Professional Documents

Culture Documents

Flow Chart (L-2)

Flow Chart (L-2)

Uploaded by

Jaza0 ratings0% found this document useful (0 votes)

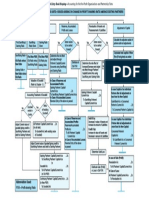

56 views1 pageThis document outlines the accounting process for partnership firms. It discusses how profits and losses are allocated based on whether a partnership deed exists. If a deed exists, profit/loss is shared according to the deed. If not, profit/loss is shared equally. The document also describes how a Profit and Loss Appropriation account is used to debit expenses like interest and commission and credit income like interest charged on capital or drawings. Finally, distributable profit is allocated to partners' capital or current accounts based on their profit-sharing ratios.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the accounting process for partnership firms. It discusses how profits and losses are allocated based on whether a partnership deed exists. If a deed exists, profit/loss is shared according to the deed. If not, profit/loss is shared equally. The document also describes how a Profit and Loss Appropriation account is used to debit expenses like interest and commission and credit income like interest charged on capital or drawings. Finally, distributable profit is allocated to partners' capital or current accounts based on their profit-sharing ratios.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

56 views1 pageFlow Chart (L-2)

Flow Chart (L-2)

Uploaded by

JazaThis document outlines the accounting process for partnership firms. It discusses how profits and losses are allocated based on whether a partnership deed exists. If a deed exists, profit/loss is shared according to the deed. If not, profit/loss is shared equally. The document also describes how a Profit and Loss Appropriation account is used to debit expenses like interest and commission and credit income like interest charged on capital or drawings. Finally, distributable profit is allocated to partners' capital or current accounts based on their profit-sharing ratios.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

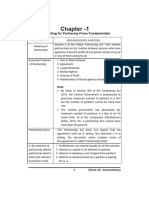

ACCOUNTING FOR PARTNERSHIP FIRMS — FUNDAMENTALS

Charge Against Profit Appropriation of Profit

Interest on Capital is not allowed

Profit and Loss Account (After debiting Partnership No Interest on Drawings is not charged

operating and non-operating expenses, Deed Exists Remuneration to Partners is not allowed

losses and crediting operating and Profit/Loss is shared Equally

non-operating incomes) Yes

Prepare Profit and Loss

Appropriation Account

Further Debited by

Manager’s Commission Debited by Credited by

Rent Paid to Partner

Interest on Loan by Partner @ 6% p.a. Interest on Current Account Interest charged on Debit Balance in

(If no Partnership Deed exists or at the (If so provided in Partnership Deed or Partner’s Current Account

rate provided in the Partnership Deed) Agreed Otherwise) Interest on Drawings charged at

Interest on Capital if it is a Charge Interest on Capital at agreed rate of Determine Distributable Profit agreed rate of interest

interest

Remuneration to Partners as agreed

Partner’s Capital A/c ...Dr.

Credited By Transfer to Reserve

To Interest on Current A/c

Guarantee To Interest on Drawing A/c

For Interest on Current Account:

Interest on Loan given by the firm to the of Profit to Partner(s) No

partners at the agreed rate of interest Interest on Partner’s Current A/c ...Dr.

by Partner(s) Interest on Drawings A/c ...Dr.

To Partner’s Capital A/c

or firm Interest on Current A/c ...Dr.

For Interest on Capital:

Determine Net Profit/Loss Interest on Capital A/c ...Dr. To Profit and Loss Appropriation A/c

Yes

To Partner’s Capital A/c

For Salary/Remuneration to Deficiency shared by

Net Profit/Loss transferred to Profit and

Partners: agreed Partners/Firm

Loss Appropriation Account

Partner’s Salary A/c ...Dr. Distribute Profit in PSR

To Partner’s Capital A/c

Profit and Loss A/c ...Dr. Profit and Loss Appropriation A/c ...Dr.

