Professional Documents

Culture Documents

FAR 1 - Journal Entries

FAR 1 - Journal Entries

Uploaded by

Anime LoverCopyright:

Available Formats

You might also like

- Syllabus Redesigning Outline Form: University Committee On Curriculum Development and EvaluationDocument8 pagesSyllabus Redesigning Outline Form: University Committee On Curriculum Development and EvaluationAnime LoverNo ratings yet

- Mr. Addams' Financial StatementDocument10 pagesMr. Addams' Financial StatementKim KoalaNo ratings yet

- Basic Accounting ModelDocument3 pagesBasic Accounting Modeldlinds2X1No ratings yet

- Jose Rizal Heavy Bombers Trial Balance: Totals P 44,793,750 P 44,793,750Document16 pagesJose Rizal Heavy Bombers Trial Balance: Totals P 44,793,750 P 44,793,750Sou TV0% (1)

- GT1Fin AccDocument26 pagesGT1Fin AccZapirah Nirel LayloNo ratings yet

- FAR 1 - Journal EntriesDocument3 pagesFAR 1 - Journal EntriesAnime LoverNo ratings yet

- Proposed City Ordinance No. 2021 002 Granting Financial Subsidy To Deped Non Teaching PersonnelDocument3 pagesProposed City Ordinance No. 2021 002 Granting Financial Subsidy To Deped Non Teaching PersonnelRyan JD Lim100% (1)

- Search For The Graf SpeeDocument5 pagesSearch For The Graf SpeeChristina Chavez Clinton0% (1)

- Inside Indian IndentureDocument504 pagesInside Indian IndentureRananjey100% (2)

- MichelinDocument12 pagesMichelinShilpi Kumar50% (2)

- Analyzing, Recording, Posting and Trial Balance: Normal Balance of AccountsDocument6 pagesAnalyzing, Recording, Posting and Trial Balance: Normal Balance of AccountsMich Binayug100% (1)

- Recording Transactions in A Financial Transaction WorksheetDocument1 pageRecording Transactions in A Financial Transaction WorksheetSHENo ratings yet

- Trial Balance - Daria TolentinoDocument1 pageTrial Balance - Daria TolentinoShaira Nicole VasquezNo ratings yet

- 600 Assembly Work: 2x + 6y 480Document5 pages600 Assembly Work: 2x + 6y 480John Louie DungcaNo ratings yet

- Lesson 1 ExtendDocument6 pagesLesson 1 ExtendRoel Cababao50% (2)

- Total: Nancy Mulles Data Encoders May 15 2018Document6 pagesTotal: Nancy Mulles Data Encoders May 15 2018Tashnim AreejNo ratings yet

- Accounting Cycle 1 768 290 Worksheet BSDocument27 pagesAccounting Cycle 1 768 290 Worksheet BSKylene Edelle LeonardoNo ratings yet

- Antonio WorksheetDocument7 pagesAntonio WorksheetAntonNo ratings yet

- ACT #4 - Jewel Ann C. Penaranda - ACT213Document20 pagesACT #4 - Jewel Ann C. Penaranda - ACT213JEWELL ANN PENARANDA100% (1)

- Worksheet AssignmentDocument2 pagesWorksheet AssignmentLyca MaeNo ratings yet

- Santa Rosa Campus City of Santa Rosa, Laguna: Polytechnic University of The PhilippinesDocument19 pagesSanta Rosa Campus City of Santa Rosa, Laguna: Polytechnic University of The Philippinesareum100% (1)

- FOA Final OutputDocument18 pagesFOA Final OutputGwyneth MogolNo ratings yet

- 01 Quiz 1Document2 pages01 Quiz 1Laisan SantosNo ratings yet

- Adjusting Entries ExampleDocument5 pagesAdjusting Entries ExampleSiak Ni LynnLadyNo ratings yet

- 77 FDocument3 pages77 FJohn CalvinNo ratings yet

- Trial BalanceDocument1 pageTrial BalanceLaurice RacraquinNo ratings yet

- Special JournalDocument7 pagesSpecial JournalJohn Christopher Sta AnaNo ratings yet

- Practice Set I AcctgDocument14 pagesPractice Set I AcctgJan Pearl Hinampas100% (1)

- General Journal, GeveraDocument2 pagesGeneral Journal, GeveraFeiya LiuNo ratings yet

