Professional Documents

Culture Documents

Adjusting Entries-Owwsic Enterprise

Adjusting Entries-Owwsic Enterprise

Uploaded by

Lianna RoCopyright:

Available Formats

You might also like

- PRTC Practial Accounting 1Document56 pagesPRTC Practial Accounting 1Pam G.71% (21)

- BellaDocument17 pagesBellaDeimos DeezNo ratings yet

- Problem 1: University of San Jose-Recoletos Auditing ProblemsDocument9 pagesProblem 1: University of San Jose-Recoletos Auditing ProblemsPaul Doroin100% (1)

- 2019 Vol 1 CH 5 AnswersDocument21 pages2019 Vol 1 CH 5 AnswersArkhie Davocol80% (5)

- Manarang Auto Repair Shop Journal by The Month of January 2019Document9 pagesManarang Auto Repair Shop Journal by The Month of January 2019Renz MoralesNo ratings yet

- Account Number Account Title Debit Credit: Other Information For AdjustmentsDocument9 pagesAccount Number Account Title Debit Credit: Other Information For Adjustmentsalta100% (2)

- ACT1101, PRB, Midterm, Wit Ans KeyDocument5 pagesACT1101, PRB, Midterm, Wit Ans KeyDyen100% (1)

- Tutorial Test 3Document2 pagesTutorial Test 3Hải NhưNo ratings yet

- Answer 1Document7 pagesAnswer 1Mylene HeragaNo ratings yet

- Bulacan State University: College of Business AdministrationDocument13 pagesBulacan State University: College of Business AdministrationLiana100% (1)

- Buenaventuraej Bsa1bmidterm Activity 1 Edgar DetoyaDocument21 pagesBuenaventuraej Bsa1bmidterm Activity 1 Edgar DetoyaAnonnNo ratings yet

- BTS Accounting Firm Trial Balance December 31, 2014Document4 pagesBTS Accounting Firm Trial Balance December 31, 2014Trisha AlaNo ratings yet

- Activity Sheet 6 10Document9 pagesActivity Sheet 6 10Yaxi AxhiaNo ratings yet

- Financial AssetsDocument127 pagesFinancial Assetscherry blossomNo ratings yet

- Tugas Kelompok Ke-1 (Minggu 3) : Case 1Document10 pagesTugas Kelompok Ke-1 (Minggu 3) : Case 1Kenny BagusNo ratings yet

- Auditing Practice Problem 5Document2 pagesAuditing Practice Problem 5Maria Fe FerrarizNo ratings yet

- ACCT 1005 - Worksheet - 2Document12 pagesACCT 1005 - Worksheet - 2Rick SimmsNo ratings yet

- Bernas Karla Pauline 11 Bonifacio FABM1 Q4Document45 pagesBernas Karla Pauline 11 Bonifacio FABM1 Q4Karla pauline BernasNo ratings yet

- TT03 Ques 110523 UpdateDocument2 pagesTT03 Ques 110523 UpdateTrần Ngọc NhưNo ratings yet

- 2019 Vol 1 CH 5 AnswersDocument23 pages2019 Vol 1 CH 5 AnswersDummy Number 2No ratings yet

- Quiz 2 Kean TisonDocument7 pagesQuiz 2 Kean TisonMr. HahhaNo ratings yet

- 03 Handout 2Document7 pages03 Handout 2micah podadorNo ratings yet

- Pointers in AuditingDocument3 pagesPointers in AuditingXandae MempinNo ratings yet

- Asynch Activities 2 CTA SEDocument1 pageAsynch Activities 2 CTA SElingat airenceNo ratings yet

- DSR Mock Test - 1 - Ca FoundationDocument5 pagesDSR Mock Test - 1 - Ca Foundationmaskguy001No ratings yet

- Koreantalk Co. General Journal 2020 Date Description DR CRDocument5 pagesKoreantalk Co. General Journal 2020 Date Description DR CRCarat ForeverNo ratings yet

- Comprehensive ProblemDocument2 pagesComprehensive ProblemCeline Floranza100% (1)

- Balance SheetDocument2 pagesBalance SheetKeight NuevaNo ratings yet

- Complete Cycle Servicing Graded ActivityDocument2 pagesComplete Cycle Servicing Graded ActivityErfel Al KitmaNo ratings yet