Guaranteeing Partner’s Capital/Current A/c ...Dr. To Partners’ Capital/Current A/cs

To Profit and Loss Appropriation A/c Profit and Loss Appropriation A/c ...Dr. To Guaranteed Partner’s Capital/Current A/c

To Partner’s Capital A/c

To Salary/Remuneration A/c

To Interest on Capital A/c

To Reserve A/c

Abbreviation Used: Note: When Capital Accounts are maintained following Fixed Capital Accounts Method, amount is debited/credited to Partners’

PSR—Profit-sharing Ratio Current Accounts. In case of fluctuating capitals, amount is debited/credited to Partners’ Capital Accounts.

You might also like

- Crypto Report Card TemplateDocument11 pagesCrypto Report Card Templatemrb.rafsterNo ratings yet

- FinAccUnit 3 - Partnership Accounts Lecture Notes PDFDocument8 pagesFinAccUnit 3 - Partnership Accounts Lecture Notes PDFSherona Reid100% (5)

- Day Trading With The InstitutionsDocument102 pagesDay Trading With The Institutionslowtarhk50% (2)

- 2.02 Policies & Procedures Front Office, 99 PagesDocument4 pages2.02 Policies & Procedures Front Office, 99 Pagesorientalhospitality100% (7)

- Ceres+Gardening+Company+Submission Shradha PuroDocument6 pagesCeres+Gardening+Company+Submission Shradha PuroShradha PuroNo ratings yet

- Maybank (Group Assignment)Document7 pagesMaybank (Group Assignment)Olivia RinaNo ratings yet

- 1 - Accounting For Partnership Firms - FundamentalsDocument12 pages1 - Accounting For Partnership Firms - FundamentalsAnkit Roy100% (1)

- Flow Chart-1Document1 pageFlow Chart-1Pankaj MahajanNo ratings yet

- Partnership Firms Part 2 Appropriation of ProfitDocument14 pagesPartnership Firms Part 2 Appropriation of ProfitDeepti BistNo ratings yet

- Set 1 Test No.1 Answer KeyDocument4 pagesSet 1 Test No.1 Answer KeyJOHAN JOJONo ratings yet

- Ilovepdf MergedDocument10 pagesIlovepdf MergedDivyam RohillaNo ratings yet

- Flow Chart (L-8)Document2 pagesFlow Chart (L-8)Simer preet kaurNo ratings yet

- Flow Chart (L-5)Document1 pageFlow Chart (L-5)Ak AgarwalNo ratings yet

- Accounting For Partnership Firms - FundamentalsDocument5 pagesAccounting For Partnership Firms - FundamentalsPainNo ratings yet

- Part1 Topic 5 Accounting For Partnership Firms Admission of A PartnerDocument54 pagesPart1 Topic 5 Accounting For Partnership Firms Admission of A PartnerShivani ChoudhariNo ratings yet

- Accounting For PartnershipDocument15 pagesAccounting For Partnershipnagesh dashNo ratings yet

- PartnershipDocument6 pagesPartnershipJoanne TolentinoNo ratings yet

- 12 AccountancyDocument4 pages12 AccountancyAbhishek DhillonNo ratings yet

- Dayag Notes Partnership FormationDocument3 pagesDayag Notes Partnership FormationGirl Lang AkoNo ratings yet

- Work Sheet On Accounting For Partnership FundamentalsDocument19 pagesWork Sheet On Accounting For Partnership Fundamentals8qk77kkhwbNo ratings yet

- Flow Chart (L-4)Document1 pageFlow Chart (L-4)Gurjit BrarNo ratings yet

- Accounting For Partnership Firms - Fundamentals 2021Document183 pagesAccounting For Partnership Firms - Fundamentals 2021JPS J100% (1)

- Accspec 1Document2 pagesAccspec 1Aye ChavezNo ratings yet

- B. Com. Sem-1 Fincancial Account (English)Document4 pagesB. Com. Sem-1 Fincancial Account (English)babu20021996No ratings yet

- Partnership NotesDocument35 pagesPartnership Notesa86476007No ratings yet

- Ad Acc As QusDocument196 pagesAd Acc As QusRadhika GargNo ratings yet

- Part1 Topic 4 Reconstitution of PartnershipDocument21 pagesPart1 Topic 4 Reconstitution of PartnershipShivani ChoudhariNo ratings yet