- ACCTG CYCLE Comprehensive ProblmDocument12 pagesACCTG CYCLE Comprehensive ProblmMaria Nicole OasinNo ratings yet

- JoneDocument2 pagesJoneMa. Joan ApolinarNo ratings yet

- MerchandisingDocument11 pagesMerchandisingAIRA NHAIRE MECATE100% (1)

- Castro CompanyDocument41 pagesCastro CompanyMarinel Abril100% (1)

- 01 Activity 2Document4 pages01 Activity 2Laisan SantosNo ratings yet

- Bondoc Johnpaulo Act2b Accounting Module6Document8 pagesBondoc Johnpaulo Act2b Accounting Module6Joeces Ian DizonNo ratings yet

- Canvas Activity - Journalizing - Oct - 29 PDFDocument2 pagesCanvas Activity - Journalizing - Oct - 29 PDFJian Francisco100% (2)

- Diaz - Journal EntriesDocument4 pagesDiaz - Journal EntriesPangitkaNo ratings yet

- Seat Work 02 - DingcongDocument3 pagesSeat Work 02 - DingcongJheilson S. DingcongNo ratings yet

- Accounting For Nonvat and Vat Registered Business Solution To Assign 1 Quiz 1Document16 pagesAccounting For Nonvat and Vat Registered Business Solution To Assign 1 Quiz 1Fider GracianNo ratings yet

- 2021 FAR Straight Problem - Hyc2Document2 pages2021 FAR Straight Problem - Hyc2Mariecris BatasNo ratings yet

- Mendez Bags Trial Balance For The Year Ended December 31, 2019 Account Title Debit CreditDocument9 pagesMendez Bags Trial Balance For The Year Ended December 31, 2019 Account Title Debit CreditMecah Lou Odchigue LanzaderasNo ratings yet

- Or, Deposit Slip and Withdrawl SlipDocument4 pagesOr, Deposit Slip and Withdrawl SlipJessica Rose AlbaracinNo ratings yet

- ACTIVITY 1 MabalaDocument5 pagesACTIVITY 1 MabalaJulie mabuyoNo ratings yet

- Seatwork #6Document5 pagesSeatwork #6Jasmine Maningo100% (1)

- Trial Balance Wk17 GeneralizationDocument1 pageTrial Balance Wk17 GeneralizationYenique SalongaNo ratings yet

- Jose Rizal Heavy BombersDocument10 pagesJose Rizal Heavy BombersClaud NineNo ratings yet

- Exercises in MerchandisingDocument10 pagesExercises in MerchandisingJhon Robert BelandoNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WasErika Repedro0% (1)

- Midterm Summative Examination (B-FND003) (ECO11 & ENR11) - Set A (Answers, Jan Marwin G. Alindog)Document6 pagesMidterm Summative Examination (B-FND003) (ECO11 & ENR11) - Set A (Answers, Jan Marwin G. Alindog)Vaseline QtipsNo ratings yet

- Answer Problem 1Document9 pagesAnswer Problem 1MARY JUSTINE PAQUIBOTNo ratings yet

- Module 2 - Completing The Accounting CycleDocument45 pagesModule 2 - Completing The Accounting CycleShane TorrieNo ratings yet

- Chart of Accounts Assets Liabilities Owner'S Equity Income ExpensesDocument2 pagesChart of Accounts Assets Liabilities Owner'S Equity Income ExpensesErika Bucao100% (1)

- Financial Statement ExampleDocument12 pagesFinancial Statement ExampleRhem Capisan100% (1)

- Financial Accounting and Reporting: Exercise 1Document8 pagesFinancial Accounting and Reporting: Exercise 1Lenneth Mones0% (1)

- Problem 3 ACCA101Document3 pagesProblem 3 ACCA101Nicole FidelsonNo ratings yet

- Finals Non Graded Exercises 002 - Journalizing Under Mechandising Concern With Vat Page 28Document6 pagesFinals Non Graded Exercises 002 - Journalizing Under Mechandising Concern With Vat Page 28Garpt KudasaiNo ratings yet

- Whole Cycle - Accounting Act.Document26 pagesWhole Cycle - Accounting Act.IL MareNo ratings yet