- JPIA REVIEW S3 Cash and ReceivablesDocument3 pagesJPIA REVIEW S3 Cash and ReceivableshsdownshsalaNo ratings yet

- Cash and AccrualDocument1 pageCash and AccrualGloria BeltranNo ratings yet

- Answer (Question) Module 4 Quiz 1 Adjusting Entries, Worksheet, FS PreparationDocument1 pageAnswer (Question) Module 4 Quiz 1 Adjusting Entries, Worksheet, FS Preparationkakao100% (1)

- Dental Clinic AnswerDocument16 pagesDental Clinic AnswerMaria Licuanan100% (1)

- 06 BTLE 30043 Santos Repair Shop Complete Cycle StudentDocument29 pages06 BTLE 30043 Santos Repair Shop Complete Cycle StudentnicoleshiNo ratings yet

- Exercises For Adjusting EntriesDocument3 pagesExercises For Adjusting EntriesJunmirMalicVillanuevaNo ratings yet

- Task 2. Ban Gay and Ban Trai's Partnership: Statements of Changes in Partners' CapitalDocument11 pagesTask 2. Ban Gay and Ban Trai's Partnership: Statements of Changes in Partners' CapitalHuyen VuNo ratings yet

- ReviewerDocument4 pagesReviewerDrie LimNo ratings yet

- Journal Trial Balance: TotalsDocument2 pagesJournal Trial Balance: TotalsFinancial Unit MIMAROPANo ratings yet

- Simulated Exam Procedural ApplicationDocument3 pagesSimulated Exam Procedural ApplicationRosevie ZantuaNo ratings yet

- Practical Exr 2Document2 pagesPractical Exr 2GUDATA ABARANo ratings yet

- Updates - Midterm Lspu ExamDocument6 pagesUpdates - Midterm Lspu ExamAngelo HilomaNo ratings yet

- Drill 9.1 Adjusting EntriesDocument7 pagesDrill 9.1 Adjusting EntriesJouhara ObeñitaNo ratings yet

- Goodwill 2004 - 3,43,700 (Printing Mistake)Document9 pagesGoodwill 2004 - 3,43,700 (Printing Mistake)vasanthgurusamynsNo ratings yet

- Practice Qs - Closing Entries - SolutionDocument2 pagesPractice Qs - Closing Entries - Solutionteenwolves.ytNo ratings yet

- Hope Company Adjusted Trial Balances December 31, 20XX: Home Office Branch (DR) (CR) (DR) (CR)Document1 pageHope Company Adjusted Trial Balances December 31, 20XX: Home Office Branch (DR) (CR) (DR) (CR)Unknown 01No ratings yet

- Acc01b1 Rek1b01 Main PDFDocument10 pagesAcc01b1 Rek1b01 Main PDFLebohang NgubaneNo ratings yet

- Chapter 3 Practice ProblemDocument4 pagesChapter 3 Practice ProblemNafis AhmedNo ratings yet

- W4 - SW1 - Statement of Financial PositionDocument2 pagesW4 - SW1 - Statement of Financial PositionJere Mae MarananNo ratings yet

- This Study Resource Was: BS Accountancy ISAP Chapter Practical Accounting 1 ReviewerDocument9 pagesThis Study Resource Was: BS Accountancy ISAP Chapter Practical Accounting 1 ReviewerDes BalinoNo ratings yet

- Lspu Updates Final Exam PDFDocument4 pagesLspu Updates Final Exam PDFAngelo HilomaNo ratings yet

- Accounting 1 Funal F 20Document3 pagesAccounting 1 Funal F 20Pak KhNo ratings yet

- Kelly Consulting CaseDocument18 pagesKelly Consulting CaseJavid BalakishiyevNo ratings yet

- Businesses in PoblacionDocument29 pagesBusinesses in PoblacionnicoleshiNo ratings yet

- 2 CashDocument8 pages2 CashEISEN BELWIGANNo ratings yet

- Handout +Cash+and+Cash+EquivalentsDocument7 pagesHandout +Cash+and+Cash+Equivalentsbenedictmoses.koe.acctNo ratings yet

- Btap BCQTDocument8 pagesBtap BCQT21Vân KhánhNo ratings yet

- 23-24-S2-BU6005 Assessment 2-Group ProjectDocument22 pages23-24-S2-BU6005 Assessment 2-Group Projectabooody1027No ratings yet