- Study Material CH.-1 Fundamentals of Partnership 2023-24Document28 pagesStudy Material CH.-1 Fundamentals of Partnership 2023-24vsy9926No ratings yet

- Partnership Firms - Part5 Guarantee and Past AdjustmentDocument15 pagesPartnership Firms - Part5 Guarantee and Past AdjustmentDeepti BistNo ratings yet

- Partnership: Basics: DefinitionsDocument13 pagesPartnership: Basics: DefinitionsShiv PatelNo ratings yet

- Advacc BookDocument4 pagesAdvacc Book20220633No ratings yet

- Fundamentals PDFDocument103 pagesFundamentals PDFDhairya JainNo ratings yet

- Session 4 - Partnership AccountsDocument23 pagesSession 4 - Partnership AccountsFrederickNo ratings yet

- Special TransactionsDocument3 pagesSpecial TransactionsTracy AguirreNo ratings yet

- FORMATDocument10 pagesFORMATShreeram vikiNo ratings yet

- AdjustmentsDocument3 pagesAdjustmentsapi-417927166No ratings yet

- PARTNERSHIPDocument8 pagesPARTNERSHIPShayne BenaweNo ratings yet

- Flow Chart (L-6)Document2 pagesFlow Chart (L-6)Ak AgarwalNo ratings yet

- Dissolution of Partnership FirmDocument17 pagesDissolution of Partnership FirmRenu Bala JainNo ratings yet

- Interest On Drawings 1Document10 pagesInterest On Drawings 1giennachemparathyNo ratings yet

- AFAR - Sir BradDocument36 pagesAFAR - Sir BradOliveros JaymarkNo ratings yet

- Accounting For Special TransactionDocument2 pagesAccounting For Special TransactionconsulivyNo ratings yet

- CH-01 FundamenatsDocument3 pagesCH-01 FundamenatsNitin KumarNo ratings yet

- CH - 04 Dissolution of Partnership FirmDocument10 pagesCH - 04 Dissolution of Partnership FirmMahathi AmudhanNo ratings yet

- Admission of A PartnerDocument5 pagesAdmission of A PartnerHigreeve SrudhiNo ratings yet

- Chapter 6: Appropriation of Profits: Rohit AgarwalDocument4 pagesChapter 6: Appropriation of Profits: Rohit AgarwalbcomNo ratings yet

- Advance Accounts Summary NotesDocument80 pagesAdvance Accounts Summary NotesJaisika SoniNo ratings yet

- Admission of A Partner, Class 12, CbseDocument13 pagesAdmission of A Partner, Class 12, CbseTULIP DAHIYANo ratings yet

- Retirement or Death of Partner NewDocument5 pagesRetirement or Death of Partner NewAnkit Roy100% (1)

- First 20 PagesDocument21 pagesFirst 20 Pageszainab.xf77No ratings yet

- CH - 2 Accounting For Partnership Firms: Fundamentals: According To Section 4 of The Partnership Act 1932Document12 pagesCH - 2 Accounting For Partnership Firms: Fundamentals: According To Section 4 of The Partnership Act 1932Laksh KhannaNo ratings yet

- C-1 (Fundamentals of Partnership)Document6 pagesC-1 (Fundamentals of Partnership)adwitanegi068No ratings yet

- Chapter 17Document36 pagesChapter 17metarereNo ratings yet

- Introduction To Partnership AccountsDocument88 pagesIntroduction To Partnership Accountssaheer100% (1)

- Combinepdf PDFDocument189 pagesCombinepdf PDFom sharmaNo ratings yet

- Welcome To The 11 Accountancy Webinar: by CA. (DR.) G. S. Grewal Sunday, 21 June, 2020Document58 pagesWelcome To The 11 Accountancy Webinar: by CA. (DR.) G. S. Grewal Sunday, 21 June, 2020kai georgeNo ratings yet

- Accounts Class 12Document12 pagesAccounts Class 12Bhanu PratapNo ratings yet

- 1 - Partnership ReviewDocument6 pages1 - Partnership ReviewTherese Anne VillaricoNo ratings yet