- Lucero - Jose - Rizal - Heavy - Bombers - Statement - of - Cash - FlowsDocument1 pageLucero - Jose - Rizal - Heavy - Bombers - Statement - of - Cash - FlowsKemerut100% (1)

- Cbmec 1 New Module 1Document22 pagesCbmec 1 New Module 1Calabia, Angelica MerelosNo ratings yet

- Chapter 1 Acctg Equation JournalizingDocument4 pagesChapter 1 Acctg Equation JournalizingNicole Marie Pontay BajadeNo ratings yet

- FSDocument44 pagesFSMaria Beatriz Aban Munda100% (2)

- Pequit Company Chart of Accounts For The Year Ended December 31, 2019 Account No. Description Account TypeDocument41 pagesPequit Company Chart of Accounts For The Year Ended December 31, 2019 Account No. Description Account TypePia Suril0% (1)

- Financial Accounting and ReportingDocument1 pageFinancial Accounting and ReportingPaula BautistaNo ratings yet

- Bart MDocument3 pagesBart MSteph Borinaga0% (1)

- Accounting Page 3 5Document3 pagesAccounting Page 3 5Leah AnchetaNo ratings yet

- EALS - Introduction To Life ScienceDocument23 pagesEALS - Introduction To Life ScienceAnime LoverNo ratings yet

- Pas 1 Pas 2 SeatworkDocument2 pagesPas 1 Pas 2 SeatworkAnime LoverNo ratings yet

- Ge 2:reading in Philippine HistoryDocument5 pagesGe 2:reading in Philippine HistoryAnime LoverNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WasAnime LoverNo ratings yet

- CFM02 FAR2 2018 Conceptual FrameworkDocument7 pagesCFM02 FAR2 2018 Conceptual FrameworkAnime LoverNo ratings yet

- Unit I - Accounting EquationDocument6 pagesUnit I - Accounting EquationAnime LoverNo ratings yet

- Rationalism Empiricism: Name: Date: Course and Section: ProfessorDocument2 pagesRationalism Empiricism: Name: Date: Course and Section: ProfessorAnime LoverNo ratings yet

- Unit 2: The Discipline of Counseling: Name: Jazmin K. Crisostomo Strand/ Grade/ Section: HUMSS 12-3Document5 pagesUnit 2: The Discipline of Counseling: Name: Jazmin K. Crisostomo Strand/ Grade/ Section: HUMSS 12-3Anime LoverNo ratings yet

- Chapter 2: The Sociological PerspectiveDocument3 pagesChapter 2: The Sociological PerspectiveAnime LoverNo ratings yet

- Research 1Document5 pagesResearch 1Anime LoverNo ratings yet

- PR1 RESEARCH Chapter 1Document7 pagesPR1 RESEARCH Chapter 1Anime LoverNo ratings yet

- JajshdhbdbrurhejsDocument1 pageJajshdhbdbrurhejsAnime LoverNo ratings yet

- P E-ScriptDocument5 pagesP E-ScriptAnime LoverNo ratings yet

- Philo Manual PDFDocument146 pagesPhilo Manual PDFAnime LoverNo ratings yet

- Final ProjectDocument5 pagesFinal ProjectAkshayNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument16 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancevedhasai198No ratings yet

- Argument Lesson Socratic SeminarDocument5 pagesArgument Lesson Socratic Seminarapi-346495805No ratings yet

- Test The VisionaryDocument2 pagesTest The VisionaryrlcruzNo ratings yet

- Ignacy Jan Paderewski A Discography of His European RecordingsDocument9 pagesIgnacy Jan Paderewski A Discography of His European RecordingsCody NguyenNo ratings yet

- Đề 1Document9 pagesĐề 1Tôm TômNo ratings yet

- Philately GlossaryDocument10 pagesPhilately GlossaryJoaoNo ratings yet

- CVDocument1 pageCVarvindkNo ratings yet

- OSX Entrepreneurship Ch07Document29 pagesOSX Entrepreneurship Ch07Camila Alexandra SHIALER FIGUEROANo ratings yet

- 3D Sex and Zen Extreme Ecstasy 2011Document77 pages3D Sex and Zen Extreme Ecstasy 2011kalyscoNo ratings yet

- Voluntarism - IEPDocument1 pageVoluntarism - IEPLeandro BertoncelloNo ratings yet