- ACC101 - Accounting CycleDocument3 pagesACC101 - Accounting CycleJade PielNo ratings yet

- Statement of Financial PositionDocument2 pagesStatement of Financial PositionmoNo ratings yet

- Assignment Part 2 Checked and AdjustedDocument3 pagesAssignment Part 2 Checked and AdjustedDarwin Dionisio ClementeNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Bono AptDocument64 pagesBono Aptjosue henry vasquez neyeraNo ratings yet

- Adhi 3.0Document51 pagesAdhi 3.0sandipkumar9334No ratings yet

- Maple Leafs Financial RatiosDocument8 pagesMaple Leafs Financial RatiosjeffreygodlyNo ratings yet

- 2022 MSCF Employment ReportDocument8 pages2022 MSCF Employment ReportP MNo ratings yet

- Principles of Mktg-Q4-Module-7Document27 pagesPrinciples of Mktg-Q4-Module-7Sharlyn Marie An Noble-Badillo100% (1)

- Do Green Mutual Funds Perform WellDocument18 pagesDo Green Mutual Funds Perform WellAromNo ratings yet

- Qdoc - Tips - Database of Big BrandsDocument33 pagesQdoc - Tips - Database of Big BrandsUday kumarNo ratings yet

- Rutas Group 5Document17 pagesRutas Group 5akshatNo ratings yet

- JordanDocument2 pagesJordanMatt Jerrard Rañola RoqueNo ratings yet

- Mobile Services: Your Account SummaryDocument2 pagesMobile Services: Your Account SummaryayushiqueenNo ratings yet

- Investsec Strategy Middle ClassDocument43 pagesInvestsec Strategy Middle ClassDeepul WadhwaNo ratings yet

- Concept of EntrepreneurshipDocument9 pagesConcept of EntrepreneurshipAryanNo ratings yet

- AMH 2020 Worksheet Chapter 20Document5 pagesAMH 2020 Worksheet Chapter 20Imani AlvaradoNo ratings yet

- Invoice 0092000202: Camposol Fresh USA INC. 5555 Anglers Avenue Suite 20 FL 33301 - USADocument1 pageInvoice 0092000202: Camposol Fresh USA INC. 5555 Anglers Avenue Suite 20 FL 33301 - USAArmando BroncasNo ratings yet

- Client's Guide On Forms - Policy Change Request FormDocument14 pagesClient's Guide On Forms - Policy Change Request FormJulienne Mhae ReyesNo ratings yet

- Tsigereda TsehayDocument112 pagesTsigereda Tsehaymetekyamarkos0947No ratings yet

- POF 06 - Supply ContractsDocument19 pagesPOF 06 - Supply ContractsNIHAL PAREKKATTIL (RA1911003010868)No ratings yet

- Chapter 7 FORECASTING QUESTIONS & ANSWERS Q7.1 Accurate ...Document30 pagesChapter 7 FORECASTING QUESTIONS & ANSWERS Q7.1 Accurate ...Balya 220No ratings yet

- Mengumpulkan Informasi Dan Meramalkan Permintaan PDFDocument33 pagesMengumpulkan Informasi Dan Meramalkan Permintaan PDFVincent eyamaNo ratings yet

- Ishares Core Growth Etf Portfolio: Key FactsDocument2 pagesIshares Core Growth Etf Portfolio: Key FactsTushar PatelNo ratings yet

- Unit 1.4 - Procedure For Procuring Capital GoodsDocument18 pagesUnit 1.4 - Procedure For Procuring Capital Goodsmusonza murwiraNo ratings yet

- FORM A2 Revised FormDocument6 pagesFORM A2 Revised Formcopy catNo ratings yet

- Udaan Survey Calling Pitch 3.0Document6 pagesUdaan Survey Calling Pitch 3.0Phanindra100% (1)

- This Study Resource Was: Value Added Tax (CPAR) TheoriesDocument6 pagesThis Study Resource Was: Value Added Tax (CPAR) TheoriesAllen KateNo ratings yet

- Mathematics - Question and AnswersDocument9 pagesMathematics - Question and Answersphirihannock43No ratings yet

- Income Tax Solutions - Reddy and Moorthy BookDocument39 pagesIncome Tax Solutions - Reddy and Moorthy Bookuser108768No ratings yet

