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- 2023 VATLecture3 Input TaxDocument31 pages2023 VATLecture3 Input TaxZance JordaanNo ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Instructions For Filling Out FORM ITR 3Document231 pagesInstructions For Filling Out FORM ITR 3Samantha JNo ratings yet

- Sec 183Document1 pageSec 183goelshubham92No ratings yet

- Difference Between GSTRDocument4 pagesDifference Between GSTRdevNo ratings yet

- Vat Sro 220 SDDocument2 pagesVat Sro 220 SDbanglauserNo ratings yet

- CR-Nov-Dec-2021Document7 pagesCR-Nov-Dec-2021banglauserNo ratings yet

- Mushak 25 - Application For Drawback For Postal ExportDocument2 pagesMushak 25 - Application For Drawback For Postal ExportbanglauserNo ratings yet

- Withholding VAT Guideline 2015-2016Document20 pagesWithholding VAT Guideline 2015-2016banglauserNo ratings yet

- Withholding VAT Guideline (2017-18)Document29 pagesWithholding VAT Guideline (2017-18)banglauserNo ratings yet

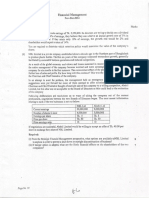

- Fm-May-June 2015Document18 pagesFm-May-June 2015banglauserNo ratings yet

- STRATEGIC BUSINESS MANAGEMENT - JA-23 - Suggested - AnswersDocument15 pagesSTRATEGIC BUSINESS MANAGEMENT - JA-23 - Suggested - AnswersbanglauserNo ratings yet

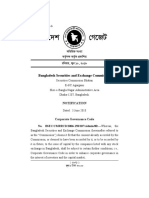

- BSEC Circular On ValuationDocument7 pagesBSEC Circular On ValuationbanglauserNo ratings yet

- Fm-Nov-Dec 2014Document14 pagesFm-Nov-Dec 2014banglauserNo ratings yet

- Fm-May-June 2013Document16 pagesFm-May-June 2013banglauserNo ratings yet

- Suggested Answers: Financial ManagementDocument14 pagesSuggested Answers: Financial ManagementbanglauserNo ratings yet

- Fm-May-June 2011Document10 pagesFm-May-June 2011banglauserNo ratings yet

- Fm-Nov-Dec 2012Document14 pagesFm-Nov-Dec 2012banglauserNo ratings yet

- May-June 2012 Answer To The Ques. No.l: Financial ManagementDocument11 pagesMay-June 2012 Answer To The Ques. No.l: Financial ManagementbanglauserNo ratings yet

- Rules Regardign Firm enlistment-FRCDocument36 pagesRules Regardign Firm enlistment-FRCbanglauserNo ratings yet

- Logitech Surround Sound Speaker System Z906 User's Guide: Model: S-00102 (110V ) S-00103 (220V )Document36 pagesLogitech Surround Sound Speaker System Z906 User's Guide: Model: S-00102 (110V ) S-00103 (220V )banglauserNo ratings yet

- Questions On IFRS 9Document3 pagesQuestions On IFRS 9banglauserNo ratings yet

- Questions On IAS 19Document5 pagesQuestions On IAS 19banglauserNo ratings yet

- Evsjv 'K Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Document32 pagesEvsjv 'K Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1banglauserNo ratings yet

- Ias 12 Recognition and Measurement of Deferred Tax Assets When An Entity Is Loss Making May 2014Document1 pageIas 12 Recognition and Measurement of Deferred Tax Assets When An Entity Is Loss Making May 2014banglauserNo ratings yet

- Income ChecklistDocument17 pagesIncome ChecklistbanglauserNo ratings yet

VAT Summary

VAT Summary

Uploaded by

banglauser0 ratings0% found this document useful (0 votes)

56 views1 pageThe document summarizes registration and enlistment requirements for value-added tax (VAT) in Mushak, including compulsory registration thresholds based on turnover, applicable forms, responsible administration, and requirements for changes to registered information. Registration is required if annual turnover exceeds 50 lakh or the business provides specially designated goods/services or participates in government tenders. Voluntary registrants must remain registered for at least one year.