- Fba 311 B.i.t-1-1Document131 pagesFba 311 B.i.t-1-1faith olaNo ratings yet

- Financial Analysis ExercisesDocument1 pageFinancial Analysis ExercisesSpencer MosquisaNo ratings yet

- 4B07 NguyenThiMyNgan A Contrastive Analysis of Refusing An Offer in English and VietnameseDocument27 pages4B07 NguyenThiMyNgan A Contrastive Analysis of Refusing An Offer in English and Vietnamesephamxiem100% (2)

- Data InterpretationDocument44 pagesData InterpretationSwati Choudhary100% (2)

- EMPIREFILM With ISBN PDFDocument89 pagesEMPIREFILM With ISBN PDFBryan WatermanNo ratings yet

- Corporal PunishmentDocument19 pagesCorporal PunishmentMuhammad IrfanNo ratings yet

- Environment Position PaperDocument6 pagesEnvironment Position PaperJenlisa KimanobanNo ratings yet

- Risk Management ReviewerDocument7 pagesRisk Management ReviewerPhoebe WalastikNo ratings yet

- Test QuestionsDocument5 pagesTest QuestionsAdrian FranzingisNo ratings yet

- Fotip Imperialism Digital WorkbookDocument21 pagesFotip Imperialism Digital Workbookapi-622302174No ratings yet

- FingerplaysDocument5 pagesFingerplaysAmy Heavner0% (1)

- Essay 1Document3 pagesEssay 1api-607929863No ratings yet

- Micro ReviewDocument134 pagesMicro ReviewNiki NourNo ratings yet

- Jaydapinketsmithenwissam AvanzadoremiDocument6 pagesJaydapinketsmithenwissam AvanzadoremiGysht HwuNo ratings yet

- As 3711.1-2000 Freight Containers Classification Dimensions and RatingsDocument8 pagesAs 3711.1-2000 Freight Containers Classification Dimensions and RatingsSAI Global - APACNo ratings yet

FAR 1 - Journal Entries

FAR 1 - Journal Entries

Uploaded by

Anime LoverOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FAR 1 - Journal Entries

FAR 1 - Journal Entries

Uploaded by

Anime LoverCopyright:

Available Formats

Journalizing Transactions

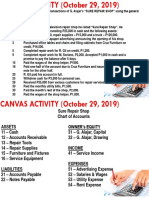

The chart of accounts for Vincent Boron Delivery Service is as follows:

Assets Income

110 Cash 410 Delivery Revenues

120 Accounts Receivable Expenses

130 Prepaid Insurance 510 Salaries Expense

140 Service Vehicle 520 Gas and Oil Expense

150 Office Equipment 530 Repair Expense

540 Advertising Expense

Liabilities 550 Supplies Expense

210 Accounts Payable 590 Miscellaneous Expense

Owner's Equity

310 Boron, Capital

320 Boron, Withdrawals

The entity completed the following transactions in May 2020:

May 3 Placed four week-end advertisements in the Sun Daily Central Luzon for P18,500; the

amount is due in 30 days.

6 Bought supplies on account from Supplies, Inc ., P8,800.

15 Boron invested in the business own office equipment with a fair market value of P52,500.

17 Received P61,800 from charge customers to apply on their accounts.

22 Received a bill from Park Trucking for repair services performed, P8,500.

26 Paid Supplies, Inc ., P8,800 in full payment of account.

29 Paid salaries to employees, P21,000.

30 Received P39,000 for services performed.

31 Received and paid gasoline and oil bill relating to the service vehicle, P12,500.

31 Billed South China Bank for services performed, P45,000.

31 Boron withdrew cash for personal use, P14,500.

Required:

Prepare the journal entries for the May transactions.

John Karlo Dalangin, a dentist, established Dalangin Clinic. The following transactions occurred during

June of this year:

a. Dalangin deposited P280,000 in a bank account in the name of the business.

b. Bought a 3-in-1 office equipment from Pitular Equipment for P4,950, paying P1,000 in cash and the

balance on account.

c. Bought waiting room chairs and a table, paying cash, P12,300.

d. Bought office intercom on account from NE Office Supply, P2,750.

e. Received and paid the telephone bill, P1,080.

f. Performed professional services on account, P12,940.

g. Received and paid the electric bill, P1,850.

h. Received and paid the bill for the Regional Dental Convention, P3,500.

i. Performed professional services for cash, P17,650.

j. Partially settled accounts with NE Office Supply, P1,000.

k. Paid rent for the month, P8,400.