- Mar AprDocument2 pagesMar Aprhassanalisa2002No ratings yet

- In The Loop Jan Apr 2023Document28 pagesIn The Loop Jan Apr 2023kit katNo ratings yet

- Export Mktg. PPT Slides (18!10!2020) (Dr. DHOND)Document94 pagesExport Mktg. PPT Slides (18!10!2020) (Dr. DHOND)vishrut.damaniNo ratings yet

Adjusting Entries-Owwsic Enterprise

Adjusting Entries-Owwsic Enterprise

Uploaded by

Lianna RoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adjusting Entries-Owwsic Enterprise

Adjusting Entries-Owwsic Enterprise

Uploaded by

Lianna RoCopyright:

Available Formats

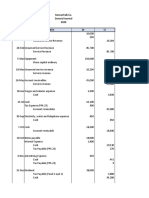

Adjusting Entries-Owwsic Enterprise

Dec 31,2020

JOURNAL Page 1

Date Particulars Pr Dr. Cr

.1 31 Cash in Bank- Union Bank P 100,000

F. Herrera, Capital P100,000

To record the transfer from personal funds from

F.Herrera to Union bank payroll acct amounting to

P 30,000 - Oct. 9

P 32,000- Non.9

P 38,000- Dec. 3

2 31 Office Supplies 6,000

Service Income 3,000

Cash 3,000

To record the use up of P6,000 supplies , 50% was

materials consumed in provision of Service to Customers

3 28 Equipment 1,232,000

Accounts Payable 1,100,000

Deferred Input Vat 132,000

To record the purchase of equipment on account , VAT

inclusive

4 31 Furniture and Fixture 113,000

Cash in Bank- BDO 113,000

To record the delivery of newly acquired furniture and fixture

from F. Herrera Mansion to office for business use

5 31 Gen and admin-Salaries and wages 5,000

Salaries and wages 5,000

Cash in Bank- Union bank 10,000

To record 50% of salaries paid to employees which is

not directly attributable to the provision of service.

6 31 Depreciation- Building 5,333.33

Depreciation- Equipment 233.33

Accumulated depreciation- Building 5,333.33

Accumulated depreciation-Equipment 233.33

To record the depreciation of equipment (7,000 with 5 yrs life t

and building (800,000 with 25yrs life and ) in provision of

service

7 31 Withholding tax Payable 68,000

Cash in bank- BDO 68,000

To record Payment for withholding taxes and VAT during the

month of November and December were not taken up in the

books

8 31 Interest Expense 10,273.97

Cash in bank- BDO 10,273.97

To record Interest on loans is computed using 365 day

(1,000,000 x6.25% /365days x 60 days

9 31 Doubtful Accounts 11,908.80

Allowance for Doubtful accounts 11,908.80

To record 2% of ending balance of accounts receivable is

estimated to be uncollectible ( 595,440.00 x 2%)

10 31 Cash in bank- BDO 814.00

Interest Income 814.00

To record t Interest income earned from cash deposited with

BDO amounting to ₱814

11 31 Utilities Expense 6,956.25

Cash in Bank - BDO 6,956.25

To record Utilities for the month of December is

estimated to be the 150% of the average consumption of

the two preceding months ( Oct 5000 + Nov ₱4,275) /2

= 4637.50 *150%= P 6,956.25

12 31 Representation and Entertainment 3,418.00

Cash in Bank- BDO

To record the Unrecorded transaction included 3,418.00

payments for the refreshments to entertain the convoy of

Mr. Jacob Buenaventura, a potential customer. Total

amount spent is ₱3,418.l

13 31 Equipment 30,000

Cash in Bank 50,000

Cash in bank- BDO 30,000

Gain on Sale of Equipment 50,000

To record e last unrecorded transaction pertains to a purchase

of equipment made on December 1 for ₱30,000 net of VAT. The

purchase was unrecorded because three working days after the

equipment was sold for cash,₱50,000 net of VAT.