Original Description:

VAT Summary for registration compliance

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes registration and enlistment requirements for value-added tax (VAT) in Mushak, including compulsory registration thresholds based on turnover, applicable forms, responsible administration, and requirements for changes to registered information. Registration is required if annual turnover exceeds 50 lakh or the business provides specially designated goods/services or participates in government tenders. Voluntary registrants must remain registered for at least one year.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

56 views1 pageVAT Summary

VAT Summary

Uploaded by

banglauserThe document summarizes registration and enlistment requirements for value-added tax (VAT) in Mushak, including compulsory registration thresholds based on turnover, applicable forms, responsible administration, and requirements for changes to registered information. Registration is required if annual turnover exceeds 50 lakh or the business provides specially designated goods/services or participates in government tenders. Voluntary registrants must remain registered for at least one year.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

Registration/Enlistment

Related Section: 2(1), 2(6), 2(15), 2(26), 2(37), 2(42), 2(46-48), 2(52), 2(53-57), 2(65), 2(74-76), 2(88), 4-

14

Related Rules: 2(Ga) 2(Gha), 2(Tata), 2 (Dha), 2(Ta), 2 (Tha), 3-15

Related SROs:

SRO-263-AIN/2019/79-Mushak: Central registration rule 2019

GO-17/Mushak/2019-Mandatory of registration regardless Turnover

GO-21/Mushak/2019-Clariffication on Central registration

Form: Mushak 2.1-VAT or Turnover tax registration form

Mushak 2.2- VAT Registration form for non-resident

Mushak 2.3-VAT Registration or ToT certificate

Mushak 2.4-Cancellation or suspended application

Mushak 2.5- New/Changes in information

Limit (12 Months turnover-Receipt or receivable consideration on taxable goods or services-: Below 50

Lac (exemption), in between 50 Lac to 3 Crore (ToT Enlistment), over 3 Crore (Compulsory registration)

Compulsory registration: Limit Exceed + SD imposed goods or service (2 nd schedule), participation in a

tender, import-export, GO-17

Voluntary registration: after registration, need to be remain registered for one year

Changes of information: except registered address, within 15 days to divisional officer. For registered

address, before 15 days of changes

13 Digit: Last 4 digit-Office code-first 2 digit commissioner code and last 2 digit divisional code

Administration: Divisional officer

You might also like

- MA - Final Assignment 1Document5 pagesMA - Final Assignment 1helennguyen242004No ratings yet

- ATX Summary Notes Tax Year 2022 23Document45 pagesATX Summary Notes Tax Year 2022 23sheharyar.kgsNo ratings yet

- Financial Reporting First Take - Ron KingDocument340 pagesFinancial Reporting First Take - Ron KingYuan Fu100% (1)

- FAC3702 Question Bank 2015Document105 pagesFAC3702 Question Bank 2015Itumeleng KekanaNo ratings yet

- Accountant TestDocument3 pagesAccountant TestMax SuperNo ratings yet

- F6 SMART Notes FA20 Till March-2022 byDocument44 pagesF6 SMART Notes FA20 Till March-2022 byAshfaq Ul Haq OniNo ratings yet

- Txzaf 2019 Jun QDocument16 pagesTxzaf 2019 Jun QAyomideNo ratings yet

- Presentation of Financial StatementsDocument40 pagesPresentation of Financial StatementsQuinta NovitaNo ratings yet

- Taxation - Botswana (TX - Bwa) : Applied SkillsDocument20 pagesTaxation - Botswana (TX - Bwa) : Applied Skillsgajendra.naiduNo ratings yet

- Deferred Tax Silvia IFRSBoxDocument10 pagesDeferred Tax Silvia IFRSBoxteddy matendawafaNo ratings yet

- Prog: Bscac Level: 2.2: Year: 2016Document137 pagesProg: Bscac Level: 2.2: Year: 2016Zic Zac100% (1)

- Citn New Professional Syllabus - Income TaxDocument214 pagesCitn New Professional Syllabus - Income Taxtwweettybird100% (2)

- Financial Accounting and Reporting 02Document6 pagesFinancial Accounting and Reporting 02Nuah SilvestreNo ratings yet

- Journal List For AccountingDocument5 pagesJournal List For AccountingNikhil Chandra ShilNo ratings yet

- Fac 3703Document99 pagesFac 3703Nozipho MpofuNo ratings yet

- NPV Practice CompleteDocument5 pagesNPV Practice CompleteShakeel AslamNo ratings yet

- AAT ITAX Focus Notes FA2015 No. 1 - EXTERNAL TUTORDocument90 pagesAAT ITAX Focus Notes FA2015 No. 1 - EXTERNAL TUTORLindaBakóNo ratings yet