I. Paid salaries of the part-time receptionist, P3,500.

m. Dalangin withdrew cash for personal use, P8,500.

n. Received P5,500 on account from patients who were previously billed.

Required:

1. Establish the following T-accounts: Cash; Accounts Receivable; Office Equipment; Office Furniture;

Accounts Payable; Dalangin, Capital; Dalangin Withdrawals; Professional Fees; Salaries Expense; Rent

Expense; Utilities Expense; and Miscellaneous Expense.

2.Record the transactions directly into the T-accounts using the alphabets to identify each transaction.

3. Prepare a trial balance.

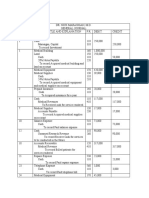

Joanne Java Review School entered into the following transactions during October 2019:

Oct. 1 Java made additional investments of P50,000 in the business.

2 Bought liability insurance for one year, P14,500.

3 Received a bill for advertising from SouthMin News, P3,200.

4 Paid rent for the month, P8,900.

7 Received a bill for equipment repair from E. Hipolito, P2,880.

10 Received and deposited tuition from students, P62,500.

11 Received and paid the telephone bill, P2,300.

15 Bought chairs from E. Awayan Furniture, P18,800, paying P8,800 in cash and the balance on

account.

18 Paid accounts to SouthMin News, P3,200.

21 Java withdrew P8,000 for personal use.

24 Received a bill for gas and oil from Mindanao Oil Corp ., P1,800.

25 Received and deposited tuition from students, P61,400.

27 Paid salaries of the office assistants, P12,000.

28 Bought a photocopier on account from Dadiangas Office Machines, P7,500.

29 Received P7,000 tuition from a student who had charged the tuition on account last month.

30 Received and paid the water utilities bill, P3,600.

31 Paid for flower arrangements for front office, P620.

31 Java invested personal computer, with a fair market value of P12,300, in the business

.Required:

Prepare the journal entries for the October transactions. Use the following accounts:

Cash; Accounts Receivable; Prepaid Insurance; Equipment; Furniture; Accounts Payable; Java,Capital;

Java, Withdrawals; School Fees; Salaries Expense; Rent Expense; Gas and Oil Expense; Advertising

Expense; Repair Expense; Supplies Expense; Utilities Expense; Telecommunications Expense and

Miscellaneous Expense.

You might also like

- Syllabus Redesigning Outline Form: University Committee On Curriculum Development and EvaluationDocument8 pagesSyllabus Redesigning Outline Form: University Committee On Curriculum Development and EvaluationAnime LoverNo ratings yet

- Mr. Addams' Financial StatementDocument10 pagesMr. Addams' Financial StatementKim KoalaNo ratings yet

- Basic Accounting ModelDocument3 pagesBasic Accounting Modeldlinds2X1No ratings yet

- Jose Rizal Heavy Bombers Trial Balance: Totals P 44,793,750 P 44,793,750Document16 pagesJose Rizal Heavy Bombers Trial Balance: Totals P 44,793,750 P 44,793,750Sou TV0% (1)

- GT1Fin AccDocument26 pagesGT1Fin AccZapirah Nirel LayloNo ratings yet

- FAR 1 - Journal EntriesDocument3 pagesFAR 1 - Journal EntriesAnime LoverNo ratings yet

- Proposed City Ordinance No. 2021 002 Granting Financial Subsidy To Deped Non Teaching PersonnelDocument3 pagesProposed City Ordinance No. 2021 002 Granting Financial Subsidy To Deped Non Teaching PersonnelRyan JD Lim100% (1)

- Search For The Graf SpeeDocument5 pagesSearch For The Graf SpeeChristina Chavez Clinton0% (1)

- Inside Indian IndentureDocument504 pagesInside Indian IndentureRananjey100% (2)

- MichelinDocument12 pagesMichelinShilpi Kumar50% (2)

- Analyzing, Recording, Posting and Trial Balance: Normal Balance of AccountsDocument6 pagesAnalyzing, Recording, Posting and Trial Balance: Normal Balance of AccountsMich Binayug100% (1)