You might also like

- PRTC Practial Accounting 1Document56 pagesPRTC Practial Accounting 1Pam G.71% (21)

- BellaDocument17 pagesBellaDeimos DeezNo ratings yet

- Problem 1: University of San Jose-Recoletos Auditing ProblemsDocument9 pagesProblem 1: University of San Jose-Recoletos Auditing ProblemsPaul Doroin100% (1)

- 2019 Vol 1 CH 5 AnswersDocument21 pages2019 Vol 1 CH 5 AnswersArkhie Davocol80% (5)

- Manarang Auto Repair Shop Journal by The Month of January 2019Document9 pagesManarang Auto Repair Shop Journal by The Month of January 2019Renz MoralesNo ratings yet

- Account Number Account Title Debit Credit: Other Information For AdjustmentsDocument9 pagesAccount Number Account Title Debit Credit: Other Information For Adjustmentsalta100% (2)

- ACT1101, PRB, Midterm, Wit Ans KeyDocument5 pagesACT1101, PRB, Midterm, Wit Ans KeyDyen100% (1)

- Tutorial Test 3Document2 pagesTutorial Test 3Hải NhưNo ratings yet

- Answer 1Document7 pagesAnswer 1Mylene HeragaNo ratings yet

- Bulacan State University: College of Business AdministrationDocument13 pagesBulacan State University: College of Business AdministrationLiana100% (1)

- Buenaventuraej Bsa1bmidterm Activity 1 Edgar DetoyaDocument21 pagesBuenaventuraej Bsa1bmidterm Activity 1 Edgar DetoyaAnonnNo ratings yet

- BTS Accounting Firm Trial Balance December 31, 2014Document4 pagesBTS Accounting Firm Trial Balance December 31, 2014Trisha AlaNo ratings yet

- Activity Sheet 6 10Document9 pagesActivity Sheet 6 10Yaxi AxhiaNo ratings yet

- Financial AssetsDocument127 pagesFinancial Assetscherry blossomNo ratings yet

- Tugas Kelompok Ke-1 (Minggu 3) : Case 1Document10 pagesTugas Kelompok Ke-1 (Minggu 3) : Case 1Kenny BagusNo ratings yet

- Auditing Practice Problem 5Document2 pagesAuditing Practice Problem 5Maria Fe FerrarizNo ratings yet

- ACCT 1005 - Worksheet - 2Document12 pagesACCT 1005 - Worksheet - 2Rick SimmsNo ratings yet

- Bernas Karla Pauline 11 Bonifacio FABM1 Q4Document45 pagesBernas Karla Pauline 11 Bonifacio FABM1 Q4Karla pauline BernasNo ratings yet

- TT03 Ques 110523 UpdateDocument2 pagesTT03 Ques 110523 UpdateTrần Ngọc NhưNo ratings yet

- 2019 Vol 1 CH 5 AnswersDocument23 pages2019 Vol 1 CH 5 AnswersDummy Number 2No ratings yet

- Quiz 2 Kean TisonDocument7 pagesQuiz 2 Kean TisonMr. HahhaNo ratings yet

- 03 Handout 2Document7 pages03 Handout 2micah podadorNo ratings yet

- Pointers in AuditingDocument3 pagesPointers in AuditingXandae MempinNo ratings yet

- Asynch Activities 2 CTA SEDocument1 pageAsynch Activities 2 CTA SElingat airenceNo ratings yet

- DSR Mock Test - 1 - Ca FoundationDocument5 pagesDSR Mock Test - 1 - Ca Foundationmaskguy001No ratings yet

- Koreantalk Co. General Journal 2020 Date Description DR CRDocument5 pagesKoreantalk Co. General Journal 2020 Date Description DR CRCarat ForeverNo ratings yet

- Comprehensive ProblemDocument2 pagesComprehensive ProblemCeline Floranza100% (1)

- Balance SheetDocument2 pagesBalance SheetKeight NuevaNo ratings yet

- Complete Cycle Servicing Graded ActivityDocument2 pagesComplete Cycle Servicing Graded ActivityErfel Al KitmaNo ratings yet

- JPIA REVIEW S3 Cash and ReceivablesDocument3 pagesJPIA REVIEW S3 Cash and ReceivableshsdownshsalaNo ratings yet

- Cash and AccrualDocument1 pageCash and AccrualGloria BeltranNo ratings yet

- Answer (Question) Module 4 Quiz 1 Adjusting Entries, Worksheet, FS PreparationDocument1 pageAnswer (Question) Module 4 Quiz 1 Adjusting Entries, Worksheet, FS Preparationkakao100% (1)