- Monetary or Non-Monetary - CPDbox - Making IFRS EasyDocument97 pagesMonetary or Non-Monetary - CPDbox - Making IFRS EasyRachelle Anne M PardeñoNo ratings yet

- VAT and SD Act 2012 EnglishDocument91 pagesVAT and SD Act 2012 EnglishMonjurul HassanNo ratings yet

- NFRS AuditDocument32 pagesNFRS AuditBidhan Sapkota100% (1)

- Icaew Cfab Pot 2019 SyllabusDocument10 pagesIcaew Cfab Pot 2019 SyllabusAnonymous ulFku1vNo ratings yet

- General Fin Reporting 2013 Exam W SolutionsDocument69 pagesGeneral Fin Reporting 2013 Exam W SolutionsTosha Lopez100% (1)

- TX ZWE Examinable Documents 2021Document3 pagesTX ZWE Examinable Documents 2021Tawanda Tatenda HerbertNo ratings yet

- Nust Tax Module Jan 2018Document180 pagesNust Tax Module Jan 2018Phebieon MukwenhaNo ratings yet

- Individual Assignment 2Document2 pagesIndividual Assignment 2Loveness NyakurimwaNo ratings yet

- Ifrs 8Document3 pagesIfrs 8Samantha IslamNo ratings yet

- 2023 VAT - 1 - Administration 1Document62 pages2023 VAT - 1 - Administration 1Zance JordaanNo ratings yet

- IFRS 15 QuestionsDocument6 pagesIFRS 15 QuestionsSahilPatelNo ratings yet

- IPSAS 19 - Provisions and ContingenciesDocument38 pagesIPSAS 19 - Provisions and ContingenciesShafii SigeraNo ratings yet

- FR Tutorials 2022 - Some Theory Question SolutionDocument26 pagesFR Tutorials 2022 - Some Theory Question SolutionLaud Listowell100% (2)

- Auditing: Cpa Exam ReviewDocument9 pagesAuditing: Cpa Exam ReviewShruti SrivastavaNo ratings yet

- Tutorial Letter 101/3/2015: General Financial ReportingDocument45 pagesTutorial Letter 101/3/2015: General Financial Reportingemila_moodleyNo ratings yet

- Thông tư 200/2014 (Tiếng Anh) Circular 200/2014 (English-Free)Document367 pagesThông tư 200/2014 (Tiếng Anh) Circular 200/2014 (English-Free)Kent PhamNo ratings yet

- Audit All Past Suggested Paper ICANDocument280 pagesAudit All Past Suggested Paper ICANMichael AdhikariNo ratings yet

- I Cap If Rs QuestionsDocument34 pagesI Cap If Rs QuestionsUsmän MïrżäNo ratings yet

- MAC3701 Question Bank 2016Document65 pagesMAC3701 Question Bank 2016Blessings MunkuliNo ratings yet

- P2 MindmapsDocument49 pagesP2 MindmapsPui Fun LeoNo ratings yet

- Workshop On Deferred TaxationDocument21 pagesWorkshop On Deferred TaxationYusuf KhanNo ratings yet

- Applying IFRS Revenue From Contracts With CustomersDocument76 pagesApplying IFRS Revenue From Contracts With CustomersDhe SagalaNo ratings yet

- An Overview of SingerBDDocument19 pagesAn Overview of SingerBDEmon Hossain100% (1)

- Accounting RatiosDocument42 pagesAccounting RatiosApollo Institute of Hospital AdministrationNo ratings yet

- ISA 315 - MGT AssertionsDocument5 pagesISA 315 - MGT AssertionsAwaisQureshiNo ratings yet

- DRC VAT Training CAs Day 1-2Document40 pagesDRC VAT Training CAs Day 1-2iftekharul alam100% (1)

- AC2091 Financial Reporting: Session 4Document40 pagesAC2091 Financial Reporting: Session 4NadiaIssabellaNo ratings yet

- MACC 709 GROUP 3 ASSIGNMENT GROSS INCOME 2020 (2) Final SolutionDocument8 pagesMACC 709 GROUP 3 ASSIGNMENT GROSS INCOME 2020 (2) Final SolutionFadzai MhepoNo ratings yet

- UntitledDocument21 pagesUntitleddhirajpironNo ratings yet

- Additional Deferred Tax Examples.2Document3 pagesAdditional Deferred Tax Examples.2milton1986100% (1)