- Recording Transactions in A Financial Transaction WorksheetDocument1 pageRecording Transactions in A Financial Transaction WorksheetSHENo ratings yet

- Trial Balance - Daria TolentinoDocument1 pageTrial Balance - Daria TolentinoShaira Nicole VasquezNo ratings yet

- 600 Assembly Work: 2x + 6y 480Document5 pages600 Assembly Work: 2x + 6y 480John Louie DungcaNo ratings yet

- Lesson 1 ExtendDocument6 pagesLesson 1 ExtendRoel Cababao50% (2)

- Total: Nancy Mulles Data Encoders May 15 2018Document6 pagesTotal: Nancy Mulles Data Encoders May 15 2018Tashnim AreejNo ratings yet

- Accounting Cycle 1 768 290 Worksheet BSDocument27 pagesAccounting Cycle 1 768 290 Worksheet BSKylene Edelle LeonardoNo ratings yet

- Antonio WorksheetDocument7 pagesAntonio WorksheetAntonNo ratings yet

- ACT #4 - Jewel Ann C. Penaranda - ACT213Document20 pagesACT #4 - Jewel Ann C. Penaranda - ACT213JEWELL ANN PENARANDA100% (1)

- Worksheet AssignmentDocument2 pagesWorksheet AssignmentLyca MaeNo ratings yet

- Santa Rosa Campus City of Santa Rosa, Laguna: Polytechnic University of The PhilippinesDocument19 pagesSanta Rosa Campus City of Santa Rosa, Laguna: Polytechnic University of The Philippinesareum100% (1)

- FOA Final OutputDocument18 pagesFOA Final OutputGwyneth MogolNo ratings yet

- 01 Quiz 1Document2 pages01 Quiz 1Laisan SantosNo ratings yet

- Adjusting Entries ExampleDocument5 pagesAdjusting Entries ExampleSiak Ni LynnLadyNo ratings yet

- 77 FDocument3 pages77 FJohn CalvinNo ratings yet

- Trial BalanceDocument1 pageTrial BalanceLaurice RacraquinNo ratings yet

- Special JournalDocument7 pagesSpecial JournalJohn Christopher Sta AnaNo ratings yet

- Practice Set I AcctgDocument14 pagesPractice Set I AcctgJan Pearl Hinampas100% (1)

- General Journal, GeveraDocument2 pagesGeneral Journal, GeveraFeiya LiuNo ratings yet

- ACCTG CYCLE Comprehensive ProblmDocument12 pagesACCTG CYCLE Comprehensive ProblmMaria Nicole OasinNo ratings yet

- JoneDocument2 pagesJoneMa. Joan ApolinarNo ratings yet

- MerchandisingDocument11 pagesMerchandisingAIRA NHAIRE MECATE100% (1)

- Castro CompanyDocument41 pagesCastro CompanyMarinel Abril100% (1)

- 01 Activity 2Document4 pages01 Activity 2Laisan SantosNo ratings yet

- Bondoc Johnpaulo Act2b Accounting Module6Document8 pagesBondoc Johnpaulo Act2b Accounting Module6Joeces Ian DizonNo ratings yet

- Canvas Activity - Journalizing - Oct - 29 PDFDocument2 pagesCanvas Activity - Journalizing - Oct - 29 PDFJian Francisco100% (2)

- Diaz - Journal EntriesDocument4 pagesDiaz - Journal EntriesPangitkaNo ratings yet

- Seat Work 02 - DingcongDocument3 pagesSeat Work 02 - DingcongJheilson S. DingcongNo ratings yet

- Accounting For Nonvat and Vat Registered Business Solution To Assign 1 Quiz 1Document16 pagesAccounting For Nonvat and Vat Registered Business Solution To Assign 1 Quiz 1Fider GracianNo ratings yet

- 2021 FAR Straight Problem - Hyc2Document2 pages2021 FAR Straight Problem - Hyc2Mariecris BatasNo ratings yet

- Mendez Bags Trial Balance For The Year Ended December 31, 2019 Account Title Debit CreditDocument9 pagesMendez Bags Trial Balance For The Year Ended December 31, 2019 Account Title Debit CreditMecah Lou Odchigue LanzaderasNo ratings yet