- 01 Partnership FormationDocument5 pages01 Partnership FormationJohn Carl TuazonNo ratings yet

- Afar NotesDocument20 pagesAfar NotesChristian James Umali BrionesNo ratings yet

- Partnership Operations: Accounting Cycle of A PartnershipDocument13 pagesPartnership Operations: Accounting Cycle of A Partnershipred100% (1)

- Change in P.S.R.Document30 pagesChange in P.S.R.Pratyush SainiNo ratings yet

- Ncert Sol Class 12 Accountancy Chapter 4 PDFDocument41 pagesNcert Sol Class 12 Accountancy Chapter 4 PDFAnupam DasNo ratings yet

- Afar NotesDocument6 pagesAfar NotesGio BurburanNo ratings yet

- Pagos Efectuados A LaboratoriosDocument14 pagesPagos Efectuados A LaboratoriosCronista.comNo ratings yet

- FinalDocument2 pagesFinalSANJAY SHARMANo ratings yet

- Important Government Schemes Ministry of Agriculturr Lyst8515Document17 pagesImportant Government Schemes Ministry of Agriculturr Lyst8515Prachi SinghNo ratings yet

- Railwire Billing Oct 2021Document1 pageRailwire Billing Oct 2021Suseel MenonNo ratings yet

- Avoid Common Mistakes in Completing The BMCDocument3 pagesAvoid Common Mistakes in Completing The BMCdiptiNo ratings yet

- Special Power of AttorneyDocument1 pageSpecial Power of AttorneyAllen Sandra navaretteNo ratings yet

- Chap 26 Consolidation Controlled Entities)Document21 pagesChap 26 Consolidation Controlled Entities)Linh Le Thi ThuyNo ratings yet

- Changes in The Occupational Structure of IndiaDocument12 pagesChanges in The Occupational Structure of IndiaS1626No ratings yet

- Ziva Pharmaceuticals Exploring InternatiDocument10 pagesZiva Pharmaceuticals Exploring Internatisherif shamsNo ratings yet

- Tamiya Clod Buster ManualDocument28 pagesTamiya Clod Buster ManualDavid EveridgeNo ratings yet

- RD Pawnshop-StrategicDocument6 pagesRD Pawnshop-StrategicJovelyn Laforteza100% (1)

- Bid FormDocument1 pageBid FormAileen EstanislaoNo ratings yet

- Types of StrategiesDocument36 pagesTypes of StrategiesSam JunejaNo ratings yet

- LM - Chapter 13Document18 pagesLM - Chapter 13PASCUA RENALYN M.No ratings yet

- ACFAR ReviewDocument39 pagesACFAR ReviewYza IgartaNo ratings yet

- 4 Managerial EconomicsDocument8 pages4 Managerial EconomicsBoSs GamingNo ratings yet

- Ocean TransportationDocument12 pagesOcean TransportationDhanraj KumawatNo ratings yet

- PF Pending ListDocument6 pagesPF Pending Listcontactus kannanNo ratings yet

- Acctg 106 Practice DrillDocument2 pagesAcctg 106 Practice DrillMjhayeNo ratings yet

- NewBookReleaseInfo-Gann Planets Vol II PDFDocument8 pagesNewBookReleaseInfo-Gann Planets Vol II PDFJim Baxter50% (2)

- SPAN Margin System For PlatformsDocument7 pagesSPAN Margin System For Platformsprashantmehra02No ratings yet

- Results Date List Q4Document5 pagesResults Date List Q4Rony BNo ratings yet

- Exercises-for-Accounting-Equation-and-Double-entry-system (1)Document3 pagesExercises-for-Accounting-Equation-and-Double-entry-system (1)sheenacgacitaNo ratings yet

- CPHalf Yearly PTService Request ReceiptDocument1 pageCPHalf Yearly PTService Request ReceiptNEELAKANDAN B BALASUBRAMANINo ratings yet

- Ebook Economic Analysis of Social Issues 1St Edition Alan Grant Test Bank Full Chapter PDFDocument45 pagesEbook Economic Analysis of Social Issues 1St Edition Alan Grant Test Bank Full Chapter PDFsusanowensacmqnxoret100% (13)