- Dental Clinic AnswerDocument16 pagesDental Clinic AnswerMaria Licuanan100% (1)

- 06 BTLE 30043 Santos Repair Shop Complete Cycle StudentDocument29 pages06 BTLE 30043 Santos Repair Shop Complete Cycle StudentnicoleshiNo ratings yet

- Exercises For Adjusting EntriesDocument3 pagesExercises For Adjusting EntriesJunmirMalicVillanuevaNo ratings yet

- Task 2. Ban Gay and Ban Trai's Partnership: Statements of Changes in Partners' CapitalDocument11 pagesTask 2. Ban Gay and Ban Trai's Partnership: Statements of Changes in Partners' CapitalHuyen VuNo ratings yet

- ReviewerDocument4 pagesReviewerDrie LimNo ratings yet

- Journal Trial Balance: TotalsDocument2 pagesJournal Trial Balance: TotalsFinancial Unit MIMAROPANo ratings yet

- Simulated Exam Procedural ApplicationDocument3 pagesSimulated Exam Procedural ApplicationRosevie ZantuaNo ratings yet

- Practical Exr 2Document2 pagesPractical Exr 2GUDATA ABARANo ratings yet

- Updates - Midterm Lspu ExamDocument6 pagesUpdates - Midterm Lspu ExamAngelo HilomaNo ratings yet

- Drill 9.1 Adjusting EntriesDocument7 pagesDrill 9.1 Adjusting EntriesJouhara ObeñitaNo ratings yet

- Goodwill 2004 - 3,43,700 (Printing Mistake)Document9 pagesGoodwill 2004 - 3,43,700 (Printing Mistake)vasanthgurusamynsNo ratings yet

- Practice Qs - Closing Entries - SolutionDocument2 pagesPractice Qs - Closing Entries - Solutionteenwolves.ytNo ratings yet

- Hope Company Adjusted Trial Balances December 31, 20XX: Home Office Branch (DR) (CR) (DR) (CR)Document1 pageHope Company Adjusted Trial Balances December 31, 20XX: Home Office Branch (DR) (CR) (DR) (CR)Unknown 01No ratings yet

- Acc01b1 Rek1b01 Main PDFDocument10 pagesAcc01b1 Rek1b01 Main PDFLebohang NgubaneNo ratings yet

- Chapter 3 Practice ProblemDocument4 pagesChapter 3 Practice ProblemNafis AhmedNo ratings yet

- W4 - SW1 - Statement of Financial PositionDocument2 pagesW4 - SW1 - Statement of Financial PositionJere Mae MarananNo ratings yet

- This Study Resource Was: BS Accountancy ISAP Chapter Practical Accounting 1 ReviewerDocument9 pagesThis Study Resource Was: BS Accountancy ISAP Chapter Practical Accounting 1 ReviewerDes BalinoNo ratings yet

- Lspu Updates Final Exam PDFDocument4 pagesLspu Updates Final Exam PDFAngelo HilomaNo ratings yet

- Accounting 1 Funal F 20Document3 pagesAccounting 1 Funal F 20Pak KhNo ratings yet

- Kelly Consulting CaseDocument18 pagesKelly Consulting CaseJavid BalakishiyevNo ratings yet

- Businesses in PoblacionDocument29 pagesBusinesses in PoblacionnicoleshiNo ratings yet

- 2 CashDocument8 pages2 CashEISEN BELWIGANNo ratings yet

- Handout +Cash+and+Cash+EquivalentsDocument7 pagesHandout +Cash+and+Cash+Equivalentsbenedictmoses.koe.acctNo ratings yet

- Btap BCQTDocument8 pagesBtap BCQT21Vân KhánhNo ratings yet

- 23-24-S2-BU6005 Assessment 2-Group ProjectDocument22 pages23-24-S2-BU6005 Assessment 2-Group Projectabooody1027No ratings yet

- ACC101 - Accounting CycleDocument3 pagesACC101 - Accounting CycleJade PielNo ratings yet

- Statement of Financial PositionDocument2 pagesStatement of Financial PositionmoNo ratings yet

- Assignment Part 2 Checked and AdjustedDocument3 pagesAssignment Part 2 Checked and AdjustedDarwin Dionisio ClementeNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Bono AptDocument64 pagesBono Aptjosue henry vasquez neyeraNo ratings yet