- Or, Deposit Slip and Withdrawl SlipDocument4 pagesOr, Deposit Slip and Withdrawl SlipJessica Rose AlbaracinNo ratings yet

- ACTIVITY 1 MabalaDocument5 pagesACTIVITY 1 MabalaJulie mabuyoNo ratings yet

- Seatwork #6Document5 pagesSeatwork #6Jasmine Maningo100% (1)

- Trial Balance Wk17 GeneralizationDocument1 pageTrial Balance Wk17 GeneralizationYenique SalongaNo ratings yet

- Jose Rizal Heavy BombersDocument10 pagesJose Rizal Heavy BombersClaud NineNo ratings yet

- Exercises in MerchandisingDocument10 pagesExercises in MerchandisingJhon Robert BelandoNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WasErika Repedro0% (1)

- Midterm Summative Examination (B-FND003) (ECO11 & ENR11) - Set A (Answers, Jan Marwin G. Alindog)Document6 pagesMidterm Summative Examination (B-FND003) (ECO11 & ENR11) - Set A (Answers, Jan Marwin G. Alindog)Vaseline QtipsNo ratings yet

- Answer Problem 1Document9 pagesAnswer Problem 1MARY JUSTINE PAQUIBOTNo ratings yet

- Module 2 - Completing The Accounting CycleDocument45 pagesModule 2 - Completing The Accounting CycleShane TorrieNo ratings yet

- Chart of Accounts Assets Liabilities Owner'S Equity Income ExpensesDocument2 pagesChart of Accounts Assets Liabilities Owner'S Equity Income ExpensesErika Bucao100% (1)

- Financial Statement ExampleDocument12 pagesFinancial Statement ExampleRhem Capisan100% (1)

- Financial Accounting and Reporting: Exercise 1Document8 pagesFinancial Accounting and Reporting: Exercise 1Lenneth Mones0% (1)

- Problem 3 ACCA101Document3 pagesProblem 3 ACCA101Nicole FidelsonNo ratings yet

- Finals Non Graded Exercises 002 - Journalizing Under Mechandising Concern With Vat Page 28Document6 pagesFinals Non Graded Exercises 002 - Journalizing Under Mechandising Concern With Vat Page 28Garpt KudasaiNo ratings yet

- Whole Cycle - Accounting Act.Document26 pagesWhole Cycle - Accounting Act.IL MareNo ratings yet

- Lucero - Jose - Rizal - Heavy - Bombers - Statement - of - Cash - FlowsDocument1 pageLucero - Jose - Rizal - Heavy - Bombers - Statement - of - Cash - FlowsKemerut100% (1)

- Cbmec 1 New Module 1Document22 pagesCbmec 1 New Module 1Calabia, Angelica MerelosNo ratings yet

- Chapter 1 Acctg Equation JournalizingDocument4 pagesChapter 1 Acctg Equation JournalizingNicole Marie Pontay BajadeNo ratings yet

- FSDocument44 pagesFSMaria Beatriz Aban Munda100% (2)

- Pequit Company Chart of Accounts For The Year Ended December 31, 2019 Account No. Description Account TypeDocument41 pagesPequit Company Chart of Accounts For The Year Ended December 31, 2019 Account No. Description Account TypePia Suril0% (1)

- Financial Accounting and ReportingDocument1 pageFinancial Accounting and ReportingPaula BautistaNo ratings yet

- Bart MDocument3 pagesBart MSteph Borinaga0% (1)

- Accounting Page 3 5Document3 pagesAccounting Page 3 5Leah AnchetaNo ratings yet

- EALS - Introduction To Life ScienceDocument23 pagesEALS - Introduction To Life ScienceAnime LoverNo ratings yet

- Pas 1 Pas 2 SeatworkDocument2 pagesPas 1 Pas 2 SeatworkAnime LoverNo ratings yet

- Ge 2:reading in Philippine HistoryDocument5 pagesGe 2:reading in Philippine HistoryAnime LoverNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WasAnime LoverNo ratings yet

- CFM02 FAR2 2018 Conceptual FrameworkDocument7 pagesCFM02 FAR2 2018 Conceptual FrameworkAnime LoverNo ratings yet

- Unit I - Accounting EquationDocument6 pagesUnit I - Accounting EquationAnime LoverNo ratings yet