- AUE3761 - Y - 2023 - Test - 1 - Solution With Comments For StudentsDocument9 pagesAUE3761 - Y - 2023 - Test - 1 - Solution With Comments For Studentsmandisanomzamo72No ratings yet

- Smart Notes Acca f6 2015 (35 Pages)Document38 pagesSmart Notes Acca f6 2015 (35 Pages)SrabonBarua100% (2)

- 2016 Icaz Cta Unisa Taxation Tutorial 102 PDFDocument70 pages2016 Icaz Cta Unisa Taxation Tutorial 102 PDFArtwell ZuluNo ratings yet

- KPMG Analysis of The Finance Act 2021 - FinalDocument47 pagesKPMG Analysis of The Finance Act 2021 - FinalNirvan MaudhooNo ratings yet

- Accounting II SyllabusDocument4 pagesAccounting II SyllabusRyan Busch100% (2)

- Financial Management and ControlDocument18 pagesFinancial Management and ControlcrystalNo ratings yet

- Chapter 18 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document10 pagesChapter 18 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- 2023 VATLecture3 Input TaxDocument31 pages2023 VATLecture3 Input TaxZance JordaanNo ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Instructions For Filling Out FORM ITR 3Document231 pagesInstructions For Filling Out FORM ITR 3Samantha JNo ratings yet

- Sec 183Document1 pageSec 183goelshubham92No ratings yet

- Difference Between GSTRDocument4 pagesDifference Between GSTRdevNo ratings yet

- Vat Sro 220 SDDocument2 pagesVat Sro 220 SDbanglauserNo ratings yet

- CR-Nov-Dec-2021Document7 pagesCR-Nov-Dec-2021banglauserNo ratings yet

- Mushak 25 - Application For Drawback For Postal ExportDocument2 pagesMushak 25 - Application For Drawback For Postal ExportbanglauserNo ratings yet

- Withholding VAT Guideline 2015-2016Document20 pagesWithholding VAT Guideline 2015-2016banglauserNo ratings yet

- Withholding VAT Guideline (2017-18)Document29 pagesWithholding VAT Guideline (2017-18)banglauserNo ratings yet

- Fm-May-June 2015Document18 pagesFm-May-June 2015banglauserNo ratings yet

- STRATEGIC BUSINESS MANAGEMENT - JA-23 - Suggested - AnswersDocument15 pagesSTRATEGIC BUSINESS MANAGEMENT - JA-23 - Suggested - AnswersbanglauserNo ratings yet

- BSEC Circular On ValuationDocument7 pagesBSEC Circular On ValuationbanglauserNo ratings yet

- Fm-Nov-Dec 2014Document14 pagesFm-Nov-Dec 2014banglauserNo ratings yet

- Fm-May-June 2013Document16 pagesFm-May-June 2013banglauserNo ratings yet

- Suggested Answers: Financial ManagementDocument14 pagesSuggested Answers: Financial ManagementbanglauserNo ratings yet

- Fm-May-June 2011Document10 pagesFm-May-June 2011banglauserNo ratings yet

- Fm-Nov-Dec 2012Document14 pagesFm-Nov-Dec 2012banglauserNo ratings yet

- May-June 2012 Answer To The Ques. No.l: Financial ManagementDocument11 pagesMay-June 2012 Answer To The Ques. No.l: Financial ManagementbanglauserNo ratings yet

- Rules Regardign Firm enlistment-FRCDocument36 pagesRules Regardign Firm enlistment-FRCbanglauserNo ratings yet

- Logitech Surround Sound Speaker System Z906 User's Guide: Model: S-00102 (110V ) S-00103 (220V )Document36 pagesLogitech Surround Sound Speaker System Z906 User's Guide: Model: S-00102 (110V ) S-00103 (220V )banglauserNo ratings yet

- Questions On IFRS 9Document3 pagesQuestions On IFRS 9banglauserNo ratings yet

- Questions On IAS 19Document5 pagesQuestions On IAS 19banglauserNo ratings yet

- Evsjv 'K Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Document32 pagesEvsjv 'K Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1banglauserNo ratings yet

- Ias 12 Recognition and Measurement of Deferred Tax Assets When An Entity Is Loss Making May 2014Document1 pageIas 12 Recognition and Measurement of Deferred Tax Assets When An Entity Is Loss Making May 2014banglauserNo ratings yet

- Income ChecklistDocument17 pagesIncome ChecklistbanglauserNo ratings yet