- Adhi 3.0Document51 pagesAdhi 3.0sandipkumar9334No ratings yet

- Maple Leafs Financial RatiosDocument8 pagesMaple Leafs Financial RatiosjeffreygodlyNo ratings yet

- 2022 MSCF Employment ReportDocument8 pages2022 MSCF Employment ReportP MNo ratings yet

- Principles of Mktg-Q4-Module-7Document27 pagesPrinciples of Mktg-Q4-Module-7Sharlyn Marie An Noble-Badillo100% (1)

- Do Green Mutual Funds Perform WellDocument18 pagesDo Green Mutual Funds Perform WellAromNo ratings yet

- Qdoc - Tips - Database of Big BrandsDocument33 pagesQdoc - Tips - Database of Big BrandsUday kumarNo ratings yet

- Rutas Group 5Document17 pagesRutas Group 5akshatNo ratings yet

- JordanDocument2 pagesJordanMatt Jerrard Rañola RoqueNo ratings yet

- Mobile Services: Your Account SummaryDocument2 pagesMobile Services: Your Account SummaryayushiqueenNo ratings yet

- Investsec Strategy Middle ClassDocument43 pagesInvestsec Strategy Middle ClassDeepul WadhwaNo ratings yet

- Concept of EntrepreneurshipDocument9 pagesConcept of EntrepreneurshipAryanNo ratings yet

- AMH 2020 Worksheet Chapter 20Document5 pagesAMH 2020 Worksheet Chapter 20Imani AlvaradoNo ratings yet

- Invoice 0092000202: Camposol Fresh USA INC. 5555 Anglers Avenue Suite 20 FL 33301 - USADocument1 pageInvoice 0092000202: Camposol Fresh USA INC. 5555 Anglers Avenue Suite 20 FL 33301 - USAArmando BroncasNo ratings yet

- Client's Guide On Forms - Policy Change Request FormDocument14 pagesClient's Guide On Forms - Policy Change Request FormJulienne Mhae ReyesNo ratings yet

- Tsigereda TsehayDocument112 pagesTsigereda Tsehaymetekyamarkos0947No ratings yet

- POF 06 - Supply ContractsDocument19 pagesPOF 06 - Supply ContractsNIHAL PAREKKATTIL (RA1911003010868)No ratings yet

- Chapter 7 FORECASTING QUESTIONS & ANSWERS Q7.1 Accurate ...Document30 pagesChapter 7 FORECASTING QUESTIONS & ANSWERS Q7.1 Accurate ...Balya 220No ratings yet

- Mengumpulkan Informasi Dan Meramalkan Permintaan PDFDocument33 pagesMengumpulkan Informasi Dan Meramalkan Permintaan PDFVincent eyamaNo ratings yet

- Ishares Core Growth Etf Portfolio: Key FactsDocument2 pagesIshares Core Growth Etf Portfolio: Key FactsTushar PatelNo ratings yet

- Unit 1.4 - Procedure For Procuring Capital GoodsDocument18 pagesUnit 1.4 - Procedure For Procuring Capital Goodsmusonza murwiraNo ratings yet

- FORM A2 Revised FormDocument6 pagesFORM A2 Revised Formcopy catNo ratings yet

- Udaan Survey Calling Pitch 3.0Document6 pagesUdaan Survey Calling Pitch 3.0Phanindra100% (1)

- This Study Resource Was: Value Added Tax (CPAR) TheoriesDocument6 pagesThis Study Resource Was: Value Added Tax (CPAR) TheoriesAllen KateNo ratings yet

- Mathematics - Question and AnswersDocument9 pagesMathematics - Question and Answersphirihannock43No ratings yet

- Income Tax Solutions - Reddy and Moorthy BookDocument39 pagesIncome Tax Solutions - Reddy and Moorthy Bookuser108768No ratings yet

- Mar AprDocument2 pagesMar Aprhassanalisa2002No ratings yet

- In The Loop Jan Apr 2023Document28 pagesIn The Loop Jan Apr 2023kit katNo ratings yet

- Export Mktg. PPT Slides (18!10!2020) (Dr. DHOND)Document94 pagesExport Mktg. PPT Slides (18!10!2020) (Dr. DHOND)vishrut.damaniNo ratings yet