- Rationalism Empiricism: Name: Date: Course and Section: ProfessorDocument2 pagesRationalism Empiricism: Name: Date: Course and Section: ProfessorAnime LoverNo ratings yet

- Unit 2: The Discipline of Counseling: Name: Jazmin K. Crisostomo Strand/ Grade/ Section: HUMSS 12-3Document5 pagesUnit 2: The Discipline of Counseling: Name: Jazmin K. Crisostomo Strand/ Grade/ Section: HUMSS 12-3Anime LoverNo ratings yet

- Chapter 2: The Sociological PerspectiveDocument3 pagesChapter 2: The Sociological PerspectiveAnime LoverNo ratings yet

- Research 1Document5 pagesResearch 1Anime LoverNo ratings yet

- PR1 RESEARCH Chapter 1Document7 pagesPR1 RESEARCH Chapter 1Anime LoverNo ratings yet

- JajshdhbdbrurhejsDocument1 pageJajshdhbdbrurhejsAnime LoverNo ratings yet

- P E-ScriptDocument5 pagesP E-ScriptAnime LoverNo ratings yet

- Philo Manual PDFDocument146 pagesPhilo Manual PDFAnime LoverNo ratings yet

- Final ProjectDocument5 pagesFinal ProjectAkshayNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument16 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancevedhasai198No ratings yet

- Argument Lesson Socratic SeminarDocument5 pagesArgument Lesson Socratic Seminarapi-346495805No ratings yet

- Test The VisionaryDocument2 pagesTest The VisionaryrlcruzNo ratings yet

- Ignacy Jan Paderewski A Discography of His European RecordingsDocument9 pagesIgnacy Jan Paderewski A Discography of His European RecordingsCody NguyenNo ratings yet

- Đề 1Document9 pagesĐề 1Tôm TômNo ratings yet

- Philately GlossaryDocument10 pagesPhilately GlossaryJoaoNo ratings yet

- CVDocument1 pageCVarvindkNo ratings yet

- OSX Entrepreneurship Ch07Document29 pagesOSX Entrepreneurship Ch07Camila Alexandra SHIALER FIGUEROANo ratings yet

- 3D Sex and Zen Extreme Ecstasy 2011Document77 pages3D Sex and Zen Extreme Ecstasy 2011kalyscoNo ratings yet

- Voluntarism - IEPDocument1 pageVoluntarism - IEPLeandro BertoncelloNo ratings yet

- Fba 311 B.i.t-1-1Document131 pagesFba 311 B.i.t-1-1faith olaNo ratings yet

- Financial Analysis ExercisesDocument1 pageFinancial Analysis ExercisesSpencer MosquisaNo ratings yet

- 4B07 NguyenThiMyNgan A Contrastive Analysis of Refusing An Offer in English and VietnameseDocument27 pages4B07 NguyenThiMyNgan A Contrastive Analysis of Refusing An Offer in English and Vietnamesephamxiem100% (2)

- Data InterpretationDocument44 pagesData InterpretationSwati Choudhary100% (2)

- EMPIREFILM With ISBN PDFDocument89 pagesEMPIREFILM With ISBN PDFBryan WatermanNo ratings yet

- Corporal PunishmentDocument19 pagesCorporal PunishmentMuhammad IrfanNo ratings yet

- Environment Position PaperDocument6 pagesEnvironment Position PaperJenlisa KimanobanNo ratings yet

- Risk Management ReviewerDocument7 pagesRisk Management ReviewerPhoebe WalastikNo ratings yet

- Test QuestionsDocument5 pagesTest QuestionsAdrian FranzingisNo ratings yet

- Fotip Imperialism Digital WorkbookDocument21 pagesFotip Imperialism Digital Workbookapi-622302174No ratings yet

- FingerplaysDocument5 pagesFingerplaysAmy Heavner0% (1)

- Essay 1Document3 pagesEssay 1api-607929863No ratings yet

- Micro ReviewDocument134 pagesMicro ReviewNiki NourNo ratings yet

- Jaydapinketsmithenwissam AvanzadoremiDocument6 pagesJaydapinketsmithenwissam AvanzadoremiGysht HwuNo ratings yet

- As 3711.1-2000 Freight Containers Classification Dimensions and RatingsDocument8 pagesAs 3711.1-2000 Freight Containers Classification Dimensions and RatingsSAI Global - APACNo ratings yet